- Home

- »

- Next Generation Technologies

- »

-

MicroLED Interconnect Market Size, Industry Report, 2033GVR Report cover

![MicroLED Interconnect Market Size, Share & Trends Report]()

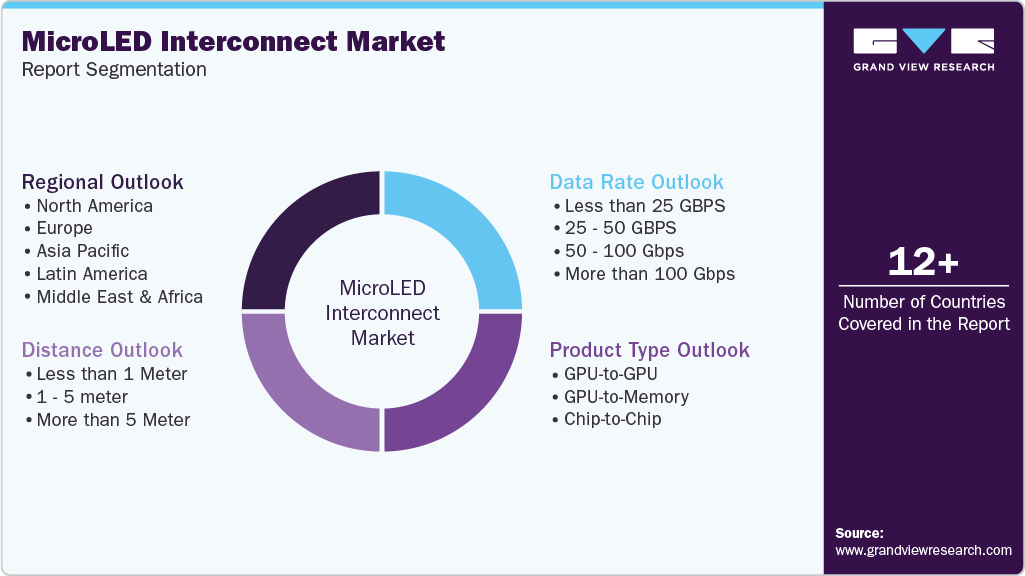

MicroLED Interconnect Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (GPU-to-GPU, GPU-to-Memory, Chip-to-Chip), By Data Rate (Less Than 25 Gbps, More than 100 Gbps), By Distance, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-661-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

MicroLED Interconnect Market Summary

The global microLED interconnect market size was estimated at USD 142.7 million in 2024 and is projected to reach USD 722.0 million by 2033, growing at a CAGR of 18.8% from 2025 to 2033. The increasing demand for high-performance, low-power, and high-bandwidth data transfer solutions in various applications primarily drives the market growth.

Key Market Trends & Insights

- North America dominated the global microLED interconnect market with the largest revenue share of 31.6% in 2024.

- The microLED interconnect market in the U.S. led the North America region and held the largest revenue share in 2024.

- By product type, chip-to-chip led the market, holding the largest revenue share of 55.6% in 2024.

- By data rate, the less than 25 Gbps segment accounted for the prominent revenue share of microLED interconnect industry in 2024

- By distance, the less than 1 meter segment led the market, holding the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 142.7 Million

- 2033 Projected Market Size: USD 722.0 Million

- CAGR (2025-2033): 18.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest Growing Market

This includes sectors like high-performance computing, AI, and data centers. The increasing adoption of chiplet-based architectures in AI and HPC systems is driving the need for high-density, low-latency, and energy-efficient interconnects. Traditional electrical interconnects, such as copper traces, struggle with signal integrity and power loss at scale. MicroLED-based optical interconnects offer a compelling alternative by enabling ultra-short-range optical communication between GPUs, memory modules, and computer chips. This demand is pushing rapid investment in chip-to-chip, GPU-to-GPU, and GPU-to-memory optical links, all of which require specialized microLED interconnect solutions to deliver high-speed, low-power performance at the package level.AI training workloads, high-frequency trading, and simulation-based workloads in scientific computing increasingly require high-bandwidth (>50 Gbps) communication between processing elements. MicroLEDs, with their high modulation speeds and energy-efficient optical emissions, are emerging as a promising light source for short-reach optical links within boards and between tightly packed modules. Unlike traditional copper interconnects, which face signal degradation and thermal constraints at higher data rates and tighter geometries, microLEDs enable direct optical transmission at chip-to-chip and GPU-to-GPU levels, supporting latencies below one ns and energy consumption as low as a few fJ/bit under optimal conditions.

Recent R&D breakthroughs in microLED driver design, wafer bonding, and co-packaged optics have significantly enhanced the viability of µLEDs for high-speed interconnects. Researchers have demonstrated modulation speeds exceeding 10 GHz, and multi-wavelength µLED arrays are being integrated into optical interposers and co-packaged optical modules. These advances are translating into early-stage commercialization opportunities for interconnects in data centers, AI accelerators, and edge computing devices. As system architects shift toward ultra-dense, low-latency compute fabrics, microLED interconnects are emerging as a scalable solution for achieving terabit-level bandwidth within compact, power-constrained environments.

