- Home

- »

- IT Services & Applications

- »

-

Managed Domain Name System Market Size Report, 2030GVR Report cover

![Managed Domain Name System Market Size, Share & Trends Report]()

Managed Domain Name System Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Anycast Network, DDoS Protection, GeoDNS), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-504-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Managed Domain Name System Market Summary

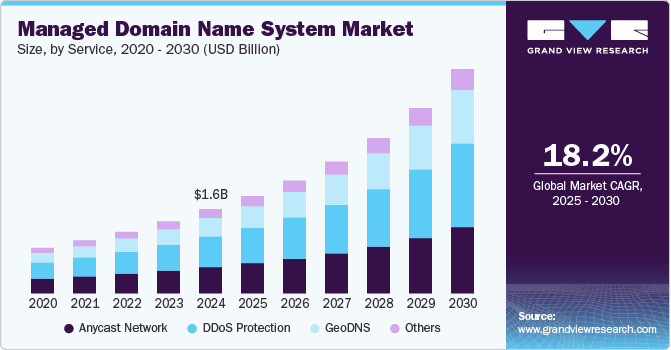

The global managed domain name system market size was estimated at USD 1.56 billion in 2024 and is projected to reach USD 4.14 billion by 2030, growing at a CAGR of 18.2% from 2025 to 2030. The growing demand for enhanced security and protection against cyber threats drives the market growth.

Key Market Trends & Insights

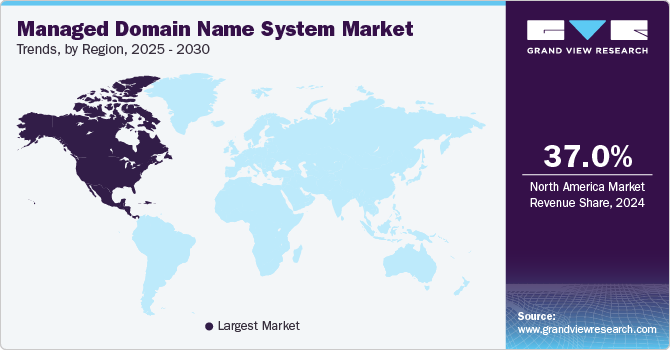

- North America held a significant share of around 37% in 2024.

- The demand for managed domain name system (DNS) in the U.S. is experiencing significant growth.

- Based on service, the DDoS protection segment dominated the industry with a revenue share of over 36% in 2024.

- Based on deployment, the cloud segment dominated the industry with a revenue share of over 59% in 2024.

- Based on enterprise size, the large enterprises segment dominated the market and accounted for a revenue share of 53.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.56 Billion

- 2030 Projected Market Size: USD 4.14 Billion

- CAGR (2025-2030): 18.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

DNS infrastructure is often targeted in Distributed Denial-of-Service (DDoS) attacks, domain hijacking, and cache poisoning. Managed DNS providers offer advanced security features such as DDoS mitigation, DNSSEC (Domain Name System Security Extensions), and traffic filtering to protect against these threats. By outsourcing their DNS management, businesses can benefit from robust security protocols and monitoring, ensuring their websites and online applications are safe from malicious attacks. As cyber threats evolve, companies increasingly recognize the value of leveraging managed DNS distributed denial of service (DDoS) protection to fortify their digital infrastructure.

The need for improved network performance and uptime drives the managed domain name system (DNS) industry. Traditional, in-house DNS anycast networks may not offer the performance or reliability needed to meet modern business demands. Managed DNS distributed denial of service (DDoS) protection, on the other hand, provide enhanced uptime guarantees through robust infrastructure, monitoring, and failover mechanisms. In the event of DNS server failures, managed DNS distributed denial of service (DDoS) protection automatically reroute traffic to backup servers, minimizing downtime and ensuring uninterrupted access to online distributed denial of service (DDoS) protection. As businesses rely more heavily on their online presence for revenue generation and customer engagement, providing high uptime and network reliability has become a critical concern, driving the adoption of managed DNS anycast networks.

In addition, the rise in global internet traffic, driven by the proliferation of online content, streaming distributed denial of service (DDoS) protection, IoT devices, and mobile applications, is also contributing to the growth of the managed DNS industry. Fast, reliable, and high-performance DNS distributed denial of service (DDoS) protection are critical in ensuring a seamless user experience, particularly for businesses in e-commerce, entertainment, and social media. Managed DNS distributed denial of service (DDoS) protection help optimize DNS query response times, reduce latency, and improve website and application performance. As internet traffic continues to soar, organizations are turning to managed DNS anycast networks to handle the increased traffic volume and ensure optimal performance for their users across the globe. According to Cloudflare, Inc.'s fifth annual Year in Review, global internet traffic experienced a 17% increase in 2024 compared to the previous year, highlighting the world's growing reliance on the Internet.

