- Home

- »

- Water & Sludge Treatment

- »

-

Industrial Water Treatment Chemicals Market Report, 2033GVR Report cover

![Industrial Water Treatment Chemicals Market Size, Share & Trends Report]()

Industrial Water Treatment Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Cooling & Boilers, Water Desalination, Raw Water Treatment), By End-use (Food & Beverage, Pharmaceuticals, Microelectronics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-684-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Industrial Water Treatment Chemicals Market Summary

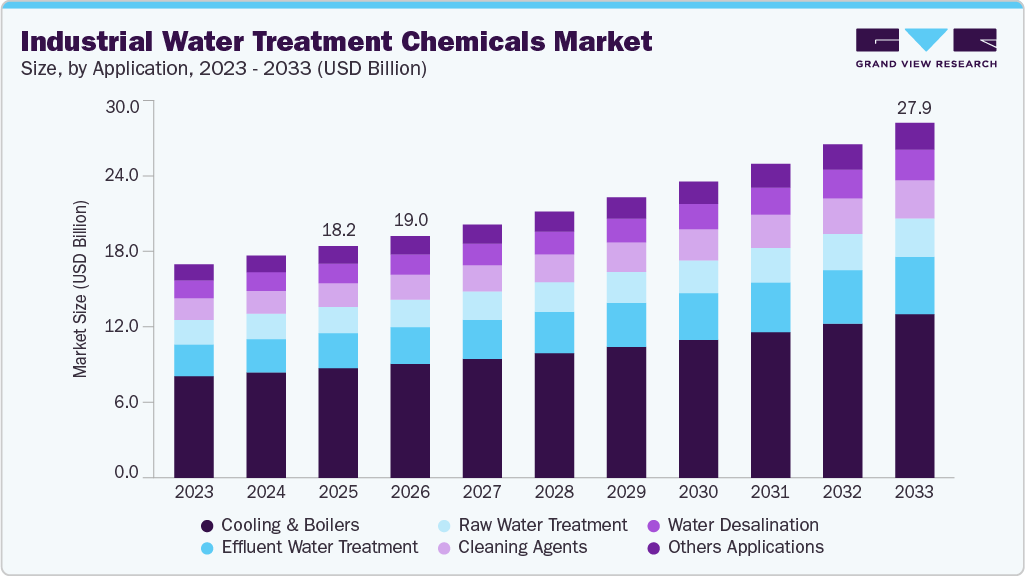

The global industrial water treatment chemicals market size was estimated at USD 17,486.9 million in 2024 and is projected to reach USD 27,941.2 million by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The market demand for industrial water treatment chemicals is increasingly fueled by the rapid expansion of industrial infrastructure, escalating water scarcity concerns, and stricter environmental regulations worldwide.

