- Home

- »

- Medical Devices

- »

-

Medical Transport Boxes Market Size & Share Report, 2030GVR Report cover

![Medical Transport Boxes Market Size, Share & Trends Report]()

Medical Transport Boxes Market Size, Share & Trends Analysis Report By Material (Plastic, Stainless Steel), By Cooling Technology (Passive, Active), By Application, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-095-1

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global medical transport boxes market size was valued at USD 616.48 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.10% from 2023 to 2030. This can be attributed to the increasing global disease burden that has led to an increase in the use of transport boxes that transport various medical products. The increased demand for medical transport boxes from various healthcare settings is further contributing to its market growth.

The medical transport boxes offer safe and secure transportation of temperature-sensitive laboratory and clinical specimens between operating sites. According to the U .S. National Library of Medicine, approximately 452,947 clinical trial studies are registered in 221 countries worldwide, as of May 2023. Thus, clinical trials are expected to boost the demand for medical transportation boxes in the coming years.

The growth in demand for ultra-low temperature cold chain health products is attributed to the increasing importance of cell & gene therapy (CGT) and advancements in the development of several high-temperature sensitive vaccines. For instance, in October 2022 , B Medical Systems and Secop Group announced a partnership to develop a novel technology for the generation of new transport boxes that can safely store and transport biospecimens, vaccines, and other temperature-sensitive products at ultra-low temperatures even in areas with tropical ambient conditions.

In addition, in May 2023, B Medical System India Pvt Ltd, a firm of B Medical System inaugurated its Customer Excellence Center, a research and development facility in Mumbai, India. This R&D facility supports the company’s endeavors of creating reliable, safe, and sustainable healthcare systems by offering high-quality cold chain products such as transport boxes in India. This strategic move has strengthened the R&D portfolio of the company.

The COVID-19 pandemic had a high impact on the medical transport boxes market. Many transport box manufacturing companies witnessed increased sales revenue during the mid-COVID-19 pandemic. This growth can be attributed to the increasing demand for vaccines and liquid plasma transportation for the treatment of COVID-19 patients. However, strict regulations undertaken by the government such as nationwide lockdowns and supply chain breakdown led to a shortage of transport boxes globally.

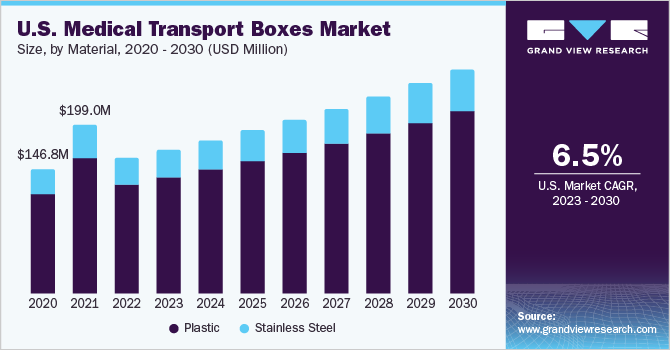

Material Insights

Based on material, the market is segmented into plastic and stainless steel. The plastic segment accounted for the largest revenue share of 79.99% in 2022 and is expected to witness the fastest CAGR during the forecast period. This can be attributed to the various advantages associated with it and its wide availability of portable plastic-based medical transport boxes with precise temperature control, suitable for storage and transportation of biological products such as medicines, blood, and reagents.

Key players such as Nilkamal Material Handling offer strong, durable, and easy to clean & wash plastic ice boxes for storage and transportation of pharmaceutical products such as drugs. These ice boxes are made from polyethylene plastic. Thus, the majority of the companies involved in manufacturing and developing novel plastic-based transportation products improve product availability worldwide, thereby driving market growth.

