- Home

- »

- Clinical Diagnostics

- »

-

Membrane Chromatography Market, Industry Report, 2030GVR Report cover

![Membrane Chromatography Market Size, Share & Trends Report]()

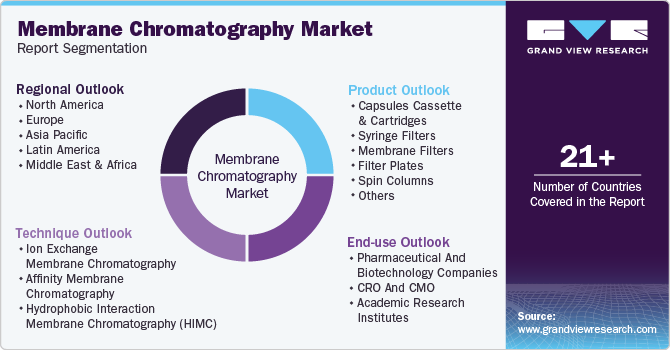

Membrane Chromatography Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Capsules Cassette & Cartridges, Syringe Filters, Membrane Filters), By Technique, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-369-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Membrane Chromatography Market Summary

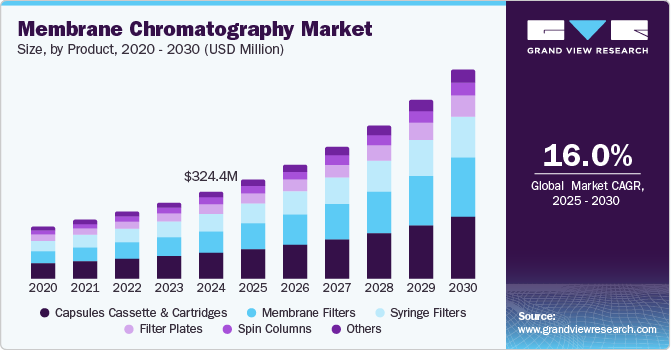

The global membrane chromatography market size was estimated at USD 324.4 million in 2024 and is projected to reach USD 779.3 million by 2030, growing at a CAGR of 16.0% from 2025 to 2030. The membrane chromatography market has experienced robust growth, primarily driven by the increasing demand for biopharmaceuticals and a heightened regulatory focus on cleaning validation for downstream purification processes.

Key Market Trends & Insights

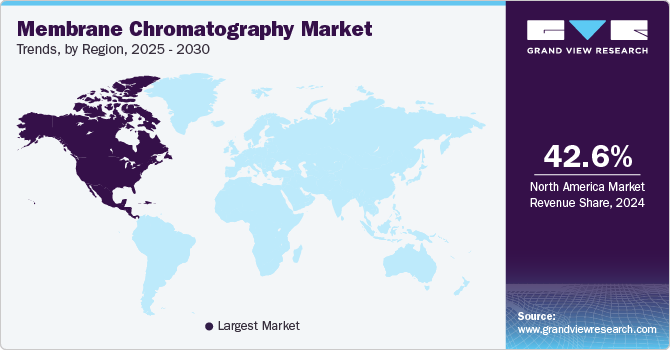

- North America membrane chromatography market dominated the global market with a revenue share of 42.6% in 2024.

- U.S. dominated the North America membrane chromatography market with a revenue share of 84.2% in 2024.

- Based on product, capsules cassette & cartridges segment dominated the market and accounted for a share of 30.2% in 2024.

- Based on technique, Ion exchange membrane chromatography segment dominated the market and accounted for a share of 47.2% in 2024.

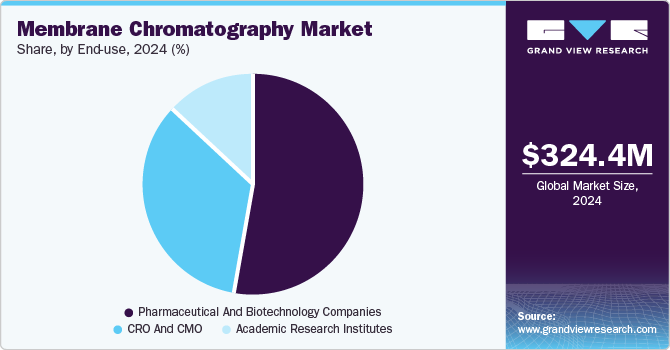

- Based on end use, pharmaceutical and biotechnology companies segment led the market with a revenue share of 53.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 324.4 Million

- 2030 Projected Market Size: USD 779.3 Million

- CAGR (2025-2030): 16.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As biopharmaceutical purification becomes more scrutinized, the need for efficient, cost-effective solutions has led to a surge in membrane chromatography usage. This technology offers significant advantages over traditional column chromatography, including higher binding capacities and reduced buffer consumption, which are critical for optimizing biopharmaceutical production.

