- Home

- »

- Network Security

- »

-

Maritime Cybersecurity Market Size, Industry Report, 2033GVR Report cover

![Maritime Cybersecurity Market Size, Share & Trends Report]()

Maritime Cybersecurity Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Security Type, By Deployment (On-premise, Cloud), By Organization Size, By End-user (Commercial Shipping, Port Operators), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-686-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Maritime Cybersecurity Market Summary

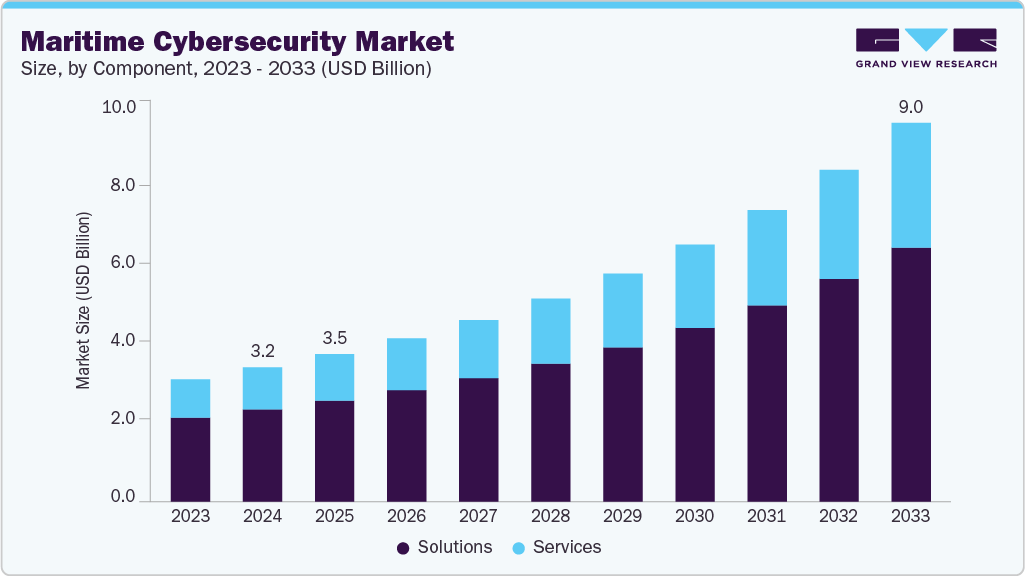

The global maritime cybersecurity market size was estimated at USD 3.19 billion in 2024 and is projected to reach USD 9.01 billion by 2033, growing at a CAGR of 12.5% from 2025 to 2033. The market is rapidly evolving to address the challenges of securing interconnected shipboard systems, port infrastructure, and global maritime supply chains.

Key Market Trends & Insights

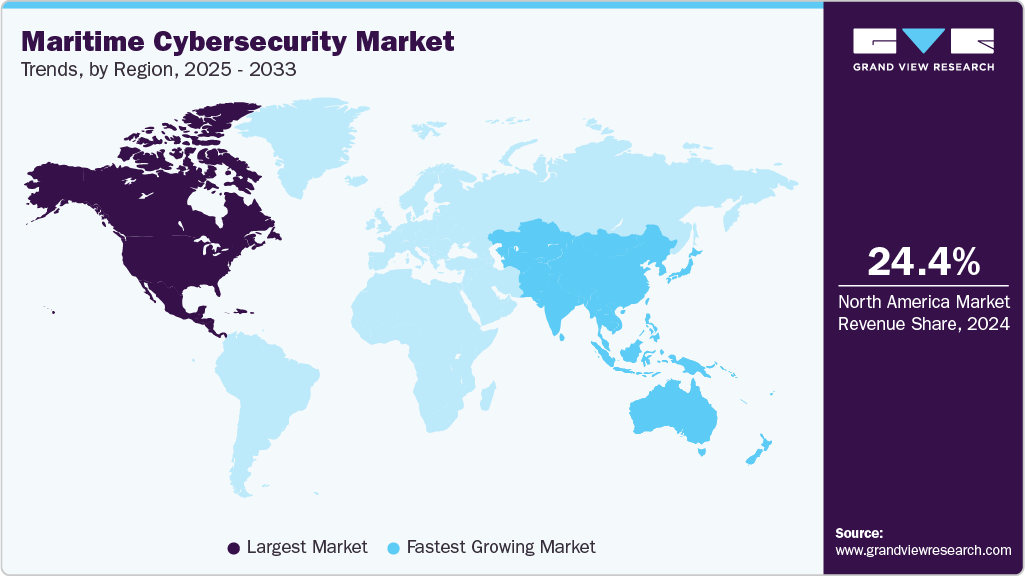

- North America held a 24.37% revenue share of the global maritime cybersecurity market in 2024.

