- Home

- »

- Research

- »

-

Marketing Cloud Platform Market Size, Industry Report, 2033GVR Report cover

![Marketing Cloud Platform Market Size, Share & Trends Report]()

Marketing Cloud Platform Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode (Public Cloud, Private Cloud), By Organization, By Marketing Function, By End-use (BFSI, IT & Telecom, Travel & Hospitality), By Region, And Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marketing Cloud Platform Market Summary

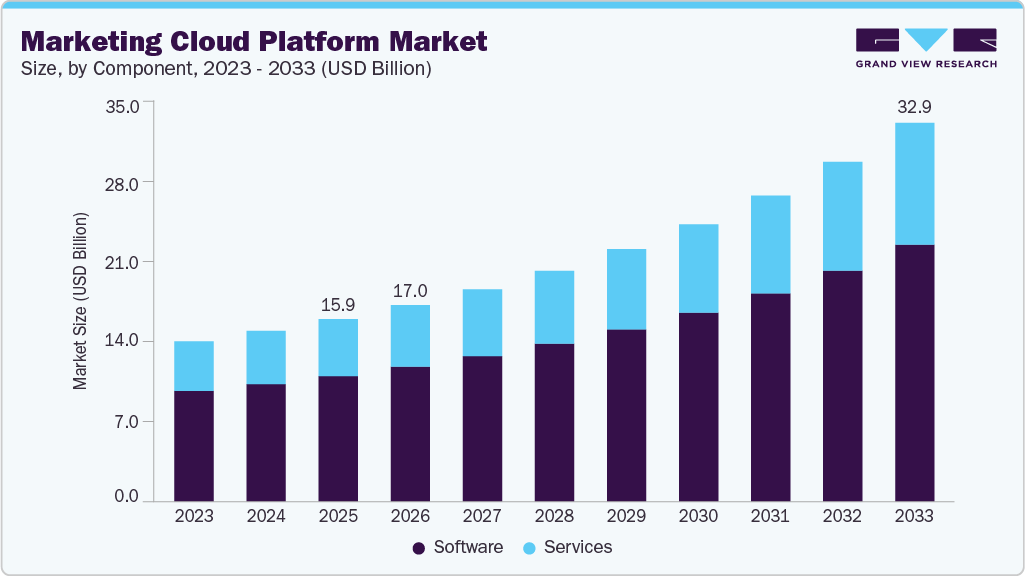

The global marketing cloud platform market size was estimated at USD 15.86 billion in 2025 and is projected to reach USD 32.88 billion by 2033, growing at a CAGR of 9.8% from 2026 to 2033. The growth is attributed to the rising adoption of data-driven marketing strategies, increasing demand for personalized customer experiences, and rapid integration of artificial intelligence (AI) and machine learning (ML) technologies into marketing workflows.

Key Market Trends & Insights

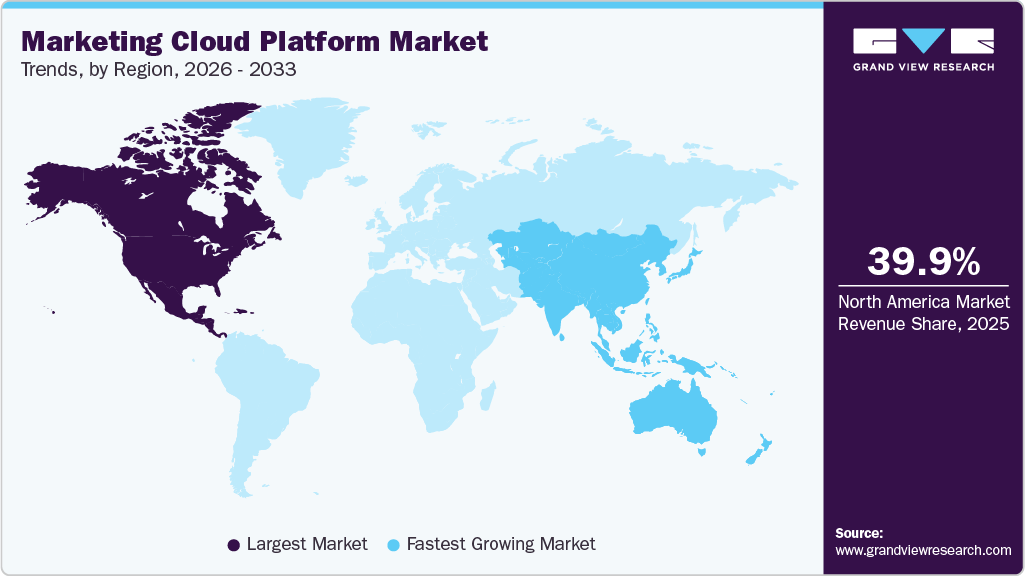

- North America held a 39.9% revenue share of the global marketing cloud platform industry in 2025.

