- Home

- »

- Advanced Interior Materials

- »

-

Liquid Analytical Instrument Market, Industry Report, 2030GVR Report cover

![Liquid Analytical Instrument Market Size, Share & Trends Report]()

Liquid Analytical Instrument Market (2025 - 2030) Size, Share & Trends Analysis Report By Instrument, By Application (Drug Discovery, Water Purification), By End-use (Chemical, Energy, Food & Beverage, Healthcare & Biotechnology), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-751-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Analytical Instrument Market Summary

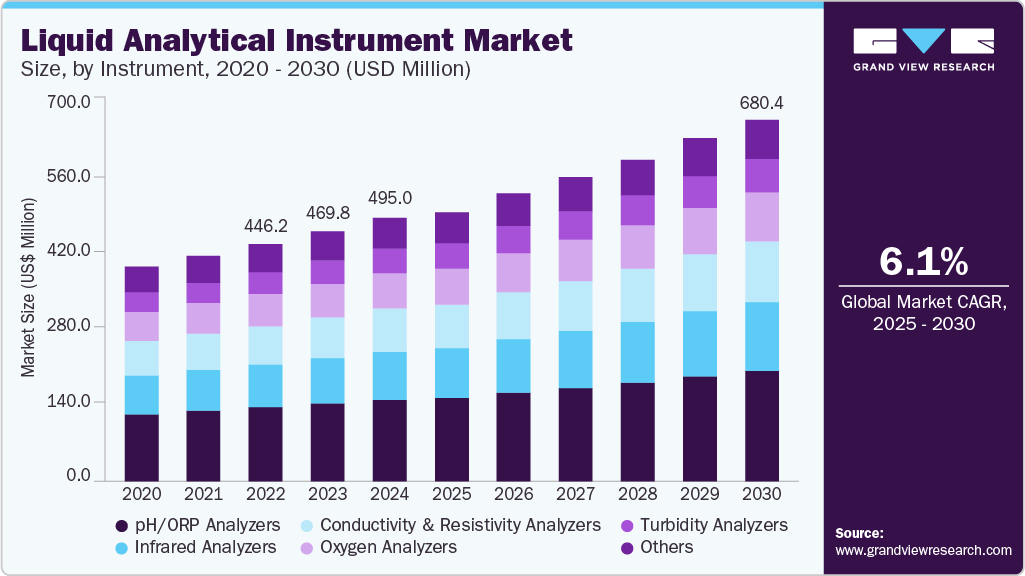

The global liquid analytical instrument market size was estimated at USD 495.0 million in 2024 and is projected to reach USD 680.4 million by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The market is experiencing a notable evolution driven by increased demand for real-time, precise monitoring in industries such as water treatment, pharmaceuticals, food & beverage, and chemicals.

