- Home

- »

- Pharmaceuticals

- »

-

India Vaccine Market Size & Share, Industry Report, 2033GVR Report cover

![India Vaccine Market Size, Share & Trends Report]()

India Vaccine Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Viral Vaccines, Bacterial Vaccines, Cancer Vaccines), By Type, By Route Of Administration (Oral, Parenteral, Nasal), By Age Group, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-742-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

India Vaccine Market Size & Trends

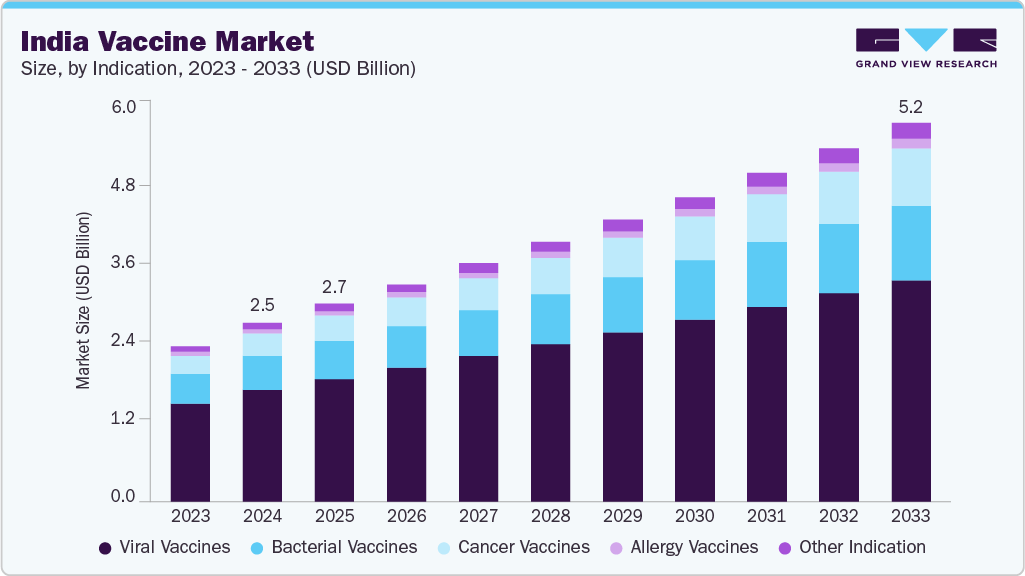

The India vaccine market was estimated at USD 2.45 billion in 2024 and is projected to reach USD 5.20 billion by 2033, growing at a CAGR of 8.50% from 2025 to 2033. This growth is driven by a high burden of infectious diseases, including tuberculosis, hepatitis, pneumonia, and influenza, highlighting the need for effective vaccination programs. For instance, in June 2025, the World Health Organization reported that approximately 29.8 million individuals in India were living with HBV infection in 2022, which was the third leading cause of cirrhosis and accounted for around 98,305 deaths.

Chronic HBV increased the risk of hepatocellular carcinoma, with 25% developing HCC, and reactivation triggering acute-on-chronic liver failure. Rising awareness and new infectious threats have increased vaccine demand, supporting market expansion.

Advancements in vaccine technology and manufacturing have fueled market expansion in India. Indigenous vaccines such as HPV and COVID-19 have improved self-reliance in production. In June 2025, the Serum Institute of India (SII) became the first vaccine manufacturer worldwide to submit a Prequalification Dossier to the WHO in the electronic Common Technical Document format via the ePQS portal, marking a step forward in regulatory innovation. In 2023, India launched its first indigenous HPV vaccine, Cervavac, developed through collaboration between SII, the Department of Biotechnology, BIRAC, and the Bill & Melinda Gates Foundation. Modern manufacturing methods, facility expansions, and global partnerships have boosted domestic and international supply. These advances, supported by cost-effective production, strengthen India’s leading global vaccine producer position.