- The U.S. marketing cloud platform industry is experiencing growth, driven by early technology adoption, strong cloud infrastructure, and widespread enterprise investment in data-driven marketing.

- By component, the software segment accounted for the largest revenue share of 68.8% in 2025.

- By deployment mode, the public cloud segment held the largest revenue share of 55.8% in 2025.

- By organization, the large enterprises segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 15.86 Billion

- 2033 Projected Market Size: USD 32.88 Billion

- CAGR (2026-2033): 9.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, the expansion of omnichannel marketing, the growing use of cloud-based analytics tools, and increasing digital transformation initiatives across industries are further fueling market growth. Moreover, the shift toward subscription-based and SaaS marketing platforms enables enterprises to enhance customer engagement, streamline campaign management, and achieve better return on marketing investments.Modern marketing strategies are evolving from siloed, channel-specific campaigns to integrated, data-driven ecosystems that prioritize personalization, automation, and customer journey orchestration. Enterprises are increasingly adopting AI-enabled marketing cloud platforms to unify data across touchpoints, predict consumer behavior, and deliver contextualized engagement on a scale. These platforms enable seamless integration of CRM, analytics, social, and commerce systems, allowing marketers to create dynamic, omnichannel experiences that enhance brand loyalty and conversion rates. As consumer privacy regulations tighten, organizations are also emphasizing secure data management and consent-based personalization, ensuring compliance while maintaining trust.

In addition, enterprises across sectors are boosting investments in marketing technology to stay competitive in a digital-first economy. A notable trend is the adoption of composable and modular marketing cloud architectures, enabling flexibility, faster deployment, and interoperability with third-party applications. Moreover, vendors are embedding generative AI, predictive analytics, and automation to optimize campaign management, content creation, and customer insights. For instance, in June 2023, Salesforce introduced AI-powered “Marketing GPT” capabilities within its marketing cloud to help businesses generate personalized content and automate audience targeting. Similarly, Adobe and Oracle are enhancing their marketing clouds with real-time data platforms and cross-channel intelligence features.

In conclusion, as enterprises shift toward experience-driven marketing, the marketing cloud platform industry is evolving rapidly to support hyper-personalization, data unification, and AI-driven automation. This transformation positions marketing cloud solutions as a cornerstone of digital growth strategies enabling organizations to achieve resilience, scalability, and measurable ROI in an increasingly competitive landscape.

Component Insights

The software segment accounted for the largest revenue share of 68.8% in 2025, driven by the growing adoption of AI-powered marketing automation, data analytics, and customer experience management tools. As organizations increasingly seek to unify customer data and deliver personalized, omnichannel engagement, marketing cloud software provides a centralized solution for content creation, campaign management, and performance analytics. Vendors are continuously enhancing their offerings with AI and machine learning capabilities to support predictive insights and real-time decision-making. For instance, in October 2025, Treasure Data introduced its AI Marketing Cloud, a platform designed to unify customer data, automate audience segmentation, and deliver scalable, personalized marketing experiences. The rising demand for intelligent, scalable, and cloud-native software solutions that enhances marketing efficiency, data integration, and ROI continues to drive the dominance of the software segment in the global marketing cloud platform industry. Going forward, the integration of generative AI and real-time data orchestration is expected to further strengthen the role of software as the core enabler of modern digital marketing ecosystems.

The services segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing reliance of enterprises on managed and professional services to optimize their marketing cloud deployments and ensure seamless integration across digital ecosystems. As organizations face challenges in managing complex marketing stacks and deriving actionable insights from vast datasets, service providers are offering implementation, customization, training, and maintenance support to enhance operational efficiency and maximize ROI. Moreover, the rising adoption of AI-driven and omnichannel marketing strategies is fueling demand for specialized consulting and managed services that enable real-time data synchronization, cross-platform automation, and performance monitoring. Consequently, the expanding need for end-to-end service capabilities that complement software solutions is expected to propel the rapid growth of the services segment in the global marketing cloud platform industry.

