- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Grade Polypropylene Market Size Report, 2033GVR Report cover

![Medical Grade Polypropylene Market Size, Share & Trends Report]()

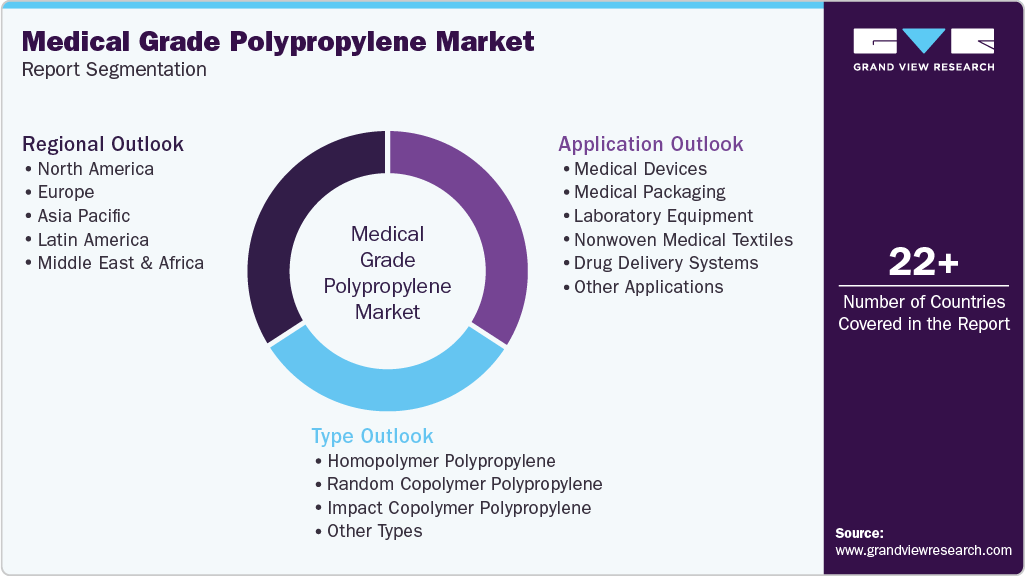

Medical Grade Polypropylene Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Homopolymer Polypropylene, Random Copolymer Polypropylene), By Application (Medical Devices, Medical Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-700-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Grade Polypropylene Market Summary