The growth of healthcare infrastructure and better access to medical services have supported the expansion of the vaccine market in India. New facilities in underserved regions have improved vaccination delivery. For instance, in March 2025, the Health and Family Welfare Department, Government of Tamil Nadu reported that Tamil Nadu extended immunization services to 4,848 rural health and wellness centres and 500 urban centres.

Daily vaccination sessions were held in hospitals and health centres, while village health nurses conducted outreach at anganwadis and public locations every Wednesday. Free, high-quality vaccines were made more accessible, reducing out-of-pocket costs for families. Secure cold-chain management ensured safe redistribution of unused doses. Alongside mobile units, digital tracking, and strong distribution networks, these efforts have increased vaccine coverage and driven long-term market growth.

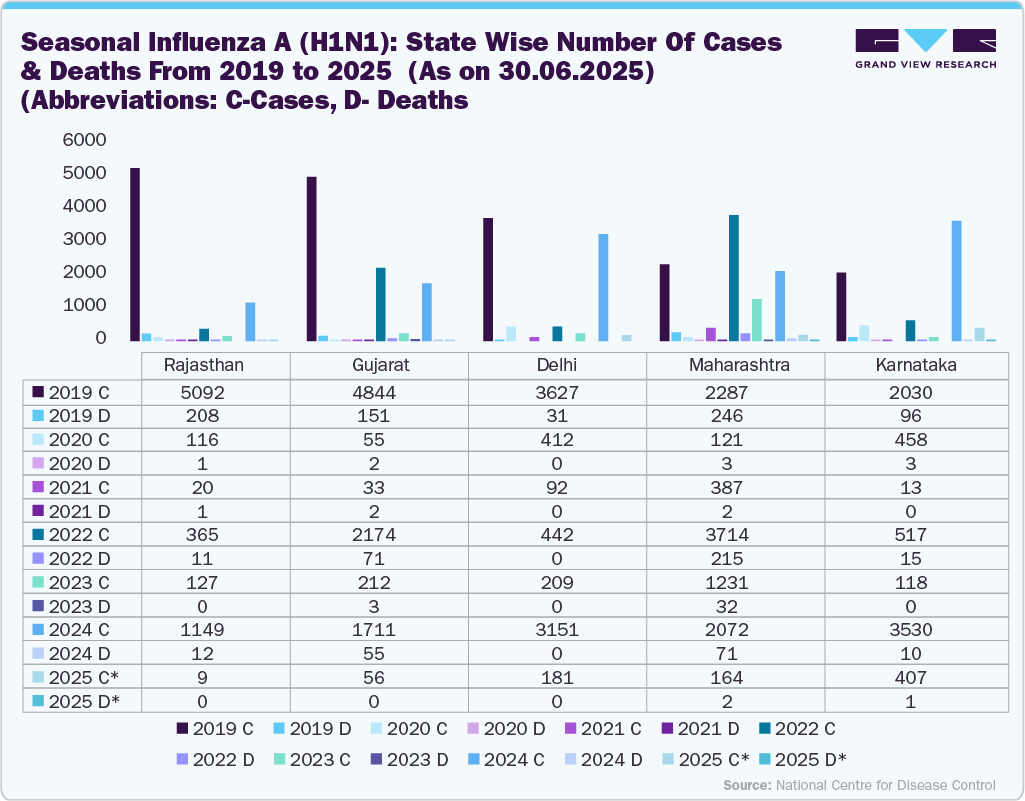

The resurgence of seasonal influenza A (H1N1) in India, with over 20,000 reported cases and 347 deaths as of June 2025, underscores a pressing public health challenge. High-risk groups, including the elderly, children, and individuals with chronic conditions, have been particularly affected, leading to increased hospitalizations and outpatient visits. Health authorities are emphasizing robust vaccination strategies, including potential integration of influenza vaccines into the national immunization schedule. Strengthened surveillance and awareness campaigns are essential to reduce transmission, protect vulnerable populations, and enhance healthcare preparedness.