Deployment Mode Insights

The public cloud segment accounted for the largest revenue share of 55.8% in 2025, primarily due to the growing shift toward digital-first business models, the expansion of omnichannel marketing ecosystems, and the increasing integration of AI and automation into marketing workflows. Enterprises are prioritizing deployment models that offer scalability, agility, and cost efficiency, enabling marketers to execute and analyze campaigns in real time. This has accelerated the preference for public cloud environments, which provide seamless integration, global accessibility, and faster innovation cycles. For instance, in October 2025, Netcore Cloud launched its “Agentic Marketing 2025” initiative in collaboration with Google Cloud, introducing AI-native, cloud-hosted marketing capabilities designed to help brands automate decision-making and enhance customer engagement through predictive intelligence. As organizations continue to adopt AI-driven, cloud-hosted marketing platforms, the public cloud segment is expected to remain the dominant deployment mode serving as the foundation for scalable, intelligent, and data-driven marketing transformation.

The hybrid-cloud deployment segment is expected to grow at a significant CAGR over the forecast period due to a number of converging trends: enterprises are seeking greater flexibility and workload portability, enabling seamless movement of data and applications between private and public clouds; growing regulatory pressures and data sovereignty concerns are driving organizations to adopt hybrid architectures that ensure compliance without sacrificing innovation; and as marketing operations become more data-intensive with real-time personalization, organizations require architectures that combine on-premises control with cloud-scale analytics and orchestration. Furthermore, there is increasing demand for unified customer data platforms, SaaS integrations, and AI-driven activation tools that must operate across hybrid environments. For instance, in October 2025, Treasure Data launched its AI Marketing Cloud, built on a unified customer-data foundation yet designed with interoperable hybrid-cloud flexibility, enabling enterprises to retain control over data and systems while leveraging cloud-native scale and intelligence. Overall, as marketing ecosystems grow in complexity and enterprises demand both agility and governance, hybrid-cloud deployment is emerging as the strategic backbone for the future of marketing-cloud platforms.

Organization Insights

The large enterprises segment accounted for the largest revenue share in 2025 by organization, as major corporations increasingly invest in advanced marketing technologies to manage expansive customer bases, execute omnichannel campaigns, and derive actionable insights from large volumes of data. These organizations are prioritizing enterprise-grade capabilities such as AI-powered personalization, unified customer data platforms, and full-scale campaign orchestration across digital touchpoints, which positions them as heavy adopters of marketing cloud solutions. For instance, in April 2024, WPP announced a collaboration with Google Cloud to integrate Google’s generative-AI tools with WPP’s enterprise marketing platform, enabling real-time, data-driven creative execution and global client-scale engagements. Consequently, as large enterprises scale digital marketing operations and demand deeper integration between marketing, sales, and service systems, their dominance in the market is expected to continue.

The small and medium-sized enterprises (SMEs) segment is predicted to witness the fastest CAGR in the upcoming years, driven by the growing accessibility of agile, cost-effective solutions that enable nimble marketing operations, automation of customer outreach, and competitive capability against larger players. This trend is further supported by the expansion of SaaS-based offerings and the democratization of advanced marketing technology, making it feasible for smaller firms to adopt tools once reserved for enterprise organizations. For instance, in October 2025, Kuailu Tech launched a low-code AI office platform designed to boost productivity and ERP efficiency for SMEs, underscoring how vendors are tailoring solutions specifically for smaller organizations to leverage marketing cloud capabilities. As SaaS economics improve and digital-first marketing becomes essential across business sizes, SME adoption is set to accelerate and significantly shape market growth.

Marketing Function Insights

The advertising & branding segment accounted for the largest share in 2025, driven by the rising demand for personalized, data-driven, and cross-channel advertising campaigns. Organizations are increasingly leveraging marketing cloud platforms to enhance brand visibility, optimize ad spending, and measure campaign performance across digital touchpoints such as social media, search, and display networks. The integration of AI, predictive analytics, and automation tools within marketing clouds enables real-time audience targeting, creative optimization, and performance tracking significantly improving campaign effectiveness. Moreover, the growing shift toward digital-first branding strategies and the adoption of programmatic advertising have further boosted reliance on cloud-based platforms to manage large-scale campaigns seamlessly. Consequently, as businesses prioritize consistent brand experiences and measurable ROI, the advertising & branding segment continues to dominate the market, serving as a key driver of marketing transformation across industries.

