- Home

- »

- Communications Infrastructure

- »

-

Local Area Network Market Size, Share, Industry Report 2033GVR Report cover

![Local Area Network Market Size, Share & Trends Report]()

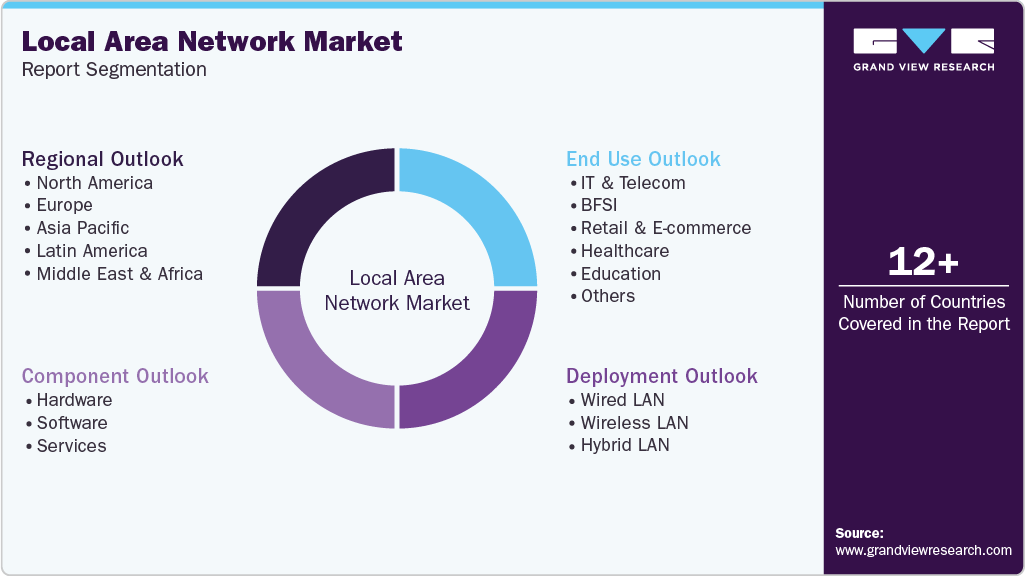

Local Area Network Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment, By End-use, By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-672-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Local Area Network Market Summary

The global local area network market size was estimated at USD 94.51 billion in 2024 and is projected to reach USD 139.21 billion in 2033, growing at a CAGR of 4.6% from 2025 to 2033. The rapid increase in global data consumption has significantly impacted the demand for high-performance local area networks.

Key Market Trends & Insights

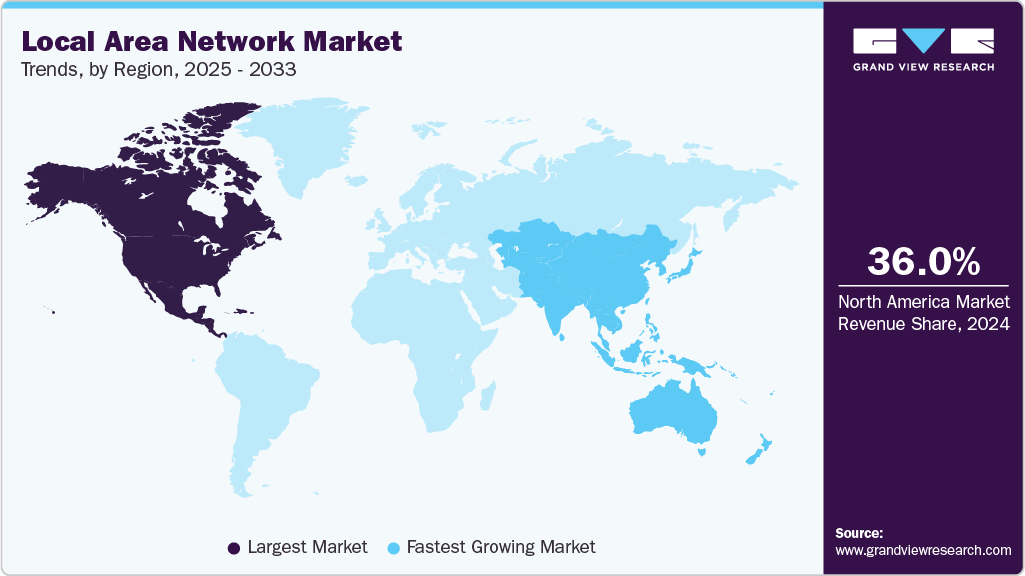

- North America dominated the local area network (LAN) market with the largest revenue share of 36.02% in 2024.

