- Home

- »

- Automotive & Transportation

- »

-

Logistics Robot Market Size & Share, Industry Report, 2030GVR Report cover

![Logistics Robot Market Size, Share & Trends Report]()

Logistics Robot Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Industry (E-commerce, Healthcare), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Logistics Robot Market Summary

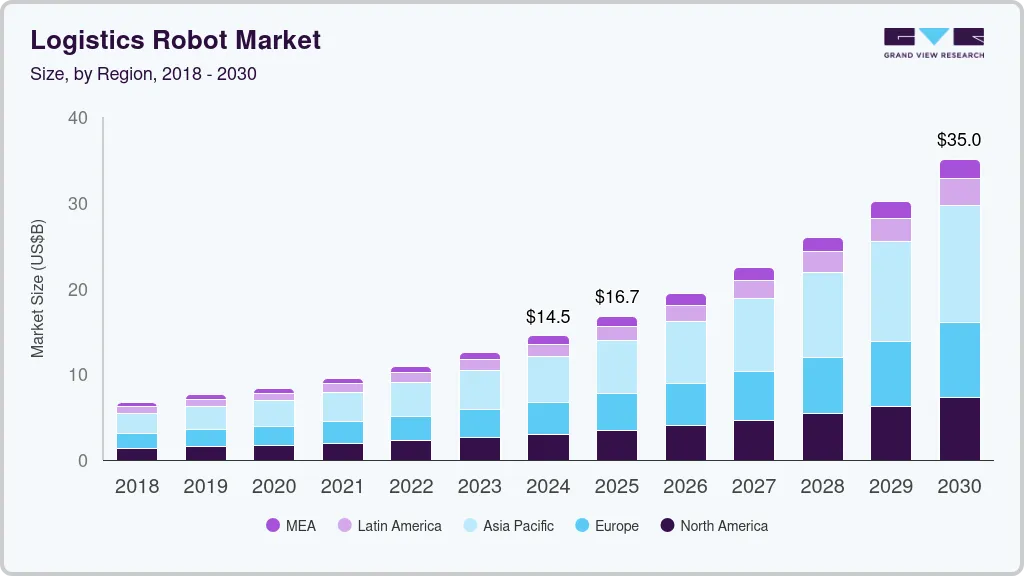

The global logistics robot market size was estimated at USD 14.5 billion in 2024 and is projected to reach USD 35.05 billion by 2030, growing at a CAGR of 15.9% from 2025 to 2030. The market is expanding rapidly due to the increasing demand for automation, technological advancements, and industry-specific requirements.

Key Market Trends & Insights

- Asia Pacific dominated the market with a share of 36.8% in 2024.

- The logistics robot industry in China has experienced significant advancements in recent years.

- By component, the hardware segment dominated the market in 2024 and accounted for a 62.2% global revenue share.

- By application, the warehouse and storage segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.5 Billion

- 2030 Projected Market Size: USD 35.05 Billion

- CAGR (2025-2030): 15.9%

- Asia Pacific: Largest market in 2024

The push toward efficiency, cost reduction, and scalability in logistics operations is driving the adoption of robotics across warehouses, distribution centers, and fulfillment hubs.

The surge in e-commerce and omnichannel retailing has led to an unprecedented need for efficient and automated warehousing solutions. Companies such as Amazon.com, Inc., Alibaba.com, and Walmart are leveraging autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and robotic picking systems to optimize their warehouse operations. These robots are designed to reduce manual handling, improve order accuracy, and enhance sorting and packaging efficiency. Moreover, with same-day and next-day delivery expectations becoming the industry norm, automation has become a necessity rather than an option. By deploying robotics, companies can achieve faster turnaround times, better space utilization, and a more streamlined supply chain.

Significant advancements in artificial intelligence (AI), machine learning (ML), and computer vision have enhanced the capabilities of logistics robots. AI-powered robots can now navigate complex warehouse layouts, avoid obstacles, and optimize pick-and-place operations without human supervision. Machine learning algorithms enable robots to learn from past tasks, continuously improving their efficiency and adaptability. Computer vision technology, combined with 3D sensors and LiDAR, allows robots to precisely identify, classify, and handle objects of different sizes, shapes, and weights. These innovations make logistics robots more intelligent, autonomous, and cost-effective, encouraging widespread adoption.