The content management segment is expected to grow at the fastest CAGR during the forecast period, fueled by the rapid proliferation of digital assets, increasing demand for omnichannel brand consistency, and the integration of AI and automation in content lifecycle management. As organizations scale their digital marketing operations, there is a growing need to efficiently manage and deliver personalized content across diverse platforms, languages, and formats. Leading enterprises are adopting AI-powered content management systems (CMS) to streamline content creation, classification, and distribution while ensuring compliance with brand standards. This trend is further supported by the rising importance of dynamic asset management and intelligent content personalization in driving customer engagement and campaign performance. For instance, in May 2025, Google Cloud and Philips announced a strategic collaboration to transform digital asset management and consumer marketing through AI. Leveraging Google’s Vertex AI, Philips modernized its global image library and marketing workflows, processing over 200,000 images into 8,000 unique, brand-aligned assets within hours, illustrating the potential of AI-driven content management to enhance creative efficiency and marketing speed. Consequently, as enterprises increasingly adopt intelligent content orchestration and automation solutions, the content management segment is set to emerge as a pivotal driver of innovation and growth within the global market.

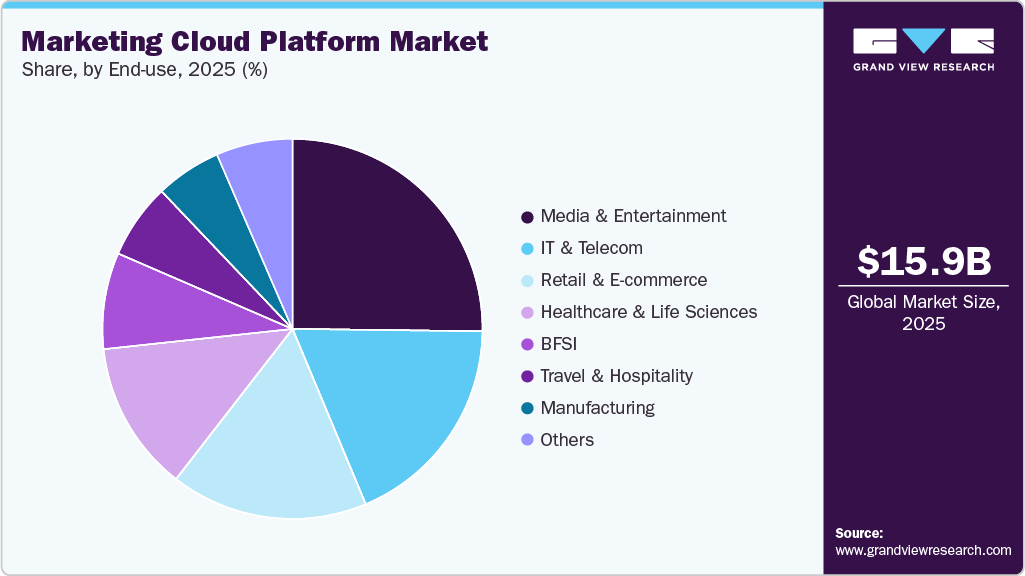

End-use Insights

The retail & e-commerce segment accounted for the largest revenue share in 2025, driven by retailers’ growing need to deliver seamless omnichannel customer experiences, optimize personalized promotions, and leverage data-driven insights for inventory and campaign management. As competition intensifies and consumer expectations rise, retail and e-commerce players are prioritizing real-time analytics, automation, and integrated marketing operations to stay ahead. For instance, in October 2024, Dentsu and Flipkart Commerce Cloud announced a regional collaboration aimed at revolutionizing retail commerce in Southeast Asia and Hong Kong leveraging marketing cloud capabilities, customer data platforms, and digital commerce solutions to enhance engagement and conversion across channels. Consequently, as the retail & e-commerce industry continues to embrace cloud-based marketing ecosystems, this segment remains the dominant end-use category in the market.

