- Home

- »

- Plastics, Polymers & Resins

- »

-

Injection Molded Plastic Market Size And Share Report, 2030GVR Report cover

![Injection Molded Plastic Market Size, Share & Trends Report]()

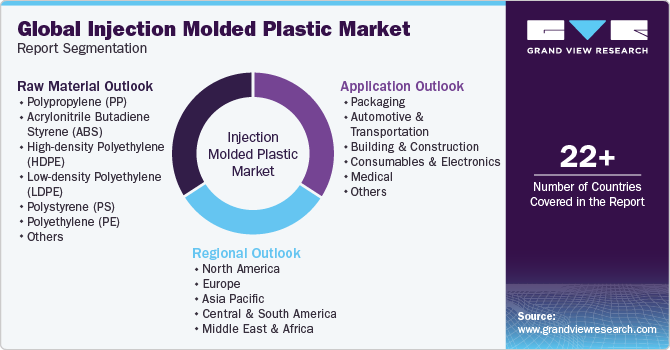

Injection Molded Plastic Market (2024 - 2030) Size, Share & Trends Analysis Report By Raw Material (PP, ABS, HDPE, LDPE, PS, PE, PVC, PET, PU, PEEK), By Application (Packaging, Building & Construction, Automotive & Transportation, Electrical & Electronics, Medical), By Region, And Segment Forecasts

- Report ID: 978-1-68038-128-3

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Injection Molded Plastic Market Summary

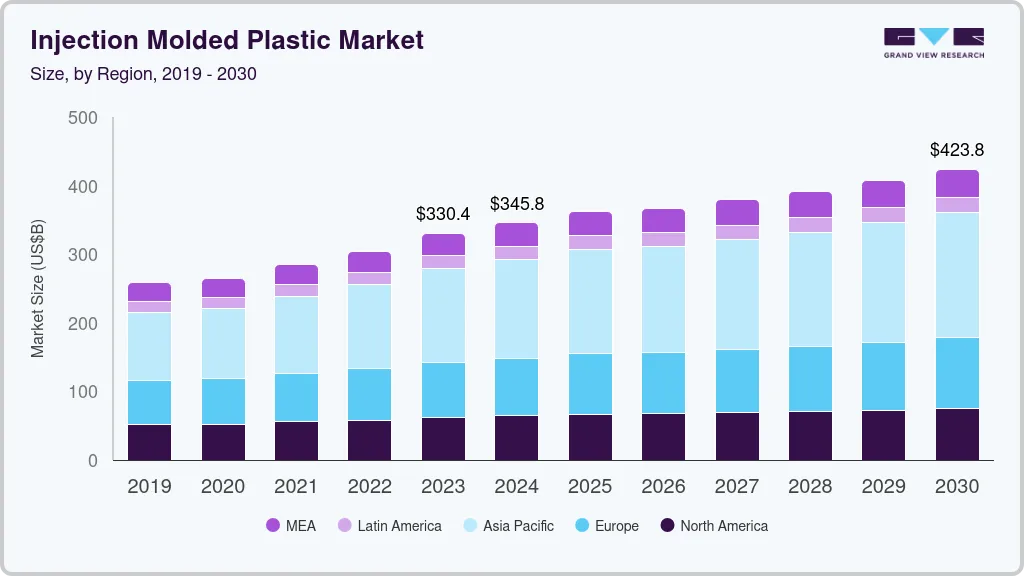

The global injection molded plastic market size was estimated at USD 330.41 billion in 2023 and is projected to reach USD 423.75 billion by 2030, growing at a CAGR of 3.4% from 2024 to 2030. Growing demand for plastic components from various end-use industries including automotive, packaging, home appliances, electrical and electronics, and medical devices is anticipated to drive the growth.

Key Market Trends & Insights

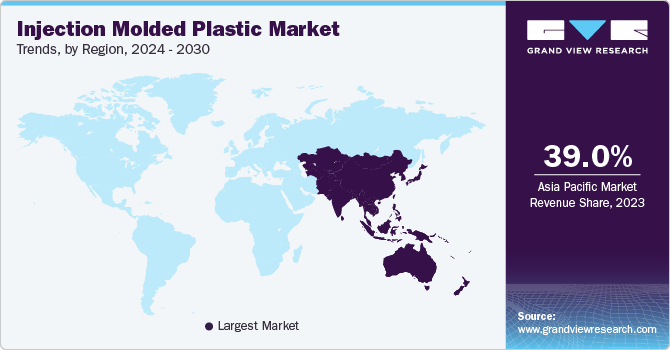

- Asia Pacific dominated the market and held a revenue share of over 39.0% in 2023.

- Europe is anticipated to witness significant growth in the artificial intelligence market.