- The local area network (LAN) market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By component, the hardware segment led the market with the largest revenue share of 57.06% in 2024.

- By deployment, the wired LAN segment led the market with the largest revenue share of 55.85% in 2024.

- By end use, the IT & telecom segment led the market with the largest revenue share of 27.34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 94.51 Billion

- 2033 Projected Market Size: USD 139.21 Billion

- CAGR (2025-2033): 4.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprises, government agencies, and educational institutions are experiencing growing data traffic due to the proliferation of video conferencing, cloud-based applications, and data-intensive workloads. This surge is pushing organizations to upgrade their LAN infrastructure with high-speed Ethernet technologies such as Gigabit Ethernet, 10/25/40/100 Gigabit LANs. In addition, high-bandwidth applications like virtual desktops, AI workloads, and real-time collaboration tools require low-latency and high-throughput LAN solutions to ensure seamless connectivity.Enterprises are undergoing digital transformation to enhance operational efficiency, customer experience, and competitiveness. As part of this transition, organizations are modernizing their IT infrastructure, including LAN networks, to support advanced technologies such as cloud computing, big data analytics, and AI. The rise in hybrid and remote work models has also made it essential to establish secure and scalable LAN connections between on-premises systems and remote endpoints. These digital initiatives necessitate the deployment of more robust and manageable LAN systems, especially those capable of supporting virtualization, software-defined networking (SDN), and automation.

In addition, the expanding deployment of Internet of Things (IoT) devices across industries such as manufacturing, healthcare, logistics, and smart cities is creating massive demand for resilient and high-density LAN infrastructure. Each connected sensor, device, and control system contributes to an increasingly complex network that requires efficient communication within a localized environment. LANs form the backbone for machine-to-machine (M2M) communication, industrial automation, smart building controls, and environmental monitoring. The ability to manage thousands of endpoints with low latency and minimal downtime makes LANs indispensable for enabling real-time data transfer and process automation.

Moreover, modern buildings and campus environments are increasingly equipped with connected systems for lighting, HVAC, surveillance, access control, and digital signage. These systems rely on efficient LAN connectivity for centralized monitoring, control, and automation. LAN infrastructure is also essential for connecting video surveillance cameras, biometric systems, and occupancy sensors in real-time. Educational institutions, corporate campuses, and healthcare facilities are upgrading their LANs to ensure high availability and seamless integration of smart systems, contributing to energy efficiency, safety, and digital learning experiences.

One significant restraint for the local area network (LAN) industry is the high initial cost of deployment and ongoing maintenance. Establishing a robust LAN infrastructure, especially in large enterprises, data centers, and industrial environments, requires substantial investment in networking hardware such as switches, routers, access points, cabling, and network management software. In addition, the transition to newer technologies like Wi-Fi 6/6E, fiber-optic LANs, and software-defined LANs can involve replacing legacy systems, which further increases capital expenditure.

Component Insights

The market is classified into hardware, software, and services. The hardware segment led the market with the largest revenue share of 57.06% in 2024. The hardware segment is further segmented into switches, routers, cables & connectors, servers & storage devices, and others. The segment dominance can be attributed to the essential role hardware plays in establishing and maintaining the foundational infrastructure of Local Area Networks (LANs). Core components such as switches, routers, access points, cables, and servers are critical to ensuring seamless data transmission, connectivity, and network performance across various environments, including enterprises, data centers, educational campuses, and industrial facilities.

