- Home

- »

- Consumer F&B

- »

-

Malt Ingredients Market Size, Share & Trends Report, 2030GVR Report cover

![Malt Ingredients Market Size, Share & Trends Report]()

Malt Ingredients Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Barley, Wheat, Rye), By Applications (Food, Beverage, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-413-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Malt Ingredients Market Size & Trends

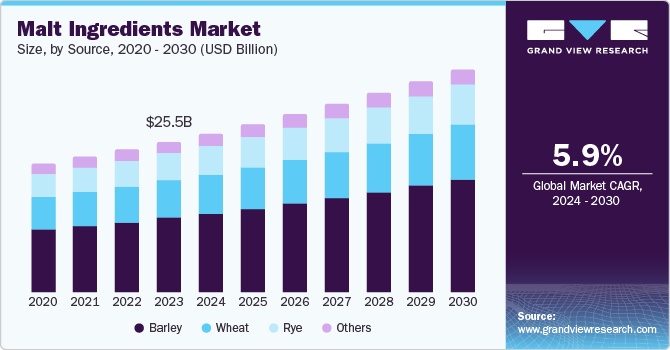

The global malt ingredients market size was valued at USD 25.5 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. This growth is attributed to the rising demand for plant-based ingredients, natural sweeteners, and versatile, sustainable ingredients among brewers is fueling market expansion. In addition, the growing popularity of craft beer, microbreweries, and alcoholic beverages such as whiskey, beer, and vodka is another major driver. Furthermore, product innovations such as dark malt and the growing disposable incomes of consumers are also contributing to market growth. Moreover, expanding applications of malt ingredients in the food industry as colorants, flavors, and additives in snacks, bakery, and dairy products are further driving the market.

Malt ingredients are used in the production of beer, whiskey, malted shakes, malt vinegar, and other beverages. However, wheat, rye, sorghum, and others are the sources for obtaining malt. In addition, malt ingredients are crucial in the production of food and beverage industries, where these ingredients, such as barley, are widely used in the processing of flour and bakery items, such as biscuits and cakes Furthermore, malt ingredients have broad applications in sectors such as food & beverage pharmaceuticals, personal care, and many others. They are enriched with macro and micronutrients such as proteins, vitamins B, zinc, iron, and calcium with low-fat content, thus making them a suitable preference for a food and beverage additive. Therefore, it possesses numerous health advantages, such as, increasing insulin activity, reducing heart diseases, controlling cholesterol etc.; hence, it is adopted in the pharmaceuticals and personal care industry.

Moreover, many consumers are showing interest in new and more soothing offerings of spirits than ordinary spirits, boosting the revenue increment of malt ingredients among alcoholic beverage producers. However, consumers look for premium, super-premium spirits, and flavorful spirits, including crafted and traditional blended varieties. Some important factors contributing to the market expansion include product innovation, the rising disposable income of the consumers, and rising demand for distilling industries and craft brewing witnessed positive growth in the forecast years, indicating the wide expansion of the malt ingredient market in numerous countries.

Source Insights

Barley grains dominated the market and accounted for the largest revenue share of 49.4% in 2023. Barley is the primary source of malt due to its high enzyme content and starch composition, making it essential for brewing and food applications. In addition, the increasing consumer awareness of health benefits associated with barley, such as its role in reducing diabetes risk and improving digestion, further boosts its demand in various food and beverage sectors. Furthermore, the versatility of barley in producing different types of malt, including crystal malt, roasted malt, and caramel malt, expands its applications in the food and beverage industry, contributing to its market growth.

The rye grains are projected to grow at a CAGR of 5.7% over the forecast period. Rye is used for making baked goods such as sourdough bread, crispbread, and pumpernickel, as rye grain is essential for the making of bread. It is golden orange-colored with an exceptional spicy rye flavor preparing rye beers. In addition, rye is utilized in fermented alcoholic drinks such as kvass, whiskey, vodka, and beer and is also used for the distillation of rye whisky; malted rye gives spicy rye to beers, adding a unique flavor and giving a wholesome and refreshing taste. Rye crop as raw material is available and is a fast-growing annual crop with long linear leaves backing its accessibility for production.

