- Home

- »

- Electronic Devices

- »

-

Laser Printer Market Size And Share, Industry Report, 2033GVR Report cover

![Laser Printer Market Size, Share & Trends Report]()

Laser Printer Market (2025 - 2033) Size, Share & Trends Analysis Report By Printer Type (Single-function, Multifunction), By Connectivity (Wired, Wireless), By Output (Monochrome, Color), By End-use (Industrial, Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-447-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laser Printer Market Summary

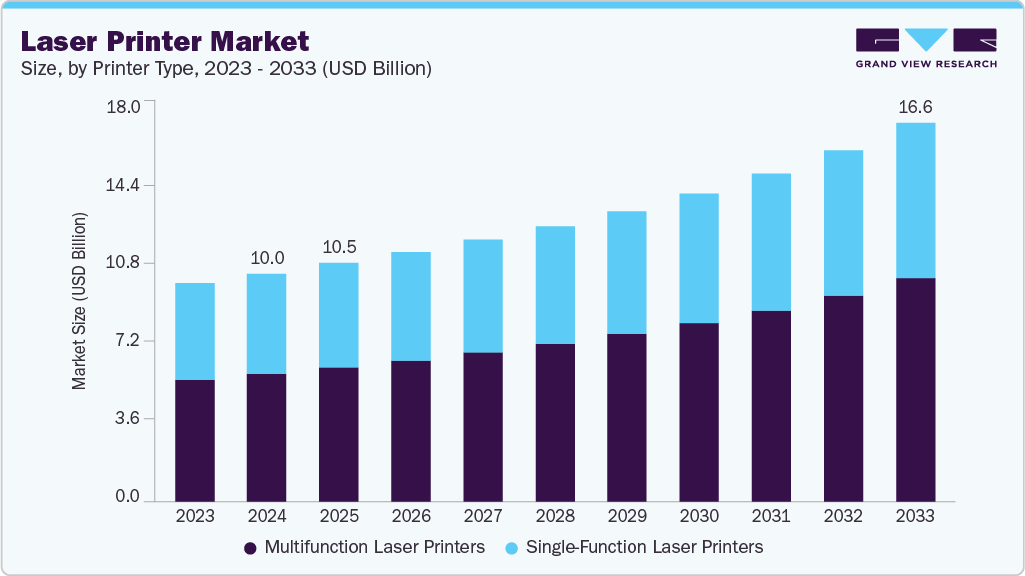

The global laser printer market size was estimated at USD 10.02 billion in 2024, and is projected to reach USD 16.63 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. The growing need for efficient and high-speed printing solutions among enterprises and educational institutions is driving the market’s growth.

