- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Rye Market Size, Share, Growth And Trends Report, 2030GVR Report cover

![Rye Market Size, Share & Trends Report]()

Rye Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Whole, Processed), By Application (Food, Feed, Beverage), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-163-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rye Market Summary

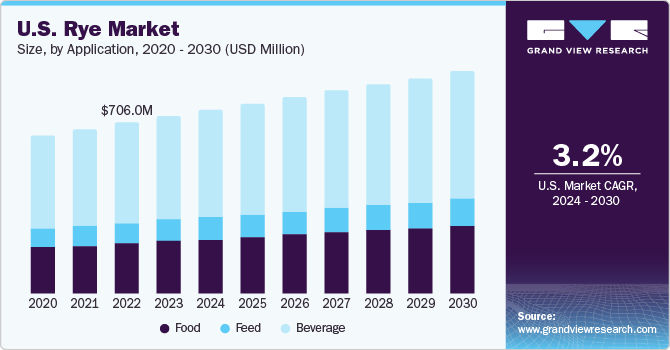

The global rye market size was estimated at USD 3.89 billion in 2023 and is projected to reach USD 4.98 billion by 2030, growing at a CAGR of 3.6% from 2024 to 2030. The increasing demand for rye in the market can be attributed to its nutritional profile.

Key Market Trends & Insights

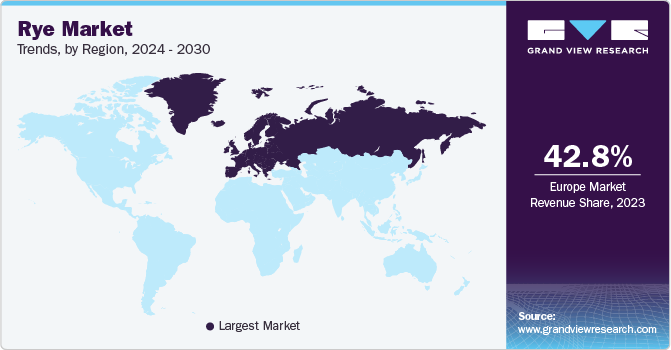

- Europe dominated the overall market in 2023 with a share of about 42.8%.

- Asia Pacific region is expected to expand at the fastest rate during the forecast period.

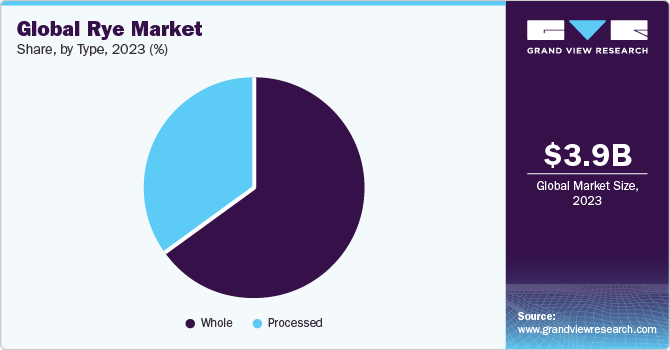

- Based on type, the whole rye segment accounted for the largest revenue share of 63.2% in 2023.

- Based on application, the beverage segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.89 Billion

- 2030 Projected Market Size: USD 4.98 Billion

- CAGR (2024-2030): 3.6%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Rye stands out as an excellent source of essential nutrients such as vitamin B6, thiamine, niacin, iron, folate, fiber, and riboflavin, with additional traces of zinc, pantothenic acid, phosphorus, magnesium, calcium, and other micronutrients. Its numerous health benefits include promoting heart health, controlling blood sugar, supporting digestive health, and reducing inflammation.

In addition, the food industry is witnessing substantial investment in research and development to harness the potential of rye as a versatile ingredient. Researchers are actively exploring ways to develop novel rye-based products with higher fiber content and increased levels of bioactive compounds. These efforts aim to balance improving the health benefits of rye and maintaining the high quality and taste consumers expect from their food.

Food processing technology advancements are also pivotal in meeting the demand for high-quality rye products. For instance, several companies are employing heat treatment methods to modify the pasting properties of rye flours, which, in turn, enhances the baking quality of rye-based products. Additionally, enzymes like xylanase and transglutaminase are being utilized to improve the rheological properties of rye dough, resulting in better bread quality.

Furthermore, there is a growing interest among both consumers and industries in promoting agricultural practices that reduce greenhouse gas emissions and enhance carbon storage. For example, in April 2022, research at the University of Alberta demonstrated the significant environmental benefits of certain perennial grains, such as rye. In contrast to annual crops, this study revealed that a crop of perennial rye has the capacity to absorb a substantial amount of carbon dioxide (CO2). This research builds upon previous studies highlighting the advantages of incorporating perennial crops into farming practices. Consequently, these insights will likely drive increased demand for perennial rye as a valuable crop in sustainable agriculture.

Market Concentration & Characteristics

The global market is rye characterized by a moderate degree of innovation. Several players in the rye industry are producing rye varieties with improved resistance to disease and adopting precision farming to optimize rye cultivation.

Several market players such as The Soufflet Group and Olam International Ltd., are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Type Insights

The whole rye segment accounted for the largest revenue share of 63.2% in 2023. The growing demand for whole-grain rye is due to increasing awareness of the health benefits associated with Wholes. Whole rye is recognized for its nutritional value, as it contains the entire grain kernel, including the bran, germ, and endosperm. This means it retains essential nutrients, such as dietary fiber, vitamins, minerals, and antioxidants. Consumers are becoming more health-conscious and actively seeking foods offering these nutritional advantages. The fiber in Whole rye is particularly significant for its role in supporting digestive health, regulating blood sugar levels, and aiding in weight management.

