- Home

- »

- Sensors & Controls

- »

-

Industrial Automation And Control Systems Market, 2033GVR Report cover

![Industrial Automation And Control Systems Market Size, Share & Trends Report]()

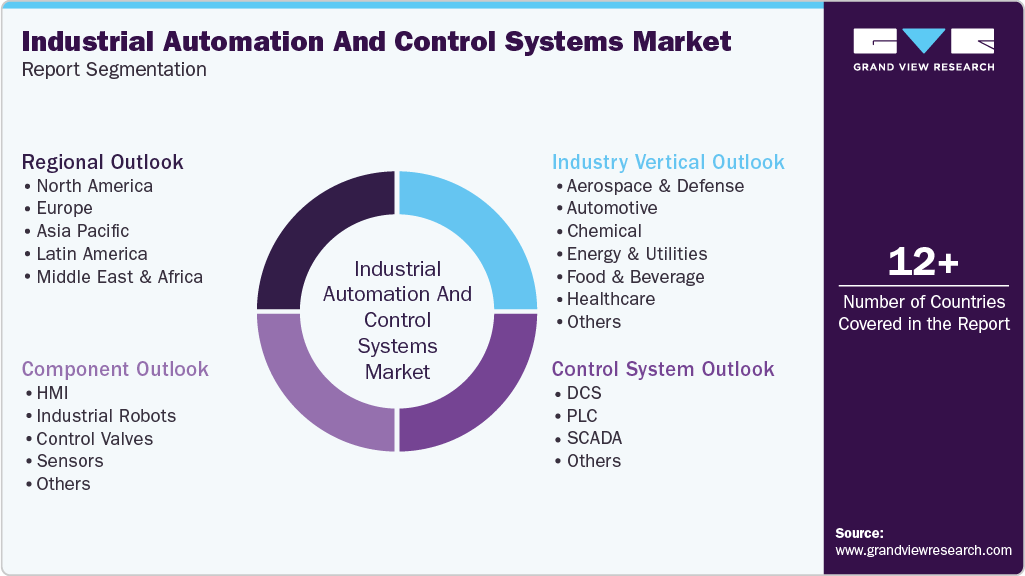

Industrial Automation And Control Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (HMI, Industrial Robots, Control Valves, Sensors), By Control System (DCS, PLC, SCADA), By Industry Vertical, By Region And Segment Forecasts

- Report ID: GVR-4-68038-130-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Automation And Control Systems Market Summary

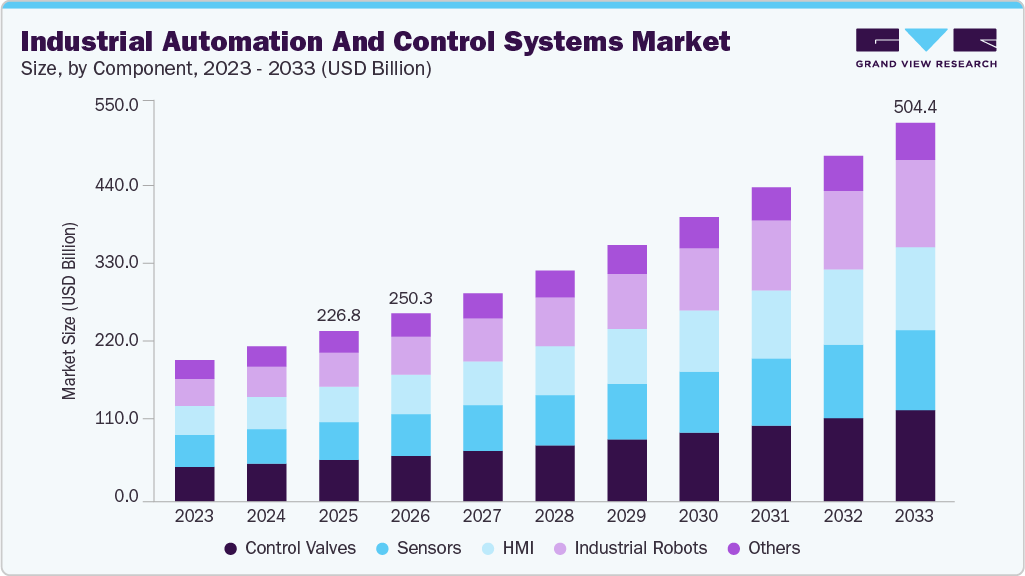

The global industrial automation and control systems market size was estimated at USD 226.76 billion in 2025 and is projected to reach USD 504.38 billion by 2033, growing at a CAGR of 10.5% from 2026 to 2033. The market growth is driven by the rising demand for efficiency, precision, and safety across manufacturing industries.

