- Home

- »

- Homecare & Decor

- »

-

Japan Kitchenware Market Size, Share, Industry Report 2033GVR Report cover

![Japan Kitchenware Market Size, Share & Trends Report]()

Japan Kitchenware Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cookware, Bakeware, Tableware), By Application (Residential, Commercial), By Distribution Channel (Supermarkets & Hypermarkets), And Segment Forecasts

- Report ID: GVR-4-68040-679-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Kitchenware Market Size & Trends

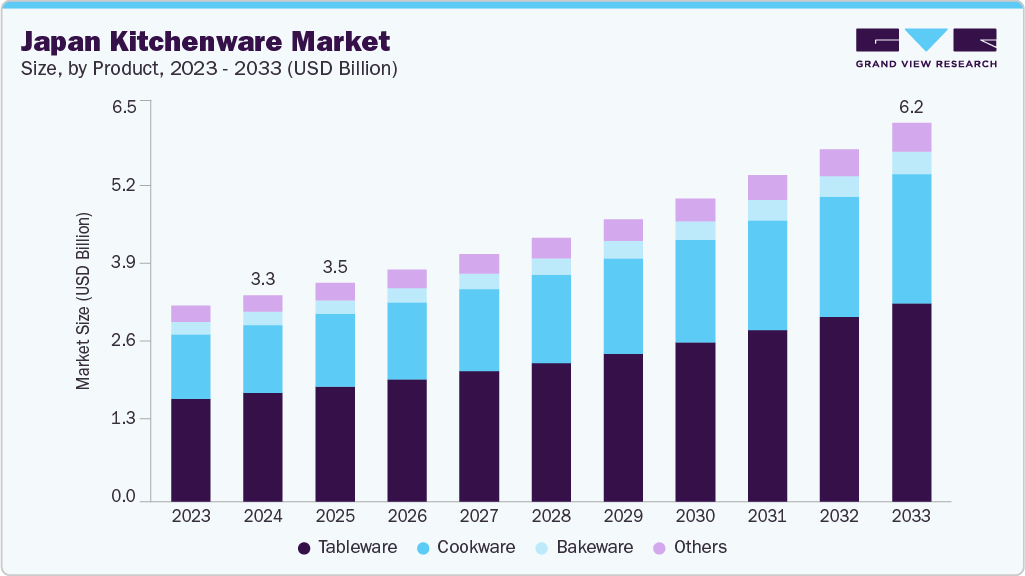

The Japan kitchenware market size was estimated at USD 3.32 billion in 2024 and is projected to reach USD 6.17 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The demand for kitchenware in Japan has been rising steadily, driven by shifting lifestyles and cultural trends. Japanese consumers have become more focused on health and home cooking, spurred partly by the lasting effects of the pandemic that kept many people indoors and encouraged new culinary hobbies. Japan’s strong food culture also fuels a natural interest in quality tools for preparing traditional and modern dishes. The growing popularity of cooking shows, social media food influencers, and online recipe sharing has also inspired people to experiment more in their kitchens, increasing demand for innovative and specialized kitchen tools.

