- Home

- »

- Biotechnology

- »

-

Latin America In Vitro Diagnostics Market Size Report, 2030GVR Report cover

![Latin America In Vitro Diagnostics Market Size, Share & Trends Report Report]()

Latin America In Vitro Diagnostics Market (2023 - 2030) Size, Share & Trends Report Analysis By Product (Instruments, Reagents), By Technology (Immunoassay), By Application (Infectious Diseases), By End-use, And Segment Forecasts

- Report ID: GVR-1-68038-014-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The Latin America in vitro diagnostics market size was valued at USD 6.0 billion in 2022 and is anticipated to decline at a compound annual growth rate (CAGR) of 1.6% from 2023 to 2030. The growing population base, favorable government insurance policies, and improved healthcare infrastructure are the high-impact rendering growth drivers of the Latin America In Vitro Diagnostics (IVD) market. The growing base of the geriatric population with increased susceptibility to infections is estimated to provide the market with significant growth potential. In Chile, the population aged 65 and above is expected to double from 2010 to 2030.

The government of Latin America introduces favorable programs and initiatives to spread awareness about in vitro diagnostics devices among local device manufacturers. For instance, The ALADDiV is the Latin American alliance for developing in-vitro diagnostics. It promotes patient access to new health technologies, bridging the gap between the manufacturer and the end user.

The risk for abdominal obesity, which further results in cardiovascular and metabolic disorders, is over 48% in Brazil, Colombia, Mexico, and Argentina compared to the other countries. The key players are targeting these unmet needs by launching IVD devices for preventive care. For instance, Becton Dickinson has versatile immunoassay reagents available in Brazil, including BD Cytometric Bead Array (CBA) Solution, BD Immunoassay ELISA Reagents, and BD ELISPOT Reagents.

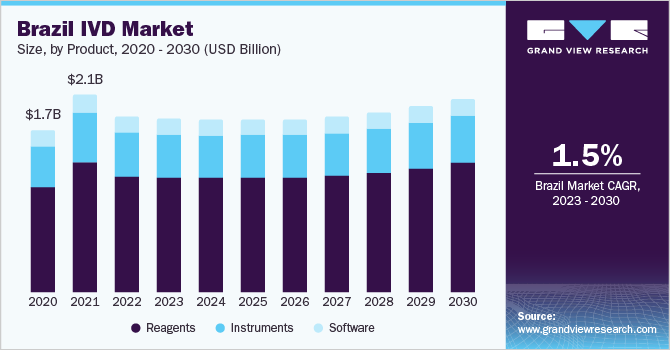

Product Insights

In 2022, the reagents segment dominated the market share and is expected to grow at the fastest CAGR over the forecast period. The segment's large share is attributed to the escalating usage rates in various fields, such as academic institutes, healthcare centers, and clinical laboratories. The innovations in technology and higher investment by market players for new product development have proved to be opportunistic for the growth of the instruments market over the forecast period.

Application Insights

On the basis of application, the market is segmented into infectious diseases, diabetes, oncology, nephrology, autoimmune diseases, drug testing, and others. The infectious diseases segment held the largest revenue share in the Latin America in-vitro diagnostics market in 2022. The increasing incidences of infectious diseases and low awareness about hygienic conditions in Latin American countries are attributed to the high market share. The cases of vector-borne infections, such as dengue, hemorrhagic fever, and yellow fever, have also been high since 1995 at twice the rate. The Pan American Health Organization and the WHO work together to eradicate this region's infectious diseases.

On the other hand, the oncology segment is estimated to witness lucrative growth over the forecast period owing to the increasing cases of cancer, favorable government initiatives for early diagnosis, and rising awareness. According to an article published by the International Agency for Research on Cancer of the World Health Organization in June 2022, approximately 1.5 million new cancer cases and 700,000 cancer deaths were reported in Latin America.

End-use Insights

IVD devices find end-use applications in hospitals, laboratories, and home care. The hospitals segment held a significant share in 2022. Wide acceptance of In Vitro Diagnostics (IVD) tests coupled with the increasing rate of outsourcing laboratory services by public hospitals is one of the factors leading to the share mentioned above.

Homecare is one of the fastest-growing segments over the forecast period owing to the increasing demand for point-of-care (POC) IVD devices. Lab test is the biggest privately held Brazilian company in the in vitro diagnostic devices market. The company is expected to expand its business to manufacture POC devices and assembly analyzers in Brazil.