Key Market Trends & Insights

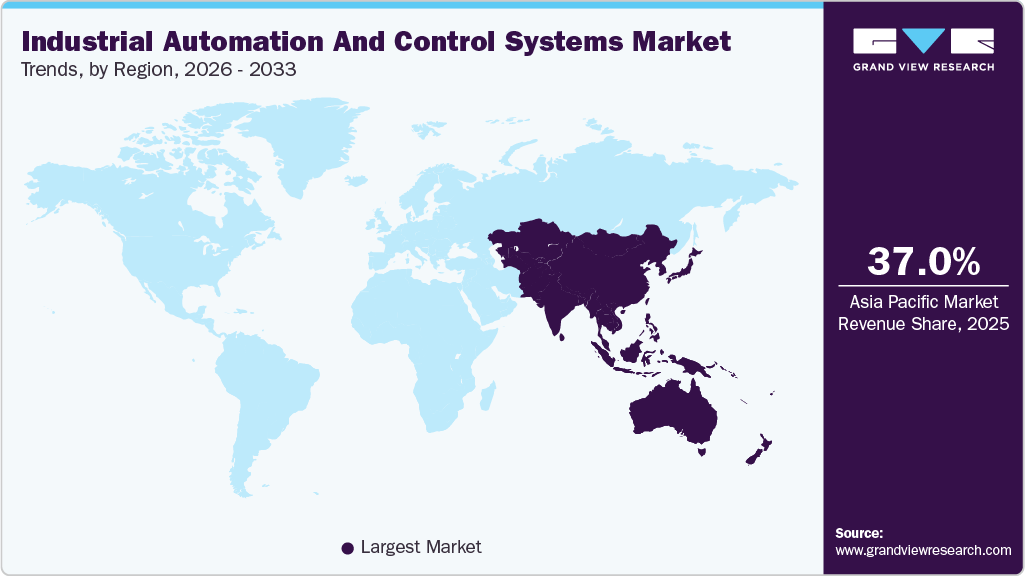

- The industrial automation and control systems market in Asia Pacific accounted for the largest revenue share of over 37% in 2025.

- The China industrial automation and control systems market dominated the market with a share of over 34% in 2025.

- Based on component, the control valves segment is expected to grow at the highest CAGR of over 24% in 2025.

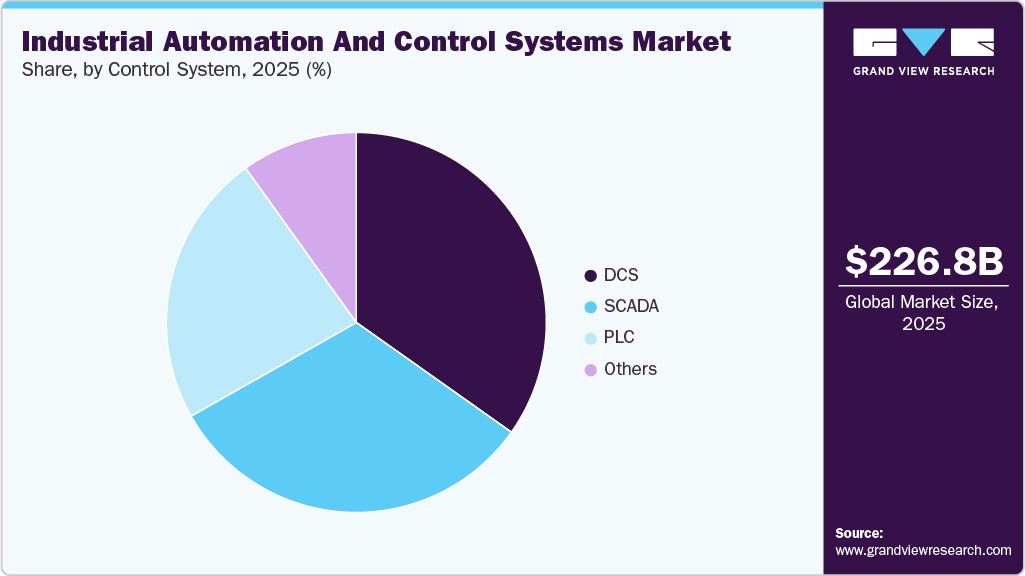

- Based on control system, the distributed control system (DCS) segment accounted for the largest revenue share of over 34% in 2025.

