- Home

- »

- Automotive & Transportation

- »

-

Internal Gear Skiving Machine Market, Industry Report, 2033GVR Report cover

![Internal Gear Skiving Machine Market Size, Share & Trends Report]()

Internal Gear Skiving Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Machine Type (Standalone, Multi-functional), By Automation Level, By Gear Size, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-780-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Internal Gear Skiving Machine Market Summary

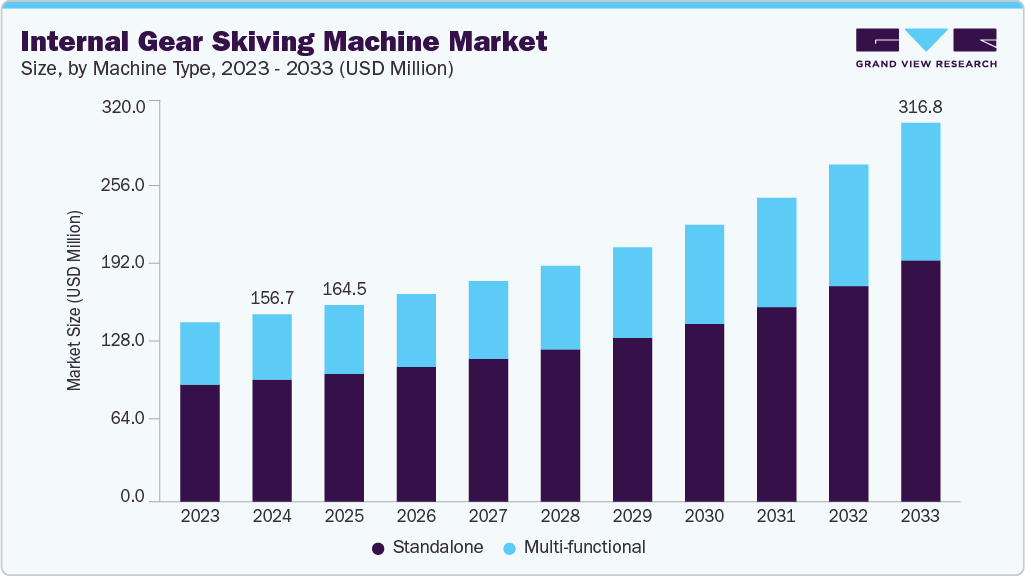

The global internal gear skiving machine market size was estimated at USD 156.7 million in 2024, and is projected to reach USD 316.8 million by 2033, growing at a CAGR of 8.5% from 2025 to 2033. This growth is driven by the rapid electrification of drivetrains across automotive and industrial sectors, increasing adoption of Industry 4.0 enabled machining solutions, advancements in hybrid and micro-manufacturing technologies, supportive government initiatives promoting localized precision manufacturing, and rising automation demand due to workforce shortages in skilled machining operations.

Key Market Trends & Insights

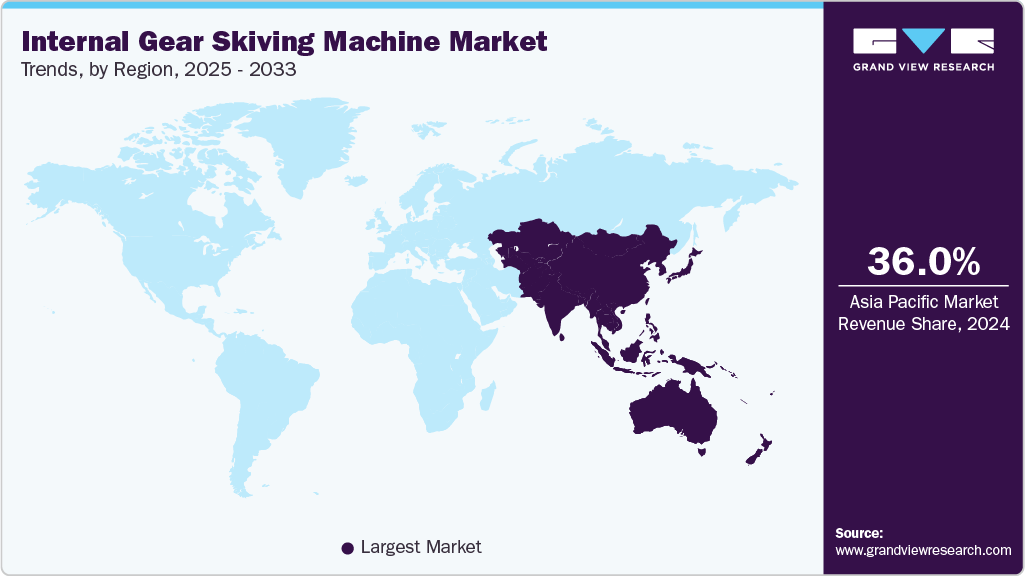

- The Asia Pacific internal gear skiving machine market accounted for a 36.0% share in 2024.