Currently, influenza vaccination coverage in India is only around 1.5%, revealing a significant gap in preventive care. This scenario presents a substantial growth opportunity for the India vaccine industry, driving manufacturers to scale production and distribution. Targeted vaccination drives and public awareness campaigns can improve uptake, while investment in new formulations and combination vaccines could enhance effectiveness. Rising demand will stimulate competition, innovation, and pricing strategies, ultimately strengthening the vaccine ecosystem and supporting public health outcomes in the country.

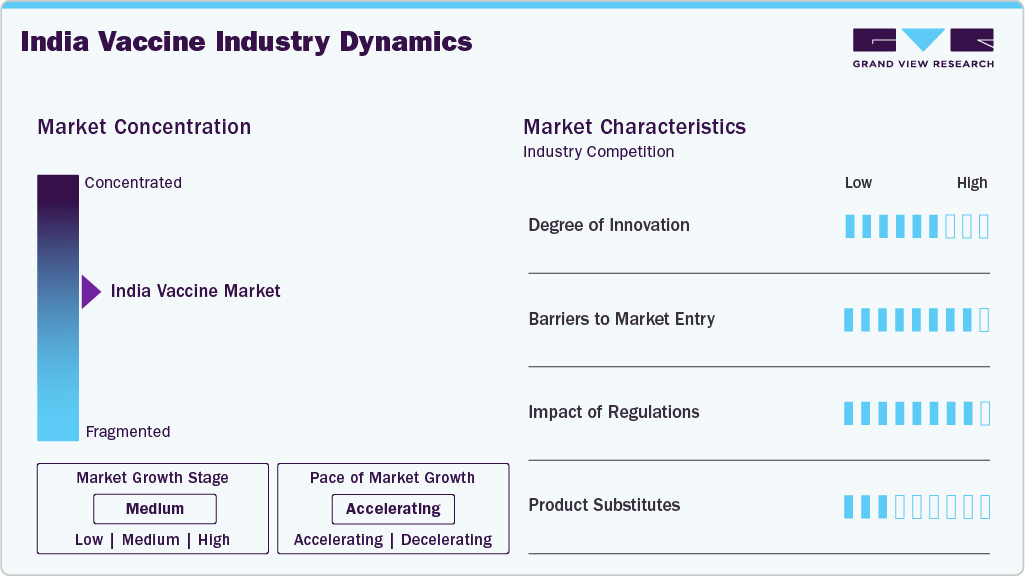

Market Concentration & Characteristics

The degree of innovation in India’s vaccine market is high, driven by the development of mRNA vaccines, novel viral vector platforms, and recombinant technologies. Moderna, BioNTech, and Serum Institute of India have introduced advanced vaccines for COVID-19, influenza, and HPV. Indigenous R&D efforts focus on improving stability, efficacy, and multi-dose combinations for pediatric and adult populations. Continuous innovation in the route of administration, including nasal and oral vaccines, is enhancing patient compliance. These advancements allow faster adaptation to emerging infectious diseases, increasing market responsiveness.

Barriers to market entry are significant due to high capital requirements, sophisticated manufacturing infrastructure, and stringent quality standards. Establishing large-scale vaccine production facilities requires substantial investment in GMP-compliant plants and cold-chain logistics. Regulatory approvals for novel vaccines demand rigorous clinical trials and extensive documentation. Partnerships or licensing agreements are often needed for access to proprietary technologies. In addition, achieving nationwide distribution and brand recognition poses challenges for new entrants targeting pediatric and adult vaccines.

The impact of regulations on the vaccine market in India is profound, with the Central Drugs Standard Control Organization (CDSCO) enforcing rigorous safety, efficacy, and quality standards. Regulatory frameworks dictate clinical trial protocols, licensing, and post-market surveillance. Compliance ensures product safety and international acceptance, enabling exports to Africa, Latin America, and Southeast Asia. Approval timelines affect the launch speed for new vaccines, especially advanced platforms like mRNA or viral vector vaccines. Regulatory support for accelerated approvals during pandemics has enhanced responsiveness to urgent public health needs.