Scalability and ease of use further enhance the appeal of membrane chromatography, particularly for large biomolecules such as monoclonal antibodies and viral vectors, which are pivotal in therapeutic and vaccine production. The rise in demand for biologics is compounded by stringent regulatory standards for purity and safety, compelling companies in the bioprocessing industry to adopt advanced purification technologies such as membrane chromatography. This shift is supported by forecasts indicating that the biopharmaceutical market is expected to grow substantially, necessitating innovative purification methods to maintain quality and compliance.

Regulatory approvals for biopharmaceutical manufacturing are also fueling market growth. For instance, in April 2024, Boehringer Ingelheim Biopharmaceuticals China successfully passed pre-approval inspections conducted by both the European Medicines Agency and the U.S. Food and Drug Administration. Such achievements highlight the capacity of companies to meet regulatory demands, thereby encouraging further investments in purification technologies. As regulatory bodies increasingly endorse biopharmaceuticals aimed at addressing diverse medical conditions, the demand for membrane chromatography continues to rise.

In addition to regulatory factors, robust R&D expenditures in the biopharmaceutical sector are propelling market expansion. The International Federation of Pharmaceutical Manufacturers & Associations reported that the biopharmaceutical industry’s annual R&D spending exceeds USD 202 billion, significantly outpacing sectors such as aerospace and defense by 7.3 times. This trend underlines the sector’s commitment to innovation and underscores the growing number of product launches, including Waters Corporation’s introduction of the XBridge Premier GTx BEH SEC columns in August 2023, tailored for gene therapy applications. Such innovations epitomize the advancements that membrane chromatography brings to the biopharmaceutical landscape, driving efficiency and supporting the industry’s rapid evolution.

Product Insights

Capsules cassette & cartridges dominated the market and accounted for a share of 30.2% in 2024. Various growth factors drive the demand for capsules and cartridges in the membrane chromatography market. These components offer significant advantages in scalability, efficiency, and ease of use compared to traditional chromatography techniques. They enable faster processing times, higher throughput, and reduced costs associated with purification processes in biopharmaceutical manufacturing. Moreover, the increasing adoption of single-use technologies across the biopharmaceutical industry is a key driver, as it minimizes the risk of cross-contamination and simplifies cleaning validation processes.

Membrane filters are expected to grow at the fastest CAGR of 18.2% over the forecast period. It offers precise molecular separation capabilities, crucial for purifying biomolecules in biopharmaceutical production. Their ability to selectively separate target molecules based on size, charge, and hydrophobicity contributes to higher purity and yield, which is essential for meeting stringent regulatory requirements. Moreover, advancements in membrane technology, such as improvements in membrane materials, pore size distribution, and surface chemistry, continue to enhance filtration efficiency and performance. The trend towards single-use technologies in bioprocessing further boosts the adoption of membrane filters due to their disposability, which reduces operational complexity and lowers the risk of contamination. These factors collectively drive the growth of membrane filters in the membrane chromatography market, positioning them as pivotal components in modern biopharmaceutical manufacturing processes.

Technique Insights

Ion exchange membrane chromatography dominated the market and accounted for a share of 47.2% in 2024. The growth is attributed to its less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period. For instance, wireless capsule endoscopy (WCE) is a cutting-edge medical technology that revolutionizes the way gastrointestinal disorders are diagnosed and monitored. One of the primary advantages of WCE is its non-invasive nature. Unlike traditional endoscopic procedures that require sedation and insertion of a flexible tube through the mouth or rectum, WCE involves swallowing a capsule, eliminating discomfort and risks associated with invasive techniques.

Affinity membrane chromatography is expected to register significant growth over the forecast period due to its efficient purification of biomolecules, lower pressure drops facilitating faster processing, and cost-effectiveness, as membrane systems reduce operational costs compared to traditional resin-based methods. Moreover, the simplicity and flexibility of this technique streamline laboratory and manufacturing processes, while its sustainable attributes align with the biopharmaceutical industry’s focus on environmental responsibility.

End Use Insights

Pharmaceutical and biotechnology companies led the market with a revenue share of 53.3% in 2024. The rising demand for biopharmaceutical products such as vaccines, monoclonal antibodies, and gene therapies requires efficient and scalable purification methods, with membrane chromatography being particularly effective. Companies are heavily investing in research and development to enhance downstream processing efficiency, reduce costs, and improve product quality, leading to increased adoption of membrane chromatography techniques. Moreover, strict regulatory requirements for product purity and safety are driving pharmaceutical and biotechnology firms to embrace advanced purification technologies, further boosting the market. The shift towards personalized medicine and the production of smaller, more specialized batches of biopharmaceuticals also favors the flexibility and efficiency offered by membrane chromatography.