Key Market Trends & Insights

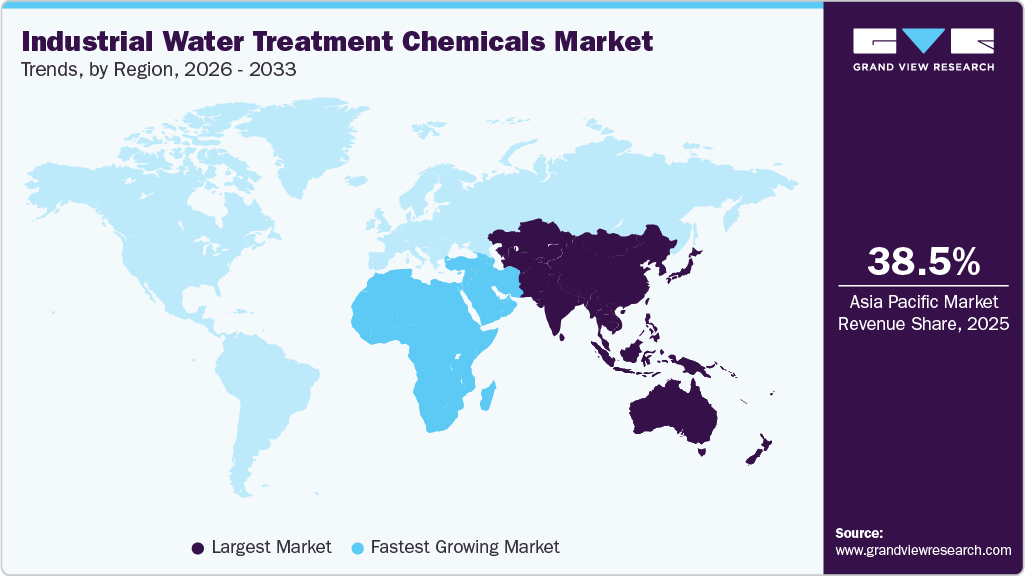

- Asia Pacific dominated the industrial water treatment chemicals market with the largest revenue share of 38.7% in 2024.

- The industrial water treatment chemicals market in China held a substantial revenue share of the APAC market in 2024.

- By application, cooling & boilers industrial water treatment chemicals dominated the market with a revenue share of 47.5% in 2024.

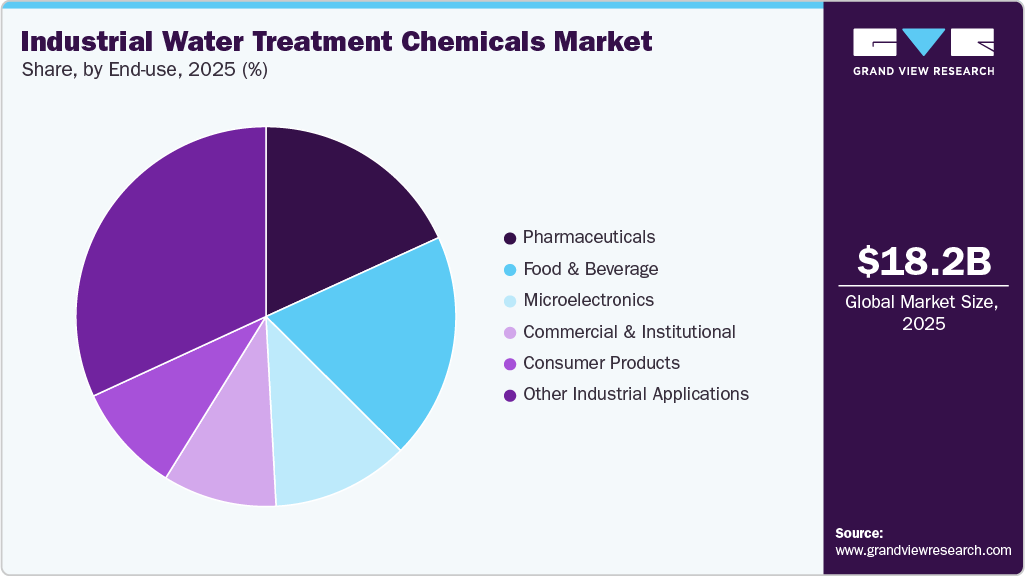

- By end-use, food & beverages dominated the industrial water treatment chemicals market with a revenue share of 19.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17,486.9 Million

- 2033 Projected Market Size: USD 27,941.2 Million

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing region

Industries such as power generation, oil & gas, food & beverages, pharmaceuticals, and microelectronics are becoming increasingly reliant on specialized chemical formulations to ensure operational efficiency, regulatory compliance, and sustainability.Key growth drivers include the rising demand for clean and process-optimized water in critical manufacturing processes, the growing adoption of Zero Liquid Discharge (ZLD) systems, and government mandates enforcing effluent quality and water reuse across emerging and developed economies. Additionally, technological advancements in smart chemical dosing and digital water monitoring are enhancing treatment efficiency and reinforcing the long-term value of chemical-based solutions.