Product substitutes exist but are limited to most vaccine segments, particularly viral and pediatric vaccines. For influenza, alternatives include prophylactic antivirals, while for bacterial diseases, antibiotic treatment is possible but less preventive. Cancer vaccines face minimal direct substitutes, making prophylactic vaccines crucial. Subunit and conjugate vaccines compete with live attenuated or mRNA options within the same disease indication. Patient preference, route of administration, and age-specific recommendations influence substitution patterns in pediatric and adult populations.

Indication Insights

The viral vaccines segment dominated the market with the largest revenue share of 62.46% in 2024, driven by the high prevalence of infectious diseases such as influenza, hepatitis, and measles. Widespread immunization programs for pediatric and adult groups boosted demand for MMR, rotavirus, and influenza vaccines. For instance, in June 2024, the World Health Organization reported a human case of avian influenza A(H9N2) in a four-year-old child from West Bengal, highlighting ongoing viral threats and the critical role of vaccination. Companies like Serum Institute of India and GSK PLC supported large-scale production and distribution, strengthening availability. Rising awareness, adoption of recombinant and mRNA vaccines, and growing export demand further reinforced market leadership, driven by disease burden and innovation.

The cancer vaccines segment is projected to grow at the fastest CAGR of 10.85% over the forecast period, due to the rising incidence of cervical, liver, and other cancer types in India. Increased focus on prophylactic and therapeutic vaccines for HPV and other cancers is stimulating market demand. Merck & Co. and Moderna are advancing R&D for next-generation cancer vaccines. For instance, in April 2024, the Serum Institute of India announced a collaboration with Univercells to bring affordable personalized oncology treatments to the masses. The partnership focused on combining mRNA with recombinant BCG (VPM1002) to create point-of-care cancer treatments, with Univercells’ technology reducing production costs by up to 90% and supporting localized manufacturing. Expanded clinical trials and successful regulatory approvals have accelerated product availability. Adoption of personalized vaccine strategies has enhanced treatment outcomes. Growing awareness among healthcare providers and patients regarding preventive cancer vaccination contributes to adoption. Investment in manufacturing and cold-chain infrastructure ensures adequate supply for domestic and international markets.

Type Insights

The subunit vaccines segment dominated the market with the largest revenue share of 30.20% in 2024, driven by its safety profile and efficacy across pediatric and adult indications. Vaccines such as hepatitis B, HPV, and influenza rely on subunit technology, which reduces adverse reactions while maintaining immune response. Indian manufacturers, including Serum Institute of India and Bharat Biotech, have scaled production capacities to meet growing demand. Advanced formulation techniques and multi-dose presentations improved patient compliance. Global demand for subunit vaccines, especially in emerging markets, has expanded export opportunities. For instance, in July 2025, MedPath reported that Pfizer’s Respiratory Syncytial Virus (RSV) Prefusion F Subunit Vaccine (RSVPref) had received approval from India's CDSCO expert panel to conduct a Phase III clinical trial in adults after review at the Subject Expert Committee meeting held on June 24, 2025. The segment’s reliability and broad application make it a leading choice for vaccine deployment.

The inactivated segment is projected to grow at the second fastest CAGR of 9.80% over the forecast period, driven by increasing adoption for influenza, hepatitis, and polio prevention. These vaccines offer firm safety profiles and are suitable for pediatric and adult populations. Companies such as CSL Ltd. and Sinovac Biotech have expanded production to meet rising domestic and export demand. In February 2025, Zydus Lifesciences launched VaxiFlu-4, India’s first quadrivalent inactivated influenza vaccine for the 2025 Southern Hemisphere flu season, protecting against four WHO-recommended strains. Quality was ensured by clearance from India’s Central Drug Laboratory and development at Zydus’s Vaccine Technology Centre. Improved stability, multi-dose formats, and growing awareness have enhanced adoption across urban and rural populations, supporting sustained segment growth.