- China's internal gear skiving machine industry held a dominant position in 2024.

- By machine type, the standalone segment accounted for the largest share of 65.2% in 2024.

- By automation level, the semi-automatic segment held the largest market share in 2024.

- By gear size, the small gears (upto 200 mm) segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 156.7 Million

- 2030 Projected Market Size: USD 316.8 Million

- CAGR (2025-2030): 8.5%

- Asia Pacific: Largest market in 2024

The rapid electrification of vehicle drivetrains is significantly propelling market growth. The U.S. Department of Energy (DOE), through its Vehicle Technologies Office (VTO) and Electric Drive Technical Team, has emphasized the need for advanced manufacturing processes to support the expansion of electric vehicles. Electric drivetrains rely on compact, high-precision internal gears used in e-axles and planetary systems, which require tighter tolerances and faster production rates. Skiving technology offers a cost-efficient and precise solution for such components. Supported by national EV manufacturing incentives, the global market is witnessing strong adoption of internal gear skiving machines across automotive and industrial sectors.

The global move toward digitalized and automated manufacturing boosts demand for smart skiving machines. National programs led by the National Institute of Standards and Technology (NIST) and Manufacturing USA encourage manufacturers to adopt digitally integrated CNC skiving systems with process monitoring, data analytics, and predictive maintenance features. These initiatives are driving the modernization of machine tools and enabling small and medium-sized enterprises (SMEs) to upgrade production capabilities. As a result, integrating skiving machines into Industry 4.0 environments is accelerating, enhancing efficiency and productivity across multiple industries.

Government-funded R&D efforts by institutions such as the Oak Ridge National Laboratory (ORNL), NASA, and the Department of Energy’s Advanced Manufacturing Office are accelerating technological advancements in hybrid and micro-manufacturing. These research programs combine additive manufacturing with finishing processes such as hard skiving, enabling faster production of micro-gears and high-precision internal gears for aerospace, robotics, and medical devices. The integration of skiving into hybrid production lines is expanding its applications beyond traditional automotive uses and boosting the demand for advanced machine configurations capable of precision machining at micron levels.

Evolving export control policies and industrial strategies propel localized machine tool manufacturing investments, directly impacting the market. The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) has updated export classifications for high-precision machine tools, ensuring compliance with dual-use technology regulations. These policy adjustments boost regional manufacturing capabilities and encourage OEMs to develop domestic production ecosystems for critical gear-making equipment. Such shifts reinforce supply chain resilience while stimulating demand for compliant, high-precision skiving machines in North America, Europe, and Asia.

Labor shortages in precision machining are driving rapid adoption of automated and user-friendly skiving solutions, further boosting market growth. Government-backed initiatives under NIST’s Manufacturing Extension Partnership (MEP) and Manufacturing USA are helping manufacturers modernize operations and implement automation-driven training programs. The push toward digital manufacturing and upskilling programs has resulted in greater investment in self-calibrating, turnkey skiving systems that minimize operator dependency and enhance production consistency. This focus on workforce modernization and automation propels market expansion, especially among small and medium-sized manufacturers upgrading to advanced gear machining technologies.

Machine Type Insights

The standalone segment accounted for the largest share of 65.2% in 2024. Standalone internal gear skiving machines are witnessing sustained demand across small and medium-sized manufacturers due to their flexibility, compact footprint, and cost-effectiveness. These machines allow for dedicated, high-precision gear production lines, making them attractive to tier-2 and tier-3 suppliers operating under tight capital constraints. The modernization of small machining workshops through national manufacturing extension programs and the rising production of EV drivetrain components are propelling the adoption of standalone machines as they balance accuracy with affordability. Furthermore, the ability to retrofit digital controls and automated tool changers is boosting their relevance in the smart manufacturing era.

