- Home

- »

- Plastics, Polymers & Resins

- »

-

IoT Enabled Packaging Market Size, Industry Report, 2030GVR Report cover

![IoT Enabled Packaging Market Size, Share & Trends Report]()

IoT Enabled Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (RFID & NFC Tags, Smart Sensors), By End Use (Retail & Logistics, Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-525-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT Enabled Packaging Market Size & Trends

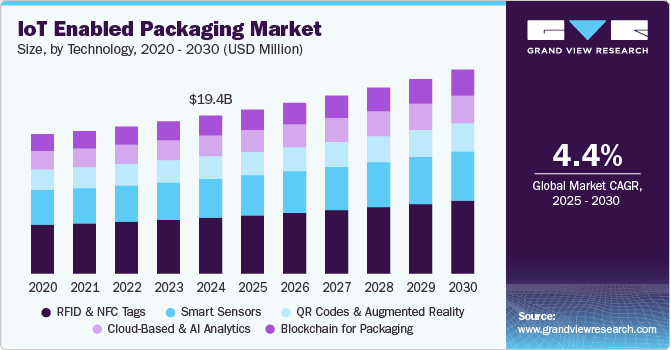

The global IoT enabled packaging market was estimated at USD 19.37 billion in 2024 and is expected to expand at a CAGR of 4.4% from 2025 to 2030. The market is witnessing significant growth driven by the growing demand for smarter, more efficient supply chains. IoT-enabled packaging provides real-time data on the condition, location, and status of products during transport and storage, which allows businesses to optimize logistics, reduce losses, and improve efficiency.

The increasing consumer demand for personalized experiences also contributes to market growth. IoT-enabled packaging can collect data on consumer preferences and behaviors, allowing brands to tailor marketing campaigns and product offers more effectively. Smart packaging can also provide interactive elements such as QR codes or Near Field Communication (NFC) tags, which consumers can scan to learn more about the product, track its journey, or even participate in loyalty programs. For example, in the food and beverage industry, brands use smart packaging to engage consumers by providing them with detailed product information or offering exclusive content via mobile apps, enhancing the consumer's connection to the brand.

The rise of sustainability concerns is also driving market growth. The ability to track and manage packaging materials more effectively supports waste reduction and improves recycling efforts. IoT-enabled packaging can help companies monitor the lifecycle of packaging materials, optimize the use of resources, and ensure that packaging is properly disposed of or recycled. For example, in the electronics industry, some companies are incorporating smart packaging that helps track the product's carbon footprint throughout its supply chain, thus aligning with sustainability goals and improving the brand's reputation in the market.

Regulatory requirements and industry standards are further boosting the adoption of IoT-enabled packaging, particularly in sectors such as pharmaceuticals, food, and logistics. Regulatory bodies increasingly require companies to ensure their product's safety, quality, and authenticity. IoT-enabled packaging provides a means to meet these standards by offering traceability, tamper-proof features, and real-time monitoring of conditions such as temperature and humidity. The pharmaceutical industry is embracing IoT-enabled packaging solutions to comply with Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) regulations, ensuring drugs are safely delivered to consumers while maintaining product integrity.

Technology Insights

The RFID & NFC tags segment recorded the largest market revenue share of over 35.0% in 2024. The main drivers for this market segment include the increasing demand for real-time tracking and inventory management, improving the overall visibility of the supply chain. In addition, the growing need for product authentication, anti-counterfeiting measures, and the growing use of smartphones to interact with product packaging are key factors driving the adoption of RFID & NFC tags in packaging.

The blockchain for the packaging segment is projected to grow at the fastest CAGR of 5.0% during the forecast period. Blockchain technology in packaging refers to using decentralized and secure digital ledgers to track product information throughout the supply chain. This technology allows businesses and consumers to verify the authenticity, origin, and journey of products in real-time, reducing the risk of fraud and enhancing trust in the product's quality and safety.

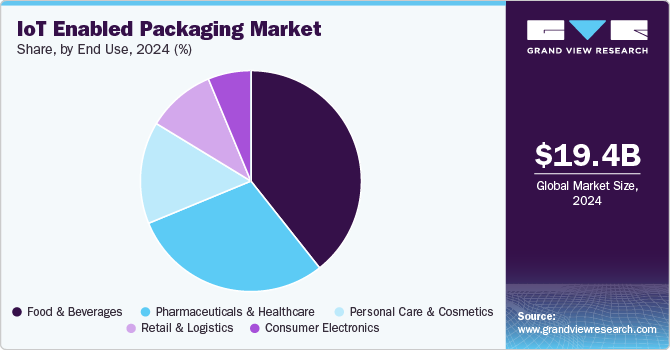

End Use Insights

The food & beverage segment recorded the largest market share of over 39.0% in 2024. The growing demand for traceability, enhanced safety standards, and the need for real-time monitoring are major drivers in the food and beverages sector. Consumers are increasingly concerned about food quality, freshness, and sustainability, pushing brands to adopt technologies such as IoT to offer transparency and improve product handling during transportation. Moreover, regulatory requirements for food safety and the increasing preference for personalized, fresh food products are encouraging companies to incorporate smart packaging solutions.

