- Home

- »

- Pharmaceuticals

- »

-

Latin America Nutritional Supplements Market Report, 2030GVR Report cover

![Latin America Nutritional Supplements Market Size, Share & Trends Report]()

Latin America Nutritional Supplements Market Size, Share & Trends Analysis Report By Product (Sports Nutrition, Fat Burners, Dietary Supplements), By Formulation, By Sales Channel, By Consumer Group, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-416-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

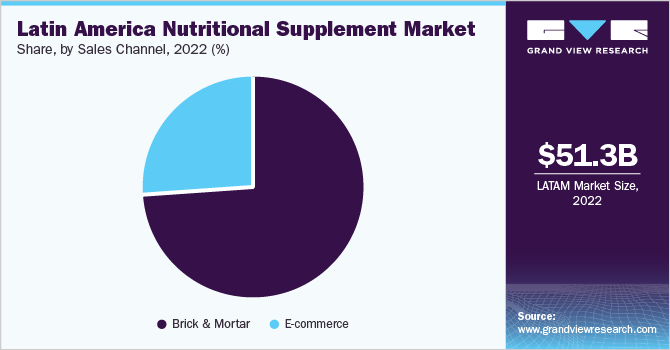

The Latin America nutritional supplements market size was valued at USD 51.32 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. The Latin American population has had a history of a high prevalence of chronic diseases like hypertension, diabetes, and metabolic diseases. As per the WHO, more than 60% of the male and female population in the region are overweight or obese. According to Glanbia Nutritionals, more than 50% of consumers planned to become more active after COVID-19 which is expected to increase the demand for nutritional supplements in coming years. Regulatory approvals in the region are expected to fuel the demand for supplements over the forecast period. For instance, in April 2023, Brazilian Health Regulatory Agency approved of Setria Glutathione for functional foods supplements.

Immunity boosting supplements accounted for the majority of purchasing nutritional supplements during the pandemic. More than 80% of Brazilians showed interest in purchasing vitamins, minerals, and other nutritional supplements for boosting their immunity levels. The increase in awareness levels and increase in uptake of products is driving the market growth.

Activity levels have taken a nosedive since the pandemic started, making more people predisposed to chronic ailments. This has made weight loss and maintenance a primary concern for the Latin American people. Glanbia states more than 43% of Latin Americans are becoming conscious of their weight. The high risk of obesity has been a primary reason for the growth of fitness centers and gyms, in turn creating a huge market for sports nutrition, thus aiding the growth of the market.

Latin American countries have been keenly increasing their uptake of nutritional supplements and more so since the COVID-19 pandemic. As per ALANUR, in Chile, 50% of households are daily consumers of dietary supplements. Out of all the types, vitamins held the largest share owing to their multifarious benefits. Supplementation complements the diet. It not only completes the daily nutritional requirement but also boosts immunity. More than 90% of the population has a better perception of both mental and physical health post use of nutritional supplements.

Different Latin American countries have different regulatory norms about nutritional supplements. The countries also have different rules for food supplements, all the norms have been in conformation with the Codex Alimentarius guidelines for international food supplement regulation. Many trade blocs exist in the Latin American region like the Southern Common Market Argentina, Brazil, and several others.

Latin America was one of the regions to suffer the worst of the brunt of the COVID-19 pandemic. Due to a high number of already existing comorbidities, the pandemic claimed many lives in the region. A paper published on PubMed, states in June 2020, that Latin America became the largest hotspot for COVID. Preventative health has been gaining momentum ever since COVID-19 which has led to stronger growth of the regional market. A recent study reported, that 3 out of 4 people in Peru have been regularly including immunity-boosting supplements in their diet.

Product Insights

The functional foods segment held the biggest market share of 57.7% in 2022. Latin America has been witnessing substantial growth in consumption of functional foods in recent years. The region has a large and diverse population, with varying healthcare needs. Obesity, diabetes, and cardiovascular disease have all become more prevalent in the region. Functional supplements are being used by consumers to supplement their diets and address certain health issues. Latin America's growing middle-class population has increased purchasing power and willingness to spend on health and wellness items. This has increased the need for supplements in past few years. Furthermore, the availability of numerous brands of supplements through multiple retail channels, such as pharmacies, health shops, supermarkets, and e-commerce platforms, has increased consumer access to these goods in Latin America. All the above-mentioned factors are promoting the market growth of the regional market.

Formulation Insights

Powder formulations held the largest revenue share of 37.5% as of 2022. Powder formulation products have been in demand and are the most easily available due to their benefits like easy absorption and easy suspension in all liquids. The majority of sports nutrition products are available in the form of powders so that they can be easily absorbed by the body. Increased demand for protein powders and other supplements has in turn resulted in the growth of the powder formulation segment.

The capsules segment is the fastest-growing formulation segment. It has been steadily witnessing substantial growth in the past few years. Functional foods like omega-3 and some prebiotics come in the form of capsules and have in turn been a major reason for the high revenue share. The main advantage of this formulation is that capsules cause lesser gastrointestinal tract irritation than any other formulation type and are thus popular among all age groups.

