- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Elastomers Market Size, Share, Growth Report, 2030GVR Report cover

![Medical Elastomers Market Size, Share & Trends Report]()

Medical Elastomers Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Thermoplastic Elastomer, Thermoset Elastomer), By Application (Medical Tubes, Medical Bags, Catheters, Syringes, Implants, Gloves), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-074-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Elastomers Market Size & Trends

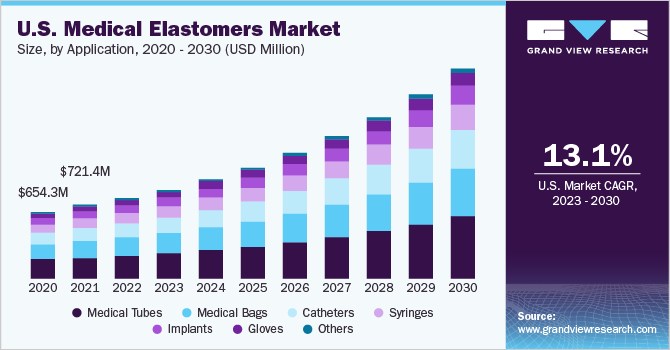

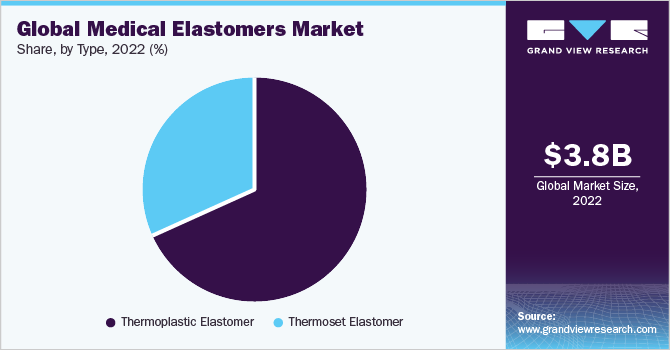

The global medical elastomers market size was valued at USD 3.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 12.74% from 2023 to 2030. The rising usage of medical elastomers for the production of disposable medical equipment such as valves, syringes, and tubing is expected to drive the market globally. Additionally, the growing demand for critical implants for artificial heart valves and joints is driving the production of medical elastomers. Medical elastomers possess various physical properties, including durability, biocompatibility, flexibility, and resistance to high temperatures and chemicals, making them suitable for the manufacturing of various medical devices such as tubes, syringes, catheters, gloves, and bags.

Furthermore, the demand for silicone is expected to witness a significant increase worldwide in the coming years, owing to its utilization in developing medical elastomers. It is employed for the encapsulation of biomedical products in the medical industry. Silicone exhibits endless opportunities for developing and launching new products in the market. Ongoing technological advancements for manufacturing silicone-based advanced materials are expected to drive the growth of the medical elastomer market over the forecast period.

The U.S. is one of the largest consumers of medical elastomers, and the market is expected to grow at a significant rate over the forecast period. A significant percentage of the country's population has gained access to healthcare facilities and services, owing to two important government programs – the Affordable Care Act (ACA) and Medicaid. This has increased the demand for medical products and healthcare services, which has created extensive demand for medical elastomers in the U.S. These materials are generally used in products like medical tubes, bags, syringes, and implants.

The presence of key manufacturers such as Eastman Chemical Co., Dow Inc., and DuPont can be regarded as a major factor driving the market for medical elastomer in the country. In addition, the constantly rising patient population due to increasingly prevalent COVID-19 variants has propelled the need for various medical components such as gloves, syringes, masks, catheters, and others, thereby boosting the demand for medical elastomers.

According to the American Cancer Society, breast cancer is the most common cancer that affects women in the U.S., except for skin cancer. It is the most frequently diagnosed cancer among women in the country. Women in their middle and older years have a higher chance of developing it. Hormone therapy for menopausal symptoms raises estrogen levels, which is one of the main factors in female breast cancer. In the coming years, it is expected that the rising demand for silicone breast implants in mastectomy procedures to treat breast cancer will fuel the market in the U.S.

Application Insights

The medical tubes application segment dominated the market with more than 29.0% share of the global revenue in 2022. The growth in demand for medical tubes to give medications and fluids, along with the rising cases of respiratory diseases, such as lung cancer, asthma, and pulmonary fibrosis, is expected to boost the demand for elastomers in the medical industry in the coming years.

Advancements and innovations in drug delivery systems by medical device manufacturers are resulting in the demand for customizable medical tubes, further propelling the demand. The growing number of mergers and acquisitions among various companies in the medical device sector is expected to drive the global demand and reach of disposable medical devices, thereby boosting market growth.

The market for medical tubes is expanding as a result of the rapidly aging population and the increasing incidences of chronic diseases among them, as well as the rising demand for minimally invasive medical procedures and disposable tube-based medical equipment. Moreover, the introduction of new products and strategic initiatives taken by major industry competitors will further fuel market expansion.

Type Insights

The thermoplastic elastomer segment dominated the medical elastomer market with over 68.0% of the revenue share in 2022. The type segment comprises thermoplastic elastomers and thermoset elastomers. The leading share of thermoplastic elastomers in the market is owing to the rising expenditure on healthcare and medical facilities, and investments in medical equipment such as surgical gloves, plastic syringes, instruments, and other plastic items utilized for consumer and industrial applications. This has driven the demand for lightweight plastics like TPE in these as well as other medical items.

