- Home

- »

- Power Generation & Storage

- »

-

Marine Battery Market Size & Share, Industry Report, 2033GVR Report cover

![Marine Battery Market Size, Share & Trends Report]()

Marine Battery Market (2026 - 2033) Size, Share & Trends Analysis Report By Ships, By Battery, By Nominal Capacity, By Propulsion Type, By Ship Power, By Battery Design, By Battery Type, By Sales Channel, By Energy Density, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-268-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Battery Market Summary

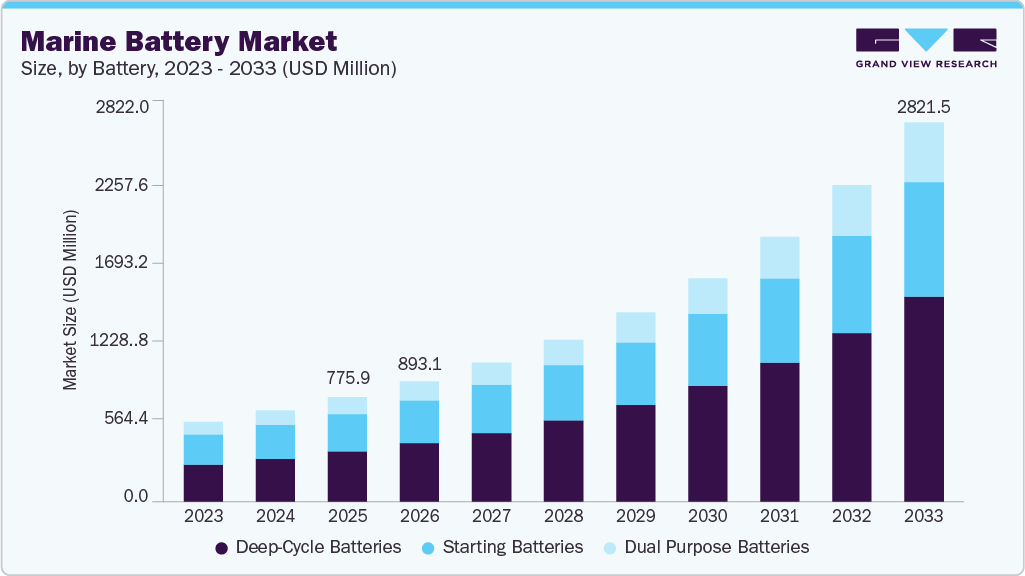

The global marine battery market size was estimated at USD 775.9 million in 2025 and is projected to reach USD 2,821.5 million by 2033, growing at a CAGR of 17.9% from 2026 to 2033. Market growth is primarily driven by the rapid electrification of marine vessels, including recreational boats, ferries, offshore support vessels, and inland waterway transport, alongside the rising adoption of hybrid and fully electric propulsion systems.

