- Home

- »

- Plastics, Polymers & Resins

- »

-

India Molded Pulp Packaging Market, Industry Report, 2030GVR Report cover

![India Molded Pulp Packaging Market Size, Share & Trends Report]()

India Molded Pulp Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-wood Pulp), By Molded Type (Thick Wall, Transfer), By Product Type (Trays, End Caps), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-591-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2028

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Molded Pulp Packaging Market Trends

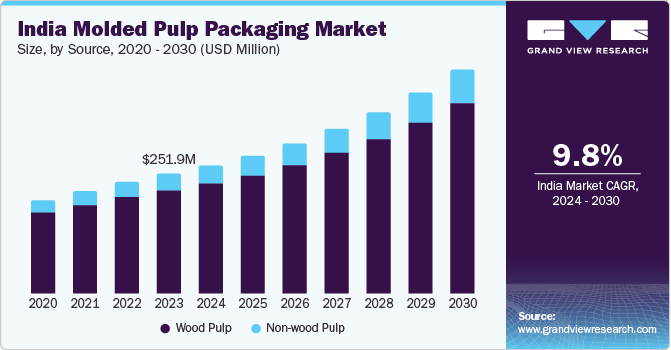

The India molded pulp packaging market size was estimated at USD 251.9 million in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030. The increasing demand for sustainable and environment-friendly packaging solutions is primarily attributed to the negative impact of plastic packaging on the environment. The food and beverage industry is the largest user of molded pulp packaging due to its requirement for sustainable packaging solutions and strict regulations to reduce plastic usage. The demand for eco-friendly packaging solutions is also expected to grow in the electronics and automotive industries.

The Indian government has imposed strict regulations to reduce plastic usage. So, companies from various sectors explore alternatives such as molded pulp packaging. Indian consumers and businesses are becoming increasingly conscious of the environment and are growing in preference for sustainable packaging solutions. To reduce plastic waste and promote eco-friendly alternatives, e-commerce player Big Basket has completely eliminated the use of single-use plastic for its fruits and vegetable deliveries. Amazon India, a major player in e-commerce, has responded to state-level bans on single-use plastics by incorporating molded pulp packaging into its packaging strategy.

Molded pulp packaging has become popular for businesses that want to use sustainable yet affordable packaging solutions. PaperFoam India Pvt Ltd is a leading manufacturer in this industry and offers competitively priced molded pulp packaging across various sectors.

Indian companies are increasingly adopting molded pulp packaging as a sustainable alternative to promote resource conservation and waste reduction, which aligns with global efforts towards a circular economy. Godrej Interio, a prominent furniture manufacturer, has incorporated molded pulp packaging from recycled materials into its product packaging range. Godrej Interio has set a great example of operating in a circular economy by emphasizing its packaging's recyclability and closing the loop on material usage.

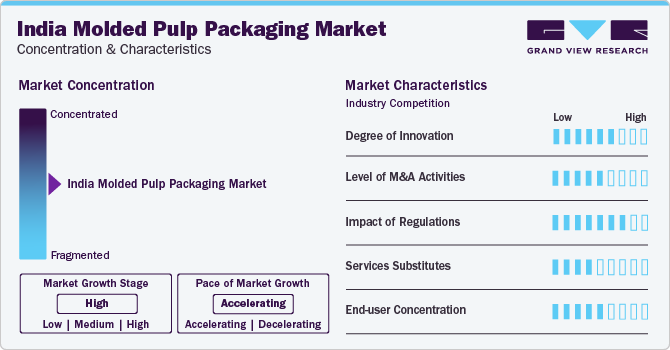

Market Concentration & Characteristics

The industry growth stage is high, and the industry growth pace is accelerating. This sector is characterized by significant innovation, including heightened consumer demand for sustainable alternatives, technological progressions, and regulatory imperatives. For instance, ABB partnered with Zume in 2021 to produce sustainable packaging using molded pulp compostable materials made from agricultural waste, aiming to replace single-use plastics on a large scale. The collaboration involves ABB supplying robotic cells to automate production, enabling the cost-effective production of compostable packaging certified as ASTM D6868 compostable.