Key Market Trends & Insights

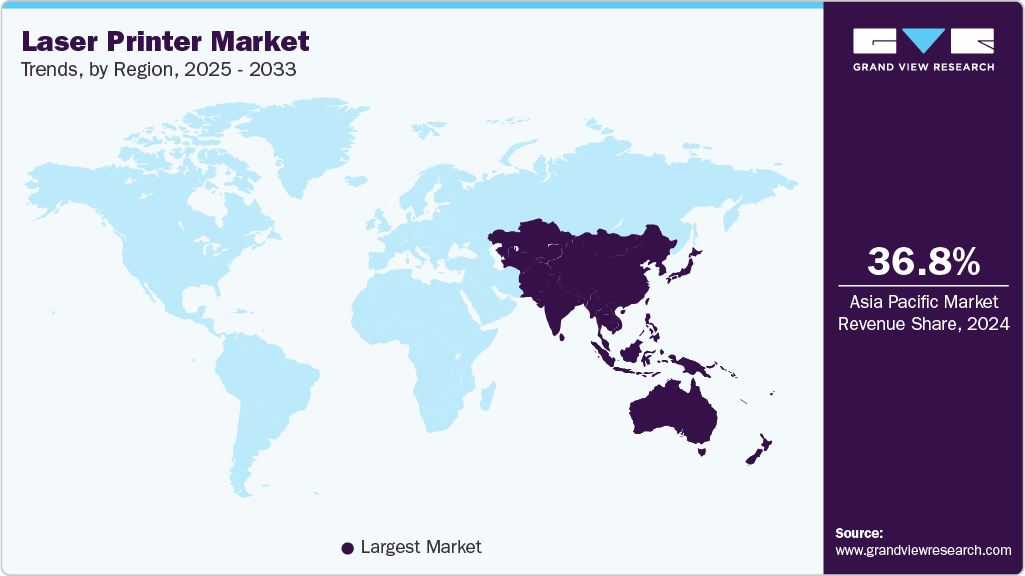

- The Asia Pacific laser printer market accounted for a global revenue share of 36.8% in 2024.

- The laser printer industry in China held a dominant position in 2024.

- By printer type, the multifunction laser printers segment accounted for the largest share of 55.9% in 2024.

- By connectivity, the wired segment held the largest market share in 2024.

- By output, the monochrome segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.02 Billion

- 2033 Projected Market Size: USD 16.63 Billion

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest Market in 2024

Laser printers provide numerous advantages, such as high-speed output and exceptional print quality, which make them a favored option for both businesses and individuals. Renowned for their rapid printing capabilities, especially with large document volumes, laser printers are ideal in settings where quick turnaround times are critical. In addition, they offer cost-effectiveness; while the upfront investment may be higher, the cost per page is generally lower compared to inkjet printers, particularly for black-and-white printing.The expansion of e-commerce and online retailing is significantly contributing to the growth of the global laser printer industry. E-commerce businesses require substantial volumes of printed materials for packaging, shipping labels, invoices, and promotional inserts. Laser printers are well-suited for these tasks due to their high speed, reliable output, and ability to handle large print jobs efficiently. Online retailers benefit from the speed and efficiency of laser printers in processing large numbers of orders. Fast printing speeds help in reducing bottlenecks in packing and shipping operations, ensuring that orders are fulfilled promptly, which is critical in a competitive e-commerce environment.

Technological advancements have led to the development of laser printers capable of producing ultra-high-resolution prints, making them suitable for detailed graphics and complex documents. This is particularly beneficial in industries such as marketing and design, where print quality is paramount. Artificial Intelligence (AI)-driven predictive maintenance is becoming more prevalent in laser printers, allowing for proactive identification and resolution of potential issues before they cause downtime. This leads to increased printer uptime and reduced maintenance costs.

Companies manufacturing laser printers are investing in Research and Development (R&D) and continually launching new products. For instance, in June 2024, Brother Industries, Ltd. announced the launch of its latest Monochrome Laser Printer series, designed to enhance productivity and efficiency in modern workplaces. With high-speed printing, multifunction capabilities, and robust connectivity options, this series is the ideal solution for businesses seeking reliable, cost-effective printing with seamless workflows.

Printer Type Insights

The multifunction laser printers segment led the laser printer market, accounting for the largest share of 55.9% in 2024. The segment’s growth is attributed to the customization and flexibility of multifunction laser printers. Multifunction laser printers offer customizable features and configurations, allowing businesses to tailor the device to their specific needs. This flexibility is appealing to various industries and office environments. Moreover, multifunction laser printers aid businesses save space and reducing costs by combining features such as printing, scanning, copying, and faxing in one device.

The single-function laser printers segment is expected to grow at a significant CAGR during the forecast period. The segment’s growth can be attributed to the cost-effectiveness, simplicity, and reliability of single-function laser printers. Single-function laser printers generally have a lower purchase price compared to multifunction devices. This makes them an attractive option for businesses or individuals with budget constraints who need high-quality printing without additional functions. Moreover, they typically offer straightforward operation with fewer features, making them easy to use and ideal for users who require a simple, reliable printing solution.