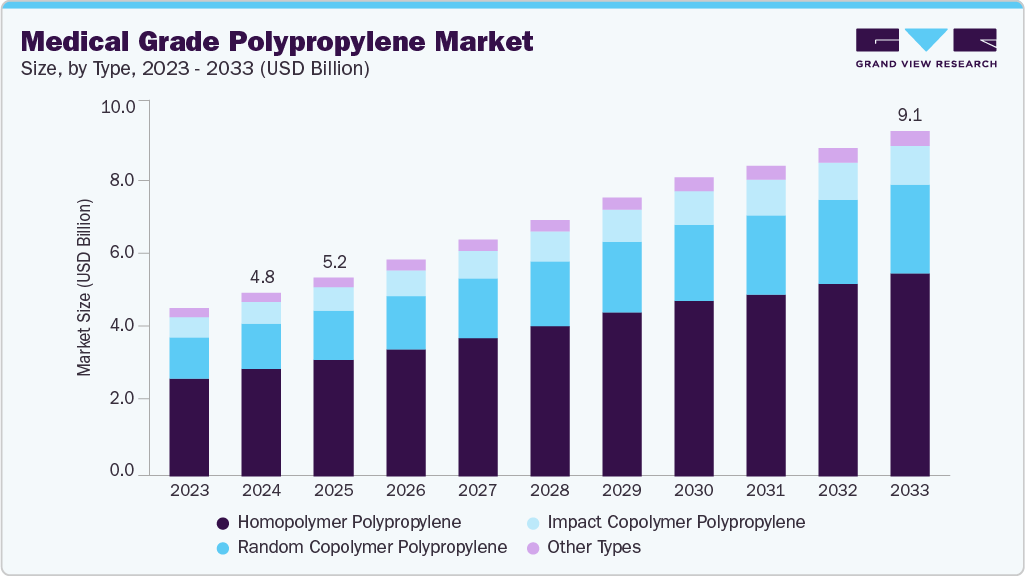

The global medical grade polypropylene market size was estimated at USD 4.85 billion in 2024 and is projected to reach USD 9.11 billion by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The market is projected to experience consistent growth, fueled by the rising demand for safe, long-lasting, and affordable materials in the healthcare sector.

Key Market Trends & Insights

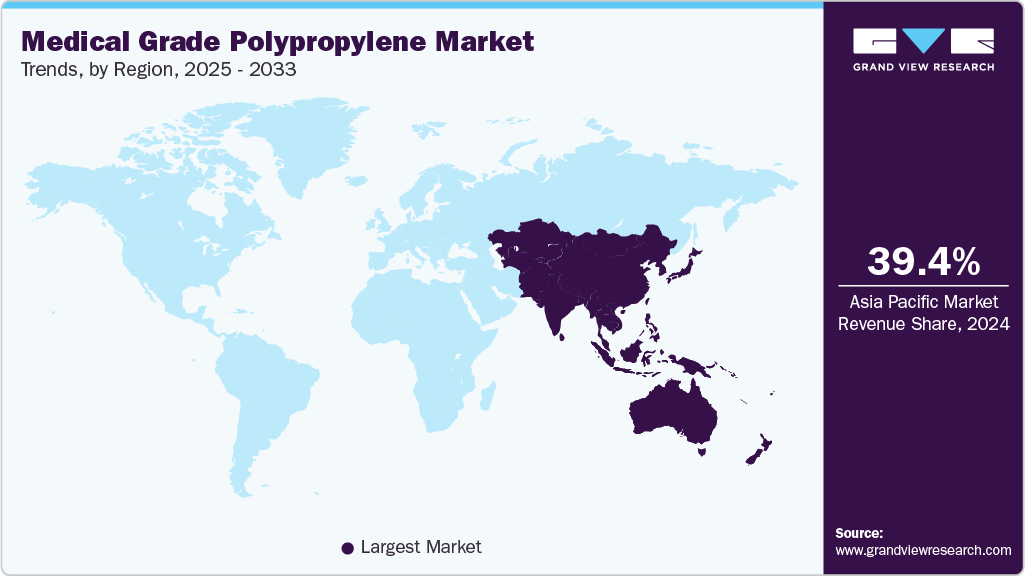

- Asia Pacific dominated the Medical Grade Polypropylene Market with the largest revenue share of 39.42% in 2024.

- The Medical Grade Polypropylene Market in Europe is expected to grow at a substantial CAGR of 7.3% from 2025 to 2033.

- By type, the Random Copolymer Polypropylene segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2033 in terms of revenue.

- By application, the Medical Devices segment is expected to grow at the fastest CAGR of 7.7% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 4.85 Billion

- 2033 Projected Market Size: USD 9.11 Billion

- CAGR (2025-2033): 7.1%

- Asia Pacific: Largest market in 2024

Growing investments in the production of medical devices, particularly in developing nations, are driving the use of polypropylene. The medical grade polypropylene market is expected to see gradual growth, driven by increasing demands in essential areas such as medical devices, diagnostics, pharmaceutical packaging, and laboratory equipment. The lightweight characteristics of the material, along with its chemical resistance and capacity to endure a range of sterilization processes, are crucial for ensuring patient safety, preserving product integrity, and facilitating cost-effective healthcare solutions. The shift toward biocompatible, recyclable, and regulatory-compliant polypropylene grades is quickening due to elevated quality standards and sustainability goals, particularly in advanced healthcare markets.