Key Market Trends & Insights

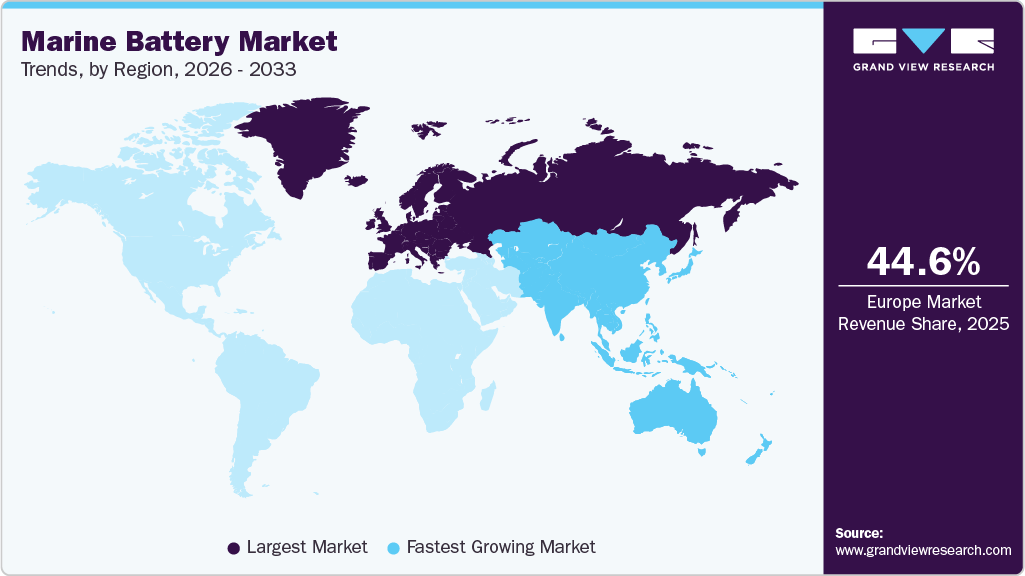

- Europe marine battery market held the largest share of over 44.6% of the global market in 2025.

- The UK marine battery industry led Europe, accounting for the largest revenue share in 2025.

- Based on ships, commercial held the highest market share in 2025.

- Based on battery, deep-cycle batteries held the highest market share in 2025.

- Based on propulsion type, conventional held the highest market share of over 80.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 775.9 Million

- 2033 Projected Market Size: USD 2,821.5 Million

- CAGR (2026-2033): 17.9%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

Increasing fuel costs, tightening maritime emission regulations, and the global push to decarbonize shipping operations are accelerating the transition from conventional diesel-based power systems to advanced marine battery solutions.

Technological advancements in lithium-ion, solid-state, and advanced lead-acid marine batteries are enhancing energy density, safety, thermal management, and lifecycle performance, making batteries increasingly viable for large-scale marine applications. Governments across North America, Europe, and the Asia-Pacific are supporting the market through subsidies, pilot projects, and electrification programs for ports and coastal transport. Strategic collaborations between battery manufacturers, shipbuilders, marine OEMs, and energy system integrators are strengthening the ecosystem, positioning marine batteries as a critical enabler of sustainable and next-generation maritime transportation.

Drivers, Opportunities & Restraints

The marine battery industry is primarily driven by the accelerating electrification of marine vessels, including ferries, recreational boats, offshore support vessels, and naval platforms, as the maritime industry seeks to reduce emissions and operating costs. Stringent environmental regulations targeting sulfur oxides (SOx), nitrogen oxides (NOx), and greenhouse gas emissions, along with decarbonization initiatives led by the IMO and regional maritime authorities, are compelling shipowners and port operators to adopt battery-powered and hybrid propulsion systems. In addition, rising fuel prices, increasing demand for energy-efficient and low-noise vessels, and the expansion of electric and hybrid solutions in ports and inland waterways are further supporting market growth.

Despite these drivers, the market faces several restraints. High upfront costs associated with marine-grade battery systems, including specialized safety features, thermal management, and certification requirements, can limit adoption, particularly among small and mid-sized vessel operators. Technical challenges related to battery weight, space constraints onboard vessels, limited charging infrastructure at ports, and concerns over battery lifespan and safety in harsh marine environments also restrict market expansion. Furthermore, the lack of standardized regulations and interoperability across regions adds complexity to large-scale deployment.

The marine battery industry presents strong opportunities through ongoing advancements in lithium-ion, solid-state, and next-generation battery chemistries that enhance energy density, safety, and durability for marine applications. Growing investments in shore power infrastructure, fast-charging systems, and smart energy management solutions at ports are creating favorable conditions for wider adoption. In addition, increasing collaborations between battery manufacturers, shipbuilders, marine OEMs, and energy system integrators are enabling integrated propulsion and energy storage solutions, supporting the development of zero-emission vessels and positioning marine batteries as a key component of the global transition toward sustainable maritime transportation.

Battery Insights

Deep-cycle batteries emerged as the largest battery segment with a market share of about 48.1% in 2025 and is expected to witness robust growth over the forecast period. These batteries are engineered with thick plates and robust construction to withstand repeated deep discharges, making them ideal for providing sustained power over extended periods. Deep-cycle batteries find widespread use in marine vessels for various applications, including powering trolling motors, navigation systems, lighting, and onboard electronics, ensuring reliable operation and performance on the water.

With advancements in battery technology, deep-cycle batteries have become more efficient, durable, and reliable, offering enhanced energy density and longer cycle life. Manufacturers are continuously innovating to develop deep-cycle batteries capable of meeting the evolving needs of the marine industry, such as improved charge acceptance, faster charging times, and better resistance to vibration and shock.