The logistics industry faces an increasing challenge in hiring and retaining warehouse workers. The aging workforce and the physically demanding nature of warehouse jobs have led to significant labor shortages, especially in North America, Europe, and parts of Asia Pacific. In addition, rising wages and employee benefits have made manual labor expensive. Logistics robots provide a cost-effective and scalable solution, allowing warehouses to operate 24/7 with minimal human intervention. These robots eliminate fatigue-related errors and reduce workplace injuries, further decreasing overall operational costs.

While the market is expanding rapidly, several challenges hinder its widespread adoption and operational efficiency. One of the primary challenges facing the market is the high upfront cost of robotic systems. The investment in hardware, software, installation, and infrastructure modifications can be substantial, making it difficult for small and mid-sized enterprises (SMEs) to afford robotic solutions. Moreover, maintenance and repair costs, software upgrades, and AI model training add to the total cost of ownership. While long-term cost savings and increased efficiency justify the investment, the initial capital expenditure (CAPEX) remains a major barrier, especially in price-sensitive markets.

Component Insights

The hardware segment dominated the market in 2024 and accounted for a 62.2% global revenue share. The hardware segment is further segmented into automated guided vehicles, autonomous mobile robots, and robot arms. A major driver behind the dominance of the hardware segment is the rapid adoption of AMRs and AGVs in warehouses and fulfillment centers. These robots help streamline logistics operations by reducing manual labor, improving accuracy, and increasing operational efficiency. AMRs are particularly favored for their AI-driven navigation and adaptability, allowing them to move freely without requiring fixed pathways. Furthermore, advancements in sensor technology, actuators, and edge computing have further contributed to this segment’s dominance. Modern logistics robots are equipped with LiDAR sensors, ultrasonic detectors, and 3D vision systems, enabling them to navigate complex environments and detect obstacles with high precision.

Services is anticipated to witness the fastest growth over the forecast period owing to the increasing need for robot deployment, maintenance, training, integration, and support services. As logistics automation becomes more widespread, companies require specialized expertise to deploy and manage robotic systems efficiently. The increasing complexity of robotic technologies and the need for seamless integration into existing supply chain infrastructures have fueled the rapid expansion of service-based offerings. One of the key drivers of this segment’s growth is the rising adoption of the Robotics-as-a-Service (RaaS) model. Many companies, especially small and medium-sized enterprises (SMEs), opt for subscription-based robotic solutions instead of making high upfront capital investments.

Application Insights

The warehouse and storage segment led the market in 2024 owing to the increasing demand for automation in inventory management, order fulfillment, and material handling. With the rapid growth of e-commerce, third-party logistics (3PL), and omnichannel retailing, businesses are under immense pressure to process and deliver orders faster while maintaining cost efficiency. Logistics robots have become essential in warehouses, distribution centers, and storage facilities to enhance operational efficiency, reduce labor costs, and optimize space utilization.

The transportation and delivery segment is projected to experience the fastest growth over the forecast period. The rising demand for last-mile delivery automation is a major factor fueling the transportation and delivery segment’s growth in the market. With the expansion of e-commerce, online grocery shopping, and omnichannel retail, consumers increasingly expect same-day and next-day deliveries. To meet these demands, companies are deploying autonomous delivery robots, drones, and AI-powered logistics vehicles to enhance speed and efficiency. Moreover, the shift toward contactless delivery solutions-accelerated by the COVID-19 pandemic-has increased the adoption of self-driving delivery robots and automated package-handling systems, ensuring safer and faster fulfillment processes.

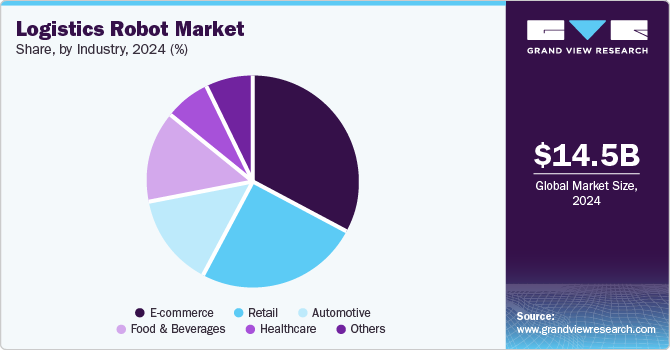

Industry Insights

The e-commerce segment dominated the market in 2024 and is primarily driven by the explosive growth of online shopping and the resulting demand for rapid, reliable order fulfillment. E-commerce companies have adopted advanced logistics technologies to keep pace with increasingly high order volumes and consumer expectations for fast delivery. To meet these challenges, firms have invested heavily in robotics solutions-such as Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), and sophisticated robotic arms-that optimize warehouse operations, reduce manual labor, and significantly cut down processing times.

