- Home

- »

- Medical Devices

- »

-

Medical Device Cleaning Market Size & Share Report, 2030GVR Report cover

![Medical Device Cleaning Market Size, Share & Trends Report]()

Medical Device Cleaning Market (2023 - 2030) Size, Share & Trends Analysis Report By Device (Non-critical, Semi-critical, Critical), By Technique (Cleaning, Disinfection), By EPA Classification, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-450-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Cleaning Market Summary

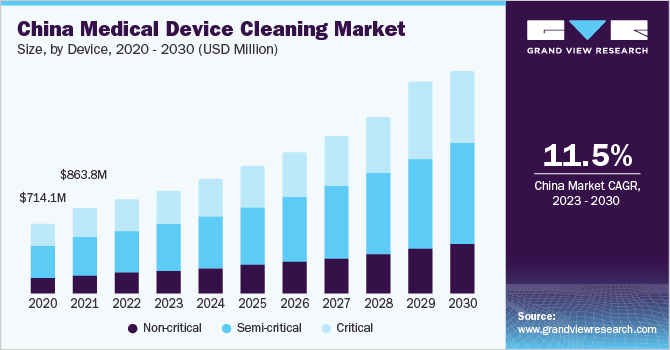

The global medical device cleaning market size was valued at USD 21.3 billion in 2022 and is projected to reach USD 47.3 billion by 2030, growing at a CAGR of 10.6% from 2023 to 2030. The rising prevalence of Hospital-Acquired Infections (HAIs) is expected to be a major factor responsible for the steady growth of the overall market during the forecast period.

Key Market Trends & Insights

- North America dominated the medical device cleaning market in 2022 with around 33.52%.

- Based on device type, semi-critical segment held the largest market share of 45.9% in 2022.

- Based on technique, the disinfection segment held the largest market share of 52.2% in 2022.

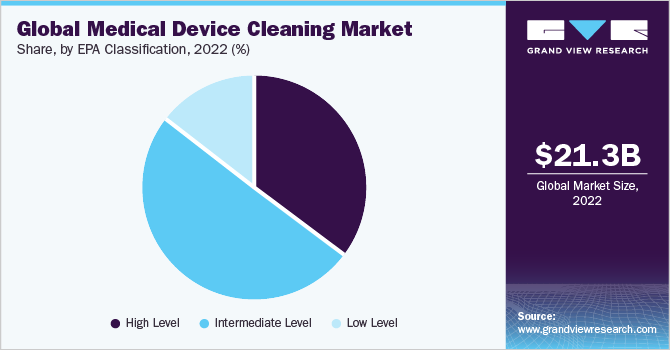

- Based on EPA classification, the intermediate level segment held the largest share of over 50.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 21.3 Billion

- 2030 Projected Market Size: USD 47.3 Billion

- CAGR (2023-2030): 10.6%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Diseases, such as Urinary Tract Infections (UTIs), Surgical Site Infections (SSIs), and Methicillin-Resistant Staphylococcus Aureus (MRSA) infections, are some of the most common hospital-acquired infections. High risk of infection from drug-resistant pathogens, bloodborne pathogens, and other infectious agents in operating rooms is one of the major concerns for hospitals. For instance, frequent usage of urinary catheters leads to high risk of UTIs and may result in CAUTIs.

According to a research published in NCBI, UTIs account for 25.0% of all bacterial infections. According to a report from the National Nosocomial Infection Surveillance (NNIS) System, most hospital-acquired UTIs are associated with CA-bacteriuria, and catheterization is the most frequently occurring healthcare-associated infection globally, accounting for up to 40% of hospital-acquired infections in the U.S. each year. As a result of this, market is expected to grow.

Moreover, increase in the prevalence of SSIs is anticipated to boost penetration of infection control measures. As per a research published in NIH in 2018, 40% to 60% of infections were estimated to be SSIs. The constant implementation of infection prevention and control measures has resulted in a significant reduction in the number of hospital-acquired infection cases, and the situation is expected to improve in the coming years provided these measures are adopted at the same rate. According to a report issued by Centers for Disease Control and Prevention in 2022, SSI Standardized Infection Ratio (SIR) associated with all NHSN operational procedure categories combined decreased by roughly 5% in 2020 compared to the previous year.