Rapid urbanization, rising economic development, and expanding industrial activity are the factors contributing to an ongoing increase in demand for water. To meet the constantly expanding demand and ensure customer safety, a variety of goods are used. Boiler treatment, wastewater effluent treatment, cooling treatment, and purification are the four fundamental procedures involved. Due to the changing climate, shifting patterns of energy production, land use, and expanding population, there will likely be an increase in the need for freshwater. Most of the freshwater usage in the nation is for irrigation, and cooling, along with industrial and municipal purposes, as well as for aquaculture and cattle.

As a result of the erratic rainfall and precipitation, Asia Pacific, Central & South America, and Africa have a low per capita supply of freshwater for human consumption. These areas represent developing markets for the biocides employed in the control of industrial effluent to preserve hygienic conditions and offer drinkable water resources for the populations.

Water desalination techniques are attaining strong significance due to the scarcity of freshwater. In desalination facilities, excess salts as well as other minerals are eradicated from the solution through membrane-based or thermal-based techniques, thus rendering it fit for industrial consumption. RO (reverse osmosis) and distillation are used for seawater desalination, while electrodialysis and RO are used to desalt brackish water.

High operational costs associated with chemical-intensive systems, driven by raw material price volatility and energy-intensive processes, pose significant cost burdens, particularly for small-to-medium industrial operators. Moreover, stringent environmental and health regulations surrounding toxic by-products and chemical residuals (e.g., PFAS, heavy metals) are compelling chemical suppliers to invest in reformulation and compliance efforts. Another layer of complexity is introduced by the region-specific and often fragmented regulatory landscape, which increases administrative costs and slows the time-to-market for new products. Intense market competition, commoditization of certain product categories, and pricing pressures further compress margins and limit differentiation for conventional formulations.

Despite these hurdles, the market is ripe with strategic opportunities. The shift toward green chemistry and the increasing integration of water treatment chemicals with digital and automated systems offer avenues for innovation-led growth. Growing government investments in industrial wastewater treatment, particularly in Asia Pacific, the Middle East, and Latin America, are expanding the addressable market for chemical providers. Furthermore, the rising focus on circular economy models, emphasizing water recycling, sludge minimization, and closed-loop systems, is creating strong demand for high-performance, multifunctional, and eco-friendly chemical formulations. Companies that can align their portfolios with sustainability goals, regulatory expectations, and digitally enabled services stand to gain a significant competitive advantage in the years ahead.