- The U.S. market’s growth is driven by the country's expansive commercial shipping operations, strategic naval presence, and high concentration of technologically advanced ports.

- By security type, the network security segment held the largest revenue share of 33.17% in 2024.

- By organization size, the large enterprises segment accounted for the largest revenue share of 70.81% in 2024.

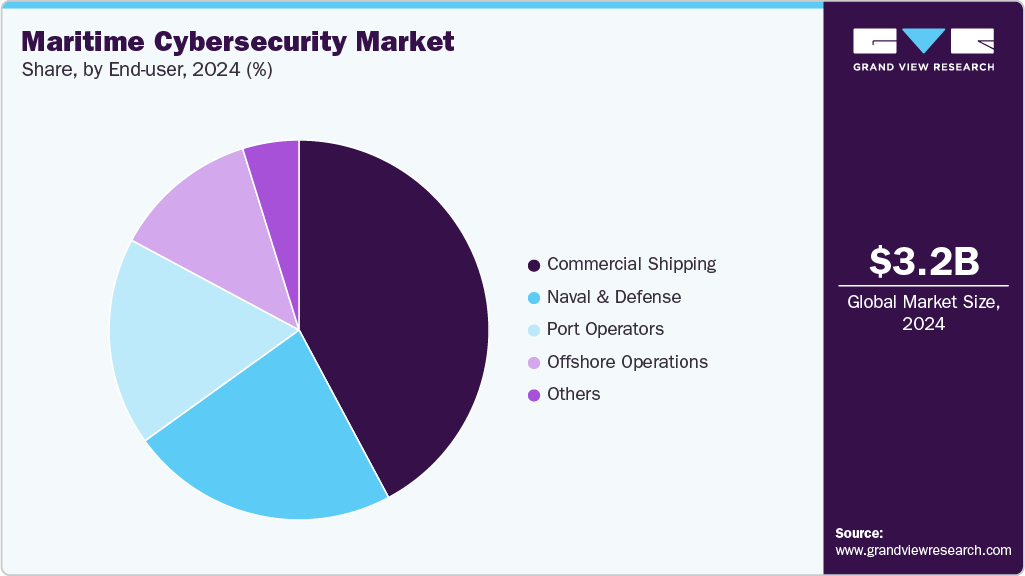

- By end-user, the commercial shipping segment led the maritime cybersecurity industry with the largest share of 42.19% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.19 Billion

- 2033 Projected Market Size: USD 9.01 Billion

- CAGR (2025-2033): 12.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As maritime operations digitize through satellite navigation, AI-enabled cargo handling, and real-time logistics platforms, the risk of cyberattacks on operational technology (OT) and vessel communication systems has increased, which is driving the growth of the maritime cybersecurity industry.Shipping companies and port operators are increasingly adopting layered cybersecurity frameworks that protect both IT and OT environments, incorporating network segmentation, encryption protocols, and threat detection tools tailored to maritime environments. Additionally, compliance with international regulations such as the IMO 2021 cybersecurity mandate and ISPS Code is also prompting operators to embed cybersecurity from vessel design to daily operations. Therefore, maritime stakeholders are investing in specialized cybersecurity solutions like intrusion detection systems, identity and access management, and risk and compliance tools to mitigate ransomware, spoofing, and remote access threats.