Key Market Trends & Insights

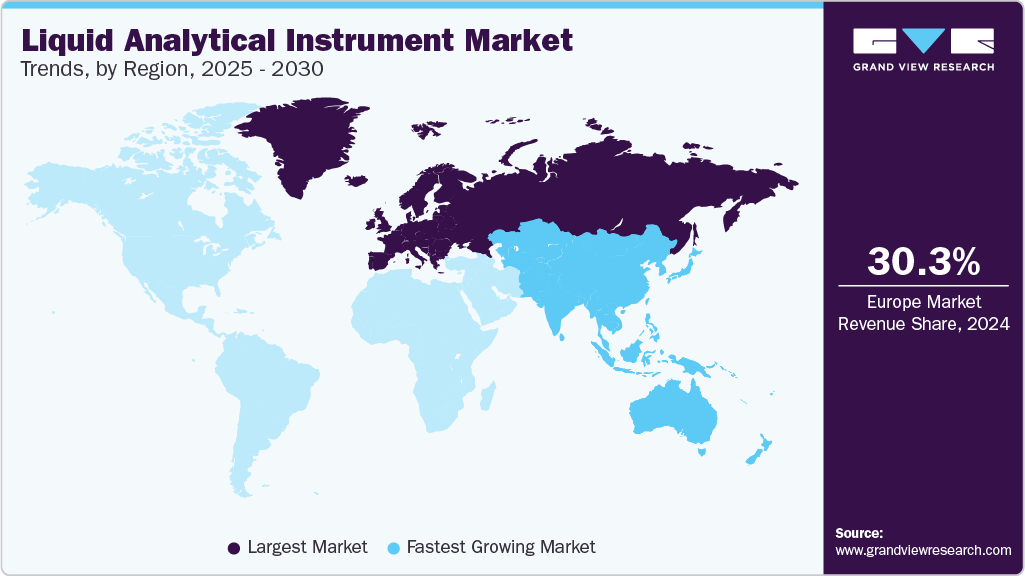

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, ph/orp analyzers accounted for a revenue of USD 156.6 million in 2024.

- Infrared Analyzers is the most lucrative instrument segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 495.0 Million

- 2030 Projected Market Size: USD 680.4 Million

- CAGR (2025-2030): 6.1%

- Europe: Largest market in 2024

There is a growing emphasis on process optimization, regulatory compliance, and sustainability, which is pushing industries to invest in advanced analytical tools such as pH meters, conductivity sensors, dissolved oxygen analyzers, and multi-parameter systems.

Another significant trend is the shift toward digitalization and automation. Modern liquid analytical instruments are increasingly being embedded with smart features such as wireless connectivity, cloud-based data storage, and predictive maintenance capabilities. These innovations not only improve accuracy and ease of use but also support data-driven decision-making across operations. Moreover, the rise in environmental monitoring initiatives and stricter quality control standards worldwide is further boosting the adoption of these technologies across a diverse range of applications.

Drivers, Opportunities & Restraints

The liquid analytical instrumentation industry is experiencing robust growth, propelled by several key factors. Stringent environmental regulations across industries such as water treatment, pharmaceuticals, and food and beverage are compelling companies to adopt advanced analytical tools for precise monitoring and compliance. Technological advancements in sensor technologies, including AI and IoT integration, are enhancing the capabilities of liquid analyzers, enabling real-time data collection and predictive maintenance. In addition, the increasing emphasis on process optimization and sustainability is driving demand for instruments that ensure product quality and minimize environmental impact.

Despite the market's expansion, several challenges hinder its growth. The high initial investment required for advanced liquid analytical instruments poses a significant barrier, particularly for small to mid-sized laboratories with limited budgets. Moreover, the complexity of these instruments necessitates specialized training and a skilled workforce, which is currently in short supply. Issues such as sensor calibration failures, drift in readings, and contamination further complicate maintenance and reliability, potentially leading to operational inefficiencies.

The market presents numerous opportunities for growth and innovation. The integration of artificial intelligence and machine learning into liquid analytical instruments is revolutionizing data analysis, offering faster and more accurate results. In addition, the increasing demand for compact, portable, and automated systems is opening avenues in healthcare diagnostics and field applications. Emerging markets in regions like Asia-Pacific, Latin America, and Africa are witnessing industrialization and stricter regulatory frameworks, creating a fertile ground for market expansion.

Instrument Insights

The pH/ORP analyzers instrument segment led the market with the largest revenue share of 31.1% in 2024. pH/ORP analyzers are essential tools for monitoring and controlling the acidity, alkalinity, and redox potential in various industrial processes. These instruments are widely used in applications such as water treatment, chemical manufacturing, and food processing to ensure product quality and compliance with environmental regulations.

Infrared analyzers utilize the absorption of infrared light to identify and quantify specific gases or chemical compounds in a sample. This technology is particularly valuable in applications such as environmental monitoring, industrial emissions control, and process optimization, where precise gas composition analysis is critical. IR analyzers are known for their high sensitivity, selectivity, and non-destructive testing capabilities, making them suitable for continuous monitoring in challenging environments.