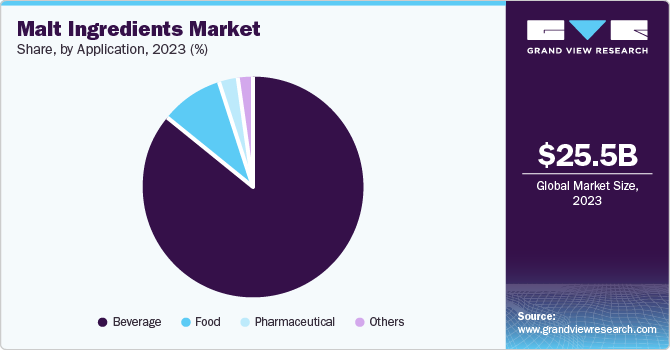

Application Insights

Beverages led the market and accounted for the largest revenue share of 85.8% in 2023. Alcoholic and non-alcoholic beverages are generally processed using malt ingredients. Malt is a significant demand in the beverage industry as it is an essential element in the production of beverages such as beer and whiskey. Furthermore, consumer demand for the craft brewing and distilling industries worldwide results in the growth of the segment.

Food applications are expected to grow at a CAGR of 5.5% over the forecast period. It is used in confectionaries for making malt vinegar and chocolate shakes, flavored drinks such as Horlicks & Milo, and baked items such as malt loaf and bagels and is often used in the production of cookies, snack bars, flakes, milk powder, and etc. The food industry's product application scope has surged as a result of increasing health awareness and health benefits related to malt ingredients have been prompting the application in several food products, especially bakery products.

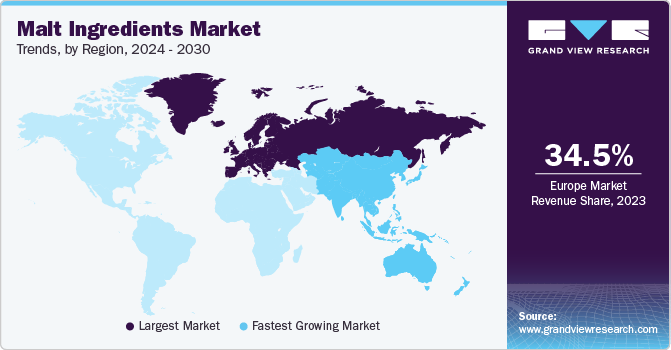

Regional Insights

The Europe malt ingredients market dominated the global market and accounted for the largest revenue share of 34.5% in 2023. The region's spirit drink industry is the largest in the world. The main raw materials used by the spirit drinks industries are cereals, potatoes, sugarcane, sugar beets, and wine. These are used to make various types of spirits, and nearly all of them are based on grain.

UK Malt Ingredients Market Trends

The malt ingredients market in the UK is expected to grow significantly over the forecast years owing to the rising demand for alcoholic beverages and the high consumption of beer craft breweries. Diverse applications of malt ingredients in the non-alcoholic beverage industry have significantly increased revenue. Food manufacturers are finding better ways to formulate existing products along with producing more innovative and unique products to meet increasing demand.

Asia Pacific Malt Ingredients Market Trends

Asia Pacific malt ingredient market is expected to grow at the fastest CAGR of 9.8% over the forecast period. This growth is attributed to the major players in the market contributing to market expansion strategies and product innovations to boost the market. Furthermore, growing demand for healthier food items throughout all categories of the food and beverage sectors has resulted in the proliferation of new trends for malt ingredients to be used in these products.

The growth of the malt ingredients market in China is driven by the rising demand for alcoholic beverages, particularly beer, as malt is essential for production. In addition, increasing health awareness among consumers has led to a preference for functional foods, enhancing the appeal of malt ingredients. The expansion of the food and beverage industry, coupled with innovations in malt products, further supports market growth. Furthermore, the growing popularity of craft brewing and non-alcoholic malt beverages is also boosting demand in the region.