The multi-functional segment is expected to grow at the fastest CAGR during the forecast period. Multi-functional internal gear skiving machines, which combine turning, milling, and grinding operations, are gaining significant traction as manufacturers aim to reduce production time and improve gear quality. These machines are increasingly integrated into digitally connected production cells under Industry 4.0 frameworks. The growing emphasis on hybrid machining solutions, supported by initiatives such as NIST’s Smart Manufacturing testbeds and DOE’s Advanced Manufacturing Office programs, is boosting the adoption of multi-functional systems, enabling high-precision, one-setup operations for complex gear geometries used in electric and aerospace drive systems.

Automation Level Insights

The semi-automatic segment held the largest market share in 2024. Semi-automatic skiving machines continue to hold a steady market share, particularly in regions where manual intervention remains feasible and cost control is a priority. SMEs in emerging manufacturing hubs gradually adopt semi-automatic systems to transition from traditional hobbing and shaping processes. Their lower maintenance costs and compatibility with existing operator skills propel short-term adoption, especially in localized automotive part production lines supported by regional industrial development programs.

The fully automatic segment is expected to grow at the fastest CAGR during the forecast period. Fully automatic internal gear skiving machines drive the next wave of market expansion, fueled by rising automation mandates and labor shortages in precision machining. These machines integrate AI-based monitoring, tool-wear diagnostics, and CNC control systems, enabling continuous production with minimal human supervision. Supported by national smart manufacturing initiatives and factory digitalization grants, the fully automatic segment is experiencing strong growth in North America, Europe, and East Asia. OEMs prioritize operational efficiency, repeatability, and high throughput.

Gear Size Insights

The small gears (upto 200 mm) segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period. The surging production of compact planetary gears and micro-gears for electric vehicles, drones, and robotics is boosting demand for skiving machines optimized for small-diameter gear cutting. These gears require ultra-precise tooth geometry and surface finishing, which skiving delivers more efficiently than shaping or broaching. The push toward lightweight, high-speed transmissions in EVs and automation systems, supported by government electrification policies, is propelling the growth of this segment globally.

The medium gears (200-500 mm) segment is projected to grow significantly over the forecast period. Medium-sized gear production is experiencing increasing demand from heavy-duty vehicle and aerospace gear applications. Skiving machines' capability to maintain consistent precision in medium gear diameters drives adoption across transmission system manufacturers and aircraft component suppliers. In addition, the integration of CNC control systems enables accurate skiving of hardened materials, boosting their utilization in applications requiring strength and precision, particularly in aviation and defense equipment manufacturing.

Technology Insights

The CNC segment dominated the market in 2024 and is projected to grow at the fastest CAGR over the forecast period. CNC-based internal gear skiving machines drive most of the global market growth, supported by the expansion of smart manufacturing ecosystems and precision engineering requirements in the automotive and aerospace sectors. These machines enable adaptive control, rapid prototyping, and integration with digital twin environments. The increasing governmental focus on advanced manufacturing and digital integration, such as through NIST and Manufacturing USA initiatives, is boosting global adoption of CNC skiving machines for high-volume, high-tolerance gear production.

The conventional segment is projected to grow significantly over the forecast period. While advanced CNC skiving machines dominate new installations, conventional skiving machines maintain relevance among small-scale workshops and maintenance operations. Their lower initial investment and simple operational structure make them suitable for low-volume gear production and tool room applications. In regions with limited access to CNC infrastructure, conventional machines continue to propel localized market activity, especially where cost optimization outweighs automation.

