- Home

- »

- Consumer F&B

- »

-

Macadamia Milk Market Size, Share And Growth Report 2030GVR Report cover

![Macadamia Milk Market Size, Share & Trends Report]()

Macadamia Milk Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Plain/Unsweetened Milk, and Flavored/Sweetened Milk), By Nature, By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-411-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Macadamia Milk Market Size & Trends

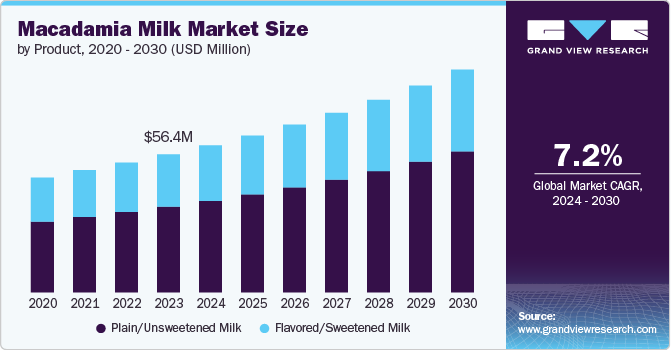

The global macadamia milk market size was estimated at USD 56.37 million in 2023 and is anticipated to grow at a CAGR of 7.2% from 2024 to 2030.Macadamia nuts are rich in monounsaturated fats, vitamins, and minerals, which contribute to heart health and improve cognitive function and overall well-being. As nutrition-conscious consumers seek alternatives that align with their health goals, macadamia milk’s nutritional profile becomes a significant selling point. Moreover, the absence of cholesterol and lower levels of saturated fat compared to cow's milk further enhance its appeal. The trend is particularly prominent among millennials and Gen Z consumers, who prioritize nutrition, sustainability, and ethical consumption, making macadamia milk a favorable choice for this demographic.

Increasing awareness among consumers regarding the versatility of macadamia milk has opened avenues for its use in functional beverages and is now finding integration in smoothies, desserts, sauces, cereals, and coffee drinks, enhancing its presence in the food service industry. As brands leverage social media and influencer marketing, particularly targeting younger, health-aware demographics, the perception of macadamia milk as a premium product continues to gain momentum. Moreover, the clean-label trend drives demand for natural, organic, and minimally processed foods, with nuts milk often positioned as a premium option in the dairy-free category.

The rise of veganism and vegetarianism has spurred the demand for diverse plant-based dairy options, with macadamia nut milk being a favored choice due to its luxurious creaminess and versatility in cooking and baking. Moreover, the increasing popularity of macrobiotic and paleo diets has contributed to the shift away from traditional dairy products. Besides, the convenience factor has also played a crucial role, with consumers seeking easy-to-use, ready-to-drink options that fit seamlessly into their busy lifestyles.

The expansion of retail channels and increasing product availability have significantly contributed to the macadamia milk market growth. With the rise of e-commerce and the proliferation of health food stores, consumers now have easier access to a variety of nut milk products, often accompanied by an abundance of information regarding their health benefits. This enhanced visibility has played a vital role in driving awareness and consumption as more people become exposed to the diverse applications of plant-based milk in everyday cooking and baking.

Manufacturers are focusing on developing a variety of macadamia milk-based products, including flavored options and fortified versions enriched with vitamins and minerals, catering to varying consumer preferences. Moreover, sustainable packaging solutions and transparent labeling practices are also becoming key marketing strategies, as environmentally conscious consumers favor brands that prioritize sustainability. As competition within the plant-based milk sector intensifies, brands are increasingly investing in marketing campaigns that highlight the unique qualities of nut milk, thereby attracting a larger consumer base.

