- Home

- »

- Animal Feed and Feed Additives

- »

-

Lysine Market Size, Share, Growth And Trends Report 2030GVR Report cover

![Lysine Market Size, Share & Trends Report]()

Lysine Market (2024 - 2030) Size, Share & Trends Analysis By Application (Animal Feed (Swine, Poultry), Food & Dietary Supplements, Pharmaceuticals), By Form (Powder, Liquid, Granules), By Region, And Segment Forecasts

- Report ID: 978-1-68038-137-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lysine Market Summary

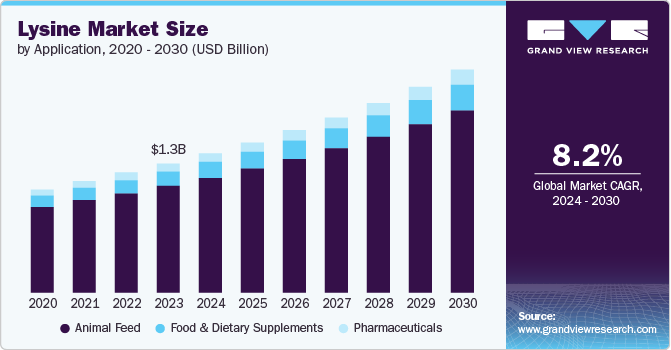

The global lysine market size was estimated at USD 1.26 billion in 2023 and is projected to reach USD 2.18 billion by 2030, growing at a CAGR of 8.2% from 2024 to 2030. The market growth can be attributed to the increasing demand for protein-rich diets including meat consumption, among the developing nations.

Key Market Trends & Insights

- The Asia Pacific lysine market accounted for 39.6% of the market share in 2023.

- The lysine market in Europe held a market share of 29.8% in 2023.

- Based on application, the animal feed dominated the market with 82.7% of the share in 2023.

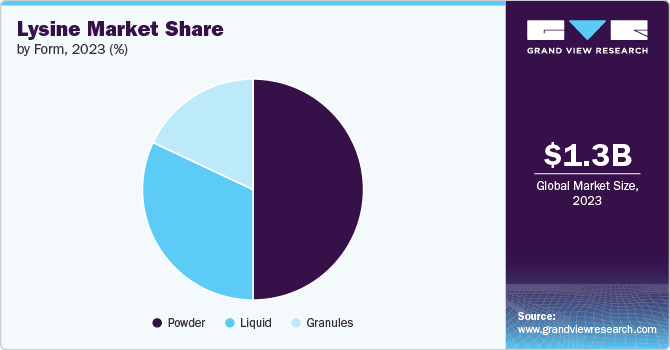

- Based on form, the powder segment dominated the market with a substantial share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.26 Billion

- 2030 Projected Market Size: USD 2.18 Billion

- CAGR (2024-2030): 8.2%

- Asia Pacific: Largest market in 2023

Lysine, an essential amino acid, is a critical ingredient for animal nutrition as it enhances livestock growth and meat quality. It is particularly valued in intensive livestock farming systems where optimizing growth rates is essential.

The growing awareness of amino acid benefits has considerably driven demand for lysine. Consumers have increasingly recognized the importance of lysine in their diets. Lysine often helps produce enzymes, antibodies, and hormones, supporting the overall immune system. In addition, rising incomes worldwide have supported greater investment in nutritional supplements and animal feed. This has further led to market growth.

Furthermore, technological advancements in lysine production have contributed to market expansion. This includes efficient fermentation processes that convert sugar substrates into lysine. Such technological improvements have led to cost-effective and large-scale synthesis of lysine hydrochloride and thereby contributed to market growth.

Application Insights

Animal feed dominated the market with 82.7% of the share in 2023 owing to the growing demand for nutrient-rich food products. It contributes to protein production, calcium absorption, and the synthesis of enzymes, hormones, and antibodies. Moreover, lysine plays a pivotal role in animal nutrition due to its role in metabolic processes. It helps animals gain weight faster by maximizing nutrient absorption from limited feed, resulting in quality meat production.

In terms of application, pharmaceuticals are expected to emerge as the fastest-growing segment during the forecast period as lysine helps maintain healthy immunity and improve metabolism. It plays a crucial role in various metabolic processes and is part of protein synthesis. Furthermore, regular lysine intake has often resulted in reduced outbreaks of cold sores and genital herpes. L-lysine HCL helps form collagen in the skin, contributing to skin strength, suppleness, and elasticity.