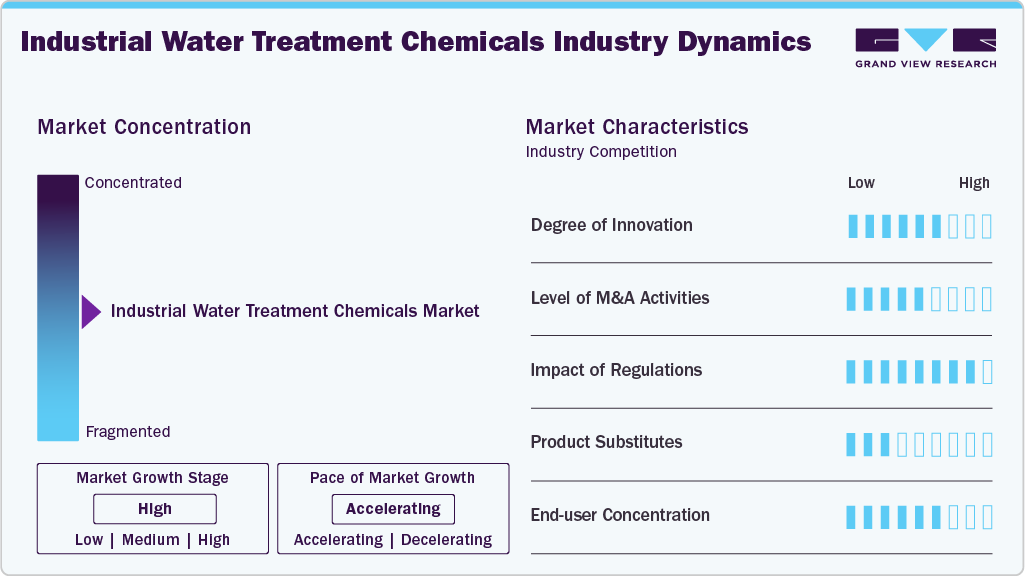

Market Concentration & Characteristics

The industrial water treatment chemicals market is moderately fragmented, with a few major players holding significant market share due to their vertical integration and expansive global operations. These leading companies benefit from economies of scale, integrated production capabilities, and secure access to key raw materials, allowing them to offer consistent quality and cost-effective solutions. Their robust distribution networks and strong presence across the water treatment value chain, from raw material processing to chemical formulation, enable them to effectively serve diverse end-use industries such as power generation, oil & gas, chemicals, food & beverage, and manufacturing.

At the same time, emerging players in the Asia-Pacific and Middle East regions are gaining ground in the industrial water treatment chemicals market by leveraging access to abundant local resources, lower production costs, and rising domestic demand. These regional manufacturers are investing strategically in chemical production hubs and industrial parks, enabling them to offer cost-effective solutions for high-volume applications such as boiler treatment, cooling water systems, and effluent treatment in industries like power, petrochemicals, and textiles. This evolving landscape, shaped by consolidation among global leaders and regional expansion driven by cost competitiveness, is redefining the competitive dynamics of the market.

However, the market faces significant challenges, notably, regulatory pressure is mounting on industrial water treatment chemicals like biocides, antiscalants, and flocculants due to concerns over environmental toxicity and sludge generation. Frameworks such as the EU Biocidal Products Regulation and EPA guidelines are pushing for safer alternatives, creating a challenge for suppliers to balance regulatory compliance with performance and cost-efficiency.

Application Insights

Cooling & boilers applications of industrial water treatment chemicals dominated the market and accounted for the largest revenue share of 47.5% in 2024. This is attributed to their utilization in various industries, including power plants, steel and metal, sugar and paper mills, and petrochemicals, for their need to prevent scaling, corrosion, and microbial fouling, thereby improving system efficiency and extending equipment life. In sectors like power generation, petrochemicals, and food processing, these chemicals are critical for maintaining optimal thermal performance and regulatory compliance.

Growing environmental concerns and tightening discharge norms are accelerating the shift toward phosphate-free and biodegradable formulations. Advancements like real-time monitoring and smart dosing systems are enhancing precision and sustainability. Major players such as Kurita and Nalco Water are leading innovation with eco-friendly chemistries and digitally integrated water management solutions. The growth of the industrial, power, and manufacturing sectors is anticipated to augment the demand for boiler chemicals and systems in various emerging countries such as Brazil, China, Malaysia, India, and Indonesia during the forecast period..

The effluent water treatment chemicals segment is expected to grow fastest with a CAGR of 6.4% from 2025 to 2033, driven by rising industrial discharge regulations and the need for effective removal of pollutants, heavy metals, and organic contaminants across industries like textiles, pulp & paper, chemicals, and food processing. Key applications include coagulants, flocculants, biocides, and oxidizing agents that enable compliance with stringent environmental norms. The growing shift toward zero liquid discharge (ZLD) and the adoption of advanced treatment technologies, like membrane filtration and electrocoagulation, further fuel demand.

Additionally, real-time AI-driven dosing systems and biodegradable, low-toxicity formulations are transforming the segment toward more sustainable and efficient treatment solutions.

End-use Insights

Food & beverages of industrial water treatment chemicals dominated the market with a revenue share of 19.3% in 2024, due to strict hygiene standards, regulatory compliance (e.g., FDA CFR Title 21, EU Regulation 852/2004), and the critical role of water in processing, cleaning, and sanitation. Chemicals like peracetic acid, sodium hypochlorite, and food-grade corrosion inhibitors are essential across brewing, dairy, meat, and beverage segments.

Rising adoption of water recycling systems and Zero Liquid Discharge (ZLD) policies, especially in countries like India, is further boosting the use of advanced, non-toxic, and membrane-compatible chemistries. Global F&B players are also prioritizing sustainable water treatment through phosphate-free additives and smart dosing technologies.