Cooling Technology Insights

Based on cooling technology, the medical transport boxes market is segmented as passive and active. The passive segment accounted for the largest revenue share of 82.40% in 2022 and is expected to witness the fastest CAGR during the forecast period. Passive cooling devices include vaccine carriers and cold boxes. They control the heat flow through the container walls to maintain the vaccines and other products within a standard temperature to prevent further damage. Thus, high advantages associated with these products such as low cost and low maintenance are some of the major factors that contribute to this segment’s growth.

The active cooling technology market is also expected to witness significant CAGR during the forecast period owing to the high demand for products in emerging markets. Developing countries are mostly in the tropical region. Hence, these countries require more active cooling transport boxes with air conditioning for transporting medical products from one place to another without compromising the safety and quality of the products. In January 2021 , Blackfrog Technologies launched Emvolio, a next-generation battery-powered portable active cooling device, specifically designed to support the final mile delivery of vaccines.

Application Insights

Based on application, the medical transport boxes market is segmented into blood and its components, vaccine, urine, and others. The blood and its components segment accounted for the largest revenue share of 33.31% in 2022. This can be attributed to the increasing demand and high adoption of blood and its components such as red blood cells (RBCC), white blood cells (WBC), plasma, and platelets.

According to the American National Red Cross, the Red Cross organization collects approximately 12,500 blood and 3000 platelet donations daily. All blood and its components must be transported by maintaining the right temperature ranges. Thus, MT2 of B Medical System plays an important role in transportation. Therefore, the increase in donations of blood and its components is projected to propel the demand for transport boxes, thereby driving its market growth.

The vaccine segment is expected to witness the fastest growth during the forecast period owing to the new government initiatives for offering cold chain services to low-middle-income countries. In July 2022 , the Government of Japan, through UNICEF, supported the Government of Eswatini by providing cold chain equipment to store COVID-19 vaccines at the right temperature. Under this initiative, the Eswatini government received 40 cold boxes, 100 vaccine carriers, 14 deep refrigerators, and 5 deep freezers. This helped the Ministry of Health in distributing the COVID-19 vaccines safely across the country.

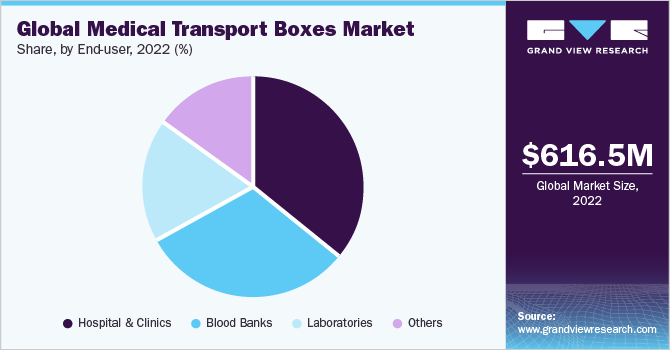

End-user Insights

Based on end-user, the market for medical transport boxes is segmented into hospitals & clinics, blood banks, laboratories, and others. The hospital & clinics segment accounted for the largest market share of 36.19% in 2022. This can be attributed to the increasing applications of transport boxes in hospitals & clinics that further enhanced the growth of these products in the market.

Medical transport boxes are commonly used in hospitals and clinics to safely store and transport biological and pharmaceutical products. According to American Hospital Association (AHA), more than 6,200 hospitals and 400 different healthcare systems are available in the U.S. Thus, the increasing number of hospitals and clinics is projected to fuel demand for the storage and transport of equipment over the forecast period.

The blood banks segment is expected to witness the fastest growth during the forecast period, owing to the increasing number of mobile blood banks and donation centers globally. For instance, according to Canadian Blood Services, Canada has more than 4,000 mobile donor centers and 35 permanent donor centers. Blood transport boxes are commonly used in these mobile donor centers for storing collected blood and its products. Thus, the increasing number of blood banks soared the demand for blood transport boxes during the forecast period.