Form Insights

The powder segment dominated the market with a substantial share in 2023. The market witnessed an increase in demand for finely milled and powdered lysine as it is versatile for various applications. The powder form simplifies handling, storage, and mixing. It is convenient for both manufacturers and end users as it ensures efficient utilization in animal feed, food supplements, and pharmaceuticals. In addition, lysine powder is adaptable across different industries with its fine texture that allows precise dosage adjustments. In addition, the versatility that these granules offer allows manufacturers to incorporate them directly into different products, including dietary supplements and pharmaceuticals. This makes it suitable for diverse formulations and processes and further drives market expansion.

Lysine granules are expected to grow at a CAGR of 8.7% over the forecast period owing to their practicality and ease of use. Their granular structure ensures uniform distribution and precise dosage adjustments. Moreover, lysine granules provide better stability and longer shelf life compared to liquid forms. They are less prone to degradation and moisture absorption. This makes them suitable for storage and transportation.

Regional Insights

The lysine market in North America secured 24.7% of the global revenue share in 2023. This can be credited to the robust pharmaceutical infrastructure. Lysine hydrochloride plays a crucial role in collagen synthesis and calcium absorption, which makes it essential for health and wellness products. In addition, the animal feed industry has significantly influenced the lysine market in this region with intensified livestock production. Lysine supplementation enhances animal growth rates and meat quality, thereby supporting the demand for lysine in animal nutrition.

U.S. Lysine Market Trends

The U.S. lysine market was propelled by the increasing demand for meat and dairy products. The market has witnessed consumers increasingly opt for lysine-rich diets due to their health benefits. Lysine is essential for collagen synthesis and calcium absorption. This has led health-conscious consumers to seek nutrient-rich food, contributing to the demand for lysine in the food and beverage sector.

Asia Pacific Lysine Market Trends

The Asia Pacific lysine market accounted for 39.6% of the market share in 2023 owing to rapid urbanization and surging meat consumption. The market witnessed a rise in demand for lysine for breeding livestock breeding. Furthermore, the shift toward convenience foods and ready-to-eat nutrient-rich food drove demand for lysine-rich products.

Europe Lysine Market Trends

The lysine market in Europe held a market share of 29.8% in 2023 owing to the steady demand from the animal feed industry. Manufacturers relied heavily on lysine as an additive to combat rising costs due to inflation and unpredictable consumer spending. As a result, lysine prices surged owing to the increased demand from the food sector and ongoing logistical challenges. In addition, innovations in lysine production technology enabled efficient manufacturing processes. These advances, coupled with expanding product portfolios, contributed to the market’s growth.

Key Lysine Company Insights

The global lysine market is intensely competitive with numerous regional and international players such as ADM, Evonik, and COFCO Biochemical. These players have prioritized product innovation, facility expansion, and distribution channel enhancement to gain a competitive edge. They have invested in strategic partnerships to expand market share and attract customers.

-

Global Bio-chem Technology Group Company Limited (GBT), based in China, specializes in corn refined and corn-based biochemical products. Their product portfolio includes corn starch, corn sweeteners, corn gluten, corn fiber, corn oil, and corn gluten feed. In addition, GBT offers amino acids, modified starches, and polyol chemicals

Key Lysine Companies:

The following are the leading companies in the lysine market. These companies collectively hold the largest market share and dictate industry trends.

- Global Bio-chem Technology Group Company Limited

- Ajinomoto Co. Ltd.

- Cheil Jedang Corp

- ADM

- Evonik

- COFCO Biochemical

- Juneng Golden Corn Co. Ltd.

- changchun dacheng industry group co.,ltd

- KYOWA HAKKO BIO CO., LTD.

- Cargill

Lysine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.36 billion

Revenue forecast in 2030

USD 2.18 billion

Growth Rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, form, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Global Bio-chem Technology Group Company Limited; Ajinomoto Co. Ltd.; Cheil Jedang Corp; ADM; Evonik Industries; COFCO Biochemical; Juneng Golden Corn Co. Ltd.; Changchun Dacheng Industry Group Co.,ltd; KYOWA HAKKO BIO CO.,LTD.; Cargill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lysine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lysine market report based on application, form and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Animal Feed

-

Food & Dietary Supplements

-

Pharmaceuticals

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Powder

-

Liquid

-

Granules

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.