The India malt ingredients market is expected to witness rapid growth over the forecast years owing to several new brewing-producing units that have started operations in the country. This has led the world’s leading brewing companies to seek an immense potential market in the country. In addition, as malt is the key raw material for distilled malt whiskeys and brewing nutraceutical energy drinks, the country's higher consumption of alcoholic beverages supports the industrial demand for malt barley.

North America Malt Ingredients Market Trends

The North America malt ingredients market is expected to witness significant growth over the forecast period. This growth is attributed to the vast demand from the brewery sector, especially the shifting consumer trend for craft beer. In addition, consumers seek unique and flavorful beers, which propels the market in terms of beer market. Furthermore, the growing emergence of microbreweries and the increasing production of craft beer has also led to rising demand for specialty malts in the region.

The malt ingredients market in the U.S. is anticipated to grow significantly as the U.S. is renowned for suitable growing circumstances for barley crops. Craft beer is a leading segment that contributes to most of the breweries in the country. In addition, brewing malts from the U.S. are available in a wide range of flavors, aromas, and colors. Further demand from consumers for those who look for sweet or spicy and utilize rich flavors adequately supports market growth.

Key Malt Ingredients Company Insights

Some of the key companies in the malt ingredients market include Cargill, Incorporated, Axéréal, Crisp Malt, Muntons Plc, VIVESCIA, Simpsons Malt, and ADM the market & are focusing on continuous development and innovation to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

ADM (Archer Daniels Midland) is a global food processing and commodities trading corporation. They have a strong emphasis on both human and animal nutrition. They transform crops into ingredients and provide solutions for foods, beverages, and supplements worldwide. ADM offers a broad range of solutions and services for livestock, aquaculture, and pets, utilizing sustainable practices to create safe and healthy nutrition for people and animals. They also offer products and services across segments such as food ingredients, animal nutrition, biofuels, nutraceuticals and health supplements, personal care, etc.

-

Simpsons Malt is a maltster-based company. They offer premium malt to the brewing, distilling, and food industries across the world. Their quality malts are popular for their taste and flavor, supporting brewers and distillers in crafting the finest beers and whiskies. The company also offers pale ale, pilsner, crystal, imperial, amber, brown, chocolate, black, roasted and aromatic barley, roasted wheat, peated malts, pinhead oats, oat flakes, and rye crystals.

Key Malt Ingredients Companies:

The following are the leading companies in the malt ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated.

- Axéréal

- Crisp Malt

- Muntons Plc

- VIVESCIA

- Simpsons Malt

- Briess Malt & Ingredients

- ADM

- GrainCorp.

- InVivo

Recent Developments

-

In June 2023, Simpsons Malt Ltd announced a long-term collaboration with Yara UK and Varda to significantly reduce the carbon footprint of malting barley and distilling wheat production. This partnership will utilize fossil-free green fertilizers and precision farming techniques to help Simpsons Malt achieve its goal of carbon-neutral production by 2030. The initiative aims to enhance nutrient use efficiency and lower carbon emissions in agriculture, addressing the growing demand for sustainable practices in the food and drink sector. The collaboration is seen as a step towards a more transparent and eco-friendly supply chain.

-

In March 2023, Malteries Soufflet announced a non-binding proposal to acquire United Malt Group for A$5.001 per share, representing a 45.3% premium over its recent closing price. This acquisition aims to create the world's largest maltster, enhancing production capacity to 3.7 million tons annually. The deal, which requires further due diligence and shareholder approval, is part of Malteries Soufflet's strategy to strengthen its position in the craft beer market and expand its global footprint, particularly in strategic regions such as the U.S., Canada, and Australia.

Malt Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.0 billion

Revenue forecast in 2030

USD 38.0 billion

Growth Rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Cargill, Incorporated.; Axéréal; Crisp Malt; Muntons Plc; VIVESCIA; Simpsons Malt; Briess Malt & Ingredients; ADM; GrainCorp.; InVivo

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Malt Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global malt ingredients market report based on source, application, and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Barley

-

Wheat

-

Rye

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverage

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.