- Home

- »

- Consumer F&B

- »

-

Japan Pet Food Market Size & Share, Industry Report, 2030GVR Report cover

![Japan Pet Food Market Size, Share & Trends Report]()

Japan Pet Food Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Wet Pet Food, Dry Pet Food, Snacks/Treats), By Pet Type (Cat, Dog), By Category (Traditional, Specialist), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-576-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Japan Pet Food Market Size & Trends

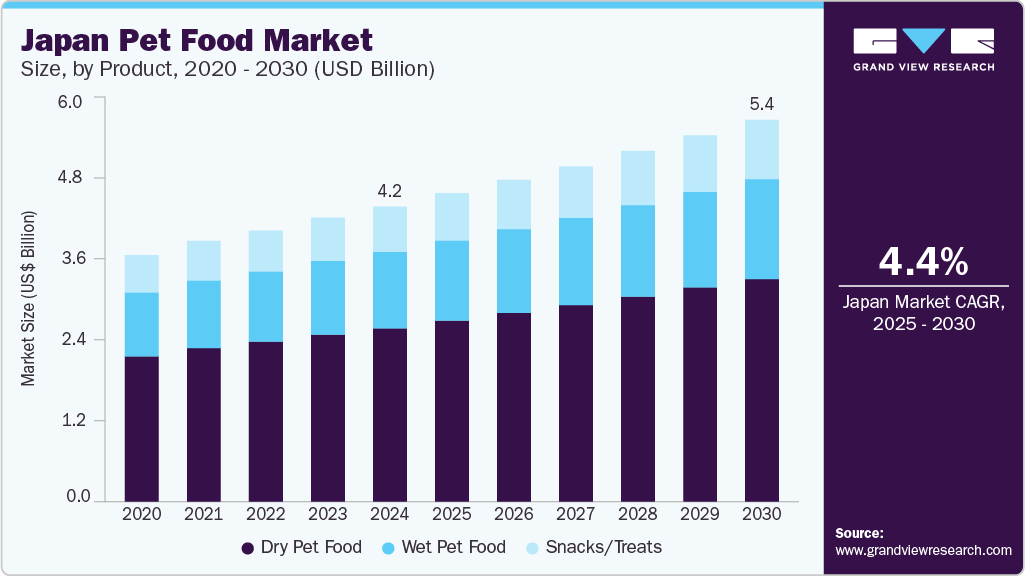

The Japan pet food market size was estimated at USD 4.20 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The industry is expanding due to several social, economic, and cultural factors that are shaping pet ownership behaviors and product preferences. One of the primary drivers is the aging population. Japan has one of the oldest populations globally, and many elderly citizens are adopting pets, particularly dogs and cats, for companionship. This demographic shift has created a demand for pet food tailored to senior pets-products with softer textures, digestive support, and enhanced nutrition to address aging-related issues in animals. Companies like Unicharm and Mars Japan are responding by offering "senior-specific" formulas and wet food options suited to the needs of older animals.

Japanese pet owners are also highly detail-oriented and value safety, traceability, and premium quality in the food they provide their pets. Local consumers often seek domestically produced pet food over imported products due to concerns over food safety and ingredient sourcing. This preference has encouraged Japanese manufacturers to emphasize "Made in Japan" labels, with detailed ingredient sourcing and production information clearly displayed on packaging. Brands like AIXIA and Inaba Foods have capitalized on this trend by focusing on Japanese seafood ingredients and high levels of product transparency.

Health-consciousness is another distinctive trend among Japanese pet owners. Functional foods designed to address specific health concerns-such as kidney care for cats or low-fat diets for dogs-are in high demand. There is growing popularity for food fortified with probiotics, taurine, and other supplements, particularly for indoor pets, which make up a large share of animals in densely populated urban areas like Tokyo and Osaka. These urban conditions also mean that pet owners favor compact, odor-controlled packaging and portion-controlled servings to suit small living spaces.

