- Home

- »

- Communication Services

- »

-

Marketing Analytics Software Market Size Report, 2030GVR Report cover

![Marketing Analytics Software Market Size, Share & Trends Report]()

Marketing Analytics Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Solution, Service), By Deployment, By Organization Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-286-6

- Number of Report Pages: 154

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marketing Analytics Software Market Summary

The global marketing analytics software market size was estimated at USD 3.78 billion in 2022 and is projected to reach USD 12.51 billion by 2030, growing at a CAGR of 16.7% from 2023 to 2030. The continuous need to penetrate the market more effectively and understand consumer demands is expected to encourage organizations and institutions to adopt marketing analytics tools and solutions.

Key Market Trends & Insights

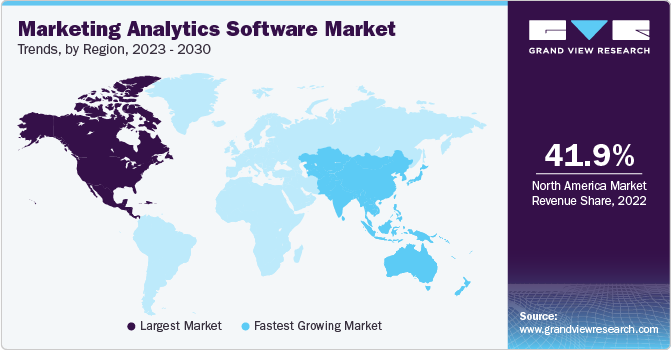

- North America dominated the marketing analytics software market with the largest revenue share of 41.9% in 2022.

- By application, the social media marketing segment led the market with the largest revenue share of 28.9% in 2022.

- By deployment, the cloud segment led the market with the largest revenue share of 72.3% in 2022.

- By organization size, the small & medium enterprises segment is expected to register at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3.78 Billion

- 2030 Projected Market Size: USD 12.51 Billion

- CAGR (2023-2030): 16.7%

- North America: Largest market in 2022

The use of marketing analytics enables companies to understand the performance of their marketing campaigns better and engage in comparative analysis as to which application offers the highest returns. It is done by gauging critical business metrics, such as marketing attribution, overall marketing effectiveness, and return on investment (ROI).Cloud computing technology has been one of the primary growth drivers for the market. Large enterprises engage in several marketing channels, which results in the generation of large datasets. Cloud computing enables marketers to organize and analyze structured and non-structured data cost-effectively using marketing analytics platforms. The popularity of cloud-based marketing analytics software has increased owing to benefits such as better functionality and cost-effectiveness, and this has encouraged service providers, such as Oracle Corporation and Adobe Inc., to offer cloud analytics solutions to marketers.

The rapid penetration of social media platforms has also offered growth opportunities to market players. Facebook and Instagram are two of the most used social media platforms worldwide that offer marketers new channels to advertise their products. Social media platforms gather a large amount of user data, such as audience demographics and demands, which can be effectively utilized to understand consumer buying preferences and offer products, services, and solutions according to their needs. Several SMEs such as Zulily, LLC, RealEats, and large enterprises such as TGI Fridays Franchisor, LLC and Subway IP LLC have used marketing analytics solutions, which have helped the companies enhance their product applications and improve business operations.

Organizations continuously undertake various measures to optimize their marketing investment, which is spent on marketing campaigns. Big data analytics has facilitated the growth of the market as it helps in analyzing customer loyalty, marketing performance, and consumer engagement. The popularity of the Marketing Mix Model (MMM) is fueling market growth due to the technology's ability to help organizations estimate spending on different advertising channels and their effectiveness. It has resulted in a rising demand to upskill marketers or hire technically qualified marketers responsible for incremental market growth.

Social media marketing is a crucial strategy opted for by publishers for monetization. The digital marketing model envisages the application developers getting paid by the advertising agencies for serving the advertisements via their mobile apps. Mobile-based advertising is playing a decisive role in driving global media consumption. Hence, social media is emerging as a vital marketing channel for advertising agencies and brands. By enabling features such as sophisticated user targeting and data tracking, social media marketing platforms also allow advertisers to target customers with pinpoint accuracy. Several publishers and marketers are adding social media channels and cross-device campaigns to their advertising strategies.

Apart from targeting users individually based on their interests and locations, among other parameters, advertisers and marketers are also leveraging advances in technology to improve the ability to ensure that appropriate ads are delivered flawlessly to the relevant users. Any further advances in technology would continue to improve the effectiveness of the delivery of marketing solutions.