Ships Insights

Commercial ships emerged as the largest ship segment with a market share of about 80.7% in 2025 and is expected to witness robust growth over the forecast period. Commercial vessels, including container ships, bulk carriers, and tankers, are increasingly adopting battery systems to enhance operational efficiency, reduce fuel consumption, and comply with stringent emissions regulations. Electric propulsion systems powered by marine batteries offer commercial ship operators a viable solution to mitigate environmental impact while optimizing performance and reducing operating costs.

The adoption of marine batteries in commercial ships is particularly notable in short-sea shipping and coastal routes, where vessels frequently operate in emission control areas (ECAs) and face pressure to reduce air pollution and greenhouse gas emissions. By integrating battery systems into their fleets, shipping companies can achieve substantial reductions in emissions, improve energy efficiency, and enhance overall environmental sustainability. Moreover, advancements in battery technology, such as increased energy density and faster charging capabilities, are further driving the uptake of marine batteries in commercial shipping, signaling a shift towards cleaner and more sustainable maritime transportation solutions.

Nominal Capacity Insights

> 250 AH emerged as the largest nominal capacity segment with a market share of about 46.2% in 2025 and is expected to witness robust growth over the forecast period. These batteries offer a robust solution for powering various onboard systems, including propulsion, navigation, and auxiliary equipment, in vessels such as commercial ships, ferries, and offshore platforms. With capacities > 250 AH, these batteries provide ample energy reserves to support extended voyages and demanding operational conditions at sea.

As the maritime industry continues to embrace electrification and sustainability initiatives, the demand for >250 AH marine batteries is poised for considerable growth. Manufacturers are investing in research and development to enhance the performance, efficiency, and durability of these high-capacity batteries, aiming to meet the stringent requirements of marine applications while ensuring reliability and safety. The >250 AH battery sub-segment is expected to play a crucial role in powering the next generation of eco-friendly and energy-efficient marine vessels, driving innovation and advancements in the global market.

Propulsion Type Insights

Conventional emerged as the largest propulsion type segment with a market share of about 80.6% in 2025 and is expected to witness robust growth over the forecast period. While electric propulsion systems are gaining traction, many marine vessels still utilize conventional power sources such as diesel engines or gas turbines. In such cases, marine batteries serve as auxiliary power sources, providing backup power for essential systems, as well as supporting functions like lighting, navigation, and communication onboard.

Despite the increasing interest in alternative propulsion technologies, the conventional segment remains relevant due to the widespread use of combustion engines in various marine applications, including commercial shipping, offshore operations, and naval vessels.

Ship Power Insights

150 - 745 KW emerged as the largest ship power segment with a market share of about 32.8% in 2025 and is expected to witness robust growth over the forecast period. Marine vessels within this power range encompass a diverse range of applications, including ferries, workboats, offshore support vessels, and smaller cargo ships. Battery systems in this category provide sufficient power to propel vessels through various marine environments while also supporting onboard systems and equipment essential for safe and efficient operations.

As the maritime industry increasingly focuses on reducing emissions and transitioning towards cleaner energy sources, the demand for battery systems within the 150 - 745 kW power range is expected to surge. These batteries play a crucial role in enabling hybrid and electric propulsion systems, contributing to lower fuel consumption, reduced greenhouse gas emissions, and improved environmental sustainability. In addition, advancements in battery technology, such as higher energy densities and faster charging capabilities, are further driving the adoption of marine batteries in this power range, paving the way for a more efficient and eco-friendly future for marine transportation.

Battery Type Insights

Lithium emerged as the largest battery type segment with a market share of about 59.8% in 2025 and is expected to witness robust growth over the forecast period. As a preferred choice for marine propulsion and onboard systems, lithium batteries provide reliable performance, fast charging capabilities, and longer cycle life compared to traditional lead-acid batteries. Their lightweight and compact design makes them ideal for space-constrained marine environments, contributing to overall vessel efficiency and performance.

The adoption of lithium batteries in the marine industry is driven by their ability to support electric propulsion systems, hybrid configurations, and auxiliary power requirements across a wide range of vessel types, including yachts, ferries, and commercial ships. With ongoing advancements in lithium battery technology, such as improved safety features and higher energy densities, this sub-segment is poised for continued growth, offering marine operators a sustainable and cost-effective solution to meet their power storage needs while reducing environmental impact.

