- Home

- »

- Smart Textiles

- »

-

Medical Nitrile Gloves Market Size And Share Report, 2030GVR Report cover

![Medical Nitrile Gloves Market Size, Share & Trends Report]()

Medical Nitrile Gloves Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Powdered, Powder Free), By Product (Disposable, Durable), By Application (Examination, Surgical), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-220-4

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Nitrile Gloves Market Size & Trends

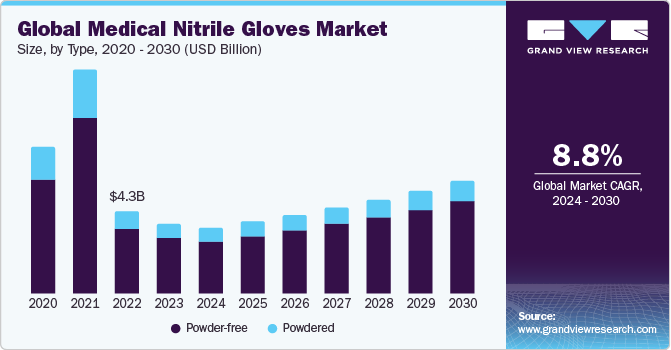

The global medical nitrile gloves market size was estimated at USD 3,707.4 million in 2023 and is anticipated to grow at a compounded annual growth rate (CAGR) of 8.8% from 2024 to 2030. The increased global awareness of infection control and demand for personal protective equipment (PPE) are driving the demand for medical nitrile gloves. The versatile attributes of nitrile gloves, including their durability, chemical resistance, and hypoallergenic properties, position them as a preferred choice for healthcare professionals in various settings. In addition, growing emphasis on stringent hygiene standards, coupled with the need for protective measures against healthcare-associated infections (HAIs), contributes significantly to the sustained and increasing demand for medical nitrile gloves worldwide.

As healthcare infrastructure expands and infection prevention remains a top priority, the market is expected to continue its upward trajectory. According to the U.S. Centers for Medicare & Medicaid Services, healthcare expenditures increased from USD 4,455.9 billion in 2022 to USD 5,247.4 billion in 2025. The increasing healthcare expenditures in the U.S. are pivotal in driving the market growth. As healthcare activities increase in response to greater funding and resources allocated to the industry, there is a growing need for essential medical supplies, including medical nitrile gloves. These gloves, known for their superior barrier protection and infection control properties, are in high demand across healthcare settings.

The adoption of innovative practices in medical and healthcare industries and the development of advanced medical care products & devices are expected to positively impact the use of healthcare services across the globe. In addition, increasing disposable income is expected to enable its population to avail themselves of advanced healthcare services and use improved products, which is expected to drive expenditure in the healthcare industry. In addition, factors, such as the expansion of public healthcare systems, increased economic prosperity, and population growth, are expected to contribute to a rise in healthcare spending. Furthermore, growing aging population, rising number of individuals with chronic & long-term conditions, increasing labor costs, staff shortages, and high demand for comprehensive ecosystem services are all projected to drive up healthcare expenditure.

According to the Centers for Disease Control and Prevention, there was a 7% increase in CLABSI, a 5% increase in CAUTI, a 14% increase in hospital-onset MRSA bacteremia, and a 12% increase in VAE observed between 2020 and 2021. In addition, the COVID-19 pandemic has increased the risk of HAIs. Adopting proper hygiene practices and adhering to aseptic techniques by healthcare workers are among the methods that can be employed to prevent the transmission of microbes, thus mitigating the risk of these infections. With growing patient awareness regarding infection risks and the expansion of healthcare services into diverse environments, medical nitrile gloves continue to play a crucial role in infection control measures, ensuring the protection of both patients and healthcare professionals.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of its growth is accelerating. The market has witnessed substantial growth in recent years, driven by increasing awareness of infection control and high demand for PPE. The market size has expanded significantly due to factors, such as the rise in HAIs and the need for durable and hypoallergenic alternatives to latex gloves.