Pharmaceuticals-based industrial water treatment chemicals are expected to grow fastest with a CAGR of 6.3% from 2025 to 2033, due to their stringent demands for water purity, microbial control, and regulatory compliance across processes like API synthesis, formulation, and equipment sterilization. High-purity water systems, such as purified water and water for injection, require precise chemical dosing with disinfectants, pH adjusters, and corrosion inhibitors. Rising adoption of single-use technologies and zero liquid discharge mandates further fuels demand for eco-friendly, high-performance treatment solutions. Sustainability goals and strict effluent regulations are pushing the use of green-certified and biodegradable chemicals tailored for pharmaceutical operations.

Regional Insights

The industrial water treatment chemicals market in Asia Pacific dominated with a 38.7% share in 2024, due to rising water scarcity, stringent environmental mandates, and growing industrial activity are key drivers for the industrial water treatment chemicals market. Government initiatives like China’s 14th Five-Year Plan and India’s Zero Liquid Discharge (ZLD) policies are accelerating demand for advanced treatment solutions in sectors such as textiles, chemicals, and electronics. Rapid industrialization in Southeast Asia and the need for efficient wastewater management are boosting investments in water infrastructure and chemical dosing systems. Meanwhile, mature markets like Japan and South Korea demand high-purity, eco-certified chemicals, prompting regional manufacturers to adopt green chemistry and biodegradable alternatives.

The industrial water treatment chemicals market in China held a substantial revenue share of the APAC market in 2024, driven by the country’s vast industrial base, severe water resource challenges, and tightening environmental regulations. High water-consuming sectors like power, petrochemicals, and electronics are fueling demand for advanced chemical solutions, including flocculants, antiscalants, corrosion inhibitors, and biocides. Government initiatives under the 14th Five-Year Plan and water pollution control action plans are accelerating the adoption of zero liquid discharge (ZLD) and wastewater reuse technologies. Additionally, rising preferences for eco-friendly, high-performance formulations and the integration of digital water management systems are reshaping chemical usage across industrial zones.

Europe Industrial Water Treatment Chemicals Market Trends

The industrial water treatment chemicals market in Europe held 30.1% of the global revenue share in 2024. This can be credited to using Industrial Water Treatment Chemicals in water treatment applications, driven by strict environmental regulations, a heightened focus on sustainability, and increasing concerns over water quality. Countries such as Germany, France, and the Netherlands are at the forefront of investing in advanced water and wastewater treatment technologies to comply with the EU’s environmental standards, including the Water Framework Directive and REACH regulations.

Industrial water treatment chemicals, especially primary and tertiary types, are valued in these applications for their strong cationic surfactant properties. They function effectively as flocculants, corrosion inhibitors, and dispersants, playing a key role in coagulation and flocculation processes by aiding in the aggregation and removal of suspended particles. Additionally, fatty amine derivatives are used in scale and corrosion control, particularly in industrial boilers and cooling systems, and sludge conditioning to enhance dewatering and reduce operational costs.

North America Industrial Water Treatment Chemicals Market Trends

The North America industrial water treatment chemicals market secured 21.0% of the revenue share in 2024, driven by a mature industrial base, strict environmental regulations, and rising sustainability goals. High water usage across sectors like power, oil & gas, food & beverage, and microelectronics fuels demand for specialty chemicals such as biocides, antiscalants, and corrosion inhibitors. Regulatory frameworks like the EPA’s Clean Water Act and Canada’s WSER push industries toward compliance and water reuse practices. Growing interest in ESG targets and smart dosing technologies further accelerates the adoption of advanced, eco-friendly treatment solutions across the region.

Middle East & Africa Industrial Water Treatment Chemicals Market Trends

The Middle East & Africa industrial water treatment chemicals market is expected to grow the fastest with a CAGR of 6.5% during the forecast period. The region is experiencing strong growth, primarily driven by rapid industrialization, severe water scarcity, and growing regulatory emphasis on sustainable water management. In the Middle East, the dominance of desalination, accounting for over 40% of global capacity, fuels demand for antiscalants, biocides, and membrane cleaners to ensure operational efficiency. Africa is experiencing rising chemical usage due to expanding industrial zones and tighter effluent discharge regulations. Across both regions, government initiatives, climate-resilient policies, and digital water management adoption are enhancing chemical demand across sectors like oil & gas, power, mining, and food processing.