Connectivity Insights

The wired segment held the dominating share in the market in 2024. The segment's growth is attributed to the stable and reliable performance of wired laser printers. Wired connections, such as Ethernet and Universal Serial Bus (USB), provide stable and reliable data transfer with minimal risk of interference or signal loss, ensuring consistent print quality and performance. Moreover, wired connections are perceived as more secure than wireless networks, reducing the risk of unauthorized access and data breaches. This is particularly important for businesses and organizations handling sensitive or confidential information.

The wireless segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the increased mobility and flexibility offered by laser printers. Wireless connectivity allows users to print from various devices, such as smartphones, tablets, and laptops, without the need for physical connections. This flexibility is particularly valuable in mobile or remote work environments. With wireless technology, multiple users can connect to a single printer from different devices and locations, enhancing the convenience and efficiency of printing tasks.

Output Insights

The monochrome segment dominated the laser printer industry in 2024. The segment's growth is attributed to its cost-effectiveness and its ability to meet high-quality printing needs. Monochrome laser printers generally offer a lower cost per printed page compared to color printers. This makes them a cost-effective choice for businesses and organizations that primarily need to print black-and-white documents. Monochrome laser printers are ideal for high-volume text printing, which is common in many office environments. Their ability to handle large volumes of black-and-white documents efficiently supports productivity in settings with significant printing demands.

The color segment is projected to grow at the fastest CAGR over the forecast period. The segment’s growth is attributed to the increased demand for high-quality color printing for professional and marketing materials. Businesses require high-quality color printing for professional documents, marketing materials, and presentations. Color laser printers provide vibrant and accurate color reproduction, which is essential for creating impactful marketing collateral and visually appealing documents. As consumers and businesses become more accustomed to high-quality color prints from other mediums, there is a growing expectation for similar quality from office and personal printers.

End-use Insights

The commercial segment dominated the laser printer market in 2024. The segment’s growth is attributed to rising business activity and the global expansion of enterprises. As businesses continue to expand and operate in increasingly competitive environments, the demand for reliable and efficient printing solutions has risen. Laser printers offer the speed, quality, and durability needed to support high-volume printing in commercial settings. As businesses expand globally, the need for standardized, high-quality printing solutions increases. Laser printers are well-suited to meet the demands of multinational operations.

The industrial segment is expected to register a significant CAGR over the forecast period.The segment’s growth is attributed to the need for high-volume printing in industrial environments. Industrial environments, such as manufacturing plants, warehouses, and logistics centers, require robust printing solutions capable of handling high volumes of print jobs. Laser printers are favored for their ability to produce large quantities of documents quickly and reliably, making them ideal for industrial applications. Moreover, industrial settings often require precise labeling, barcoding, and documentation for inventory management, shipping, and compliance purposes. Laser printers provide the high-resolution print quality necessary for clear and accurate labels and documents, supporting efficient operations.

Regional Insights

The North America laser printer market held a significant share in 2024. The market’s growth in the region is attributed to the technological advancements in the region. North America is a hub for technological innovation, with continuous advancements in laser printing technology. Features such as wireless connectivity, mobile printing, cloud integration, and energy efficiency are appealing to businesses and consumers, driving the adoption of laser printers.

U.S. Laser Printer Market Trends

The U.S. laser printer industry held a dominant position in 2024. Ongoing corporate investments aimed at upgrading office equipment and improving productivity further drive the market in the country. The education sector's ongoing digital transformation necessitates reliable printing solutions for hybrid learning environments. In addition, the healthcare industry continues to rely on high-quality printing for patient records and lab reports.

Europe Laser Printer Market Trends

In 2024, Europe was identified as a lucrative region in the laser printer industry. Europe has a strong focus on sustainability and environmental responsibility. Laser printers, which often have lower energy consumption and produce less waste compared to inkjet printers, align with these values. The push for energy-efficient devices and reduced carbon footprints is contributing to the market’s growth.

