- Home

- »

- Sensors & Controls

- »

-

Leak Detection And Repair Market, Industry Report, 2033GVR Report cover

![Leak Detection And Repair Market Size, Share & Trends Report]()

Leak Detection And Repair Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Equipment, Services), By Product (Handheld Gas Detectors, UAV-Based Detectors), By Technology (Optical Gas Imaging, Laser Absorption Spectroscopy), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-756-8

- Number of Report Pages: 230

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Leak Detection And Repair Market Summary

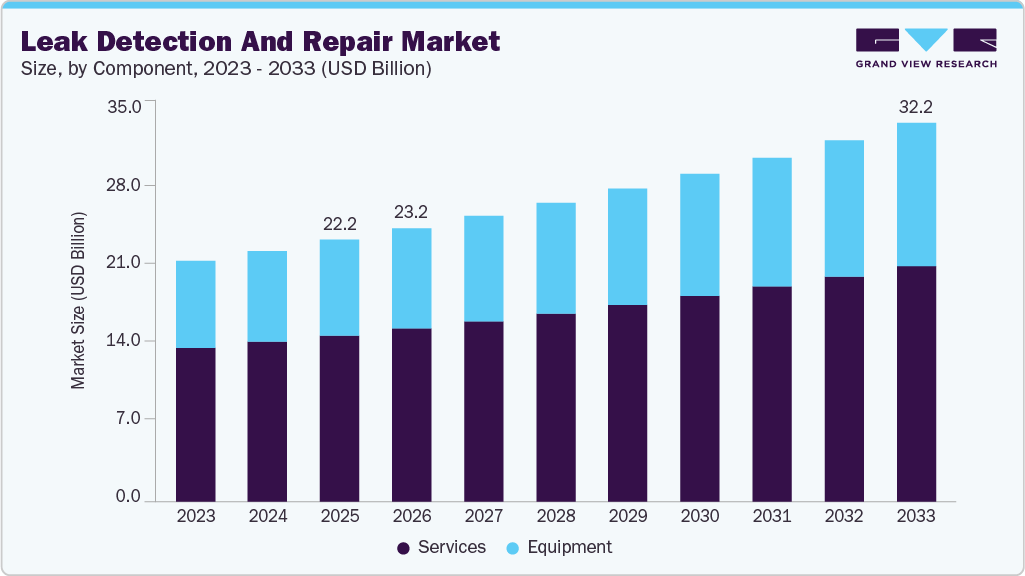

The global leak detection and repair market size was estimated at USD 22.24 billion in 2025 and is projected to reach USD 32.22 billion by 2033, growing at a CAGR of 4.8% from 2026 to 2033. The growing demand for LDAR systems among utility companies worldwide, owing to their benefits such as cost-saving, safety improvement, and environmental protection is a major driver behind the growth of the leak detection and repair market.

