- Home

- »

- Advanced Interior Materials

- »

-

Mexico Air Conditioning & Ventilation System Market Report 2033GVR Report cover

![Mexico Air Conditioning And Ventilation System Market Size, Share & Trends Report]()

Mexico Air Conditioning And Ventilation System Market (2026 - 2033) Size, Share & Trends Analysis Report By Product ((Air Conditioning (Package Air Conditioners, Ductless Mini-Split Systems), Ventilation)), By Application (Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-455-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Air Conditioning & Ventilation System Market Summary

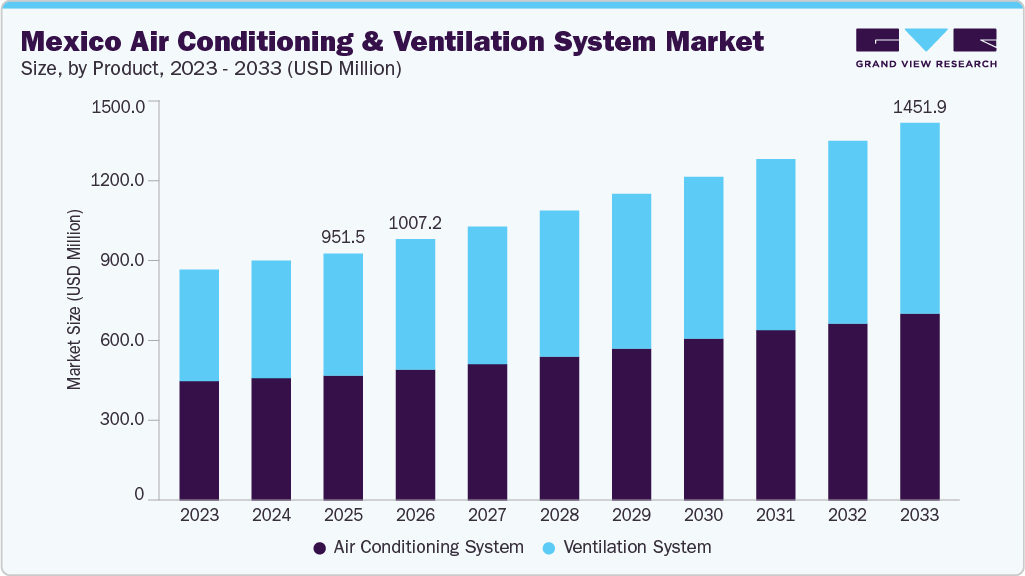

The Mexico air conditioning & ventilation system market size was estimated at USD 951.5 million in 2025 and is projected to reach USD 1,451.9 million by 2033, growing at a CAGR of 5.4% from 2026 to 2033. This market growth is driven by the continuous expansion of the commercial sector in the country, which includes retail spaces, office buildings, and hospitality establishments.

Key Market Trends & Insights

- The Mexico air conditioning & ventilation system market is expected to grow at a substantial CAGR of 5.4% from 2026 to 2033.

- By product, the ventilation system segment is expected to grow at a considerable CAGR of 5.5% from 2026 to 2033 in terms of revenue.

- By application, the commercial segment is expected to grow at a considerable CAGR of 5.5% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 951.5 Million

- 2033 Projected Market Size: USD 1,451.9 Million

- CAGR (2026-2033): 5.4%

Moreover, the push toward sustainability and the presence of a regulatory environment in the country that favors green technologies are encouraging investments in eco-friendly air conditioning & ventilation systems. Ventilation systems are gaining increased traction across institutional and commercial environments due to rising awareness of indoor air quality (IAQ). The post-pandemic emphasis on occupant health has led to greater implementation of fresh air exchange systems, high-efficiency filters, and demand-controlled ventilation in public buildings, airports, and healthcare centers. Hospitals and laboratories, in particular, are investing in precise air handling and pressurization technologies to maintain sterile and contamination-free environments.

Market Concentration & Characteristics

The Mexico air conditioning and ventilation system industry shows a moderate level of concentration, with a mix of domestic and global manufacturers competing within the space. Leading global brands, along with established Mexican companies, dominate the market, leveraging their brand reputation, extensive distribution networks, and comprehensive service offerings.

The market shows steady innovation, focused mainly on energy efficiency, smart controls, and indoor air quality improvements. Manufacturers are integrating IoT-based monitoring, sensors, and automation into ventilation and cooling systems. Product upgrades are usually incremental rather than disruptive, aimed at meeting efficiency targets and reducing operating costs. Demand for low-noise, compact, and easy-to-install systems also shapes innovation trends.