The software segment is expected to witness at the fastest CAGR of 5.5% throughout the forecast period. This growth can be attributed to the rising adoption of network management, monitoring, and security software solutions that enable centralized control and automation across increasingly complex network environments. As organizations move toward software-defined networking (SDN) and cloud-managed LANs, demand is growing for intelligent software platforms that enhance visibility, optimize performance, and strengthen security. In addition, the shift to hybrid work models and the proliferation of connected devices are further driving the need for scalable, agile, and secure LAN software solutions, positioning this segment for sustained expansion.

Deployment Insights

The market is classified into wired LAN, wireless LAN, and hybrid LAN. The wired LAN segment led the market with the largest revenue share of 55.85% in 2024. This dominance is primarily driven by the reliability, speed, and security offered by wired connections, making them the preferred choice in data centers, enterprise environments, and industrial settings where consistent, high-performance connectivity is essential. The established infrastructure and lower susceptibility to interference also contribute to the segment’s strong market presence.

This growth is driven by the increasing demand for mobility, flexibility, and scalability across various end use sectors such as education, healthcare, retail, and smart buildings. Advancements in wireless technologies, including Wi-Fi 6, Wi-Fi 6E, and the emerging Wi-Fi 7, are enhancing network speed, capacity, and efficiency, making wireless LANs more viable for high-density and mission-critical environments. In addition, the rise of remote work, bring-your-own-device (BYOD) policies, and IoT integration is accelerating the adoption of wireless LANs, particularly in settings where physical cabling is impractical or cost-prohibitive.

End Use Insights

The market is classified into IT & telecom, BFSI, retail & e-commerce, healthcare, education, and others. Among them, the IT & telecom segment led the market with the largest revenue share of 27.34% in 2024. This dominance is primarily due to the sector’s high reliance on robust, high-speed, and scalable network infrastructure to support data centers, cloud services, software development, and continuous digital operations. The IT & telecom industry typically operates in bandwidth-intensive environments, requiring advanced LAN setups to ensure low latency, minimal downtime, and secure data transmission. In addition, the increasing demand for remote work solutions, real-time collaboration platforms, and virtualized services continues to drive investment in LAN technologies within this segment.

The healthcare segment is expected to witness at the fastest CAGR of 5.9% throughout the forecast period. This growth is driven by the increasing digitalization of healthcare systems, the adoption of electronic health records (EHRs), telemedicine platforms, and connected medical devices that require secure and high-speed local network infrastructure. As hospitals, clinics, and diagnostic centers integrate advanced technologies such as AI-assisted diagnostics, remote patient monitoring, and real-time data sharing, the need for reliable and scalable LAN connectivity becomes critical. Moreover, stringent regulatory requirements for data security and patient privacy are prompting healthcare providers to invest in more robust LAN solutions to ensure compliance and uninterrupted operations.

Regional Insights

North America dominated the LAN market with the largest revenue share of 36.02% in 2024. This leadership position can be attributed to the region’s advanced IT infrastructure, high rate of technology adoption, and the strong presence of major industry players and data center operators. The U.S., in particular, is at the forefront due to widespread digitization across sectors such as healthcare, education, and BFSI, coupled with increasing investments in cloud computing, cybersecurity, and smart buildings. In addition, the early adoption of next-generation networking technologies like Wi-Fi 6/6E and software-defined networking (SDN) further supports the region’s dominance in the global LAN market.

U.S. Local Area Network Market Trends

The local area network (LAN) market in the U.S. accounted for the largest market revenue share in North America in 2024. Enterprises in the U.S. are increasingly deploying software-defined LANs to gain centralized control, automation, and scalability. Cloud-managed LAN solutions, especially from players like Cisco Systems, Inc., Hewlett-Packard Enterprise Development LP, and Juniper Networks, Inc., are becoming popular due to their ease of deployment, remote management capabilities, and AI-powered analytics.

Asia Pacific Local Area Network Market Trends

The local area network (LAN) market in Asia Pacific is expected to witness at the fastest CAGR of 5.3% throughout the forecast period. This growth is driven by rapid digital transformation across emerging economies, increasing adoption of cloud computing and IoT technologies, and large-scale government investments in smart city and infrastructure projects. Countries such as China, India, Japan, and South Korea are witnessing strong demand for both wired and wireless LAN solutions to support expanding enterprise networks, educational institutions, and healthcare facilities. In addition, the growing presence of data centers, coupled with the rising deployment of advanced wireless technologies like Wi-Fi 6 and software-defined networking (SDN), is further accelerating market expansion in the region.