Application Insights

The wastewater management segment led the market with the largest revenue share of 31.3% in 2024. In wastewater management, liquid analytical instrumentation is essential for monitoring and controlling water quality. Instruments such as pH/ORP analyzers and infrared (IR) analyzers are employed to measure critical parameters like acidity, alkalinity, and the presence of specific contaminants. These tools enable real-time detection of pollutants, ensuring compliance with environmental regulations and protecting public health.

The liquid chemistry monitoring is a pivotal factor propelling the market growth. Industries such as water and wastewater treatment, pharmaceuticals, food and beverage, and biotechnology rely on precise and continuous analysis of liquid parameters like pH, conductivity, dissolved oxygen, and turbidity to ensure product quality, safety, and regulatory compliance. The increasing emphasis on environmental sustainability and stringent regulatory standards has heightened the need for real-time monitoring solutions.

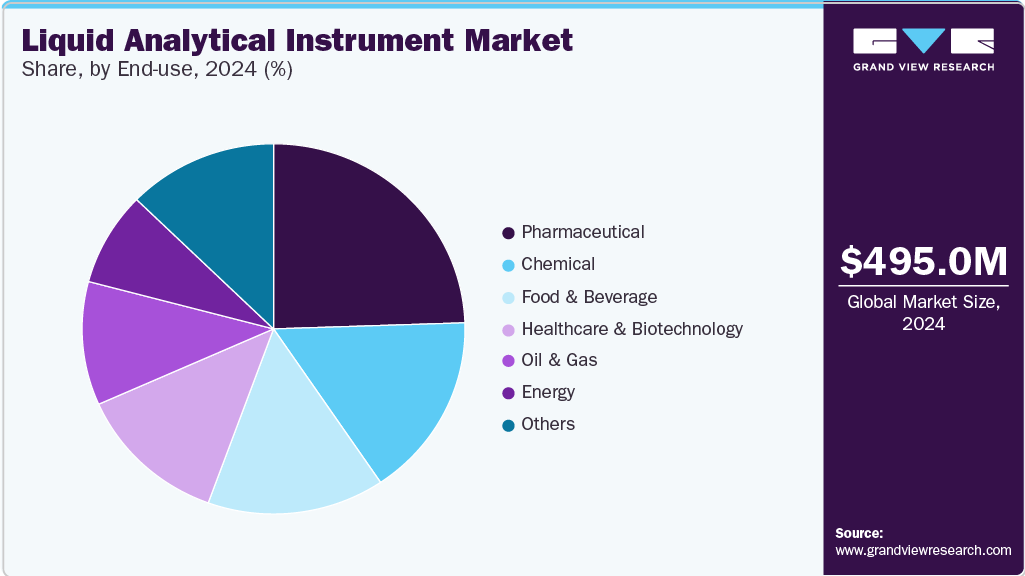

End-use Insights

The pharmaceutical segment led the market with the largest revenue share of 24.5% in 2024. The pharmaceutical sector is a significant driver of the market growth, primarily due to its stringent requirements for quality control, regulatory compliance, and process optimization. Analytical instruments such as high-performance liquid chromatography (HPLC), mass spectrometry, and pH/ORP analyzers are integral to various stages of pharmaceutical development, including drug discovery, formulation, and manufacturing.

In healthcare & biotechnology, liquid analytical instruments are crucial for research, development, and quality control processes. They are extensively used in drug discovery to analyze complex biological samples, identify biomarkers, and assess the purity and potency of pharmaceutical compounds. These instruments also support the optimization of fermentation processes in biotechnology by monitoring parameters such as pH, oxygen levels, and nutrient concentrations, ensuring consistent yields of bioproducts.

Regional Insights

The liquid analytical instrument market in North America is characterized by advanced technological adoption and a strong regulatory framework. Industries such as pharmaceuticals, food & beverage, and water treatment drive demand for high-precision instruments like pH/ORP analyzers, conductivity sensors, and infrared analyzers. The region's emphasis on quality control, environmental compliance, and process optimization fuels the market growth.