Additionally, ports and offshore operators are accelerating the adoption of incident response platforms and managed cybersecurity services to ensure operational continuity amid rising attack complexity. As digital twins, remote vessel monitoring, and AI-based port logistics are gaining traction, the need for real-time cybersecurity visibility across geographically distributed assets is becoming critical. Moreover, this shift is also supported by increased public-private collaboration, where maritime authorities and commercial fleets are formalizing cyber information-sharing protocols to improve sector-wide resilience. For instance, in January 2022, the Port of Los Angeles, in collaboration with IBM, launched the Port Cyber Resilience Center (CRC), a public-private initiative aimed at automating and enhancing the real-time sharing of cyber threat data among port stakeholders. This center leverages AI-based threat detection and cross-sector data feeds to strengthen the port’s ability to anticipate and mitigate attacks. Therefore, the global maritime cybersecurity market is transitioning from fragmented controls to proactive, intelligence-driven architectures that prioritize regulatory alignment and cyber-physical system protection.

Component Insights

The solutions segment accounted for the largest revenue share of 68.65% in 2024, driven by the growing reliance on comprehensive and integrated platforms that address the complex security requirements of the maritime industry. Additionally, as the sector undergoes rapid digital transformation, with increased deployment of interconnected onboard systems, satellite communications, and cloud-based logistics infrastructure, investors are prioritizing cybersecurity solutions that provide end-to-end protection, real-time threat detection, and regulatory compliance. These solutions encompass intrusion detection, encryption, identity and access management, and risk assessment tools tailored specifically for maritime environments. For instance, in January 2025, Cydome introduced a full Endpoint Detection and Response (EDR) solution integrated into its maritime cybersecurity platform, delivering advanced capabilities for continuous monitoring, automated threat mitigation, and forensic analysis across fleet-wide assets. This development enables ship operators to strengthen cyber resilience and reduce operational risks by proactively identifying and neutralizing cyber threats in real time. In conclusion, the growing need for scalable, intelligent, and regulation-aligned cybersecurity frameworks is driving the segment’s growth.

The services segment is expected to grow at the fastest CAGR of 13.1% during the forecast period, driven by the escalating need for continuous protection of operational technology networks and critical maritime infrastructure. As maritime operators face a surge in cyberattacks targeting onboard control systems, cargo management platforms, and port automation technologies, there is a growing reliance on third-party service providers to deliver specialized cybersecurity capabilities. These services encompass vulnerability assessments, real-time threat detection, compliance readiness, and managed incident response, addressing both regulatory mandates and operational demands. For instance, ABS Consulting launched a cybersecurity service aimed at protecting operational technology environments from targeted cyber threats, delivering risk management, monitoring, and threat response support for maritime clients. The offering is specifically designed to secure complex OT networks that support vessel and offshore platform operations, aligning with the maritime industry's need for robust cyber defense strategies. In conclusion, the increasing frequency of cyberattacks on maritime infrastructure is fueling the adoption of professional and managed cybersecurity services, positioning the services segment as the fastest-growing segment.

Security Type Insights

The network security segment led the maritime cybersecurity industry with the largest revenue share of 33.17% in 2024, driven by the increasing need to secure communication that connects vessels, ports, offshore platforms, and global logistics networks. As maritime operations increasingly rely on interconnected systems and real-time data flows for navigation and fleet coordination, securing network infrastructure against intrusion, data exfiltration, and system disruption has become a top priority. Network security solutions include advanced firewalls, intrusion detection and prevention systems, secure access controls, and network traffic monitoring form the first line of defense against both external and internal cyber threats. For instance, in September 2022, Cybereason announced a strategic partnership with Infinigate Group to expand access to its AI-driven cybersecurity platform across Europe, focusing on endpoint and network threat detection, prevention, and response for high-risk sectors, including maritime logistics. This collaboration is intended to strengthen real-time visibility and threat mitigation across distributed network environments, addressing the growing cyber risk in increasingly digitized maritime ecosystems. In conclusion, the rising threat landscape, combined with the operational criticality of maritime communication networks, is strengthening the position of the network security segment.

The Operational Technology (OT) Security segment is expected to grow at a CAGR of 13.0% over the forecast period, driven by the escalating need to secure critical control systems that govern vessel operations, port automation, and offshore infrastructure. As the maritime industry undergoes digital transformation, OT environments are increasingly integrated with IT systems, thereby expanding the attack surface and exposing vital operational assets to sophisticated cyber threats. In response, maritime stakeholders are prioritizing OT-specific cybersecurity strategies that include threat detection, protocol-aware intrusion prevention, real-time asset monitoring, and secure segmentation. For instance, in April 2024, Hexagon and Dragos partnered to strengthen cybersecurity, integrating Dragos' threat detection and response capabilities into Hexagon’s OT monitoring platforms to deliver comprehensive protection for maritime and port operations. This collaboration aims to improve asset visibility, identify control system vulnerabilities, and facilitate rapid incident response without disrupting mission-critical functions. In conclusion, the convergence of OT networks, coupled with the increasing cyber threat to operational infrastructure, is driving investment in OT security solutions, establishing it as the fastest-growing segment.

