- Home

- »

- Medical Devices

- »

-

Microsutures Market Size And Share, Industry Report, 2030GVR Report cover

![Microsutures Market Size, Share & Trends Report]()

Microsutures Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Absorbable, Non-Absorbable), By Surgery (General Surgery, Ophthalmology, Neurosurgery), By End Use, By Material (Nylon, Polydioxanone), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-598-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microsutures Market Summary

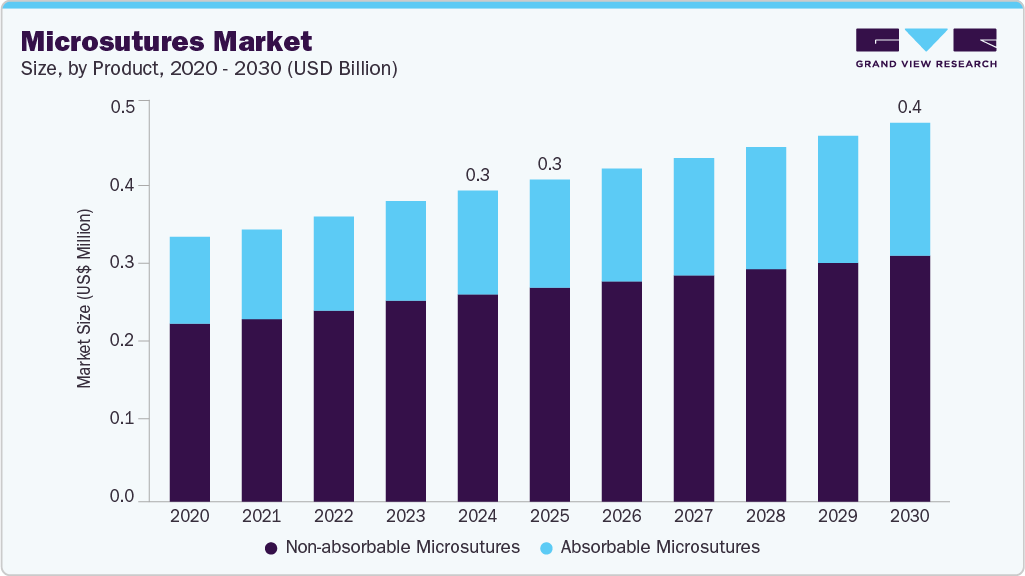

The global microsutures market size valued at USD 0.31 billion in 2024 and projected to reach USD 0.38 billion by 2030, growing at a CAGR of 3.31% from 2025 to 2030. This market growth is largely attributed to the advancements in minimally invasive surgical techniques, increasing prevalence of chronic diseases requiring precise wound management, and an increase in medical tourism.

Key Market Trends & Insights

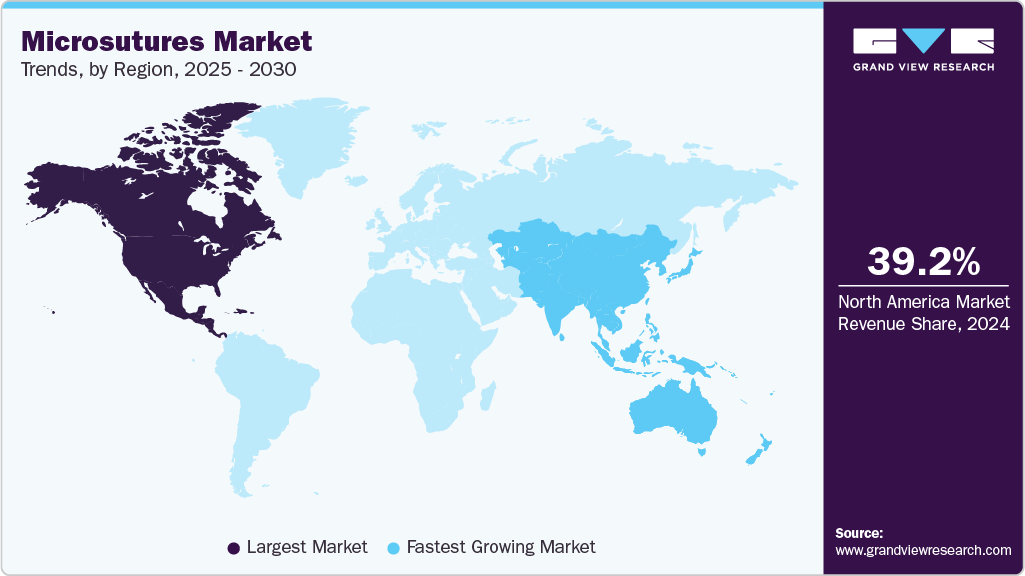

- North America dominated the microsutures market with the largest revenue share of 39.22% in 2024.

- The microsutures market in the U.S. accounted for the largest market revenue share of 77.87% in North America in 2024.

