- Home

- »

- Clinical Diagnostics

- »

-

Infectious Disease In Vitro Diagnostics Market Report, 2030GVR Report cover

![Infectious Disease In Vitro Diagnostics Market Size, Share & Trends Report]()

Infectious Disease In Vitro Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents, Software), By Technology, By Application, By Test Location, By Region, And Segment Forecasts

- Report ID: 978-1-68038-716-2

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infectious Disease In Vitro Diagnostics Market Summary

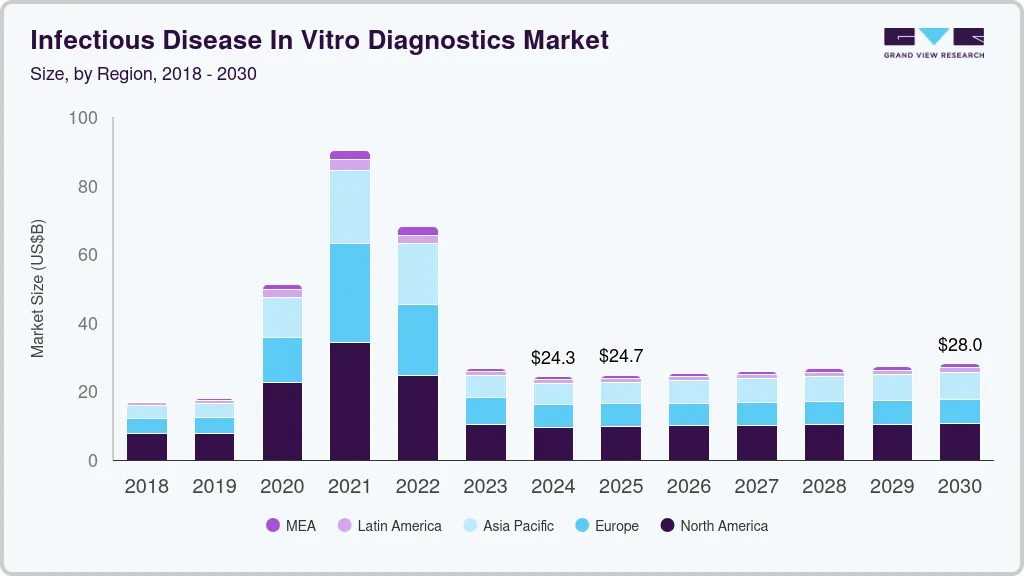

The global infectious disease in vitro diagnostics market size was estimated at USD 24.30 billion in 2024 and is projected to reach USD 28.05 billion by 2030, growing at a CAGR of 2.5% from 2025 to 2030. The growing geriatric population susceptible to infectious diseases, rising awareness about early testing, high demand for PoC testing owing to the pandemic, and rising prevalence of infectious diseases are key factors driving the market over the forecast period.