Merger and acquisition activities within India molded pulp packaging industry have been moderate, driven by strategic consolidation, product diversification, and geographic expansion. Large packaging firms have acquired smaller ones specializing in molded pulp packaging to strengthen their position in sustainable packaging. In August 2023, Valmet announced its partnership with Naini Papers, which includes providing vital technologies and automation for a cooking and fiber line renovation, along with a new specialty paper machine PM 3, to enhance the mill's capabilities and address the need for specialty coated paper by the beginning of 2025.

Regulations impact the Indian molded pulp packaging industry, compelling companies to adopt eco-friendly solutions to comply with environmental mandates. While adhering to regulations necessitates initial investment, it offers opportunities for market differentiation and appeals to eco-conscious consumers, driving innovation within the industry. In 2022, the government approved Sinar Mas’s plans to invest USD 2.41 billion to establish a paper plant in Raigad, Maharashtra, generating 7,000 employment opportunities. The first phase covers 300 hectares, and the second phase expands to 600 hectares.

The market, while focused on eco-friendly solutions, faces competition from alternative materials. Recycled plastic offers a cost-effective option but with a focus on high post-consumer content. Biodegradable plastics derived from plants are another alternative, although their composting acceptance may vary. Reusable containers represent the most sustainable long-term option but may only be practical for some applications. Metal and glass packaging offer durability and recyclability but come with increased production energy and transportation costs, respectively. Ultimately, the optimal selection hinges on cost, environmental impact, product protection, and functionality.

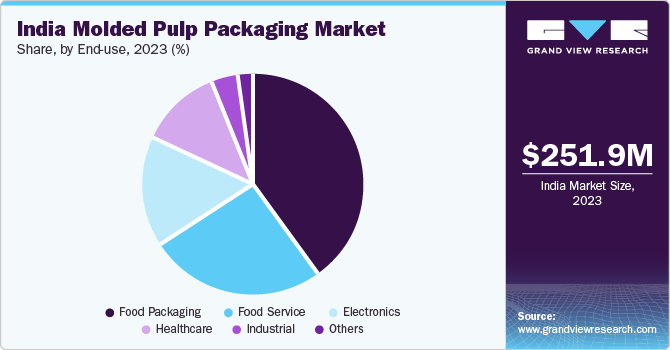

The molded pulp packaging industry in India exhibits moderate end-user concentration. While the food and beverage sector remains a significant end-user, the industry is actively expanding into new markets. This is evident in the growing demand for molded pulp packaging in healthcare, consumer electronics, and industrial applications. This diversification strengthens the industry by reducing dependence on a single end-user segment.

Source Insights

Based on source, wood pulp dominated the market and accounted for a share of over 85% in 2023, owing to its abundance, renewability, and eco-friendly nature. The market is experiencing significant growth driven by increasing environmental concerns and stringent regulations regarding plastic usage. As a sustainable and biodegradable material, wood pulp is preferred by many industries for packaging purposes in India. For instance, HP's innovative packaging solutions focus on molded fiber products made from renewable, recycled, and natural fibers like wood pulp, enhancing sustainability in the industry. This approach aligns with HP's commitment to environmentally friendly practices and the production of recyclable and biodegradable packaging materials.

The non-wood pulp segment is expected to register the fastest CAGR during the forecast period. Environmental concerns and strict regulations drive the segment growth. This segment leverages sustainable alternatives like sugarcane waste (bagasse) for egg cartons, fast-growing bamboo for premium packaging, and recycled paper for disposable tableware. This eco-friendly approach, aligned with consumer preferences, positions the non-wood pulp segment for continued growth. For instance, Bambrew, a Bengaluru-based eco-friendly startup, produces sustainable packaging alternatives using bamboo, sugarcane, and seaweed to combat single-use plastics. Its handmade products sourced from tribal communities have reduced over 10,000 tons of plastic waste and meet European compostability standards and FDA food-grade certification.