Regulations play a strong role in shaping product design and adoption across the market. Energy-efficiency standards, building codes, and refrigerant norms are pushing manufacturers toward compliant and eco-friendly solutions. Commercial and industrial buyers increasingly prioritize certified systems to meet safety and environmental requirements. Regulatory pressure supports replacement demand but can increase upfront system costs.

End-user demand is moderately concentrated, with commercial and industrial sectors accounting for a significant share of total revenue. Large offices, hospitals, manufacturing plants, and data centers dominate high-value purchases. Residential demand is more fragmented but growing steadily with urban housing expansion. This mix creates a stable base demand while allowing room for volume-driven growth.

Drivers, Opportunities & Restraints

The economic growth of Mexico, coupled with ongoing urbanization, has led to a boom in commercial and industrial construction in the country. As several new businesses are investing in the establishment of their production facilities, while the existing companies are expanding their existing capacities, there is a surge in demand for modern office buildings, retail spaces, manufacturing plants, and warehouses in Mexico. For instance, in October 2023, Lingong Machinery Group (LGMG) announced its plan to establish an industrial park in the northern state of Nuevo Leon in the country that is expected to generate an investment worth USD 5.00 billion. Such initiatives are anticipated to drive the commercial construction projects in the country during the forecast period.

Moreover, multinational corporations, which are aiming to operate in Mexico, require modern, well-equipped facilities that meet international standards. This has spurred the demand for advanced HVAC systems that can provide reliable climate control in various settings, from large-scale manufacturing plants to sophisticated office complexes. In addition, the investments by the Government of Mexico in the development of infrastructure, including airports, hospitals, and schools, are further driving the requirement for robust air conditioning and ventilation systems in the country.

Key restraints in Mexico’s air conditioning & ventilation system industry include the high upfront cost of adopting advanced, energy-efficient, and eco-friendly HVAC systems. This financial barrier often discourages small businesses and residential users from upgrading to modern solutions, despite their long-term benefits. The significant initial investment needed for installation, technology upgrades, and compliance with new standards limits broader adoption and slows the transition toward more sustainable systems across the country.

Product Insights

Ventilation systems hold the largest market share of 50.2% in 2025, due to strong demand from commercial buildings, healthcare facilities, and industrial sites. Growing focus on indoor air quality, worker safety, and compliance with building codes continues to support adoption. Data centers and manufacturing units are key contributors, driving demand for AHUs, industrial fans, and dehumidifiers. Ongoing retrofitting of existing buildings further strengthens the segment’s revenue dominance.

The air conditioning system segment is expected to grow at a significant CAGR of 5.3% from 2026 to 2033 in terms of revenue, led by rising residential penetration and expanding commercial infrastructure. Increasing urbanization, higher disposable income, and warmer climate conditions are boosting demand for split and ductless mini-split systems. Energy-efficient and inverter-based models are gaining traction as electricity costs rise. Together, these factors are driving faster volume growth compared to ventilation systems.

