- Home

- »

- Advanced Interior Materials

- »

-

India Ferrosilicon Market Size, Share & Growth Report, 2030GVR Report cover

![India Ferrosilicon Market Size, Share & Trends Report]()

India Ferrosilicon Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Carbon & Other Alloy Steel, Cast Iron, Electric Steel), By Application (Deoxidizer, Inoculant), And Segment Forecasts

- Report ID: GVR-4-68040-053-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

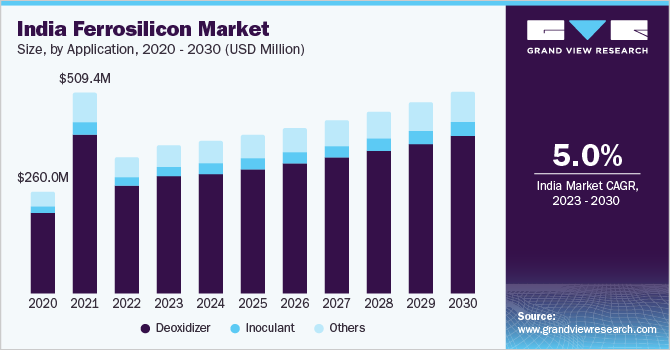

The India ferrosilicon market size was valued at USD 347.7 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Positive government policy and rising private investment in the steel sector are propelling the demand for ferrosilicon (FeSi) in India. The product is widely used as a deoxidizer in the steel industry. Deoxidizers help eliminate gas holes, metal oxides, and porosity, which further improves the fluidity of the metal. Adding a certain quantity of FeSi to the steel helps in improving the hardness, strength, elasticity, and permeability of the metal. According to the Indian Ferroalloys Producers’ Association (IFAPA), India's bulk ferroalloy industry has an installed capacity of 5.1 million tons per year, while the capacity for noble ferroalloys is 50,000 tons per year. Out of 5.15 million tons of bulk ferroalloys, around 0.25 million tons is of FeSi.

Most of the ferroalloy manufacturing facilities in India are located in Andhra Pradesh, Chhattisgarh, Jharkhand, Karnataka, Madhya Pradesh, Maharashtra, Odisha, and West Bengal, due to the abundance of raw materials. However, the industry has recently expanded to North-Eastern India; several small-scale factories that produce FeSi and ferrosilicon manganese have been established in Meghalaya.

Increasing investment in the domestic construction and infrastructure sector by the government of India is expected to boost the steel demand, which, in turn, is expected to have a positive impact on the market. For instance, in the budget 2023–2024, the Indian government allocated INR 16,000 crores (USD 1,932.9 million) to a new initiative to develop “sustainable cities of tomorrow”. The initiatives are anticipated to transform multiple cities in India by improving their infrastructure, and mobility, and creating urban sustainability.

The use of aluminum as a substitute for steel, mainly in automotive applications, is projected to restrain steel production and thus, impact the demand for FeSi. The key reason behind the increasing use of aluminum in vehicles is its low weight and stiffness. This improves fuel efficiency & vehicle performance and helps manufacturers comply with the stringent regulations imposed by government bodies regarding safety and emissions.

Application Insights

Based on applications, the industry has been further segmented into deoxidizers, inoculants, and others. Deoxidizer was the largest application segment and accounted for the maximum share of more than 78.95% of the overall revenue in 2022. Increasing ferrosilicon demand for deoxidizing various ferrous alloys, steel manufacturing, and the processing industry, is expected to drive growth over the forecast period. Increasing investment in the above-mentioned industry is expected to propel the demand for deoxidizers. For instance, in November 2022, the JSW Group announced that the company is going to invest INR 1 trillion in Karnataka over the next five years.

The investment would be used to expand its steel plant, port infrastructure, and renewable energy capabilities. The company is targeting to make the Ballari steel plant in Karnataka to be one of the biggest steel plants in the world. The inoculant segment is expected to register a steady growth rate, in terms of volume over the forecast period. Inoculants offer improved homogeneity of cast iron and eliminate the formation of carbides into thin parts or salient angles. The inoculants are widely used in the manufacturing of cast iron.