The COVID-19 is expected to have a positive impact on medical device cleaning market.In healthcare environments where certain medical procedures are conducted, environmental surfaces are more likely to be contaminated with the COVID-19 virus. As a result, these surfaces must be adequately cleaned and disinfected to prevent future transmission, especially in sites where COVID-19 patients are admitted. Similarly, this recommendation applies to non-traditional venues for isolation of COVID-19 patients with uncomplicated and moderate disease, such as residences and non-traditional facilities, which is predicted to promote market growth.

The pandemic has also created significant opportunities for local manufacturers. Due to restrictions on movement at international borders, supply chain of major players was disrupted. This created an opportunity for local players to enter the market and meet unmet demands of end users. To enhance their foothold in the market, key companies are adopting various policies and plans to gain a higher market share. The rising number of COVID-19 cases has resulted in a lack of medical supplies; as a result, local manufacturers are ramping up production to satisfy the increased demand.

Firms are also adopting several strategies such as collaborations and launch of new products to gain a higher market share. For instance, in April 2021, surface disinfectant wipes 2.0 CaviWipes, which are completely certified for the Emerging Viral Pathogen Claim EPA's and are active against 42 illnesses, including SARS-CoV-2, have been released by Metrex. CaviWipes wipes have a universal contact duration of two minutes, making them ideal for one-step cleaning and disinfection of hard, non-permeable surfaces in healthcare environments. This is expected to help the company enhance its presence worldwide.

Manual cleaning and disinfection techniques alone are insufficient to control hospital-acquired infections. Housekeepers clean just 40% to 50% of the surfaces that need be cleaned in order to maintain a sanitary environment. This could be due to incapacity of hospitals to follow strict guidelines established by regulatory authorities or it could be due to MDR microbiota's resistance to such strict cleaning and sterilization processes.

Device Insights

Based on device type, the market has been segmented into non-critical, semi-critical and critical. Semi-critical segment held the largest market share of 45.9% in 2022. Semi-critical devices include those that are exposed to mucus membrane. Dental equipment, endoscopes, and some surgical instruments are a few examples of the devices in this category. These devices are required to be sterilized before use, mostly using heat or chemical method as frequency of sterilization required is high. Factors impacting market growth include increasing use of disposable devices, reducing prices due to high competition, and stringent regulatory guidelines by Centers for Disease Control and Prevention (CDC).

The critical segment is anticipated to witness the fastest growth rate over the forecast period. This category includes devices that penetrate body tissues. These devices are sterilized before packaging and majority of them are single-use devices. Heat sterilization and ethylene oxide (EtO) are most widely used methods in hospital settings. Most of the commercially available single-use surgical equipment are sterilized by radiation method. However, the process is not performed within hospital settings, and thus has not been considered in the scope of this report. Similar to semi-critical devices, increase in adoption of single-use devices has reduced the need for cleaning, disinfecting, and sterilizing critical devices, which is anticipated to hinder the market growth.

Technique Insights

Based on technique, the market has been segmented into cleaning, disinfection, and sterilization. The disinfection segment held the largest market share of 52.2% in 2022. Disinfection is an important step in reprocessing of semi-critical and critical medical devices. The disinfectants used in this step are generally categorized as bactericidal, fungicidal, and virucidal. Selection of these materials generally depends on the type of medical equipment. However, selection of such materials for processing of devices such as endoscopes is difficult. For example, decisions regarding selection of method- sterilization or high-level disinfection. Disinfectants in combination with detergents are also considered in this segment.

The sterilization segment is further expected to exhibit lucrative growth. Sterilization includes the removal of any microorganism present on medical equipment. Steam and EtO sterilization are the most commonly employed sterilization methods in hospital settings. The introduction of surgical devices made of materials other than stainless steel has led to the need for finding alternatives for heat sterilization. Trends of forming a central sterile services department (Sterile Processing Department) is increasing the demand for advanced sterilization equipment to optimize the time and money required in the process.

EPA Classification Insights

Based on EPA classification, the market has been segmented into high level, intermediate level, and low level. The intermediate level segment held the largest share of over 50.1% in 2022. Intermediate level disinfectants are the chemical agents that are tuberculocidal and kill the disease-producing microbes. Some of the most common types of intermediate-level disinfectants are water-based phenolics, quat and alcohol blends, bleach, and hydrogen peroxide blends. The increasing prevalence of HAIs and the spread of infectious diseases are contributing to the segment growth.

On the other hand, the high-level segment is expected to register the fastest CAGR during the forecast period.High-level disinfection refers to the treatment of dental instruments and medical equipment for inhibiting microorganisms. It includes the reprocessing of heat-sensitive semi-critical medical equipment and dental instruments. Some of the most used high-level disinfectants are glutaraldehydes, special hydrogen peroxide, and special peracetic acid products.