Japanese consumers are also highly brand-loyal and research-driven. They often consult veterinarians or pet nutritionists before switching food and are influenced by rankings in Japanese pet magazines and websites like Petline or Rakuten Pet Store. E-commerce is rapidly becoming the preferred channel, particularly among younger generations and busy urban professionals. Japanese platforms such as Rakuten and Yahoo! Japan Shopping offer a wide range of pet food, including both domestic and high-end international brands like Hill’s Science Diet and Royal Canin.

Consumer Insights

Japanese consumers prioritize safety, traceability, and local production when buying pet food. Due to past concerns over contaminated imports, especially from overseas, many pet owners prefer “Made in Japan” products. These are viewed as cleaner, more reliable, and better regulated. Packaging often highlights the origin of ingredients, production methods, and adherence to Japanese safety standards.

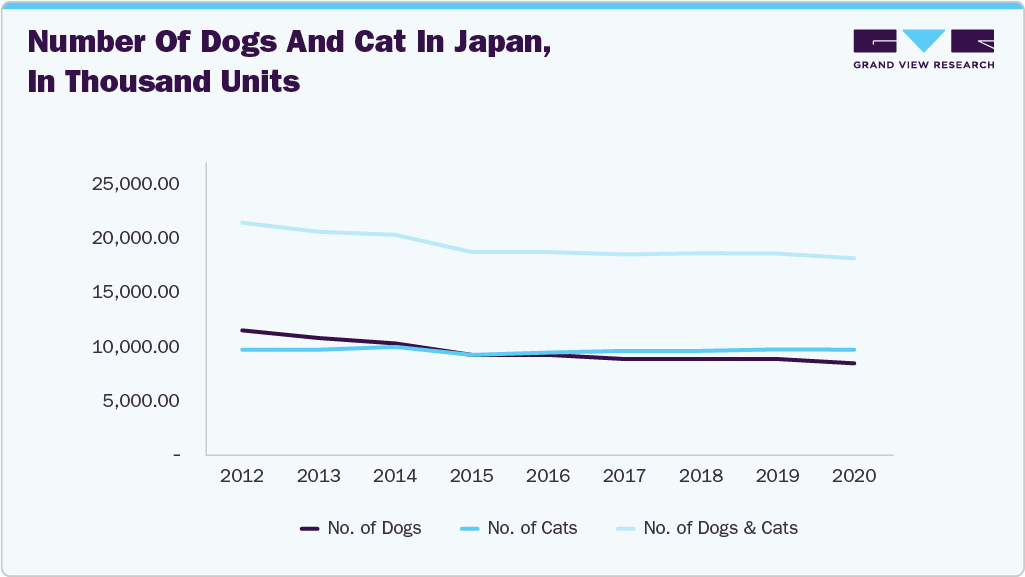

As of October 2020, Japan had approximately 18.13 million dogs (8.5 million) and cats (9.6 million) domesticated, according to the annual survey conducted by the Japan Pet Food Association (JPFA). The number of cats exceeded the number of dogs in 2017 for the first time since the JPFA survey began in 1993. However, the overall number of pets in Japan is exhibiting a declining trend due to the decrease in the dog population exceeding the increase in the cat population. By comparison, the number of pets in Japan is larger than the population of Japanese citizens under 15 years old, which totals 15.33 million (as of April 2019, Ministry of Internal Affairs & Communication).

In 2023, approximately 397,000 dogs and 369,000 cats were newly adopted into households in Japan. These figures represent a decline of 29,000 for dogs and 63,000 for cats compared to 2022. While the country experienced an increase in pet adoptions during the COVID-19 pandemic-driven by more people staying at home-the latest statistics indicate that this surge in pet ownership has moderated as the pandemic subsided.

According to an online survey conducted by the Pet Food Association between September and October 2023, which gathered valid responses from approximately 50,000 individuals aged 20 to 79, the total number of pet dogs in Japan stood at 6.84 million, a decrease of 209,000 from the previous year. In contrast, the population of pet cats reached 9.07 million, reflecting an increase of 232,000 year-on-year. Collectively, the total number of pet dogs and cats in Japan amounted to 15.91 million, marking a net increase of 23,000 compared to 2022.

