- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Injection Molded Plastic Market Size Report, 2030GVR Report cover

![Medical Injection Molded Plastic Market Size, Share & Trends Report]()

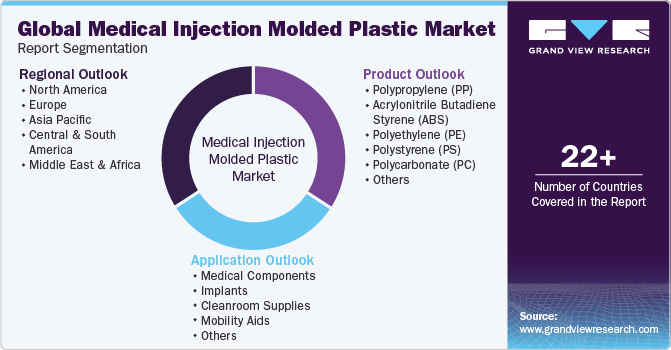

Medical Injection Molded Plastic Market Size, Share & Trends Analysis Report By Product (Polypropylene, Acrylonitrile Butadiene Styrene), By Application (Medical Components, Implants), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-953-2

- Number of Report Pages: 122

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

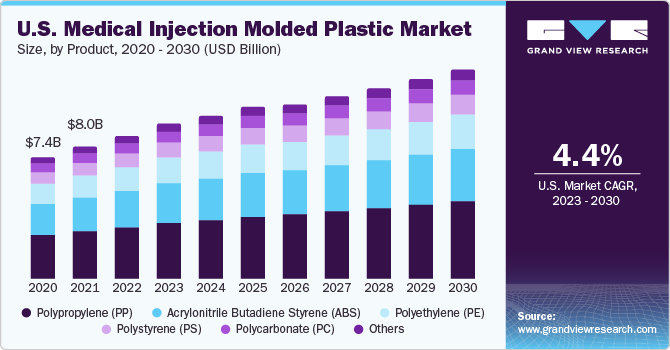

The global medical injection molded plastic market size was estimated at USD 25.64 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth can be attributed to the increasing healthcare expenditure, increasing prevalence of chronic diseases, and growing aging population worldwide. According to the American Medical Association (AMA), the healthcare expenditure in the U.S. rose in 2021 by 2.7% to reach USD 4.3 trillion, which was equivalent to USD 12,914 per capita.

The rising demand for medical devices is expected to drive the market over the forecast period. According to the World Health Organization (WHO), at present there are approximately 2 million units of different kinds of medical devices in the world, which are categorized into more than 7000 generic devices groups. Medical injection molded plastics have played a significant role in revolutionizing the healthcare sector. With the improvements in the healthcare industry, medical injection molded plastics are one of the few adaptable materials that have been able to keep up with the industry's changing needs. These devices have been employed in a variety of applications including disposable plastic syringes, blood bags, and new heart valves, among others.

The frequent increment in the costs of medical devices and reduced margins have severely impacted healthcare providers and health plans in the U.S. This compelled the government to ensure a significant transformation of healthcare funding and insurance coverage segments in the country through the introduction of Affordable Care Act (ACA) and Medicaid, which provide medical aid to the low-income population of the country. This is expected to drive the product demand in the healthcare industry over the forecast period.

The global demand for injection-molded polypropylene from medical component manufacturers is expected to remain the highest during the forecast period owing to its superior properties, including ease of sterilization and high-impact resistance. An increase in healthcare expenditure, primarily in the U.S., China, and Germany, is expected to drive the demand for medical components, implants, mobility aids, etc., developed from injection molded plastics over the forecast period.

Furthermore, the market growth can be attributed to the growing demand for generic drugs and medical devices from consumers as a result of increasing healthcare spending. Rising healthcare cost has been one of the biggest challenges faced by the U.S. healthcare industry in recent times. To provide cost-effective healthcare services to the population of the country, several urgent care clinics were established over the past few years.

According to a blog by Fierce Healthcare, the number of urgent care clinics saw a significant rise. With the constant rise in urgent care clinics, the demand for medical equipment is expected to rise and positively influence the market growth over the forecast period. Key medical applications include diagnostic drug kits, surgical consumables, drug delivery products, and others. Rising demand for medical injection molded plastics in the medical industry owing to the rapid growth of the population and increased healthcare spending in North America is further expected to drive the market in the region.

