- Home

- »

- Pharmaceuticals

- »

-

Metabolic Disorder Therapeutics Market Size Report, 2030GVR Report cover

![Metabolic Disorder Therapeutics Market Size, Share & Trends Report]()

Metabolic Disorder Therapeutics Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease, By Therapy, By Route Of Administration (Oral, Parenteral), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-011-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Metabolic Disorder Therapeutics Market Summary

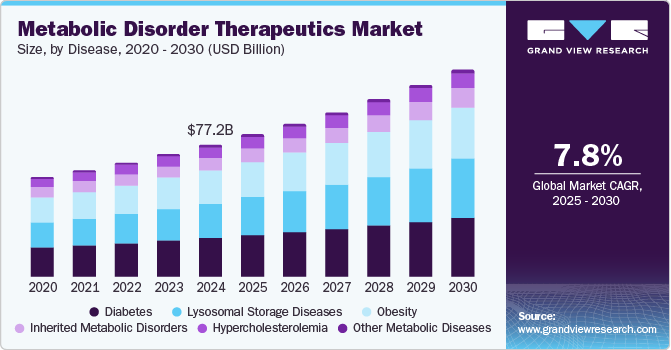

The global metabolic disorder therapeutics market size was estimated at USD 77,240.5 million in 2024 and is projected to reach USD 120,714.7 million by 2030, growing at a CAGR of 7.8% from 2025 to 2030. In Europe, reports indicate that approximately 25% of adults are afflicted by metabolic syndrome, a statistic mirrored in Brazil and South Africa with prevalence rates of 25.2% and 29.2%, respectively.

Key Market Trends & Insights

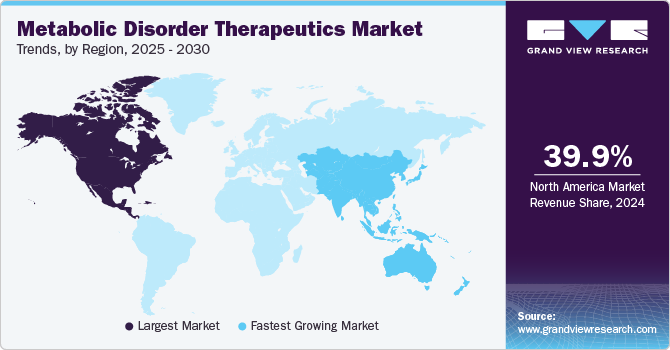

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UK is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, diabetes accounted for a revenue of USD 24,604.5 million in 2024.

- Lysosomal Storage Diseases is the most lucrative disease segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 77,240.5 Million

- 2030 Projected Market Size: USD 120,714.7 Million

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

Mexico faces a serious challenge as well, with around 30% of its adult population affected, particularly among the aging demographics. These statistics underscore the urgent need for modern treatments to combat the rising tide of metabolic disorders, propelling market demand.

Innovative biotechnology and pharmaceuticals have paved the way for the launch of novel drug formulations and targeted therapies that cater to the unique needs of individual patients. Tailored metabolic disorder therapies offering enhanced efficacy and safety profiles to improve patient outcomes are being developed. Moreover, partnerships and collaborations in the industry reflect a shift towards precision medicine approaches. For instance, in November 2024, Ascendis Pharma and Novo Nordisk A/S formed a collaboration to develop and commercialize TransCon technology products for metabolic and cardiovascular diseases.

Increased financial investment in research and development has led to a wider array of therapeutic options and improved access to care for patients suffering from metabolic disorders. This trend is further supported by regulatory bodies that provide essential backing for clinical trials targeting new therapies. For instance, in September 2024, Travere Therapeutics announced that the FDA granted full approval for FILSPARI (sparsentan), establishing it as the only non-immunosuppressive treatment to significantly slow kidney function decline in IgA nephropathy.

Furthermore, growing awareness and education about metabolic disorders are driving market demand. As healthcare professionals and the public become more informed about the importance of early diagnosis and effective management strategies, more individuals are seeking treatment. With educational initiatives emphasizing the need for timely interventions, broader recognition of these disorders and their consequences is fostering a more proactive approach to healthcare. Collectively, these factors underscore a burgeoning Metabolic Disorder Therapeutics Market, ripe with opportunities for innovative solutions and impactful regulatory support.

Disease Insights

Diabetes dominated the market and accounted for a share of 29.8% in 2024, driven by the increasing prevalence of diabetes, particularly type 2 diabetes, affecting more than 5% of the global population. Lifestyle factors, including sedentary behavior and poor dietary habits, exacerbate this issue. The ongoing requirement for consistent medication to regulate blood sugar levels ensures sustained demand for antidiabetic therapies, bolstered by advancements in drug development and heightened awareness of effective diabetes management practices.