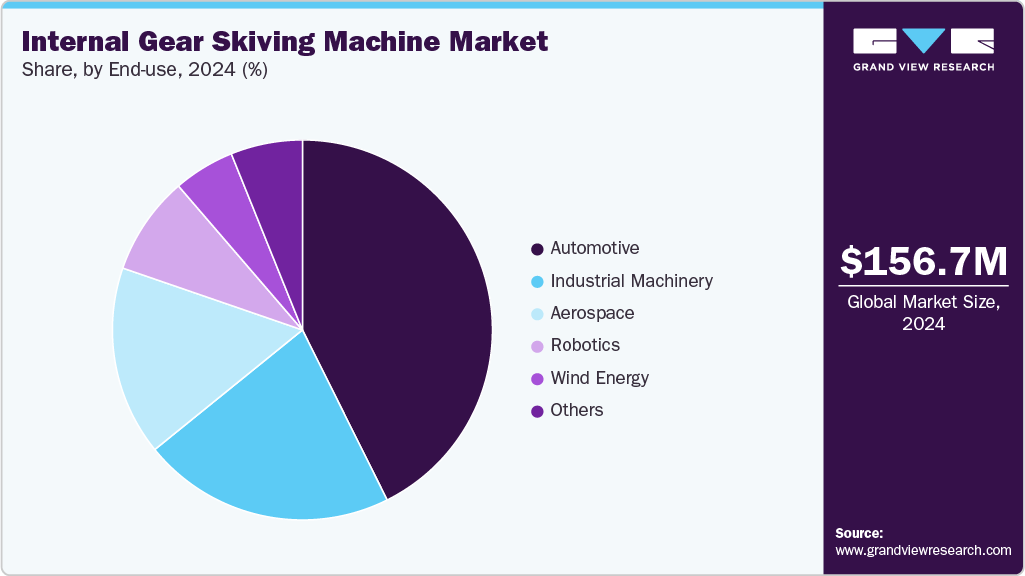

End-use Insights

The automotive segment dominated the market in 2024 and is projected to grow at the fastest CAGR over the forecast period. The automotive sector remains the largest end use segment, primarily driven by the transition to hybrid and electric powertrains. The need for compact, high-efficiency gear systems in EVs and high production volumes propels demand for internal gear skiving machines. These systems offer faster cutting speeds and superior surface accuracy compared to broaching, making them essential for planetary and reduction gear production. Government-backed incentives for EV manufacturing and localization policies further boost this segment’s growth trajectory.

The aerospace segment is projected to grow significantly over the forecast period. The aerospace sector is rapidly embracing internal gear skiving technology for manufacturing lightweight, high-precision gears in turbine, actuator, and flight control systems. The shift toward titanium and advanced alloys, which require exacting cutting conditions, has made CNC skiving the preferred solution for maintaining geometric consistency and surface finish. Supported by defense and space manufacturing programs under agencies like NASA and the U.S. Department of Defense, the segment is witnessing strong growth, as aerospace OEMs prioritize automated precision gear production to enhance safety and performance standards.

Regional Insights

The North America internal gear skiving machine market accounted for a 25.5% share in 2024. North America is emerging as a leading hub for advanced gear machining technologies, propelling growth by Industry 4.0 adoption and domestic manufacturing revitalization policies. The U.S. Infrastructure Investment and Jobs Act and the CHIPS and Science Act have collectively boosted the setup of precision manufacturing facilities, benefiting suppliers of high-accuracy machine tools such as internal gear skiving systems. Moreover, the rapid localization of electric vehicle (EV) drivetrain production by companies like Ford, GM, and Tesla has expanded the demand for small and medium internal gears requiring skiving-grade precision. The U.S. Department of Energy’s Vehicle Technologies Office (VTO) has outlined drivetrain efficiency programs that rely heavily on precision gear components, further propelling demand for high-speed, automated skiving machines in the region.

U.S. Internal Gear Skiving Machine Market Trends

The internal gear skiving machine market in the U.S. holds the largest share of the North American market, supported by strong investments in aerospace, defense, and EV manufacturing. The National Institute of Standards and Technology (NIST) and Manufacturing USA initiatives have accelerated the adoption of digitally integrated CNC gear skiving equipment across private and public-sector manufacturers. In the aerospace domain, companies under NASA’s Artemis and Commercial Crew Programs have increased procurement of precision gear systems for actuators and flight control units, where internal skiving is preferred for accuracy and repeatability. Simultaneously, the U.S. Air Force’s modernization of its maintenance facilities through Advanced Manufacturing Cells, incorporating CNC gear machining, has boosted the domestic demand for high-end skiving machines.

Europe Internal Gear Skiving Machine Market Trends

The internal gear skiving machine market in Europe was identified as a lucrative region in 2024. Europe is shifting toward sustainable and digitalized gear manufacturing, driven by EU Green Deal goals and industry-wide decarbonization initiatives. European machine tool builders are integrating energy-efficient CNC skiving machines designed to reduce tool wear and optimize cutting fluid usage. The European Commission’s Horizon Europe program has provided R&D funding to projects focusing on precision motion systems and e-mobility components, stimulating the need for advanced gear manufacturing equipment. Furthermore, Europe’s established automotive base, supported by EV platform expansions from Volkswagen, Renault, and Stellantis, propels market growth for high-efficiency internal gear skiving systems supporting lighter, quieter, and more durable drivetrains.