Deployment Insights

The on-premises segment accounted for the largest revenue share of 64.98% in 2024, driven by the maritime sector's preference for localized control, data confidentiality, and operational autonomy. On-premises deployments are favored across naval defense, offshore platforms, and port infrastructure, where consistent connectivity cannot be guaranteed and real-time threat response, low-latency system performance, and strict compliance with national and international security regulations are required. These deployments allow organizations to retain full governance over cybersecurity infrastructure, mitigate risks associated with external network dependencies, and tailor system configurations to their specific operational environments. In conclusion, the demand for secure and self-contained cybersecurity frameworks is strengthening the dominance of the on-premises deployment model.

The cloud segment is predicted to witness the fastest CAGR of 13.3% over the forecast period, fueled by the increasing demand for real-time and centrally managed cybersecurity infrastructure across complex maritime ecosystems. Additionally, as ports and shipping operators embrace digital transformation, cloud-based solutions offer the flexibility to deploy advanced threat detection, compliance tools, and security updates. Moreover, these solutions enable continuous monitoring, improved cyber visibility, and enhanced coordination across fleets and terminals, particularly for geographically distributed operations. For instance, in November 2024, Waterfall Security Solutions partnered with GoCloud to deliver secure, cloud-enabled cybersecurity infrastructure for North America's largest maritime port, combining cloud-native technologies with unidirectional gateway protection to ensure secure data transmission without exposing critical operational systems to external threats. In conclusion, the rising complexity of maritime operations, combined with the need for scalable and continuously updated cybersecurity capabilities, is propelling the adoption of cloud-based solutions.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of 70.81% in 2024, driven by their expansive global operations, high-value digital assets, and exacting regulatory requirements. Multinational shipping companies, offshore energy operators, and port authorities manage complex IT and operational technology infrastructures that span multiple jurisdictions, making them prime targets for advanced cyberattacks. Consequently, these organizations invest heavily in robust cybersecurity ecosystems, including advanced threat detection, network defense architectures, managed services, and compliance support. They are also early adopters of AI-enhanced analytics, cloud-integrated platforms, and zero‑trust frameworks tailored for maritime environments. For instance, in June 2025, Cydome entered a strategic partnership with MarineNet to integrate its ClassNK‑approved cybersecurity solutions into MarineNet’s MN‑Station platform, providing large maritime enterprises with a cohesive IT and security management system tailored to vessel and shore-based operations. In conclusion, the operational complexity, asset criticality, and compliance-driven imperatives of large maritime organizations continue to strengthen their position in the global market.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at the fastest CAGR of 13.2% during the forecast period, driven by the rising need for scalable and cost-effective cybersecurity solutions that address the limited resources and operational complexity of smaller maritime organizations. As SMEs increasingly adopt digital tools, their exposure to cyber risk has grown alongside their adoption of IoT, AI, and remote capabilities. Moreover, these organizations lack internal cybersecurity teams and budget for extensive in-house solutions, prompting a shift toward outsourced, platform-based security services. For instance, in July 2024, the Maritime and Port Authority of Singapore (MPA) partnered with Microsoft under a memorandum of understanding to deliver cybersecurity capabilities targeting SMEs through cloud computing, AI tools, and digital twins. The scheme enables smaller maritime firms to tap into advanced threat detection, early cyber issue identification, and timely response protocols without the need for significant in-house investment.

