- Home

- »

- Automotive & Transportation

- »

-

Intralogistics Market Size And Share, Industry Report, 2033GVR Report cover

![Intralogistics Market Size, Share & Trends Report]()

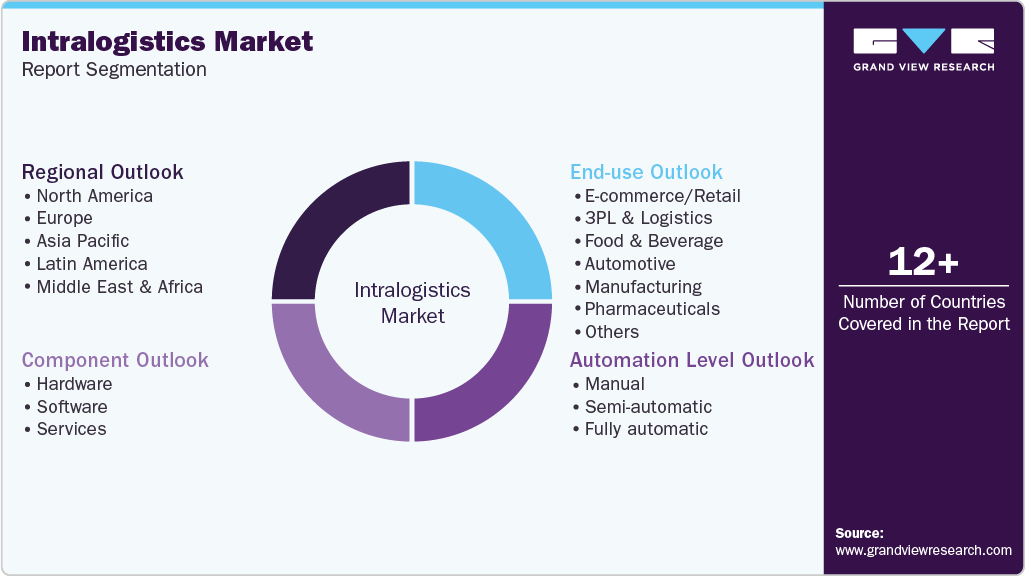

Intralogistics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Automation Level, By End Use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-805-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intralogistics Market Summary

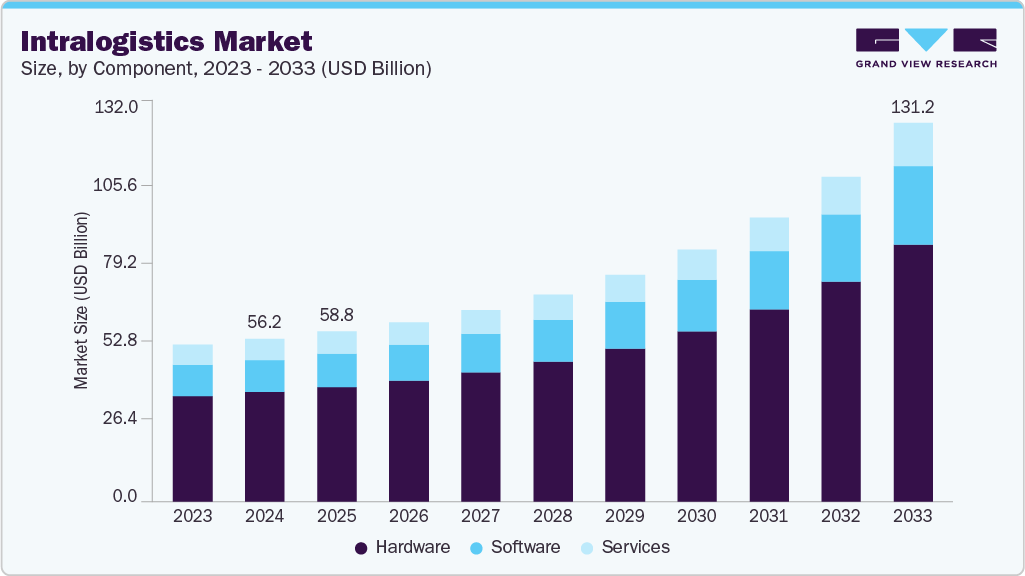

The global intralogistics market size was estimated at USD 56.22 billion in 2024, and is projected to reach USD 131.17 billion by 2033, growing at a CAGR of 10.6% from 2025 to 2033. The market is experiencing robust global growth, driven by the accelerating shift toward automation and digital transformation in supply chain and warehouse operations.