Route of Administration Insights

The oral segment dominated the market with the largest revenue share of 95.08% in 2024, fueled by ease of administration and high patient compliance. Oral vaccines such as polio and rotavirus are widely used in pediatric programs, and manufacturers like Serum Institute of India and Bharat Biotech have optimized formulations for stability and mass distribution. For instance, in August 2024, The Hindu reported that Bharat Biotech launched Hillchol (BBV131), a single-strain oral cholera vaccine developed under license from Hilleman Laboratories and funded by Merck (USA) and Wellcome Trust (UK). Suitable for individuals over one year, the vaccine is administered on Day 0 and Day 14, produced at Hyderabad and Bhubaneswar facilities with a capacity of 200 million doses. Oral delivery reduces the need for trained personnel, increases rural accessibility, and improves acceptance, sustaining market dominance.

The parenteral segment is projected to grow at the second-fastest CAGR of 7.98% over the forecast period, driven by vaccines requiring higher immunogenicity and targeted immune response. Vaccines like HPV, influenza, and COVID-19 rely on intramuscular or subcutaneous delivery to enhance efficacy. Companies like Moderna, BioNTech, and GSK PLC are expanding parenteral vaccine offerings using advanced formulations. Parenteral administration allows combination vaccines, reducing the number of doses required. Hospitals and retail clinics increasingly prefer parenteral vaccines for adults and high-risk populations. Enhanced clinical trial data supporting safety and effectiveness are improving acceptance. Continuous expansion of production and distribution capacity promotes growth in this segment.

Age Group Insights

The adult age group segment dominated the market with the largest revenue share of 57.40% in 2024, driven by the rising prevalence of influenza, HPV, shingles, and COVID-19 infections. Increased awareness of preventive healthcare and adult vaccination campaigns has boosted adoption. For instance, in November 2024, the Indian Journal of Medical Research highlighted gaps in adult immunization. HPV prevalence among cervical cancer patients ranged from 88% to 98% in Andhra Pradesh, Odisha, and Delhi. Influenza vaccine uptake among adults over 45 was ≤2%, and hepatitis B coverage among healthcare workers in Delhi and Mumbai was 55–64%. Companies such as GSK, Merck, and AstraZeneca focus on adult-targeted vaccines. Advanced platforms, improved cold-chain infrastructure, and higher affordability support sustained market growth.

The pediatric age group segment is projected to grow at the second-fastest CAGR of 7.78% over the forecast period, driven by rising government and private healthcare initiatives to prevent childhood infections. Vaccines for MMR, rotavirus, pneumococcal diseases, and hepatitis are in high demand. Companies such as Serum Institute of India, Bharat Biotech, and CSL Ltd. focus on pediatric vaccines with multi-dose and combination options. Awareness among parents regarding immunization benefits has increased adoption rates. Improved delivery mechanisms, such as oral and parenteral vaccines, facilitate easier vaccination for children. Expanded outreach programs in semi-urban and rural regions have widened coverage. Continuous innovation in pediatric vaccine formulations supports sustained growth.