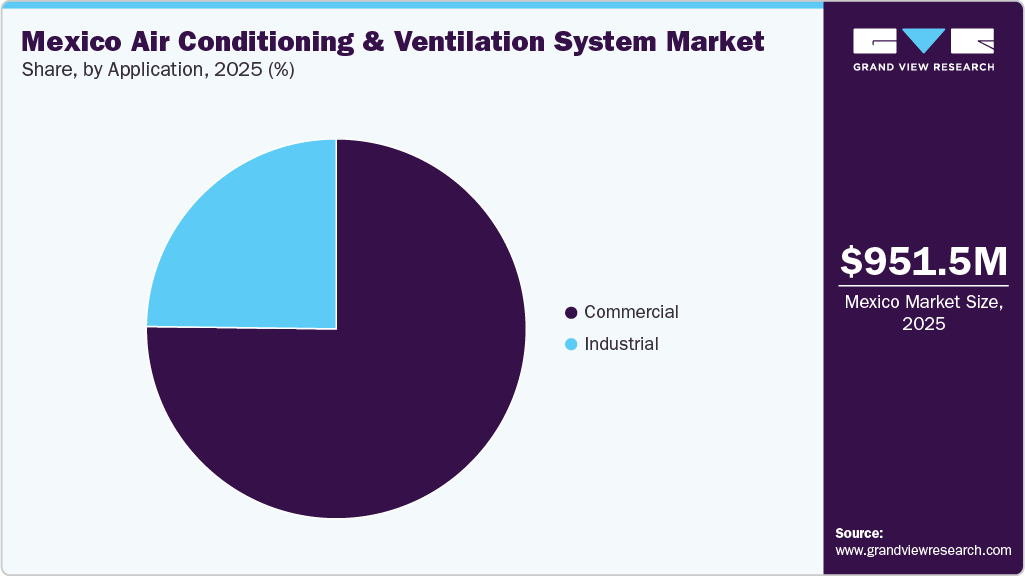

Application Insights

The commercial segment held 75.2% of the Mexican revenue share in 2025. Air conditioning & ventilation systems in commercial applications play critical roles in ensuring comfortable and healthy environments for both employees and customers. For instance, centralized air conditioning (AC) systems in large office buildings regulate the temperature across various floors, maintaining a comfortable working environment that contributes to increased productivity and employee satisfaction. In addition, shopping malls utilize extensive AC systems to provide a comfortable shopping experience and control humidity levels, thereby protecting the merchandise and reducing the levels of airborne bacteria and viruses.

The growth of the industrial segment is expected to grow at a significant CAGR of 5.0% from 2026 to 2033 in terms of revenue. Industrial air conditioning systems play a crucial role in maintaining the optimal functioning of machinery and equipment that operate under specific environmental conditions, as well as facilitating certain industrial processes that generate significant heat, which must be effectively removed. These specialized AC units deliver greater power, efficiency, and accuracy compared to conventional HVAC systems, offering stable cooling and moisture control. This ensures that high standards of production and operational effectiveness are maintained.

State Insights

Mexico City held 16.2% of the revenue share in 2025 due to its dense population, extensive commercial infrastructure, and increasing adoption of energy-efficient HVAC technologies in residential and office spaces. As the country’s economic and administrative hub, the city drives demand from large-scale construction projects, shopping centers, and high-rise buildings, further supported by government incentives and environmental regulations promoting modern, eco-friendly air management solutions.

Nuevo León is expected to experience strong growth in Mexico’s air conditioning & ventilation systems market due to its booming industrial base, rising urbanization, and expanding residential and commercial construction. As a key manufacturing and logistics hub, particularly around Monterrey, the demand for advanced HVAC solutions is rising in factories, offices, and housing developments. In addition, high summer temperatures and increased investment in energy-efficient infrastructure further accelerate market adoption in the region.

Key Mexico Air Conditioning & Ventilation System Company Insights

Some of the key players operating in the market include Carrier Corporation, DAIKIN INDUSTRIES, Ltd, and Johnson Controls.

-

Carrier Corporation is a provider of heating, ventilating, and air conditioning (HVAC), refrigeration, and building automation solutions. In Mexico, Carrier has a well-established presence through its manufacturing facilities, distribution networks, and service offerings that cater primarily to commercial and industrial clients. The company offers a broad portfolio of products, including air-cooled and water-cooled chillers, air handling units (AHUs), packaged rooftop units, and advanced control systems. Carrier's solutions are widely adopted in office buildings, shopping centers, healthcare facilities, and industrial plants, owing to their focus on energy efficiency, reliability, and compliance with international standards.

-

Daikin Industries Ltd. is one of the most prominent players in the market. The company is in inverter-based technology and Variable Refrigerant Volume (VRV/VRF) systems, which have gained significant traction in commercial and institutional buildings across Mexico. Daikin has strategically invested in North American operations, including a strong distributor and installer network in Mexico, to support growing demand for energy-efficient and smart climate control systems. Its product offerings-ranging from split systems and air-cooled chillers to advanced ventilation and air purification solutions-are widely used in sectors such as hospitality, healthcare, retail, and manufacturing.

Key Mexico Air Conditioning And Ventilation System Companies:

- Carrier

- DAIKIN INDUSTRIES, Ltd

- Johnson Controls Inc.

- Lennox International, Inc.

- Trane

- Samsung Electronics Co., Ltd.

- LG Electronics

- Mitsubishi Corporation

- Honeywell Inc.