Key Market Trends & Insights

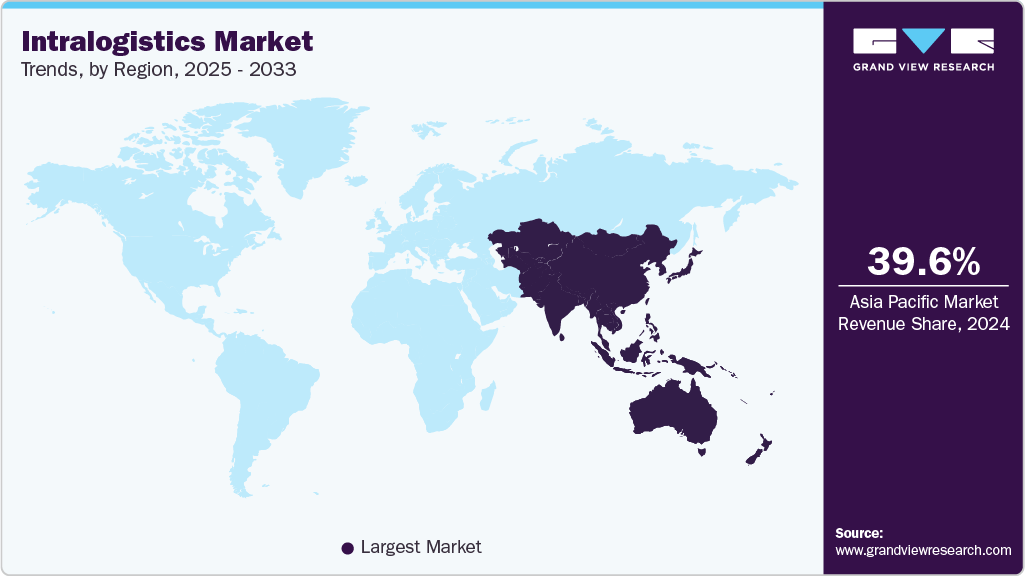

- Asia Pacific intralogistics market accounted for a 39.6% share of the overall market in 2024.

- The intralogistics industry in China held a dominant position in 2024.

- By component, the hardware segment accounted for the largest share of 67.4% in 2024.

- By automation level, the semi-automatic segment held the largest market share in 2024.

