- Home

- »

- Sensors & Controls

- »

-

Lighting Control System Market Size And Share Report, 2030GVR Report cover

![Lighting Control System Market Size, Share, & Trends Report]()

Lighting Control System Market (2024 - 2030) Size, Share, & Trends Analysis Report By Component (Hardware, Software, Services), By Communication Protocol, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lighting Control System Market Summary

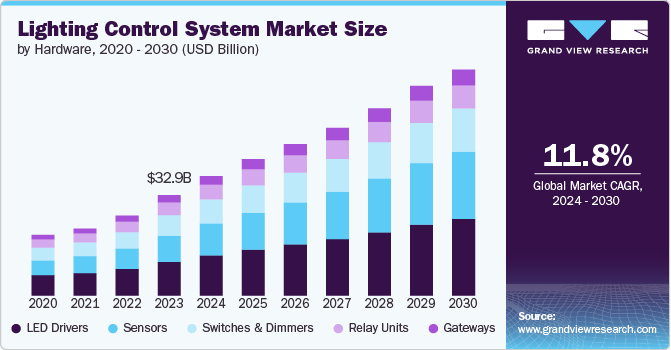

The global lighting control system market size was estimated at USD 32,929.5 million in 2023 and is projected to reach USD 76,690.8 million by 2030, growing at a CAGR of 11.8% from 2024 to 2030. The market is experiencing significant growth, driven by various technological advancements and increasing demand for energy efficiency.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- In terms of segment, hardware accounted for a revenue of USD 32,929.5 million in 2023.

- Hardware is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 32,929.5 Million

- 2030 Projected Market Size: USD 76,690.8 Million

- CAGR (2024-2030): 11.8%

- Europe: Largest market in 2023

Governments and private sectors are heavily investing in intelligent lighting systems that reduce energy consumption, lower operational costs, and contribute to sustainability goals. The integration of IoT (Internet of Things) in lighting control systems allows for automated and remote management, which further enhances efficiency and user convenience.

The market is expected to witness significant growth during the forecast period owing to the rising demand for connected homes and commercial spaces. The shift towards LED lighting, which is more energy-efficient and durable, is creating a substantial demand for advanced lighting control solutions. Additionally, there is a growing interest in human-centric lighting, which adjusts the intensity and color temperature based on the time of day to improve well-being and productivity. This is opening new avenues for innovation and market expansion.

The increasing adoption of energy-saving initiatives by the governments worldwide, advancements in wireless communication technologies, and the rising awareness among consumers regarding the benefits of smart lighting solutions is further boosting the growth of the market. The demand for lighting control systems is also bolstered by stringent building codes and regulations that mandate energy-efficient solutions in both residential and commercial sectors.

In recent years, the market has seen a shift from traditional wired control systems to wireless and hybrid systems. The advent of cloud-based solutions has enabled real-time monitoring and control, which is now a standard feature in modern lighting control systems. Another trend is the increasing use of AI and machine learning algorithms to optimize lighting conditions based on environmental factors and usage patterns, offering personalized and adaptive lighting experiences.

The market is increasingly focused on ensuring the security of the data collected and transmitted by smart lighting systems. With the integration of IoT, these systems collect vast amounts of data, raising concerns about privacy and security. Regulations such as GDPR in Europe and CCPA in California have set strict guidelines for the handling of personal data. Companies in the lighting control system market are required to implement robust encryption methods, ensure data anonymization, and comply with these regulations to avoid penalties and maintain consumer trust.

Component Insights

The hardware segment accounted for the largest revenue share of over 56% in 2023. The increased adoption of advanced sensor technologies, such as occupancy sensors and ambient light sensors, which enhance the efficiency and functionality of lighting systems is driving the demand for hardware components in the market. These sensors enable automated adjustments based on real-time data, contributing to energy savings and improved user experiences. Further, the rising integration of smart switches and dimmers, which allow users to customize lighting settings remotely or via voice commands, is also driving growth in this segment. As smart homes and buildings become more prevalent, the demand for sophisticated hardware components that support seamless connectivity and automation is surging.

The LED segment of the lighting control market is experiencing significant growth in the hardware segment, primarily driven by the rapid advancements in LED technology and its superior energy efficiency compared to traditional lighting solutions. The transition from incandescent and fluorescent lighting to LEDs is not only fueled by their lower energy consumption but also by their longer lifespan and reduced maintenance costs.

The software segment is expected to grow at a significant CAGR during the forecast period. In the software segment, the growing trend of cloud-based lighting control solutions is a major driver of market expansion. Cloud platforms provide users with remote access and control over their lighting systems through smartphones and tablets, offering convenience and flexibility. The ability to integrate with other smart home systems and platforms, such as home automation hubs and energy management systems, is enhancing the appeal of cloud-based solutions. This trend is driven by the increasing demand for seamless, interconnected smart home ecosystems that offer centralized control and advanced automation capabilities.