Lysosomal storage diseases (LSDs) are expected to grow at the fastest CAGR of 9.3% over the forecast period. LSDs are progressive neurological conditions resulting from enzyme deficiencies, causing severe symptoms and early mortality. Current therapies, including enzyme replacement and substrate reduction, are limited for neurological issues. Recent advancements in gene therapy and targeted treatments provide promising prospects for improved patient outcomes and management options.

Therapy Insights

Enzyme replacement therapy (ERT) led the market with a revenue share of 30.6% in 2024. ERT targets the fundamental enzyme deficiencies associated with lysosomal storage disorders, significantly improving patient health and quality of life. Growing awareness and enhanced diagnostic capabilities are leading to increased patient identification and treatment, while advancements in ERT formulations and delivery methods are improving adherence and driving demand.

Gene therapy is anticipated to witness the fastest rate of 9.7% over the forecast period. Gene therapy holds significant potential to offer curative solutions for inherited metabolic diseases with limited treatment options. By directly targeting defective genes through gene editing and viral vector delivery, this transformative approach is showing promising results in recent clinical trials. For instance, in September 2023, UC Davis Health initiated the first gene therapy for Wilson Disease. As regulatory approvals increase, improved patient outcomes are anticipated.

Route Of Administration Insights

Parenteral therapeutics held the largest market share of 50.0% in 2024, aided by rapid onset of action and high bioavailability. Parenteral administration effectively bypasses the gastrointestinal tract, avoiding first-pass metabolism, crucial for immediate therapeutic effects. This method ensures precise dosing and is vital for medications with poor oral absorption, improving treatment adherence and patient outcomes.

Oral therapeutics are expected to register the fastest CAGR of 8.2% over the forecast period. Oral administration is non-invasive, easy for patients to self-administer, and typically preferred over injections, resulting in higher treatment adherence. This route accommodates diverse formulations, offering enhanced therapeutic options for metabolic disorders, while advancements in drug delivery technologies are improving the bioavailability of oral medications for conditions such as diabetes and obesity.

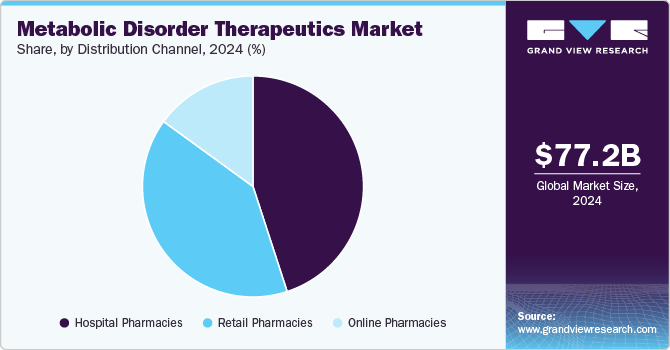

Distribution Channel Insights

Hospital pharmacies dominated the market with a revenue share of 44.6% in 2024. Hospital pharmacies play a vital role in dispensing complex medications, particularly for metabolic disorders that necessitate specialized handling. The rising hospitalization rates for these conditions, combined with enhanced healthcare infrastructure and trained professionals, underscore the importance of hospital pharmacies in providing immediate access and effective management of therapeutic interventions.

The online pharmacies sector is projected to grow at the fastest CAGR of 8.8% over the forecast period. Online pharmacies provide convenience and accessibility, enabling patients, particularly those with chronic conditions or mobility challenges, to order medications from home. Competitive pricing, automated refill reminders, and comprehensive medication information promote adherence, while the privacy offered appeals to patients hesitant to discuss sensitive health issues in person.

Regional Insights

North America metabolic disorder therapeutics market dominated the global market with a revenue share of 39.9% in 2024. North America boasts a strong healthcare infrastructure, substantial investments in research and development, and a notable prevalence of metabolic disorders such as diabetes and obesity. The region’s advanced medical technologies, vibrant pharmaceutical industry, and supportive government policies bolster innovative therapies, while growing public awareness enhances the demand for effective treatments.

U.S. Metabolic Disorder Therapeutics Market Trends

The metabolic disorder therapeutics market in the U.S. dominated the North America metabolic disorder therapeutics market with a revenue share of 90.5% in 2024. The healthcare system in the U.S. ensures access to advanced therapies and clinical trials. According to the CDC, over 30% of U.S. adults are estimated to have metabolic syndrome, with notable disparities related to race and socioeconomic status. Significant investments in biotechnology and pharmaceutical research, combined with the presence of major companies and a focus on personalized medicine, are aiding the metabolic disorder therapeutics industry in the country.