Sales Channel Insights

OEM emerged as the largest sales channel segment with a market share of about 62.4% in 2025 and is expected to witness robust growth over the forecast period. OEMs seek to meet increasingly stringent emissions regulations and cater to the growing demand for eco-friendly marine solutions; they are turning to advanced battery technologies to power electric propulsion systems and onboard electronics. By partnering with battery manufacturers, OEMs can offer complete vessel solutions equipped with high-performance batteries, ensuring seamless integration and optimal performance for end-users.

The OEM sales channel plays a pivotal role in driving innovation and adoption of marine batteries across the maritime industry. As OEMs collaborate with battery manufacturers to develop custom solutions tailored to specific vessel requirements, they enable the widespread adoption of electric propulsion and hybrid power systems, contributing to a greener and more sustainable future for marine transportation. Through strategic partnerships and investments in research and development, OEMs are poised to shape the trajectory of the global market, facilitating the transition towards cleaner and more efficient marine propulsion technologies.

Energy Density Insights

100 - 500 WH/Kg emerged as the largest energy density segment with a market share of about 63.5% in 2025 and is expected to witness robust growth over the forecast period. Batteries falling within this range provide sufficient energy density to support various marine vessels, including smaller boats, yachts, and some commercial ships. With advancements in battery technology, batteries in this energy density range offer improved performance, allowing vessels to operate efficiently while minimizing weight and space constraints.

Marine batteries within the 100 - 500 WH/Kg energy density range play a crucial role in enabling electric propulsion systems and supporting onboard electronics, navigation systems, and auxiliary equipment. Their ability to provide a favorable balance between energy density, power output, and weight makes them well-suited for powering marine vessels across different sizes and applications.

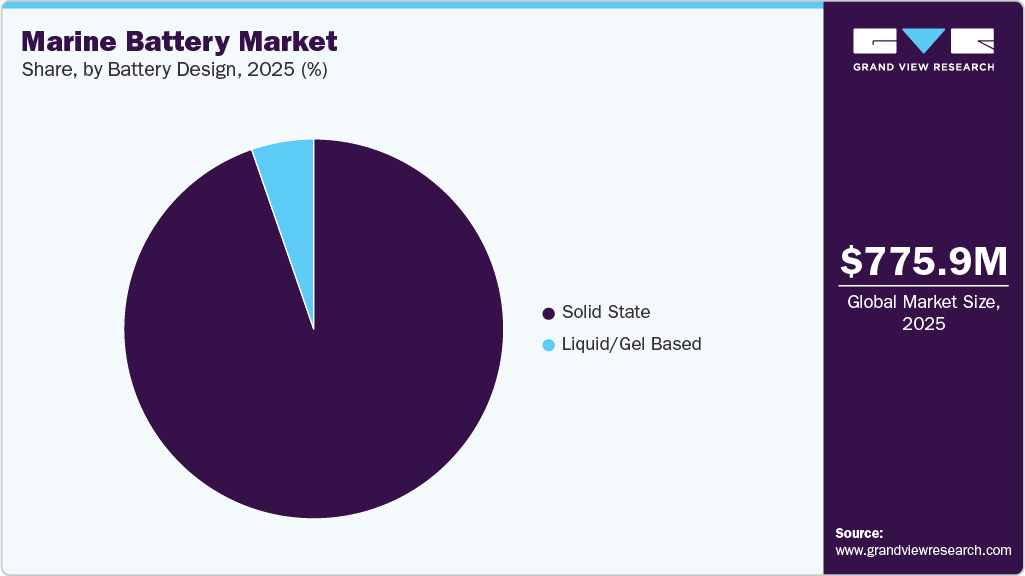

Battery Design Insights

Solid state emerged as the largest battery design segment with a market share of about 94.6% in 2025 and is expected to witness robust growth over the forecast period. These batteries utilize solid electrolytes instead of traditional liquid or gel electrolytes, offering improved safety, stability, and energy density. With their inherently safer design and reduced risk of thermal runaway, solid-state batteries are gaining traction in marine applications where reliability and safety are paramount concerns.