Key Market Trends & Insights

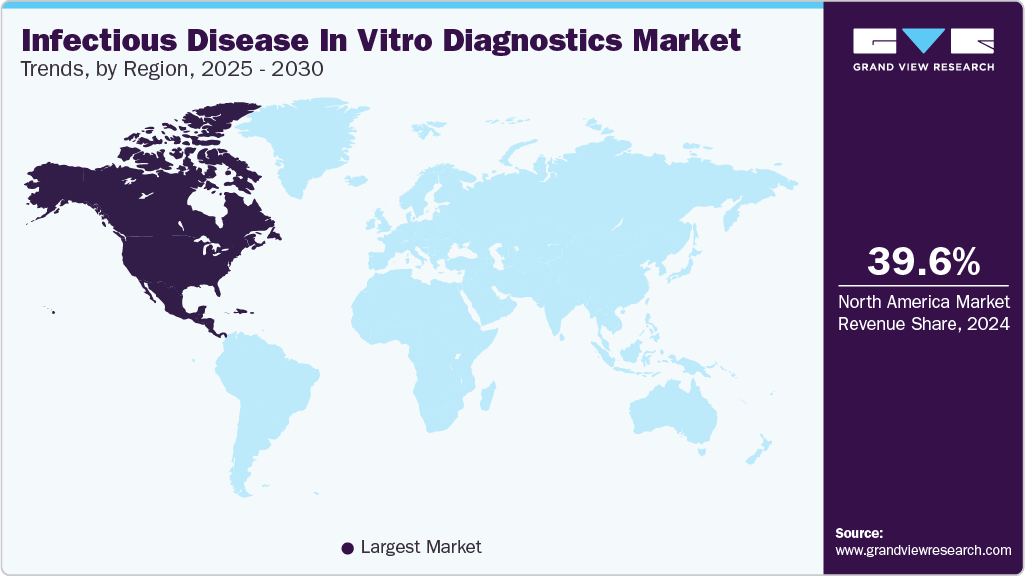

- North America infectious disease in vitro diagnostics market accounted for 39.56% share of the global market in 2024.

- The infectious disease in vitro diagnostics market in the U.S. is expected to grow over the forecast period.

- By product, reagents segment led the market and accounted for 67.63% of the global revenue share in 2024.

- By technology, immunoassay technology segment accounted for the largest revenue share of 35.73% in 2024.

- By application, the COVID-19 application segment accounted for the largest market revenue share of 14.86% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.30 Billion

- 2030 Projected Market Size: USD 28.05 Billion

- CAGR (2025-2030): 2.5%

- North America: Largest market in 2024

The industry witnessed a paradigm shift during the pandemic due to the launch of novel and innovative products for SARS-CoV-2 testing. It amplified the adoption of these products, resulting in the exponential growth of the industry in recent years.

The growing geriatric population globally and numerous untapped opportunities in developing countries are factors expected to propel the infectious disease in vitro diagnostics industry growth during the forecast period. For instance, in December 2024, a Moroccan biotech firm Moldiag launched Africa's first domestically produced mpox test kits, marking a significant step toward reducing the continent's reliance on imported medical supplies. The testing kits were developed in response to the World Health Organization declaring mpox a global emergency. The Africa CDC has approved the tests for USD 5 and is distributing them across Burundi, Uganda, Congo, Senegal, and Nigeria. The rising prevalence of infectious diseases is a major factor driving steep revenue generation. In addition, aged people have to be tested regularly to avoid severe infections, which creates growth opportunities for in Vitro Diagnostic (IVD) tests in countries such as Russia, Japan, Germany, and the U.S., which have higher elderly populations globally.

Furthermore, 40% of HIV cases are transmitted by people unaware of their positive status. This demonstrates an unmet need for diagnostic tests for HIV. The acquisition, expansion, and new product development are becoming a prominent strategy for growth and portfolio diversification. For instance, in November 2024, QIAGEN announced that it is expanding its operations by establishing a new Esplugues de Llobregat facility near Barcelona, Spain, set to open in early 2026. This 8,000-square-meter site will serve as a global innovation hub for the QIAstat-Dx system, which is used for rapid syndromic testing to identify illnesses such as respiratory, gastrointestinal, and meningitis/encephalitis conditions. Moreover, in January 2025, bioMérieux, a global leader in IVDs, announced the acquisition of Norwegian diagnostics firm SpinChip Diagnostics ASA for USD 154.57 million to improve its point-of-care testing capabilities. SpinChip's innovative benchtop analyzer delivers lab-quality results from whole blood samples within 10 minutes. In addition, the availability of at-home collection and self-testing kits reduces patient visits to clinics and supports patient discretion. In November 2023, the U.S. FDA approved an at-home test for chlamydia and gonorrhea for early detection of these sexually transmitted infections.

