- Home

- »

- Healthcare IT

- »

-

Medical Information Market Size, Industry Report, 2020-2027GVR Report cover

![Medical Information Market Size, Share & Trends Report]()

Medical Information Market (2020 - 2027) Size, Share & Trends Analysis Report By Service Provider (In House, Outsourcing), By Therapeutic Area, By Product Life Cycle, By Company Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-122-8

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global medical information market size was valued at USD 2.15 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2020 to 2027. The growth can be attributed to the increase in the number of clinical trials coupled with the rising prevalence of rare diseases. In addition, manufacturers in the healthcare sector are outsourcing medical affairs, regulatory services to Contract Research Organizations (CROs) to reduce their operational costs. Medical Information (MI) services act as a valuable resource for information in the pharmaceutical industry. It offers knowledge about their products which is not easily accessible. For instance, excipient details for licensed products, unpublished data on stability, and information related to availability and application of unlicensed or under development products. As the rate of Covid-19 infections increasing, the research and development activities are accelerated.

Biopharmaceutical companies are at the forefront in the fight against the coronavirus pandemic. A considerable number of large biotech companies are in the middle of a race to develop a vaccine. This is expected to surge the demand for MI solutions. The market is technology-driven as there are continuous research and development being undertaken for innovative and cost-effective solutions. The emergence of advanced technologies such as artificial intelligence, machine learning, big data, speech and video analytics, cloud computing, blockchain, and the internet of things is expected to change the market dynamics over the forecast period.

One of the major emerging trends in the industry is data-driven medicine. Various medical sources provide large volumes of MI functions, which can be analyzed to gain insights for predictive analysis. Big data analytics is expected to help lower the rate of medication errors, create preventive plans for illnesses, reduce waiting time due to understaffing, prevent patients from readmission to the hospital, and improve long-term care.

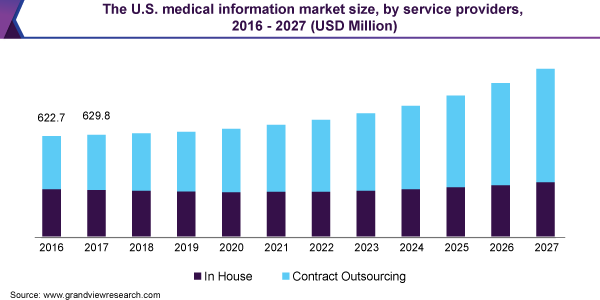

Service Provider Insights

The contract outsourcing segment accounted for the largest revenue share of around 55.8% in 2019. The extensive workflow for medical information activities is likely to pressurize the pharmaceutical or medical device company in terms of the costs, resources, expertise, and oversight required for running the MI activities smoothly.

The companies involved in the MI services business needs to process to regulatory requirements, therapeutic area knowledge, data/tools management proficiency, and medical writing skills. Therefore, outsourcing the MI functions segment to an external functional service provider (FSP) has proved to become the best practical solution for providing medical information to healthcare professionals and other information seekers.

The majority of pharmaceutical manufacturers perform MI management activities inhouse; some outsource part of the activities to third party providers. Increasing pressure from regulatory bodies and to reduce overall operational cost manufacturers opt to outsource MI functions to CROs.

In addition, outsourcing help companies concentrating on resources to core activities. In addition, associated benefits of outsourcing medical information services such as reduce regulatory compliance risk, optimization of internal resources in other important tasks, saving expenditure on training and development activities, and minimize process delays.

Therapeutic Area Insights

The oncology segment is expected to hold the largest market share at 31.38% of the medical information market in 2019. This can be attributed to the increasing number of clinical trials, treatments, and awareness amongst cancer patients. According to the American Cancer Society, in 2018, 17.0 million new cancer cases were reported, and 9.5 million cancer deaths were recorded globally.

The immunology market segment is anticipated to grow at a lucrative rate during the forecast period. The growing healthcare burden coupled with unmet medical needs has led to an increase in treatment options for diseases. Novel site discovery of an existing drug is a major approach taken by industry players. There is a need for new treatment therapies and better preclinical models, which is expected to propel the segment growth in the coming years.

Product Life Cycle Insights

The clinical phase accounted for the majority of revenue shares of around 47.0% in 2019 and is expected to maintain its dominance throughout the forecast period. The clinical phase is essential for the evaluation of the efficacy and safety of the medical product in humans. The rising development of specialty medicines, growing R&D in healthcare companies for launching new products, and increasing demand for digital health devices are factors expected to slowly increase the need for MI services.

Post-market approval procedures require that manufacturers must report significant and unexpected adverse reactions. This ensures that medical information is submitted before the approval phase. The Office of Surveillance & Epidemiology in the U.S. identifies concerns regarding drug safety and recommends actions for the improvement of product safety. This is done by relevant publications monitoring, conducting research using computer databases, and looking out for signals of safety issues of marketed drugs. The increasing regulatory burden on manufacturers regarding MI services is expected to fuel market growth in the coming years.

Company Size Insights

Medium-sized companies held the dominant market share of 47.0% as of 2019 and expected to maintain its position over the forecast period. With limited resources and geographic presence, these companies either tend to outsource their complete MI functions with only a few inhouse people coordinating with vendors or opt to build an internal team for all their major MI activities and outsource small services such as translation services to CROs. This helps the company achieve cost-effectiveness.