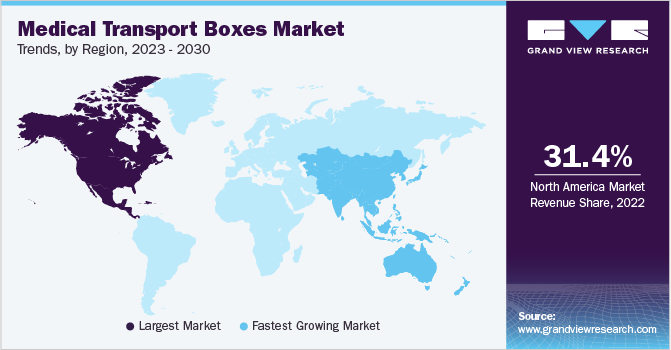

Regional Insights

North America accounted for the largest market share of 31.42% in 2022. This can be attributed to the strong presence of companies that are engaged in developing, manufacturing, and commercializing medical transport in the region. For instance, in February 2022 , Thermo Fisher Scientific launched commercial integrated packaging and distribution services for cell and gene therapies that seamlessly transition them from clinics to commercial launch for patients across the U.S. and Europe.

The Asia Pacific region is expected to witness the fastest CAGR during the forecast period. This growth can be attributed to growing investments in healthcare logistic infrastructure and high healthcare spending contributing to the growth of the medical transport boxes industry. According to Invest India , the country’s medical cold storage infrastructure accounts for 43.5% of the total revenue of the cold chain industry; hence the market is expected to have significant potential to grow.

Key Companies & Market Share Insights

Strategic partnerships, major R&D investments, and new product developments or product modifications are among the key strategies adopted by market players to gain a competitive edge in the market. In March 2023 , B Medical Systems collaborated with the Ministry of Aid and European Affairs (MAEE) to safeguard the affected areas. They were directly able to receive the required biological and medical supplies using medical transport boxes. Under this collaboration, B Medical System donated 50 medical transport boxes to the MAEE. Some prominent players in the global medical transport boxes market include:

-

B Medical Systems (Azenta)

-

Avantor, Inc.

-

Thermo Fisher Scientific Inc.

-

Sonoco Products Company

-

SARSTEDT AG & Co. KG

-

Haier Group

-

Nilkamal

-

BITO-Lagertechnik Bittmann GmbH

Medical Transport Boxes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 659.50 million

Revenue forecast in 2030

USD 1.06 billion

Growth rate

CAGR of 7.10% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, cooling technology, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B Medical Systems (Azenta); Avantor, Inc.; Thermo Fisher Scientific Inc.; Sonoco Products Company; SARSTEDT AG & Co. KG; Haier Group; Nilkamal; BITO-Lagertechnik Bittmann GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Transport Boxes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical transport boxes market report based on material, cooling technology, application, end-user, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Stainless Steel

-

-

Cooling Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Passive

-

Active

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood and its Components

-

Vaccine

-

Urine

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital & Clinics

-

Blood Banks

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical transport boxes market size was estimated at USD 616.48 million in 2022 and is expected to reach USD 659.50 million in 2023.

b. The global medical transport boxes market is expected to grow at a compound annual growth rate of 7.10% from 2023 to 2030 to reach USD 1.06 billion by 2030.

b. The plastic segment by material dominated the market for medical transport boxes in 2022 and accounted for the largest revenue share of around 79.99%.

b. Some key players operating in the medical transport boxes market include B Medical System (Azenta); Avantor, Inc.; Thermo Fisher Scientific Inc.; Sonoco Products Company; SARSTEDT AG & Co. KG; Haier Group; Nilkama; BITO-Lagertechnik Bittmann GmbH, and others.

b. Key factors driving the medical transport boxes market growth include the wide availability of portable plastic-based medical transport boxes, increasing use of transport boxes for carrying various medical products, increased demand for medical transport boxes from various healthcare settings, growing demand for ultra-low temperature cold chain health products owing to the rising importance of cell & gene therapy (CGT)

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."