- Home

- »

- Renewable Chemicals

- »

-

Long Chain Dicarboxylic Acid Market Size Report, 2030GVR Report cover

![Long Chain Dicarboxylic Acid Market Size, Share & Trends Report]()

Long Chain Dicarboxylic Acid Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Nylon & Other Polyamides, Powder Coatings, Lubricants, Adhesives, Pharmaceuticals, Corrosion Inhibitors), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-733-9

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Long Chain Dicarboxylic Acid Market Trends

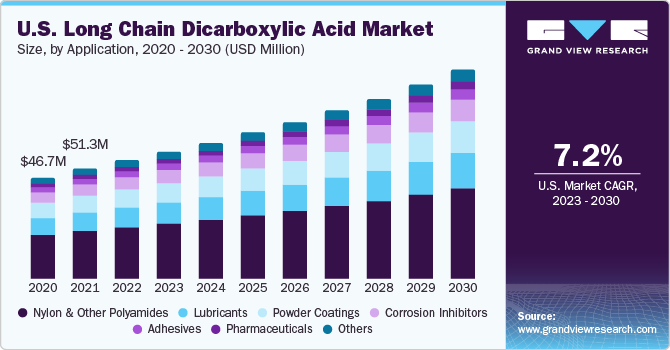

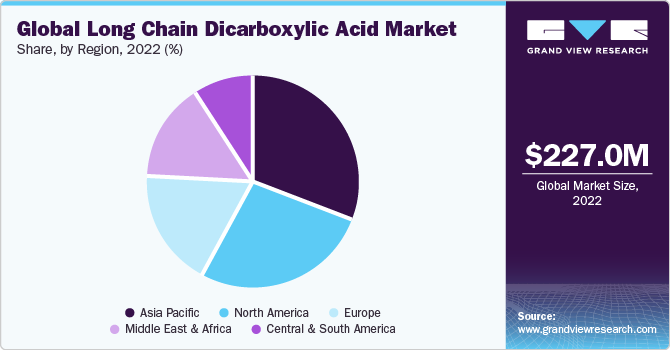

The global long chain dicarboxylic acid market size was valued at USD 227.0 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2023 to 2030 on account of its increased usage in nylon & other polyamide and powder coating applications. The long-chain dicarboxylic acid is produced through fermentation using either aerobic or anaerobic processes. The manufacturing process for long-chain dicarboxylic acid (LCDA) is a bio-based product and offers environmental compliance advantages.

Increasing usage of applications such as nylon & other polyamides, powder coatings, lubricants, pharmaceuticals, corrosion inhibitors, & adhesives across end industries such as automotive, and building & construction is anticipated to propel industry growth over the next nine years. The powder coating due to its uniform, durable, and attractive finish is used to coat aluminum extrusion frames. These frames are further utilized to manufacture windows and door frames used in the building and construction industry.

Nylon & other polyamide is the largest application segment. It is expected to gain market share over the forecast period on account of beneficial properties such as strength, heat resistance, and durability. These properties make nylon & other polyamides lucrative for usage in end-user industries which include electronic components, packaging, automotive, and building & construction. High-performance nylon is used to manufacture manifolds, as it helps to reduce the weight of the system. The reduction in the weight of the system lowers production costs and increases fuel efficiency.

The rising demand for long-chain dicarboxylic acids from applications such as lubricants, powder coatings, and corrosion inhibitors, is expected to drive the market over the forecast period. The stringent environmental regulations laid down by the REACH and EPA to use bio-based product is also expected to increase the demand for long-chain dicarboxylic acid from 2016 to 2025.

The high cost of the acid is expected to restrain the LCDA market over the forecast period. The cost of LCDA varies depending on the cost of raw materials, which tend to be volatile. The substantial investment necessary in research and development is also a major cost responsible for the high price of LCDA.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 30.7% in 2022 and is expected to grow at the fastest CAGR of 7.32% during the forecast period. The government of China has set up policies to attract investment in the building & construction sector which is driving the industry growth. The high-performance nylon is used for exterior building & construction products including glazing, expansion joints, seals, window setting blocks, door bulb seals, etc. The growing demand for LCDA is due to growing needs from the end-use industries such as building & construction, automotive, and industrial equipment manufacturing.

