- Home

- »

- Next Generation Technologies

- »

-

IoT Wearable Device Market Size, Industry Report, 2030GVR Report cover

![IoT Wearable Device Market Size, Share & Trends Report]()

IoT Wearable Device Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Sensors, Actuators), By Connectivity (Bluetooth, Wi-Fi), By Type (Smartwatches, Fitness Bands), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-559-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

IoT Wearable Device Market Summary

The global iot wearable device market size was estimated at USD 18.80 billion in 2024 and is projected to reach USD 37.37 billion by 2030, growing at a CAGR of 9.8% from 2025 to 2030. The market growth is largely driven by the growing technological advancements, increasing consumer demand for health and fitness solutions, and the broader integration of wearable devices within the Internet of Things (IoT) ecosystem.

Key Market Trends & Insights

- North America IoT wearable devices industry dominated globally with a share of over 34% in 2024.

- The U.S. IoT wearable device industry accounted for the largest market share in 2024.

- In terms of product, the sensors segment accounted for the largest market share of over 40% in 2024.

- In terms of type, the smartwatches accounted for the largest market share in 2024.

- In terms of end use, the industrial IoT (IIoT) segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.80 Billion

- 2030 Projected Market Size: USD 37.37 Billion

- CAGR (2025-2030): 9.8%

- North America: Largest market in 2024

These devices, which range from smartwatches and fitness trackers to more specialized medical wearables, are gaining popularity owing to their ability to monitor health metrics, provide real-time data, and enhance everyday convenience. These factors further accelerate the adoption of IoT wearable device solutions, boosting the IoT wearable device industry expansion.

The growing integration of wearables with broader IoT ecosystems is revolutionizing user experiences by enabling seamless data sharing across devices. This interconnectedness allows wearables to interact with smart homes, healthcare systems, and other connected technologies, enhancing the functionality and convenience of daily life. The ability to sync with multiple devices further boosts the value proposition of wearables, particularly in enhancing productivity, safety, and lifestyle management.

In addition, the growing adoption of IoT wearable devices in health and wellness monitoring is boosting market demand. IoT wearables are increasingly designed to monitor vital health metrics such as heart rate, blood pressure, and oxygen saturation in real-time. These devices help users proactively manage their health, supporting the growing trend of personalized healthcare. With continuous advancements in sensor technology, wearables are becoming indispensable tools in preventive health and fitness, enabling users to stay ahead of potential health issues. These factors are expected to contribute significantly to the IoT wearable device industry expansion.

Furthermore, the introduction of faster and more reliable connectivity options, such as 5G, is a significant driver in the IoT wearable device industry. These technologies offer increased bandwidth, lower latency, and the ability to handle larger volumes of data, which are critical for applications such as real-time health monitoring, augmented reality, and smart automation. This connectivity leap makes wearables more capable, efficient, and appealing to a broader range of consumers and industries, which is expected to drive the market growth in the coming years.

Moreover, the integration of AR and VR in IoT wearables is revolutionizing user interaction by blending digital and physical worlds. These devices offer immersive experiences across sectors such as gaming, education, healthcare, and training, allowing real-time interaction with digital content. This trend is enhancing productivity, learning, and entertainment, providing more engaging and practical solutions for both consumers and professionals, thereby boosting the IoT wearable device industry.

Product Insights

The sensors segment accounted for the largest market share of over 40% in 2024, driven by the increasing need for accurate, real-time data collection and health monitoring. As wearables become more focused on health, fitness, and medical applications, the integration of sensors such as heart rate monitors, accelerometers, gyroscopes, and temperature sensors allows for continuous tracking of vital signs and physical activities. These sensors enable wearables to deliver valuable insights for users and healthcare professionals, driving the growth of the market as consumers seek devices that can offer precise, actionable data for better decision-making and personalized care.

The processors segment is expected to witness the fastest CAGR of over 10% from 2025 to 2030. This rapid growth is driven by the growing advancements in processors, which have enabled the high-performance computing power required to run complex applications on small, power-efficient devices. The development of low-power, high-performance processors allows wearables to offer real-time data processing, enhanced AI capabilities, and seamless connectivity without sacrificing battery life. The growing integration of features such as AI-driven personalization, augmented reality, and continuous health monitoring in wearables makes efficient processors crucial for providing a smooth, responsive user experience, which is further driving segmental growth.

