- Home

- »

- Food Additives & Nutricosmetics

- »

-

Malic Acid Market Size, Share, Growth, Industry Report, 2030GVR Report cover

![Malic Acid Market Size, Share & Trends Report]()

Malic Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (L-Malic Acid, D-Malic Acid, DL-Malic Acid), By End-use (Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics, Textiles), By Region, And Segment Forecasts

- Report ID: 978-1-68038-371-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Malic Acid Market Summary

The global malic acid market size was estimated at USD 239.3 million in 2024 and is projected to reach USD 324.7 million by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The increasing demand for malic acid in the food and beverage industry, particularly for its flavor-enhancing properties, is expected to drive growth for this market.

Key Market Trends & Insights

- The Asia Pacific malic acid market held the largest share of global industry and accounted for 43.2% in 2024.

- China held the largest share of the Asia Pacific malic acid industry in 2024.

- By product, L-malic acid dominated the malic acid industry and accounted for a revenue share of 53.5% in 2024.

- By end-use, the food & beverage segment dominated the malic acid market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 239.3 Million

- 2030 Projected Market Size: USD 324.7 Million

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

Malic acid is one of the preferred acidulants and flavoring agents used in food processing, owing to its excellent blending capabilities and ability to enhance the taste profile of various products. Applications of malic acid include beverages, confectionery, bakery items, desserts, and fruit preparations. It is widely used in carbonated soft drinks, fruit juices, and sports drinks as it provides a tart, clean taste. In addition, the changing consumer preferences and inclination among manufacturers toward the use of natural and clean-label ingredients support the adoption of malic acid, especially when derived from natural sources. The rapid expansion of the food and beverage processing industries, particularly in emerging economies such as China, India, Brazil, and Thailand, is anticipated to influence market growth positively. Rising urbanization, increasing disposable incomes, and changing dietary habits in these countries further contribute to the growth of packaged and processed food products, which boosts the need for flavoring agents such as malic acid.

Growing demand for carbonated soft drinks directly influences the demand for malic acid, which is widely used to enhance the flavor and acidity of these beverages. Malic acid prices in the Asia Pacific region have traditionally been low due to low production costs. Government incentives and a large number of small-scale producers catering to regional and overseas demand benefit China, a major malic acid producer in the region. Improvement in downstream demand coupled with stable benzene and butane prices, especially in China, is estimated to drive the market.

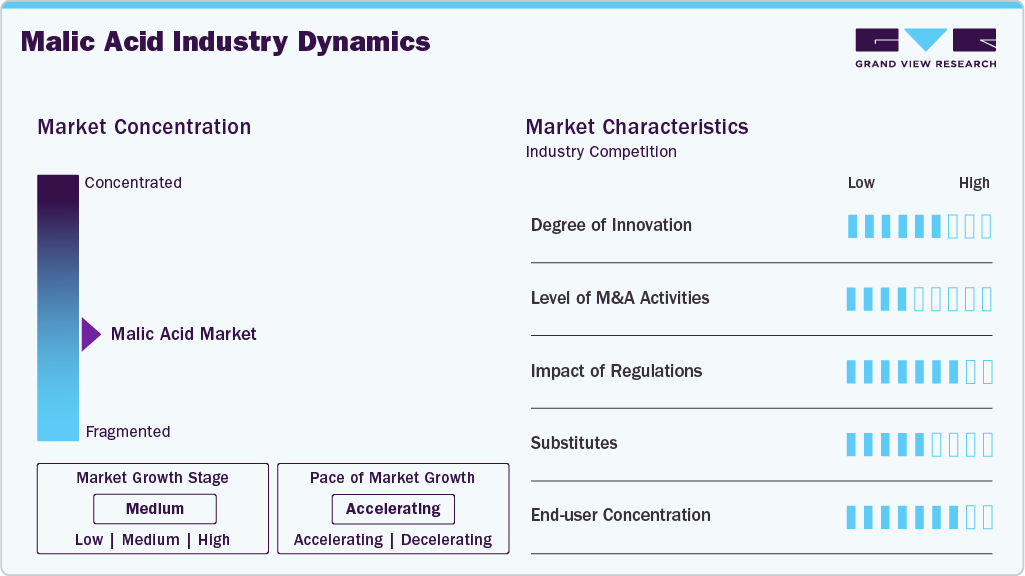

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Innovation in the malic acid market remains moderate, particularly in areas such as sustainable production methods and the development of new applications. While the market is relatively mature, ongoing research and development efforts are focused on improving manufacturing efficiency, reducing environmental impact, and exploring bio-based production techniques.