End-user Insights

The commercial shipping segment led the maritime cybersecurity industry with the largest share of 42.19% in 2024, driven by the digitalization of fleet operations, heightened exposure to cyber risks, and increasingly stringent regulatory requirements. Key drivers include the growing dependence on integrated navigation systems and satellite connectivity, the expansion of IoT-based cargo tracking and smart fleet platforms, and the need to comply with evolving international cybersecurity regulations such as IMO 2021 and IACS Unified Requirements E26 and E27. Additionally, commercial shipping operators are prioritizing onboard threat visibility, incident response readiness, and compliance monitoring as cyberattacks targeting vessels and shipping infrastructure continue to rise. For instance, in July 2024, DNV announced its acquisition of CyberOwl to enhance its maritime cybersecurity portfolio and support commercial fleet operators with real-time risk monitoring and compliance reporting. This highlights the tightening of cybersecurity standards across the maritime industry and the increasing pressure on shipping companies to ensure continuous protection of their digital infrastructure. In conclusion, the commercial shipping sector’s expansive digital footprint, global operational exposure, and regulatory obligations are driving sustained cybersecurity investments in the global market.

The naval and defense segment is expected to grow at the fastest CAGR of 12.9% during the forecast period. This is fueled by the rising complexity of modern maritime warfare, the expansion of digitally enabled defense systems, and the escalating threat of cyberattacks. Additionally, as naval forces globally integrate advanced technologies such as multi-domain C4ISR systems, autonomous platforms, and AI-driven targeting and navigation capabilities, the need to secure operational technology and communications infrastructure has become critical. This growing digital footprint across fleet assets demands resilient, cyber-hardened systems that ensure mission continuity and national security. For instance, in November 2024, BAE Systems secured a USD 251 million contract from the U.S. Navy to support the development, sustainment, and modernization of the AEGIS Combat System, including cybersecurity enhancements that strengthen system resilience and threat response capabilities across naval vessels.In conclusion, the increasing sophistication of cyber threats targeting defense infrastructure, combined with the digital transformation of naval fleets, is accelerating cybersecurity investments, thereby contributing to the global market growth.

Regional Insights

North America maritime cybersecurity market accounted for the largest share of 24.37% in 2024, supported by its advanced port infrastructure, elevated cyber threat exposure, and proactive regulatory environment. Additionally, the region is witnessing a push toward the integration of AI-driven analytics, cloud-based cybersecurity frameworks, and real-time monitoring systems across both commercial and defense maritime sectors. Moreover, major ports in the United States and Canada are embedding cybersecurity into their broader digital transformation agendas, with a focus on securing operational technology, vessel-to-shore communication networks, and logistics platforms. Furthermore, growing collaboration between federal agencies and private sector stakeholders is fostering investment in cyber resilience initiatives, particularly at high-traffic ports along the Gulf Coast, Pacific Northwest, and Atlantic corridors. These region-specific advancements underscore North America’s leadership in advancing maritime cybersecurity standards, infrastructure, and operational preparedness.

U.S. Maritime Cybersecurity Market Trends

The U.S. maritime cybersecurity industry’s growth is driven by the country's expansive commercial shipping operations, strategic naval presence, and high concentration of technologically advanced ports. Increasing cyber threats targeting critical maritime infrastructure, such as port automation systems, vessel navigation networks, and logistics platforms, have prompted substantial investments in cybersecurity solutions across both the public and private sectors. Additionally, government-backed initiatives, such as the Cybersecurity and Infrastructure Security Agency’s collaboration with maritime stakeholders, are enhancing threat intelligence sharing and resilience planning. As major ports such as Los Angeles, New York-New Jersey, and Houston advance their digital modernization initiatives, the United States maritime cybersecurity market is placing increased emphasis on comprehensive cybersecurity integration. This strategic focus on securing interconnected maritime environments reinforces the country’s position as a global leader in the development and implementation of advanced maritime cybersecurity capabilities.

Europe Maritime Cybersecurity Market Trends

The maritime cybersecurity industry in Europe is anticipated to register considerable growth from 2025 to 2033. The growth is attributed to the strong regulatory enforcement and heightened geopolitical tensions influencing national security priorities. Also, the implementation of the EU Network and Information Systems (NIS2) Directive and the International Maritime Organization’s cybersecurity guidelines have accelerated compliance-driven investments across European shipping lines and port authorities. Moreover, the rise in cyber incidents targeting critical maritime infrastructure in the Baltic and North Sea regions has prompted a surge in public-private cybersecurity collaboration and threat intelligence sharing. With the European Union prioritizing maritime resilience as part of its broader digital sovereignty strategy, the region is fostering innovation in operational technology protection across national and cross-border maritime networks.