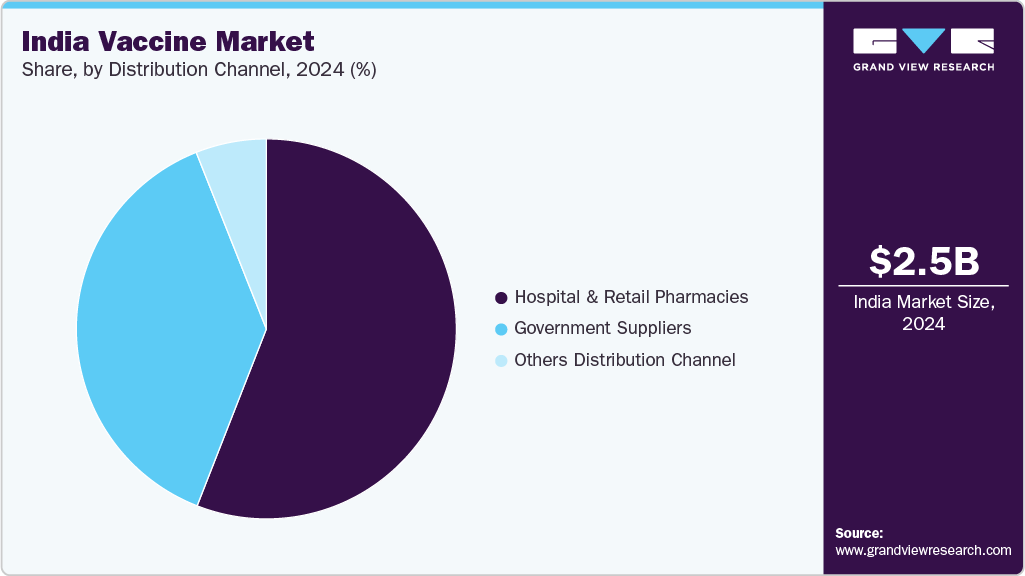

Distribution Channel Insights

The hospital & retail pharmacies segment dominated the market with the largest revenue share of 55.94% in 2024, driven by accessibility, convenience, and availability of a wide range of vaccines. Urban hospitals and pharmacy chains offer adult and pediatric vaccines, ensuring high coverage. Companies such as Serum Institute of India, GSK PLC, and Merck & Co. maintain strong partnerships with hospitals and retail chains for efficient distribution. Cold-chain management and inventory systems ensure vaccine potency and timely availability. Patient preference for established hospitals and pharmacies enhances uptake. Specialized clinics and immunization centers in metro and tier-1 cities further strengthen market dominance. Widespread awareness campaigns by hospitals and pharmacies improve adoption rates.

The government suppliers segment is projected to grow at a CAGR of 7.29% over the forecast period, driven by large-scale procurement for immunization programs targeting rural and semi-urban populations. Bulk supply agreements with Indian manufacturers such as Serum Institute of India, Bharat Biotech, and CSL Ltd ensure sufficient availability. Strategic allocation of vaccines to cover pediatric and adult populations enhances market reach. Efficient logistics and cold-chain infrastructure allow distribution to remote areas. Partnerships with international health organizations expand access to specialized vaccines. Increased adoption of multi-dose and combination vaccines reduces overall costs. Growing vaccination campaigns for influenza, HPV, and polio support sustained growth in this segment.

Key India Vaccine Company Insights

Moderna Inc., BioNTech SE, and CSL Ltd. are major players in the India market, utilizing mRNA and recombinant technologies for pediatric and adult vaccines. Serum Institute of India Pvt. Ltd. leads in viral and pediatric vaccines, including HPV, MMR, and influenza, ensuring widespread domestic and international distribution. GSK PLC and Merck & Co. Inc. focus on specialized vaccines such as shingles, RSV, and cancer, driving innovation in immunization programs. Sinovac Biotech Ltd. and AstraZeneca PLC support public health initiatives through strategic collaborations, particularly in COVID-19 and influenza vaccines. Companies invest in manufacturing expansion, cold-chain infrastructure, and R&D for novel platforms. Competitive rivalry is high, fueled by innovation, robust pipelines, and global partnerships, enhancing access across hospitals, pharmacies, and government channels.

Key India Vaccine Companies:

- Moderna Inc

- BioNTech SE ADR

- CSL Ltd

- Sinovac Biotech Ltd

- AstraZeneca PLC

- Serum Institute of India Pvt. Ltd.

- GSK PLC.

- Merck & Co Inc

Recent Developments

-

In April 2025, Takeda’s dengue vaccine, TAK-003 (Qdenga), is expected to launch in India by 2026 after regulatory approval. The tetravalent live-attenuated vaccine, WHO-prequalified in May 2024, showed 64.2% efficacy in previously exposed individuals and 53.5% in dengue-naive cases, with 84.1% protection against hospitalization.