U.S. Liquid Analytical Instrument Market Trends

The liquid analytical instrument market in the U.S. is expected to grow at a significant CAGR of 6.5% from 2025 to 2030. The United States stands as a dominant force in the U.S. market, owing to its robust industrial base and significant investments in research and development. Key sectors including pharmaceuticals, biotechnology, and environmental monitoring contribute to the widespread adoption of liquid analytical instruments.

The Canada liquid analytical instrument market is expected to grow at the fastest CAGR of 7.9% from 2025 to 2030. Canada's market is influenced by its strong emphasis on environmental sustainability and natural resource management. Industries such as mining, agriculture, and water treatment require precise analytical tools to monitor and manage liquid processes effectively.

Europe Liquid Analytical Instrument Market Trends

Europe dominated the liquid analytical instrument market with the largest revenue share of 30.3% in 2024. Europe exhibits a diverse and mature in Europe market, with significant contributions from countries such as Germany, the UK, and France. The region's stringent environmental regulations and quality standards in sectors such as pharmaceuticals, food and beverage, and water treatment necessitate the use of advanced analytical instruments. Ongoing investments in research and development further enhance the market's growth prospects.

The liquid analytical instrument market in the Germany is driven by its strong industrial sector, particularly in chemicals, pharmaceuticals, and environmental monitoring. The country's commitment to precision engineering and innovation fosters the development and adoption of advanced analytical instruments. Germany's regulatory framework also ensures high standards in quality control and environmental compliance, supporting market growth.

The UK liquid analytical instrument market is driven by its robust healthcare and pharmaceutical industries, which require precise analytical tools for research and quality control. The country's focus on innovation and regulatory adherence promotes the adoption of advanced liquid analytical instruments.

Asia Pacific Liquid Analytical Instrument Market Trends

The liquid analytical instrument market in the Asia Pacific is experiencing rapid growth, driven by industrialization and urbanization in countries like China and India. Sectors such as pharmaceuticals, food and beverage, and environmental monitoring are major contributors to this growth. The region's increasing focus on quality control and environmental sustainability further propels the demand for advanced analytical instruments.

The China liquid analytical instrument market held a significant share in the Asia Pacific market owing to its large-scale industrial activities and stringent regulatory requirements in sectors like pharmaceuticals, chemicals, and environmental monitoring. The government's initiatives to enhance environmental protection and industrial efficiency drive the adoption of advanced analytical instruments.

The liquid analytical instrument market in the India is expected to grow at the fastest CAGR of 8.1% from 2025 to 2030. India's market is witnessing growth, fueled by its expanding pharmaceutical, chemical, and water treatment industries. The country's focus on improving infrastructure and regulatory standards enhances the demand for precise analytical tools. Government initiatives aimed at environmental protection and industrial development further support the market's expansion.

Middle East & Africa Liquid Analytical Instrument Market Trends

The liquid analytical instrument market in the Middle East & Africa is emerging, with countries focusing on industrial development and environmental sustainability. Sectors such as oil and gas, water treatment, and agriculture require advanced analytical instruments to monitor and manage liquid processes effectively. Government initiatives and investments in infrastructure contribute to the market's growth potential.

The Saudi Arabia liquid analytical instrument market is expanding, driven by its oil and gas industry and initiatives in water treatment and environmental monitoring. The country's focus on technological advancement and regulatory compliance fosters the adoption of advanced analytical instruments. Saudi Arabia's investments in infrastructure and industrial development further support market growth.

Latin America Liquid Analytical Instrument Market Trends

The liquid analytical instrument market in Latin America is developing, with countries like Brazil investing in industrial growth and environmental monitoring. The region's agricultural, mining, and water treatment sectors require advanced analytical instruments to ensure quality control and regulatory compliance. Ongoing investments in infrastructure and technology adoption contribute to the market's growth prospects.

The Brazil liquid analytical instrument market is influenced by its large agricultural and mining industries, which necessitate precise analytical tools for process optimization and environmental monitoring. The country's regulatory framework and focus on sustainable development drive the demand for advanced analytical instruments. Brazil's commitment to technological advancement further supports market growth.

Key Liquid Analytical Instrument Company Insights

Some of the key players operating in the liquid analytical instrument industry include ABB, Schneider Electric, and Honeywell International Inc.

