- Home

- »

- Next Generation Technologies

- »

-

Industrial Ethernet Market Size, Share, Industry Report, 2033GVR Report cover

![Industrial Ethernet Market Size, Share & Trends Report]()

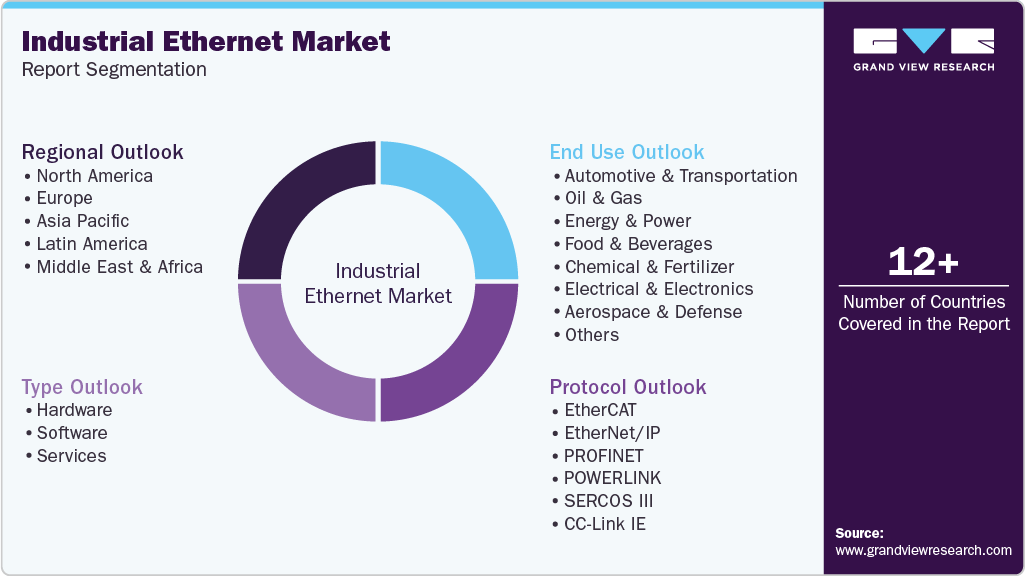

Industrial Ethernet Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Hardware, Software), By Protocol (EtherCAT, EtherNet/IP), By End-use (Oil & Gas, Energy & Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-408-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Ethernet Market Summary

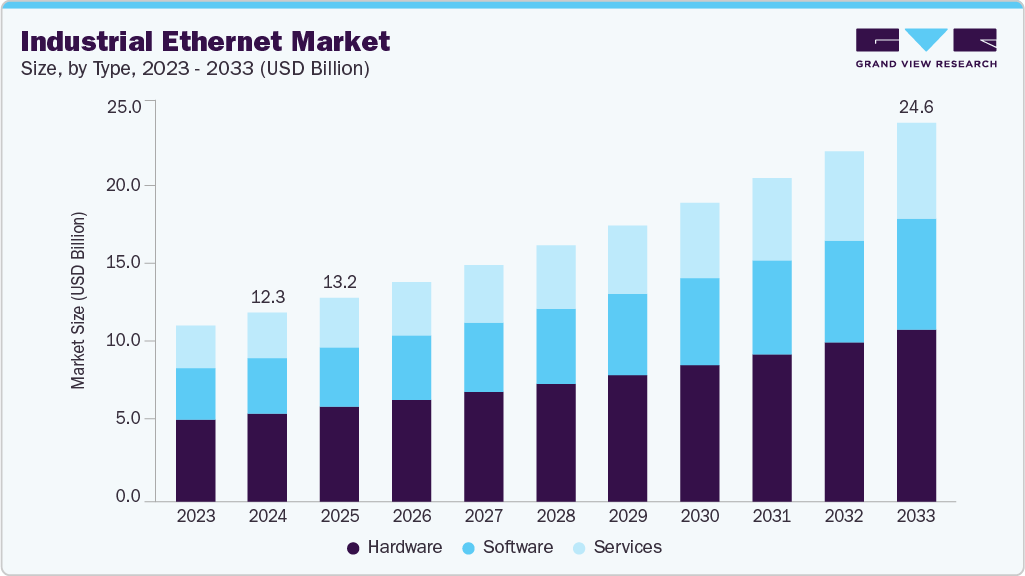

The global industrial ethernet market size was estimated at USD 12.30 billion in 2024 and is projected to reach USD 24.63 billion by 2033, growing at a CAGR of 8.1% from 2025 to 2033. The market is experiencing significant growth, driven by the increasing demand for robust and reliable networking solutions in industrial settings.