In recent years, Japan's pet population has been shaped by four prominent trends: indoor living, smaller size, aging, and lifestyle-related illnesses. A growing majority of pets are kept indoors-84.7% of dogs and 90.4% of cats-leading to longer lifespans but also increased risk of obesity and age-related diseases. Dog ownership favors small breeds such as Toy Poodles, Chihuahuas, Shibas, and Miniature Dachshunds, while crossbred cats dominate the feline population.

In 2023, East Japan led Japan's pet food market with a 36% share due to its strong economy and demand for premium products. Western Japan is emerging with a 17% share, driven by rising income and young pet owners. South Japan, with 15%, has a diverse pet base, including exotic species, and is seeing growth in cat ownership due to its climate. North Japan is the top production region, especially Hebei and Shandong, while Beijing shows strong consumption. Northeast Japan, particularly Liaoning, is a key pet breeding hub and a strategic area for pet food brands targeting breeders.

The expansion of e-commerce and subscription-based pet food services has further fueled growth. E-commerce platforms like JD.com and Tmall have made premium and imported pet foods widely accessible, while local brands are enhancing their presence with targeted digital marketing, pet influencer partnerships, and AI-driven recommendations for pet nutrition. In August 2023, Uneno Co., Ltd., a Kyoto-based dashi manufacturer with over 120 years of history, partnered with the modern dog brand mellowbear to launch a canine-friendly furikake called “Kunkun Fragrant Fish Furikake (Bonito flavor).” The furikake utilizes “dashigara,” a low-salt residue from Uneno’s dashi production, making it both nutritious and safe for dogs. Slow-dried at low temperatures to enhance aroma, the topping is designed to boost both the flavor and nutritional value of dog meals. This collaboration not only bridges traditional Japanese culinary practices with contemporary pet care but also addresses food waste by repurposing dashi byproducts for pet nutrition.

Product Insights

Dry pet food accounted for a revenue share of 58.8% in 2024. In Japan, the demand for dry pet food is steadily increasing, driven by a combination of urban lifestyles, aging pet populations, and consumer preference for convenience. Japanese pet owners, many of whom live in smaller homes or apartments, value the space-saving and easy-to-store nature of dry kibble. Moreover, dry pet food aligns well with the needs of Japan's aging pets, offering tailored nutritional formulas such as low-calorie, joint-supporting, or digestion-friendly blends, which help manage common age-related health issues.

The pet snacks/treats market is expected to grow at a CAGR of 4.7% from 2025 to 2030. Japanese pet owners are increasingly using treats not only for training and positive reinforcement but also as a way to express love and strengthen emotional bonds with their pets. This shift in perception is contributing significantly to the expansion of the treat segment.There is also a marked rise in demand for functional treats that offer specific health benefits, such as joint support for aging pets, dental health, digestion improvement, and stress relief-all of which align with Japan’s aging pet population and indoor-living trends. Japanese consumers tend to be highly selective, favoring products with clean labels, domestically sourced ingredients, and scientifically backed benefits.

Pet Type Insights

Pet food for dogs accounted for a revenue share of 59.5% in 2024. In Japan, dog pet food sales are experiencing notable growth, driven by the steady increase in dog ownership and a deepening cultural trend of treating dogs as beloved family members. Japanese dog owners are placing increasing importance on their pets’ health, nutrition, and overall well-being, leading to strong demand for high-quality, customized food options that address specific dietary requirements, health conditions, and life stages.The market is witnessing rising interest in premium, natural, and functional dog foods, including grain-free, hypoallergenic, and breed-specific formulations, which appeal to discerning consumers seeking to provide the best for their pets.