Latin America Industrial Water Treatment Chemicals Market Trends

The Latin American industrial water treatment chemicals market is witnessing steady growth, largely driven by expanding industrial sectors such as mining, oil & gas, petrochemicals, and pulp & paper. Rising regulatory scrutiny, growing water stress, and the push toward environmentally compliant practices are fueling demand for coagulants, flocculants, biocides, and antiscalants. National agencies like ANA (Brazil) and CONAGUA (Mexico) are tightening water discharge and reuse standards, prompting industries to adopt advanced treatment solutions. Additionally, the shift toward green chemistry and digitally enabled systems reflects the region’s move toward sustainable and efficient water management.

Key Industrial Water Treatment Chemicals Company Insights

Some key players operating in the industrial water treatment chemicals market include Evonik and Kao Corporation.

- Evonik, headquartered in Essen, Germany, is a leading global chemical company and a dominant, mature player in the Industrial Water Treatment Chemicals market. With decades of amine and surface chemistry expertise, Evonik offers an extensive portfolio of Industrial Water Treatment Chemicals and their derivatives, including primary, secondary, and tertiary amines tailored for a wide range of industrial and specialty applications. Evonik’s Industrial Water Treatment Chemicals deliver essential performance attributes such as emulsification, hydrophobicity, anti-static behavior, surface activity, and corrosion inhibition, making them indispensable in end-use industries like agriculture as adjuvants, personal and home care as conditioning agents, oil & gas as corrosion inhibitors, textiles, and water treatment. Backed by vertically integrated production and global manufacturing sites, Evonik ensures consistent quality, robust supply chains, and regional responsiveness. Its advanced R&D centers, particularly in Germany, the U.S., and Asia, focus on green chemistry, sustainable synthesis methods, and performance optimization tailored to customer-specific needs. Evonik also leads the development of eco-friendly fatty amine solutions, including biogenic and low-VOC formulations.

KLK OLEO and Indo Amines Limited are emerging market participants in the industrial water treatment chemicals market.

- KLK OLEO, headquartered in Malaysia, is an emerging and dynamic player in the global Industrial Water Treatment Chemicals market, steadily expanding its presence across key regions such as Asia-Pacific, Europe, and the Americas. Traditionally recognized for its strength in oleochemicals, KLK OLEO is increasingly integrating advanced fatty amine technologies into its product portfolio to address the growing demand for high-performance, sustainable, and biodegradable surfactants. Its Industrial Water Treatment Chemicals are used extensively in personal care, home care, agriculture, oilfield chemicals, and water treatment applications. Through strategic investments, vertical integration, and technology collaborations, KLK OLEO is enhancing its capability to deliver consistent quality, regulatory-compliant, and customized fatty amine solutions tailored to global customer needs. The company emphasizes sustainability, leveraging renewable feedstocks and green chemistry principles to support environmentally responsible production. In addition, KLK OLEO offers comprehensive value-added services such as technical consultation, application development, and supply chain reliability, positioning itself as a trusted and agile partner in the evolving global Industrial Water Treatment Chemicals market.

Key Industrial Water Treatment Chemicals Companies:

The following are the leading companies in the industrial water treatment chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Italmatch Chemicals

- Dow

- Cortec Corporation

- Buckman

- Akzo Nobel N.V.

- Solvay

- Solenis

- Kemira

- SNF Group

- SUEZ

- Ecolab Inc.

- BASF

- Clariant

Recent Developments

-

In November 2024, Ecolab expanded its footprint in the industrial water treatment chemicals market with the acquisition of Barclay Water Management, a provider of proprietary water safety and digital monitoring solutions. This move strengthens Ecolab’s position in North America by integrating Barclay’s iChlor Monochloramine System and digital capabilities with Ecolab’s ECOLAB3D platform. The acquisition enhances Ecolab’s ability to offer comprehensive water safety, asset protection, and efficiency-driven solutions to industrial and institutional customers.