Europe Metabolic Disorder Therapeutics Market Trends

Europe metabolic disorder therapeutics market held substantial market share in 2024. The region has launched multiple health initiatives to enhance diagnosis and treatment of diabetes and obesity. Supportive regulatory frameworks promote the introduction of innovative therapies, while substantial healthcare expenditures ensure access. Collaborative efforts among European nations to boost research funding and biotechnology advancements further solidify the region’s prominence in metabolic disorder therapeutics.

The metabolic disorder therapeutics market in Germany led the Europe market in 2024. The country hosts numerous biotech firms and research institutions dedicated to metabolic disorders, driving innovation in treatment options. Germany’s strong healthcare system offers comprehensive patient coverage, ensuring access to advanced therapies. Rising public awareness of metabolic health issues and governmental support for healthcare initiatives further enhance this landscape.

Asia Pacific Metabolic Disorder Therapeutics Market Trends

Asia Pacific metabolic disorder therapeutics market is expected to register the fastest CAGR of 8.5% in the forecast period. The region’s growing middle class is fueling demand for effective healthcare solutions, supported by improvements in healthcare infrastructure that enhance treatment access. Government initiatives targeting metabolic diseases through public health campaigns are further stimulating market growth. The ICMR-INDIAB study indicates that diabetes prevalence in India is 11.4%, with obesity at 28.6% and hypertension at 35.5%, highlighting the necessity for innovative therapeutic approaches to address these concerns.

The metabolic disorder therapeutics market in China is expected to grow at the fastest rate of 9.8% over the forecast period in the Asia Pacific market. In Asia, particularly in China, the prevalence of metabolic syndrome is approximately 28.8%, driven by rapid urbanization and lifestyle changes. The Chinese government has prioritized healthcare reforms, enhancing access to medications and treatment options. Economic growth has boosted disposable incomes, enabling greater healthcare service utilization, while ongoing investments in biotechnology and pharmaceutical research are fostering innovation in treatment development.

Key Metabolic Disorder Therapeutics Company Insights

Some key companies operating in the market include Novo Nordisk A/S; Eli Lilly and Company; Takeda Pharmaceutical Company Limited; Sanofi; among others. Companies are actively pursuing strategic initiatives, including collaborations, product innovations, and increased investment in R&D, to effectively tackle the growing prevalence of metabolic disorders.

-

Novo Nordisk A/S operates in diabetes care, specializing in innovative insulin products, GLP-1 receptor agonists, and therapies for obesity and metabolic disorders, with a focus on enhancing glycemic control and managing diabetes-related complications.

-

Sanofi provides a diverse portfolio of insulin products and GLP-1 receptor agonists to improve patient outcomes. The company also invests in innovative solutions, including RNA-based therapies, to comprehensively address metabolic diseases.

Key Metabolic Disorder Therapeutics Companies:

The following are the leading companies in the metabolic disorder therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Sanofi

- Merck KGaA

- AstraZeneca

- AbbVie Inc.

- Johnson & Johnson Innovative Medicine

- Amgen Inc.

- Biocon

- BioMarin

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Cipla Inc.

Recent Developments

-

In October 2024, Boehringer Ingelheim received U.S. FDA Breakthrough Therapy designation for survodutide and initiated two Phase III trials for specific metabolic conditions.

-

In September 2024, Novo Nordisk A/S announced successful results from a Phase 2a trial of monlunabant, demonstrating significant weight loss in participants compared to placebo, following the acquisition of Inversago Pharmaceuticals.

-

In August 2024, Eli Lilly and Company announced the release of single-dose vials of Zepbound (tirzepatide), priced at over 50% less than other obesity incretin medicines, enhancing access for adults with obesity.

-

In July 2024, Merck signed a non-binding Memorandum of Understanding with Gene Therapy Research Institution, collaborating on GMP production of viral vectors to accelerate gene therapy advancements for Parkinson’s Disease.

Metabolic Disorder Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.06 billion

Revenue forecast in 2030

USD 120.71 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease, therapy, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novo Nordisk A/S; Eli Lilly and Company; Takeda Pharmaceutical Company Limited; Sanofi; Merck KGaA; AstraZeneca; AbbVie Inc.; Johnson & Johnson Innovative Medicine; Amgen Inc.; Biocon; BioMarin; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Cipla Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metabolic Disorder Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metabolic disorder therapeutics market report based on disease, therapy, route of administration, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Lysosomal Storage Diseases

-

Diabetes

-

Obesity

-

Inherited Metabolic Disorders

-

Hypercholesterolemia

-

Other Metabolic Diseases

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzyme Replacement Therapy

-

Cellular Transplantation

-

Small Molecule Based Therapy

-

Substrate Reduction Therapy

-

Gene Therapy

-

Drug Therapy

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.