Pharmaceuticals & healthcare is projected to grow at the fastest CAGR of 4.7% during the forecast period. The rising demand for patient safety, adherence to medical prescriptions, and strict regulatory compliance are the main drivers of IoT-enabled packaging in pharmaceuticals. As pharmaceutical companies increasingly focus on ensuring their products' efficacy, especially in biologics and temperature-sensitive medications, IoT solutions become essential for compliance with regulatory standards such as those set by the FDA and EMA.

In retail and logistics, IoT-enabled packaging facilitates supply chain optimization by providing real-time tracking, monitoring environmental conditions, and ensuring more efficient inventory management. Smart packaging can provide insights into stock levels, expiration dates, and even shipping conditions, reducing losses due to spoilage or damage during transportation. This also enhances the overall consumer experience, as customers can receive real-time updates on their orders.

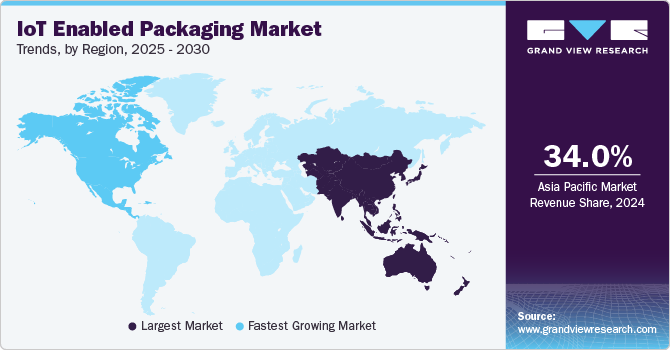

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 34.0% in 2024 and is anticipated to grow at the fastest CAGR of 4.7% over the forecast period. The region’s significant growth in the IoT-enabled packaging market is due to several interconnected factors. The region's massive manufacturing base, particularly in countries such as China, South Korea, Japan, and India, has created an extensive ecosystem for smart packaging innovation. The region's robust e-commerce sector has also been a significant driver of IoT-enabled packaging adoption. Countries such as Indonesia, Vietnam, and Malaysia have seen exponential growth in online retail, creating a pressing need for smart packaging solutions.

China IoT Enabled Packaging Market Trends

China IoT enabled packaging market growth can be attributed to its massive manufacturing infrastructure, combined with strong government support through initiatives such as "Made in China 2025" and heavy investments in smart manufacturing. Chinese companies have been rapidly integrating sensors, RFID tags, and smart labels into packaging solutions across industries, particularly in food, pharmaceuticals, and consumer goods.

North America IoT Enabled Packaging Market Trends

The IoT enabled packaging market in North America is expected to grow at the fastest CAGR over the forecast period. The region benefits from advanced technological infrastructure, high consumer adoption of smart devices, and a robust ecosystem of technology companies and packaging manufacturers. Major players such as Amazon, Walmart, and Target have been investing heavily in smart packaging solutions to enhance their supply chain visibility and improve customer experience. For example, Walmart has implemented RFID-enabled packaging across its distribution network to track inventory in real-time and reduce losses.

The U.S. IoT enabled packaging market growth can be attributed to its country's advanced technological infrastructure and the presence of major technology companies and packaging innovators. Companies such as Amazon, with its vast logistics network, have been instrumental in pushing the boundaries of what's possible with smart packaging. The U.S. also benefits from a strong regulatory framework and investment climate that supports IoT innovation in packaging. The FDA's support for smart packaging in pharmaceutical applications has been particularly influential, leading to developments like smart pill bottles that track medication adherence and send reminders to patients.

Europe IoT Enabled Packaging Market Trends

The IoT enabled packaging market in Europe is expected to grow significantly over the forecast period. The European Union's stringent regulations on food safety, pharmaceutical tracking, and environmental sustainability are key drivers for the market in the region. For example, the EU's Digital Product Passport initiative requires detailed tracking of products throughout their lifecycle, pushing companies to adopt IoT-enabled packaging solutions. Companies such as SIG in Switzerland and Tetra Pak in Sweden have developed smart packaging solutions that monitor product freshness, temperature variations, and supply chain conditions in real-time, particularly benefiting the region's substantial dairy and beverage industries.