In addition, increasing healthcare spending, the development of medical facilities, and the rise of pharmaceutical and diagnostic services in emerging markets are contributing to a broader adoption of medical-grade polypropylene. With the healthcare sector focusing on performance, patient safety, and adherence to regulations, steady growth in the market is anticipated in the coming years.

Drivers, Opportunities & Restraints

The medical-grade polypropylene market is anticipated to continue growing, driven by the rising demand from industries such as medical devices, pharmaceutical packaging, diagnostics, and laboratory equipment. Its lightweight characteristics, resistance to chemicals, and compatibility with various sterilization techniques make it vital for safe, single-use medical application and efficient healthcare delivery. The increasing adoption of polypropylene in syringes, IV components, and diagnostic kits further bolsters market expansion, especially with the development of healthcare infrastructure in emerging regions.

Emerging prospects are anticipated in the medical-grade polypropylene sector, driven by a growing focus on sustainability and circular economy initiatives. The creation of polypropylene grades that are recyclable, biocompatible, and resistant to sterilization is gaining popularity, especially in Europe and North America. In addition, the rise of point-of-care diagnostics, the expansion of home healthcare, and the increased production of single-use medical and pharmaceutical items are generating new opportunities for polypropylene application in safe, compliant, and cost-efficient medical solutions.

The medical-grade polypropylene industry is anticipated to face challenges due to increasing environmental concerns associated with plastic waste and the limited recyclability of certain healthcare products. Rising regulatory requirements concerning material biocompatibility, traceability, and sterilization compatibility could elevate development and compliance expenditures. Moreover, variations in raw material costs and disruptions in the global supply chain may affect production stability, while competition from alternative materials such as medical-grade polyolefins and specialty polymers might restrict the use of polypropylene in certain high-performance applications.