Key Market Trends & Insights

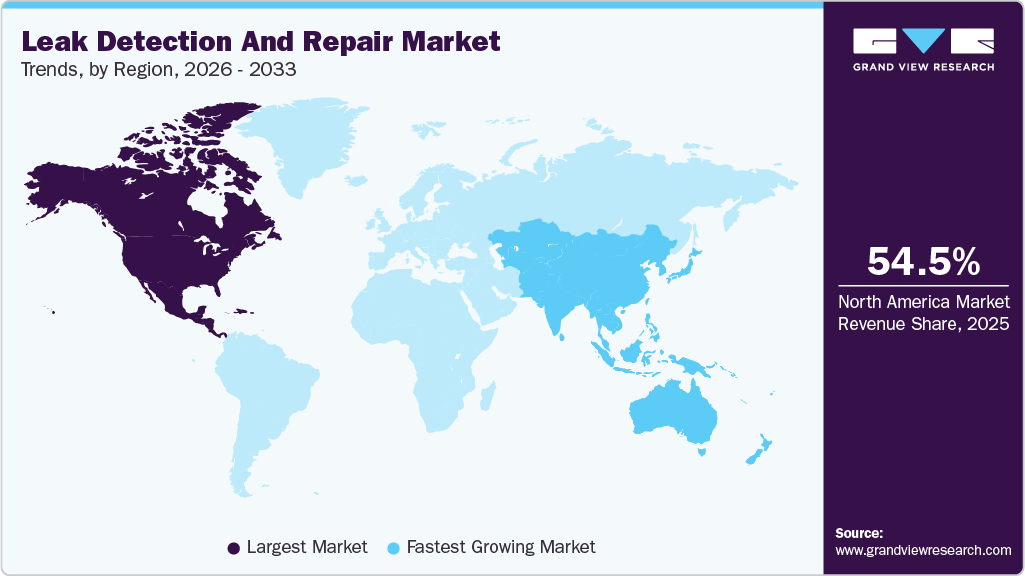

- North America leak detection and repair market dominated globally and accounted for a market share of 54.5% in 2025.

- The leak detection and repair market in the U.S. is expected to grow at a significant CAGR from 2026 to 2033.

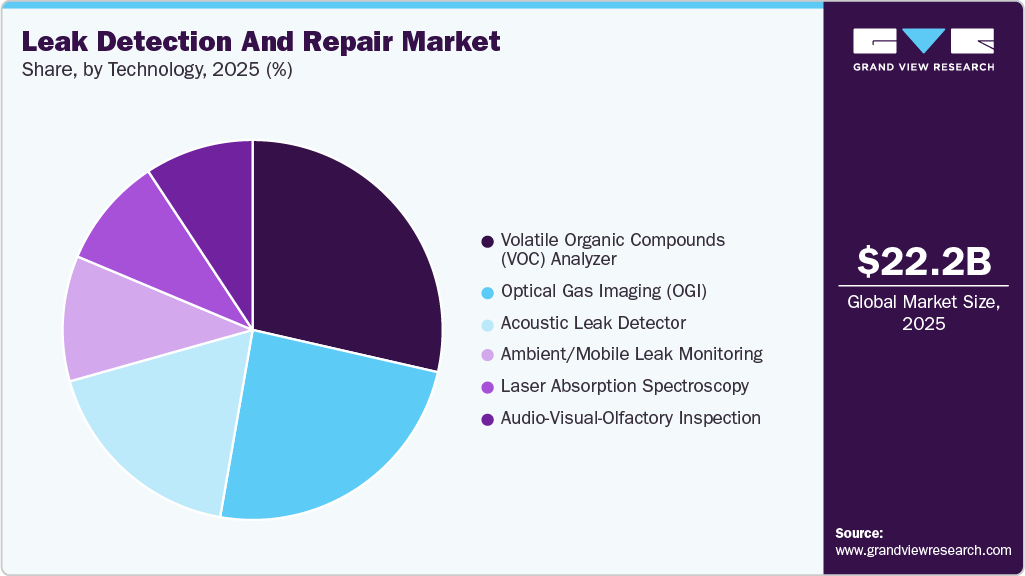

- By technology, the Volatile Organic Compounds (VOC) analyzer segment dominated the market in 2025.

- By component, the services segment dominated the market in 2025 with a revenue share of more than 63.5%.

- By product, the handheld gas detectors segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 22.24 Billion

- 2033 Projected Market Size: USD 32.22 Billion

- CAGR (2026-2033): 4.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

LDAR systems are widely used in petroleum, oil, and gas companies to make workplaces healthier by reducing the risk of accidents caused due to fire outbreaks and explosions. Increasing developments in petroleum and natural gas infrastructure worldwide are also anticipated to boost market’s growth. LDAR solutions are used by natural gas and petroleum companies for detecting and locating leaks in petroleum and natural gas pipelines before they become a potential hazard. According to the U.S. Energy Information Administration’s State-to-State Capacity Tracker, in 2022, collectively from five projects, interstate natural gas pipeline capacity of 897 million cubic feet per day was added in the U.S. These five projects include Florida Gas Transmission’s Mobile County Project, Columbia Gulf Transmission’s Louisiana XPress Project, Florida Gas Transmission’s Southwest Alabama Project, Gulfstream Natural Gas’s Gulfstream Phase VI Expansion Project, and ANR Pipeline Company’s Wisconsin Access Project.