The processed segment is anticipated to witness the fastest market growth over the forecast period. Malted rye is commonly used in brewing and distilling, particularly in producing rye whiskey and certain beer styles. The malting process enhances the fermentability of the rye, as the enzymes produced during germination convert starches into fermentable sugars. This conversion is crucial for the fermentation process, where yeast consumes these sugars to produce alcohol and other flavor compounds. Consumers are increasingly interested in exploring various flavors and styles in their beverages. This has led to a demand for diverse and unique ingredients, including malted rye, which can impart spicy, fruity, and grainy notes to beverages.

To address the demand for unique beverages, several companies are offering diverse offerings. In September 2023, U.S.-based Basil Hayden announced the launch of rye whiskey made from malted rye. The whiskey has a light amber color and a flowery smell-the whiskey tastes of toasted rye, vanilla, and warm spice notes.

Application Insights

The beverage segment accounted for the largest revenue share in 2023. The increasing adoption of plant-based diets and the shift towards more plant-centric lifestyles have generated a notable surge in the demand for dairy alternatives in response to this trend, food manufacturers and innovators have been exploring various plant-based ingredients to create alternatives to traditional dairy products. For instance, in July 2022, Danone, a provider of dairy products, announced the launch of Alpo Totally Nordic Rye, a plant-based alternative to milk made from rye grain. Danone launched these products in Finland and Sweden.

The food segment is estimated to register the fastest CAGR over the forecast period. The consumption of rye-based food products has been associated with increased satisfaction and potential health benefits, including controlling blood lipid levels and inflammation. Additionally, recent years have witnessed significant research efforts to develop innovative rye-based food products. Rye can be used in various food products, including bread, crackers, pasta, cereals, and snacks. Its versatility allows food companies to incorporate rye into staple and specialty foods, catering to a broad consumer base. Canada-based provider of bread, Dempster offers rye bread in five rye variations: Harvest Pumpernickel, Mild Light, Fruit & Berry, Country Caraway, and Golden Grains.

Regional Insights

Europe dominated the overall market in 2023 with a share of about 42.8%. Rye is a staple in the traditional cuisines of many European countries, such as Germany, Scandinavia, and the Baltic states. Artisanal and traditional bakeries often use rye flour to make traditional bread and baked goods, which appeals to consumers looking for authentic and local flavors. Food manufacturers and processors have been developing new rye-based products, such as rye crisps, flakes, rye-based beverages, and snacks. These innovations have expanded the range of rye products and attracted consumers looking for variety.

Germany accounted for Europe's largest share of the market in 2023. The growing usage of rye in the food & beverage processing industry is likely to drive the demand for rye in Germany. Rye is considered a popular crop grown in Germany. Several common food & beverages consumed in the country contain rye, including whiskey, beer, crackers, and bread.

Asia Pacific region is expected to expand at the fastest rate during the forecast period. Increasing awareness of gluten sensitivities and celiac disease among consumers is driving the demand for rye-based products in the region. The bakery and food industry in Asia Pacific is also responding to changing consumer preferences. Rye flour and rye-based products are increasingly used to create a wide range of baked goods, including bread, pastries, and crackers, to cater to evolving tastes.

Key Companies & Market Share Insights

-

Agrex Inc., Vandaele Seeds Ltd, The Soufflet Group, and Olam International Ltd are some dominant players operating in the rye market.

-

Olam International has a global presence and operates in approximately 60 countries.

-

The Soufflet Group operates in the international cereal markets through its Soufflet Négoce subsidiary.

-

Golden State Grains, Grain Millers, Inc., and Welter Seed & Honey Co. are some emerging market players functioning in the market.

-

Golden State Grains offers a wide range of rye crop varieties, including Abruzzi, Century, Gazelle, Landrace, Seashore, and Merced Rye

Key Rye Companies:

- Agrex Inc.

- Vandaele Seeds Ltd

- The Soufflet Group

- Olam International Ltd

- Louis Dreyfus Co. BV

- Agrozan Commodities DMCC

- Archer Daniels Midland Co

Recent Developments

-

In August 2023, U.S.-based Hemingway Whiskey Company announced the launch of Hemingway Rye Whiskey Signature Edition. The whiskey has a balance of sweet and spicy flavors, with notes of dried fruits, nuts, cocoa, and citrus zest.

-

In May 2021, South Africa-based South Bakals announced the launch of rye bread mix under its rustic rye range. The rye bread mixes are ideal for sandwich meals, meal accompaniment, and a snack.

Rye Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.02 billion

Revenue forecast in 2030

USD 4.98 billion

Growth Rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Turkey

Key companies profiled

Agrex Inc.; Vandaele Seeds Ltd; The Soufflet Group; Olam International Ltd; Louis Dreyfus Co. BV; Agrozan Commodities DMCC; Archer Daniels Midland Co

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rye Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rye market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018- 2030)

-

Whole

-

Processed

-

-

Application Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

Food

-

Feed

-

Beverage

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global rye market size was estimated at USD 3.89 billion in 2023 and is expected to reach USD 4.02 billion in 2024.

b. The global rye market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 4.98 billion by 2030.

b. Europe region held a dominant revenue share of 42.7% in 2023 owing to the rise in the number of health-conscious consumers coupled with high demand for organic foods

b. Some of the major players in the market include Agrex Inc., Vandaele Seeds Ltd, The Soufflet Group , Olam International Ltd, Louis Dreyfus Co. BV, Agrozan Commodities DMCC, and Archer Daniels Midland Co among others

b. The rising popularity of plant-based diets coupled with popularity of clean label ingredients among all age groups is supporting the demand for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.