- Home

- »

- Plastics, Polymers & Resins

- »

-

Mexico Plastic Additive Market Size, Industry Report, 2030GVR Report cover

![Mexico Plastic Additive Market Size, Share & Trends Report]()

Mexico Plastic Additive Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Plasticizers, Flame Retardants, Impact Modifiers, Antioxidants, Antimicrobials), By Plastic Type (Commodity, Engineering, High Performance), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-542-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Plastic Additive Market Size & Trends

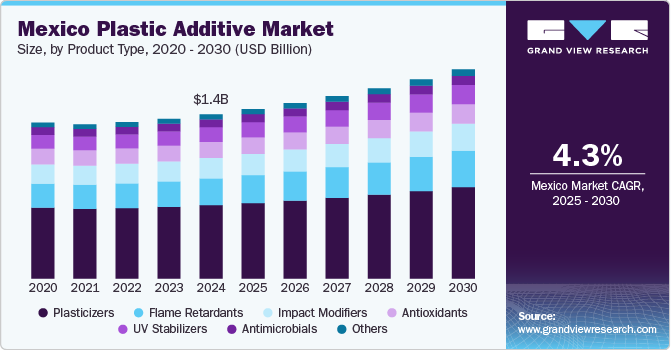

The Mexico plastic additive market size was estimated at USD 1.37 billion in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. The rapid expansion of Mexico’s e-commerce sector is significantly driving the demand for plastic additives in packaging and consumer goods applications, as online retail platforms require durable, cost-effective, and high-performance packaging solutions.

With logistics and delivery services expanding nationwide, businesses require more advanced polymer formulations to improve packaging resilience and ensure that products-ranging from electronics to personal care items-arrive in optimal condition. This has led to a substantial increase in the consumption of UV stabilizers, impact modifiers, and anti-static agents, which improve product longevity and maintain aesthetic appeal across transit and storage conditions.

Additionally, the growing adoption of electric vehicles (EVs) in Mexico is significantly influencing the demand for plastic additives, a crucial component in the production of lightweight, high-performance vehicle materials. As the automotive industry transitions toward sustainability, EV manufacturers are increasingly incorporating advanced polymers to enhance battery efficiency, reduce vehicle weight, and improve durability.

Plastic additives-such as stabilizers, flame retardants, impact modifiers, and processing aids-play a key role in ensuring these materials meet stringent safety and performance standards. With Mexico emerging as a regional hub for EV production, the upward trend in manufacturing directly translates into heightened demand for specialized plastic additives, catering to both local production and export markets.

However, crude oil prices' volatility is a significant restraint on the Mexico plastic additives market, as it directly impacts the cost of raw materials such as polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC)-all key polymer bases used in additive formulations. The price fluctuations create cost uncertainties for plastic additive manufacturers, who rely on petrochemical feedstocks like ethylene, propylene, and styrene for production.

The Mexico plastic additive industry relies on both domestic production and imported raw materials, making it highly susceptible to global supply chain disruptions. Port congestion, logistical inefficiencies, and geopolitical tensions can delay shipments of key chemical precursors, leading to shortages and price spikes. These disruptions directly affect production timelines and make inventory management more complex for manufacturers.

The market is slightly fragmented owing to the presence of key companies, such as Everlight Chemical Industrial Corp, Perfect Colourants & Plastics Pvt., Polynt S.p.A., Mexichem, S.A.B. de C.V., LyondellBasell Industries, Huntsman de Mexico, S.A. de C.V., and Avient Corporation. These companies have adopted various strategies, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their market presence.

Product Insights

The plasticizers segment recorded the largest market revenue share of over 44.72% in 2024 and is projected to grow at a CAGR of 3.9% during the forecast period. It is driven by the growing demand for flexible PVC in the construction, automotive, and packaging industries. Dioctyl phthalate (DOP) and non-phthalate alternatives such as adipates and citrates are gaining traction due to increasing environmental regulations and consumer preference for safer materials. The country’s construction boom, with infrastructure projects like Tren Maya and Dos Bocas Refinery, has amplified the need for flexible PVC applications.

Flame retardants are projected to grow at the fastest CAGR of 5.6% over the forecast period due to their growing use in applications including packaging, consumer products, construction, automotive, medical, and electrical & electronics. Rising demand for flame retardants from various applications such as medical and electrical & electronics, on account of the growing demand for thermoplastics to reduce carbon emissions and increased investment in research & development, is expected to drive the segment over the forecast period.