- Panasonic Holdings Corporation

- Fujitsu

- Midea

- Rheem Manufacturing Company

- Danfoss

- Robert Bosch GmbH

Recent Developments

-

In January 2026, Daikin uses advanced IP-based communication to enhance control and connectivity in its HVAC systems. The approach allows reliable data transmission over existing wiring, reducing installation complexity. It improves energy management while maintaining indoor comfort across commercial applications. Overall, the solution supports smarter, more efficient HVAC operations with minimal infrastructure changes.

-

In July 2024, Robert Bosch GmbH acquired the global residential and light commercial HVAC business of Johnson Controls and the Johnson Controls-Hitachi Air Conditioning (JCH) joint venture for USD 8 billion.

-

In January 2024, LG Electronics announced the opening of a new scroll compressor production line at its factory in Monterrey, Mexico. This new line will bolster LG’s scroll compressor manufacturing infrastructure, enabling the company to produce more of its acclaimed, eco-conscious solutions while creating a shorter supply chain for servicing customers across North America.

Mexico Air Conditioning And Ventilation System Market Report Scope

Report Attribute

Details

Market size in 2026

USD 1,007.2 million

Revenue forecast in 2033

USD 1,451.9 million

Growth rate

CAGR of 5.4% from 2026 to 2033

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

Mexico

Key companies profiled

Carrier, DAIKIN INDUSTRIES, Ltd, Johnson Controls Inc., Lennox International, Inc., Trane, Samsung Electronics Co., Ltd., LG Electronics, Mitsubishi Corporation, Honeywell Inc., Panasonic Holdings Corporation, Fujitsu, Midea, Rheem Manufacturing Company, Danfoss, Robert Bosch GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Air Conditioning & Ventilation System Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Mexico air conditioning & ventilation system market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Air Conditioning System

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Window Unit Air Conditioning System

-

Ductless Mini-Split Systems

-

-

Ventilation System

-

Air Purifier

-

Standalone/Portable

-

In-duct/Fixed

-

-

Air Handling Units

-

Modular AHU

-

Packaged AHU

-

-

Axial Fans

-

Roof Vents

-

Centrifugal Fans

-

Dehumidifier

-

Refrigerative Dehumidifier

-

Desiccant Dehumidifier

-

Electronic/Heat Pump Dehumidifier

-

-

-

-

Application Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Commercial

-

Retail Shops

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Transport

-

Others

-

-

Industrial

-

Manufacturing

-

Data Centers

-

Others

-

-

-

Regions Outlook (Revenue, USD Million; Volume, Thousand Units; 2021 - 2033)

-

Aguascalientes

-

Baja California

-

Baja California Sur

-

Campeche

-

Chiapas

-

Chihuahua

-

Coahuila

-

Colima

-

Durango

-

Guanajuato

-

Guerrero

-

Hidalgo

-

Jalisco

-

México

-

Mexico City

-

Michoacán

-

Morelos

-

Nayarit

-

Nuevo León

-

Oaxaca

-

Puebla

-

Querétaro

-

Quintana Roo

-

San Luis Potosí

-

Sinaloa

-

Sonora

-

Tabasco

-

Tamaulipas

-

Tlaxcala

-

Veracruz

-

Yucatán

-

Zacatecas

-

Frequently Asked Questions About This Report

b. The Mexico air conditioning and ventilation system market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2026 to 2033, reaching USD 1,451.9 million by 2033

b. Some of the key players operating in the Mexico air conditioning & ventilation system market include Carrier, DAIKIN INDUSTRIES, Ltd, Johnson Controls Inc., Lennox International, Inc., Trane, Samsung Electronics Co., Ltd., LG Electronics, Mitsubishi Corporation, Honeywell International Inc., Panasonic Holdings Corporation, Fujitsu, Midea, Rheem Manufacturing Company, Danfoss, Robert Bosch GmbH.

b. Mexico air conditioning & ventilation system market is driven by the continuous expansion of the commercial sector in the country that includes retail spaces, office buildings, and hospitality establishments. Moreover, the push toward sustainability and the presence of a regulatory environment in the country that favors green technologies are encouraging investments in eco-friendly air conditioning & ventilation systems.

b. The Mexico air conditioning & ventilation system market size was estimated at USD 951.5 million in 2025 and is expected to reach USD 1,007.2 million in 2026

Which segment accounted for the largest Mexico air conditioning and ventilation system market share?b. Mexico City held 16.2% of the Mexico revenue share in 2025 due to its dense population, extensive commercial infrastructure, and increasing adoption of energy-efficient HVAC technologies in residential and office spaces

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.