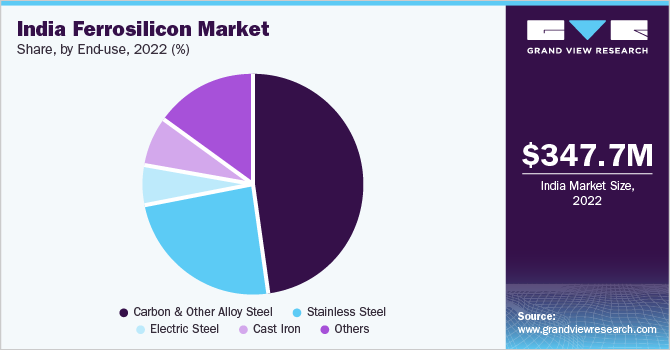

End-use Insights

Based on end-uses, the industry has been further categorized into carbon & other alloy steel, stainless steel, electric steel, cast iron, and others. The carbon & other alloy end-use segment dominated the market in 2022 and accounted for the maximum share of more than 48.40% of the overall revenue. Carbon steel is used in building construction, pipeline network, railway tracks, and machinery parts owing to its high strength. Rising investments in these sectors are projected to augment the demand for products over the forecast period. The electric steel segment is expected to grow at a steady CAGR from 2023 to 2030. In the electric steel manufacturing industry, the product has a high demand as a source of silicon as it improves wear- & scale-resistance, strength, and elasticity of the metal, which, in turn, will have a positive impact on the segment growth over coming years.

The cast iron segment is expected to register the fastest CAGR, in terms of revenue, over the forecast period. Cast iron products, such as gray iron, ductile iron, and malleable iron, have various applications in industrial machinery, railway, energy, and heavy-duty applications; which drives the segment growth. In March 2021, the Indian Railways announced its National Rail Plan (NRP) for India 2030. As part of the plan, Vision 2024 has been launched, which suggests an acceleration in the implementation of projects by 2024, such as multi-tracking of congested routes, 100% electrification, and up-gradation of speed to 130 kilometers per hour.

Country Insights

The market in South India is expected to register a growth rate of 4.7%, in terms of revenue, over the forecast period. The growth is attributed to increasing investments by state governments to boost the manufacturing and construction & infrastructure sector in their state, which is propelling the demand for steel and cast-iron products. In January 2023, the Tamil Nadu government approved an investment of INR 15,610.4 crore (USD 1885.8 million) for eight new projects.

The investment will be made in automotive, Electric Vehicle(EV) manufacturing, textile, oxygen production, and wireless technology. Increasing investment by the state government is expected to propel the demand for steel and cast iron products, which is expected to augment the consumption of FeSi over the forecast period.

Key Companies & Market Share Insights

Key players engage in capacity expansions or new plant establishment and R&D activities to stay ahead of their competitors. For example, in December 2021, Shyam Metalics announced that it will expand its integrated production capacity of steel-making and ferroalloys from 5.71 MTPA to 11.5 MTPA by the financial year 2025 at a total Capex of INR 2,960 crore. Some of the prominent players in the India ferrosilicon market include:

-

Berry Alloys Ltd.

-

G K Min Met Alloys Co

-

Hindustan Alloys Pvt. Ltd.

-

Maithan Alloys Ltd.

-

Metallic Ferro Alloys LLP

-

Pioneer Carbide Pvt. Ltd.

-

Shyam Metalics

India Ferrosilicon Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 377.7 million

Revenue forecast in 2030

USD 512.8 million

Growth rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Country scope

India

Key companies profiled

Berry Alloys Ltd.; G K Min Met Alloys Co.; Hindustan Alloys Pvt. Ltd.;Maithan Alloys Ltd.; Metallic Ferro Alloys LLP; Pioneer Carbide Pvt. Ltd.; Shyam Metalics; Rama-Ferro-Alloy

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Ferrosilicon Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the India ferrosilicon market report on the basis of product, application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Deoxidizer

-

Inoculant

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon & Other Alloy Steel

-

Stainless Steel

-

Electric Steel

-

Cast Iron

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

India

-

South India

-

-

Frequently Asked Questions About This Report

b. The India ferrosilicon market size was estimated at USD 347.7 million in 2022 and is expected to reach USD 377.7 million in 2023.

b. The India ferrosilicon market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2033 to reach USD 512.8 million by 2030.

b. The deoxidizer segment dominated the market with a revenue share of over 79.0% in 2022. The segment is witnessing significant growth owing to increasing demand for deoxidizers for steel manufacturing in India.

b. Some of the key vendors of the India ferrosilicon market are BERRY ALLOYS LIMITED G K Min Met Alloys Co, Maithan Alloys Ltd, and Shyam Metalics.

b. The key factor that is driving the growth of the India ferrosilicon market is the government's initiatives towards achieving its goal of 300 million tons of crude steel capacity by 2030. This in turn is expected to increase the demand for ferrosilicon as a deoxidizer in the steel manufacturing process.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.