The increase in coronavirus research funding that followed the advent of the COVID-19 pandemic fueled the demand for biopharmaceutical laboratory equipment. Additionally, worldwide efforts to develop a coronavirus vaccine increased the demand for lab supplies. The expansion of thermoplastic elastomers for the manufacture of medical equipment is predicted to benefit from the steady and continuous supply of laboratory equipment.

However, as most plastic polymers are being made from crude oil, their costs are influenced by changes in the price of crude oil in the world market. Due to supply and demand, seasonal variations, natural disasters, and other reasons, crude oil is a commodity that experiences significant price swings, which eventually has an impact on the cost of its by-products, such as plastic polymers.

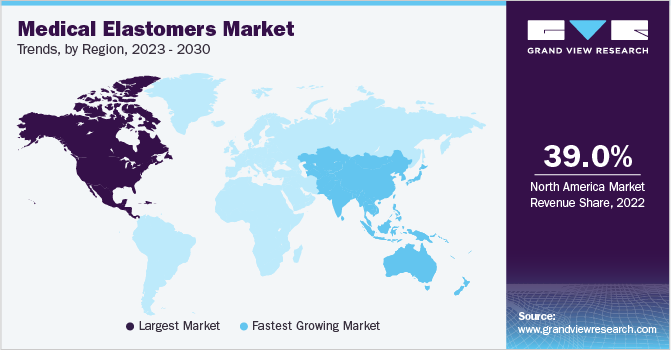

Regional Insights

North America dominated the market for medical elastomers and accounted for over 39.0% share of the global revenue in 2022. One of the key trends influencing the expansion of the regional market is the rising per capita healthcare spending in the U.S. in the form of health insurance. Over the coming years, this is anticipated to increase the demand for generic medications and medical equipment, propelling the growth of the market in North America. The critical applications of this industry include medical tubing, medical bags, implants, and syringes.

Asia Pacific is expected to expand at a significant rate over the forecast period. The demand for high-quality medical components and devices from the healthcare industry in major economies such as China, Australia, and India is increasing on account of rising expenditure in this sector. In addition, improving service and safety standards in hospitals is expected to drive the market for medical elastomers over the forecast period.

Key Companies & Market Share Insights

Key manufacturers operating in the market include BASF SE, Celanese Corporation, DOW, DuPont, DSM, and Solvay, among others. Market participants are engaged in expanding the portfolio of medical elastomers as well as their applications. Manufacturers of medical elastomer-based products are concentrating on optimizing the pre- and post-production process, as the technology is developing rapidly.

In November 2022, Celanese completed the acquisition of the Mobility and Materials division of DuPont's thermoplastics and elastomers business. This acquisition will improve Celanese's product line-up and elastomer and thermoplastics production capabilities, which will increase the availability of medical elastomers. Some of the prominent players in the global medical elastomers market include:

-

BASF SE

-

Celanese Corporation

-

DOW

-

Solvay

-

DuPont

-

DSM

-

KRATON CORPORATION

-

Trelleborg AB

-

Kuraray Co., Ltd.

-

Teknor Apex

-

Momentive

-

PolyOne Corporation

-

HEXPOL AB

-

Foster Corporation

-

Biomerics, LLC

Medical Elastomers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.17 billion

Revenue forecast in 2030

USD 9.66 billion

Growth rate

CAGR of 12.74% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Australia; Thailand; Malaysia; Indonesia; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

BASF SE; Celanese Corporation; Dow; Solvay; DuPont; DSM; KRATON CORPORATION; Trelleborg AB; Kuraray Co., Ltd.; Teknor Apex; Momentive; PolyOne Corporation; HEXPOL AB; Foster Corporation; Biomerics, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

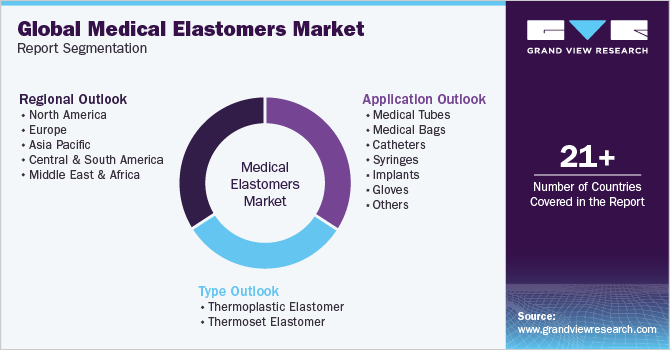

Global Medical Elastomers Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global medical elastomers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Thermoplastic Elastomer

-

Thermoset Elastomer

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Medical Tubes

-

Medical Bags

-

Catheters

-

Syringes

-

Implants

-

Gloves

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical elastomers market size was estimated at USD 3.77 billion in 2022 and is expected to reach USD 4.17 billion in 2023.

b. The global medical elastomers market is expected to grow at a compound annual growth rate of 12.74% from 2023 to 2030 to reach USD 9.66 billion by 2030.

b. The medical tube application segment dominated the market for medical elastomers and accounted for the largest revenue share of 29.67% in 2022.

b. Some key players operating in the medical elastomers market include BASF SE, Celanese Corporation, DOW, Solvay, DuPont, DSM, KRATON CORPORATION, and others.

b. The key factor that is driving the medical elastomers market is the rising usage of medical elastomers for the production of disposable medical equipment such as valves, syringes, and tubing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.