Type Insights

The smartwatches accounted for the largest market share in 2024, driven by increasing consumer demand for multifunctional, connected devices. Smartwatches now go beyond simple timekeeping, offering features such as health monitoring (heart rate, ECG, sleep tracking), fitness tracking, notifications, and even payments. With advancements in battery life, processor efficiency, and integration with mobile devices, the segment is expected to continue to grow in the coming years, offering convenience, personalization, and seamless connectivity for everyday tasks.

The wearable AR/VR devices segment is expected to witness the fastest CAGR from 2025 to 2030, driven by advancements in immersive technology and the growing demand for interactive experiences in gaming, training, education, and healthcare. These devices are transforming the way users engage with digital content by blending the physical and virtual worlds. With the growing accessibility of AR/VR technology, these wearables enable real-time interaction with digital environments, providing new opportunities in areas such as remote collaboration, virtual training, and immersive entertainment, and thereby driving segmental growth.

End Use Insights

The industrial IoT (IIoT) segment accounted for the largest market share in 2024, driven by the need to improve safety, productivity, and operational efficiency in industries such as manufacturing, logistics, and construction. Wearables such as smart helmets, glasses, and sensors help monitor workers' health, track environmental conditions, and collect real-time data to optimize processes and reduce risks. As industries continue to embrace connected technologies for better decision-making and automation, IIoT wearables are becoming essential tools in the workforce.

The automotive and transportation segment is expected to witness the fastest CAGR from 2025 to 2030. propelled by the rapid adoption of connected car technologies, autonomous vehicles, and electric vehicles (EVs). IoT wearables in automotive settings, such as smartwatches, health monitors, and driver-assist devices, enhance safety, enable real-time health and fatigue monitoring for drivers, and support seamless vehicle-to-device communication. The integration of 5G connectivity, edge computing, and artificial intelligence further enables predictive maintenance, advanced driver assistance systems (ADAS), and in-car infotainment, all of which are increasingly demanded by regulatory pushes for telematics and smart safety features. These factors are significantly contributing to segmental growth.

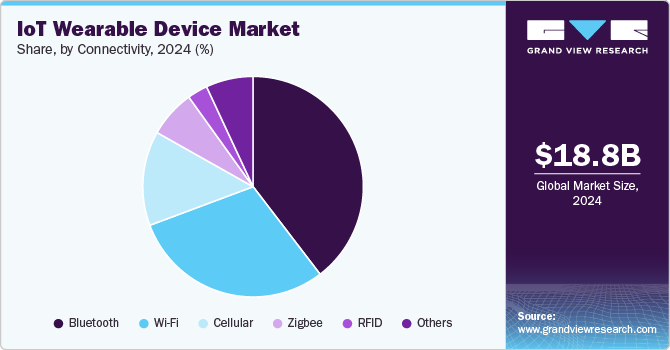

Connectivity Insights

The Bluetooth segment accounted for the largest market share in 2024, driven by its critical role in enabling seamless, low-energy connectivity. The growing adoption of Bluetooth Low Energy (BLE) is a key trend, as it supports efficient communication between wearables and devices such as smartphones, fitness trackers, and smartwatches without draining battery life. BLE’s ability to facilitate real-time data transfer is especially vital in health, fitness, and lifestyle applications. As consumers demand more responsive and energy-efficient wearables, Bluetooth continues to be at the core of connected, data-driven user experiences.

The cellular segment is expected to witness a significant CAGR from 2025 to 2030, driven by increasing demand for standalone connectivity in wearable devices. As users seek greater mobility and convenience, wearables with built-in cellular capabilities are gaining popularity for enabling real-time communication, GPS tracking, and remote monitoring without the need for a connected smartphone. This trend is particularly prominent in fitness, healthcare, and lifestyle applications, where continuous data access and user independence are critical. The shift toward untethered wearable experiences is fueling innovation and adoption in the cellular connectivity space.