The media and entertainment segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing adoption of AI-powered personalization, data-driven content marketing, and multi-channel audience engagement strategies. As media companies and streaming platforms compete to deliver highly customized viewer experiences, marketing cloud platforms are becoming integral for managing content workflows, optimizing ad placements, and analyzing real-time engagement metrics. The integration of cloud-based marketing solutions enables seamless collaboration, faster campaign execution, and improved ROI across digital channels. Moreover, as the demand for personalized entertainment rises across OTT platforms, music streaming, and gaming ecosystems, marketing cloud providers are focusing on solutions that unify audience insights and automate campaign orchestration. Consequently, the rapid digital transformation across the media landscape is positioning the segment as one of the most dynamic adopters of marketing cloud technologies globally.

Regional Insights

North America marketing cloud platform industry accounted for the largest share of 39.9% in 2025 in the global marketing cloud platform industry, driven by the strong presence of leading cloud providers, advanced digital marketing maturity, and early adoption of AI and data analytics solutions among enterprises. The region’s businesses are heavily investing in omnichannel marketing automation, customer data platforms (CDPs), and predictive analytics to deliver personalized customer experiences on a scale. In addition the widespread integration of generative AI tools for content creation, campaign optimization, and customer journey mapping is transforming marketing operations across sectors such as retail, BFSI, and media. The U.S. continues to lead due to the robust ecosystem of Martech startups, strategic collaborations between technology vendors and advertisers, and the growing demand for privacy-compliant, data-driven marketing models. This innovation-driven environment continues to strengthen North America’s dominance in the global market.

U.S. Marketing Cloud Platform Market Trends

The U.S. marketing cloud platform industry is experiencing growth, driven by early technology adoption, strong cloud infrastructure, and widespread enterprise investment in data-driven marketing. The region’s robust digital advertising ecosystem, led by major players such as Google, Salesforce, Adobe, and Oracle, has accelerated the integration of AI, predictive analytics, and automation in marketing workflows. Moreover, enterprises across sectors particularly retail, BFSI, and media are leveraging cloud-based marketing solutions to enhance omnichannel customer engagement, real-time personalization, and ROI measurement. Growing focus on privacy-compliant data utilization and integration of generative AI into content creation and campaign optimization further characterize the evolving market. The U.S. also leads in cross-cloud partnerships and platform innovation, supported by high digital maturity and the presence of large-scale marketing technology ecosystems.

Europe Marketing Cloud Platform Market Industry Trends

The marketing cloud platform industry in Europe is expected to register considerable CAGR from 2026 to 2033. The growth is primarily driven by the region’s strong emphasis on data privacy, customer trust, and regulatory compliance under frameworks such as GDPR. European enterprises are focusing on building localized, compliant marketing ecosystems that balance personalization with strict data governance. In addition the region is witnessing growing adoption of cloud-based marketing tools among industries such as retail, BFSI, and automotive to enhance customer experience and loyalty through data-driven insights. Furthermore, the increasing integration of AI and automation into marketing workflows is enabling European companies to optimize campaign performance while reducing operational complexity. The rise of multi-cloud and hybrid deployments, especially among large enterprises in Western Europe, reflects a strategic push toward resilience, scalability, and digital sovereignty. Overall, Europe’s marketing cloud landscape is defined by its responsible innovation approach where technology adoption is guided by transparency, ethics, and long-term customer engagement.

The UK marketing cloud platform industry is undergoing a strategic transformation asenterprises are placing increased emphasis on first-party data strategies and consent-driven marketing, reflecting the UK’s rigorous data protection and consumer privacy environment. In addition organizations are also accelerating the adoption of AI and automation in marketing workflows, using platforms that integrate predictive analytics and unified customer profiles to enhance personalization at scale. Moreover, the retail and e-commerce sectors in the UK are leading in this transformation, leveraging marketing cloud solutions to streamline omnichannel experiences and connect physical and digital breakpoints such as using headless commerce alongside marketing platforms. Furthermore, the rise of low-code/no-code marketing tools in the UK is enabling smaller teams to experiment with faster and scale campaigns without heavy dependency on IT. This results in a dynamic UK market where innovation, regulatory compliance, and agile marketing operations converge to drive growth in marketing cloud platform adoption.