Impact modifiers are a group of additives that are used to improve the durability of molded and extruded plastics, especially those that are tough or can be used in cold weather conditions. These are important additives intended for increasing elasticity to overcome the stiffness of materials. Elasticity helps impact modifiers absorb the impact energy and make polymeric compounds stronger. Impact modifiers are available as resins and are rubbery.

Antioxidants are additives used in the manufacture of plastics to stop the deterioration process brought on by both thermomechanical and thermooxidative conditions. They accelerate color deterioration, boost plastic tensile strength and elongation, and lessen cracking impact and other surface damage. In addition, they help the material endure longer.

Plastic Type Insights

Commodity plastics accounted for the largest revenue share of over 67.26% in 2024 and are projected to grow at the fastest CAGR during the forecast period. Commodity plastics include polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS), and polyethylene terephthalate (PET), which are widely used in packaging, consumer goods, and construction. The country’s growing manufacturing sector, particularly in food and beverage packaging, has led to a high demand for PET bottles and flexible packaging films, thereby boosting product demand.

Mexico’s role as a global automotive manufacturing hub is a major driver of the engineering plastics market, which includes polyamides (PA), polycarbonates (PC), acrylonitrile butadiene styrene (ABS), polyoxymethylene (POM), and polybutylene terephthalate (PBT). These materials are used in lightweight automotive components, electrical connectors, and durable consumer goods. The push for electric vehicles (EVs), with companies like Tesla investing in local production, is expected to accelerate the use of high-performance engineering plastics.

The high-performance plastics segment, including polyether ether ketone (PEEK), polyimides (PI), fluoropolymers (PTFE, PVDF), and liquid crystal polymers (LCP), is growing due to demand in aerospace, medical devices, and advanced manufacturing. Mexico’s aerospace industry, concentrated in Querétaro, has seen increased investment, leading to greater use of high-temperature-resistant and lightweight polymers in aircraft components.

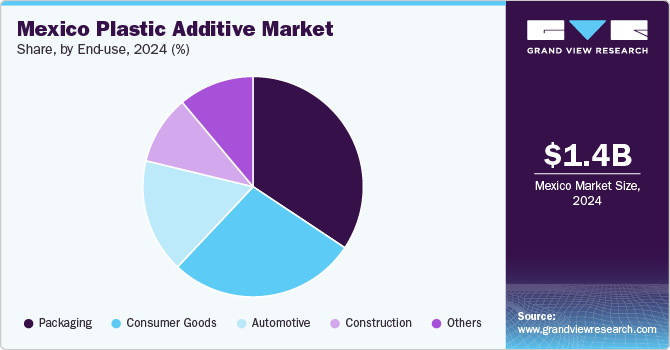

End Use Insights

Packaging dominated the Mexico plastic additive industry, with a revenue share of 34.35% in 2024, owing to its availability in various forms, including flexible packaging, glass packaging, metal packaging, rigid plastic packaging, and paper container packaging. The usage of plastic additives in packaging gives protection to the packed products against microbes, increases product shelf life, and enhances the aesthetic value. The packaging industry is driven by rising demand for personal care products and packed food products, which, in turn, is anticipated to increase the consumption of plastic additives in packaging products.

Automotive is projected to grow at the fastest CAGR of 4.4% over the forecast period due to lightweight initiatives to improve fuel efficiency and the rapid expansion of electric vehicle (EV) production in the country. The shift toward sustainable mobility is also boosting the market for bio-based and recycled automotive plastics. Additionally, Mexico’s strong supply chain integration with the U.S. automotive market under USMCA further strengthens demand for high-performance plastics in vehicle manufacturing.

The consumer goods industry has always been one of the most crucial application segments for plastic additives. With rising disposable income and consumer spending on day-to-day household goods, manufacturers are constantly updating their product lines to include practical, appealing, and straightforward products for customers as a step toward convenient living. Plastic additives are used in soaps and detergents, hand lotions, window cleaners, disinfectants, surface sprays, cleaning cloths, toothpaste, mouthwashes, plastic wrap, and garbage bags.