Asia Pacific Laser Printer Market Trends

The Asia Pacific laser printer industry is expected to grow at the fastest CAGR of 6.5% over the forecast period. Rapid economic growth and e-commerce growth in the region drive the market’s growth in the region. The booming e-commerce sector in Asia Pacific generates substantial demand for printed materials, such as shipping labels, invoices, and marketing materials. Laser printers, with their ability to handle high-volume printing efficiently, are essential in supporting e-commerce operations.

Key Laser Printer Company Insights

Some of the key companies in the laser printer market include HP Development Company, L.P., Xerox Corporation, Seiko Epson Corporation, and Konica Minolta, Inc. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

HP Development Company, L.P. is a multinational technology company headquartered in California, U.S. The company operates through three segments, namely personal systems, printing, and corporate investments. The printing segment provides consumer and commercial printer hardware, supplies, services, and solutions. This segment is also focused on graphics 3D, printing, and personalization in the commercial and industrial markets.

-

Xerox Corporation, headquartered in Norwalk, Connecticut, is a leading American technology company known for its pioneering role in office technology and document management solutions. The company offers a wide range of products and services, including digital printers, multifunction devices, managed print services, workflow automation, enterprise content management, and cybersecurity solutions, serving diverse industries such as banking, education, healthcare, government, manufacturing, and retail worldwide.

Key Laser Printer Companies:

The following are the leading companies in the laser printer market. These companies collectively hold the largest market share and dictate industry trends.

- HP Development Company, L.P.

- Canon Inc.

- Brother Industries, Ltd.

- Xerox Corporation

- Lexmark International, Inc.

- Ricoh

- Seiko Epson Corporation

- Konica Minolta, Inc.

- Dell Inc.

- TOSHIBA CORPORATION

Recent Developments

-

In October 2025, Brother International Corporation unveiled its next-generation lineup of color laser printers and all-in-ones designed specifically to meet the evolving needs of small and medium-sized businesses. The new lineup focuses on delivering enhancements in image quality, security, sustainability, and scanning capabilities to support today’s dynamic work environments. Key features include fast, high-quality printing with lifelike colors and sharp black output, faster first-page-out times, and durable, compact designs that are over 25% smaller than previous models, making them suitable for various workspace settings.

-

In March 2024, HP Development Company, L.P. introduced the HP Color LaserJet 3000 series, a new addition to its office print portfolio designed for high performance in compact spaces. Powered by the innovative TerraJet toner technology, the series offers enhanced color quality, faster print speeds, and improved energy efficiency, meeting the needs of small and medium-sized businesses in today’s hybrid work environment.

Laser Printer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.46 billion

Revenue forecast in 2033

USD 16.63 billion

Growth rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Printer type, connectivity, output, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

HP Development Company, L.P.; Canon Inc.; Brother Industries, Ltd.; Xerox Corporation; Lexmark International, Inc.; Ricoh; Seiko Epson Corporation; Konica Minolta, Inc.; Dell Inc.; TOSHIBA CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laser Printer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global laser printer market report based on printer type, connectivity, output, end-use, and region:

-

Printer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-function Laser Printers

-

Multifunction Laser Printers

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired

-

Wireless

-

-

Output Outlook (Revenue, USD Million, 2021 - 2033)

-

Monochrome

-

Color

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

Commercial

-

Educational Institutions

-

Enterprises

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global laser printer market size was estimated at USD 10.02 billion in 2024 and is expected to reach USD 10.46 billion in 2025.

b. The global laser printer market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 16.63 billion by 2033.

b. Asia Pacific dominated the laser printer market with a share of over 36.8% in 2024. This is attributable to the growing e-commerce sector in the region.

b. Some key players operating in the laser printer market include HP Development Company, L.P.; Canon Inc.; Brother Industries, Ltd.; Xerox Corporation; Lexmark International, Inc.; Ricoh; Seiko Epson Corporation; Konica Minolta, Inc.; Dell Inc.; TOSHIBA CORPORATION.

b. Key factors driving market growth include the increasing need for high-speed and efficient printing solutions and advancements in laser printer technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.