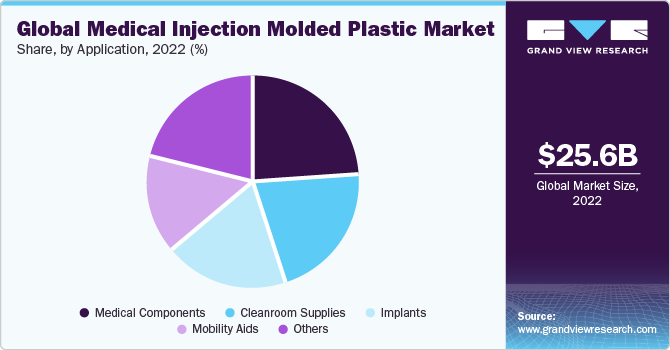

Application Insights

Medical components emerged as the leading application segment and accounted for the largest share of 24.4% of the overall revenue in 2022. Injection-molded plastics play a vital role in various medical component applications due to their cost-effectiveness, versatility, and ability to meet stringent quality and regulatory requirements. These are used in the manufacturing of syringes and needles, blood glucose meters, ventilators, infusion pumps, connectors and fittings, cartridge housings and sample holders, crowns, denture bases, orthodontic devices, anesthesia equipment such as masks and tubing connectors, face shields, wound care products, specimen containers, etc.

The COVID-19 pandemic thrust the global healthcare supply chain into the spotlight due to the substantial increase in demand for medical components. This surge in demand encompassed protective and personal equipment (PPE), face masks, gloves, and gowns, as well as technology-intensive equipment like MRI scanners and mechanical ventilators. While developing countries focused on manufacturing PPE, face masks, and gloves, developed countries concentrated on producing technology-intensive equipment such as MRI scanners and mechanical ventilators. The impulsive impact of COVID-19 led to a surge in demand for the aforementioned equipment in 2020-2021.

The increasing healthcare expenditure and changing lifestyles worldwide are generating significant demand for medical plastics in medical component applications, including testing equipment, ventilators, syringes, and medical trays. According to the U.S. Centers for Medicare & Medicaid Services, hospital expenditures grew by 4.4% to USD 1,323.9 billion in 2021. Similarly, expenditures for physician and clinical services increased by 5.6% to USD 864.6 billion in the same year. This growth in the mentioned sectors is anticipated to drive the market during the forecast period.

Product Insights

Polypropylene (PP) emerged as the leading product segment and accounted for the largest share of over 34.0% of the overall revenue in 2022. PP is the preferred choice for manufacturing protective packaging and medical equipment due to its outstanding toughness and durability. Its lightweight properties, resistance to bacteria and chemicals, and cost-effectiveness position it for robust growth in the market. Additionally, its ability to be molded to precise specifications makes it highly sought after in the production of syringes. It is one of the most commonly used plastics, with extensive applications in various sectors, including medical packaging. According to ‘Plastics Europe’, PP accounted for 19.3% share of the overall plastic production in 2021.

The polycarbonate segment is expected to experience a CAGR of 3.8% during the forecast period. Polycarbonate stands out as a versatile and widely used material within the medical sector. It finds application in the manufacturing of various medical devices and equipment, including face shields, blood oxygenators, catheters, and connectors, among others. It also plays a vital role in producing eyeglass lenses, optical components, and medical packaging. Several companies are focusing on innovation and the development of new products utilizing polycarbonate.

In November 2020, SABIC announced its plans to introduce a new family of LNP CRX polycarbonate (PC) materials during a medical design and manufacturing event (MD&M). These innovative copolymers were created to address a common issue in medical applications, where repeated cleaning can result in environmental stress cracking, ultimately leading to component failures. These new materials not only mitigate stress cracking but also exhibit enhanced chemical resistance compared to currently available alternatives.