The healthcare segment is expected to witness significant growth over the forecast period. Hospitals and medical facilities increasingly rely on automation to streamline logistics operations such as transporting medications, laboratory samples, food, and medical waste. This shift helps reduce human error, improves efficiency, and allows healthcare professionals to devote more time to direct patient care. In addition, the drive to contain rising healthcare costs is prompting institutions to invest in automation. Hospitals can achieve substantial cost savings by reducing manual labor and streamlining supply chain processes while improving operational throughput.

Regional Insights

Asia Pacific dominated the market with a share of 36.8% in 2024. This dominance is attributed to the region's rapid industrialization, strong adoption of automation technologies, and substantial investments in smart manufacturing and logistics infrastructure. Key economies such as China, Japan, and India have been at the forefront of integrating advanced robotics into warehouses, distribution centers, and transportation hubs, leading to streamlined supply chain operations and reduced reliance on manual labor.

China Logistics Robot Industry Trends

The logistics robot industry in China has experienced significant advancements in recent years, reflecting a broader trend toward automation and intelligent manufacturing. For instance, in August 2024, China successfully tested the SA750U, an unmanned civilian drone capable of carrying up to 3.2 metric tons of cargo. Developed in Hunan province, the drone can operate at altitudes up to 7,300 meters and cover distances up to 2,200 kilometers. This development aligns with China's plans to enhance its low-altitude economy, projected to become a USD 280 billion industry by 2030, encouraging drone innovation and efficiency in logistics.

India logistics robot market is rising significantly due to several factors, including the rapid expansion of e-commerce, increasing labor costs, government initiatives, and advancements in automation. The logistics industry in India is evolving, with companies focusing on automation to improve efficiency, reduce operational costs, and enhance supply chain resilience. India’s booming e-commerce sector is a key market driver. The sector, led by giants like Flipkart Internet Private Limited, Amazon.com, Inc., and Reliance Retail Ltd, is witnessing an increasing demand for faster deliveries and efficient warehouse management. As a result, companies are deploying autonomous mobile robots (AMRs), robotic sorting systems, and automated storage and retrieval systems (AS/RS) to optimize operations. This trend is expected to accelerate with the rise of same-day and next-day delivery models.

North America Logistics Robot Industry Trends

The logistics robot industry in North America is anticipated to register a significant growth rate over the forecast. North America is at the forefront of AI and robotics innovations. Companies like Boston Dynamics, Locus Robotics, and Fetch Robotics are developing advanced logistics robots capable of autonomous navigation, real-time data analysis, and machine learning-based decision-making. AI-powered robots enhance warehouse efficiency by optimizing workflows, reducing errors, and improving inventory tracking.

The U.S. logistics robot industry is experiencing significant growth and transformation. A notable trend is the rise of Robotics as a Service (RaaS) model, which allows companies to automate their logistics processes without significant upfront investment in hardware. This model reduces fixed costs and allows for greater flexibility in operations. As a result, more businesses are able to integrate robotic solutions into their logistics frameworks, enhancing their operational capabilities.

Europe Logistics Robot Industry Trends

The logistics robot industry in Europe focuses on automation and efficiency. Companies are investing heavily in robotic technologies to streamline warehouse operations and improve supply chain management. Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) are becoming increasingly common in warehouses, where they assist with tasks like inventory management, picking, and transportation.

The UK logistics robot industry is growing due to their growing e-commerce. As online shopping continues to rise, logistics providers invest in robotic solutions to optimize their operations, particularly in last-mile delivery. This includes using delivery drones and self-driving vehicles, which aim to enhance delivery speed and efficiency while meeting customer expectations for rapid fulfillment.

The logistics robot industry in Germany is experiencing significant growth, driven by its strong emphasis on Industry 4.0-a technological revolution that integrates smart systems into manufacturing and logistics. The country's advanced industrial base and commitment to automation have accelerated the adoption of robotics, particularly in logistics and supply chain management. Another key factor driving the growth of logistics robotics in Germany is the adoption of AI and machine learning. AI-powered robots are being used to optimize warehouse workflows, predict demand fluctuations, and enhance decision-making.

Key Logistics Robot Company Insights

To address the growing demand for logistics robots and ensure continued growth in a competitive environment, companies adopt a combination of strategies, including mergers and acquisitions, product developments, partnerships, and geographic and vertical expansions. By improving their technological offerings, collaborating with key industry players, and entering new markets, logistics robot providers are positioning themselves to meet the evolving demands of industries such as e-commerce, retail, healthcare, and automotive. These strategies enhance their market position and contribute to global digital infrastructure's broader growth and evolution.