Product Insights

The plain/unsweetened milk accounted for a revenue share of 62.2% in 2023. Plain or unsweetened macadamia milk has emerged as a popular choice among health-conscious individuals looking to reduce sugar intake without compromising on flavor. Modern consumers are more discerning about their food and beverage choices, often favoring products that are free from artificial additives, preservatives, and sugars. Moreover, plain/unsweetened milk typically contains simple ingredients such as macadamia nuts and water, making it an attractive option for those who prioritize transparency and quality in their purchasing decisions.

The flavored/sweetened milk is anticipated to witness a growth rate of 6.7% from 2024 to 2030. Flavored macadamia milk, often enriched with added vitamins and minerals, allows consumers to opt for unique flavor combinations while maintaining a perception of healthier consumption. Varieties such as vanilla, chocolate, and coffee-infused nut milk present a delicious way to enjoy a dairy-free beverage while catering to a broader audience, including those who may not typically consume plain alternatives. The growing trend of customization in the food and beverage industry also fuels interest in flavored and sweetened nut milk.

Nature Insights

Conventional macadamia milk accounted for a revenue share of 68.5% in 2023, driven by the increasing popularity of low-calorie and no-calorie beverages. The conventional segment typically comprises nuts sourced from farms that may employ standard agricultural practices, including the use of synthetic pesticides, herbicides, and fertilizers. These products often come at a lower price point, appealing to budget-conscious consumers who seek a dairy alternative without the premium price associated with organic products. Moreover, increasing the availability of conventional varieties in supermarkets and online platforms will further boost the segment growth.

The organic macadamia milk is estimated to grow at a CAGR of 8.7% from 2024 to 2030. With a growing emphasis on clean eating and organic produce, the organic segment is gaining traction among consumers willing to pay a premium for products that align with their health and ethical values. Organic products are often perceived as a higher-quality option, as it is produced from nuts grown without synthetic pesticides or fertilizers, thus appealing to those concerned about the environmental impact of conventional farming practices. Moreover, organic macadamia milk is often enriched with added nutrients, further enhancing its appeal among health enthusiasts.

Packaging Insights

Tetra Pak accounted for a revenue share of 59.7% in 2023. Tetra Pak offers a variety of carton sizes, making it easy for consumers to choose the product that best suits their needs, whether it be single-serving sizes for on-the-go lifestyles or larger family packs.Moreover, its user-friendly design features such as easy-open caps and pour spouts add to the overall customer experience, making macadamia milk an attractive choice for consumers who value convenience. Besides, the use of Tetra Pak's recyclable and lightweight materials also appeals to environmentally conscious consumers, positioning both the product and the packaging as eco-friendly options in the dairy alternative landscape.

The macadamia milk cans are estimated to grow at a CAGR of 8.9% from 2024 to 2030. Canned packaging offers numerous advantages, including extended shelf life, ease of transportation, and protection against light and oxygen, which can degrade product quality. Moreover, the compact nature of cans makes them more convenient for on-the-go consumption, aligning with the lifestyles of busy individuals who seek quick and healthy drink options without compromising quality. Besides, the ability to stack cans easily affects retail distribution positively, enabling brands to maximize shelf space and enhance visibility in stores. The visually appealing designs and vibrant labels on canned products can also draw in consumers and influence purchasing decisions at the point of sale.