These advancements are driven by regulatory scenarios that promote sustainable practices and growing awareness regarding the use of environmentally friendly ingredients. Merger and acquisition activities in the malic acid market are limited. However, companies focus on strategic partnerships to strengthen their market presence. For instance, in November 2024, the Government of Canada announced its latest investment in Bartek Ingredients Inc., one of the key market participants in the malic acid industry. Government support is expected to aid Bartek’s plans and commitment to continue its efforts to develop a new facility featuring innovation-based processes and advanced equipment. Regulations play a significant role in shaping product formulations and raw material sourcing for multiple industries including food & beverages. Stringent food safety standards, various regulations, and guidelines regarding use of ingredients in industries such as personal care influence demand for malic acid.

Alternative acidulants are available in the market, however malic acid maintains strong demand due to its unique properties, including its persistent sourness, excellent blending capabilities, and ability to enhance flavor without overpowering other ingredients. The food and beverage sector largely dominates the market, which continues to lead due to the increasing global demand for processed food. However, other industries such as personal care and pharmaceuticals are gradually expanding the use of malic acid.

Product Insights

L-malic acid dominated the malic acid industry and accounted for a revenue share of 53.5% in 2024. This is attributed to its growing inclusion in several end-use industries, such as food & beverages and pharmaceuticals. In the food & beverages industry, L-malic acid is used as a sour conditioner and gives a flavor similar to the natural flavor of fruits. It is also used as a yeast growth-promoting agent by accelerating fermentation. The growing importance of L-malic acid in treating heart diseases is expected to propel the segment's growth over the forecast period. It is soluble in ethanol, methanol, ether, and water. The chemical name of L-malic acid is L-hydroxy butane diacid with a molecular weight of 134.09 g/mol. There are various methods to produce L-malic acid, including acid hydrolysis of polymalic acid, one-step fermentation, and enzymatic transformation of fumaric acid to L-malate.

The DL-Malic acid segment is projected to experience the fastest CAGR over the forecast period. It is primarily driven by the increasing adoption by numerous industries such as food and beverages, pharmaceuticals, and cosmetics. DL-Malic Acid is widely used as a flavor enhancer and acidulant in food products due to its ability to provide a smooth, tart taste. In addition, its role as a pH regulator in various industry offerings is expected to fuel its demand. The inclination toward the use of natural and clean-label ingredients also supports the growth of this segment. Moreover, expanding applications in pharmaceutical formulations, where DL-Malic Acid is used to improve drug stability and bioavailability, contributes significantly to market expansion.

End Use Insights

The food & beverage segment dominated the malic acid market in 2024. Significant increase in demand experienced by the food & beverages industry, especially in Asia Pacific, primarily fuels segment growth. Effective distribution strategies adopted by the key market participants in the beverage market and increasing market penetration of the quick commerce industry are expected to generate lucrative opportunities in countries such as India and China. In addition, the new launches of food and beverage products incorporating malic acid as a natural flavor enhancer and acidulant further boost demand. For instance, in March 2024, PepsiCo, one of the global brands offering an extensive portfolio of carbonated drinks, launched a new line of sparkling water beverages with six flavor varieties. The increase in such industry applications is likely to generate novel opportunities for this segment during the forecast period.

The personal care and cosmetics segment is projected to experience the fastest CAGR during the forecast period. Growth of this segment is mainly driven by malic acid’s multifunctional properties, including its role as a pH adjuster and skin-conditioning agent. Its excellent exfoliating ability helps in removal of dead skin cells, promoting a youthful and healthy skin appearance, which is highly valued in skincare formulations.

According to a report published by India Brand Equity Foundation, the cosmetics, beauty, and grooming market is expected to reach USD 20.0 billion by 2025. In the pharmaceutical industry, only about 5.0% of malic acid is used for manufacturing a variety of syrups and tablets due to its functionalities, such as enhanced assimilation and absorption in the body. Malic acid helps in reducing the effects of anti-cancer drugs on human body cells. Malic acid is used to stabilize medicines and in formulations of amino acid solutions to treat diseases such as hypertension, liver disease, uremia, anemia, and many others. In the textile industry, malic acid does not produce any unpleasant smell like other chemicals. It is also used as a textile finishing chemical to impart desired wrinkle-free characteristics to fabrics.

In the textiles industry, chemicals are used as complexing agents, sequestering agents, emulsifiers, dispersing agents, wetting agents, as well as colorants, such as dyes, dye-protective agents, pH regulators, leveling agents, UV absorbers, and finishing agents. Using chemicals in the textile industry makes the process easier and imparts the desired appearance to fabrics. Other segments include setting retardant in plasters and cement in combination with tartaric acid. It helps improve setting time & strength and enhances slump retention. It is also used to solubilize aluminum phosphate in the soil.