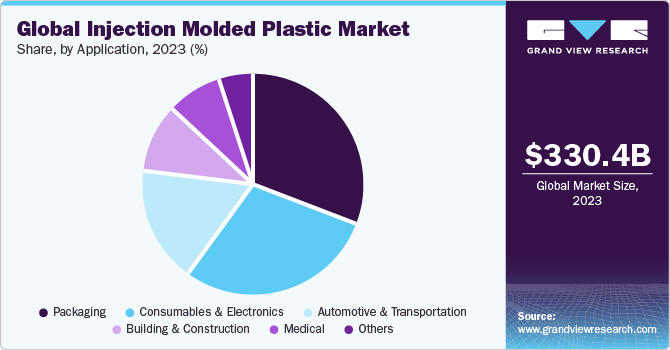

- By application, the packaging segment dominated t.he market and accounted for the largest revenue share of 32% in 2023.

- By raw material, the polypropylene segment held the largest share of over 20% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 330.41 Billion

- 2030 Projected Market Size: USD 423.75 Billion

- CAGR (2024-2030): 3.4%

- Asia Pacific: Largest market in 2023

Modern advancements that reduce the rate of defective production have increased the usage of injection molded technology in the mass production of complex plastic shapes, which is expected to boost the injection molded plastic market growth over the forecast period.

The U.S. market growth is expected to be driven by demand in automotive, medical, and building & construction applications. Increasing electronic appliances such as microwave ovens, washing machines, and refrigerators demand in the U.S. is expected to fuel North America’s injection molded plastics market over the forecast period. The segment accounted for a volume share of 81.7% in overall U.S. injection molded plastics market demand.

With rapid developments in automotive technologies, conventional plastics are being increasingly replaced by high-performance materials, including thermoplastic elastomers having properties of both plastic and rubber and lesser weight as compared to steel and other plastic materials. The demand for injection molded plastic parts in the country is majorly generated from the expanding automotive industry and the rise in the number of construction activities. The U.S. has witnessed a massive growth in automobile production in the recent past.

Injection molded plastics market prices are highly influenced by factors such as production volume, technologies, regulatory requirements, labor costs, currency fluctuations, elasticity of demand & supply, and raw materials trade-related tariffs. Since 2023, various geopolitical conflicts in Eastern Europe, Western Asia and Horn of Africa have strained routes of shipping, thereby increasing freight costs, which in turn have added to soaring Injection Molded Plastics prices.

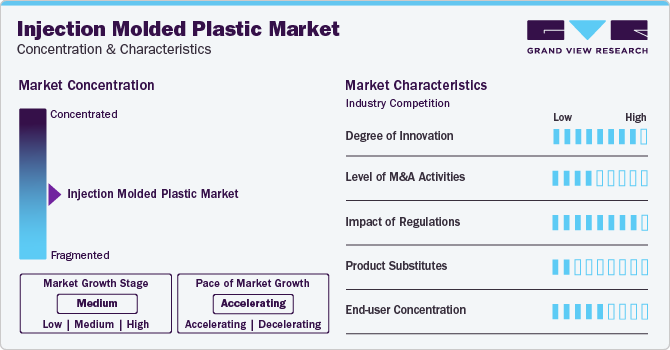

Market Concentration & Characteristics

Market growth is driven by rising investments in the packaging and automotive sector. This leads end-users to spend increasingly on food & beverage packaging for several applications including processed foods, pet foods, bottled water, and tea.

With growing demand patterns, automotive companies such as Fiat Automobiles S.p.A. and Toyota Boshoku Corporation are increasing their production capacities. Moreover, the industry is largely characterized by dominance of regional players, leading within their respective regional markets.

Automobile manufacturers are focusing on reducing vehicle weight in order to enhance fuel efficiency. The increasing usage of plastics to replace metals and alloys in automotive components is predicted to boost product demand in the automobile end-use segment, offering huge opportunities for injection-molded plastics to enter the market.

In addition, injection molding manufacturers are largely supported by their local governments in the form of subsidies, specialized policies for clearances, and other economic incentives, as injection molding offers toughness, stiffness, and strength to the product. For example, in October 2023, IPEX announced the opening of an innovative plastics manufacturing facility in Pineville, North Carolina. The new 200,000-square-foot cutting-edge facility has entirely electric injection molding machines, proprietary automation, cloud connection, and industry-leading health and safety standards. The plant will greatly boost IPEX's US manufacturing capacity for plumbing, electrical, industrial, and municipal fittings.

Raw Material Insights

The polypropylene segment held the largest share of over 20% in 2023 owing to its increasing consumption in automotive components, household goods, and packaging applications. Growing demand for injection molded plastics types including polypropylene finished products penetration in protective caps in electrical contacts and battery housings, food packaging is anticipated to further drive its demand over the forecast period. Polypropylene components are widely used in food packaging and electrical contacts due to corrosion resistance and electrical insulation properties respectively. On account of the aforementioned factors, the segment is expected to witness the highest growth over the forecast period.

Moreover, acrylonitrile butadiene styrene (ABS) emerged as the second most common injection molded plastic in terms of the overall revenue share in 2023. Rising acrylonitrile butadiene styrene component demand in medical devices, automotive components, electronic housings, and consumer appliance manufacturing is expected to drive its growth over the forecast period. Superior product properties, such as strength and durability is anticipated to drive demand over forecast period. The product finds applications in the household appliances, automobile parts, tools, and medical devices industries.