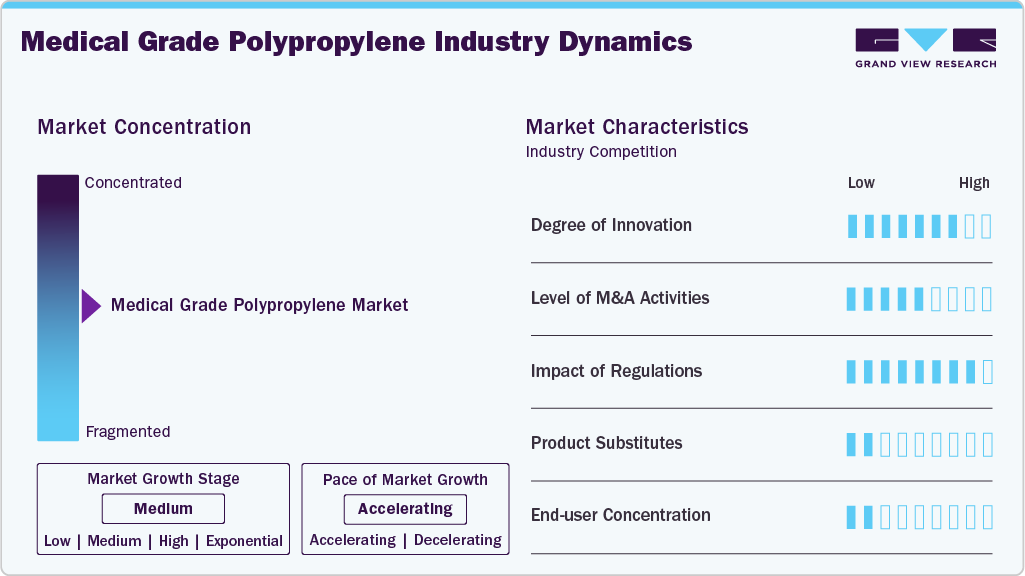

Market Concentration & Characteristics

The medical grade polypropylene market is presently experiencing a moderate growth phase, with a speeding up trend, fueled by a rise in application in vital healthcare areas like medical devices, pharmaceutical packaging, diagnostics, and laboratory tools. Although the market is somewhat divided, leading companies exert considerable power over the competitive environment because of their robust regulatory knowledge, extensive product ranges, and worldwide distribution systems. Leading firms such as Borealis AG, LyondellBasell Industries, SABIC, ExxonMobil Chemical, Braskem, TotalEnergies Corbion, INEOS Olefins & Polymers, Trinseo, LG Chem, and Avient Corporation are crucial in influencing market dynamics. These companies promote innovation by creating sophisticated medical-grade polypropylene formulations, environmentally friendly and recyclable substances, and high-efficiency solutions designed to comply with stringent regulatory standards and adapt to the changing demands of customers in international healthcare markets.

The medical-grade polypropylene sector is being influenced by mergers and acquisitions, as leading companies buy specialized firms to enhance their global presence, broaden their product offerings, and improve supply chain efficiency. These efforts are fostering innovation in eco-friendly, biocompatible polypropylene solutions due to the growing strictness of regulatory demands. Regulatory standards, particularly in Europe and North America, are shaping material choices by promoting the use of recyclable, non-toxic, and sterilization-compatible polymers. The increasing costs associated with compliance and the ongoing changes in healthcare standards are leading to investments in cleaner processing technologies and advanced medical-grade formulations.

The medical grade polypropylene market experiences a moderate level of competition from alternative materials such as medical-grade polyethylene, polycarbonate, and specialty polymers such as TPE and TPU. However, polypropylene maintains a strong position due to its lightweight nature, chemical resistance, sterilization compatibility, and cost-effectiveness. There is notable concentration among end users, particularly within the medical device, pharmaceutical, and diagnostics sectors, where large OEMs, healthcare institutions, and contract manufacturers heavily influence procurement decisions. This concentration shapes product development priorities and demand patterns, making the market sensitive to shifts in healthcare regulations, innovation cycles, and evolving user specifications.

Type Insights

Homopolymer polypropylene led the medical-grade polypropylene market within the type segmentation by revenue, capturing a market share of 58.46% in 2024. This leadership position of homopolymer PP can be credited to its widespread use in medical devices, containers, syringes, and caps due to its excellent stiffness, chemical resistance, and compatibility with sterilization processes. The ongoing development of hospital infrastructure, increased production of single-use medical products, and strict hygiene standards, particularly in North America, Europe, and emerging healthcare markets in Asia, are expected to support steady demand for homopolymer polypropylene in the coming years.

Random copolymer polypropylene is expected to have the highest CAGR of 7.5% during the forecast period, driven by its increasing use in medical packaging, intravenous components, diagnostic instruments, and transparent lab ware. The rising demand for single-use medical products and point-of-care diagnostics, along with stricter regulations on product safety and effectiveness, is likely to further accelerate the growth of random copolymer polypropylene, especially in regions with advanced healthcare systems and evolving diagnostic infrastructure.