The German marketing cloud platform industry is undergoing transformation, driven by the nation’s emphasis on data security, enterprise-grade marketing solutions, and integration with Industry 4.0 ecosystems. German businesses particularly in manufacturing, automotive, and industrial sectors are leveraging marketing cloud platforms to unify customer data, enable real-time automation, and deliver highly personalized campaigns across digital and physical touchpoints. In addition, there is a significant push toward cloud-native infrastructure that meets German data-sovereignty requirements, driving preference for hybrid or private-cloud deployments with robust local compliance features. Also, the adoption of AI and machine learning tools for segmentation, content generation, and campaign optimization is progressing, especially as firms aim to scale globally while maintaining rigorous governance. Consequently, Germany’s market is characterized by a blend of technological ambition, regulatory discipline, and operational precision, making it a strategic landscape for marketing cloud platform providers.

Asia Pacific Marketing Cloud Platform Market Trends

The Asia Pacific marketing cloud platform industry is expected to register the fastest CAGR from 2026 to 2033, driven by the widespread prevalence of mobile-first consumer behavior and high internet penetration are driving companies to adopt digital-marketing solutions rapidly. In addition, the region’s booming e-commerce sector, especially in China, India and Southeast Asia, is fostering demand for cloud-based marketing tools that support omnichannel engagement and real-time personalization. Moreover, businesses are increasingly integrating AI-driven personalization and predictive analytics into their marketing strategies to tailor content, scoring and campaigns across devices. Furthermore, the adoption of social-media and influencer marketing ecosystems is pushing vendors to deliver platforms that unify data from multiple channels and automate workflows. In addition the imperative for data localization, cloud sovereignty and flexible deployment models is influencing regional architecture choices, resulting in stronger uptake of hybrid or multi-cloud marketing solutions.

The Japan marketing cloud platform industry is experiencing steady growth, supported by the country’s advanced digital infrastructure, data-driven marketing practices, and increasing adoption of AI-powered solutions. Japanese enterprises are prioritizing personalized, omnichannel engagement strategies as consumers shift rapidly toward mobile and social-first interactions. The integration of marketing automation, predictive analytics, and customer data platforms is enabling organizations to deliver highly contextualized experiences across digital ecosystems. Moreover, Japan’s stringent data privacy and localization regulations are driving demand for secure, compliant, and hybrid cloud-based deployments. The market also benefits from the growing participation of small and medium-sized enterprises adopting SaaS and low-code marketing tools to enhance operational agility and customer engagement. Subsequenty, the Japanese marketing cloud landscape is characterized by innovation, compliance-conscious deployment, and a strong focus on customer-centric digital transformation.

Marketing cloud platform market in China is advancing rapidly, propelled by a mobile-first, content-rich consumer environment and strong investments in digital marketing capabilities. Chinese enterprises are increasingly harnessing AI-driven personalization, real-time analytics, and short-form video/social commerce integrations to engage tech-savvy consumers across platforms like Douyin, Xiaohongshu and WeChat. The rapid development of cloud-native marketing technologies is supported by domestic infrastructure expansion and large-scale rollouts of data-centric marketing tools. At the same time, the regulatory emphasis on data sovereignty, local compliance, and ecosystem control means that cloud marketing solutions are tailored for the Chinese market context. As brands seek to integrate omnichannel campaigns, loyalty platforms, and AI-enabled content workflows, China is emerging as a dynamic and strategic market for marketing cloud platform adoption.

The India marketing cloud platform industry is experiencing robust growth, driven by the country’s rapid digital transformation, surging mobile and internet adoption, and the proliferation of affordable data connectivity, which together are creating a fertile environment for marketing cloud solutions. Indian brands are increasingly investing in integrated platforms for personalization, real-time analytics, automation, and first-party data strategies, as the country’s digital advertising spend expands and new consumer segments in Tier-2 and Tier-3 cities become reachable. Adoption is further fueled by a strong local SaaS ecosystem, cost-effective talent pool, and increasing tie-ups between global vendors and domestic firms to tailor solutions for Indian market dynamics. As enterprises across retail, e-commerce, BFSI, and media sectors advance their marketing technology stacks, the Indian market is set to become a pivotal growth region for marketing cloud platforms.