The India LAN market accounted for the largest market revenue share in Asia Pacific in 2024. Flagship initiatives such as Digital India, Smart Cities Mission, BharatNet, and Make in India are significantly enhancing the country's digital infrastructure. These programs have led to the rapid expansion of fiber optic networks, public Wi-Fi, and broadband penetration, all of which require robust LAN setups at the last mile to ensure reliable local connectivity. In addition, the rapid digitization of schools, universities, hospitals, and diagnostic centers is creating strong demand for campus-wide LAN networks. Applications such as e-learning platforms, digital classrooms, telemedicine, and electronic health records (EHRs) require secure, high-speed LANs to function effectively, particularly in Tier 1 and Tier 2 cities.

The local area network market in China has rapidly emerged as a global data center hub, with hyperscalers such as Alibaba Cloud, Tencent Cloud, Huawei Cloud, and Baidu Cloud expanding capacity across the country. The need for high-throughput and scalable LAN architectures within data centers, particularly for east-west traffic, drives significant demand for enterprise switches, fiber-optic cabling, and SDN-enabled LAN systems. In addition, China’s Cybersecurity Law and related data localization requirements compel organizations to build secure, compliant, and self-contained LAN infrastructure within national borders. Enterprises are investing in segmented LANs, on-premises storage, and internal security protocols to meet these legal obligations and reduce exposure to external cyber threats.

Europe Local Area Network Market Trends

The local area network (LAN) market in Europe is undergoing widespread digital transformation across public and private sectors, driven by the European Union’s Digital Decade initiative and country-specific strategies like Germany’s Industrie 4.0 and France’s Digital Plan. These policies emphasize investments in high-speed connectivity, smart infrastructure, and digital services, all of which require robust LAN deployments across enterprises, schools, hospitals, and government buildings. In addition, the EU’s push for energy-efficient, smart buildings under frameworks like the Green Deal and Energy Performance of Buildings Directive (EPBD) is driving demand for intelligent LAN infrastructure. Smart HVAC, lighting, access control, and energy monitoring systems rely heavily on LAN connectivity to function efficiently in commercial and residential real estate across Europe.

The UK local area network (LAN) market is anticipated to grow at a significant CAGR during the forecast period. The UK government is actively modernizing National Health Service (NHS) facilities and public sector IT infrastructure under initiatives like the NHS Long Term Plan and Digital Health Strategy. These programs require a secure, scalable LAN infrastructure to support electronic health records (EHRs), connected medical devices, and digital diagnostics, especially in regional hospitals and community health centers. In addition, universities, colleges, and K-12 institutions across the UK are investing in upgraded LAN networks to support digital learning environments. The Department for Education’s (DfE) EdTech strategy encourages cloud adoption, smart classrooms, and e-assessments, all of which rely on high-speed LAN and wireless infrastructure, especially in high-density student settings.

Key Local Area Network Company Insights

Some of the leading local area network (LAN) providers globally included in the study are Cisco Systems, Inc., Hewlett-Packard Enterprise Development LP, Extreme Networks, and Huawei Technologies Co., Ltd., among others. Companies operating in the local area network (LAN) industry are actively investing in research and development (R&D) to enhance the performance, scalability, and sustainability of their networking solutions. Key areas of innovation include the advancement of software-defined LANs (SD-LANs), integration of AI-powered network analytics, and the development of intelligent edge switching and wireless access technologies.

Vendors are increasingly leveraging artificial intelligence (AI), the Internet of Things (IoT), and cloud-based network management platforms to optimize traffic flow, enable real-time monitoring, and support predictive maintenance. These technologies help ensure secure, low-latency connectivity in diverse environments, including enterprise campuses, data centers, and industrial facilities.