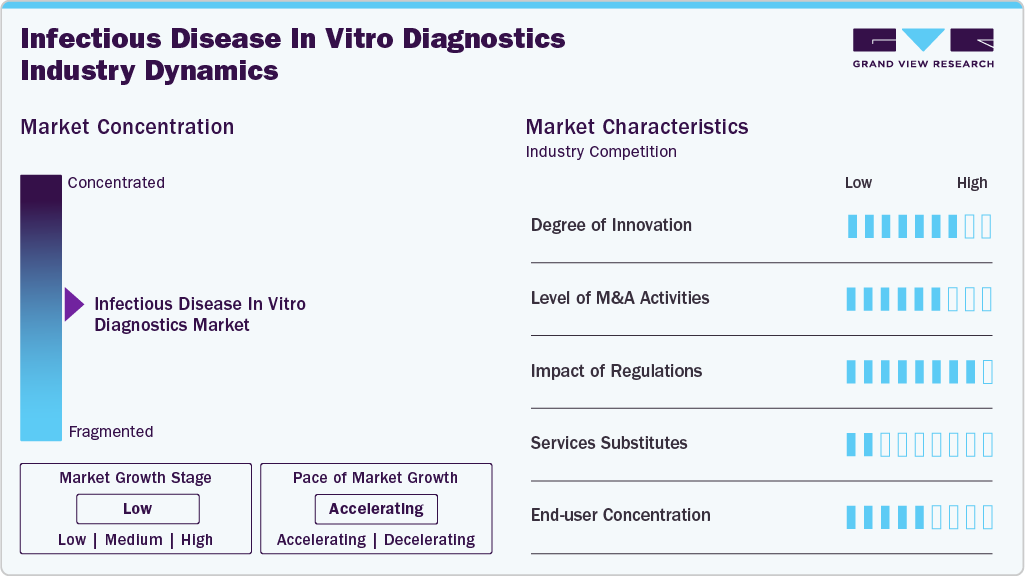

Market Concentration & Characteristics

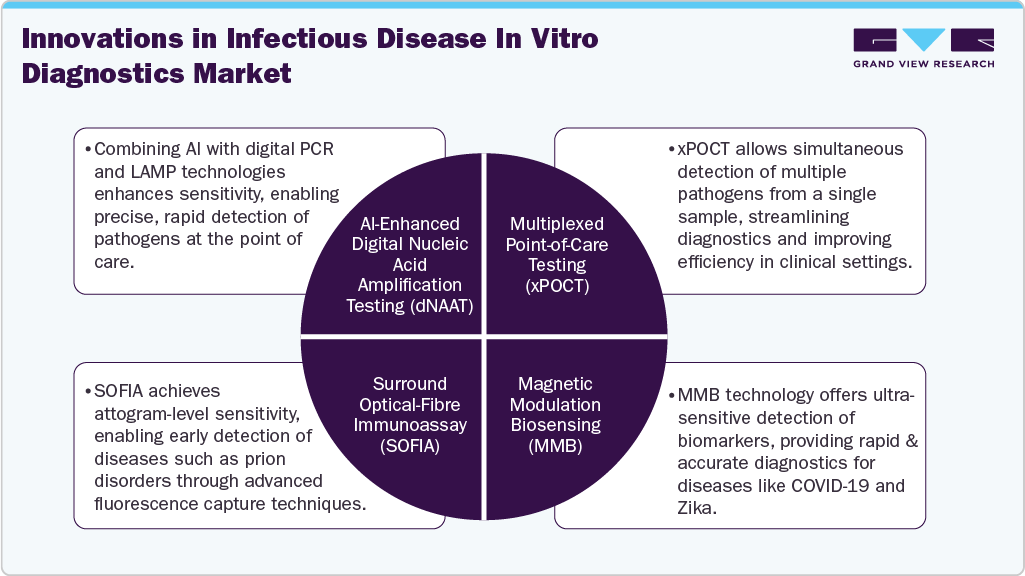

The growth stage is low, and the pace of the market growth is accelerating. The industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by increasing development of novel molecular diagnostics & immunoassays and point-of-care tests for infectious diseases. Moreover, market players are continuously involved in the development of novel POC testing products to capture the market opportunities.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new regions and technologies and the need to consolidate in a rapidly growing market.

The industry is also subject to increasing regulatory scrutiny. The regulatory framework for product approvals has always been one of the major restraining factors in the clinical diagnostic industry. The regulatory framework for the diagnostic sector is very stringent in countries where the market has a high potential to grow due to the availability of a large patient pool. Such a discrete and uncertain regulatory scenario for IVDs products creates confusion among manufacturers regarding commercialization.