Molded Type Insights

Based on molded type, the transfer segment dominated the market with the largest revenue share in 2023 due to the country's flourishing food and beverage sector and the presence of major electronic companies. The surge in demand is fueled by the necessity to securely store and transport delicate electronic products, coupled with the rising recognition and adoption of sustainable and environmentally friendly packaging solutions across diverse industries.

Moreover, factors such as the expansion of e-commerce platforms, focus on reducing carbon footprints, and the versatility, cost-efficiency, and biodegradability of molded pulp packaging also play significant roles in enhancing its popularity in India. According to the International Molded Fiber Association (IMFA), a transfer molded segment is produced using a single forming and transfer mold, with wall thickness varying from 1/8 to 3/16 inches.

The thermoformed segment is expected to grow at the fastest CAGR during the forecast period. The thermoformed molded pulp segment thrives due to its efficiency and versatility. High-volume production caters to fast-paced sectors like food and beverage, such as egg cartons and trays. Advancements make it cost-competitive, while the ability to create complex shapes with improved strength expands its applications to premium packaging for electronics or cosmetics. This technology aligns perfectly with the growing demand for sustainable and functional packaging solutions.

For instance, Solenis' Contour PFAS-free technology for molded pulp offers oil and grease resistance, replacing PFAS in food containers while meeting performance requirements such as water and oil holdout for one hour. This innovative solution is cost-competitive, easy to implement, and customizable for various pulp types and molding conditions, with ongoing development for higher-temperature applications.

Product Type Insights

The trays segment dominated the market with the largest revenue share in 2023 due to their adaptability. The design effectively protects diverse products, from delicate berries (replacing plastic clamshells) to meat (replacing foam trays). This functionality offers a sustainable and cost-competitive alternative to growing environmental concerns and regulations on single-use plastics. Furthermore, molded pulp trays can be customized for optimal stacking and storage, improving efficiency throughout the supply chain. For instance, Bell Printers Private Limited uses high-quality molded pulp tray packaging with luxury rigid boxes for men's grooming set packaging in India. This packaging solution combines elegance and functionality for premium product presentation.

Clamshells are expected to grow at the fastest CAGR during the forecast period. The clamshell segment in India's molded pulp market is flourishing due to its convenience. The secure closure system, ideal for single-serve salads or takeout containers (replacing plastic clamshells), protects contents and fosters easy access. Clamshell sizes can be customized for portion control, aligning with the fight against food waste. Additionally, transparent windows showcase products like bakery goods, while ample surface area allows for effective branding.

One such innovation by Aveda's Uruku Lipstick packaging features a reusable case made of environmentally friendly plastic with a woody texture, enabling more organic ingredients in the formula while reducing unit costs per lipstick. This innovative design emphasizes sustainability and cost-efficiency in packaging solutions for cosmetic products.

End-use Insights

The food packaging segment dominated the market with the largest revenue share in 2023. The food packaging segment reigns supreme in India's molded pulp market, driven by a powerful combination of factors. Its versatility is evident in the wide range of applications, from protective trays cradling delicate berries (replacing plastic clamshells) to sturdy containers for bakery goods and meat (replacing foam trays). This functionality aligns perfectly with growing environmental consciousness, as molded pulp offers a biodegradable and compostable alternative.

Furthermore, cost-competitiveness in specific applications and strict regulations on single-use plastics solidify molded pulp's dominance in food packaging. For instance, Nestlé prioritizes sustainable packaging, aiming for 100% recyclable or reusable materials by 2025, including molded pulp containers. It focuses on eco-friendly molded pulp solutions for food packaging, wrapping, and transportation, showcasing its commitment to sustainability.

The electronics segment is anticipated to grow at the fastest CAGR during the forecast period. The electronics segment in India's molded pulp packaging market is a promising niche driven by specific applications. Molded pulp's ability to provide cushioning protection and eco-friendly disposal makes it ideal for delicate components like light bulbs (replacing foam packaging) or smaller electronics.