Furthermore, the rise in mobile internet usage also contributes to the managed DNS industry growth. As mobile applications and distributed denial of service (DDoS) protection become more integral to business operations and customer engagement, ensuring fast, responsive, and reliable DNS anycast network for mobile users is crucial. Managed domain name system (DNS) providers offer mobile-optimized DNS distributed denial of service (DDoS) protection that reduces latency and improves mobile app performance. With mobile internet traffic outpacing traditional desktop usage in many regions, businesses prioritize optimizing mobile experience, further driving demand for efficient and reliable DNS distributed denial of service (DDoS) protection.

Service Insights

Based on service, the market is segmented into anycast network, distributed denial of service (DDoS) protection, geoDNS, and others. The DDoS protection segment dominated the industry with a revenue share of over 36% in 2024. The proliferation of hybrid and multi-cloud environments drives the demand for DDoS protection in managed DNS distributed denial of service (DDoS) protection. Organizations adopting these architectures require scalable and secure DNS anycast networks capable of handling complex traffic patterns and diverse workloads. DDoS protection ensures that traffic directed to hybrid and multi-cloud environments remains secure, minimizing the risk of service disruptions caused by malicious actors. As businesses increasingly rely on these environments to drive operational efficiency, the demand for managed DNS anycast networks with robust DDoS mitigation capabilities is growing.

The geoDNS segment is anticipated to grow significantly with a CAGR of 19.8% over the forecast period. The rise of content delivery networks (CDNs) and edge computing drives the demand for geoDNS anycast networks. CDNs and edge platforms rely on distributed architectures to deliver content and process data closer to end use. GeoDNS is a foundational technology for these systems, enabling efficient traffic routing and enhancing the performance of CDN and edge infrastructures. As businesses increasingly adopt these technologies to improve scalability and reduce data transfer costs, integrating geoDNS into managed DNS distributed denial of service (DDoS) protection has become a key requirement, boosting market growth.

Deployment Insights

Based on deployment, the market is segmented into on-premises and cloud. The cloud segment dominated the industry with a revenue share of over 59% in 2024. The increasing adoption of DevOps and Infrastructure-as-Code (IaC) practices drives cloud segment growth. Developers and IT teams are utilizing cloud-managed DNS anycast networks to automate DNS configurations and integrate them into continuous integration and continuous deployment (CI/CD) pipelines. This automation streamlines DNS management, reduces manual errors, and accelerates deploying new applications and distributed denial of service (DDoS) protection. As DevOps practices continue to gain traction, the demand for DNS distributed denial of service (DDoS) protection that aligns with cloud-native and IaC frameworks is expected to grow. According to DevOps Research and Assessment (DORA), cloud adoption among DevOps teams grew by 50% between 2019 and 2023. In addition, 70% of organizations that fully adopted a DevOps culture experienced enhanced operational efficiency.

The on-premises segment is anticipated to register a considerable growth over the forecast period. The growing importance of disaster recovery and business continuity planning further supports the demand for on-premises DNS anycast networks. By deploying DNS servers across multiple physical locations, organizations can create redundant and resilient systems that continue to function during network outages or hardware failures. On-premises DNS infrastructure ensures uninterrupted service availability, which is critical for industries where downtime can result in significant financial losses or operational disruptions. This self-reliant approach is often preferred by organizations seeking to mitigate risks and maintain full control over their disaster recovery strategies.

Enterprise Size Insights

Based on enterprise size, the market is segmented into large enterprises and SMEs. The large enterprises segment dominated the market and accounted for a revenue share of 53.1% in 2024. The growing focus on improving website performance and reducing downtime among large enterprises drives segment growth. Enterprises handle millions of customer interactions daily, and even minimal latency or outages can result in significant revenue loss and reputational damage. Managed DNS anycast networks enhance performance by routing traffic through the most efficient paths, leveraging distributed server networks, and providing robust failover mechanisms. This ensures users can access enterprise websites and distributed denial of service (DDoS) protection without interruptions, even during high traffic or server failures.

The SMEs segment is expected to grow significantly with a CAGR of over 18% from 2025 to 2030. The rapid growth of e-commerce is a major driver for managed DNS adoption among SMEs. As small businesses increasingly shift to online retail, they require DNS anycast networks capable of handling high traffic volumes, particularly during sales campaigns or peak seasons. Managed DNS distributed denial of service (DDoS) protection offer enhanced traffic management and failover capabilities, ensuring uninterrupted online transactions and boosting customer confidence in these businesses. SMEs involved in retail, hospitality, and other consumer-facing industries are particularly leveraging these anycast networks to capitalize on the e-commerce boom.