Cloud-based lighting control systems are gaining traction as businesses and consumers increasingly adopt cloud technologies for their scalability, flexibility, and cost-effectiveness. Further, as cloud solutions continue to evolve, they enable enhanced features such as remote diagnostics and automatic updates, which drive their adoption across diverse sectors, from smart cities to industrial applications.

Communication Protocols Insights

The wired segment accounted for the largest market share of over 64% in 2023. The opportunities for wired lighting control systems are expanding as industries seek to modernize existing infrastructures. The integration of wired systems with new smart technologies, such as building management systems (BMS) and energy management systems (EMS), is enhancing their functionality and appeal. Furthermore, stringent energy efficiency regulations and sustainability initiatives are creating demand for solutions that can provide precise control and monitoring of energy usage. Wired systems offer the advantage of high data security and lower risk of hacking compared to wireless alternatives, which is increasingly important in sensitive environments such as data centers and critical infrastructure.

The wireless segment is expected to grow at a significant CAGR during the forecast period. Wireless lighting control systems are experiencing robust growth, driven by their flexibility and ease of installation. The rise in smart home technologies and the proliferation of IoT devices are major factors propelling the growth of this segment. One of the primary drivers is the growing consumer preference for wireless solutions that offer convenience and scalability without the need for extensive rewiring. Innovations in wireless communication technologies, such as Zigbee, Z-Wave, and Wi-Fi, are enhancing the capabilities and reliability of these systems, making them suitable for both residential and commercial applications. The ability to integrate seamlessly with other smart devices and systems, such as voice assistants and mobile apps, is also boosting their popularity.

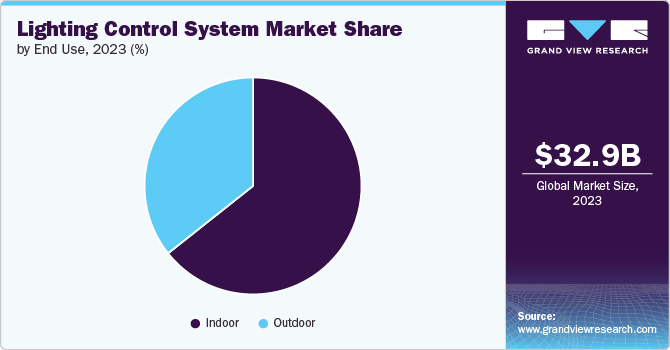

End Use Insights

The indoor segment accounted for the largest market share of over 64% in 2023. The indoor lighting control segment is experiencing robust growth driven by the increasing adoption of smart home technologies and advancements in building automation. The growing focus on energy efficiency and sustainability within residential and commercial buildings is among the key factors driving the growth of the segment. As businesses and homeowners seek to reduce their energy consumption and operational costs, there is a rising demand for advanced lighting control systems that offer features such as occupancy sensing, dimming, and automated scheduling. These systems not only help in reducing energy waste but also enhance user convenience and comfort by allowing precise control over lighting conditions based on specific needs and preferences.

The outdoor segment is expected to grow at a significant CAGR during the forecast period. The outdoor lighting control segment is experiencing notable growth due to the increasing emphasis on smart city initiatives and enhanced public safety. Further, the deployment of smart street lighting systems that utilize IoT technologies for real-time monitoring and adaptive control is growing significantly. These systems can adjust lighting levels based on factors such as traffic flow, weather conditions, and time of day, which not only improves visibility and safety but also contributes to significant energy savings. The integration of sensors and data analytics in outdoor lighting systems is transforming traditional street lighting into intelligent networks that can respond dynamically to changing environmental conditions.

Regional Insights

The lighting control system market in North America held a market share of over 27% in 2023. The lighting control system market is witnessing substantial growth in the North America region, driven by the increasing adoption of smart home technologies and the push towards energy-efficient solutions. The region benefits from strong regulatory support and incentives for green buildings, particularly in the U.S., where building codes are becoming more stringent regarding energy consumption. Further, the advancements in wireless technologies and the integration of IoT in lighting systems, which enhance user convenience and system efficiency is among the key drivers in the market.

U.S. Lighting Control System Market Trends

The lighting control system market in the U.S. is growing significantly at a CAGR of 10.0% from 2024 to 2030. In the U.S., the market growth is strongly influenced by the accelerated adoption of smart lighting solutions in both urban and suburban areas. A significant trend is the growing implementation of human-centric lighting systems, which adjust lighting conditions to improve productivity and well-being. Furthermore, the U.S. market is experiencing a surge in retrofitting projects, where existing buildings are upgraded with advanced lighting control technologies to meet new energy codes and standards.