In the construction industry, plastic additives are used in fittings and fixtures of buildings, including ceiling systems, wall coverings, worktops, floors & carpets, radiators, wiring accessories, and door handles. It is essential to use plastic additives in the construction industry, as microbes are found everywhere, such as in hotels, leisure centers, education facilities, and offices. It is important to safeguard the infrastructure against bacterial attack in order to avoid an unhealthy environment and material degradation. Plastic additives inhibit the growth of microbes and protect against cross-contamination and material damage.

Key Mexico Plastic Additive Company Insights

The presence of both multinational corporations and domestic manufacturers characterizes the competitive landscape of Mexico's plastic additives market. Key players such as BASF Mexicana SA de CV, Evonik Industries de Mexico SA de CV, and Avient Corporation have established a significant presence, leveraging their extensive product portfolios and advanced technologies to cater to diverse industrial applications. Moreover, the market is witnessing a shift towards sustainable and eco-friendly additives, driven by stringent environmental regulations and growing consumer awareness. This trend is prompting companies to invest in research and development to innovate and offer products that meet these evolving demands.

-

In November 2024, Orbia Polymer Solutions (AlphaGary) expanded its manufacturing capabilities in Mexico. The company increased its compounding capacity to meet the growing demand for its products in the region. This expansion allows AlphaGary to better serve its customers by providing more products and reducing lead times.

-

In February 2024, Avient Corporation expanded its services in Latin America by opening a new ColorWorks Design and Technology Center in Mexico City. This is the company's sixth ColorWorks facility globally, joining locations in Brazil, Italy, Singapore, and the U.S. The center will provide customers with technical support during the early stages of plastic product development, aiming to accelerate time to market, manage costs, and ensure color consistency.

Key Mexico Plastic Additive Companies:

- Everlight Chemical Industrial Corp

- Perfect Colourants & Plastics Pvt.

- Polynt S.p.A.

- Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV)

- BASF Mexicana SA de CV

- Evonik Industries de Mexico SA de CV

- Grupo Plastikrom, SA de CV

- M.A. Hanna De Mexico (Avient Corporation)

- Avient Corporation

- LyondellBasell Industries

- Huntsman de Mexico, S.A. de C.V.

- PPG Industries, Inc.

Mexico Plastic Additive Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.41 billion

Revenue forecast in 2030

USD 1.74 billion

Growth rate

CAGR of 4.3% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, plastic type, end use

Key companies profiled

Everlight Chemical Industrial Corp; Perfect Colourants & Plastics Pvt.; Polynt S.p.A.; Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV); BASF Mexicana SA de CV; Evonik Industries de Mexico SA de CV,Grupo Plastikrom, SA de CV; M.A. Hanna De Mexico (Avient Corporation); Avient Corporation; LyondellBasell Industries; Huntsman de Mexico, S.A. de C.V.; PPG Industries, Inc.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Plastic Additive Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico plastic additive market report based on product, plastic type, and end use:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plasticizers

-

Flame Retardants

-

Impact Modifiers

-

Antioxidants

-

Antimicrobials

-

UV Stabilizers

-

Other Products

-

-

Plastic Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Commodity Plastics

-

Engineering Plastics

-

High Performance Plastics

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Consumer Goods

-

Construction

-

Other End Uses

-

Frequently Asked Questions About This Report

b. The Mexico plastic additive market was estimated at around USD 1.37 billion in 2024 and is expected to reach around USD 1.41 billion in 2025.

b. The Mexico plastic additive market is expected to grow at a compound annual growth rate of 4.3% from 2025 to 2030, reaching around USD 1.74 billion by 2030.

b. The commodity plastics segment recorded the largest market revenue share, over 63.09%, in 2024, owing to its wide use in packaging, consumer goods, and construction industries.

b. The key players in the Mexico plastic additive market include Everlight Chemical Industrial Corp, Perfect Colourants & Plastics Pvt., Polynt S.p.A., Mexichem, S.A.B. de C.V. (Orbia Advance Corporation S.A.B. de CV), BASF Mexicana SA de CV, Evonik Industries de Mexico SA de CV,Grupo Plastikrom, SA de CV, M.A. Hanna De Mexico (Avient Corporation), and Avient Corporation.

b. The Mexico plastic additive market is driven by the demand for plastic additives in packaging and consumer goods applications, as online retail platforms require durable, cost-effective, and high-performance packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.