-

In December 2024, Serum Institute of India (SII) entered into a license and manufacturing agreement with Bavarian Nordic A/S for the MVA-BN® mpox vaccine. The collaboration involved transferring the manufacturing process to SII, enabling vaccine supply in India and contract manufacturing for Bavarian Nordic upon regulatory approval

-

In April 2023, GSK India introduced Shingrix, a recombinant, non-live vaccine designed to protect adults 50 and older from shingles and post-herpetic neuralgia. Research indicates that more than 90% of people in India are exposed to the varicella zoster virus by the age of 40, leaving around 260 million adults at risk of developing the disease.

India Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.71 billion

Revenue forecast in 2033

USD 5.20 billion

Growth rate

CAGR of 8.50% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, type, route of administration, age group, distribution channel

Key companies profiled

Moderna Inc.; BioNTech SE ADR; CSL Ltd; Sinovac Biotech Ltd; AstraZeneca PLC; Serum Institute of India Pvt. Ltd.; GSK PLC; Merck & Co. Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Vaccine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the India vaccine market report based on indication, type, route of administration, age group, and distribution channel:

-

Indication Outlook (Revenue, USD Billion, 2021 - 2033)

-

Viral Vaccines

-

Hepatitis

-

Pediatric (Children)

-

Adult

-

-

Influenza

-

Pediatric (Children)

-

Adult

-

-

HPV

-

Pediatric (Children)

-

Adult

-

-

MMR

-

Pediatric (Children)

-

Adult

-

-

Rotavirus

-

Pediatric (Children)

-

Adult

-

-

Herpes Zoster

-

Pediatric (Children)

-

Adult

-

-

Japanese Encephalitis

-

Pediatric (Children)

-

Adult

-

-

RSV

-

Pediatric (Children)

-

Adult

-

-

Others

-

Pediatric (Children)

-

Adult

-

-

-

Bacterial Vaccines

-

Meningococcal Diseases

-

Pediatric (Children)

-

Adult

-

-

Pneumococcal diseases

-

DPT

-

Others Bacterial Vaccines

-

-

Cancer Vaccines

-

Pediatric (Children)

-

Adult

-

-

Allergy Vaccines

-

Pediatric (Children)

-

Adult

-

-

Other Indication

-

Pediatric (Children)

-

Adult

-

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Subunit Vaccines

-

Recombinant Vaccines

-

Conjugate Vaccines

-

Toxoid Vaccines

-

-

Inactivated

-

Live Attenuated

-

mRNA Vaccines

-

Viral Vector Vaccines

-

-

Route of Administration Outlook (Revenue, USD Billion, 2021 - 2033)

-

Oral

-

Parenteral

-

Nasal

-

-

Age Group Outlook (Revenue, USD Billion, 2021 - 2033)

-

Pediatric Age Group

-

Adult Age Group

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospital & Retail Pharmacies

-

Government Suppliers

-

Others Distribution Channel

-

Frequently Asked Questions About This Report

b. The India vaccine market size was estimated at USD 2.45 billion in 2024 and is expected to reach USD 2.71 billion in 2025.

b. The India vaccine market is projected to grow at a CAGR of 8.50% from 2025 to 2033 to reach USD 5.20 million by 2033.

b. Based on indication, viral vaccines segment dominated the market with the largest revenue share of 62.46% in 2024, driven by the high prevalence of infectious diseases such as influenza, hepatitis, and measles. Widespread immunization programs for pediatric and adult groups boosted demand for MMR, rotavirus, and influenza vaccines.

b. Key players in the India vaccine market are Moderna Inc., BioNTech SE, and CSL Ltd utilizing mRNA and recombinant technologies for pediatric and adult vaccines. Serum Institute of India Pvt. Ltd. leads in viral and pediatric vaccines, including HPV, MMR, and influenza, ensuring widespread domestic and international distribution.

b. Key factors driving the growth of the market include government initiatives, increased healthcare awareness, rising prevalence of infectious diseases, growing healthcare infrastructure, strong domestic production capabilities, and expanding international demand for vaccines, especially in emerging markets. Additionally, regulatory support and private sector investments play significant roles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.