Key Marketing Cloud Platform Company Insights

Key players operating in the marketing cloud platform industry include Acoustic, L.P., Adobe Inc., ActiveCampaign, LLC, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2025,Oracle Corporation expanded its partnership with Google LLC to offer Google’s Gemini AI models via Oracle Cloud Infrastructure (OCI) Generative AI service enabling advanced agentic AI, multimodal content generation and marketing workflow automation across the cloud stack.

-

In June 2025,Salesforce launched its “Marketing Cloud Next” a major evolution of its marketing cloud solution that embeds autonomous AI agents, cross-channel orchestration and real-time personalization.

-

In June 2025, Infosys Ltd. and Adobe announced a strategic collaboration combining Infosys’s Aster marketing-services platform with Adobe’s marketing cloud technologies to enable unified customer experiences, hyper-personalization and workload efficiencies for global brands.

-

In May 2025, Salesforce, Inc. signed a definitive agreement to acquire Informatica for about USD 8 billion, bringing in Informatica’s data catalog, integration and governance capabilities to bolster Salesforce’s Data Cloud and AI-driven marketing platform.

-

In March 2025, Adobe Inc. announced a partnership with The Estée Lauder Companies to utilize its Firefly generative-AI tools and Creative Cloud/Experience Cloud workflow to accelerate digital marketing content production, resizing and omni-channel asset distribution.

Key Marketing Cloud Platform Companies:

The following key companies have been profiled for this study on the marketing cloud platform market.

- Acoustic, L.P.

- Adobe Inc.

- ActiveCampaign, LLC

- Cheetah Digital (a CM Group company)

- HubSpot, Inc.

- IBM

- Klaviyo Inc.

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- SharpSpring, Inc.

- Teradata Corporation

- Treasure Data, Inc.

- Zoho Corporation Pvt. Ltd.

Marketing Cloud Platform Market Report Scope

Report Attribute

Details

Market size in 2026

USD 14.15 billion

Revenue forecast in 2033

USD 32.88 billion

Growth rate

CAGR of 9.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast Period

2026 - 2033

Quantitative Units

Revenue in USD billion and CAGR from 2026 to 2033

Report Scope

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Component, deployment mode, organization, marketing function, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Acoustic, L.P.; Adobe Inc.; ActiveCampaign, LLC; Cheetah Digital (a CM Group company); HubSpot, Inc.; IBM; Klaviyo Inc.; Oracle Corporation; Salesforce, Inc.; SAP SE; SAS Institute Inc.; SharpSpring, Inc.; Teradata Corporation; Treasure Data, Inc.; Zoho Corporation Pvt. Ltd; Others

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marketing Cloud Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the marketing cloud platform market report based on component, deployment mode, organization, marketing function, end-use, and region.

-

Marketing Cloud Platform Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

Managed Services

-

Professional Services

-

-

-

Marketing Cloud Platform Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Marketing Cloud Platform Organization Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Marketing Cloud Platform Marketing Function Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advertising & Branding

-

Customer Data Management

-

Campaign Management

-

Content Management

-

Email Marketing

-

Social Media Marketing

-

Analytics & Reporting

-

-

Marketing Cloud Platform End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Healthcare & Life Sciences

-

Retail & E-commerce

-

Media & Entertainment

-

Travel & Hospitality

-

Manufacturing

-

Others

-

-

Marketing Cloud Platform Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The software segment accounted for the largest revenue share in 2025 in the marketing cloud platform market, driven by the growing adoption of AI-powered marketing automation, data analytics, and customer experience management tools.

b. Some key players operating in the market include Acoustic, L.P., Adobe Inc., ActiveCampaign, LLC, Cheetah Digital (a CM Group company), HubSpot, Inc., IBM, Klaviyo Inc., Oracle Corporation, Salesforce, Inc., SAP SE, SAS Institute Inc., SharpSpring, Inc., Teradata Corporation, Treasure Data, Inc., Zoho Corporation Pvt. Ltd. and Others.

b. Factors such as rising adoption of data-driven marketing strategies, increasing demand for personalized customer experiences, and rapid integration of artificial intelligence (AI) and machine learning (ML) technologies into marketing workflows play a key role in accelerating the marketing cloud platform market.

b. The global marketing cloud platform market size was estimated at USD 15.86 billion in 2025 and is expected to reach USD 17.04 billion in 2026.

b. The global marketing cloud platform market is expected to grow at a compound annual growth rate of 9.8% from 2026 to 2033 to reach USD 32.88 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.