- Based on industry vertical, the manufacturing segment accounted for the highest market share of over 17% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 226.76 Billion

- 2033 Projected Market Size: USD 504.38 Billion

- CAGR (2026-2033): 10.5%

- Asia Pacific: Largest market in 2025

Technological advancements in artificial intelligence, machine learning, industrial IoT, and edge computing enable real-time process optimization and intelligent decision-making, further accelerating the growth of the industrial automation and control systems industry. The increasing adoption of automation solutions such as robotics, artificial intelligence, and IoT-based control systems to reduce human error, enhance productivity, and improve operational efficiency is significantly driving the market growth. The growing emphasis on digital transformation and Industry 4.0 implementation, along with rising labor costs and the global shortage of skilled workers, is accelerating enterprise investments in automation technologies, thereby contributing to the sustained expansion of the industrial automation and control systems market.

Government initiatives worldwide are significant drivers fueling the growth of the industrial automation and control systems industry. Initiatives such as India’s Make in India program, which promotes industrial modernization and smart manufacturing, and Europe’s Green Deal, which incentivizes automation solutions that reduce energy consumption and carbon emissions, are encouraging manufacturers to upgrade legacy systems. Government support in the form of tax incentives, capital subsidies, and research and development grants lowers the financial barriers to automation investments, thereby propelling the expansion of the industrial automation and control systems industry.

In addition, the rapid integration of artificial intelligence (AI) and machine learning into automation platforms is creating substantial growth opportunities for the industrial automation and control systems market. These technologies enable advanced process analytics, predictive maintenance, adaptive control, and real-time decision support, which are increasingly sought by industries aiming to improve asset utilization and reduce unplanned downtime. This trend is driving demand for customized, modular, and scalable control systems, further strengthening market growth.

Moreover, leading manufacturers are actively strengthening their market position by investing in advanced production technologies and expanding their automation solution portfolios. Companies are forming strategic partnerships with software developers and cloud service providers to integrate AI, IoT, edge analytics, and cloud-based monitoring into industrial control architectures, delivering higher value and performance to end users. The emphasis on energy-efficient operations, flexible production lines, and enhanced workplace safety is further increasing the attractiveness of modern automation systems, thereby supporting sustained market expansion.

Component Insights

The control valves segment accounted for the largest market share of over 24% in 2025, driven by increasing demand for process optimization, stringent regulations on operational safety, and the widespread adoption of Industry 4.0. Advancements in smart valve technologies, including integration with sensors and real-time monitoring systems, enable predictive maintenance and enhance system reliability. These factors reflect a continued effort to improve energy efficiency and real-time diagnostics in the control valve segment.

The industrial robots segment is expected to register the fastest CAGR of over 12% from 2026 to 2033. This growth is attributed to the increased adoption of smart manufacturing technologies, rising labor costs, and the demand for high-precision and consistent production output. The integration of AI, IoT, and machine vision into robotic systems has enhanced their flexibility, real-time decision-making, and productivity across automotive, electronics, and pharmaceutical sectors, thereby driving further growth in this segment.

Control System Insights

The DCS segment accounted for the largest market share in 2025, driven by the rising focus on reducing unplanned downtime through predictive maintenance. The energy transition towards renewable and sustainable power sources has also intensified demand for advanced distributed control systems capable of managing complex, decentralized operations. The expansion of smart grid infrastructure further supports DCS adoption in the industrial automation and control systems industry.

The SCADA segment is expected to witness the fastest CAGR from 2026 to 2033. This growth is primarily driven by the increasing demand for real-time process visualization, remote asset monitoring, and centralized control across critical infrastructure sectors. The integration of SCADA with cloud platforms and edge computing is enhancing data analytics and decision-making capabilities, while rising cybersecurity investments are driving the deployment of secure SCADA architectures. Government initiatives supporting industrial digitalization and the modernization of aging infrastructure continue to fuel market expansion.

Industry Vertical Insights

The manufacturing segment accounted for the largest market share in 2025, driven by the increasing adoption of smart manufacturing practices and the integration of Industrial IoT technologies. Manufacturers are increasingly deploying advanced automation systems to enhance productivity, reduce operational costs, and ensure consistent product quality. The growing emphasis on predictive maintenance, remote monitoring, and robotics integration is transforming traditional production environments into fully connected, agile systems. These factors reflect the segments' accelerating shift toward intelligent automation in the market.