Moreover, ongoing advancements in technology and product innovation have played a crucial role in shaping the market. Manufacturers are continually improving glove materials, enhancing durability, flexibility, and barrier properties. For example, the development of textured surfaces on nitrile gloves improves grip and tactile sensitivity, addressing the need for precision in medical procedures.

Furthermore, stringent regulations and standards in the healthcare industry drive market growth. Compliance with regulatory requirements is essential for manufacturers to ensure product safety and quality. For instance, adherence to standards, such as the Food and Drug Administration (FDA) requirements in the U.S. and the European Medical Devices Regulation (MDR), enhances the market acceptance of nitrile gloves.

The demand for medical nitrile gloves varies across regions, influenced by factors, such as healthcare infrastructure, regulatory landscape, and disease prevalence. Emerging economies with expanding healthcare sectors contribute significantly to market growth, while developed regions prioritize technological advancements and product quality.

Type Insights

The powdered type segment dominated the market and accounted for a share of 78% in 2023. The powdered form makes it easier to put on and take off gloves, which can be important for workers who frequently change gloves during their tasks. The healthcare sector is a major product consumer. The demand for powdered nitrile gloves is driven by the need for PPE in hospitals, clinics, and other healthcare facilities.

Powder-free nitrile gloves go through a chlorination process to enhance their ease of wearing and removal without relying on the use of powder. During this procedure, the gloves are treated with a chlorine solution, followed by a thorough water rinse and drying, effectively removing the majority of powdered residue, contaminants, and proteins. As a result, this process imparts greater strength to powder-free gloves in comparison to their powdered counterparts.

However, there are drawbacks associated with the chlorination process, including the potential for powder-free gloves to become more challenging to remove rapidly and a potential reduction in the overall grip of the gloves. To counteract these issues, manufacturers employ polymer coatings like acrylics, silicones, and hydrogels. These coatings offer a lower surface friction than the glove material itself, making it easier for users to put on and remove the gloves.

Product Insights

Disposable nitrile gloves are usually thinner as compared to durable gloves, which offer greater sensitivity. These gloves protect against mild chemicals and irritants; however, they are not suitable for use with harsh chemicals or in harsh environments in industries, such as metal & manufacturing or oil & gas. Durable nitrile gloves offer higher chemical resistance compared to other disposable gloves. Disposable nitrile gloves are meant for single use and are discarded after every use. Safety assurance and cost-effectiveness are some of the advantages offered by disposable nitrile gloves. These factors are expected to drive product demand over the coming years.

Durable nitrile gloves are specifically crafted for use in challenging environments and intended for multiple uses. They provide several advantages, including enhanced durability, strength, minimal waste generation, and other environmental benefits. These gloves are characterized by their thickness, surpassing that of disposable nitrile gloves, ensuring prolonged use without tearing easily. This thickness contributes to enhanced hand protection, particularly in demanding work settings. Despite their durability, these gloves are less sensitive compared to their disposable counterparts, potentially causing discomfort during intricate tasks. In addition, they necessitate more frequent cleaning after use, introducing an inconvenience compared to disposable gloves, which can be easily discarded post-use.

Application Insights

Examination nitrile gloves are commonly used by healthcare professionals during routine physical examinations of patients. This includes activities, such as checking vital signs, palpating specific areas, and conducting general health assessments. The thin and tactile nature of these gloves allows for detailed examinations without compromising sensitivity. In diagnostic settings, healthcare providers frequently use examination gloves when collecting samples or performing procedures that do not involve surgery. This can include tasks, such as obtaining blood samples, conducting swab tests, or performing dermatological examinations.

Surgical nitrile gloves are a critical component in the operating room, where they are worn by surgeons and other members of the surgical team. These gloves provide a sterile barrier, preventing contamination during surgical interventions. The textured surface of surgical nitrile gloves enhances the surgeon's grip on delicate instruments, allowing for precise movements during surgery. This is crucial for maintaining control and minimizing the risk of errors. Moreover, surgical gloves are essential for maintaining a sterile environment in the operating room. They undergo rigorous sterilization processes and are packaged in a way that ensures their sterility until they are done by the surgical team.