There are a very limited number of direct substitute products and services for IVDs. The use of imaging tools to monitor infections can, to some extent, hamper the market's growth. However, IVD tests for infectious diseases overcome the threat of substitutes due to their accuracy and cost-effectiveness.

End use concentration is a significant factor in the market. The presence of several end users, such as hospitals, clinics, laboratories, and patients, is driving the demand for IVD tests. Moreover, increasing demand for rapid and self-tests for multiple infectious diseases creates new market opportunities for market players in different end-use applications.

Product Insights

Reagents led the market and accounted for 67.63% of the global revenue share in 2024. This can be attributed to the high-volume usage of reagents and test kits for the diagnosis of infectious diseases. Moreover, the COVID-19 testing programs to screen SARS-CoV-2 infection, are escalating the usage of reagents. For instance, as of May 2023, the U.S. FDA approved 449 tests and collection devices for COVID-19 infection detection. Out of the 449 products available in the market, around 116 can be used as OTC or the samples can be collected at home.

Rapid innovation is becoming a key factor in the focus on achieving a competitive edge. For instance, in February 2024, the Diagnostic Microbiology and Infectious Disease cited that identifying and diagnosing pathogenic microorganisms and viruses has significantly evolved with the adoption of advanced molecular techniques in clinical microbiology labs. Next-generation sequencing (NGS), which focuses on detecting nucleic acids and genetic profiling, has brought significant transformation in identifying infectious agents. Consumer demands in the software segment are evolving continuously; the use of the software is not limited to laboratories. Some consumers prefer cloud computing, while others opt for concierge services and need a team of professionals for software management. In January 2023, QIAGEN launched EZ2 Connect MDx platform to propel its automation capabilities in sample processing.

Technology Insights

Immunoassay technology accounted for the largest revenue share of 35.73% in 2024. Companies are focusing on the development and commercialization of immunoassays for infectious diseases due to increased demand for rapid tests. In June 2024, MP Biomedicals completed its infectious disease diagnostic test series with advanced rapid immunochromatographic tests. These new diagnostic kits offer accurate and fast detection of Helicobacter pylori, Salmonella typhi, and Vibrio cholerae (O1 and O139), improving gastrointestinal diagnostics. Hence, the use of immunoassays to detect different infectious diseases is expected to increase in the coming years.

The microbiology technology segment is expected to increase over the forecast period. This can be attributed to the rising global incidence of infectious diseases, such as tuberculosis, HIV, and hepatitis, and emerging viral threats like COVID-19 and monkeypox. Growing awareness among patients and healthcare providers about the importance of early disease detection contributes to the increased use of infectious disease IVDs. Moreover, key players are engaged in launching novel instruments and expanding their product portfolios for microbiology technology. For instance, in June 2024, QIAGEN launched digital PCR Microbial DNA Detection Assays to enable a timely response during public health emergencies or health crises, such as infectious disease outbreaks. These assays provide highly accurate and sensitive pathogen detection, supporting quick intervention measures and effectively monitoring disease transmission.

Application Insights

The COVID-19 application accounted for the largest market revenue share of 14.86% in 2024. The high share of the segment can be attributed to the increased adoption of SARS-CoV-2 testing to limit the spread of the infection and government initiatives to enhance public testing. Moreover, the introduction of rapid combination tests for multiple infections is expected to support segment growth over the forecast period. For instance, in June 2024, Roche announced that it received Emergency Use Authorization (EUA) from the U.S. FDA for its cobas liat SARS-CoV-2, Influenza A/B, and RSV nucleic acid test. This automated, real-time PCR test can detect multiple viruses at once, including COVID-19, flu A and B, and RSV, using the cobas liat system.