Small-sized companies face immense pressure to launch their healthcare products in the market. These companies have limited financial resources, global presence, and labor. Therefore, they are not likely to opt for inhouse MI functions. Large-sized companies are well-established and have global operations. These companies usually outsource their medical information services to a company that can lower their costs or supports the heavy workload.

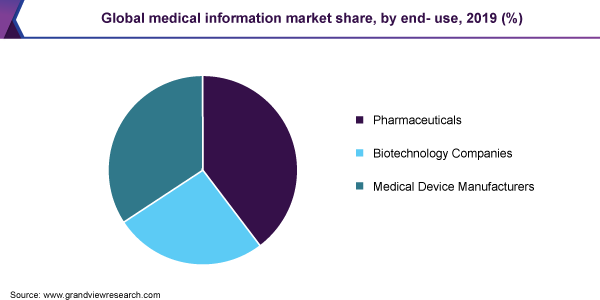

End-use Insights

Pharmaceutical manufacturers held the dominant position in the market with a revenue share of around 39.0% as of 2019. Medical information specialists for pharmaceuticals are responsible for adverse drug reaction reporting, answering inquiries, providing a medicine helpline for the public, proactive provision of information, training & education, and support for drug and therapeutic committees.

Innovators are expected to garner the largest share, by pharmaceuticals. This is because innovators must abide by more regulatory norms as compared to the generics. This results in a higher amount of medical information services for innovators, which drives the market growth.

Generic manufacturers are required to follow comparatively fewer regulations than the innovators. Information related to these generics is also abundantly available; hence, the demand for MI solutions is relatively less. However, increasing the requirement of pharmacovigilance for generic drugs also drives the demand.

The biotechnology product manufacturer segment is expected to witness lucrative growth owing to increasing research activities in the field of biologics and lack of awareness regarding the same as compared to biosimilars which increase the demand for these services from the healthcare professionals.

Regional Insights

North America dominated the industry with a revenue share of 36.0% in 2019. This is attributable to the presence of a well-established regulatory framework in the region. Moreover, the presence of major service providers focusing on novel drug development is expected to fuel the adoption rate of the market for medical information over the forecast period.

Asia Pacific region is anticipated to register a lucrative growth in the forthcoming years owing to the rising awareness among patients, increasing investments and favorable government initiatives for meeting the healthcare demands are the factors driving regional growth. In addition, geographical expansion by various healthcare companies is a major factor that has created a demand for MI solutions. These solutions are generally outsourced to countries such as China and India as they provide skilled labor at a low cost.

Key Companies & Market Share Insights

The industry is highly competitive in nature, with a handful of companies dominating the global market. Pharmaceutical manufacturers, regulatory, pharmacovigilance, and MI service providers are adopting strategic initiatives such as joint ventures, strategic collaborations, product launches, and mergers & acquisitions to capitalize on the market opportunities in the best possible way. For instance, in July 2020, IQVIA launched the Orchestrated Customer Engagement (OCE) Optimizer, a solution that can empower life sciences companies to plan and refine marketing engagements with healthcare providers on demand. Some of the prominent players in the medical information market include:

-

Accenture plc

-

Infosys Limited

-

PAREXEL International Corporation

-

IQVIA

-

C3i Solutions

-

McKesson Corporation

-

PriemVigilance

-

Propharma Group

-

Cognizant

-

PharmCentre

Medical Information Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 2.22 billion

Revenue forecast in 2027

USD 3.66 billion

Growth Rate

CAGR of 7.4% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service provider, product life cycle, therapeutic area, company size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

The U.S.; Canada; The U.K.; Germany; France; Italy; Spain; Japan; China; India; Brazil; Mexico; South Africa; Saudi Arabia

Key companies profiled

IQVIA; Parexel International Corporation; C3i Solutions; PrimeVigilance; McKesson Corporation; Propharma Group; Accenture; Cognizant; Infosys Limited; PharmCentre

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the reportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global medical information market report on the basis of the service provider, product life cycle, therapeutic area, company size, end-use, and region:

-

Service Provider Outlook (Revenue, USD Million, 2016 - 2027)

-

In house

-

Contract outsourcing

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2016 - 2027)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Life Cycle Outlook (Revenue, USD Million, 2016 - 2027)

-

Pre-clinical

-

Clinical

-

Post Market Approval

-

-

Company Size Outlook (Revenue, USD Million, 2016 - 2027)

-

Small

-

Medium

-

Large Scale

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Pharmaceuticals

-

Innovators

-

Generics

-

-

Biotechnology Companies

-

Biologics

-

ATMPs

-

Biosimilars

-

-

Medical Device Manufacturers

-

Therapeutic

-

Diagnostic

-

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global medical information market size was estimated at USD 2.16 billion in 2019 and is expected to reach USD 2.23 billion in 2020.

b. The global medical information market is expected to grow at a compound annual growth rate of 7.4% from 2020 to 2027 to reach USD 3.67 billion by 2027.

b. North America dominated the medical information market with a share of 36.2% in 2019. This is attributable to the presence of a well-established regulatory framework in the region.

b. Some key players operating in the medical information market include IQVIA, Parexel International Corporation, C3i Solutions, PrimeVigilance, McKesson Corporation, Propharma Group, Accenture, Cognizant, Infosys Limited, and PharmCentre.

b. Key factors that are driving the medical information market growth include increasing demand for outsourcing activities and pressure from regulatory bodies on healthcare manufacturers pertinent to safety information.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.