Several gas emission monitoring companies use machine learning and artificial intelligence to detect leaks in their infrastructure more efficiently. A machine learning algorithm identifies leaks and emission risks on the ground using satellite imagery. The data obtained from machine learning allows operators to identify trends and patterns over time, thereby helping them make data-driven decisions. As a result, various oil & gas companies are trying to replace their traditional leak detection and repair systems with technologically enhanced LDAR systems.

Various key companies are focused on developing handheld LDAR systems, creating new opportunities for market growth. For instance, in October 2023, GasDog.com, a gas detection equipment and services provider, announced the launch of its latest products - toxic gas detectors and combustible gas detectors. These detectors were designed to transform gas safety measures, providing industries and individuals with cutting-edge technology to monitor and detect gas emissions effectively. These are portable or handheld detectors that provide accurate and reliable gas detection and monitoring for safety in various environments.

However, the increasing focus of governments on the development of renewable energy generation projects is expected to hinder market growth. For instance, in November 2022, the UK government announced that it was investing about USD 82.5 million to help speed up the development of new green technologies. On the other side, high cost of gas detection systems is other factor that could hamper the market’s growth. Though gas leak detection equipment provides benefits such as increased occupational safety and comfort, the cost of monitoring multiple gases and replacing sensors can be expensive. For organizations that require the detection of one or two gases, the total cost of ownership for equipment, maintenance, and replacement of parts can prove to be quite costly.

Component Insights

The services segment dominated the market in 2025 and accounted for more than 63.5% share of the global revenue. Leaking equipment such as pumps, valves, connectors, and compressors is the leading source of volatile organic compounds emissions in chemical manufacturing facilities and petroleum refineries. The leakage poses a threat to workers and causes air pollution. As a result, petroleum companies demand LDAR services to minimize the expensive leaks, driving the segment growth.

The equipment segment is anticipated to register the highest growth rate from 2026 to 2033. The integration of enhanced technologies in LDAR equipment is expected to create a new opportunity for the growth of the segment. Equipment with multi-gas solutions, cloud connectivity, and other such features is being increasingly used by utility companies to monitor greenhouse gases, water vapors, and carbon dioxide. At the same time, the increase in demand for LDAR equipment among scientists for sourcing individual gases is also driving the segment growth.

Product Insights

The handheld gas detectors segment dominated the market in 2025. Handheld gas detectors are increasingly in demand among oil and gas companies owing to their benefits such as fast and reliable detection, compact and lightweight structures, and ease of use. These detectors are used for detecting different gases such as methanol, carbon dioxide, ammonia, and methane. The rising natural gas production, coupled with the increasing trade of oil and gas products, is increasing the demand for handheld gas detectors in the oil & gas industry.

The UAV-based detectors segment is anticipated to register the fastest growth rate from 2026 to 2033. The use of UAV-based detectors to navigate dangerous areas is one of the critical advantages of these aerial solutions, which drives the segment growth. In addition, oil and gas companies demand UAV-based detectors due to improved safety and efficacy. UAV-based detectors are used for detecting gases such as benzene, ethanol, heptane, octane, methane, and others.

Technology Insights

The Volatile Organic Compounds (VOC) Analyzer segment dominated the market in 2025. Different gases such as propane, N-butane, N-pentane, and N-octane are considered under the volatile organic compound category. The concentration of a VOC is high in an indoor environment compared to the outdoor environment. A VOC is mainly emitted from products inside a building, such as cleaning supplies, paints, glues, and printing equipment. VOC detectors are mainly used for the rapid and accurate detection of volatile organic compounds.

The Optical Gas Imaging (OGI) segment is expected to register the fastest growth rate from 2026 to 2033. Optical gas imaging is a thermal imaging technology that utilizes highly sensitive infrared cameras to detect small fugitive emissions from the oil and gas industries. The demand for optical gas imaging detectors is high in industries such as pulp and paper, petrochemical, natural gas processing plants, and power generation plants. These detectors enable users to detect the invisible gases that escape faster in the environment and can prove harmful to the environment as well as personnel.

Regional Insights

North America leak detection and repair market dominated the market 54.5% in 2025. The government's support for the oil and gas industries in the U.S. and is also driving the country's industrial growth. The growing oil and gas industry is thereby creating the need for leak detection and repair systems in these countries. Additionally, government subsidies to oil and gas industries are also driving the regional market growth.