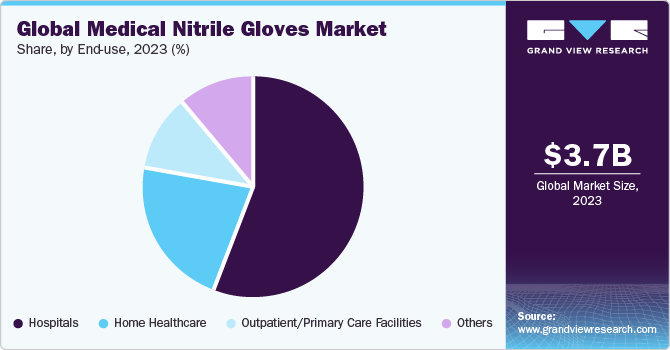

End-use Insights

Medical nitrile gloves are employed during various diagnostic procedures, such as drawing blood for laboratory tests, collecting samples for cultures, or performing swab tests. The gloves prevent direct contact between the healthcare worker's hands and bodily fluids, reducing the risk of infection transmission. Healthcare professionals, including doctors, nurses, and medical assistants, use medical nitrile gloves during routine patient examinations. These gloves provide a protective barrier, ensuring that healthcare workers can perform physical examinations while minimizing the risk of cross-contamination. The increased product utilization in home healthcare is driven by a growing emphasis on personal protective measures and infection control within the domestic setting.

As the demand for home healthcare services increases-due to growing aging population, prevalence of chronic conditions, and focus on patient comfort-the need for protective gear becomes paramount. Medical nitrile gloves offer a convenient and effective solution, allowing caregivers and individuals receiving care at home to maintain a barrier against potential infections. The gloves facilitate safe interactions, whether during routine health monitoring, administering medications, or providing wound care, contributing to the overall well-being of patients and caregivers in the home healthcare environment. This increased adoption aligns with a broader trend toward preventive measures and healthcare practices that prioritize safety and hygiene in non-clinical settings.

Regional Insights

North Americadominated the global market dominated market in 2023. High awareness of infection control, particularly after the COVID-19 pandemic, has led to an increased emphasis on PPE, with medical nitrile gloves playing a pivotal role. The expansion of healthcare infrastructure, rising healthcare spending, and the need for robust safety measures in medical facilities have contributed to the escalating demand. In addition, the prevalence of chronic diseases, an aging population, and a surge in healthcare services have fueled the adoption of nitrile gloves across various medical applications. The versatility, durability, and hypoallergenic properties of nitrile gloves make them a preferred choice for healthcare professionals. As the focus on preventing healthcare-associated infections intensifies, the demand for medical nitrile gloves in North America is expected to continue its upward trajectory, addressing the critical need for effective infection control measures in healthcare settings.

U.S. Medical Nitrile Gloves Market Trends

The U.S. medical nitrile gloves market has witnessed substantial growth, propelled by an increased emphasis on infection prevention and a rise in healthcare expenditures. Moreover, the rising aging population and expanding healthcare infrastructure have further contributed to the escalating demand for medical nitrile gloves, particularly in medical examinations and surgical procedures.

The Canada medical nitrile gloves market has witnessed substantial growth, propelled by an increased emphasis on infection prevention and a rise in healthcare expenditures. Notably, the Canadian Institute for Health Information reported a 2.8% increase in total health spending in 2023, a significant uptick from the 1.5% growth observed in 2022. High awareness of hygiene and safety has made the use of medical nitrile gloves indispensable in diverse healthcare settings throughout Canada. The combination of an aging population and expanding healthcare infrastructure has further contributed to the escalating demand for these gloves, particularly in medical examinations and surgical procedures.