Product Type Insights

The chip-to-chip segment accounted for the largest market revenue share of over 55% in 2024 in the global microLED interconnect market, primarily due to its early adoption in experimental and prototype-level deployments. This interconnect type involves the shortest physical distances, generally within the same package or board, making it the starting point for microLED-based optical link integration. Given the compact size and directional emission of microLEDs, chip-to-chip links benefit from low power consumption, minimal signal loss, and simplified alignment requirements compared to longer-range applications. Moreover, as chiplet architectures gain momentum, the need for fine-pitch, low-latency chip-to-chip optical links is growing, further supporting the dominance of this segment in the early commercialization phase.

The GPU-to-memory segment is expected to grow at the fastest CAGR over the forecast period due to the rising demand for high-bandwidth, low-latency data transfer between compute units and memory modules in AI and high-performance computing (HPC) systems. MicroLED-based optical interconnects offer solutions by enabling energy-efficient, high-speed links that support bandwidths exceeding 100 Gbps, for near-memory and stacked-memory configurations such as HBM (High Bandwidth Memory). Furthermore, emerging memory-centric architectures and the increasing adoption of co-packaged optics in accelerator designs are creating favorable conditions for microLED adoption in this segment. As chipmakers invest in next-gen GPU-memory subsystems, the demand for compact, high-speed interconnects like microLEDs is expected to surge, driving this segment’s accelerated growth.

Data Rate Insights

The less than 25 Gbps segment accounted for the prominent revenue share of microLED interconnect industry in 2024, due to the early-stage commercialization and technology readiness of microLED-based interconnects. At this stage, most microLED optical links are limited to modest modulation speeds suitable for short-reach, low-bandwidth applications such as chip-to-chip and basic board-level communication. These implementations are easier to achieve with existing microLED driver capabilities and require less complex packaging and thermal management. Additionally, the <25 Gbps range aligns well with proof-of-concept deployments, test environments, and early adoption in compact systems such as wearables, edge AI chips, and embedded systems as higher data rate µLED links (25+ Gbps) remain under development or limited to lab-scale demonstrations, the <25 Gbps segment continues to dominate current revenues.

The 50-100 Gbps segment is anticipated to grow at the fastest CAGR during the forecast period, due to its alignment with the evolving performance demands of AI, machine learning, and high-performance computing (HPC) workloads. As data-intensive applications increasingly require ultra-fast communication between processing units, microLEDs are emerging as a promising solution capable of delivering high-speed, short-reach optical interconnects within this bandwidth range. Ongoing R&D advancements have demonstrated microLED modulation speeds exceeding 10 GHz, and multi-channel implementations are making 50-100 Gbps transmission rates increasingly viable for chip-to-chip, GPU-to-GPU, and GPU-to-memory links.

Regional Insights

North America dominated the microLED interconnect market with a revenue share of over 31.6% in 2024 due to its strong presence of leading semiconductor and AI infrastructure companies actively investing in advanced packaging and high-speed interconnect technologies. Funding for R&D from both private and public institutions, including DARPA and NSF, has accelerated the development of microLED modulation, integration, and packaging techniques. Additionally, North American universities and labs are at the forefront of prototyping microLED optical interconnects for chip-to-chip and GPU-to-memory communication.

U.S. MicroLED Interconnect Market Trends

The U.S. microLED interconnect industry is poised for significant growth in 2024 due to a combination of strong government investments and R&D activity. Under the CHIPS and Science Act, the U.S. government is offering substantial grants and tax credits to support domestic micro-display fabs, which has accelerated investment in fabrication infrastructure across states such as Arizona, Texas, and New York. This public support is complemented by rising interest from FAANG companies and defense agencies in AR/VR and HUD microLED applications driven by the need for ultra-bright, power-efficient near-eye displays.

Europe MicroLED Interconnect Market Trends

Europe’s microLED interconnect industry is set to witness strong growth during the forecast period, fueled by the region’s robust innovation ecosystem in automotive, aerospace, and industrial applications. European governments and institutions, such as the European Innovation Council, are providing substantial funding and mentorship to microLED startups and scale-ups, accelerating technology development and commercialization. With the semiconductor value chain strengthening, microLED manufacturing capabilities, including mass transfer, wafer bonding, and co-packaged optics, are scaling up, reducing costs, and boosting yield.

Asia Pacific MicroLED Interconnect Market Trends

The microLED interconnect industry in Asia Pacific is anticipated to register the fastest CAGR over the forecast period. In the APAC region, China, South Korea, Japan, Taiwan, and India together form a semiconductor and display supply chain, marked by mass manufacturing capacity and aggressive innovation in optical interconnects. Governments across these countries are investing heavily, often at a national scale, in next-gen semiconductor fabs, optics R&D, and packaging infrastructure, accelerating commercial readiness and yield optimization for microLED devices.