The healthcare segment is expected to register the fastest CAGR from 2026 to 2033, owing to the increasing adoption of automation technologies in medical manufacturing and hospital operations to enhance precision, reduce human error, and improve operational efficiency. The rising demand for robotics in surgical procedures, smart diagnostic systems, and automated pharmaceutical production lines is significantly accelerating this trend. The technological shift underscores the critical role of industrial automation in transforming healthcare delivery by enabling scalability, reliability, and cost-efficiency across medical applications.

Regional Insights

North America industrial automation and control systems market accounted for a significant market share of over 28% in 2025, fueled by accelerating Industry 4.0 adoption and a strategic push toward smart manufacturing to enhance productivity and supply chain resilience. Rising labor costs and workforce shortages are driving robust demand for collaborative robotics and AI-driven predictive maintenance solutions. The region remains a global innovation hub, with edge computing and autonomous systems poised to redefine next-generation industrial automation.

U.S. Industrial Automation And Control Systems Market Trends

The U.S. industrial automation and control systems market is expected to grow at the highest CAGR of over 10% from 2026 to 2033, driven by a strong emphasis on digital transformation, advanced manufacturing, and reshoring of production. The U.S. focus on cybersecurity and data sovereignty is influencing the development of secure, scalable industrial automation ecosystems that can support long-term operational agility in the industrial automation and control systems market.

Europe Industrial Automation And Control Systems Market Trends

Europe industrial automation and control systems is expected to grow at a CAGR of over 6% from 2026 to 2033. In Europe, the industrial automation and control systems market is driven by accelerated adoption of smart manufacturing across key sectors such as automotive, energy, and pharmaceuticals. The region’s focus on sustainability and energy efficiency is prompting widespread integration of automation to reduce emissions, optimize resource use, and comply with stringent EU environmental regulations.

The UK industrial automation and control systems market is expected to grow at a significant rate in the coming years. This expansion is supported by rapid adoption of smart manufacturing and large-scale investments in Industry 4.0 initiatives. Rising labor shortages in manufacturing and logistics, coupled with increasing demand for real-time production monitoring and cybersecurity-enabled industrial networks, are driving enterprises to upgrade legacy systems with intelligent automation solutions, thereby supporting sustained market growth in the country.

The Germany industrial automation and control systems market is rapidly expanding, driven by the country’s leadership in industrial engineering, automotive manufacturing, and smart factory adoption. Germany’s strong focus on energy efficiency, carbon neutrality targets, and advanced manufacturing standards is encouraging manufacturers to implement digital control systems. The growing integration of robotics and digital twin technologies is further increasing demand for high-precision automation, reinforcing Germany’s position as a key growth hub in Europe.

Asia Pacific Industrial Automation And Control Systems Market Trends

Asia-Pacific industrial automation and control systems dominated the market with a share of over 37% in 2025, fueled by its rapid industrialization, expanding manufacturing capacity, and strong government support. Increasing foreign direct investment, the growth of electronics and automotive production hubs, and rising adoption of cloud-connected industrial platforms are fueling regional demand. National Digitalization strategies and infrastructure modernization programs are encouraging enterprises to deploy scalable automation architectures, positioning Asia-Pacific as the fastest-growing market for industrial automation and control systems.

The Japan industrial automation and control systems market is gaining momentum, driven by the strong demand for high-precision manufacturing, robotics integration, and advanced quality control systems. The aging workforce and persistent labor shortages are pushing manufacturers to adopt collaborative robots and autonomous production lines, strengthening long-term demand for sophisticated automation and control solutions.

The China industrial automation and control systems market is witnessing robust expansion, supported by large-scale investments in smart manufacturing, electronics production, and industrial digitalization. China’s rapid expansion of renewable energy capacity and smart grid infrastructure is increasing the need for advanced distributed control systems. These factors, combined with rising productivity targets, are driving widespread adoption of industrial automation technologies across the country.

Key Industrial Automation And Control Systems Company Insights

Some of the key players operating in the market are Siemens AG and Schneider Electric, among others.