Europe Medical Nitrile Gloves Market Trends

The medical nitrile gloves market in Europe is witnessing a significant trend of increasing preference for powder-free gloves due to growing concerns about allergies and skin irritation caused by the powder used in these gloves. Furthermore, the market is witnessing a shift towards environmentally friendly products, with manufacturers investing in sustainable glove production methods and developing biodegradable gloves. European countries are also aiming to reduce their reliance on Asian countries and develop domestic manufacturing capabilities. The e-commerce distribution channels have played a crucial role in the market and will continue to drive the purchase of these products.

The Germany medical nitrile gloves market growthis driven by a robust healthcare system, coupled with a proactive approach to healthcare standards, which has contributed to the adoption of stringent infection control measures, further boosting the product demand. In addition, the country's aging population has led to an increased emphasis on healthcare services, including medical examinations, diagnostics, and surgical procedures, where the use of nitrile gloves is fundamental.

Asia Medical Nitrile Gloves Market Trends

The medical nitrile gloves market in Asia Pacific is expected to grow at a high rate in the next few years, driven by factors, such as increasing demand for eco-friendly products, rising consumption of medical gloves in Asian countries, and high safety standards. The demand for examination gloves in Asia is increasing, as they are widely used for medical examinations, surgeries, chemotherapy, and other applications. Major players in the market are investing in sustainable and biodegradable glove production methods to reduce their environmental impact and meet customer expectations.

The China medical nitrile gloves market has witnessed substantial growth, propelled by factors, such as increased healthcare awareness, growing emphasis on infection control, and expansion of healthcare infrastructure. For instance, in 2021, China had surpassed one million healthcare institutions, marking an increase of 8,013 as compared to 2020. Within this total, the number of hospitals rose by 1,176 to reach 36,570, comprising 11,804 public and 24,766 private hospitals. This equates to an average of two hospitals for every 100,000 residents in the country. Moreover, as the country continues to prioritize healthcare safety and preventive measures, the market is expected to maintain its growth trajectory.

Central & South America Medical Nitrile Gloves Market Trends

The medical nitrile gloves market in Central & South America is projected to witness significant growth in the coming years, owing to factors, such as increasing prevalence of infectious diseases, rising awareness about hygiene and safety, growing healthcare expenditure, and rapidly expanding medical tourism industry. Some of the key players in the market are focusing on developing innovative and eco-friendly products, such as biodegradable nitrile gloves, to gain a competitive edge and cater to the growing demand for sustainable solutions.

The Brazil medical nitrile gloves market will witness significant growth owing to the diverse healthcare landscape encompassing public and private sectors, which has contributed to a surge in product demand in hospitals, clinics, and other medical facilities. In addition, the versatility of nitrile gloves, offering durability, chemical resistance, and hypoallergenic properties, has led to their widespread adoption in medical examinations, diagnostics, and surgical procedures across the country. As Brazil continues to prioritize healthcare safety measures, the market is expected to remain a crucial component in the nation's efforts to combat infectious diseases and ensure the well-being of healthcare professionals and patients.

Middle East & Africa Medical Nitrile Gloves Market Trends

The medical nitrile gloves market in MEA will register significant growth. The healthcare structure in the MEA countries is improving, leading to increased awareness regarding medical facilities. This is expected to drive market growth. The trends shaping the market include increasing importance of hygiene at workplaces, which is expected to boost product demand.

The Saudi Arabia medical nitrile gloves market has experienced significant growth, fueled by an increased emphasis on healthcare safety and infection control. The demand for these gloves has increased, particularly in response to the challenges presented by the COVID-19 pandemic. Within Saudi Arabia's healthcare landscape, medical nitrile gloves play a vital role in upholding aseptic conditions across hospitals, clinics, and other healthcare facilities.