HIV is projected to witness the fastest growth rate over the forecast period. Increasing introduction of novel tests, high prevalence of HIV, and rising initiatives by market players to improve access to cost-effective HIV tests are anticipated to drive the segment growth. For instance, in February 2023, Thermo Fisher Scientific Inc. partnered with MyLab to procure RT-PCR kits for various infectious diseases, such as tuberculosis & HIV. Moreover, self-testing kits for HIV are attracting more customers.

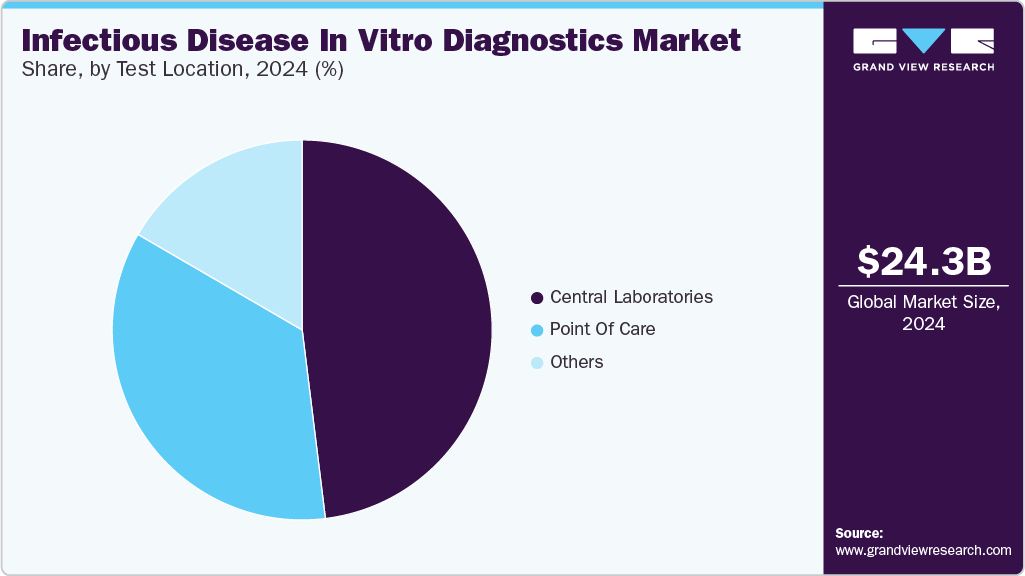

Test Location Insights

Central laboratories segment dominated in 2024 with a share of 48.06%. Laboratory-based tests ensure higher accuracy when compared to point-of-care tests, which makes them reliable. In addition, the availability of tests that allow for sample collection at home and sending it to the laboratories for testing makes testing highly convenient for the patients. Most of the key market players offer laboratory-based molecular diagnostic solutions across the globe, and these players are continuously involved in developing novel molecular diagnostic tests. In April 2023, EliTech announced its plan to launch EliVerse, a high-throughput molecular diagnostics instrument, in the Europe infectious disease in vitro diagnostics industry in 2024.

The high demand for faster turnaround time has escalated the demand for point-of-care tests. COVID-19 has strengthened segment growth and created an intensified demand for these products. The rapid turnaround time and low complexity give the products of this segment a competitive edge. Increasing demand for patient-centric healthcare services and growing adoption of technologically advanced testing products at point-of-care facilities, such as clinics and retail pharmacies, are further projected to drive the market expansion over the forecast period. For instance, in February 2023, Huwel Lifesciences designed a portable RT-PCR machine to test types of viruses.

Regional Insights

North America infectious disease in vitro diagnostics market accounted for 39.56% share of the global market in 2024. The region is expected to expand further at a lucrative rate over the forecast period. The presence of a favorable & flexible regulatory framework, the presence of major infectious disease in vitro diagnostics industry players offering novel IVD products, and the focus on increasing disease surveillance by conducting more tests are major drivers of the regional market. For instance, in March 2023, BD received 510(k) clearance from U.S. FDA for the BD Vaginal Panel on the BD COR System to detect infectious causes of vaginitis.