Germany IoT Enabled Packaging market is primarily driven by its strong focus on Industry 4.0 initiatives. The German government's significant investments in digital infrastructure and manufacturing modernization have encouraged companies to adopt smart packaging solutions. This is complemented by Germany's extensive network of research institutions and technical universities, which collaborate with industry partners to develop new IoT packaging technologies.

Key IoT Enabled Packaging Company Insights

The competitive environment of the IoT-enabled packaging industry is highly dynamic. Key players, including packaging manufacturers and technology providers, are innovating by integrating sensors, RFID tags, and cloud-based systems into the packaging to enhance supply chain transparency, track product conditions, and improve customer experience. Competition is intensified by partnerships between IoT firms and traditional packaging companies, fostering the development of tailored solutions. Established players focus on scalability, security, and real-time data analytics while emerging players aim to differentiate through cost-effective solutions and niche applications. The rapid pace of digitalization and evolving regulatory requirements ensure a constantly shifting competitive landscape.

Key IoT Enabled Packaging Companies:

The following are the leading companies in the IoT enabled packaging market. These companies collectively hold the largest market share and dictate industry trends.

- INGSOL

- Amcor plc

- Berry Global Inc

- Tetra Pak

- Crown Holding, Inc.

- FICUS PAX

- DS Smith

- Mondi

- SIG

- Stora Enso

- Sealed Air

- Ball Corporation

- Huhtamaki

- Baywater Packaging & Supply

- Masitek Instruments Inc.

Recent Developments

-

In October 2024, TOPPAN Holdings acquired Selinko SA, a Belgian company specializing in IoT solutions and ID authentication platforms, to enhance its capabilities in the European luxury market. The acquisition involves TOPPAN acquiring 100% of Selinko's stock, making it a wholly owned subsidiary. This strategic move aims to bolster TOPPAN's IoT and smart packaging services, particularly for luxury brands in Europe, which are experiencing growing demand.

-

In July 2023, Senoptica Technologies developed sensor technology to monitor the condition of packaged food. The company's technology uses patented, food-safe ink to create optical sensors that measure the oxygen level inside modified atmosphere-packaged (MAP) foods. This allows manufacturers and retailers to gain real-time insights into the condition of goods and predict spoilage before it happens.

IoT Enabled Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.12 billion

Revenue forecast in 2030

USD 25.02 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end use, region

States scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Key companies profiled

INGSOL; Amcor plc; Berry Global Inc; Tetra Pak; Crown Holding, Inc.; FICUS PAX; DS Smith; Mondi; SIG; Stora Enso; Sealed Air; Ball Corporation; Huhtamaki; Baywater Packaging & Supply; Masitek Instruments Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

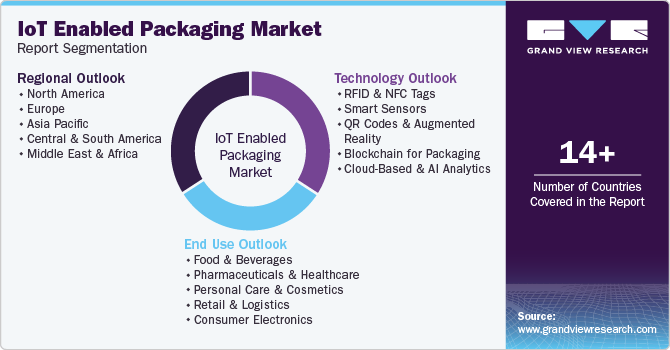

Global IoT Enabling Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT enabled packaging market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID & NFC Tags

-

Smart Sensors

-

QR Codes & Augmented Reality

-

Blockchain for Packaging

-

Cloud-Based & AI Analytics

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals & Healthcare

-

Personal Care & Cosmetics

-

Retail & Logistics

-

Consumer Electronics

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT enabled packaging market size was estimated at USD 19.37 billion in 2024 and is expected to reach USD 20.13 billion in 2025.

b. The global IoT enabled packaging market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 25.02 billion by 2030.

b. The RFID & NFC Tags technology segment dominated the IoT enabled packaging market with a share of 35.4% in 2024 as he increasing demand for real-time tracking and inventory management, improving the overall visibility of the supply chain.

b. Some of the key players operating in the IoT enabled packaging market include INGSOL; Amcor plc; Berry Global Inc; Tetra Pak; Crown Holding, Inc.; FICUS PAX; DS Smith; Mondi; SIG; Stora Enso; Sealed Air; Ball Corporation; Huhtamaki; Baywater Packaging & Supply; and Masitek Instruments Inc.

b. The key factors that are driving the IoT enabled packaging market are the growing demand for smarter, more efficient supply chains. IoT-enabled packaging provides real-time data on the condition, location, and status of products during transport and storage, which allows businesses to optimize logistics, reduce losses, and improve efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.