-

ABB Ltd. is a Swedish-Swiss multinational corporation specializing in robotics, power, and automation technologies. Headquartered in Zurich, Switzerland, ABB operates in over 100 countries and employs approximately 110,000 people worldwide. The company was formed in 1988 through the merger of Sweden's ASEA and Switzerland's Brown, Boveri & Cie. ABB provides a wide range of electrification and automation solutions, including robotics, industrial automation, and digitalization services, aiming to enhance industrial productivity and sustainability.

-

Schneider Electric SE is a French multinational corporation that specializes in digital automation and energy management. Founded in 1836, Schneider Electric is headquartered in Rueil-Malmaison, France, and operates in over 100 countries with a workforce of approximately 153,000 employees. The company provides integrated solutions across various sectors, including smart industries, resilient infrastructure, and intelligent buildings, focusing on sustainability and efficiency.

-

Honeywell International Inc. is an American multinational conglomerate headquartered in Charlotte, North Carolina. Established in 1906, Honeywell operates in four main business segments: aerospace, building technologies, performance materials and technologies, and safety and productivity solutions. The company serves various industries, including defense, aerospace, and industrial automation, providing products and services that enhance safety, efficiency, and sustainability.

Analytical Systems Keco and Electro-Chemical Devices, Inc. are some of the emerging market participants in the liquid analytical instrument industry.

-

Established in 1984 and headquartered in Houston, Texas, Analytical Systems KECO specializes in the design and manufacture of process and laboratory analyzers for industries such as gas processing, refining, chemical processing, and water treatment. Their product portfolio includes analyzers for detecting contaminants like hydrogen sulfide (H₂S), carbon dioxide (CO₂), sulfur, and hydrocarbons in liquids and gases. KECO emphasizes precision and reliability, ensuring that each analyzer undergoes rigorous quality control measures throughout the manufacturing process.

-

Founded in 1977 and based in Anaheim, California, Electro-Chemical Devices, Inc. is a leading manufacturer of liquid analytical process instrumentation. ECD offers a wide range of products, including pH, conductivity, resistivity, oxidation-reduction potential (ORP), dissolved oxygen (DO), turbidity, and ion-selective electrodes. Their instruments are utilized across various industries, such as chemical, food and beverage, oil and gas, mining, power generation, pulp and paper, semiconductor, steel, and water and wastewater treatment. ECD is recognized for its technical innovations, including the development of the industry's first 2-wire conductivity transmitters and the Sentinel product line with sensor diagnostics and predictive sensor replacement.

Key Liquid Analytical Instrument Companies:

The following are the leading companies in the liquid analytical instrument market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Analytical Systems Keco

- Electro-Chemical Devices, Inc.

- Schneider Electric

- Emerson Electric Co.

- Endress-Hauser Management AG

- Honeywell International Inc.

- METTLER TOLEDO

- Teledyne Technologies Incorporated

- Yokogawa Electric Corporation

Recent Developments

-

In October 2024, Agilent Technologies Inc. unveiled its advanced InfinityLab LC Series portfolio, introducing the 1290 Infinity III LC and 1260 Infinity III LC systems, all available in biocompatible versions. These cutting-edge HPLC systems are the first to feature Agilent’s new InfinityLab Assist Technology, a smart support platform designed to streamline operations with intuitive, built-in guidance. By automating routine tasks and simplifying maintenance, this innovation empowers laboratories to focus more on high-quality analytical results and less on system management.

-

In March 2023, Waters Corporation introduced the Alliance iS, its next-generation intelligent high-performance liquid chromatography (HPLC) system, specially designed to enhance compliance by incorporating advanced proactive error detection, troubleshooting capabilities, and user-friendly features. The platform streamlines the process of obtaining accurate and precise measurements while significantly reducing common errors by up to 40% by combining the Alliance iS HPLC system with Waters' eConnect HPLC Columns and Empower Chromatography Software. This breakthrough technology empowers QC laboratories to consistently achieve their quality, safety, compliance, and timely product delivery objectives.