Regional Insights

North America IoT wearable devices industry dominated globally with a share of over 34% in 2024, driven by early technology adoption, strong consumer demand for fitness and health monitoring devices, significant investments in digital healthcare, high smartphone penetration, advanced infrastructure, presence of key tech support, rapid innovation, and market growth. In addition, growing awareness around preventive healthcare and chronic disease management fuels the uptake of wearables across both consumer and healthcare sectors.

U.S. IoT Wearable Device Market Trends

The U.S. IoT wearable device industry accounted for the largest market share in 2024, fueled by high disposable income, tech-savvy consumers, and widespread adoption of digital health technologies. The country's strong healthcare ecosystem is integrating wearables for remote monitoring and telehealth. Increasing use of wearables for fitness, wellness, and enterprise applications-combined with favorable regulatory support for digital health-continues to propel demand and innovation in the U.S. wearable tech space.

Europe IoT Wearable Device Market Trends

Europe IoT wearable device industry accounted for a significant market share of over 24% in 2024, driven by a focus on digital transformation, rising health consciousness, and government initiatives promoting smart healthcare and aging-in-place technologies. The region’s growing elderly population and investments in public healthcare systems are spurring the use of medical-grade wearables for monitoring chronic conditions. In addition, strong data privacy regulations are shaping wearable tech development toward secure and compliant solutions.

The UK IoT wearable device industry is expected to grow at a significant CAGR in the coming years, owing to rising consumer interest in fitness tracking, wellness, and NHS-supported remote healthcare initiatives. The push for digital health post-pandemic has led to increased acceptance of wearables in medical settings, particularly for monitoring patients with chronic conditions. The UK also benefits from a thriving tech startup scene and strong collaborations between health services and tech firms, further fueling growth.

The Germany IoT wearable device market is driven by growing health awareness and increasing adoption of connected devices within both the consumer and industrial sectors. The integration of wearables into digital healthcare initiatives and insurance-supported wellness programs is accelerating market adoption. In addition, Germany’s strong engineering base and innovation in IIoT applications are supporting the use of wearables in industrial safety and workforce productivity.

Asia-Pacific IoT Wearable Device Market Trends

The Asia-Pacific IoT wearable device industry is expected to grow at the fastest CAGR of over 13% over the forecast period, owing to its large, tech-hungry population, rising middle class, and increasing smartphone usage. Countries across the region are embracing wearables for fitness, healthcare, and personal safety. Growing investments in healthcare infrastructure and smart cities, combined with strong manufacturing capabilities in countries such as China and South Korea, are driving the production and consumption of wearable devices at scale.

The Japan IoT wearable device industry is gaining traction fueled by its aging population, advanced electronics industry, and a cultural emphasis on health and technology. The country’s strong innovation ecosystem supports cutting-edge wearable development, while government initiatives promoting healthcare digitalization and wellness are driving adoption in both consumer and medical domains.

The China IoT wearable device industry is rapidly expanding, driven by rapid urbanization and widespread mobile internet access. The market is expanding due to growing interest in health and fitness, government-backed healthcare reforms, and high-volume manufacturing capabilities. In addition, China's tech ecosystem promotes fast-paced innovation, bringing a variety of affordable wearable products to both domestic and global markets.

Key IoT Wearable Device Company Insights

Some of the key players operating in the market are Apple, Inc., and Samsung Electronics Co., Ltd., among others.

-

Apple, Inc. is a global player in consumer electronics and digital services, widely recognized for its innovation in smart devices. In the IoT wearable device industry, the company is known for its Apple Watch line, which integrates seamlessly with its iOS ecosystem. The Apple Watch offers a suite of features, including heart rate monitoring, ECG, blood oxygen tracking, fitness tracking, and advanced health insights powered by AI and machine learning.

-

Samsung Electronics, Co., Ltd. is a key player in the global IoT wearable device industry. Its Galaxy Watch and Galaxy Fit series are known for combining sleek design with robust health, fitness, and productivity features. The company integrates its wearables with the broader Android and Galaxy ecosystem, offering advanced sensors for health monitoring (including body composition analysis), long battery life, and LTE connectivity. The company also invests heavily in R&D to enhance wearable functionality and AI capabilities, reinforcing its competitive edge in the fast-evolving IoT wearable space.