-

Honeywell International Inc. is a multinational conglomerate based in Charlotte, North Carolina, with operations spanning multiple industries, including aerospace, building technologies, performance materials, and safety & productivity solutions. The company is known for its strong focus on industrial automation, digital transformation, and advanced technology-driven solutions. It is a key player in warehouse automation and logistics robotics. Its portfolio includes autonomous mobile robots (AMRs), robotic palletizing and depalletizing systems, high-speed robotic sorting solutions, and automated storage & retrieval systems (AS/RS), all integrated with AI, machine vision, and IoT for enhanced efficiency.

-

Swisslog Holding AG, a subsidiary of KUKA AG, is a leading provider of automation and robotic solutions for logistics and healthcare. Headquartered in Buchs, Switzerland, the company specializes in warehouse automation, robotic picking, automated storage & retrieval systems (AS/RS), and conveyor technologies. Swisslog Holding AG serves industries such as e-commerce, retail, food & beverage, and pharmaceuticals, offering solutions like AutoStore, CarryPick AMRs, CycloneCarrier shuttle systems, and SynQ warehouse management software.

Key Logistics Robot Companies:

The following are the leading companies in the logistics robot market. These companies collectively hold the largest market share and dictate industry trends.

- Swisslog Holding AG

- Honeywell International Inc

- KNAPP AG

- BEUMER Group

- SSI Schaefer

- Kawasaki Heavy Industries, Ltd.

- Locus Robotics

- Kion Group Ag

- Dematic

- GreyOrange

Recent Developments

-

In February 2025, Locus Robotics entered into a strategic partnership with BITO Lagertechnik, a leader in storage and order-picking systems. The partnership combines BITO Lagertechnik's expertise in developing high-quality storage systems with Locus Robots' AI-driven LocusONE orchestration platform and its fleet of autonomous mobile robots (AMRs). This integration aims to provide a coordinated, end-to-end solution that ensures reliable process optimization, rapid return on investment (ROI), and swift deployment.

-

In December 2024, Dematic expanded its presence in Taiwan by opening a new office in Taoyuan City. This strategic move aims to enhance support for local businesses in retail, food and beverage, third-party logistics, and pharmaceuticals. The office is situated in the Zhongli District, a central business area near Taoyuan International Airport and the High-Speed Rail Station, facilitating convenient access.

-

In October 2024, Swisslog Holding AG expanded its presence in North America by opening a new office in Mississauga, Ontario, Canada. This strategic move aims to support the growing Canadian market and enhance customer service across industries such as general merchandise, food and beverage, industrial manufacturing, electronics, and healthcare.

Logistics Robot Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.74 billion

Revenue forecast in 2030

USD 35.05 billion

Growth rate

CAGR of 15.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, application, industry, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Swisslog Holding AG; Honeywell International Inc; KNAPP AG; BEUMER Group; SSI Schaefer; Kawasaki Heavy Industries, Ltd.; Locus Robotics; Kion Group Ag; Dematic; GreyOrange

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Logistics Robot Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global logistics robot market based on component, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Automated Guided Vehicles

-

Autonomous Mobile Robots

-

Robot Arms

-

Others

-

-

Software

-

Fleet Management Software (FMS)

-

Warehouse Management Systems (WMS)

-

Pick & Place/Sorting Software

-

Others

-

-

Services

-

Integration & Deployment

-

Maintenance & Support

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehouse and Storage

-

Packaging and Palletizing

-

Transportation and Delivery

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Healthcare

-

Retail

-

Food & Beverages

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global logistics robot market size was estimated at USD 14.50 billion in 2024 and is expected to reach USD 16.74 billion in 2025.

b. The global logistics robot market is expected to grow at a compound annual growth rate of 15.9% from 2025 to 2030 to reach USD 35.05 billion by 2030.

b. Asia Pacific dominated the logistics robot market with a share of 36.8% in 2024. This dominance is attributed to the region's rapid industrialization, strong adoption of automation technologies, and substantial investments in smart manufacturing and logistics infrastructure.

b. Some key players operating in the logistics robot market include Swisslog Holding AG, Honeywell International Inc, KNAPP AG, BEUMER Group, SSI Schaefer, Kawasaki Heavy Industries, Ltd., Locus Robotics, Kion Group Ag, Dematic, GreyOrange.

b. Key factors that are driving the market growth include the rising adoption of automation in warehousing and supply chain operations and the growing demand for faster and more accurate order processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.