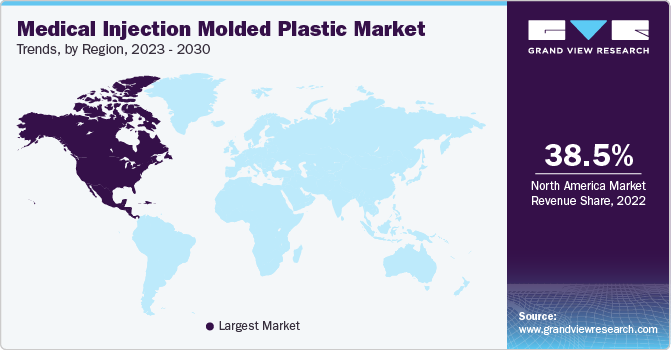

Regional Insights

North America dominated the market and accounted for more than 38.5% share of the global revenue in 2022. The region comprises mature markets and is characterized by a technologically advanced medical injection molded plastics industry, thereby contributing significantly to the global market growth. According to the National Center for Biotechnology Information (NCBI), the global medical devices industry generated a revenue of around USD 387 billion in 2017, while U.S. sales were estimated at USD 140 billion in the same year.

In the North American region, Canada is attracting significant investments in both public and private sectors owing to the increasing geriatric population and rising incidences of chronic diseases. According to the Canadian Institute for Health Information (CIHI), government spending on the healthcare industry was about 12.2% of the country’s total GDP in 2022. The country is characterized by high health consciousness and high life expectancy, viz., 85 years for women and 79 years for men. This is anticipated to pose lucrative growth opportunities for medical plastic manufacturers in the country.

The rising number of chronic diseases and a burgeoning aging population are driving up the demand for medical devices in Canada's healthcare industry. The expansion of the healthcare industry is being fueled by the introduction of new and more expensive medical devices and increased per-patient use of medical supplies. This is expected to drive the product demand over the forecast period.

The massive growth in demand for medical components in Mexico is driven by the rising incidence of cardiovascular diseases, diabetes, malignant tumors, liver diseases, metabolic disorders, and respiratory diseases, which, in turn, is likely to augment the demand for medical plastics at a significant rate over the forecast period. COVID-19-related treatments and the strengthening of the pharmaceutical industry, public healthcare, and public safety are now the main priorities of the nation, which is expected to drive the market over the forecast period.

Key Companies & Market Share Insights

Manufacturers in the concerned market aim to strengthen their position by expanding their customer base. Dow Inc.; SABIC, and Eastman Chemical Company are leading producers in the market, known for good chemical resistance and toughness of their products. These manufacturers focus on new product launches depending on the market requirements, technology acquisitions, distribution channels, and mergers & acquisitions undertaken by their competitors to meet the current and future demand of the product for developing medical components, implants, cleanroom supplies, mobility aids, etc. In December 2021, Covestro AG launched a new line of materials for hardware and medical device housings. Products consisting of medical polycarbonate and medical polycarbonate/polyester blends were launched that offer chemical resistance while using next-generation flame retardants.

Key Medical Injection Molded Plastic Companies:

- Dow, Inc.

- SABIC

- Eastman Chemical Company

- Covestro AG

- Rutland Plastic

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- INEOS Group

Medical Injection Molded Plastic Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.98 million

Revenue forecast in 2030

USD 37.61 million

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Poland; Netherlands; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Dow, Inc.; SABIC; Eastman Chemical Company; Celanese Corporation; Covestro AG; Rutland Plastic; Evonik Industries AG; Sumitomo Chemical Co., Ltd.; Arkema; INEOS Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Injection Molded Plastic Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical injection molded plastic market report based on product, application, and region:

-

Product Outlook (Volume in Kilotons; Revenue in USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene (PE)

-

Polystyrene (PS)

-

Polycarbonate (PC)

-

Others

-

-

Application Outlook (Volume in Kilotons; Revenue in USD Million, 2018 - 2030)

-

Medical Components

-

Implants

-

Cleanroom Supplies

-

Mobility Aids

-

Others

-

-

Regional Outlook (Volume in Kilotons; Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical injection molded plastic market size was estimated at USD 25.64 billion in 2022 and is expected to reach USD 27.98 billion in 2023.

b. The global medical injection molded plastic market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 37.61 billion by 2030.

b. North America dominated the medical injection molded plastic market with a share of 41.4% in 2021. The increasing per capita healthcare spending in the form of health insurance in the U.S. has been one of the major trends impacting the market in North America.

b. Some of the key players operating in the medical injection molded plastic market include Dow, Inc., SABIC, Eastman Chemical Company, Celanese Corporation, Covestro AG, Rutland Plastic, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Arkema, and INEOS Group

b. Key factors driving the medical injection molded plastic market growth include growing demand for medical devices and increasing healthcare investments across emerging economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."