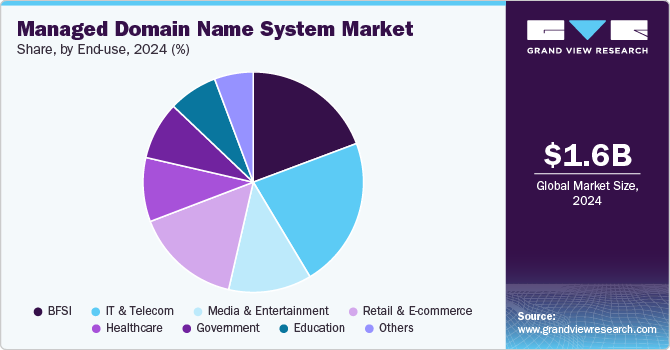

End-use Insights

The IT & telecommunication segment dominated the market and accounted for a revenue share of over 22% of the global revenue in 2024. Telecom operators and IT service providers require DNS anycast networks that provide reliable domain reanycast network and improve network performance, ensuring low latency and quick access to distributed denial of service (DDoS) protection for users. Managed DNS anycast networks help optimize traffic routing, using a global network of DNS servers to direct user requests to the most efficient server, thereby minimizing delays and enhancing the user experience. In sectors like telecom, where large volumes of data are transmitted daily, slight delays can significantly impact customer satisfaction and operational efficiency. A study by NS1 in 2023 offers an in-depth analysis of global DNS traffic trends. It shows that public resolvers lead the internet, comprising almost 60% of recursive DNS usage. The telecom sector makes up around 9%, with Google making up around 30% and Amazon Web Distributed Denial of Service (DDoS) Protection at 16%.

The retail and e-commerce segment is expected to register the fastest growth over the forecast period. E-commerce businesses face intense competition, and a slow-loading website can lead to poor user experience, abandoned shopping carts, and lost revenue. Managed DNS anycast networks offer advanced traffic routing capabilities, allowing businesses to direct customers to the fastest and most reliable servers based on geographic location and network conditions. This improves website speed and reduces latency, ensuring a smoother shopping experience for customers, which is critical in driving conversions and customer satisfaction. Fast website performance is particularly important during peak shopping seasons, such as Black Friday or holiday sales, when high traffic volumes can overwhelm traditional infrastructure.

Regional Insights

North America held a significant share of around 37% in 2024. The increasing importance of regulatory compliance and data protection drives the demand for secure and compliant DNS anycast networks in North America. Many industries in the region, such as healthcare, finance, and government, are subject to stringent data privacy regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Managed DNS providers offer compliance-ready anycast networks that help businesses meet these regulatory requirements by implementing secure DNS encryption, data logging, and reporting capabilities. This allows companies to maintain data privacy and security while meeting the necessary compliance standards, further fueling the adoption of managed DNS distributed denial of service (DDoS) protection.

U.S. Managed Domain Name System Market Trends

The demand for managed domain name system (DNS) in the U.S. is experiencing significant growth. The increasing sophistication of cyber threats, including advanced persistent threats (APTs), botnets, and phishing attacks, is a significant driver for adopting managed DNS distributed denial of service (DDoS) protection. Cybersecurity has become a top priority for businesses in the U.S., especially as cyberattacks grow in scale and complexity. Attackers can exploit DNS vulnerabilities to access sensitive data, hijack websites, or launch distributed denial-of-service (DDoS) attacks that disrupt online distributed denial of service (DDoS) protection. Managed DNS providers offer advanced security features such as DNSSEC (DNS Security Extensions) to protect against DNS spoofing and cache poisoning and DDoS protection to mitigate large-scale attacks. With businesses of all sizes facing growing cybersecurity risks, managed DNS distributed denial of service (DDoS) protection are an effective anycast network for ensuring the integrity and security of DNS infrastructure, protecting both customer data and the organization’s reputation.

Asia Pacific Managed Domain Name System Market Trends

Asia Pacific is expected to achieve the fastest CAGR of 20.2% during the forecast period in the market. Mobile commerce (m-commerce) has significantly risen in Asia Pacific, further driving the demand for managed DNS distributed denial of service (DDoS) protection. With smartphones becoming the primary tool for online transactions, businesses must ensure that their mobile apps and websites are optimized for performance and user experience. Managed DNS distributed denial of service (DDoS) protection help companies enhance mobile app performance by reducing latency and providing faster load times. By optimizing the routing of mobile traffic, DNS distributed denial of service (DDoS) protection ensure that mobile users experience smooth interactions with digital platforms, which is crucial in markets with high smartphone penetration, such as China, India, and Southeast Asia. The growing importance of m-commerce in driving sales and customer engagement across the Asia Pacific region is one of the key factors pushing the need for dependable and efficient DNS management.