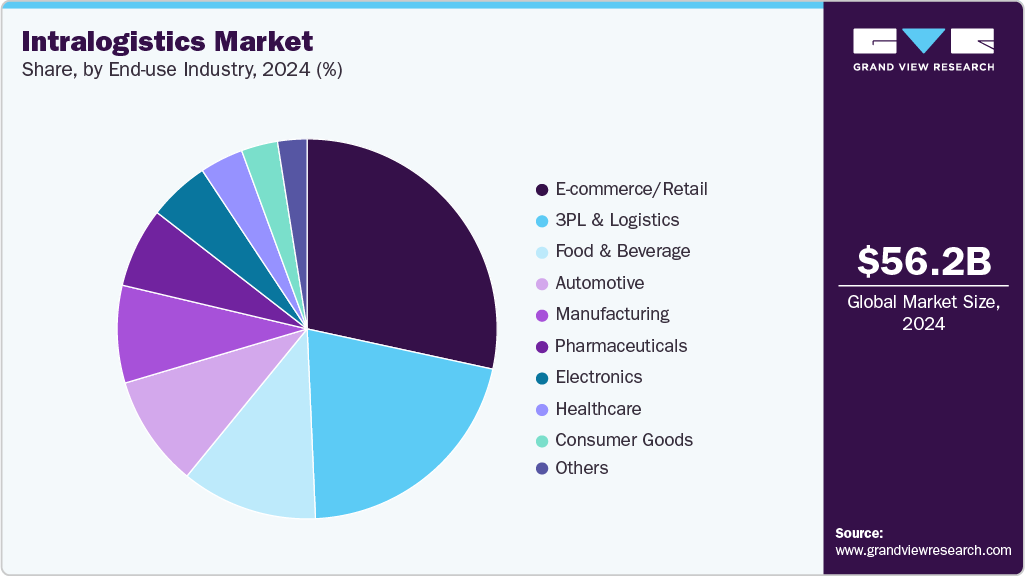

- By end use industry, the e-commerce/retail segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 56.22 Billion

- 2033 Projected Market Size: USD 131.17 Billion

- CAGR (2025-2033): 10.6%

- Asia Pacific: Largest market in 2024

Rising e-commerce activity, growing demand for faster order fulfillment, and the need to optimize warehouse efficiency are the primary market drivers. Companies are increasingly adopting automated material handling systems, robotics, and advanced storage solutions to enhance productivity, minimize human error, and reduce operational costs.Technological innovation is a defining factor in the evolution of the intralogistics landscape. The integration of Industry 4.0 technologies, including artificial intelligence (AI), Internet of Things (IoT), machine learning, and data analytics, is revolutionizing warehouse management and material handling processes. Automation solutions such as autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and robotic picking systems are increasingly deployed to ensure accuracy, speed, and flexibility in logistics operations.

Investments in intralogistics are accelerating as companies seek to modernize their operations and build resilient supply chains. Major global players and emerging startups are investing in robotics innovation, AI-based logistics platforms, and smart warehousing infrastructure. Governments in key markets such as the U.S., Germany, China, and India are supporting automation through industrial modernization programs and incentives for logistics infrastructure development.

The regulatory landscape surrounding intralogistics is evolving to ensure safety, interoperability, and sustainability in automated environments. Governments and industry bodies are establishing standards for machine safety, data security, and environmental compliance to facilitate the safe operation of robotic systems and ensure integration across various automation platforms. In addition, regulations promoting energy-efficient and low-emission logistics operations are encouraging companies to adopt green automation technologies.

Despite strong growth prospects, the intralogistics market faces several challenges. The high initial investment and integration costs associated with automation technologies can deter small and medium-sized enterprises from adopting automation on a full scale. Complexity in system interoperability and the need for skilled labor to operate advanced automation solutions also pose significant hurdles. Moreover, supply chain disruptions, semiconductor shortages, and cybersecurity concerns related to connected logistics systems add to the market’s operational risks.

Component Insights

The hardware segment accounted for the largest share of 67.4% in 2024. The rise in e-commerce and omni-channel retail, which demands faster, error-free fulfillment and real-time inventory movement, fuels the growth of the segment. High-speed sorting systems, robotic picking arms, and automated packaging machines are being deployed to meet these needs efficiently. Furthermore, advancements in sensor technology, IoT connectivity, and robotics have made these systems more intelligent, reliable, and cost-effective, encouraging broader adoption even among mid-sized warehouses. The shift toward smart, modular, and scalable automation solutions is expanding the market base for hardware vendors globally.

The software segment is expected to grow at the fastest CAGR during the forecast period. The integration of AI, machine learning, and predictive analytics is driving the growth of the segment. These technologies enable real-time tracking, demand forecasting, route optimization, and adaptive resource allocation, leading to more agile and resilient operations. Moreover, the shift toward cloud-based and SaaS platforms enables scalable deployments, facilitates easier updates, and reduces upfront costs, making advanced intralogistics software accessible to small and mid-sized enterprises as well.

Automation Level Insights

The semi-automatic segment held the largest market share of 48.3% in 2024. The segment is witnessing robust growth as companies increasingly seek a balance between manual flexibility and automation efficiency. Many organizations, especially in emerging markets and mid-sized enterprises, are adopting semi-automated systems, such as conveyors, pick-to-light systems, automated forklifts, and barcode/RFID tracking solutions, as a cost-effective entry point into warehouse automation. These systems enhance productivity and accuracy while requiring lower capital investment compared to fully automated setups, making them highly attractive for firms transitioning from manual operations.