The CRO and CMO segment is projected to grow at the fastest rate of 17.1% over the forecast period. CROs and CMOs provide specialized services that include drug development, manufacturing, and testing, enabling biopharmaceutical companies to outsource key aspects of their production processes. The increasing complexity and specificity of biopharmaceutical products, such as monoclonal antibodies and cell and gene therapies, require advanced and efficient purification methods, driving these organizations to adopt membrane chromatography technologies.

Regional Insights

North America membrane chromatography market dominated the global market with a revenue share of 42.6% in 2024, owing to the growing investments in research and development activities related to membrane chromatography. These investments fuel innovation, drive technological advancements, and enhance the competitiveness of the region’s biopharmaceutical industry. Moreover, the well-established healthcare sector in North America provides a solid presence for the growth of membrane chromatography technologies.

U.S. Membrane Chromatography Market Trends

The membrane chromatography market in the U.S. dominated the North America membrane chromatography market with a revenue share of 84.2% in 2024. The growing presence of emerging pharmaceutical companies in the U.S. market is fueling the expansion of the membrane chromatography market. As these companies continue to innovate and bring new therapies to market, the demand for efficient purification technologies, including membrane chromatography, is expected to rise significantly.

Europe Membrane Chromatography Market Trends

Europe membrane chromatography market held substantial market share in 2024 owing to the expanding portfolio in membrane chromatography. For instance, in February 2022, Sartorius AG strengthened its chromatography capabilities by acquiring Novasep’s chromatography division. This strategic move enables Sartorius to access a portfolio tailored for smaller biomolecules such as peptides, oligonucleotides, and insulin, as well as advanced systems for continuous biologics manufacturing. By incorporating Novasep’s offerings, Sartorius aims to diversify its revenue streams and strengthen its position as a leading provider of chromatography solutions.

Asia Pacific Membrane Chromatography Market Trends

Asia Pacific membrane chromatography market is expected to register the fastest CAGR of 17.7% in the forecast period. The market is witnessing a shift towards advanced technologies and innovative products to meet the growing need for high-resolution separation techniques. Moreover, stringent regulations regarding drug safety and quality control contribute to the expansion of the membrane chromatography market in the Asia Pacific. Companies operating in this market are focusing on strategic collaborations, product launches, and expansions to strengthen their market presence and cater to the diverse requirements of customers in the regions.

Key Membrane Chromatography Company Insights

Some key companies operating in the market include 3M; Asahi Kasei Corporation; Danaher Corporation; Merck KGaA; Cole-Parmer Instrument Company, LLC; among others. Companies in this market focus on research and development, strategic partnerships, and product launches. Their commitment to advancing care through technological innovations has contributed to their substantial market share.

-

Asahi Kasei Corporation offers state-of-the-art membrane filtration systems such as Microza, which utilize hollow-fiber membranes for reliable antibiotic purification and water for injection (WFI) production.

-

Merck KGaA provides innovative membrane technologies that enhance separation and purification processes. Their solutions support the production of high-quality biologics while ensuring regulatory compliance in life sciences.

Key Membrane Chromatography Companies:

The following are the leading companies in the membrane chromatography market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Asahi Kasei Corporation

- Danaher Corporation

- Merck KGaA

- Cole-Parmer Instrument Company, LLC

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Air Products Inc.

- Purilogics

- Restek Corporation

Recent Developments

-

In September 2024, Sartorius launched Vivaflow Tangential Flow Filtration Cassettes to enhance laboratory efficiency, simplifying ultrafiltration and diafiltration processes while significantly reducing operational costs and user effort.

-

In June 2024, Asahi Kasei launched a membrane system for producing water for injection, significantly enhancing water quality while reducing CO2 emissions and production costs compared to conventional distillation methods.

-

In April 2024, Merck announced an approximately USD 300 million investment in a new Life Science Research Center in Darmstadt, enhancing biopharmaceutical development as part of an investment program by 2025.

-

In March 2024, 3M’s Board approved the spin-off of its Health Care business, named Solventum Corporation, scheduled for April 1, 2024, with stock trading under the symbol ‘SOLV.’

-

In February 2024, Thermo Fisher Scientific launched the Dionex Inuvion Ion Chromatography System, enhancing laboratories’ capabilities for ion analysis, while offering reconfigurable workflows and compact design for various applications.

Membrane Chromatography Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 371.5 million

Revenue forecast in 2030

USD 779.3 million

Growth rate

CAGR of 16.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technique, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

3M; Asahi Kasei Corporation; Danaher Corporation; Merck KGaA; Cole-Parmer Instrument Company, LLC; Thermo Fisher Scientific Inc.; Sartorius AG; Air Products Inc.; Purilogics; Restek Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Membrane Chromatography Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global membrane chromatography market report based on product, technique, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules Cassette & Cartridges

-

Syringe Filters

-

Membrane Filters

-

Filter Plates

-

Spin Columns

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Ion Exchange Membrane Chromatography

-

Affinity Membrane Chromatography

-

Hydrophobic Interaction Membrane Chromatography (HIMC)

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

CRO and CMO

-

Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.