U.S. Leak Detection And Repair Market Trends

The leak detection and repair market in the U.S. is expected to grow at a significant CAGR from 2026 to 2033. The growth of the country can be attributed to the presence of stringent government regulations and norms. The pipeline leak detection regulation of the U.S requires the installation of a leak detection system on hazardous liquid pipelines.

The leak detection and repair market in Canada is anticipated to expand at a significant CAGR from 2026 to 2033. Rapid growth in the country’s oil and gas sector is driving the demand for leak detection and repair tools and services. As per the Canadian Government, Canada is the fifth largest producer of natural gas and the fourth largest producer of crude.

Asia Pacific Leak Detection And Repair Market Trends

The Asia Pacific region is expected to witness a significant growth from 2026 to 2033. The increasing demand for oil and oil products across Asia Pacific countries is expected to drive the demand for LDAR among utility companies in the region. The increasing production of natural gas in countries such as China is also creating the need for leak detection and repair systems. The subsequent expansion of oil and gas pipelines is expected to drive market growth in the region.

The leak detection and repair market in China is expected to grow at a significant CAGR of from 2026 to 2033. Growing government initiatives aimed at supporting local oil & gas companies with overseas investment, driving the growth of the natural gas market, and boosting the production and efficiency of the oil & gas industry through the adoption of gas leak detection equipment, which bodes well for the market’s growth.

India leak detection and repair market is anticipated to grow at a significant CAGR from 2026 to 2033. Increasing industrialization, rural electrification, urbanization, and growing automobile sales are some of the major factors driving the demand for leak detection and repair systems.

The leak detection and repair market in Japan is expected to grow at a significant CAGR from 2026 to 2033. Growing technological advancements and rapid economic growth of the automotive industry are major factors behind the market growth in the country.

Europe Leak Detection And Repair Market Trends

The leak detection and repair market inEurope is expected to grow at a significant CAGR from 2026 to 2033. The implementation of stringent government policies and the growing awareness of the harmful impacts of greenhouse gas pollution are major factors driving the growth of the market.

The leak detection and repair market in the UK is expected to grow at a significant CAGR from 2026 to 2033. The government’s regulatory guidance on the safe installation, maintenance, and use of gas systems, including fittings, appliances, and flues, is boosting the growth of the market.

Germany leak detection and repair market is expected to grow at a significant CAGR from 2026 to 2033. Advancements in unmanned aerial vehicles, industrial automation, and robotics are expected to drive market growth.

MEA Leak Detection And Repair Market Trends

The leak detection and repair market in MEA is anticipated to grow at a significant CAGR from 2026 to 2033. The increasing oil and gas production and export activities in the countries such as Kingdom of Saudi Arabia, UAE and South Africa is driving the demand for leak detection and repair systems.

Kingdom of Saudi Arabia (KSA) leak detection and repair market is expected to grow at a significant CAGR from 2026 to 2033. The presence of local leak detection and repair service providers in the country is boosting the market’s growth. For instance, Gas Equipment & Contracting Company (GECE) is a Riyadh-based provider of high-quality gas & fuel system solutions. The company offer gas leak detection and repair services for homes or businesses.

Key Leak Detection And Repair Market Company Insights

Some of the key companies operating in the market include Heath Consultants Incorporated, GHD, Inc., ABB Ltd., and Team Inc.

-

Heath Consultants Incorporated is a U.S.-based private company that provides line-clearing services and methane detection systems for gas suppliers. The company’s services mainly focus on the manufacturing of leak detection products for utility protection and damage prevention in oil & gas industries.

-

GHD Inc. is a U.S.-based company that serves industries such as water, transportation, environment, property & buildings, and energy & resources. It offers a range of services in the oil & gas industry as it helps to manage hazardous greenhouse gases. The projects that it undertakes entail a list of services for each inspection and the company also undertakes maintenance of the plant after the completion period.

Key Leak Detection And Repair Companies:

The following are the leading companies in the leak detection and repair market. These companies collectively hold the largest market share and dictate industry trends.

- Bridger Photonics, Inc.

- ABB Ltd.