Key Market Trends & Insights

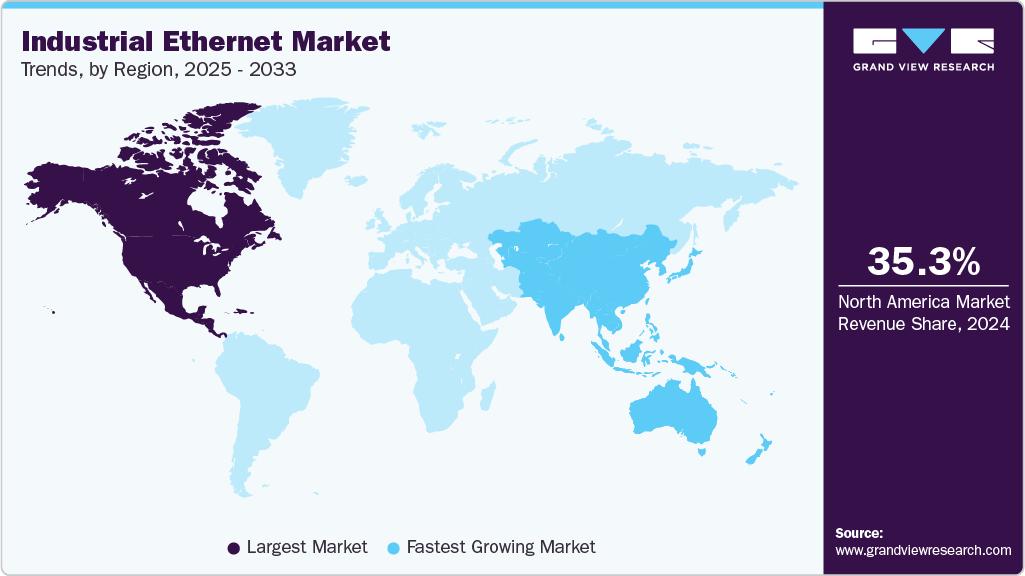

- North America dominated the global industrial ethernet market with the largest revenue share of 35.3% in 2024.

- The Industrial ethernet market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, hardware segment led the market, holding the largest revenue share of 46.8% in 2024.

- By protocol, PROFINET segment held the leading position in the market.

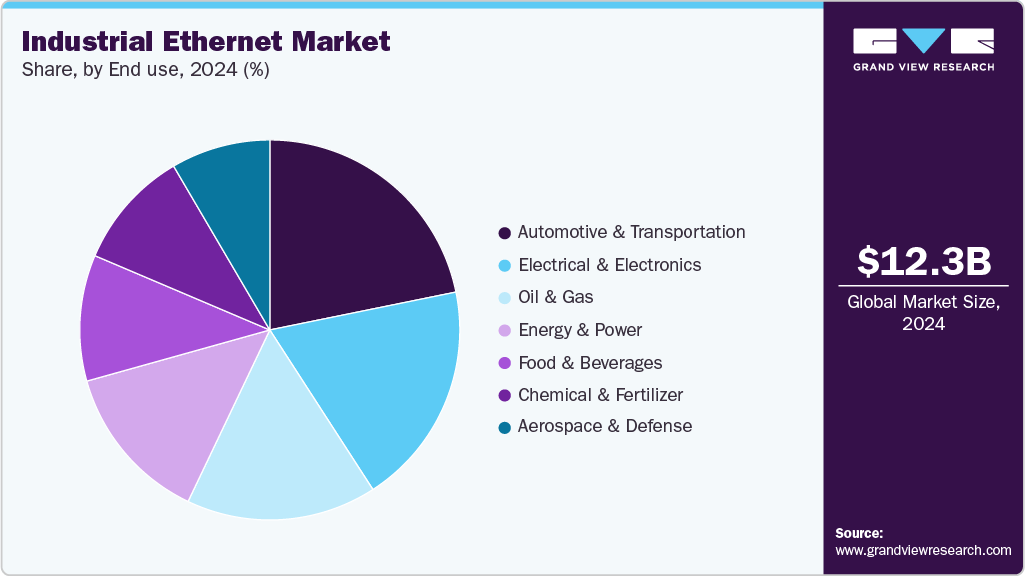

- By end use, automotive & transportation segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 12.30 Billion

- 2033 Projected Market Size: USD 24.63 Billion

- CAGR (2025-2033): 8.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As manufacturing processes become more automated and interconnected, the need for high-speed, low-latency communication networks has intensified. Industrial ethernet provides a scalable and flexible infrastructure that supports real-time data exchange and integration with advanced technologies such as IoT and Industry 4.0. This evolution is fueled by the rise of smart factories, where seamless data flow between machines and control systems is crucial. The shift from traditional fieldbus systems to Ethernet-based networks also contributes to market expansion, as Ethernet offers superior bandwidth and network management capabilities. Furthermore, the growing emphasis on predictive maintenance and data analytics in industrial operations is pushing companies to invest in Ethernet solutions that can handle large volumes of data. As a result, the market is poised for robust growth, with increasing adoption across various sectors.