Key Managed Domain Name System Company Insights

Some of the key players operating in the market include Amazon Web Distributed Denial of Service (DDoS) Protection, Inc., IBM, and Microsoft, among others.

-

Amazon Web Distributed Denial of Service (DDoS) Protection, Inc. is a subsidiary of Amazon.com which is the largest and most comprehensive cloud distributed denial of service (DDoS) protection provider, offering many cloud computing anycast networks, including computing power, storage options, databases, machine learning, analytics, and networking. AWS serves millions of customers globally, ranging from startups to large enterprises, government organizations, and educational institutions. One of the key distributed denial of service (DDoS) protection that AWS provides is the Managed Domain Name System (DNS) through Amazon Route 53, a scalable and highly available DNS web service. Route 53 is designed to route end-user requests to internet applications efficiently.

VeriSign, Inc. and Vercara, LLC. are some of the emerging market participants in the target market.

-

VeriSign, Inc., is a global company that offers domain name distributed denial of service (DDoS) protection and internet security anycast networks. Its primary offerings include domain registration distributed denial of service (DDoS) protection, managed DNS, and security products that help organizations maintain the integrity and performance of their online presence. The company’s VeriSign DDoS Protection Distributed Denial of Service (DDoS) Protection and DNSSEC anycast networks enhance the security and resilience of internet traffic by protecting against attacks that target DNS servers or exploit vulnerabilities in the domain name system.

Key Managed Domain Name System Companies:

The following are the leading companies in the managed domain name system market. These companies collectively hold the largest market share and dictate industry trends.- IBM

- Amazon Web Distributed Denial of Service (DDoS) Protection, Inc.

- CDNetworks Inc.

- Cloudflare, Inc.

- Corporation Service Company

- DigiCert, Inc.

- Infoblox

- Microsoft

- Oracle

- VeriSign, Inc.

- Vitalwerks Internet Anycast Networks, LLC

Recent Developments

-

In October 2024, Google partnered with the Global Anti-Scam Alliance and the DNS Research Federation to fight online scams. This collaboration, known as the Global Signal Exchange, aims to generate real-time insights into scams, fraud, and other cybercrimes by consolidating threat signals from various data sources to enhance visibility into cybercrime facilitators.

-

In August 2024, DigiCert, Inc. acquired Vercara, LLC, a provider of cloud-based distributed denial of service (DDoS) protection designed to enhance online security. This distributed denial of service (DDoS) protection include managed Authoritative Domain Name System (DNS) and Distributed Denial-of-Service (DDoS) protection, which safeguard organizations' networks and applications. This acquisition will bolster DigiCert's ability to shield organizations of all sizes from increasing daily cyberattacks. This merger will enable DigiCert to deliver a seamless DNS and certificate management anycast network featuring more efficient domain control validation and simplified DNS configuration.

Managed Domain Name System Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 1.79 billion

Revenue Forecast in 2030

USD 4.14 billion

Growth rate

CAGR of 18.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

IBM, Amazon Web Distributed Denial of Service (DDoS) Protection, Inc., Google, Oracle, Microsoft, DigiCert, Inc., Cloudflare, Inc., Corporation Service Company; Infoblox; CDNetworks Inc.; Vitalwerks Internet Anycast Networks, LLC; VeriSign, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Managed Domain Name System Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global managed domain name system market based on service, deployment, enterprise size, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Anycast Network

-

Distributed Denial of Service (DDoS) Protection

-

GeoDNS

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Media & Entertainment

-

Retail & E-commerce

-

Healthcare

-

Government

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growing demand for enhanced security and protection against cyber threats , the need for improved network performance and uptime drives the managed DNS market and the rise in global internet traffic, driven by the proliferation of online content, streaming distributed denial of service (DDoS) protection, IoT devices, and mobile applications drives the market growth.

b. The global managed domain name system market size was estimated at USD 1.56 billion in 2024 and is expected to reach USD 1.79 billion in 2025.

b. The global managed domain name system market is expected to grow at a compound annual growth rate of 18.2% from 2025 to 2030 to reach USD 4.14 billion by 2030.

b. The DDoS protection segment dominated the industry with a revenue share of 53.4% in 2024. The proliferation of hybrid and multi-cloud environments drives the demand for DDoS protection in managed DNS distributed denial of service (DDoS) protection.

b. Some key players operating in the managed domain name system market include IBM, Amazon Web Distributed Denial of Service (DDoS) Protection, Inc., Google, Oracle, Microsoft, DigiCert, Inc., Cloudflare, Inc., Corporation Service Company, Infoblox, CDNetworks Inc., Vitalwerks Internet Anycast Networks, LLC, VeriSign, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.