This functionality, coupled with cost-effectiveness in some instances and the evolving regulatory landscape around electronic waste management, positions molded pulp as a sustainable solution for responsible packaging within the electrical sector. For instance, companies like Samsung and HP have already introduced molded pulp packaging in some products. This shift towards molded fiber packaging aligns with its commitment to eco-friendly practices and innovation in packaging solutions.

Key India Molded Pulp Packaging Company Insights

Some of the key companies operating in the India molded pulp packaging market include Maspack Limited, JK Paper, Shree Kias Pack, Neeyog, Pulp2pack, Pakka Limited, Ecoware, Discover India Packaging, and Cirkla.

-

Maspack Limited manufactures and supplies a wide range of packaging products, such as Corrugated Boxes, Printed Corrugated Boxes, Carton Boxes, and Packaging Boxes. Its unique offerings lie in its ability to provide customized and innovative packaging solutions tailored to meet specific customer needs, ensuring high-quality and sustainable packaging options for various industries.

-

Ecoware manufactures biodegradable tableware and dinnerware from bagasse/sugarcane waste pulp. They are centered around providing eco-friendly and disposable products that decompose in just 45 days in an open compost yard, emphasizing sustainability and environmental responsibility in the packaging industry.

Key India Molded Pulp Packaging Companies:

- Huhtamaki PPL Limited

- Genpak

- Bamboo India

- Pratt Industries, Inc.

- Ecosure Pulp molding Technologies Limited

- Vijay Industries

- Bhambra International

- Good Earth Packaging

- JK Paper

- Cirkla

- GreenLand Enterprises

- Neeyog

- Shree Kias Pack

- Pulp2pack

- Pakka Limited

- Ecoware

- Discover India Packaging

- Dinearth Eco Friendly Tableware

Recent Developments

-

In January 2024, JK Paper and AIC-JKLU collaborated to launch the 'Sustainable Biomaterial Based Solutions-Accelerator Program.' This program aims to support startups in developing innovative solutions for the paper industry's challenges.

-

In September 2023, Cirkla, a sustainable packaging company, secured USD 3 million in pre-seed funding in September 2023. The funding round was led by Matrix Partners India and Stellaris Venture Partners, supporting Cirkla's expansion efforts and technological advancements.

India Molded Pulp Packaging Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 472.3 million

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product type, molded type, end-use

Country scope

India

Key companies profiled

Huhtamaki PPL Limited; Bamboo India; Pratt Industries, Inc.; Genpak; Ecosure Pulp molding Technologies Limited; Vijay Industries; Bhambra International; Good Earth Packaging; JK Paper; Cirkla,Inc.; Neeyog; Shree Kias Pack; Pulp2pack; Pakka Limited; Ecoware; Discover India Packaging; Dinearth Eco Friendly Tableware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Molded Pulp Packaging Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India molded pulp packaging market report based on source, molded type, product type, and end-use:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood Pulp

-

Non-wood Pulp

-

-

Molded Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The India molded pulp packaging market size was valued at USD 251.9 million in 2023.

b. Food Service applications accounted for the highest share of over 55% in the India molded pulp packaging market in 2023. This is due to the increasing demand for molded pulp packaging products for various food applications such as processed food, ready meals, and foodservice cutlery products.

b. Wood pulp dominated the market and accounted for a share of over 85% in 2023, owing to its abundance, renewability, and eco-friendly nature. The Indian molded pulp packaging market is experiencing significant growth driven by increasing environmental concerns and stringent regulations regarding plastic usage.

b. Some of the key players in the India molded pulp packaging market are SHREE KIAS PACK, Neeyog Packaging, Pulp2pack, SR Pulp, Maspack Limited, Rajdhani Polypacks, Yash Pakka Limited, Ecoware, Discover India Packaging, Dinearth Eco-Friendly Tableware, Prosper Universal Private Limited, SM Group, KSP Fibre Products PVT. LTD.

b. Increasing demand for sustainable packaging solutions on account of rising consumer concerns towards environment and health coupled with initiatives by the Indian government to limit use of single use plastics is expected to have a positive impact on the industry growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.