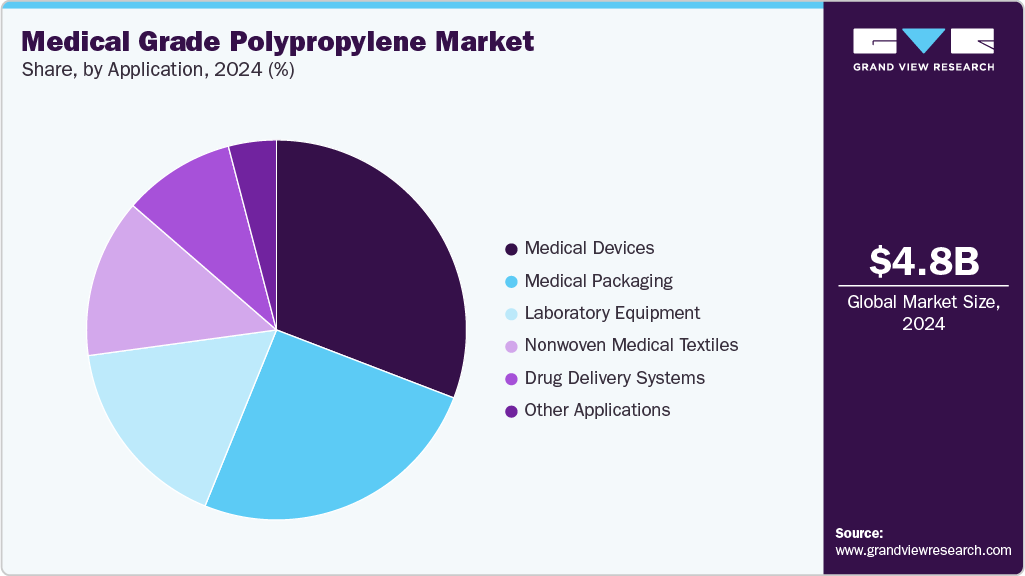

Application Insights

The medical grade polypropylene market was predominantly led by medical devices in the application segmentation, capturing a market share of 30.83% in 2024. This leadership is attributed to the extensive usage of polypropylene in syringes, IV components, diagnostic kits, surgical tools, and disposable medical instruments. Its advantageous characteristics-such as resistance to chemicals, lightweight nature, biocompatibility, and capability to endure various sterilization methods-render it an optimal material for high-volume, single-use medical products. Furthermore, the growth of hospital infrastructure, an increase in surgical procedures, and a rising need for affordable yet safe materials are driving ongoing expansion in the medical devices segment.

Medical packaging is expected to grow at a CAGR of 7.2% during the forecast period. This segment is likely to significantly influence the growth of the medical grade polypropylene market, driven by increasing demand for sterile, lightweight, and cost-effective packaging solutions in the pharmaceutical and healthcare sectors. Medical-grade polypropylene is widely used in products such as blister packs, vials, caps, pouches, and rigid containers due to its excellent chemical resistance, durability, and compatibility with sterilization processes. The growing focus on patient safety, extended shelf life, and compliance with strict regulatory standards, especially in North America, Europe, and key Asia Pacific countries, is boosting the adoption of high-performance polypropylene in medical packaging applications.

The segment for drug delivery systems is anticipated to see considerable growth due to the increasing demand for safe, effective, and affordable materials for pharmaceutical distribution. Medical grade polypropylene is commonly employed in inhalers, syringes, ampoules, cartridges, and auto-injectors because of its chemical resistance, dimensional stability, and suitability for sterilization procedures. The rising incidence of chronic illnesses, the trend towards auto-injectors, and the growth of biologics are boosting the need for innovative drug delivery methods. In addition, strict regulatory standards and the demand for designs centered around patient needs are encouraging manufacturers to adopt high-performance polypropylene options within this sector.

Regional Insights

The medical grade polypropylene market in 2024 saw the Asia Pacific region capture the largest revenue share at 39.42%. Strong growth is expected in the Asia Pacific market, fueled by the development of healthcare infrastructure, a growing population, and an increasing need for affordable medical devices and packaging solutions. Rapid advancements in diagnostics, pharmaceuticals, and hospital capacities in countries like China, India, Japan, and South Korea are resulting in a higher demand for medical-grade polypropylene used in syringes, IV components, diagnostic kits, and drug delivery systems. Furthermore, government investments in the healthcare sector, along with the emergence of local medical device manufacturing, are contributing to the growth of the regional market.

North America Medical Grade Polypropylene Market Trends

The North American medical grade polypropylene market is projected to grow at a CAGR of 7.0%, driven by robust demand in the medical device, pharmaceutical packaging, and diagnostic industries. The region's well-established healthcare system, along with increasing investments in hospital infrastructure and outpatient services, is promoting the use of high-quality, regulatory-compliant polypropylene materials.