Key Medical Nitrile Gloves Company Insights

The market is characterized by the presence of large- and small-scale manufacturers across the globe, thereby resulting in a significant level of concentration. The competition in the market is intense and is marked by the demand for innovative and reliable protective solutions. The majority of manufacturers are engaged in offering products by implementing the most innovative and state-of-the-art technologies to ensure optimum comfort, durability, and protection to end-users working in different professional fields. For instance, Armbrust American began manufacturing 100% American-made nitrile gloves in April 2023. Armbrust gloves are made in Louisiana and contain FDA-approved, chemo-rated gloves.

Key Medical Nitrile Gloves Companies:

The following are the leading companies in the medical nitrile gloves market. These companies collectively hold the largest market share and dictate industry trends.

- Ansell Ltd.

- Honeywell International, Inc.

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kimberly-Clark

- Kossan Rubber Industries Bhd

- Superior Gloves

- MCR Safety

- Supermax Corporation Berhad

- Ammex Corporation

- Cardinal Health

- Medline Industries, Inc.

- Atrium Medical Care

- Dynarex Corporation

- Mckesson Corporation

Recent Developments

-

In March 2023, American Nitrile, partnered with The Central Association for the Blind and Visually Impaired (CABVI). The collaboration aimed to distribute domestically manufactured nitrile gloves, addressing the national demand for PPE, and promoting shortened supply chains. These premium gloves, approved by the Transportation Security Administration under an AbilityOne contract from the U.S. Department of Homeland Security, adhere to the Make PPE in America Act

-

In August 2022, Supermax Corp Bhd's subsidiary, Supermax Healthcare Canada, unveiled a strategic partnership with Minco Wholesale & Supply Inc. through a formal agreement. This collaboration entails distributing Canadian manufacturer Supermax's products throughout North America. These offerings encompass rubber gloves, masks, and non-woven cotton medical products

-

In November 2022, Vizient, Inc. entered into a partnership agreement with SafeSource Direct, LLC. This collaboration represents Vizient's latest initiative to bolster the reliability and availability of essential medical supplies, emphasizing its commitment to secure the healthcare industry's critical needs. In December 2022, Nephron Nitrile opened a new plant, Nephron Pharmaceuticals Corporation, in West Columbia to produce American-made, medical-grade, first-in-class nitrile gloves

-

Nephron Nitrile built a nitrile center in Lexington County in December 2022 with an annual production goal of 2.5 billion medical gloves

Medical Nitrile Gloves Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,460.7 million

Revenue forecast in 2030

USD 5,726.8 million

Growth rate

CAGR of 8.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, end-use, region

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Ansell Ltd.; Honeywell International, Inc.; Top Glove Corp. Bhd; Hartalega Holdings Berhad; Kimberly-Clark; Kossan Rubber Industries Bhd; Superior Gloves; MCR Safety; Supermax Corp. Berhad; Ammex Corp.; Cardinal Health; Medline Industries, Inc.; Atrium Medical Care; Dynarex Corp.; Mckesson Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Nitrile Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical nitrile gloves market report on the basis of type, product, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Powdered

-

Powder-free

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Durable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Examination

-

Surgical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical nitrile gloves market size was estimated at USD 3,707.4 million in 2023 and is expected to reach USD 3,460.7 million in 2024.

b. The medical nitrile gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.8% from 2024 to 2030 to reach USD 5,726.8 million by 2030.

b. North America dominated the global medical nitrile gloves market dominated the market in 2023. Heightened awareness of infection control, particularly in the context of the COVID-19 pandemic, has led to an increased emphasis on PPE, with medical nitrile gloves playing a pivotal role.

b. Some of the key players operating in the medical nitrile gloves market include Ansell Ltd, Honeywell International, Inc., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kimberly-Clark, Kossan Rubber Industries Bhd, Superior Gloves, MCR Safety, Supermax Corporation Berhad, Ammex Corporation, Cardinal Health, Medline Industries, Inc., Atrium Medical Care, Dynarex Corporation, Mckesson Corporation among others.

b. The heightened global awareness of infection control and the increased demand for personal protective equipment (PPE), particularly in the context of the ongoing COVID-19 pandemic are driving the demand for medical nitrile gloves market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.