Key MicroLED Interconnect Company Insights

Some key companies in the microLED interconnect market are Aledia; ASE; Ayar Labs, Inc.; and AvicenaTech, Corp

-

Aledia, a France-based semiconductor company, specializes in 3D microLED technology for advanced applications beyond traditional displays, including optical interconnects and high-speed data transmission. Utilizing silicon-based nanowire microLEDs, Aledia develops ultra-bright, high-efficiency emitters capable of operating at high modulation speeds, a key requirement for short-reach optical interconnects such as chip-to-chip, GPU-to-GPU, and GPU-to-memory links. Its patented 3D architecture allows integration with standard CMOS processes, enabling compact, energy-efficient light sources ideal for co-packaged optics and photonic chiplets.

-

ASE is a global leader in advanced semiconductor packaging and test with extensive capabilities in co-packaged optics (CPO) and microLED interconnect integration. Under its VIPack platform, ASE has developed fine-pitch microbump technology that reduces interconnect pitch from 40 µm to 20 µm, enabling ultra-dense, high-bandwidth chiplet integration essential for AI and HPC applications. ASE also collaborates with photonics developers such as Lightmatter to push the boundaries of 3D-stacked photonic integration, further positioning its packaging platforms as enablers of next-gen terabit-scale optical communication systems.

Key MicroLED Interconnect Companies:

The following are the leading companies in the microLED interconnect market. These companies collectively hold the largest market share and dictate industry trends.

- ALLOS Semiconductors GmbH

- Aledia

- ASE

- Ayar Labs, Inc.

- Intel Corporation

- Micledi

- AvicenaTech, Corp

- Plessey Semiconductors Ltd

- Taiwan Semiconductor Manufacturing Company Limited

- VueReal

Recent Developments

-

In May 2025, Taiwan Semiconductor Manufacturing Company Limited partnered with Avicena to manufacture microLED-based interconnects aimed at replacing traditional electrical links with low-cost, energy-efficient optical connections for high-performance GPU communication. Avicena’s LightBundle platform uses hundreds of blue microLEDs and imaging fibers to transmit data, offering a modular, laser-free alternative that reduces complexity, power consumption, and cost compared to traditional optical chiplets.

-

In May 2025, AvicenaTech Corp raised USD 65 million in Series B funding, bringing its total to USD 120 million, to expand its team and ramp up production of its first product. The company’s LightBundle solution enables scalable, low-power optical chiplet interconnects for GPU-to-memory and die-to-die communication. It uses GaN microLED arrays integrated onto CMOS chips, paired with multi-fiber cables and silicon detectors, offering a reliable and cost-effective alternative to laser-based interconnects.

-

In March 2025, AvicenaTech launched its LightBundle interconnect platform. This scalable, modular solution extends die-to-die (D2D) communication beyond 10 meters with sub-pJ/bit energy efficiency, enabling>1 Tbps/mm shoreline density. The platform uses transceiver chiplets with integrated microLED and photodetector (PD) arrays, connected via multi-core fiber bundles, and supports standard D2D interfaces such as UCIe and BOW. LightBundle is compatible with CPO, OBO, AOC, and other packaging formats, and unlike silicon photonics, it can be integrated into a wide range of IC processes from different foundries.

MicroLED Interconnect Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 181.6 million

Revenue forecast in 2033

USD 722.0 million

Growth rate

CAGR of 18.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, data rate, distance, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ALLOS Semiconductors GmbH; Aledia; ASE; Ayar Labs, Inc.; Intel Corporation; Micledi; AvicenaTech, Corp; Plessey Semiconductors Ltd; Taiwan Semiconductor Manufacturing Company Limited; VueReal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global MicroLED Interconnect Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global microLED interconnect market report based on product type, data rate, distance, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

GPU-to-GPU

-

GPU-to-Memory

-

Chip-to-Chip

-

-

Data Rate Outlook (Revenue, USD Million, 2021 - 2033)

-

Less than 25 GBPS

-

25 - 50 GBPS

-

50 - 100 Gbps

-

More than 100 Gbps

-

-

Distance Outlook (Revenue, USD Million, 2021 - 2033)

-

Less than 1 meter

-

1 - 5 meter

-

More than 5 meter

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microLED interconnect market size was estimated at USD 142.7 million in 2024 and is expected to reach USD 181.6 million in 2025.

b. The global microLED interconnect market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2033 to reach USD 722.0 million by 2033

b. North America dominated the microLED interconnect market with a share of 31% in 2024 due to its strong presence of leading semiconductor and AI infrastructure companies actively investing in advanced packaging and high-speed interconnect technologies.

b. Some key players operating in the microLED interconnect market include Aledia; ASE; Ayar Labs, Inc.; AvicenaTech, Corp; Micledi; VueReal; Plessey Semiconductors Ltd; Intel Corporation; ALLOS Semiconductors GmbH; Taiwan Semiconductor Manufacturing Company Limited

b. Key factors that are driving the market growth include the increasing demand for high-performance, low-power, and high-bandwidth data transfer solutions in various applications primarily drives the market. This includes sectors like high-performance computing, AI, and data centers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.