The adoption of solid-state batteries in the marine industry promises to revolutionize onboard power storage and propulsion systems, driving efficiency and sustainability. Their potential for faster charging, increased energy efficiency, and longer lifespan positions solid-state batteries as a key enabler of cleaner and more reliable marine transportation solutions.

Regional Insights

Europe accounted for the largest revenue share of 44.6% in the global market, driven by strong adoption of electric and hybrid marine vessels, stringent environmental regulations, and rapid electrification of inland waterways and short-sea shipping. The region benefits from a mature maritime industry, early adoption of clean propulsion technologies, and strict emission norms under EU maritime decarbonization targets. Countries such as Germany, Norway, the Netherlands, and France are leading the deployment of battery-powered ferries, offshore support vessels, and recreational boats.

In addition, robust government incentives, funding for green ports, and strong collaboration between shipbuilders, battery manufacturers, and energy storage providers are supporting large-scale commercialization. Europe’s advanced charging infrastructure, strong R&D ecosystem, and policy alignment with climate neutrality goals continue to reinforce its leadership position in the global market.

UK Marine Battery Market Trends

The UK marine battery market is trending toward higher adoption of lithium-ion systems (especially LiFePO₄) for leisure craft, workboats, and hybrid-electric propulsion due to demand for weight reduction, faster charging, longer cycle life, and space efficiency versus traditional lead-acid. Key developments include increasing hybridization and full-electric vessel pilots, stronger focus on port-side charging infrastructure, and rising demand for advanced Battery Management Systems (BMS), thermal safety, and certification compliance (e.g., IEC/IMO class rules) to support safe onboard deployment

North America Marine Battery Market Trends

The marine battery market in North America represents a significant market share, supported by growing electrification of recreational boats, ferries, and workboats, along with strong environmental regulations. The region’s growth is driven by increasing investments in clean maritime technologies, rising adoption of hybrid propulsion systems, and supportive federal and state-level sustainability initiatives.

The presence of advanced battery technology providers, rising demand for energy storage solutions in marine applications, and modernization of port infrastructure are further strengthening market growth across the region.

The U.S. marine battery market is driven by increasing adoption of electric and hybrid vessels across recreational boating, passenger ferries, and defense applications. Federal and state policies promoting emission reduction, clean transportation, and domestic battery manufacturing are supporting market expansion.

Growing investments in battery R&D, expansion of charging infrastructure at ports and marinas, and rising demand for reliable, high-performance energy storage systems are significantly contributing to market growth in the U.S.

Asia Pacific Marine Battery Market Trends

The marine battery market in the Asia Pacific is expected to register the fastest CAGR of 22.3% over the forecast period. The rapid expansion of shipbuilding activities drives growth in the Asia Pacific, the rising adoption of electric ferries and coastal vessels, and strong battery manufacturing capabilities across China, Japan, South Korea, and India. The region benefits from cost-competitive battery production, increasing investments in maritime electrification, and government initiatives aimed at reducing emissions from ports and inland water transport. Accelerating deployment of renewable energy, expansion of battery giga factories, and increasing public and private investments in marine electrification projects are further supporting market growth. As demand for energy-efficient and low-emission marine solutions rises, the Asia Pacific is emerging as the fastest-growing regional market.

Latin America Marine Battery Market Trends

The marine battery market in Latin America is developing steadily, supported by the gradual electrification of inland waterways, rising tourism-related marine activities, and increasing awareness of sustainable marine transport. Countries such as Brazil and Mexico are key contributors, driven by port modernization efforts and growing demand for energy-efficient marine solutions. While adoption remains at an early stage compared to developed regions, improving regulatory frameworks and increasing investments in clean energy are expected to support long-term market growth.

Middle East & Africa Marine Battery Market Trends

The marine battery market in the Middle East & Africa (MEA) is in a nascent but emerging phase, driven by growing investments in port infrastructure, offshore activities, and renewable energy projects. Demand for battery systems is rising in marine logistics, patrol vessels, and offshore support applications. Although battery adoption and charging infrastructure remain limited in several countries, increasing focus on sustainability, smart ports, and clean energy integration is expected to create new growth opportunities over the forecast period.