The market is also gaining traction in the energy, transportation, and utilities industries. These sectors require reliable and secure communication networks to manage complex operations and ensure safety. For instance, Ethernet networks are used in the energy sector to monitor and control power grids, enabling real-time data acquisition and response to system anomalies. Similarly, in transportation, Ethernet solutions facilitate the management of traffic control systems and support advanced applications like vehicle-to-everything (V2X) communication. The expansion of smart grid technologies and the push towards sustainable energy solutions further drive demand for industrial Ethernet. Moreover, as more industries adopt digital transformation strategies, the need for standardized and interoperable network solutions becomes more critical. This trend creates new opportunities for Ethernet vendors to develop innovative solutions customized to diverse industrial applications.

The increasing need for cybersecurity in industrial networks is also propelling the market. With the rise in cyber threats targeting critical infrastructure, companies prioritize secure communication protocols and robust network architectures. Industrial Ethernet solutions are being enhanced with advanced security features such as encryption, intrusion detection, and secure access controls. This focus on cybersecurity is critical as industrial systems become more interconnected, increasing the potential attack surface. Adopting secure Ethernet solutions helps protect sensitive data and ensures the integrity and availability of industrial processes. Regulatory compliance and industry standards, such as the IEC 62443 series of standards for industrial cybersecurity, are further driving the adoption of secure Ethernet networks. As companies strive to safeguard their operations against cyber threats, the demand for secure industrial Ethernet solutions is expected to grow significantly.

Type Insights

Hardware led the market and accounted for 46.8% of the global revenue in 2024. Industrial environments demand highly robust and durable hardware to withstand harsh conditions such as extreme temperatures, humidity, dust, and vibrations. Devices such as industrial Ethernet switches, routers, and cables are designed to meet stringent requirements, ensuring reliable network performance in challenging settings. The durability and reliability of hardware components are paramount in preventing network failures that could lead to costly downtime or even safety hazards. The increasing need for cybersecurity in industrial networks is also propelling the market. With the rise in cyber threats targeting critical infrastructure, companies prioritize secure communication protocols and robust network architectures. Industrial Ethernet solutions are being enhanced with advanced security features such as encryption, intrusion detection, and secure access controls.

Software is projected to grow significantly over the forecast period. Industrial networks' increasing complexity and scale require advanced network management and monitoring solutions. Software tools that provide comprehensive network visibility, diagnostics, and real-time monitoring are essential for maintaining optimal network performance and quickly addressing issues. These solutions enable companies to manage their networks more efficiently, reducing downtime and improving overall operational efficiency. The rise of Industry 4.0 and the Industrial Internet of Things (IIoT) is fueling demand for software that supports the integration and interoperability of various devices and systems. Industrial Ethernet networks are becoming more interconnected, with a wide range of sensors, controllers, and machines communicating.

Protocol Insights

The PROFINET protocol segment accounted for the largest market revenue share in 2024. PROFINET's robust performance and real-time capabilities make it particularly well-suited for demanding industrial applications. It supports real-time data transfer and synchronization with high precision, which is essential for applications such as motion control and process automation. This high performance and reliability make PROFINET a preferred choice for industries requiring stringent control over their operations, contributing significantly to its market dominance. PROFINET's widespread adoption and strong industry support have bolstered its market position. It is backed by the PROFIBUS & PROFINET International (PI) organization, which ensures continuous development, standardization, and interoperability. This extensive support network has led to widespread adoption across various industries, including automotive, manufacturing, and energy.

The EtherCAT protocol segment is expected to grow significantly during the forecast period. EtherCAT's exceptional performance in terms of speed and efficiency makes it highly suitable for real-time control applications. Its unique on-the-fly processing capability allows data to be processed while passing through the network nodes, resulting in extremely low latency and high synchronization precision. This performance advantage is critical for applications such as robotics, CNC machines, and high-speed automation systems, where timely data exchange is paramount. The increasing adoption of advanced automation technologies and Industry 4.0 principles is driving the demand for high-performance industrial Ethernet protocols like EtherCAT. As industries aim to enhance productivity, efficiency, and flexibility through automation, the need for reliable and fast communication networks intensifies.