The outbreak of the COVID-19 pandemic brought about a paradigm shift in the behavior of individuals when it comes to using different digital platforms for buying. Advertising companies increasingly followed digital marketing techniques, providing publishers with advanced advertising capabilities. As the smartphone penetration rate increase, marketers look forward to collaborating with digital marketing platforms for promotional activities and eventually switching from conventional to digital marketing channels.

Individuals' rising usage of social media platforms is expected to offer new growth opportunities in the sector, enabling companies to determine marketing campaigns' performance. Using social media platforms as marketing channels helps organizations increase brand awareness, boosting sales results.

Social media analytics also enables marketers to gauge the RoI of advertising campaigns in real time. It can be through website visits via ad posts, engagement, and clicks on the advertising campaign. For instance, in 2020, McDonald's India North and East started a new social media advertisement campaign, McGrillisBack, to capture a larger revenue share in the Quick Service Restaurant (QSR) market. The campaign helped the company gain 24,000 posts on Twitter and more than 200 followers on Instagram.

Application Insights

Based on application, the market is segmented into social media marketing, e-mail marketing, search engine marketing, content marketing, and others. The social media marketing segment accounted for the largest revenue share of around 28.9% in 2022. It can be attributed to the high usage of social media platforms in developing economies, such as India, Indonesia, and Brazil. The availability of affordable internet packages has aided the internet to reach earlier inaccessible places, enabling marketers to identify people's needs and devise suitable marketing campaigns. Social media marketing also enables marketing teams to improve customer relations and monitor competition more efficiently by carefully analyzing consumer engagement trends. It is promoting the wide-scale adoption of social media marketing practices.

The e-mail marketing segment accounted for a significant revenue share in 2022. It can be attributed to factors such as effectiveness in reaching more people directly and the ability to form deeper relations. Even though social media marketing offers detailed audience data, e-mail marketing offers a higher conversion ratio as different advertising campaigns can be planned according to different groups of people. People usually subscribe to their preferred brands' e-mail lists, which allows marketers to improve engagement rates, brand awareness, and revenue generated by marketing activities.

The others segment is estimated to register the fastest CAGR of 19.9% over the forecast period. The others segment comprises web, speech, and customer life cycle analytics. The rise of omnichannel marketing and the proliferation of digital channels created a need for comprehensive analytics solutions. Speech and marketing analytics software can integrate data from multiple channels, such as call centers, social media platforms, websites, and mobile apps, providing a holistic view of customer interactions and marketing performance.

Deployment Insights

Based on deployment, the market is segmented into on-premise and cloud. The cloud segment accounted for the largest revenue share of around 72.3% in 2022. Several SMEs prefer adopting the cloud deployment model, enabling them to leverage marketing analytics software without changing the existing IT infrastructure. Furthermore, the cloud deployment model enables organizations to use public, private, or hybrid clouds according to the marketing team’s requirements. Cloud-based marketing analytics software further aids in scalability and offers flexibility for data analysis, thus offering an impetus to the marketing analytics software industry growth.

The on-premise segment is estimated to register the fastest CAGR of 18.7% over the forecast period, owing to higher security and control offered by on-premise data centers. The on-premise deployment of marketing analytics software improves data accessibility for marketing teams, helping to fit the results according to end-users. Deploying an on-premise analytics platform encourages companies to hire specialized talent, thus ensuring high-quality output. Additionally, the on-premise deployment model helps users customize their software according to the needs and requirements of their marketing teams, thus enabling them to get the desired result.

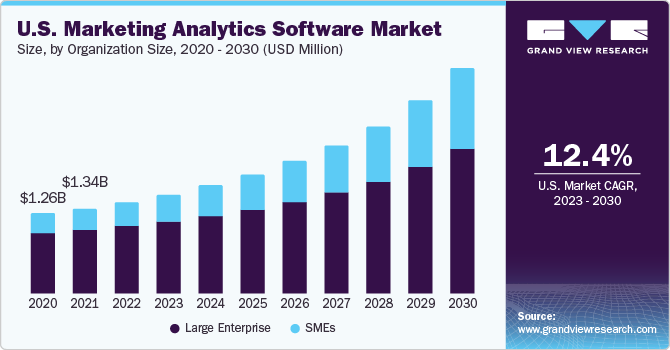

Organization Size Insights

Based on organization size, the market is segmented into large enterprises and small & medium enterprises. The large enterprises segment accounted for the largest revenue share of around 72.9% in 2022. Large enterprises indulge in exhaustive marketing practices and run different marketing campaigns. Online and offline campaigns run by brands and agencies across various channels generate large amounts of data pertaining to consumer behavior data, ad effectiveness, and audience preferences. Marketing analytics software helps marketers gain useful insights from this data, make necessary changes to their marketing campaigns, track revenue growth, and enhance service offerings.