U.S. Infectious Disease In Vitro Diagnostics Market Trends

The infectious disease in vitro diagnostics market in the U.S. is expected to grow over the forecast period. The COVID-19 outbreak dramatically changed the market landscape, as companies were engaged in developing tests with quicker turnaround times and efficacy. Post-pandemic, other infectious disease segments, such as respiratory, flu, and STIs, are garnering a higher share.

Europe Infectious Disease In Vitro Diagnostics Market Trends

The infectious disease in vitro diagnostics market in Europe was identified as a lucrative region in this industry. New IVD regulations are estimated to present a more robust and sustainable framework for compliance with IVD devices. IVD infectious disease tests are launched at various conferences, symposiums, and other events to provide early visibility.

The UK infectious disease in vitro diagnostics market is expected to grow over the forecast period due to the presence of several key companies in the diagnostic industry, and significant awareness initiatives undertaken by the government and nonprofit organizations.

The infectious disease in vitro diagnostics market in France is expected to grow over the forecast period. Technological advancements, high disease prevalence & diagnosis rate, and product reach are factors expected to drive the market over the coming years.

Germany infectious disease in vitro diagnostics market is expected to grow over the forecast period due to the strong presence of several companies in Germany, such as Roche Diagnostics, QIAGEN, bioMérieux, Siemens Healthineers, and Agilent Technologies, involved in the development of IVD infectious disease panels & reagents, stringent regulations, and government support

Asia Pacific Infectious Disease In Vitro Diagnostics Market Trends

The infectious disease in vitro diagnostics market in Asia Pacific is anticipated to witness significant growth in the infectious disease IVD market. This growth can be attributed to the high prevalence of infectious diseases and growing healthcare access in emerging economies, such as India and China. The high geriatric population in countries such as Japan also drives the adoption of IVD tests. The rapid economic development in the region and the presence of emerging market players are expected to increase the adoption of novel tests for infectious disease diagnostics in the region.

China infectious disease in vitro diagnostics market is expected to grow over the forecast period. Increased need for early diagnosis, high focus on developing instruments with novel technologies, and a rising number of collaborations between key companies & private laboratories are factors driving the market.

The infectious disease in vitro diagnostics market in Japan is expected to grow over the forecast period, owing to various initiatives undertaken by the government, favorable reimbursement scenarios, and major key players operating in the U.S. expanding in Asia Pacific countries such as Japan.

Latin America Infectious Disease In Vitro Diagnostics Market Trends

The infectious disease in vitro diagnostics market in Latin America is primarily driven by government focus on improving regulatory reforms & reimbursement scenarios, increasing patient awareness, and rising investment and funding for developing products with faster turnaround time.

Brazil infectious disease in vitro diagnostics market is expected to grow over the forecast period due to the rising prevalence of chronic diseases in the country, due to the moderate standards of living, further increasing the need for advanced diagnostic and treatment options.

Middle East and Africa Infectious Disease In Vitro Diagnostics Market Trends

The infectious disease in vitro diagnostics market in the Middle East and Africa was identified as a lucrative region in this industry. The increasing prevalence of chronic diseases created a significant need for enhanced diagnostic tools and therapeutic alternatives in the country.

Saudi Arabia infectious disease in vitro diagnostics market is expected to grow over the forecast period owing to the rapid launch of new products in the region, the increasing number of government initiatives, and the rising prevalence of infectious diseases.

Key Infectious Disease in Vitro Diagnostics Companies Insights

Key players operating in the infectious disease in vitro diagnostics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Infectious Disease in Vitro Diagnostics Companies:

The following are the leading companies in the infectious disease in vitro diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- BD

- bioMérieux SA

- F. Hoffmann-La Roche, Ltd.

- Hologic, Inc. (Gen Probe)

- Abbott

- Quidel Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Danaher

- OraSure Technologies, Inc.

Recent Developments

-

In December 2024, OraSure Technologies, a leader in point-of-care and other diagnostic tests, acquired Sherlock Biosciences, a global health company, to improve its diagnostic offerings, particularly in molecular diagnostics. Sherlock's first asset is the rapid, over-the-counter self-test for Chlamydia and Gonorrhea, delivering results in under 30 minutes using isothermal amplification from self-collected swabs.