End Use Insights

Automotive & transportation accounted for the largest market revenue share in 2024. The automotive industry's significant shift towards automation and digitalization in manufacturing processes has driven the adoption of industrial Ethernet. Modern automotive manufacturing facilities increasingly incorporate advanced technologies such as robotics, automated guided vehicles (AGVs), and real-time data analytics to enhance production efficiency, quality control, and flexibility. Industrial Ethernet provides the high-speed, reliable communication infrastructure required to support these technologies, facilitating seamless data exchange and coordination across various production stages. The rise of electric and autonomous vehicles is fueling demand for sophisticated communication networks within the automotive sector. The development and testing of these vehicles require robust and high-bandwidth networking solutions to manage the complex interactions between sensors, control systems, and external communication interfaces.

Electrical & electronics is projected to grow significantly over the forecast period. The increasing complexity and miniaturization of electronic devices require more sophisticated manufacturing processes that rely heavily on automation and precise control. Industrial Ethernet provides the necessary high-speed, reliable communication infrastructure to support these advanced manufacturing techniques, enabling efficient production and high-quality output. As the demand for smaller and more complex electronic components grows, so does the need for robust networking solutions to manage intricate production processes. The rapid adoption of smart manufacturing and Industry 4.0 principles in the electrical and electronics industries is a significant growth driver. Smart factories leverage interconnected machines, IoT devices, and data analytics to optimize production, reduce downtime, and enhance flexibility. Industrial Ethernet facilitates seamless data exchange between these devices and systems, ensuring real-time monitoring and control.

Regional Insights

North America dominated the market and accounted for a 35.3% share in 2024. The strong presence of key market players and solution providers in North America, such as Rockwell Automation, Cisco Systems, and Belden Inc., is leading the development of industrial Ethernet technologies and has extensive regional distribution networks. Their continuous innovation and development of new products customized to the specific needs of industrial applications have strengthened market growth. Moreover, these companies provide comprehensive support and services, encouraging the adoption of industrial Ethernet solutions.

U.S. Industrial Ethernet Market Trends

The industrial ethernet market in the U.S. is expected to grow significantly over the forecast period.Cyber threats pose significant risks to industrial operations, potentially leading to data breaches, operational disruptions, and safety hazards. The U.S. market is seeing increased investment in cybersecurity solutions that protect network infrastructure, including firewalls, intrusion detection systems, and secure communication protocols. Companies are prioritizing the implementation of secure industrial Ethernet networks to safeguard their operations.

Europe Industrial Ethernet Market Trends

The industrial ethernet market in Europe is at the forefront of adopting Industry 4.0 principles, which emphasize the integration of digital technologies into manufacturing and industrial processes. The European industrial sector is increasingly implementing smart factories, automation systems, and IoT solutions to enhance productivity, flexibility, and efficiency. Industrial Ethernet provides a high-speed, reliable communication infrastructure to support these advanced technologies, facilitating real-time data exchange and seamless connectivity between devices.

Asia Pacific Industrial Ethernet Trends

The industrial ethernet market in the Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region is undergoing significant industrialization and urbanization, particularly in China, India, and Southeast Asia. This growth drives demand for advanced manufacturing technologies and automation, which requires robust industrial Ethernet solutions. As industries modernize and expand, the need for reliable, high-speed communication networks to support complex industrial operations increases. Asia Pacific's prominence in the electronics and automotive industries drives significant growth in the market.

Key Industrial Ethernet Company Insights

Some key companies in the market are Cisco Systems, Rockwell Automation, and Belden Inc. These companies are implementing product launches and developments, followed by expansions, mergers and acquisitions, partnerships, and collaborations, as their primary business strategies to enhance market penetration and boost their position in the industry.

-

Cisco Systems, Inc. is a global leader in networking technologies, offering advanced Industrial Ethernet solutions that enable secure, reliable, and scalable connectivity for industrial environments. Cisco leverages its networking, cybersecurity, and IoT expertise to empower industries with resilient infrastructures that support automation, digital transformation, and real-time data exchange. The company emphasizes security, interoperability, and innovation, helping manufacturers and enterprises optimize operations and drive efficiency in increasingly connected industrial ecosystems.