-

In January 2024, Italmatch Chemicals has signed a binding agreement to acquire Brazilian water treatment company Alcolina, enhancing its industrial water treatment chemicals portfolio, particularly in bioethanol, sugar production, and industrial sectors. With two manufacturing sites and €35 million in 2023 turnover, Alcolina strengthens Italmatch’s footprint in Latin America. The acquisition complements Italmatch’s earlier regional expansion efforts, including Sudamfos do Brasil and its SugarMaxx technology collaboration. This move solidifies the company’s position in the LATAM industrial water treatment market.

Industrial Water Treatment Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18,226.1 million

Revenue forecast in 2033

USD 27,941.2 million

Growth rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Italy; France; UK; Spain; Austria; Belgium; Finland; Poland; Sweden; Turkiye; China; India; Japan; South Korea; Thailand; Australia; Indonesia; New Zealand; Singapore; Vietnam; Brazil; Argentina; Chile; Saudi Arabia; South Africa

Key companies profiled

Italmatch Chemicals; Dow; Cortec Corporation; Buckman; Akzo Nobel N.V.; Solvay; Solenis; Kemira; SNF Group; SUEZ; Ecolab Inc.; BASF; Clariant

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Water Treatment Chemicals Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global industrial water treatment chemicals market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Raw Water Treatment

-

Deoiling Polyelectrolytes (DOPE)

-

Organic Coagulants

-

Flocculants

-

Filtration Aids

-

Dewatering Aids

-

Other Raw Water Treatments

-

-

Water Desalination

-

Biocides

-

Cleaning Agents

-

Antiscalants

-

Flocculants

-

Defoaming Agents

-

Others Water Desalinations

-

-

Cleaning Agents

-

Carbonates

-

Sulfates

-

Metal Oxides

-

Silica

-

Chelating Agents incl. NaOH

-

Biofilms

-

Other Cleaning Agents

-

-

Cooling & Boilers

-

Sludge Controllers

-

Antifoams

-

Antiscalants

-

Oxygen Scavengers

-

Other Cooling & Boilers

-

-

Effluent Water Treatment

-

Deoiling Polyelectrolytes (DOPE)

-

Organic Coagulants

-

Flocculants

-

Filtration Aids

-

Dewatering Aids

-

Other Effluent Water Treatments

-

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Commercial & Institutional

-

Consumer Products

-

Food & Beverage

-

Microelectronics

-

Pharmaceuticals

-

Other Industrial End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Belgium

-

Sweden

-

Austria

-

Finland

-

Poland

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

Indonesia

-

Thailand

-

Vietnam

-

Australia

-

New Zealand

-

CIS

-

Indonesia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial water treatment chemicals market size was estimated at USD 17,486.9 million in 2024 and is expected to reach USD 18,226.1 million in 2025.

b. The global industrial water treatment chemicals market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 27,941.2 million by 2033.

b. The cooling & boiler-based industrial water treatment chemicals by application segment led the market and accounted for the largest revenue share of 47.5% in 2024, attributed to their utilization in various industries, including power plants, steel and metal, sugar and paper mills, and petrochemicals, for their need to prevent scaling, corrosion, and microbial fouling, thereby improving system efficiency and extending equipment life.

b. Some of the key players operating in the Industrial Water Treatment Chemicals Market include Italmatch Chemicals, Dow, Cortec Corporation, Buckman, Akzo Nobel N.V., Solvay, Solenis, Kemira, SNF Group, SUEZ, Ecolab Inc., BASF and Clariant.

b. The growth is attributed to Industrial Water Treatment Chemicals' uses in industries such as power generation, oil and gas, food and beverages, pharmaceuticals, and microelectronics, which are becoming increasingly reliant on specialized chemical formulations to ensure operational efficiency, regulatory compliance, and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.