- Teledyne FLIR LLC

- Honeywell International Inc.

- Emerson Electric Co.

- Schneider Electric SE

- Aeris Technologies

- Avitas Systems

- Picarro Inc.

- Kairos Aerospace

Recent Developments

-

In September 2025, SLB announced that its Methane LiDAR Camera has been approved by the U.S. EPA as an Alternative Test Method (ATM) for methane detection under the OOOO regulations targeting fugitive emissions. The autonomous camera provides high-resolution, component-level methane measurements that distinguish between leaks and permitted emissions without the need for secondary verification. With this approval, operators can use the LiDAR system as a standalone alternative to labor-intensive Optical Gas Imaging (OGI) surveys. The technology works in varied environmental conditions and is not affected by temperature differences, offering more accurate and reliable detection. Its built-in laser imaging quantifies emission rates and provides remote, digital access to data for more efficient LDAR management and reporting.

-

In January 2024, CO2Meter, a prominent manufacturer in gas detection solutions announced the launch of an industrial gas detector developed to monitor gases in industrial. The CM-900 series is developed to measure high carbon dioxide or low oxygen to protect staff and employees working around and near hazardous gases from situations such as accidental leaks.

-

In September 2023, DOD Technologies, a provider of commercial and industrial gas detection systems, equipment, and services launched the ChemLogic Revive CL4R Four-Point Toxic Gas Detection System developed to replace, and upgrade fixed four-point monitors. This system uses ChemLogic colorimetric technology to identify gas leaks, drawing ambient air samples from up to 500 feet away.

Leak Detection And Repair Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 23.34 billion

Revenue forecast in 2033

USD 32.22 billion

Growth rate

CAGR of 4.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, product, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Russia; China; India; Japan; Australia; South Korea; Brazil; Venezuela; Kingdom of Saudi Arabia; UAE; South Africa

Key companies profiled

Bridger Photonics, Inc.; ABB Ltd.; Teledyne FLIR LLC; Honeywell International Inc.; Emerson Electric Co.; Schneider Electric SE ; Aeris Technologies; Avitas Systems; Picarro Inc.; Kairos Aerospace

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Leak Detection and Repair Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global leak detection and repair market based on component, product, technology, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Equipment

-

Services

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Handheld Gas Detectors

-

UAV-Based Detectors

-

Vehicle-based Detectors

-

Manned Aircraft Detectors

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Volatile Organic Compounds (VOC) Analyzer

-

Optical Gas Imaging (OGI)

-

Laser Absorption Spectroscopy

-

Ambient/Mobile Leak Monitoring

-

Acoustic Leak Detection

-

Audio-Visual-Olfactory Inspection

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Venezuela

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global leak detection and repair market size was estimated at USD 22.24 billion in 2025 and is expected to reach USD 23.24 billion in 2026.

b. The global leak detection and repair market is expected to grow at a compound annual growth rate of 4.8% from 2026 to 2033 to reach USD 32.22 billion by 2033.

b. North America dominated the LDAR market with a share of 54.5% in 2025. This is attributable to stringent government regulations and policies.

b. Some key players operating in the LDAR market include Aeris Technologies, Inc.; IBM Thomas J. Watson Research Center; Bridger Photonics, Inc.; LI-COR, Inc.; Duke University; Colorado State University; Palo Alto Research Center; Maxion Technologies Inc.; Rebellion Photonics; Physical Sciences Inc.; Avitas Systems; PrecisionHawk; SeekOps, Inc.; Advisian; Ball Aerospace & Technologies Corp.; Gas Ops Leak Detectives, LLC (G.O.L.D. LLC).; Guideware Systems, LLC.; Summit Inspections Services, Inc.; GHD, Inc.; ERM Group, Inc.; AECOM; Guardian Compliance; ABB Ltd.; Chicago Bridge & Iron Company N.V.; Heath Consultants Incorporated; ENCOS, Inc.; Team Inc.; VelocityEHS; Picarro Inc.; Microdrones GmbH; Boreal Laser Inc.; and Kairos Aerospace, among others.

b. Key factors that are driving the leak detection and repair market growth include increasing oil & gas pipeline infrastructure and stringent government regulations to curb methane emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.