-

Rockwell Automation specializes in industrial automation and digital transformation, integrating Industrial Ethernet technologies into its control systems to enhance connectivity, flexibility, and performance in manufacturing environments. With its Allen-Bradley hardware and FactoryTalk software, Rockwell Automation provides end-to-end solutions that enable smart manufacturing, predictive maintenance, and seamless IT/OT convergence. The company focuses on sustainability, productivity, and innovation, collaborating with global industries to accelerate industrial modernization and deliver smarter, more efficient operations.

Key Industrial Ethernet Companies:

The following are the leading companies in the industrial ethernet market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Siemens

- Rockwell Automation

- OMRON Corporation

- Moxa Inc.

- Phoenix Contact

- Belden Inc.

- ABB

- Schneider Electric

- Bosch Rexroth AG

Recent Developments

-

In May 2025, Rockwell Automation introduced its EtherNet/IP In-cabinet Solution, a significant advancement to support the growing need for smarter, faster, and more connected manufacturing operations. The solution simplifies wiring and integration, accelerates panel production, and enhances diagnostics, enabling more intelligent manufacturing.

-

In April 2025, OMRON Corporation inaugurated a new Automation Center dedicated to advancing industrial automation and Ethernet-based technologies in Stuttgart. Designed as a collaborative hub, the center allows customers to explore innovative approaches to factory automation, co-develop tailored solutions, and test them in a practical, regionally relevant setting.

-

In April 2025, Belden Inc. announced the launch of the Hirschmann GREYHOUND 2000 Standard Switch, a next-generation device engineered to adapt to diverse connectivity requirements. Featuring configurable modules, high fiber port density, a rugged design, and advanced cybersecurity, the switch is optimized for power, transit, and industrial applications.

-

In July 2024, Moxa Inc. launched the MRX Series Layer 3 rackmount Ethernet switches, which support up to 64 ports and offer 16 ports with 10GbE speed. The EDS-4000/G4000 Series Layer 2 switches with 2.5GbE uplink options to enable high-bandwidth IT/OT convergence for industrial applications. These switches offer industrial-grade reliability, network redundancy, and simplified deployment, providing enhanced security and exceptional flexibility to future-proof network infrastructure.

-

In July 2024, Rockwell Automation collaborated with Cisco Systems, Inc. to develop the Stratix 5200 Ethernet switches, which enhance OT and IT integration with increased functionality, security, and seamless integration with Rockwell’s Studio 5000 software. These switches, built on the Cisco IOS XE platform, support high-speed, redundant architectures, Layer 2 access switching, and compliance with international cybersecurity standards.

-

In May 2024, Cisco Systems, Inc. integrated Splunk technology with its Extended Detection & Response (XDR) service to enhance enterprise Security Operations Centers (SOCs) by providing comprehensive threat prevention, detection, investigation, and response capabilities. This integration, along with adding AI and machine learning features, aims to improve security visibility and efficiency, helping organizations maintain robust security postures and address the global cybersecurity talent shortage.

Industrial Ethernet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.25 billion

Revenue forecast in 2033

USD 24.63 billion

Growth rate

CAGR of 8.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, protocol, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Cisco Systems, Inc.; Siemens; Rockwell Automation; OMRON Corporation; Moxa Inc.; Phoenix Contact; Belden Inc.; ABB; Schneider Electric; Bosch Rexroth AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Ethernet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial ethernet market report based on type, protocol, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2033)

-

Hardware

-

Software

-

Services

-

-

Protocol Outlook (Revenue, USD Million, 2018 - 2033)

-

EtherCAT

-

EtherNet/IP

-

PROFINET

-

POWERLINK

-

SERCOS III

-

CC-Link IE

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2033)

-

Automotive & Transportation

-

Oil & Gas

-

Energy & Power

-

Food & Beverages

-

Chemical & Fertilizer

-

Electrical & Electronics

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial ethernet market size was estimated at USD 12.30 billion in 2024 and is expected to reach USD 13.25 billion in 2025.

b. The global industrial ethernet market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2033 to reach USD 24.63 billion by 2033.

b. North America dominated the industrial ethernet market with a share of 35.3% in 2024. This is attributable to its well-developed infrastructure, which supports seamless connectivity and integration. Moreover, the region's widespread adoption of automation technologies enhances operational efficiency and drives demand for advanced networking solutions.

b. Some key players operating in the industrial ethernet market include Cisco Systems, Inc., Siemens, Rockwell Automation, OMRON Corporation, Moxa Inc., Phoenix Contact, Belden Inc., ABB, Schneider Electric, and Bosch Rexroth AG.

b. Key factors that are driving the market growth include technological advancements, rising automation demand, expanding industrial applications, and increased investments in infrastructure for improved operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.