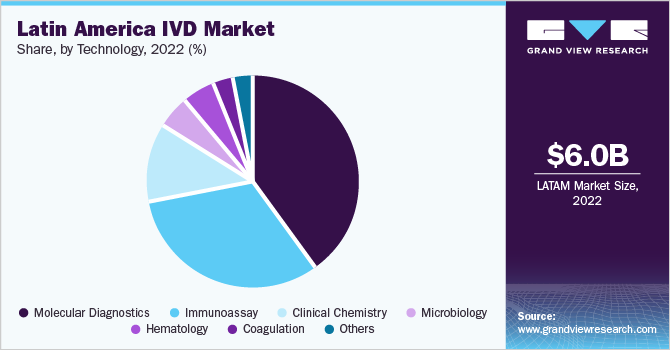

Technology Insights

On the basis of technology, the market is categorized into Immunochemistry, clinical chemistry, hematology, molecular diagnostics, coagulation, and microbiology. The molecular diagnostics segment held the largest market share of 40.2% in 2022 due to the introduction of upgraded technology, which can provide high throughput results in less time with a smaller workforce.

Clinical chemistry held a significant market share in 2022. The growing incidences of lifestyle diseases, diabetes, and anemia in Latin American countries, such as Argentina and Colombia, are estimated to contribute towards the increased adoption rates of clinical chemistry tests in this region.

The coagulation segment and the microbiology segment are both expected to grow at the fastest CAGR of 6.3% over the forecast period, which is a result of the increasing prevalence of blood disorders and infectious diseases, rising demand for advanced testing systems, and expanding research and development activities in these fields. In August 2021, Siemens Healthineers launched Sysmex CN-6000 and CN-3000 Hemostasis Systems to test mid and high-volume coagulation to diagnose abnormal bleeding or blood clotting.

Country Insights

Brazil held a revenue share of 31.5% in 2022 and was in at the forefront among other countries owing to the presence of unified healthcare infrastructure such as the SUS, the growing focus of key market players for investment in this region, and favorable reimbursement policies pertaining towards diagnostic tests. Colombia is expected to grow at a lucrative CAGR during the forecast period.

Mexico is expected to witness a significant growth of 2.9% CAGR over the forecast period due to increased demand for personalized medicine and the use of molecular and genetic tests to tailor treatments and preventive strategies for individual patients.

Key Companies & Market Share Insights

The key players in the market are undertaking various strategies to develop and maintain a strong position in the market, such as product launches, mergers, acquisitions, expansions of manufacturing units, and partnerships.

In February 2023, Roche Diagnostics announced a collaboration with the U.S. Centers for Disease Control and Prevention (CDC) to improve the laboratory systems, aiming to enhance the quality and accessibility of tests in the regions of Central America, Latin America, and Caribbean regions as well as other countries of Africa, Eastern Europe, and Central Asia. A public-private partnership (PPP) will be implemented for the prevention of the human immunodeficiency virus (HIV) and tuberculosis (TB) in the region. The following are some of the major participants in the Latin America in vitro diagnostics market:

-

BD

-

BIOMÉRIEUX

-

Abbott.

-

Quidel Corporation.

-

OraSure Technologies

-

Hologic, Inc.

-

Cepheid.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Siemens Healthcare GmbH

-

Bio-Rad Laboratories, Inc.

Latin America In Vitro Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.8 billion

Revenue forecast in 2030

USD 5.2 billion

Growth rate

CAGR of 1.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

Latin America

Country scope

Brazi;, Mexico; Argentina

Key companies profiled

BD; BIOMÉRIEUX; Abbott; Quidel Corporation; OraSure Technologies; Hologic, Inc; Cepheid; QIAGEN; F. Hoffmann-La Roche Ltd; Siemens Healthcare GmbH; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Latin America in vitro diagnostics market report on the basis of product, technology, application, end-use, and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Software

-

-

Technology Outlook (Revenue in USD Million, 2018 - 2030)

-

Immunoassay

-

Hematology

-

Clinical Chemistry

-

Molecular Diagnostics

-

Coagulation

-

Microbiology

-

Others

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Infectious Diseases

-

Diabetes

-

Oncology/Cancer

-

Cardiology

-

Nephrology

-

Autoimmune Diseases

-

Drug Testing

-

Others

-

-

End-use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Laboratory

-

Home Care

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Frequently Asked Questions About This Report

b. Latin America in vitro diagnostics market size was estimated at USD 6.0 billion in 2022 and is expected to reach USD 5.80 billion in 2023.

b. Latin America in vitro diagnostics market is expected to decline at -1.6% from 2023 to 2030 to reach USD 5.2 billion by 2030.

b. Reagents dominated Latin America in vitro diagnostics market with a share of 65.6% in 2022. This is attributable to the escalating usage rates in various fields such as academic institutes, healthcare centers, and clinical laboratories.

b. Some key players operating in Latin America in vitro diagnostics market include F. Hoffmann-La Roche Ltd., Abbott, BD, Bio-Rad Laboratories, QIAGEN, bioMerieux, Quidel Corporation, and Siemens Healthineers.

b. Key factors that are driving the market growth include a growing population base, favorable government insurance policies, and improved healthcare infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.