-

Siemens AG is a global technology and engineering company providing a comprehensive portfolio of industrial automation and control systems, including programmable logic controllers (PLCs), distributed control systems (DCS), industrial software, digital twin platforms, and smart factory solutions. The company serves a wide range of industries such as automotive, electronics, chemicals, energy, and pharmaceuticals, making it a key player in the global industrial automation and control systems industry.

-

Schneider Electric is an energy management and industrial automation solutions provider, offering advanced control systems, industrial IoT platforms, SCADA software, and smart manufacturing technologies. The company focuses on integrating digital technologies, cloud connectivity, and AI-driven analytics to enable efficient, safe, and sustainable industrial operations. Schneider Electric caters to industries including manufacturing, utilities, oil & gas, data centers, and infrastructure, with a strong global presence and extensive partner ecosystem.

Yokogawa Electric Corporation and OMRON Corporation are some of the emerging participants in the industrial automation and control systems market.

-

Yokogawa Electric Corporation is a Japan-based industrial automation company specializing in distributed control systems, process automation solutions, industrial instrumentation, and advanced monitoring platforms. The company is increasingly expanding its digital transformation offerings by integrating AI-based analytics, industrial IoT, and lifecycle asset management solutions to support smart manufacturing. Yokogawa serves industries such as oil & gas, chemicals, power generation, pharmaceuticals, and water treatment, and is strengthening its global footprint in the industrial automation and control systems industry.

-

OMRON Corporation is an automation technology provider delivering industrial control equipment, sensors, robotics, machine vision systems, and factory automation platforms. The company is gaining traction through its strong focus on intelligent manufacturing, human-machine collaboration, and AI-enabled quality inspection systems. Its continued investment in robotics and smart factory technologies positions the company as an emerging and innovative player in the global industrial automation and control systems industry.

Key Industrial Automation And Control Systems Companies:

The following key companies have been profiled for this study on the industrial automation and control systems market.

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Yokogawa Electric Corporation

Recent Developments

-

In July 2025, Honeywell International, Inc. launched a suite of AI-driven technologies aimed at advancing industrial automation toward full autonomy. Their offerings include enhanced cybersecurity tools and an expanded Digital Prime platform designed to improve operational efficiency. These innovations support smarter, more secure industrial processes.

-

In July 2025, ABB Ltd. introduced the SACE Emax 3, an advanced air circuit breaker tailored for critical infrastructure. This product enhances energy resilience, predictive maintenance, and cybersecurity, especially in demanding environments such as AI data centers and hospitals. It addresses the growing need for reliable power protection and smart monitoring.

-

In July 2025, Emerson Electric Co. released an upgraded NI SystemLink platform for centralized test management. It improves remote configuration and collaboration, boosting efficiency in complex engineering test environments.

Industrial Automation And Control Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 250.34 billion

Revenue forecast in 2033

USD 504.38 billion

Growth rate

CAGR of 10.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, control system, industry vertical, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Honeywell International, Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Industrial Automation And Control Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the industrial automation and control systems market report based on component, control system, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

HMI

-

Industrial Robots

-

Control Valves

-

Sensors

-

Others

-

-

Control System Outlook (Revenue, USD Billion, 2021 - 2033)

-

DCS

-

PLC

-

SCADA

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2021 - 2033)

-

Aerospace & Defense

-

Automotive

-

Chemical

-

Energy & Utilities

-

Food & Beverage

-

Healthcare

-

Manufacturing

-

Mining & Metal

-

Oil & Gas

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global industrial automation & control systems market size was estimated at USD 226.76 billion in 2025 and is expected to reach 250.34 billion in 2026.

b. Some key players operating in the industrial automation & control systems market include ABB; Emerson Electric Co.; Honeywell International Inc.; Kawasaki Heavy Industries, Ltd.; Mitsubishi Electric Corporation; OMRON Corporation; Rockwell Automation, Inc.; Schneider Electric; Siemens; and Yokogawa Electric Corporation.

b. Key factors that are driving the industrial automation & control systems market growth include the rising demand for mass/bulk production in the manufacturing sector and increasing adoption of industrial robots for automation of production.

b. The global industrial automation & control systems market is expected to grow at a compound annual growth rate of 10.5% from 2026 to 2033 to reach USD 504.38 billion by 2033.

b. Asia Pacific dominated the industrial automation & control systems market with a share of over 39% in 2025. This is attributable to the increasing demand for better solutions to manage industrial plants in countries such as China, India, and South Korea; as well as the presence of the key market players and emerging companies in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.