Sales Channel Insights

The upward trend of consumption and demand for nutritional supplements has been driving the sales of these OTC products for brick and mortar retail shops. They have been the preferred mode of purchasing these products by the consumers in the region. Even though the e-commerce platforms have been gaining momentum due to COVID-19 as well as the ease of use of this mode of purchase has been fueling the growth of the market.

The Latin American market for nutritional supplements is more concentrated with the presence of direct sellers, multi-level marketing companies are the most preferred way of distributing these products. In Mexico, these multilevel marketing companies have a vast network for the sale of nutritional supplements.

Consumer Group Insights

The adult consumer group dominated the regional market in 2022. The growing number of consumers from this category has been responsible for the growth of the market. Adults in the region are highly prone to developing chronic diseases, propensity toward diseases like diabetes, hypertension, and nonalcoholic fatty liver disease is high. Preventative medicine has become the key to overcoming these problems and has thus been contributing to the growth of this market.

The children segment is among the steadily growing consumer group category. Preventative medicine has been on the rise, because many diseases that develop in the later stages of life, are due to deficiencies during childhood. Vitamin D deficiency has been one of the most commonly occurring deficiencies around the globe. The uptick in the demand for vitamins has been one of the major reasons for the growth of this segment. The children’s category products are mainly focused on mental and physical growth and are thus propelling the market growth.

Country Insights

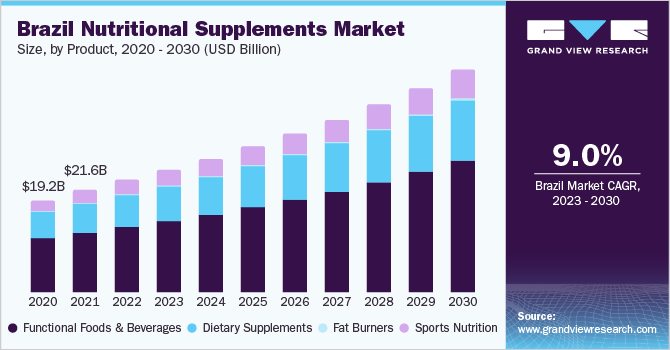

Brazil held the largest revenue share of 45.9% in 2022. Brazil’s government has been taking measures to increase the GDP per capita till 2031, the government aims at improving the GDP to 3.5% annual growth. All these initiatives have been supporting the population towards moving away from poverty, people are becoming more conscious of leading a healthy lifestyle.

Brazil was the worst-hit country during the COVID-19 pandemic, the maximum number of deaths were recorded from Brazil, and this has made the population more alert in terms of maintaining a healthy diet and supplementing their food with nutritional supplements to complete their dietary requirements, which has been the key to the growth of the market in the country.

Brazil is expected to register the fastest CAGR of 9.0% over the forecast period, from 2023 to 2030. An increase in disposable income and improvement in living standards coupled with rising awareness of a healthy and well-supplemented diet has been key to the growth of the nutritional supplements market in the country.

Key Companies & Market Share Insights

Latin America’s market for nutritional supplements has many regional companies as well as some international players. Products from these companies have been aimed at providing complete nutritional value for consumers. The number of consumers is growing and so is the opportunity for players in the region. Some of the key players in the Latin America Nutritional Supplement market include:

-

Herbalife International of America, Inc.

-

Amway International

-

Bayer AG

-

Sanofi

-

Abbott Nutrition

-

Nestle Nutrition

-

Pfizer, Inc.

-

GNC Holdings, Inc.

-

Ground & Pound Supplements

Latin America Nutritional Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 55.3 billion

Revenue forecast in 2030

USD 94.9 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, formulation, sales channel, consumer group, country

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina

Key companies profiled

Herbalife International of America, Inc.; Amway International; Bayer AG; Sanofi; Abbott Nutrition; Nestle Nutrition; Pfizer, Inc.; GNC Holdings, Inc.; Ground & Pound Supplements

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Nutritional Supplements Market Report Segmentation

This report forecasts revenue at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Latin America nutritional supplements market report based on product, formulation, sales channel, consumer group and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentil Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamin

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Food

-

Protein Bars

-

Energy Bars

-

Protein Gels

-

-

Meal Replacement Products

-

Weight Loss Products

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods & Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-commerce

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Children

-

Adults

-

21-30 years

-

31-40 years

-

41-50 years

-

51-65 years

-

-

Geriatric

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Frequently Asked Questions About This Report

b. The powder segment dominated the Latin American nutritional supplements market with a share of 37.5% in 2022. This is attributable to its advantages over other formulations, its availability in higher concentrations and higher absorption rate as compared to pills and other forms.

b. Some key players operating in the Latin American nutritional supplements market include Herbalife; Bayer AG; Pfizer, Inc.; and Merck KGaA.

b. Key factors that are driving the Latin American nutritional supplements market growth include the increasing prevalence of chronic diseases, the geriatric population, and a trend of active living.

b. The Latin American nutritional supplements market size was estimated at USD 51.32 billion in 2022 and is expected to reach USD 55.3 billion in 2023.

b. The Latin American nutritional supplements market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 94.9 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."