Regional Insights

North America malic acid market held significant revenue share of the global industry in 2024. Rising consumer demand for natural and clean-label ingredients is boosting the use of malic acid, especially in food and beverages such as fruit juices, carbonated drinks, and confectionery. Health and wellness trends emphasizing low-calorie, sugar-reduced, and functional foods also contribute to growing demand. The increasing emergence of product portfolios that feature foods and beverage products for health-conscious consumers in the region is likely to support the growth of this market over the forecast period.

U.S. Malic Acid Market Trends

The U.S. malic acid market held largest revenue share of the regional industry in 2024. The growth in the U.S. market is driven by strong demand from the food and beverage industry, where malic acid is widely used as a natural acidulant and flavor enhancer. In addition, increasing consumer inclination towards clean-label products and healthier offerings supports the rising adoption of malic acid. The expanding personal care and cosmetics industry also contributes to market growth, as malic acid is valued for its exfoliating and pH-regulating properties.

Europe Malic Acid Market Trends

Europe was identified as one of the key regions of the global malic acid industry in 2024. It is primarily driven by increasing demand for natural and clean-label ingredients. European consumers increasingly seek natural, low-sugar, and functional foods, making malic acid a key ingredient in beverages, confectionery, and other food products. Expanding malic acid usage in the pharmaceutical and cosmetics industries, particularly in oral care products and skincare, contributes to market growth.

Asia Pacific Malic Acid Market Trends

The Asia Pacific malic acid market held the largest share of global industry and accounted for 43.2% in 2024. This market's strong growth is primarily driven by the growing adoption of processed food products in Asia Pacific and the increasing demand for malic acid from the beverage industry. Significant growth in new product launches by major food and beverage industry participants for improved revenue, customer engagement, and market share is expected to develop new opportunities for this market.

China Malic Acid Market held the largest share of the Asia Pacific malic acid industry in 2024. This dominance is driven by China’s strong industrial base and large-scale production capacity, making it a leading malic acid manufacturer and supplier. The expanding food and beverage industry, driven by rising domestic consumption and increasing demand for natural and clean-label ingredients, is a key growth driver. The presence of multiple manufacturers operating in user industries such as personal care products and pharmaceuticals is expected to fuel further growth.

Key Malic Acid Company Insights

Some of the key companies in the global malic acid industry include Bartek Ingredients Inc., FUSO CHEMICAL CO., LTD., FUSO CHEMICAL CO., LTD, Thirumalai Chemicals and others. Global companies are focusing on capacity expansions, signing partnership agreements with distributors, and various other operational strategies to gain an edge in the competitive market.

-

Bartek Ingredients Inc. is a global ingredient manufacturer. Its portfolio features food-grade fumaric acid, malic acid, and Pectin enhancer. It serves a variety of user industries, including food and beverages, animal nutrition, and confectionery.

-

Thirumalai Chemicals specializes in various products, including malic acid, fumaric acid, fine chemicals, and phthalic anhydride. Its diverse portfolio serves industries such as paints, plastics, cosmetics, pharmaceuticals, and food.

Key Malic Acid Companies:

The following are the leading companies in the malic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Bartek Ingredients Inc.

- FUSO CHEMICAL CO., LTD

- ISEGEN South Africa (Pty) Ltd

- Anhui Sealong Biotechnology Co., Ltd.

- Thirumalai Chemicals

- Yongsan Chemicals

- Polynt S.p.A.

- Lonza

- Prinova Group LLC

- Nacalai Tesque, Inc.

- Guangzhou ZIO Chemical Co., Ltd.

Recent Developments

-

In September 2023, Dialog Group Bhd announced an investment of approximately USD 88.1 million to construct a specialty chemical plant in Pahang, Malaysia. Malic acid was one of the primary products planned to be manufactured in the plant with an expected annual capacity of 12,000 metric tons.

-

In July 2023, pH Plex launched malic acid-based shampoo and conditioner designed to protect and repair hair. The sulfate- and paraben-free formula is developed for all hair types.

Malic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 251.7 million

Revenue forecast in 2030

USD 324.7 million

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Bartek Ingredients Inc.; FUSO CHEMICAL CO., LTD; ISEGEN South Africa (Pty) Ltd; Anhui Sealong Biotechnology Co., Ltd.; Thirumalai Chemicals; Yongsan Chemicals; Polynt S.p.A.; Lonza; Prinova Group LLC; Nacalai Tesque, Inc.; Guangzhou ZIO Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Malic Acid Market Report Segmentation

This report forecasts revenue growth at global levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global malic acid market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

L-Malic Acid

-

D-Malic Acid

-

DL-Malic Acid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Textiles

-

Metals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.