U.S. Medical Grade Polypropylene Market Trends

The U.S. medical grade polypropylene market is expected to expand due to ongoing improvements in healthcare facilities, strict regulatory requirements, and a rise in domestic manufacturing of medical devices and pharmaceutical packaging. The increasing need for safe, lightweight, and sterilization-compatible materials in diagnostic tools, syringes, and drug delivery systems is also contributing to market growth.

Europe Medical Grade Polypropylene Market Trends

Strict medical safety regulations, the increasing focus on sustainable healthcare practices, and a significant commitment to the circular economy are expected to positively impact the European medical grade polypropylene market. There is an escalating need for recyclable, low-emission, and biocompatible polypropylene materials, especially in areas like pharmaceutical packaging, diagnostic equipment, and single-use medical products.

China Medical Grade Polypropylene Market Trends

China's market for medical-grade polypropylene is expected to witness rapid growth, propelled by the swift advancements in healthcare infrastructure, an increasing need for domestically produced medical devices, and robust government backing for the pharmaceutical and diagnostic industries. The growing network of hospitals, rising surgical procedures, and an intensified emphasis on infection prevention are driving the application of polypropylene in syringes, IV components, diagnostic kits, and sterile packaging.

Key Medical Grade Polypropylene Company Insights

The medical grade polypropylene market is currently in a medium growth stage, with an accelerating trajectory driven by expanding use in medical devices, pharmaceutical packaging, diagnostics, and labware. While the market remains moderately fragmented, major players exert significant influence on the competitive landscape. Leading firms such as Borealis AG, LyondellBasell Industries, SABIC, ExxonMobil Chemical, Braskem, TotalEnergies Corbion, INEOS Olefins & Polymers, Trinseo, LG Chem, and Avient Corporation play a vital role in shaping market dynamics. These companies drive innovation by developing biocompatible, sterilization-resistant, and regulatory-compliant polypropylene formulations to meet evolving healthcare standards and sustainability goals across global markets.

Key Medical Grade Polypropylene Companies:

The following are the leading companies in the medical grade polypropylene market. These companies collectively hold the largest market share and dictate industry trends.

- Borealis AG

- LyondellBasell Industries

- SABIC

- ExxonMobil Chemical

- Braskem

- TotalEnergies Corbion

- INEOS Olefins & Polymers

- Trinseo

- LG Chem

- Avient Corporation

Recent Developments

-

In June 2025, Henkel and Nexa3D announced the launch of xMED412, a 3D-printable resin that mimics polypropylene and is suitable for high-performance healthcare uses. This material is compliant with FDA Class I regulations and satisfies ISO 10993 standards for biocompatibility. It facilitates the creation of items such as anatomical models, surgical guides, and personalized orthotics, providing excellent impact strength, the ability to be sterilized, and scalability for decentralized medical production.

-

In February 2025, Borealis launched a new medical-grade polypropylene called Bornewables, which is derived from renewable feedstocks and specifically designed to facilitate closed-loop recycling in the healthcare sector. This innovation was tested in collaboration with Sanitas Healthcare, where medical devices were gathered, sterilized, reprocessed, and transformed into new functional products, signifying a significant advancement toward achieving circularity in regulated medical settings.

Medical Grade Polypropylene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.25 billion

Revenue forecast in 2033

USD 9.11 billion

Growth rate

CAGR of 7.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Borealis AG, LyondellBasell Industries, SABIC, ExxonMobil Chemical, Braskem, TotalEnergies Corbion, INEOS Olefins & Polymers, Trinseo, LG Chem, Avient Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Grade Polypropylene Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Medical Grade Polypropylene Market report on the basis of type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Homopolymer Polypropylene

-

Random Copolymer Polypropylene

-

Impact Copolymer Polypropylene

-

Other types

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Medical Devices

-

Medical Packaging

-

Laboratory Equipment

-

Nonwoven Medical Textiles

-

Drug Delivery Systems

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.