Regional Insights

North America dominated the medical device cleaning market in 2022 with around 33.52%. A consistent number of strategic collaborations adopted by the key market players to widen their product portfolio and infection control capabilities are expected to be responsible for the greater share captured by the region. In addition, stringent government regulations regarding the disinfection and cleaning of medical equipment and favorable reimbursement policies are expected to fuel the regional market over the forecast period. Some of the primary factors contributing to the increasing adoption of sterile practices are growing usage of non-disposable medical devices and increasing demand to reduce costs related to hospital-acquired infections.

Asia Pacific is expected to be the fastest-growing regional market during the forecast period, owing to the region's substantial outsourcing presence, rising healthcare spending, and extraordinary growth of healthcare standards and infrastructure Furthermore, the Covid-19 outbreak and the expansion of infectious disease are propelling market growth in this region. One of the primary reasons driving market growth is the presence of different volunteer and government organizations dedicated to strengthening infection control standards.

Key Companies & Market Share Insights

Key players are entering into mergers & acquisitions to increase its market share and customer base across the globe. For instance, in January 2020, Getinge AB completed the acquisition of Applikon Biotechnology B.V., a developer and supplier of advanced bioreactor systems for production of vaccines & antibodies, as well as enzymes & bioplastics for industrial biotechnology.

Furthermore,in August 2021, Ecolab established its Ecolab Healthcare Advanced Design Center to be able to collaborate with customers of the medical device industry on infection prevention solutions for its cutting-edge surgical equipment as well as develop innovative solutions for hospitals & operation centers. Thus, hospitals & surgery centers benefit from custom-designed sterile barriers and equipment drapes to increase infection control, manage operational costs & efficiencies, and improve patient outcomes, which is expected to boost the demand for such products. Thus this in turn is anticipated to boost the market growth in near future. Some prominent players in the global medical device cleaning market include:

-

Steris plc.

-

GetingeAB

-

Advanced Sterilization Products

-

The Ruhof Corp.

-

Sklar Surgical Instruments

-

Sterigenics International LLC

-

Biotrol

-

Metrex Research, LLC

-

Oro Clean Chemie AG

-

Cantel Medical Corp.

-

Ecolab

-

3M

Medical Device Cleaning Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.4 billion

Revenue forecast in 2030

USD 47.3 billion

Growth Rate

CAGR of 10.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, technique, EPA classification, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Steris plc.; GetingeAB; Advanced Sterilization Products; The Ruhof Corp.; Sklar Surgical Instruments; Sterigenics International LLC; Biotrol; Metrex Research, LLC; Oro Clean Chemie AG; Cantel Medical Corp.; Ecolab; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Cleaning Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global medical device cleaning market report on the basis of device, technique, EPA classification, and region:

-

Device Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-critical

-

Semi-critical

-

Critical

-

-

Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Cleaning

-

Detergents

-

Buffers

-

Chelators

-

Enzymes

-

Others

-

-

Disinfection

-

Chemical

-

Alcohol

-

Chlorine & Chorine Compounds

-

Aldehydes

- Phenolics

-

Metal

-

Ultraviolet

-

Others

-

-

Sterilization

-

Heat Sterilization

-

Ethylene Dioxide (ETO) Sterilization

-

Radiation Sterilization

-

-

-

EPA Classification Outlook (Revenue, USD Million, 2017 - 2030)

-

High Level

-

Intermediate Level

-

Low Level

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical device cleaning market size was estimated at USD 21.3 billion in 2022 and is expected to reach USD 23.4 billion in 2023.

b. The global medical device cleaning market is expected to grow at a compound annual growth rate of 10.6% from 2023 to 2030 to reach USD 47.3 billion by 2030.

b. North America dominated the medical device cleaning market with a share of 33.5% in 2022. This is attributable to the presence of well-established healthcare infrastructure, strict regulations for infection control at healthcare facilities, and high adoption of advanced infection prevention solutions.

b. Some key players operating in the medical device cleaning market include Metrex Research, LLC, Steris plc., GetingeAB, Advanced Sterilization Products, 3M, The Ruhof Corp., Sklar Surgical Instruments, Sterigenics International LLC, Biotrol, Oro Clean Chemie AG, Cantel Medical Corp., Ecolab, and others.

b. Key factors that are driving the medical device cleaning market growth include the increasing adoption of preventive measures to reduce hospital-acquired infections coupled with the introduction of advanced materials & methods for reprocessing medical equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.