The UK maritime cybersecurity market is experiencing growth, driven by the country's strategic focus on maritime resilience, increasing cyber threats to critical infrastructure, and robust regulatory alignment with European cybersecurity standards. As a key maritime hub with high-traffic ports such as Felixstowe, Southampton, and London Gateway, the UK is prioritizing the protection of both commercial and naval digital ecosystems through the adoption of advanced cybersecurity solutions. Additionally, the UK government’s National Cyber Strategy and the Maritime Coastguard Agency’s cybersecurity guidance for shipowners and port facilities are reinforcing compliance across the sector. Moreover, growing collaboration between defense agencies, private shipping operators, and technology providers is enabling real-time threat detection and cyber risk management. Consequently, with increased investment in cloud-native security platforms and maritime-specific SOC capabilities, the UK continues to enhance its position as a leading market in Europe.

The maritime cybersecurity market in Germany is gaining momentum, supported by the country’s strategic role in European trade and its strong industrial cybersecurity capabilities. Additionally, Germany encompasses major ports such as Hamburg, Bremerhaven, and Wilhelmshaven and is investing in advanced cybersecurity solutions to protect its automated and interconnected maritime operations. Moreover, regulatory frameworks such as the German IT Security Act 2.0 and the EU’s NIS2 Directive are compelling maritime operators to adopt robust cyber risk management practices. Further, Germany’s emphasis on secure data exchange, supply chain continuity, and public-private collaboration is accelerating the deployment of endpoint security and real-time monitoring across vessels and shore-based systems.

Asia Pacific Maritime Cybersecurity Market Trends

The Asia Pacific maritime cybersecurity industry is expected to register the fastest CAGR of 13.1% from 2025 to 2033, driven by rapid digitalization of port infrastructure, expansion of regional trade routes, and heightened vulnerability to state-sponsored cyber threats. Countries such as China, Singapore, South Korea, and Japan are heavily investing in smart port initiatives, which integrate IoT, AI, and real-time analytics into port and vessel operations. Moreover, regulatory momentum is also accelerating, with authorities introducing maritime cybersecurity frameworks aligned with IMO and domestic security standards to ensure the protection of critical infrastructure. Additionally, regional collaborations such as ASEAN’s cybersecurity capacity-building programs and Japan’s trilateral defense tech-sharing agreements are advancing threat intelligence sharing and maritime cyber resilience. Subsequently, the presence of key shipping hubs in Singapore, Busan, and Shanghai, combined with growing investment in OT-focused security solutions, positions Asia Pacific as a dynamic and rapidly evolving market for maritime cybersecurity adoption.

Japan's maritime cybersecurity market is expanding steadily, driven by the country’s strategic maritime position and increasing focus on securing digitally advanced naval and commercial port infrastructure. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) and the Japan Maritime Self-Defense Force are actively enhancing cybersecurity frameworks across both civilian and defense maritime domains. Additionally, Japan’s smart port initiatives in Kobe, Yokohama, and Tokyo are incorporating AI, IoT, and automation technologies, prompting higher investment in OT security, real-time monitoring, and risk assessment solutions. Furthermore, Japan is also strengthening trilateral cybersecurity cooperation with the United States and South Korea, particularly under its “USADEN” framework, which integrates cyber, space, and electromagnetic domain defense capabilities.

The maritime cybersecurity market in China is witnessing robust growth, propelled by the nation’s expansive maritime infrastructure and rapid adoption of smart port technologies. Additionally, as the world’s largest trading nation with major ports like Shanghai, Ningbo-Zhoushan, and Shenzhen, China is heavily investing in digital transformation across its port and shipping networks. Furthermore, the Chinese government has embedded maritime cybersecurity into its broader national cybersecurity and critical infrastructure protection frameworks, guided by policies such as the Cybersecurity Law and the Data Security Law.

India’s maritime cybersecurity market is experiencing growth, driven by the modernization of port infrastructure and strategic government initiatives aimed at enhancing critical infrastructure security. As India expands its role in global maritime trade through key ports such as Mumbai, Chennai, and Visakhapatnam, the integration of digital technologies, including automated cargo handling, electronic data interchange, and satellite-based vessel tracking, has heightened the need for robust cybersecurity measures. In addition, the Indian government, through agencies like the Ministry of Ports, Shipping, and Waterways and the Indian Computer Emergency Response Team (CERT-In), is actively promoting cybersecurity frameworks tailored to the maritime sector. Moreover, the Sagarmala Programme and Maritime India Vision 2030 further signify the push toward smart port development with cybersecurity as a foundational element. Subsequently, as cyberattacks targeting logistics and critical infrastructure rise in the region, India is prioritizing the adoption of threat detection and compliance solutions, positioning its market for strong growth.