The small & medium enterprises segment is estimated to register the fastest CAGR of 20.4% over the forecast period, owing to the rising need to design more interactive and better marketing campaigns. The growing popularity of social media and the ability to indulge in cost-effective cloud-based analytics practices encourage SMEs to engage in cost-effective marketing practices, thus offering growth opportunities. Furthermore, marketing analytics improves marketers’ search capabilities by cost-effectively providing detailed insights into prospective customers. These insights encourage SMEs to develop data-driven marketing campaigns and offer services at more affordable rates to their customers.

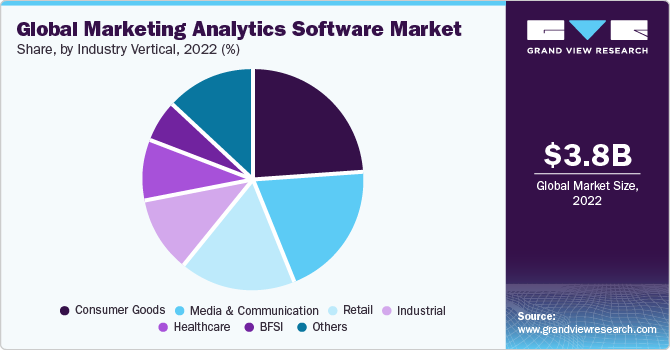

Industry Vertical Insights

Based on industry vertical, the market is segmented into retail, consumer goods, industrial, BFSI, media & communication, healthcare, and others. The consumer goods segment accounted for the largest revenue share of 23.7% in 2022. It can be attributed to the rising demand amongst consumer goods companies to identify and predict consumer behavioral trends and product positioning efficiency. Consumer goods companies generate copious amounts of data regularly, which includes data pertaining to sales and consumer buying preferences. This data is analyzed to determine the efficiency of marketing campaigns and then design a marketing strategy that churns maximum profits and improves business efficiency.

The BFSI segment is estimated to register the fastest CAGR of 22.2% over the forecast period. The rise of digital transformation within the BFSI sector has led to the proliferation of multiple customer touchpoints, such as websites, mobile apps, and social media platforms. It has generated a wealth of data, which can be harnessed to improve marketing effectiveness. Marketing analytics software allows organizations to consolidate and integrate data from various sources, enabling a holistic view of customer interactions across channels.

The media and communication segment accounted for a significant revenue share in 2022 owing to the rise in the adoption of smart devices and connected ecosystems, creating a demanding customer base. Marketers in the media and communication sector need to understand the nature of audience interaction and the type of content across various screens and channels. This data will be processed via analytics platforms for quick, holistic, and real-time views of consumers' content-viewing patterns and preferences to strategize efficient marketing campaigns. Several companies, including Netflix, have been using marketing analytics, which helps them engage in fine-grained and in-depth audience analytics and increase the content deal for "House of Cards" to nearly double the initial amount.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.9% in 2022. It can be attributed to the high social media usage trend and the region's availability of high-speed internet services. The high usage of social media offers marketers a new and efficient channel to engage in advertising and marketing practices. Furthermore, a significant e-commerce ecosystem in the region allows marketers to analyze the data generated by e-commerce sales, thus offering insights regarding customer buying preferences, which helps design efficient marketing strategies.

No one can exactly predict the result when it comes to measuring customer behavior. It is more important to gauge customer behavior regarding their purchasing patterns and decisions. The analysis tools provide what the customers are most likely to buy next time or less likely to buy. So, the incremental term defines getting more customers to shop, eventually leading marketers to sell more products. The data analysis software or tool will group these customers into new and repeated customers. They apply various algorithms and calculations, such as double delta calculations, on these groups, which allows them to measure the promotional and non-promotional impact of the marketing campaign. Customer frequency, breadth of shopping pattern, customer consistency, marketing response, average units per month, and promotional mix of sales are some of the KPIs for the business that helps in analyzing the impact of marketing actions. Marketing analytics software helps record these metrics and allows us to perform various calculations. Tracking these metrics permits identifying whether the business is growing or shrinking and allows creating and strengthening of customer relationships that will develop loyal customers. More is the repeated customers, and more is the business and incremental growth.

Asia Pacific is expected to register the fastest CAGR of 20.2% over the forecast period. It can be attributed to the vital AI development hubs in Singapore, Vietnam, and Malaysia. The emergence of new startups that offer AI-enabled analytics services is also driving the regional market. Additionally, the rapid implementation of digital government initiatives in Singapore and China has led to the emergence of several startups that offer services based on analytics and other advanced technologies, offering an impetus to regional market growth.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in May 2023, Mixpanel announced the launch of marketing analytics. Mixpanel Marketing Analytics enables brands to gain insights into the channels that drive new user acquisition through multi-touch attribution. It also helps brands enhance their return on advertising spend (ROAS) by continuously monitoring the performance of channels and campaigns. Mixpanel allows brands to identify their most valuable customer segments by creating demographic or behavioral cohorts. By understanding these segments, brands can improve their campaign targeting and tailor their marketing strategies to reach the right audience.