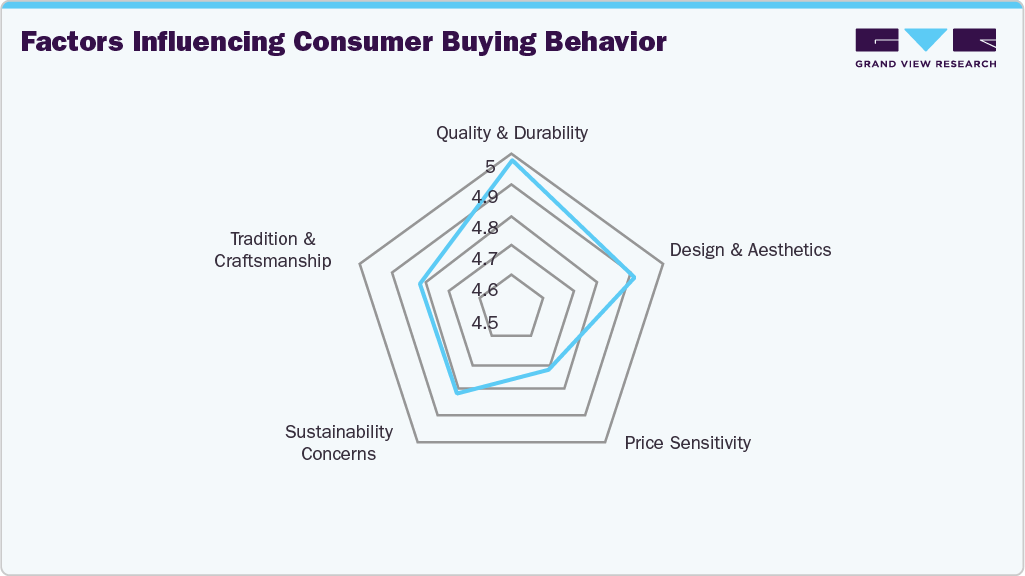

Consumers in Japan are increasingly looking for kitchenware that combines functionality with aesthetic appeal. There’s a strong interest in minimalist, stylish designs that fit seamlessly into modern Japanese homes, which often have limited kitchen space. Sustainability is another key trend, with many consumers preferring products made from eco-friendly materials such as bamboo, stainless steel, or recycled plastics. Moreover, convenience is highly valued, leading to rising demand for multi-functional items that save time and space, such as compact appliances or versatile cookware that can be used across different cooking methods.

Manufacturers actively respond to these evolving needs by launching products catering to practical and aesthetic desires. They are focusing on creating lightweight, durable items that are easy to store and clean. Many brands have introduced kitchenware tailored for smaller Japanese kitchens, such as compact rice cookers, foldable dish racks, or stackable storage solutions. In addition, there’s a noticeable push toward smart kitchen appliances equipped with digital features that simplify cooking processes in the Japanese market. Some manufacturers partner with designers to produce limited-edition lines with traditional Japanese patterns or modern color palettes to appeal to consumers seeking stylish pieces.

As for distribution, kitchenware in Japan is sold through a diverse mix of channels. Traditional department stores and specialty kitchen shops remain important, allowing customers to see and feel products before buying. However, online retail has grown rapidly, especially as consumers become more comfortable purchasing household items on e-commerce platforms. Many Japanese brands maintain strong online stores, while larger online marketplaces like Rakuten, Amazon Japan, and Yahoo! Shopping are crucial in reaching a broad audience. Home goods sections in general merchandise stores and convenience stores also carry popular, everyday kitchen items, ensuring kitchenware is accessible even during routine shopping trips.

Consumer Insights

Cookware and utensils are essential for daily use and are increasingly perceived as reflections of lifestyle, hygiene standards, and environmental values. In response to evolving consumer expectations, manufacturers align product development with minimalism, energy efficiency, and premium craftsmanship. In September 2023, Hario launched a new series of heat-resistant glass cookware that meets functional and aesthetic criteria, highlighting how domestic brands continue innovating within a highly discerning market. Thus, such product innovation further drives the market.

Cooking at home is common across all demographics, with a notable shift towards healthier preparation methods and low-oil cooking. Tools that offer performance accuracy, such as induction-compatible pans, ceramic-coated woks, and finely honed kitchen knives, are in high demand. Traditional materials like carbon steel and copper retain market value due to their superior heat distribution and longevity. Still, modern materials like nonstick ceramic and titanium are preferred for their low maintenance. Thus, the demand for kitchenware in the market is significantly growing. In 2023, Zojirushi introduced a rice cooker with AI-driven sensors that automatically adjust cooking modes based on rice type, exemplifying the integration of smart technology into daily kitchen routines.

Products that combine cooking and serving functions, or feature detachable components, are favored for both practicality and aesthetics. Minimalist, space-saving designs appeal to urban households seeking to optimize limited kitchen areas. In contrast, consumers in suburban and rural regions prioritize durability and capacity, often investing in larger cookware and electric appliances suitable for family meals and seasonal cooking. Material safety, durability, and ease of cleaning are critical product attributes influencing purchasing decisions. Dishwasher-safe cookware, utensils with antibacterial coatings, and heat-resistant handles are now standard requirements. High-quality cutting tools, especially those made using traditional forging techniques, continue to attract serious home cooks and professionals alike.

Environmental sustainability is a growing priority among Japanese consumers. Long product lifespan, repairability, and eco-conscious sourcing drive brand trust and repeat purchases. The cultural principle of mottainai, which discourages waste, underpins consumer interest in products manufactured with recycled materials, minimal packaging, and energy-saving features. Manufacturers are responding by introducing recyclable components, biodegradable packaging, and energy-efficient appliances. For example, energy-saving induction cookware and low-power cooking appliances have seen increased demand, particularly amid rising utility costs and heightened environmental awareness.

Product Insights

Tableware accounted for a revenue share of 52.5% in the Japan kitchenware industry in 2024, driven by strong cultural and lifestyle factors emphasizing the importance of presentation and dining rituals. In Japanese households, meals are often served using multiple small dishes, each with specific tableware, such as rice bowls, soup bowls, chopstick holders, and serving trays, contributing to higher demand per household. The seasonal table setting tradition, gifting practices, and frequent at-home dining, especially among aging populations and urban families, further drive sales. Furthermore, the preference for minimalist, high-quality ceramics and porcelain, often handmade or regionally crafted, adds to the value and turnover within the tableware segment.