Pet food for cats is expected to grow at a CAGR of 4.0% from 2025 to 2030.As more people in Japan, especially in cities like Tokyo and Osaka, opt for smaller living spaces, cats have become the preferred pets due to their low-maintenance nature and suitability for compact apartments. Additionally, Japan’s aging population and declining birth rate have contributed to a rise in single-person households and elderly individuals adopting cats for companionship.This growing bond between owners and their pets has led to the humanization of cats, with owners treating them as family members and seeking higher-quality food options to support their health and longevity.

Distribution Channel Insights

Sales of pet food through pet specialty stores accounted for a revenue share of 31.9% in 2024. These stores offer a curated selection of high-quality, niche, and premium pet food products that cater to specific dietary needs and health concerns, aligning with the growing trend of pet humanization and premiumization. Consumers are increasingly seeking transparency in ingredients and nutritional information, which specialty retailers are more likely to provide. Additionally, these stores often employ knowledgeable staff who can offer personalized advice and recommendations, enhancing the shopping experience for pet owners.

Sales of pet food through online/e-commerce channels are expected to grow with a CAGR of 6.0% from 2025 to 2030. The growth of e-commerce in the Japan pet food market is driven by several key factors. Primarily, the convenience of online shopping allows pet owners to access a wide range of products without leaving their homes, a trend that the digital transformation in retail has amplified. This shift has led to increased investments by retailers in their digital capabilities to meet consumer demand.

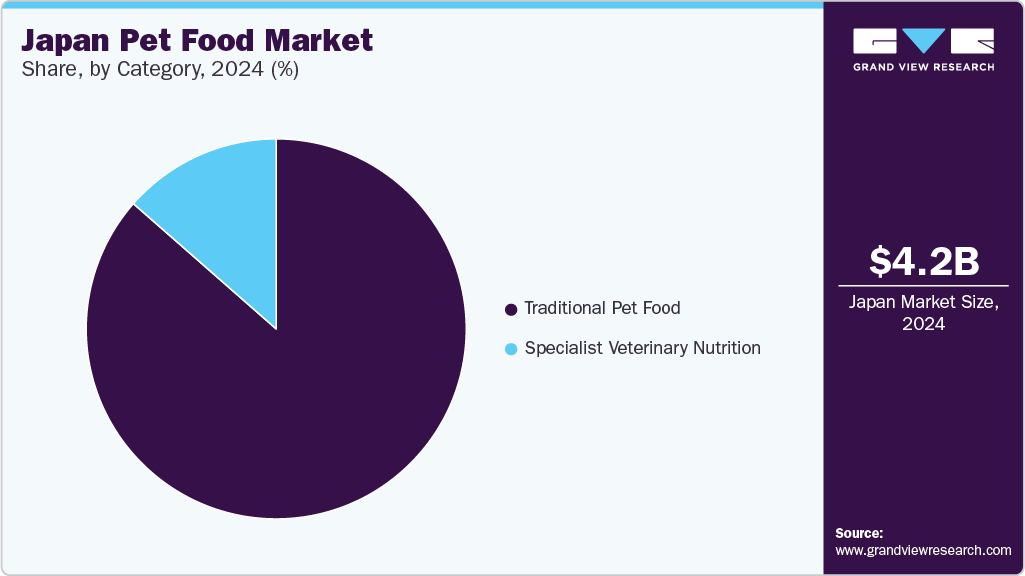

Category Insights

Traditional pet food for commuters accounted for a revenue share of 86.5% in 2024. The demand for traditional pet food in Japan is increasing as more pet owners seek reliable, convenient, and cost-effective feeding options that align with their daily routines and the needs of their pets. Despite the rise of premium and fresh pet food alternatives, traditional dry and wet pet food remains a staple in Japanese households due to its balanced nutrition, long shelf life, and ease of storage, particularly important in urban environments with limited space. Additionally, many pet owners-especially older demographics-prefer trusted, familiar brands that offer consistency and have a long-standing reputation for safety and quality.