NXP Semiconductors NV and STMicroelectronics NV are some of the emerging market participants in the IoT wearable device industry.

-

NXP Semiconductors is a global semiconductor manufacturer known for delivering secure, connected solutions that power innovation across automotive, industrial, and IoT markets. In the IoT wearable device space, NXP plays a crucial role by providing low-power, high-performance chips that support features such as wireless connectivity (NFC, Bluetooth, UWB), biometric authentication, secure data transmission, and embedded processing. Its solutions are widely used in smartwatches, fitness trackers, and health monitoring devices, offering manufacturers the tools to build compact, efficient, and secure wearables.

-

STMicroelectronics is a multinational electronics and semiconductor company that designs and manufactures a broad range of integrated devices and MEMS (Micro-Electro-Mechanical Systems) sensors. The company offers key components such as motion sensors (accelerometers, gyroscopes), environmental sensors (temperature, humidity, pressure), microcontrollers, and power management ICs. ST’s solutions are essential for activity recognition, motion tracking, and health monitoring in fitness bands, smartwatches, and industrial wearables.

Key IoT Wearable Device Companies:

The following are the leading companies in the IoT wearable device market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd.

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies, Inc.

- Apple, Inc.

- Garmin, Ltd.

- NXP Semiconductors NV

- STMicroelectronics NV

- Robert Bosch GmbH

- Cisco Systems, Inc.

- Honeywell International Inc.

Recent Developments

-

In January 2025, Garmin, Ltd. announced the launch of its Instinct3 Series, a new lineup of rugged smartwatches designed for adventurers. The series features either a brilliant AMOLED or solar-powered display for extended battery life, a metal-reinforced bezel for enhanced durability, and a built-in flashlight on all models.

-

In January 2025, at CES 2025, Intel Corporation unveiled its new Intel Core Ultra 200V series mobile processors, designed to enhance business productivity with AI-driven features and robust IT management through the Intel vPro platform. These processors offer significant performance improvements, efficiency, and security, facilitating a seamless experience with Microsoft Copilot.

-

In January 2025, NXP Semiconductors NV announced the MCX L series of ultra-low-power microcontrollers designed for smart sensor nodes and battery-constrained devices. These MCUs are expected to enhance efficiency and extend battery life in IoT applications.

IoT Wearable Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.37 billion

Revenue forecast in 2030

USD 37.37 billion

Growth Rate

CAGR of 9.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, connectivity, end use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; U.A.E.

Key companies profiled

Samsung Electronics Co., Ltd.; Huawei Technologies Co., Ltd.; Qualcomm Technologies, Inc.; Apple Inc.; Garmin Ltd.; NXP Semiconductors NV; STMicroelectronics NV; Robert Bosch GmbH; Cisco Systems, Inc.; Honeywell International Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global IoT Wearable Device Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global IoT wearable device market report based on component, type, connectivity, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Sensors

-

Actuators

-

Processors

-

Edge Devices

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartwatches

-

Fitness Bands

-

Wearable AR/VR devices

-

Others

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wi-Fi

-

Bluetooth

-

Zigbee

-

Cellular

-

RFID

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare & Medical

-

Fitness & Wellness

-

Consumer Electronics

-

Industrial & Enterprise

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global IoT wearable device market size was valued at USD 18.80 billion in 2024 and is expected to reach USD 23.37 billion in 2025.

b. The global IoT wearable device market is expected to grow at a compound annual growth rate of 9.8% from 2025 to 2030 to reach USD 37.37 billion by 2030.

b. The sensors segment registered the highest revenue share of over 40% in 2024 in the IoT wearable device market, driven by the increasing need for accurate, real-time data collection and health monitoring.

b. Some key players operating in the IoT wearable device market include Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Qualcomm Technologies, Inc., Apple Inc., Garmin Ltd., NXP Semiconductors NV, STMicroelectronics NV, Robert Bosch GmbH, Cisco Systems, Inc., and Honeywell International Inc.

b. The key factors driving the market growth include the growing technological advancements, increasing consumer demand for health and fitness solutions, and the broader integration of wearable devices within the Internet of Things (IoT) ecosystem.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.