The fully automatic segment is expected to grow at a significant CAGR during the forecast period. The global shift toward smart, autonomous, and data-driven warehouses propels the growth of the segment. Organizations are increasingly deploying automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and robotic picking systems to achieve end-to-end automation of material handling operations. This shift is driven by the demand for higher throughput, reduced human dependency, and 24/7 operational efficiency, especially in industries such as e-commerce, pharmaceuticals, and automotive manufacturing.

End Use Industry Insights

The e-commerce/retail segment dominated the market in 2024. The e-commerce and retail sector represents the largest and fastest-growing end use industry for intralogistics, primarily driven by the surge in online shopping and omni-channel retailing. The global rise in digital consumers has led to exponential growth in order volumes, SKU diversity, and fulfillment complexity. To meet customer expectations for same-day or next-day deliveries, retailers are investing heavily in conveyor and sorting solutions, automated storage and retrieval systems (AS/RS), and robotic picking technologies to accelerate warehouse throughput and minimize errors.

The pharmaceuticals segment is projected to grow at a significant CAGR of 11.5% over the forecast period. The pharmaceuticals segment is witnessing rapid adoption of intralogistics due to the need for precision, traceability, and regulatory compliance in material handling and distribution. As global drug manufacturing and distribution networks expand, pharmaceutical companies are turning to automation to ensure accuracy, hygiene, and real-time monitoring across their supply chains. Automated systems, including robotic storage units, AGVs, and conveyor systems, are being deployed to maintain consistent product handling while reducing contamination risks and human error in high-sensitivity environments.

Regional Insights

The North America intralogistics market held a significant share in 2024. The growth in the region is driven by the rising adoption of automation across warehousing and manufacturing operations. The region benefits from strong investments in robotics, autonomous mobile robots (AMRs), and warehouse management systems (WMS), particularly within the e-commerce and third-party logistics (3PL) sectors.

U.S. Intralogistics Market Trends

The U.S. intralogistics market held a dominant position in 2024, supported by the adoption of advanced technology and the dominance of leading e-commerce and retail players, such as Amazon and Walmart. Warehouses across the U.S. are increasingly deploying automated storage and retrieval systems (AS/RS), robotic picking arms, and cloud-based logistics platforms to streamline fulfillment processes.

Europe Intralogistics Industry Trends

The Europe intralogistics industry was identified as a lucrative region in 2024. The European intralogistics market is characterized by a high level of automation maturity, driven by established industrial infrastructure and a strong emphasis on operational efficiency. Adoption of Industry 4.0 technologies, including IoT, data analytics, and digital twins, is transforming warehouse management and material handling operations across the region.

The UK intralogistics market is expected to experience rapid growth over the forecast period, driven by strong e-commerce growth, increasing urban warehousing demand, and the rise of same-day delivery models. Post-Brexit supply chain realignments have increased the need for advanced automation to mitigate operational disruptions and improve inventory management.

The intralogistics industry in Germany held a substantial market share in 2024. The growth in the region is supported by its strong manufacturing base and early adoption of automation and robotics. The country is home to several leading automation solution providers and system integrators that are driving technological innovation in the sector.

Asia Pacific Intralogistics Market Trends

The Asia Pacific intralogistics market accounted for a 39.6% share of the overall market in 2024 and anticipated to grow at a CAGR of 10.8% during the forecast period. The rapid expansion of e-commerce, manufacturing, and cross-border trade drives the growth in the region. Countries such as China, Japan, South Korea, and India are investing heavily in warehouse automation, robotics, and digital supply chain infrastructure to improve logistics efficiency and competitiveness.

The China intralogistics market is expected to grow rapidly during the forecast period, fueled by its vast manufacturing and e-commerce sectors. The country is witnessing large-scale deployment of robotics, AMRs, and AI-driven warehouse management systems as part of its smart manufacturing transformation.