Specialist veterinary nutrition pet food is expected to grow at a CAGR of 4.5% from 2025 to 2030. The demand for specialist veterinary nutrition pet food is increasing in Japan due to the country’s aging pet population and the growing awareness among pet owners about disease prevention and targeted health management. With improvements in veterinary care and more pets living indoors, the average lifespan of dogs and cats in Japan has increased significantly, leading to a rise in age-related health issues such as kidney disease, obesity, diabetes, and joint problems. As a result, Japanese pet owners are turning to veterinary-recommended diets that offer clinical support and therapeutic benefits tailored to specific medical conditions.

Key Japan Pet Food Company Insights

Pet food manufacturers in the Japan region are increasingly adopting advanced food processing technologies to improve product quality, flavor, and nutritional content. Techniques such as vacuum frying, air frying, and freeze-drying are used to preserve the natural qualities and nutrients of ingredients while minimizing oil content. In addition, manufacturers are incorporating innovative packaging solutions, such as resealable and biodegradable options, to enhance convenience and sustainability. Customization is also gaining momentum, with brands offering diverse seasoning blends, organic choices, and personalized snack/treat packs to meet the varied preferences of pet owners.

Key players operating in the Japan pet food market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Japan Pet Food Companies:

- The J.M. Smucker Company

- Nestlé Purina

- Mars, Incorporated

- LUPUS Alimento

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

- Diamond Pet Foods

Recent Developments

-

In March 2024, Hills Colgate Japan announced the launch of "Science Diet Vet Essential," its first new total nutritional pet food brand. This brand will be sold exclusively at veterinary clinics and pet specialty stores nationwide, targeting pet owners seeking expert-recommended and science-based nutrition for dogs and cats. The lineup includes both core products for overall health and premium products addressing specific needs like digestive health, weight management, and dental care.

-

In August 2023, Uneno Co., Ltd., a Kyoto-based dashi manufacturer with over 120 years of history, partnered with the modern dog brand mellowbear to launch a canine-friendly furikake called “Kunkun Fragrant Fish Furikake (Bonito flavor).” The furikake utilizes “dashigara,” a low-salt residue from Uneno’s dashi production, making it both nutritious and safe for dogs. Slow-dried at low temperatures to enhance aroma, the topping is designed to boost both the flavor and nutritional value of dog meals. This collaboration not only bridges traditional Japanese culinary practices with contemporary pet care but also addresses food waste by repurposing dashi byproducts for pet nutrition.

Japan Pet Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.38 billion

Revenue forecast in 2030

USD 5.43 billion

Growth rate (Revenue)

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilo tons; revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pet type, category, distribution channel, region

Country scope

Japan

Key companies profiled

The J.M. Smucker Company; Nestlé Purina; Mars Incorporated; LUPUS Alimento; Total Alimentos; Hill’s Pet Nutrition, Inc.; General Mills Inc.; WellPet LLC; The Hartz Mountain Corporation; Diamond Pet Foods.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Pet Food Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Japan pet food market report based on product, pet type, category, distribution channel, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Wet Pet Food

-

Dry Pet Food

-

Snacks/Treats

-

-

Pet Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Cats

-

Dogs

-

Others

-

-

Category Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Traditional Pet Food

-

Specialist Veterinary Nutrition

-

Cats

-

Dogs

-

Others

-

-

-

Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

E-commerce

-

Pet Specialty Stores

-

Others

-

Frequently Asked Questions About This Report

b. The Japan pet food market size was estimated at USD 4.20 billion in 2024 and is expected to reach USD 4.38 billion in 2025.

b. The Japan pet food market is expected to grow at a compounded growth rate of 4.4% from 2024 to 2030 to reach USD 5.43 billion by 2030.

b. Pet food for dogs accounted for a revenue share of 59.5% in 2024. In Japan, dog pet food sales are experiencing notable growth, driven by the steady increase in dog ownership and a deepening cultural trend of treating dogs as beloved family members.

b. Some key players operating in Japan pet food market include The J.M. Smucker Company, Nestlé Purina, Mars, Incorporated, LUPUS Alimento, Total Alimentos, Hill’s Pet Nutrition, Inc, and others

b. Key factors that are driving the market growth include rising product innovations and growing pet culture among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.