Cookware is projected to grow at a CAGR of 7.6% from 2025 to 2033, driven by shifting consumer habits and technological innovation. Demand for quality cookware that enables precise and efficient cooking has increased as more people cook at home due to evolving work styles and a rising focus on health and fresh meals. Urban consumers seek compact, multifunctional pieces to suit smaller kitchens, while interest in premium materials like ceramic coatings, titanium, and smart induction-compatible pots is rising for their convenience and energy savings. Moreover, growing environmental awareness pushes consumers toward durable, sustainable cookware, supporting higher-value purchases and market expansion.

Distribution Channel Insights

Sale of kitchenware through supermarkets & hypermarkets accounted for a revenue share of 40.1% in 2024. These large retail formats offer curated kitchenware sections featuring popular domestic brands, seasonal product lines, and exclusive collaborations that appeal to shoppers seeking quality and affordability. Many Japanese consumers also value being able to physically inspect products for weight, feel, and craftsmanship before purchasing, a crucial factor in categories like cookware and tableware. In addition, supermarkets often leverage loyalty programs and in-store promotions that encourage impulse purchases of kitchen goods while shoppers are already buying groceries, effectively capturing household spending in a single visit.

Sales of kitchenware through online retail is projected to grow at a CAGR of 7.9% from 2025 to 2033. Shoppers increasingly rely on online channels for kitchenware because they offer extensive product comparisons, detailed reviews, and the ability to access regional or artisanal brands not always stocked in physical stores. E-commerce platforms in Japan also excel at fast, precise delivery, including same-day or time-slot services that appeal to consumers seeking convenience without sacrificing reliability. Furthermore, online retailers frequently run targeted promotions and loyalty programs that attract repeat customers, while virtual demonstrations and high-quality product visuals help replicate in-store experiences.

Application Insights

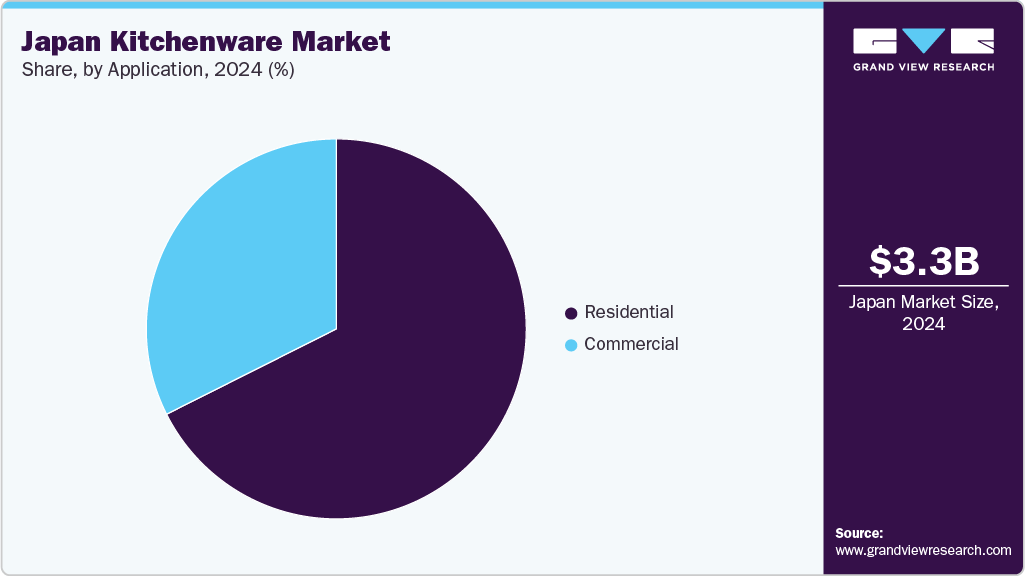

Kitchenware used for residential application accounted for a revenue share of 67.6% in 2024 in the Japan kitchenware industry. With many consumers choosing to dine in more frequently, whether for health, cost savings, or family bonding, households continue to invest in quality kitchen tools and tableware. The prevalence of smaller living spaces, especially in urban areas, fuels demand for versatile, space-saving products tailored to home use. Moreover, an aging population and a growing interest in cooking as a hobby have increased spending on specialized cookware, premium tableware, and modern appliances. These factors collectively strengthen the dominance of residential demand over commercial or hospitality segments in Japan’s kitchenware industry.