Key Maritime Cybersecurity Company Insights

Key players operating in the maritime cybersecurity industry are Naval Dome Ltd., Cydome Security Ltd., CyberOwl Ltd., and ABS Group of Companies, Inc. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some examples of such initiatives:

-

In May 2025, Thales announced advancements in its naval cybersecurity capabilities by integrating AI-powered threat detection and secure digital architectures into naval defense systems, reinforcing cyber resilience across modern maritime combat environments.

-

In June 2024, Speedcast embedded Cydome’s real-time detection, AI-driven threat analytics, vulnerability scanning, and SIEM features into its SIGMA platform. The solution offers fleet-wide monitoring, regulatory compliance support, and managed SOC services, helping maritime clients meet evolving standards such as IACS E26, IMO, and NIS2.

-

In April 2023, ABS Wavesight formed a strategic alliance with ActZero to deliver AI-driven cybersecurity solutions tailored for the maritime industry, enhancing threat detection and response across fleet and port operations.

Key Maritime Cybersecurity Companies:

The following are the leading companies in the maritime cybersecurity market. These companies collectively hold the largest market share and dictate industry trends.

- Naval Dome Ltd.

- Cydome Security Ltd.

- CyberOwl Ltd.

- ABS Group of Companies, Inc.

- Waterfall Security Solutions Ltd.

- Kongsberg Gruppen ASA

- Northrop Grumman Corporation

- Thales Group

- BAE Systems plc

- Honeywell International Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Raytheon Technologies Corporation

- Wärtsilä Corporation

- Marlink SAS

Maritime Cybersecurity Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3.51 billion

Revenue forecast in 2033

USD 9.01 billion

Growth rate

CAGR of 12.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, security type, deployment, organization size, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Naval Dome Ltd.; Cydome Security Ltd.; CyberOwl Ltd.; ABS Group of Companies, Inc.; Waterfall Security Solutions Ltd.; Kongsberg Gruppen ASA; Northrop Grumman Corporation; Thales Group; BAE Systems plc; Honeywell International Inc.; Cisco Systems, Inc.; Fortinet, Inc.; Raytheon Technologies Corporation; Wärtsilä Corporation; Marlink SAS

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Maritime Cybersecurity Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the maritime cybersecurity market report based on component, security type, deployment, organization size, end-user, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solutions

-

Risk and Compliance Management

-

Identity and Access Management

-

Firewall and Intrusion Detection Systems

-

Encryption

-

Incident Response

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Security Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Network Security

-

Endpoint Security

-

Application Security

-

Cloud Security

-

Operational Technology (OT) Security

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

End-user Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial Shipping

-

Naval and Defense

-

Port Operators

-

Offshore Operations

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global maritime cybersecurity market size was estimated at USD 3.19 billion in 2024 and is expected to reach USD 3.51 billion in 2025.

b. The global maritime cybersecurity market is expected to grow at a compound annual growth rate of 12.5% from 2025 to 2033 to reach USD 9.01 billion by 2033.

b. The large enterprises segment accounted for the largest share of 70.81% in 2024, driven by their expansive global operations, high-value digital assets, and exacting regulatory requirements.

b. Some key players operating in the market include Naval Dome Ltd., Cydome Security Ltd., CyberOwl Ltd., ABS Group of Companies, Inc., Waterfall Security Solutions Ltd., Kongsberg Gruppen ASA, Northrop Grumman Corporation, Thales Group, BAE Systems plc, Honeywell International Inc., Cisco Systems, Inc., Fortinet, Inc., Raytheon Technologies Corporation, Wärtsilä Corporation, Marlink SAS and Others.

b. Factors such as digitization through satellite navigation, AI-enabled cargo handling, and real-time logistics platforms, the risk of cyberattacks on operational technology (OT) and vessel communication systems has increased is driving the growth of maritime cybersecurity market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.