Germany internal gear skiving machine market continues to dominate the European landscape, anchored by its strong industrial base and leadership in precision engineering. Major German OEMs such as BMW, Mercedes-Benz, and Volkswagen have increased production of e-drives and hybrid systems, requiring ultra-precise internal gears for compact powertrains. Simultaneously, the German Federal Ministry for Economic Affairs and Climate Action (BMWK) has expanded funding under the “Industrie 4.0 Platform,” encouraging the integration of smart machining solutions into domestic manufacturing. German machine tool makers are also exporting multi-functional skiving systems to meet global EV supply chain needs, solidifying Germany’s position as the technological nucleus of this market.

The internal gear skiving machine market in the UK is propelled by reindustrialization efforts and rising aerospace investments under government initiatives such as the Made Smarter Programme and the UK Aerospace Technology Institute (ATI) Strategy. Adopting digital and automated gear skiving equipment has been boosted by expanding electric mobility projects (e.g., Jaguar Land Rover’s all-electric transition by 2025) and aerospace partnerships involving Rolls-Royce and BAE Systems. The UK’s growing interest in low-emission powertrains and lightweight aircraft systems drives demand for internal skiving machines capable of achieving micron-level accuracy on high-strength materials.

Asia Pacific Internal Gear Skiving Machine Market Trends

The internal gear skiving machine market in Asia-Pacific held the largest market share of 36.0% in 2024 and is projected to grow at the fastest CAGR over the forecast period, propelled by massive expansion in the automotive, robotics, and industrial automation sectors. National industrial modernization programs, such as China’s “Made in China 2025,” Japan’s “Society 5.0,” and India’s “Make in India”, are collectively driving the establishment of high-precision machining ecosystems. The region’s dominance in EV and e-mobility production, coupled with government support for domestic machine tool innovation, is boosting the adoption of CNC-based skiving machines. APAC manufacturers also leverage localized supply chains and government-backed subsidies to expand production capacity, positioning the region as the largest contributor to global market volume growth.

China internal gear skiving machine market is rapidly advancing, fueled by the country’s strategic push toward high-end manufacturing and EV powertrain production. Under the “Made in China 2025” policy, the government has prioritized domestic development of CNC machine tools and precision gear systems to reduce import dependency. Leading Chinese automotive and industrial robotics manufacturers are investing in fully automatic skiving systems for high-volume gear production, supported by R&D grants and industrial parks focused on smart equipment manufacturing. Furthermore, China’s new energy vehicle (NEV) production surge, crossing 9 million units in 2024, has boosted the demand for precision skiving machinery to produce efficient, low-noise gearsets for electric drivetrains.

India internal gear skiving machine marketis rapidly emerging as a promising market, supported by government initiatives such as “Make in India” and the Production-Linked Incentive (PLI) Scheme. The country’s growing automotive and electric two-wheeler industries drive significant demand for compact, high-precision gears in e-drives and transmission systems. Local suppliers are increasingly investing in CNC and fully automated skiving machines to meet the precision requirements of global OEMs, establishing production in India. The expansion of aerospace component manufacturing, backed by the Defence Production and Export Promotion Policy (DPEPP), boostsgear manufacturers' adoption of high-tolerance components for aviation and defense applications.

Key Internal Gear Skiving Machine Company Insights

Some major players in the market include Liebherr-Verzahntechnik GmbH, Gleason Corporation, Mitsubishi Heavy Industries, EMAG GmbH & Co. KG, Klingelnberg AG, NIDE C Machine Tool Corporation, NACHI-FUJIKOSHI Corporation, JTEKT Corporation, FFG Werke, DMG Mori, and DVS TECHNOLOGY GROUP, among others, owing to their strong technological expertise, extensive product portfolios, and strategic focus on high-precision gear manufacturing for automotive, aerospace, and industrial applications. These companies are investing heavily in R&D to advance digital machining systems, enhance process automation, and integrate Industry 4.0 capabilities into skiving operations, factors that are significantly propelling their leadership in the evolving precision engineering landscape.