-

Cisco Systems, Inc., based in California, U.S., is one of the major providers of networking technologies, including hardware, software, and related services in the local area network (LAN) industry. Established in 1984, the company has a significant presence in enterprise networking, offering products such as LAN switches (including the Catalyst and Nexus series), wireless access points, and cloud-managed networking through the Meraki platform. These products are used in sectors such as education, healthcare, public administration, and telecommunications. The company operates in multiple global markets and maintains partnerships with channel providers, system integrators, and certification programs for network professionals.

-

Hewlett-Packard Enterprise Development LP (HPE), headquartered in Texas, is a multinational company that provides enterprise IT infrastructure and services, including networking technologies for local area networks (LANs). Through its subsidiary, Aruba Networks, Hewlett-Packard Enterprise Development LP supplies LAN hardware such as switches and wireless access points, as well as network management software. These products are implemented across sectors such as education, healthcare, retail, and public services. Aruba Networks LAN solutions support both wired and wireless deployments and are compatible with current standards, including Wi-Fi 6/6E and Power over Ethernet (PoE). The company also offers centralized management platforms that allow network administrators to monitor performance, configure access policies, and manage devices across distributed environments.

Key Local Area Network Companies:

The following are the leading companies in the local area network market. These companies collectively hold the largest market share and dictate industry trends.

- Ubiquiti, Inc.

- Cisco Systems, Inc.

- Hewlett-Packard Enterprise Development LP

- Extreme Networks

- Huawei Technologies Co., Ltd.

- D-Link Corporation

- NETGEAR

- Fortinet, Inc.

- Nokia Corporation

- Primus Cable

Recent Developments

-

In June 2025, Cisco Systems, Inc. announced new AI-ready infrastructure for campus, branch, and industrial networks, including upgraded LAN hardware and cloud-managed tools. The company introduced AgenticOps, an AI-driven platform for automating IT operations, along with integrated zero-trust security through its Hybrid Mesh Firewall and Universal ZTNA. These updates aim to support secure, scalable LAN environments while enabling centralized visibility, real-time analytics, and compatibility with AI workloads in data centers and edge networks.

-

In February 2025, Hewlett-Packard Enterprise (HPE) completed its previously announced acquisition of Juniper Networks for approximately USD 14 billion. The acquisition doubles HPE’s networking business and integrates Juniper's AI-driven capabilities and cloud-native portfolio into HPE’s stack. The combined entity aims to offer an end-to-end networking solution, including silicon, hardware, operating systems, security, software, and services, optimized for AI and hybrid cloud workloads.

Local Area Network Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 97.16 billion

Revenue forecast in 2033

USD 139.21 billion

Growth rate

CAGR of 4.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Ubiquiti, Inc.; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Extreme Networks; Huawei Technologies Co., Ltd.; D-Link Corporation; NETGEAR; Fortinet, Inc.; Nokia Corporation; Primus Cable

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Local Area Network Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global local area network market report based on component, deployment, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Switches

-

Routers

-

Cables & Connectors

-

Servers & Storage Devices

-

Others

-

-

Software

-

Network Management Software

-

Security Software

-

Others

-

-

Services

-

Installation & Maintenance

-

Consulting & Training

-

Managed LAN Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Wired LAN

-

Wireless LAN

-

Hybrid LAN

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

IT & Telecom

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global local area network market size was estimated at USD 94.51 billion in 2024 and is expected to reach USD 97.16 bllion by 2025.

b. The global local area network market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2033 and is expected to reach USD 139.21 billion by 2033.

b. In the local area network (LAN) market, the hardware segment dominated the market with a 57.06% share in 2024, primarily driven by strong demand for switches, routers, cables, and other infrastructure essential for high-speed, reliable connectivity.

b. Some of the key players are Ubiquiti, Inc.; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Extreme Networks; Huawei Technologies Co., Ltd.; D-Link Corporation; NETGEAR; Fortinet, Inc.; Nokia Corporation; and Primus Cable.

b. The market growth can be attributed to the increasing demand for high-speed connectivity, rising adoption of cloud-based services, expansion of enterprise networks, and the growing need for secure and scalable network infrastructure across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.