Application Insights

The packaging segment dominated t.he market and accounted for the largest revenue share of 32% in 2023. The finished products used in packaging undergo various development phases to meet regulatory guidelines and end-user requirements. A few requirements plastics need to meet for packaging application are increased shelf life of food products, better performance toward wear, and tear, and durability.

Growth of electronics industry coupled with the cost effective availability of electrical appliances is expected to remain a key driving factor for injection molded plastics for the next seven years. Injection molded plastics are lightweight, durable and cost-effectively used in myriad applications such as coffee makers, irons, mixers, hair dryers and electric shavers.

Moreover, injection molded plastics hold immense potential in the medical and automotive industries. The industry is expected to witness the highest growth in the medical devices & components sector. Optical clarity, biocompatibility, and cost-effective methods of production are expected to drive the demand in the medical industry.

Regional Insights

Asia Pacific dominated the market and held a revenue share of over 39.0% in 2023. Increasing infrastructure spending coupled with growing automobile demand in countries such as China, India, Indonesia, and Malaysia is expected to drive market penetration in the region.

Primary end–use industries such as electronics and automobile are shifting their manufacturing base to Asia Pacific countries such as India, Thailand, and Indonesia owing to low labor costs. Government incentives in the form of tax benefits are offered to manufacturers in these regions. This factor increases the requirement for manufacturing various automotive and electrical parts, which in turn is expected to increase injection molded plastics demand over the forecast period.

Europe is anticipated to witness significant growth in the artificial intelligence market. Growth in automotive production, high standard of living, and growing population significantly contribute to growth for injection molded plastics in Europe. Well-developed infrastructure and renowned automakers, including Fiat, BMW, and Volkswagen, are propelling the development of the automotive market in this region, which creates the application scope of injection molded plastics in this region.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In April 2023, Nexa3D acquired Addifab, the parent company of Freeform Injection Molding. The acquisition strengthens the ability of Addifab's high-temperature soluble and high-impact resins to be used in conjunction with Nexa3D's ultrafast 3D printers to produce advanced tools that can be used with any type of injection molding feedstock.

-

In March 2023, ABC Technologies Holdings Inc. acquired WMG Technologies for a sum of USD 165 million. ABC Technologies Holdings Inc. offers products to its clients in three categories: fluids, HVAC, outside systems, interior systems, and others. Likewise, WMGT supplies sophisticated tooling for injection-molded exterior and interior parts, lighting molds, and optic inserts to significant global automotive OEMs at tier-1 and tier-2 levels. Additionally, it offers a wide range of other outside goods.

Key Injection Molded Plastics Companies:

- ExxonMobil Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Dow, Inc.

- Huntsman International LLC.

- Eastman Chemical Company

- INEOS Group

- LyondellBasell Industries Holdings B.V.

- SABIC

- Magna International, Inc.

- IAC Group

- Berry Global, Inc.

- Master Molded Products Corporation

- HTI Plastics Inc.

- Rutland Plastics

- AptarGroup, Inc.

- LACKS ENTERPRISES, INC.

- The Rodon Group

- Heppner Molds

Injection Molded Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 345.78 billion

Revenue forecast in 2030

USD 423.75 billion

Growth rate

CAGR of 3.4% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Malaysia; Indonesia; Australia; New Zealand; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

ExxonMobil Corporation; BASF SE; DuPont de Nemours, Inc.; Dow, Inc.; Huntsman International LLC.; Eastman Chemical Company; INEOS Group; LyondellBasell Industries Holdings B.V.; SABIC; Magna International, Inc.; IAC Group; Berry Global, Inc.; Master Molded Products Corporation; HTI Plastics Inc.; Rutland Plastics; AptarGroup, Inc.; LACKS ENTERPRISES, INC.; The Rodon Group; Heppner Molds

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Injection Molded Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Injection Molded Plastics Market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polypropylene (PP)

-

Acrylonitrile Butadiene Styrene (ABS)

-

High-density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Polystyrene (PS)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polyurethane (PU)

-

Polyether Ether Ketone (PEEK)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Packaging

-

Automotive & Transportation

-

Building & Construction

-

Consumables & Electronics

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

South Korea

-

Malaysia

-

Indonesia

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global injection molded plastic market size was estimated at USD 303.7 billion in 2022 and is expected to reach USD 330.4 billion in 2023.

b. The global injection molded plastic market is expected to grow at a compound annual growth rate of 3.6% from 2023 to 2030 to reach USD 423.7 billion by 2030.

b. The polypropylene raw material dominated the injection molded plastic market and accounted for the largest revenue share of 34.5% in 2022, owing to its increasing consumption in automotive components, household goods, and packaging applications.

b. The packaging application segment dominated the market for injection molded plastics and accounted for the largest revenue share of 30.5% in 2022.

b. Asia Pacific dominated the injection molded plastic market with a share of 39.4% in 2022. This is attributable to the increasing infrastructure spending and growing automobile demand in countries such as China, India, Japan, and South Korea.

b. Some key players operating in the injection molded plastics market include LyondellBasell; SABIC; Eastman Chemical Company; Huntsman; BASF SE, Ineos Group; and DuPont.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.