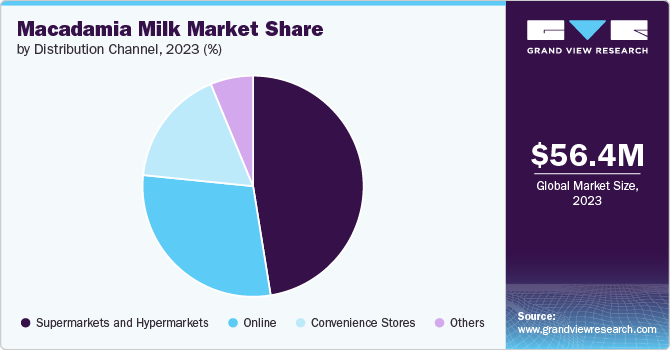

Distribution Channel Insights

The sales of macadamia milk market through supermarkets and hypermarkets accounted for a revenue share of 47.5% in 2023. Supermarkets and hypermarkets offer an extensive variety of brands and products, providing consumers with better convenience and a one-stop shopping experience. Physical retail spaces not only provide shoppers with immediate access to products but also create environments where consumers can explore various brands and types of plant-based milks. Moreover, the presence of macadamia milk alongside other dairy alternatives allows for comparative shopping, making it easier for consumers to switch from traditional dairy products. Besides, promotional activities within these stores, such as in-store tastings, discounts, and prominent product placements, further stimulate interest and encourage trial among consumers.

The online segment is estimated to grow at a CAGR of 8.1% from 2024 to 2030. E-commerce platforms provide consumers with a broader range of choices, enabling brands to reach niche markets andpromote newer macadamia milk products, whether they are organic, fortified, or infused with additional flavors. Moreover, the convenience of e-commerce has transformed the way consumers shop for groceries, allowing them to compare prices, read reviews, and explore new product offerings from the comfort of their homes. The online platforms often cater to niche markets, allowing small and emerging brands to reach a broader audience, thus driving competition and innovation within the macadamia milk segment. This dynamic growth in the online channel is further supported by the development of targeted marketing strategies, including social media promotions and influencer partnerships, which resonate with younger and tech-savvy consumers.

Regional Insights

The macadamia milk market in North America held 35.6% of the global revenue in 2023, driven by the rising awareness of the health benefits associated with the consumption of nut-based milk. Consumers in this region are increasingly adopting vegan and flexitarian diets, which prioritize plant-based products, contributing to higher demand for macadamia milk as a dairy alternative. Moreover, the integration of plant-based milk into coffee shops, specialty cafes, and retail outlets has further bolstered its visibility and accessibility, allowing it to gain traction among health-conscious consumers.

U.S. Macadamia Milk Market Trends

The macadamia milk market in the U.S. is expected to grow at a CAGR of 7.1% from 2024 to 2030. The rise of veganism and flexitarian diets in the U.S. has encouraged consumers to explore and adopt plant-based products, such as macadamia milk. Retailers are also expanding their product lines to include flavored nut milk and fortified versions enriched with vitamins and minerals, thereby appealing to a broader audience. The increasing availability of plant-based milk in grocery stores, cafes, and restaurants will further boost product sales.

Europe Macadamia Milk Market Trends

The macadamia milk market in Europe is expected to grow at a CAGR of 6.9% from 2024 to 2030. In countries such as the UK, Germany, and the Netherlands, the trend towards convenience and on-the-go consumption has made macadamia milk a popular choice among consumers seeking versatility in their diets. These countries also see a higher penetration of specialty grocery stores and health food shops that cater to niche markets, creating an environment conducive to the growth of plant milk products. Moreover, the increasing availability of nut milk in mainstream supermarkets, often positioned alongside other plant-based milks, has further driven consumer acceptance and awareness,

Asia Pacific Macadamia Milk Market Trades

The macadamia milk market in the Asia Pacific is set to grow at a CAGR of about 7.7% from 2024 to 2030. The growing population, coupled with a rapid rise in disposable income, has led to a burgeoning middle class that is increasingly experimental with food and dietary choices. Countries such as Australia and New Zealand, which are leading producers of macadamia nuts, are witnessing a domestic and export-driven demand for macadamia milk as consumers gravitate towards healthier and innovative beverage options. Moreover, the rise of environmental awareness and sustainability initiatives is influencing Asia Pacific consumers, prompting a shift towards plant-based milk alternatives.

The macadamia milk market in Australia is expected to grow at a CAGR of 7.2% from 2024 to 2030. The macadamia nuts are a well-established and beloved product within the Australian market, the transition to macadamia milk feels more familiar and acceptable to consumers. Moreover, the emphasis on local sourcing and the promotion of Australian-made products further position macadamia milk as an attractive alternative, encouraging consumers to support homegrown brands by choosing locally produced options.