There has been a shift in organizational demands when hiring marketing professionals. Companies now prefer more technically inclined marketing individuals to handle and process large datasets more efficiently. Corporations have also started engaging in M&A activities to diversify their service offerings and enhance the end-user experience. For instance, in November 2020, Accenture acquired End-to-End Analytics to positively impact the supply chain, trade promotion, pricing, and marketing using its strong portfolio of accelerators and assets.

Key Marketing Analytics Software Companies:

- Accenture

- Adobe Inc.

- Google, LLC

- Funnel.io

- IBM Corporation

- Oracle

- SAS Institute Inc.

- TABLEAU SOFTWARE, LLC Teradata

Recent Developments

-

In June 2023, in4mation Insights LLC and The Hershey Company announced a multi-year strategic partnership. In4mation Insights plans to utilize its sophisticated Bayesian analytics tools to create tailored media mix models that can effectively tackle the changing complexities in the media industry and revolutionize decision-making processes at Hershey. The Hershey Company will also employ Optimetry, a cutting-edge simulation and optimization tool developed by in4mation insights, to enhance its operations.

-

In January 2023, Growth Natives announced the launch of DiGGrowth, an AI-driven, no-code marketing analytics. DiGGrowth seamlessly incorporates the entire marketing stack, facilitating the measurement of marketing effectiveness, utilization of marketing intelligence, streamlining of data analytics, and enhancement of sales and revenue generation. With DiGGrowth, marketers can effortlessly integrate their entire marketing stack using plug-and-play connectors, obtaining comprehensive reports that provide valuable insights into their marketing effectiveness and enable accurate revenue attribution.

-

In July 2022, Neustar, a TransUnion LLC company, announced a collaboration with Adverity, an integrated data platform. This partnership provides marketers a convenient way to connect their data, enhancing marketing effectiveness and brand performance. Through this collaboration, brands and agencies can measure marketing performance across various online and offline channels, including walled gardens and television ecosystems. The collaboration enables Neustar to use Adverity Connect's automated data connectors and data management capabilities to boost marketing analytics modeling powered by Neustar Optimizer.

-

In February 2022, LinkedIn Corporation announced the acquisition of Oribi. The objective is to offer actionable insights, enable smarter decision-making, and drive better business outcomes. By integrating Oribi's technology into LinkedIn's marketing solutions platform, customers will enjoy improved campaign attribution, allowing them to optimize their advertising strategies' return on investment (ROI). In addition, LinkedIn expanded its presence in Tel Aviv, Israel, as part of this agreement, which will expand its international presence and contribute to the increased value it delivers.

-

In January 2022, Unbounce, the conversion intelligence platform, announced the acquisition of LeadsRx, Inc, a software-as-a-service (SaaS) platform specializing in marketing analytics. With this strategic acquisition, Unbounce aims to empower its small and midsize business clients by integrating advanced marketing attribution capabilities into its offerings.

Marketing Analytics Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.25 billion

Revenue forecast in 2030

USD 12.51 billion

Growth rate

CAGR of 16.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Deployment, Organization Size, Industry Vertical, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Mexico, United Arab Emirates, Saudi Arabia, South Africa

Key companies profiled

Accenture, Oracle, SAS Institute Inc., IBM Corporation, TABLEAU SOFTWARE, LLC, Teradata, Adobe Inc., Google, LLC, Funnel.io

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marketing Analytics Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global marketing analytics software market report on the basis of application, deployment, organization size, industry vertical, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Social Media Marketing

-

E-Mail Marketing

-

Search Engine Marketing

-

Content Marketing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Consumer Goods

-

Industrial

-

BFSI

-

Media & Communication

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marketing analytics software market size was estimated at USD 3.78 billion in 2022 and is expected to reach USD 4.25 billion in 2023.

b. The global marketing analytics software market is expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030 to reach USD 12.51 billion by 2030.

b. North America dominated the marketing analytics software market with a share of 41.92% in 2022. This is attributable to the rising need for large datasets of historic marketing data by marketing teams coupled with cloud-based technologies acceptance and constant research and development initiatives.

b. Some key players operating in the marketing analytics software market include Accenture, Oracle, IBM Corporation, and Funnel.io.

b. Key factors driving the marketing analytics software market growth include rising demand for consumer data to understand their needs & demands and the incremental use of technologies such as big data analytics & cloud computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.