The intralogistics market in India held a substantial market share in 2024. The growth in the region is supported by expanding e-commerce activity, industrial automation, and government initiatives like “Make in India” and the National Logistics Policy. Companies are increasingly adopting semi-automated and robotic systems to enhance efficiency, reduce dependence on manual labor, and streamline high-volume order fulfillment.

Key Intralogistics Company Insights

Some of the key companies in the intralogistics market include Daifuku Co., Ltd., Dematic, Swisslog Holding AG, BEUMER Group, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Daifuku Co., Ltd. is a provider of automated material handling and intralogistics solutions. The company specializes in designing, manufacturing, installing, and servicing comprehensive systems, including Automated Storage and Retrieval Systems (AS/RS), Automated Guided Vehicles (AGVs), conveyors, sorters, and picking systems, which streamline warehouse and manufacturing operations. Daifuku’s intralogistics solutions enable efficient storage, transport, and sorting of goods with high accuracy and speed, supporting industries such as automotive, e-commerce, food, and electronics.

-

Dematic is a provider of intralogistics and supply chain automation solutions, providing intelligent, integrated solutions that optimize material and information flow within warehouses, distribution centers, and manufacturing facilities. The company offers a broad portfolio of automation technologies, including automated guided vehicles (AGVs), conveyor systems, sortation, automated storage and retrieval systems (AS/RS), and advanced warehouse management software (WMS). Its modular, flexible, and scalable solutions serve a diverse customer base across retail, e-commerce, manufacturing, and other industries.

Key Intralogistics Companies:

The following are the leading companies in the intralogistics market. These companies collectively hold the largest market share and dictate industry trends.

- Daifuku Co., Ltd.

- Dematic

- SSI SCHÄFER

- Swisslog Holding AG

- BEUMER Group

- Jungheinrich AG

- KION GROUP AG

- Godrej Enterprises

- HÖRMANN

- DLL

Recent Developments

-

In October 2025, Smartlog and BlueSword announced a strategic partnership at the Logistics & Automation 2025 trade fair to advance the future of intralogistics through comprehensive automation solutions jointly. BlueSword, a modular and automated warehouse logistics solution, brings over 30 years of innovative technology and extensive manufacturing capabilities, offering solutions across the entire intralogistics cycle, including smart storage, picking, packing, transportation, and delivery. Complementing this, Smartlog contributes its expertise in integrating advanced mobile robotics with a proven track record of over 150 installations globally across diverse sectors. The collaboration aims to provide customers worldwide with cutting-edge, tailored automation solutions that deliver measurable precision, cost efficiency, and operational excellence from design through ongoing support and training.

Intralogistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 58.79 billion

Revenue forecast in 2033

USD 131.17 billion

Growth rate

CAGR of 10.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report automation level

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, automation level, end use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Daifuku Co., Ltd.; Dematic; SSI SCHÄFER; Swisslog Holding AG; BEUMER Group; Jungheinrich AG; KION GROUP AG; Godrej Enterprises; HÖRMANN; DLL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intralogistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intralogistics market report based on component, automation level, end use industry, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Automation Level Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Semi-automatic

-

Fully automatic

-

-

End Use Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

E-commerce/Retail

-

3PL & Logistics

-

Food & Beverage

-

Automotive

-

Manufacturing

-

Pharmaceuticals

-

Electronics

-

Healthcare

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global intralogistics market size was estimated at USD 56.22 billion in 2024 and is expected to reach USD 58.79 billion in 2025.

b. The global intralogistics market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2033 to reach USD 131.17 billion by 2033.

b. The Asia Pacific segment dominated the market in 2024 and accounted for the largest share of 39.6%.The rapid expansion of e-commerce, manufacturing, and cross-border trade drives the growth of the market in the region.

b. Some key players operating in the intralogistics market include Daifuku Co., Ltd.; Dematic; SSI SCHÄFER; Swisslog Holding AG; BEUMER Group; Jungheinrich AG; KION GROUP AG; Godrej Enterprises; HÖRMANN; DLL.

b. The intralogistics market is experiencing robust global growth, driven by the accelerating shift toward automation and digital transformation in supply chain and warehouse operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.