Kitchenware used for commercial applications is projected to grow at a CAGR of 7.8% over the forecast period of 2025-2033. As tourism rebounds and restaurants, hotels, and cafes modernize their operations, there’s a rising demand for durable, high-performance kitchenware that can withstand intensive daily use. In addition, shifts toward open kitchens and chef-led dining experiences drive interest in aesthetically pleasing cookware and serving pieces that double as part of the customer experience. The growth of specialty dining concepts, such as premium sushi bars and health-focused eateries, further stimulates demand for professional-grade tools tailored to specific cuisines. Combined with stricter hygiene standards and sustainability goals in commercial kitchens, these factors contribute to steady market expansion in the commercial segment.

Key Japan Kitchenware Company Insights

The Japan kitchenware industry showcases a blend of long-established manufacturers renowned for meticulous craftsmanship and emerging brands responding to modern lifestyle shifts. Leading companies emphasize precision engineering, space-efficient designs, and refined aesthetics, catering to consumers who expect functionality and elegance in their cooking tools. These brands extend their presence through partnerships with major retailers, specialty kitchen stores, and robust e-commerce platforms, ensuring products are accessible to diverse consumer segments.

As Japanese buyers increasingly prioritize compact, multifunctional solutions and sustainable materials, manufacturers are introducing eco-friendly construction lines, advanced technologies like smart cooking sensors, and designs tailored for smaller urban kitchens. Agile production processes and collaborative ventures allow key players to serve premium and mainstream markets, enabling them to remain competitive in Japan’s evolving landscape, where kitchenware embodies a fusion of tradition, innovation, and meticulous attention to quality and detail.

Key Japan Kitchenware Companies:

- Zwilling J.A. Henckels AG

- Le Creuset

- Royal Doulton Ltd.

- Noritake Co., Limited

- HARIO Co., Ltd.

- CRISTEL SAS

- Rösle GmbH & Co. KG

- Fissler

- BergHOFF

- Villeroy & Boch AG

Recent Developments

-

In August 2024, NIKKO Company introduced a new tableware collection under the concept "Material Waves," which explores the creative fusion of ceramics with other materials. This next-generation lineup includes pieces that integrate fine bone china with elements like handwoven bamboo and metal foil. The aim is to expand the possibilities of traditional tableware by blending craftsmanship from different disciplines, resulting in visually striking designs and functionally refined products. This launch reflects NIKKO’s commitment to innovation while preserving artisanal quality.

-

In June 2024, Le Creuset introduced a special Pokémon-themed cookware line exclusively in Japan. The collection includes colorful cast iron pots and kettles featuring popular Pokémon characters and symbols, blending Le Creuset’s classic designs with playful details from the franchise. This collaboration caters to cooking enthusiasts and Pokémon fans, turning everyday kitchen tools into collectible pieces. The launch reflects how brands creatively merge pop culture with home goods to appeal to a wider audience.

Japan Kitchenware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.54 billion

Revenue forecast in 2033

USD 6.17 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

Japan

Key companies profiled

Zwilling J.A. Henckels AG; Le Creuset; Royal Doulton Ltd.; Noritake Co., Limited; HARIO Co., Ltd.; CRISTEL SAS; Rösle GmbH & Co. KG; Fissler; BergHOFF; Villeroy & Boch AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Kitchenware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan kitchenware market based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cookware

-

Pots & Pan

-

Pressure Cooker

-

Microwave Cookware

-

-

Bakeware

-

Tins & Trays

-

Cups

-

Molds

-

Pans & Dishes

-

Rolling Pin

-

Others

-

-

Tableware

-

Dinnerware

-

Flatware

-

Stemware

-

-

Others

-

Cooking Racks

-

Cooking Tools

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online Retail

-

Others

-

Frequently Asked Questions About This Report

b. The Japan kitchenware market was estimated at USD 3.32 billion in 2024 and is expected to reach USD 3.54 billion in 2025.

b. The Japan kitchenware market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 6.17 billion by 2033.

b. Tableware accounted for a revenue share of 52.5% in the Japan kitchenware industry in 2024, highlighting its importance in everyday dining and traditional meal presentation. The demand was driven by cultural preferences for aesthetically pleasing, functional pieces used in both home and restaurant settings.

b. Some of the key players in the Japan kitchenware market include Zwilling J.A. Henckels AG, Le Creuset, Royal Doulton Ltd., Noritake Co., Limited, HARIO Co., Ltd., CRISTEL SAS, Rösle GmbH & Co. KG, Fissler, BergHOFF, Villeroy & Boch AG

b. Key factors driving the growth of the Japan kitchenware market are the country’s strong culinary heritage, which supports consistent demand for quality and precision tools. Additionally, growing interest in healthy cooking and durable, non-toxic materials is influencing product choices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.