Key Macadamia Milk Company Insights

Milkadamia, Kikkoman Corporation, Hawaiian Host Group, Giraf Limited, Patons Group, Nam Viet F&B, Noumi Limited, macamilk, Omello, and PlantBaby, Inc. are some of the dominant players operating in the macadamia milk market. The global macadamia milk market is characterized by intense competition. Key manufacturers in the market are introducing new flavored variants and fortified options to appeal to diverse consumer tastes and nutritional needs.

Moreover, strategic partnerships and collaborations between manufacturers and distributors are emerging as a powerful approach to enhance market reach and penetration. These collaborations often focus on co-branding initiatives and promotional campaigns that highlight the versatility of macadamia milk, positioning it as an ideal ingredient for both beverages and culinary applications. Furthermore, market players are also investing in geographical expansions to tap into new markets, particularly in regions witnessing a surge in demand for dairy-free products, such as North America and Europe.

Key Macadamia Milk Companies:

The following are the leading companies in the macadamia milk market. These companies collectively hold the largest market share and dictate industry trends.

- Milkadamia

- Kikkoman Corporation

- Hawaiian Host Group

- Giraf Limited

- Patons Group

- Nam Viet F&B

- Noumi Limited

- macamilk

- Omello

- PlantBaby, Inc.

Recent Developments

-

In January 2024, Milkadamia launched a new line of Organic Artisan refrigerated plant-based milks. This exciting addition to their product range aims to provide consumers with high-quality, dairy-free options that emphasize organic ingredients. This strategy helped the company to enhance its sales and expand its product macadamia milk portfolio.

-

In December 2023, Milkadamia announced a partnership with Pop Up Grocer in New York, aiming to introduce a range of innovative creamy plant-based milks crafted from raw macadamias. This collaboration highlights both brand's commitment to sustainability and delicious alternatives in the dairy market.

-

In March 2023, PlantBaby enhanced its Kiki Milk range by introducing organic macadamia milk, a clean-label milk alternative crafted from whole-food ingredients. This innovative product features a blend of macadamia nuts, cashews, Brazil nuts, sprouted pumpkin seeds, oats, coconut sugar, and marine minerals. With its emphasis on organic and wholesome components, the new macadamia milk aligns with the growing demand for healthy plant-based alternatives.

Macadamia Milk Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 60.04 million

Revenue forecast in 2030

USD 90.93 million

Growth rate (Revenue)

CAGR of 7.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Milkadamia; Kikkoman Corporation; Hawaiian Host Group; Giraf Limited; Patons Group; Nam Viet F&B; Noumi Limited; macamilk; Omello; PlantBaby, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Macadamia Milk Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global macadamia milk market report based on product, nature, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain/Unsweetened Milk

-

Flavored/Sweetened Milk

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Tetra Pak

-

Bottles

-

Cans

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets And Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global macadamia milk market was estimated at USD 56.37 million in 2023 and is expected to reach USD 60.04 million in 2024.

b. The global macadamia milk market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 90.93 million by 2030.

b. North America dominated the macadamia milk market with a share of 35.63% in 2023, driven by growing health consciousness among consumers and the rising popularity of plant-based diets. Moreover, the region's robust health food sector, supported by a substantial rise in specialty grocery stores and online retail, has facilitated easy access to macadamia milk, further boosting its consumption.

b. Some of the key market players in the macadamia milk market are Milkadamia, Kikkoman Corporation, Hawaiian Host Group, Giraf Limited, Patons Group, Nam Viet F&B, Noumi Limited, macamilk, Omello, and PlantBaby, Inc.

b. The macadamia milk market has experienced significant growth in recent years, driven by the surge in demand for dairy alternatives and increasing health consciousness among consumers. Moreover, the rise of e-commerce platforms has expanded the reach of macadamia milk manufacturers, making these products more accessible to consumers globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.