Liquid Analytical Instrument Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 505.0 million

Revenue forecast in 2030

USD 680.4 million

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Instrument, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; South Korea; Australia; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

ABB; Analytical Systems Keco; Electro-Chemical Devices, Inc.; Schneider Electric; Emerson Electric Co.; Endress-Hauser Management AG; Honeywell International Inc.; METTLER TOLEDO; Teledyne Technologies Incorporated; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Analytical Instrument Market Report Segmentation

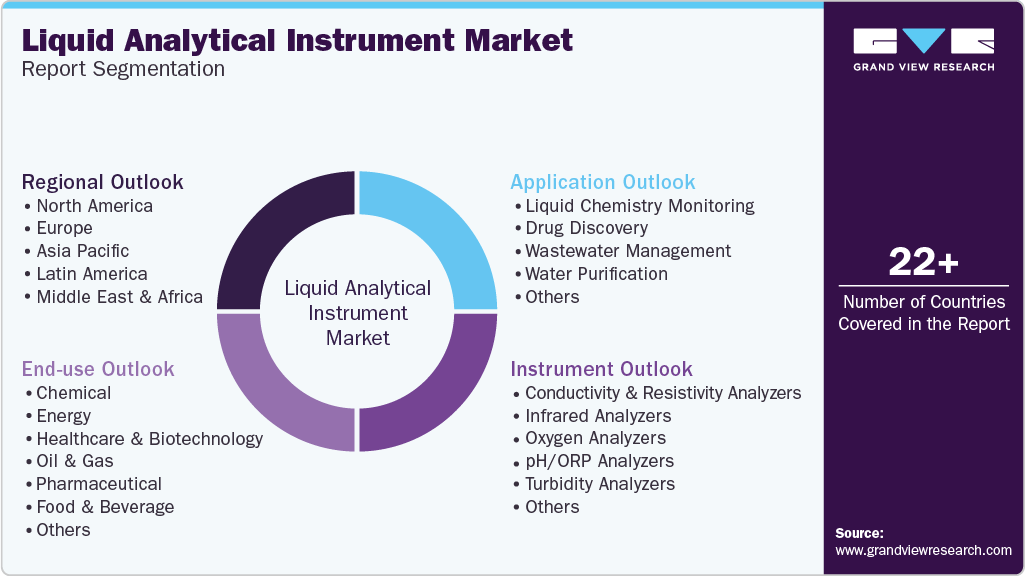

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global liquid analytical instrument market report based on the instrument, end-use, application, and region:

-

Instrument Outlook (Revenue, USD Million, 2018 - 2030)

-

Conductivity & Resistivity Analyzers

-

Infrared Analyzers

-

Oxygen Analyzers

-

pH/ORP Analyzers

-

Turbidity Analyzers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical

-

Energy

-

Healthcare & Biotechnology

-

Oil & Gas

-

Pharmaceutical

-

Food & Beverage

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Chemistry Monitoring

-

Drug Discovery

-

Wastewater Management

-

Water Purification

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global liquid analytical instrument market size was estimated at USD 495.0 million in 2024 and is expected to reach USD 505.5 million in 2025.

b. The global liquid analytical instrument market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 680.4 million by 2030.

b. The pharmaceutical end use segment held a 24.5% market share in 2024. The pharmaceutical sector is a significant driver of the liquid analytical instrument market, primarily due to its stringent requirements for quality control, regulatory compliance, and process optimization.

b. Some key players operating in the liquid analytical instrument market include ABB Ltd.; Analytical Systems Keco; Electro-Chemical Devices, Inc.; Schneider Electric SE; Emerson Electric Co.; Endress-Hauser Management AG; Honeywell International Inc.; Mettler-Toledo International Inc.; Teledyne Technologies Incorporated; and Yokogawa Electric Corporation.

b. The liquid analytical instrument market is experiencing a notable evolution driven by increased demand for real-time, precise monitoring in industries such as water treatment, pharmaceuticals, food & beverage, and chemicals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.