-

Liebherr-Verzahntechnik GmbH is a prominent company in gear manufacturing machinery, recognized for its advanced internal gear skiving solutions that combine high precision, rigidity, and productivity. The company focuses on intelligent machine integration, offering automation-ready systems that align with the growing demand for smart manufacturing. Liebherr’s expertise in precision cutting and its comprehensive service network across Europe, the U.S., and Asia continue to reinforce its dominance in gear skiving for electric vehicle transmissions and industrial drivetrains.

-

Gleason Corporation is among the most established names in gear technology. It offers a complete range of gear skiving machines with adaptive process control and real-time monitoring. The company’s “Genesis” and “OptiSkive” series are designed to optimize cycle time and surface finish, especially for high-volume automotive applications. Gleason’s sustained collaboration with OEMs and Tier-1 suppliers ensures its competitiveness in advanced gear production systems globally.

-

Mitsubishi Heavy Industries Machine Tool Co., Ltd. delivers high-speed, high-accuracy skiving machines designed for automotive gear manufacturing. The company’s focus on combining mechanical stability with smart CNC programming supports the production of compact EV gears and high-efficiency transmission components. Mitsubishi’s long-standing R&D strength and automation capabilities enable it to cater to mass and precision manufacturing segments.

Key Internal Gear Skiving Machine Companies:

The following are the leading companies in the internal gear skiving machine market. These companies collectively hold the largest market share and dictate industry trends.

- Liebherr-Verzahntechnik GmbH

- Gleason Corporation

- Mitsubishi Heavy Industries

- EMAG GmbH & Co. KG

- Klingelnberg AG

- NIDE C Machine Tool Corporation

- NACHI-FUJIKOSHI Corporation

- JTEKT Corporation

- FFG Werke

- DMG Mori

- DVS TECHNOLOGY GROUP

Recent Developments

-

In July 2025, Klingelnberg AG announced its EMO/industry exhibit plans and product focus for precision gear systems, highlighting integrated measurement and process-controlled skiving workflows that improve traceability for internal gear production in aerospace and high-end automotive applications.

-

In September 2023, DMG MORI promoted its gearSKIVING technology during Technology Days, presenting gearSKIVING workflows (including process cycles and integration options for mill-turn centers) that enable manufacturers to add skiving capability without separate dedicated lines.

Internal Gear Skiving Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 164.5 million

Revenue forecast in 2033

USD 316.8 million

Growth rate

CAGR of 8.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine type, automation level, gear size, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Liebherr-Verzahntechnik GmbH; Gleason Corporation; Mitsubishi Heavy Industries; EMAG GmbH & Co. KG; Klingelnberg AG; NIDE C Machine Tool Corporation; NACHI-FUJIKOSHI Corporation; JTEKT Corporation; FFG Werke; DMG Mori; DVS TECHNOLOGY GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Internal Gear Skiving Machine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global internal gear skiving machine market report based on machine type, automation level, gear size, technology, end-use, and region:

-

Machine Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone

-

Multi-functional

-

-

Automation Level Outlook (Revenue, USD Million, 2021 - 2033)

-

Semi-automatic

-

Fully Automatic

-

-

Gear Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small Gears (upto 200 mm)

-

Medium Gears (200-500 mm)

-

Large Gears (above 500 mm)

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

CNC

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Aerospace

-

Industrial Machinery

-

Robotics

-

Wind Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global internal gear skiving machine market size was estimated at USD 156.7 million in 2024 and is expected to reach USD 164.5 million in 2025.

b. The global internal gear skiving machine market size is expected to grow at a significant CAGR of 8.5% to reach USD 316.8 million in 2033.

b. Asia Pacific held the largest market share of 36.0% in 2024, propelled by massive expansion in the automotive, robotics, and industrial automation sectors. National industrial modernization programs, such as China’s “Made in China 2025,” Japan’s “Society 5.0,” and India’s “Make in India”, are collectively driving the establishment of high-precision machining ecosystems.

b. Some of the players in the market are Liebherr-Verzahntechnik GmbH, Gleason Corporation, Mitsubishi Heavy Industries, EMAG GmbH & Co. KG, Klingelnberg AG, NIDE C Machine Tool Corporation, NACHI-FUJIKOSHI Corporation, JTEKT Corporation, FFG Werke, DMG Mori, and DVS TECHNOLOGY GROUP.

b. The key driving trend in the internal-gear skiving machine market is the increasing demand for high-precision, efficient gear production, especially driven by sectors like automotive (including EVs), aerospace, and industrial machinery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.