Asia Pacific was leading the long-chain dicarboxylic acid owing to low manufacturing cost and easy availability of skilled workforce and raw materials. The substantial demand for the nylon & other polyamide, lubricants, and adhesives application of long-chain dicarboxylic (LCDA) is expected to boost the market demand over the forecast period.

Application Insights

The lubricants segment held a revenue share of 16.5% in 2022. An increase in demand for lubricants is observed in industrial equipment manufacturing, automotive, transportation, and other end-user industries. Lubricants help reduce friction, maintain thermal stability, and offer high load-carrying capacity to the equipment. These factors are expected to positively impact the market over the forecast period.

The powder coating segment is expected to grow at a CAGR of 7.7% over the forecast period. Powder coatings perform multiple functions in industries such as construction equipment, infrastructure, transportation, electrical, furniture, and general metal manufacturing. Hence, the demand for powder coatings from a wide range of industries is expected to fuel up its growth during the forecast period.

The LCDA applications such as adhesives, corrosion inhibitors, and pharmaceuticals together accounted for more than 20% of the market share by revenue in 2020. These applications are growing over the forecast period due to the major environmental benefits offered by LCDA. Corrosion inhibitors are used before the steel is embedded in concrete during the construction of the building. This protects the steel from the alkaline & high moisture environment and results in better durability of the building.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers accounting for a majority of the market share. Product approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach.

Key Long Chain Dicarboxylic Acid Companies:

- Cathay Biotech Inc.

- Cathay Biotech Inc.

- INVISTA

- Evonik Industries AG

- Shandong Hilead Biotechnology Co., Ltd.

- Henan Junheng Industrial Group Biotechnology Co., Ltd

- AECOCHEM

- AECOCHEM

- Capot Chemical Co.,Ltd.

Recent Developments

-

In June 2023, Cathay Biotech Inc. successfully secured additional funding and established a significant strategic partnership with China Merchants Group (CMG). As part of the collaboration, CMG has committed to purchasing bio-based polyamides manufactured by Cathay, with a minimum targeted volume of 10,000 tons for the year 2023. This collaboration marks a significant step forward for both companies in the bio-based materials market.

-

In May 2023, DuPont revealed its definitive agreement to acquire Spectrum Plastics Group from AEA Investors. This strategic move is aimed at enhancing DuPont's current portfolio, which includes packaging, biopharma & pharma processing, and medical devices. The acquisition will play a pivotal role in fortifying DuPont's position within the stable and reliable healthcare market.

-

In September 2022, INVISTA unveiled the Asia Innovation Center at the Shanghai International Chemical New Materials Innovation Center (INNOGREEN) at SCIP. This cutting-edge facility is dedicated to addressing the specific application needs of engineering polymers in critical industries like automotive and electrical & electronics.

Long Chain Dicarboxylic Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 242.4 million

Revenue forecast in 2030

USD 389.3 million

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in kilo tons and CAGR from 2023 to 2030

Report coverage

Volume & Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cathay Biotech Inc.; DuPont; INVISTA; Evonik Industries AG; Shandong Hilead Biotechnology Co., Ltd.; Henan Junheng Industrial Group Biotechnology Co., Ltd; AECOCHEM; Capot Chemical Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Long Chain Dicarboxylic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global long chain dicarboxylic acid market report based on application, and region:

-

Application Outlook (Revenue in USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Nylon & Other Polyamides

-

Powder Coatings

-

Lubricants

-

Adhesives

-

Pharmaceuticals

-

Corrosion Inhibitors

-

Others

-

-

Regional Outlook (Revenue in USD Million, Volume in Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global long chain dicarboxylic acid market size was estimated at USD 227 million in 2022 and is expected to reach USD 242.4 million in 2023.

b. The global long chain dicarboxylic acid market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 389.3 million by 2030.

b. Asia Pacific dominated the long chain dicarboxylic acid market with a share of 30.7% in 2022. This is attributable to low manufacturing costs and easy availability of skilled workforce and raw materials

b. Some key players operating in the long chain dicarboxylic acid market include Cathay Industrial Biotech Ltd., Shandong Hilead Biotechnology Co., Ltd, Invista B.V, Zibo Guangtong Chemical Co., Ltd., and Evonik Industries AG

b. Key factors that are driving the market growth include increasing usage of nylon & other polyamide and powder coating applications

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.