Key Marine Battery Company Insights

Some of the key market players operating include Corvus Energy, Leclanché S.A., Siemens AG, Saft SA, Shift Clean Energy, Echandia Marine AB, EST Floattech, Sensata Technologies, Inc., PowerTech Systems, and Lifeline Batteries, among others. These companies are actively engaged in the design, manufacturing, and integration of advanced battery and energy storage systems for electric and hybrid marine vessels such as ferries, offshore support vessels, recreational boats, and naval platforms. Market participants are focusing on high-energy-density technologies, safety-certified battery systems, modular designs, and lifecycle optimization, along with capacity expansion and strategic partnerships with shipbuilders, port operators, and vessel OEMs. In addition, collaborations with governments and maritime authorities are helping these players strengthen their global footprint and support the transition toward low-emission and zero-emission marine transportation.

Key Marine Battery Companies:

The following key companies have been profiled for this study on the marine battery market.

- Corvus Energy

- Echandia Marine AB

- EST Floattech

- Leclanché S.A.

- Lifeline Batteries

- PowerTech Systems

- Saft SA

- Sensata Technologies, Inc.

- Shift Clean Energy

- Siemens AG

Recent Developments

- In December 2025, Corvus Energy signed a strategic Memorandum of Understanding (MoU) with BYD Energy Storage to collaborate on advancing next-generation marine battery systems, combining BYD’s scale in LFP battery technology with Corvus’s expertise in marine energy storage to accelerate product development, expand global market reach, and support the maritime industry’s transition toward cleaner, more efficient energy solutions.

Marine Battery Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the global revenue generated from the manufacturing and sale of battery systems used in marine applications, including electric and hybrid vessels. It includes batteries across multiple chemistries, such as lithium-ion and lead-acid, deployed in commercial vessels, ferries, offshore support ships, recreational boats, and naval platforms worldwide.

Market size value in 2026

USD 893.1 million

Revenue forecast in 2033

USD 2,821.5 million

Growth rate

CAGR of 17.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026-2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Ships, battery, nominal capacity, propulsion type, ship power, battery design, battery type, sales channel, energy density, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Corvus Energy; Leclanché S.A.; Siemens AG; Saft SA; Shift Clean Energy; Echandia Marine AB; EST Floattech; Sensata Technologies, Inc.; PowerTech Systems; Lifeline Batteries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global marine battery market report based on ships, battery, nominal capacity, propulsion type, ship power, battery design, battery type, sales channel, energy density, and region:

-

Ships Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Defense

-

Unmanned

-

-

Battery Outlook (Revenue, USD Million, 2021 - 2033)

-

Starting Batteries

-

Deep-Cycle Batteries

-

Dual Purpose Batteries

-

-

Nominal Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

< 100 AH

-

100 - 250 AH

-

> 250 AH

-

-

Propulsion Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Hybrid

-

Fully Electric

-

-

Ship Power Outlook (Revenue, USD Million, 2021 - 2033)

-

< 75 KW

-

75 - 150 KW

-

150 - 745 KW

-

77 - 150 KW

-

-

Battery Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Solid State

-

Liquid/ Gel Based

-

-

Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium

-

Lead Acid

-

Nickel Cadmium

-

Sodium-Ion

-

Fuel Cells

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

OEM

-

After Market

-

-

Energy Density Outlook (Revenue, USD Million, 2021 - 2033)

-

<100 WH/Kg

-

100 - 500 WH/Kg

-

>500 WH/Kg

-

-

Regional Outlook (Million Nm3/hr, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marine battery market size was estimated at USD 775.9 million in 2025 and is expected to reach USD 893.1 million in 2026.

b. The global marine battery market is expected to grow at a compound annual growth rate of 17.9% from 2026 to 2033 to reach USD 2,821.5 million by 2033.

b. Based on the battery type segment, lithium held the largest revenue share of over 59% in the marine battery market in 2025.

b. Some of the key vendors operating in the global marine battery market include Corvus Energy, Leclanché S.A., Siemens AG, Saft SA, Shift Clean Energy, Echandia Marine AB, EST Floattech, Sensata Technologies, Inc., PowerTech Systems, and Lifeline Batteries, among others.

b. The key factors driving the marine battery market include the rising adoption of electric and hybrid marine vessels, growing emphasis on maritime decarbonization, and stringent emission regulations for shipping and port operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.