-

In October 2024, Quest Diagnostics secured several contracts from the U.S. Centers for Disease Control and Prevention (CDC) to support testing capabilities for two emerging infectious diseases: H5 avian influenza and the Oropouche virus. Under these agreements, Quest will launch a new molecular diagnostic test for the H5N1 strain of bird influenza by the end of October 2024, available by prescription and conducted at its San Juan Capistrano, California laboratory.

-

In March 2024, SEKISUI Diagnostics, a global leader in medical diagnostics manufacturing, obtained EUA clearance for the OSOM Flu SARS-CoV-2 Combo Test. It is approved for use in both professional and home testing settings.

-

In April 2023, EliTech announced its plan to launch ELITe InGenius in 2024. EliVerse is a novel high-throughput molecular diagnostics instrument for more than 50 CE-IVD parameters.

Infectious Disease In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.74 billion

Revenue forecast in 2030

USD 28.05 billion

Growth rate

CAGR of 2.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Products, technology, application, test location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; BD; bioMérieux SA; F. Hoffmann-La Roche, Ltd.; Hologic, Inc. (Gen Probe); Abbott; Quidel Corporation; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Danaher; OraSure Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infectious Disease In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infectious disease in vitro diagnostics market report based on products, technology, application, test location, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

MRSA

-

Streptococcus

-

Clostridium difficile

-

VRE

-

CRE

-

Respiratory Virus

-

Candida

-

TB and drug-resistant TB

-

Gastro-intestinal panel testing

-

Chlamydia

-

Gonorrhea

-

HPV

-

HIV

-

Hepatitis C

-

Hepatitis B

-

COVID-19

-

Other Infectious Diseases

-

-

Reagents

-

MRSA

-

Streptococcus

-

Clostridium difficile

-

VRE

-

CRE

-

Respiratory Virus

-

Candida

-

TB and drug-resistant TB

-

Gastro-intestinal panel testing

-

Chlamydia

-

Gonorrhea

-

HPV

-

HIV

-

Hepatitis C

-

Hepatitis B

-

COVID-19

-

Other Infectious Diseases

-

-

Software

-

MRSA

-

Streptococcus

-

Clostridium difficile

-

VRE

-

CRE

-

Respiratory Virus

-

Candida

-

TB and drug-resistant TB

-

Gastro-intestinal panel testing

-

Chlamydia

-

Gonorrhea

-

HPV

-

HIV

-

Hepatitis C

-

Hepatitis B

-

COVID-19

-

Other Infectious Diseases

-

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Immunoassay

-

Molecular diagnostics

-

Microbiology

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

MRSA

-

Streptococcus

-

Clostridium difficile

-

VRE

-

CRE

-

Respiratory Virus

-

Candida

-

TB and drug-resistant TB

-

Gastro-intestinal panel testing

-

Chlamydia

-

Gonorrhea

-

HPV

-

HIV

-

Hepatitis C

-

Hepatitis B

-

COVID-19

-

Other Infectious Diseases

-

-

Test Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Point of Care

-

Central Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global infectious disease in vitro diagnostics market size was valued at USD 24.30 billion in 2024 and is estimated to reach USD 24.75 billion in 2025.

b. The global infectious disease in vitro diagnostics market is projected to grow at a compound annual growth rate of 2.54% from 2025 to 2030 to reach USD 28.05 billion in 2030.

b. The reagents segment dominated the global infectious diseases IVD market and accounted for the largest revenue share of 67.63% in 2024. This can be attributed to the high-volume usage of reagents for conducting tests.

b. The central laboratories segment dominated the global infectious diseases IVD market and held the largest revenue share of 48.06% in 2024. Attributable to higher accuracy when compared to point-of-care tests, which makes them reliable.

b. The molecular diagnostics segment accounted for a revenue share of 31.59% in 2024 in the global infectious disease in-vitro diagnostics market. These tests are advanced and overcome the drawbacks, such as irregular growth of microorganisms in manually prepared media, longer turnaround duration, and poor sensitivity of traditional testing methods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.