Asia Pacific Lighting Control System Market Trends

The lighting control system market in Asia Pacific is growing significantly at a CAGR of 13.4% from 2024 to 2030. The region is emerging as a rapidly expanding market for lighting control systems, driven by rapid urbanization and infrastructure development across key countries such as China and India. The region’s growth is fueled by rising investments in smart city projects and commercial real estate, which are integrating advanced lighting technologies to enhance energy efficiency and operational effectiveness. Opportunities abound in Asia Pacific due to the growing middle class and increasing demand for modern, automated solutions in both residential and commercial sectors. Additionally, the trend towards integrating artificial intelligence and machine learning in lighting control systems is gaining traction, offering new avenues for innovation and market expansion.

Europe Lighting Control System Market Trends

The lighting control system market in Europe is growing significantly at a CAGR of 11.5% from 2024 to 2030. The market growth is primarily influenced by the European Union’s aggressive sustainability goals and energy efficiency regulations. The EU's commitment to reducing carbon emissions and enhancing energy performance in buildings has created a robust market for advanced lighting control solutions. Opportunities are amplified by the increasing adoption of smart city initiatives and public funding for energy-efficient retrofits. Additionally, the emphasis on human-centric lighting and its benefits for public health and productivity aligns with regional trends, presenting growth avenues in both residential and commercial sectors.

Key Lighting Control System Company Insights

The key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2024, Casambi, a smart lighting control solution provider unveiled Salvador, its latest innovation in DALI controllers. This launch marks a significant step into the wired lighting control sector, positioning the company as a major player in the mainstream lighting controls market. With Salvador, the firm enhances its portfolio, demonstrating its commitment to advanced and reliable solutions in wired lighting control.

-

In March 2024, MaxLite, an energy efficient lighting solution provider announced the launch of c-Max Network Partners, integrating its c-Max controls ready luminaires with Silvair’s advanced Bluetooth Networked Lighting Control (NLC) technology. This partnership is aimed at enhancing MaxLite’s offering with scalable, technology-agnostic solutions, including interoperable devices and flexible sensor integration.

-

In December 2023, Signify Holding, a global leader in lighting products and solutions, has announced the acquisition of Intelligent Lighting Controls, Inc. (ILC), a prominent U.S. manufacturer of wired control systems. This strategic move enhances Signify Holding ‘s connected portfolio by integrating ILC’s advanced technology and solid market position. The acquisition aims to boost the adoption of energy-efficient solutions, capitalizing on the growing demand within the North American market.

Key Lighting Control System Companies:

The following are the leading companies in the lighting control system market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Brands Lighting, Inc.

- Signify Holding

- General Electric Company

- Schneider Electric

- Toshiba

- Eaton Corporation PL

- Honeywell International Inc.

- Schneider Electric

- Digital Lumens Inc.

- Casambi

- MaxLite

- Lutron Electronics Co. Inc.

Lighting Control System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.37 billion

Revenue forecast in 2030

USD 76.69 billion

Growth rate

CAGR of 11.8% from 2024 to 2030

Actual data

2018 - 2023

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, communication protocols, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa.

Key companies profiled

Acuity Brands Lighting, Inc.; Signify Holding; General Electric Company; Schneider Electric; Toshiba; Eaton Corporation PL; Honeywell International Inc.; Schneider Electric; Digital Lumens Inc.; Casambi; MaxLite; Lutron Electronics Co. Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lighting Control System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global lighting control system market report based on component, communication protocol, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

LED Drivers

-

Sensors

-

Switches and Dimmers

-

Relay Units

-

Gateways

-

-

Software

-

Web Based

-

Cloud based

-

-

Services

-

-

Communication Protocol Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired

-

Wireless

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Residential

-

Commercial

-

-

Outdoor

-

Highways and Roadways

-

Architectural

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lighting control system market size was estimated at USD 32.93 billion in 2023 and is expected to reach USD 39.37 billion in 2024

b. The global lighting control system market is expected to grow at a compound annual growth rate of 11.8% from 2024 to 2030 to reach USD 76.69 billion by 2030

b. Europe dominated the lighting control system market with a market share of 36.9% in 2023. The growth of the lighting control system market in Europe is primarily influenced by the European Union’s aggressive sustainability goals and energy efficiency regulations. The EU's commitment to reducing carbon emissions and enhancing energy performance in buildings has created a robust market for advanced lighting control solutions. Opportunities are amplified by the increasing adoption of smart city initiatives and public funding for energy-efficient retrofits.

b. Some key players operating in the lighting control system market include Acuity Brands Lighting, Inc.; Signify Holding; General Electric Company; Schneider Electric; Toshiba; Eaton Corporation PL; Honeywell International Inc.; Schneider Electric; Digital Lumens Inc.; Casambi; MaxLite; and Lutron Electronics Co. Inc.

b. The lighting control system market is experiencing significant growth, driven by various technological advancements and increasing demand for energy efficiency. The global push towards smart cities and smart building projects is also driving the growth of the market. Governments and private sectors are heavily investing in intelligent lighting systems that reduce energy consumption, lower operational costs, and contribute to sustainability goals. The integration of IoT (Internet of Things) in lighting control systems allows for automated and remote management, which further enhances efficiency and user convenience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.