- By product, the non-absorbable microsuture segment led the market with the largest revenue share of 66.67% in 2024.

- Based on surgery, the general surgery segment led the market with the largest revenue share of 24.77% in 2024.

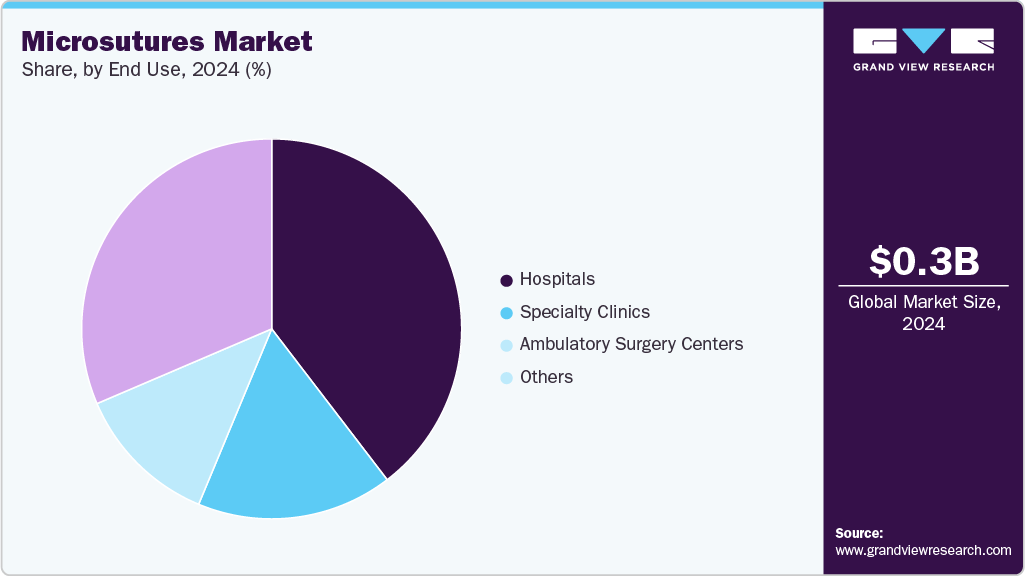

- By end use, the hospitals segment led the market with the largest revenue share of 39.60% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.31 Billion

- 2030 Projected Market Size: USD 0.38 Billion

- CAGR (2025-2030): 3.31%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing demand for cosmetic and reconstructive surgeries further propels the adoption of microsutures due to their ability to facilitate fine, less noticeable stitches, leading to better aesthetic outcomes. In addition, technological innovations in suture materials, such as biodegradable and high-strength sutures, enhance the efficiency and safety of procedures, encouraging their widespread use. The growing number of surgical procedures, mainly cosmetic and plastic surgeries, has resulted in fueling the market demand. For instance, according to the data published by the Global Survey 2023, Liposuction was the most common surgery in 2023, with over 2.2 million, followed by breast augmentation, eyelid surgery, abdominoplasty, and rhinoplasty. All these increased procedures directly influence the demand for sutures, which play a significant role in wound closure and post-surgery recovery.

Beyond cosmetic surgeries, the demand for sutures is also propelled by essential medical procedures such as cesarean sections, orthopedic surgeries, and Cardiovascular Surgery interventions, further expanding the market’s growth potential.

Number of Worldwide Surgical Procedures Performed, By Plastic Surgeons, 2019 - 2023

Rank

Surgical Procedure

Total Procedures (2023)

% of Total Surgical Procedures

Total Procedures (2022)

Total Procedures (2019)

% Change 2023 vs. 2022

% Change 2023 vs. 2019

1

Liposuction

2,237,966

14.2%

2,303,929

1,704,786

-2.9%

31.3%

2

Breast Augmentation

1,892,777

12.0%

2,174,616

1,795,551

-13.0%

5.4%

3

Eyelid Surgery

1,746,946

11.0%

1,409,103

1,259,839

24.0%

38.7%

4

Abdominoplasty

1,153,539

7.3%

1,180,623

924,031

-2.3%

24.8%

5

Rhinoplasty

1,148,559

7.3%

944,468

821,890

21.6%

39.7%

6

Breast Lift

903,266

5.7%

955,026

741,284

-5.4%

21.9%

7

Lip Enhancement/Perioral Procedure

901,991

5.7%

699,264

N/A

29.0%

N/A

8

Buttock Augmentation

771,333

4.9%

820,762

479,451

-6.0%

60.9%

9

Fat Grafting - Face

741,061

4.7%

648,894

598,823

14.2%

23.8%

10

Breast Reduction

686,125

4.3%

632,860

600,219

8.4%

14.3%

11

Face Lift

646,482

4.1%

541,491

448,485

19.4%

44.1%

12

Neck Lift

452,639

2.9%

400,593

260,747

13.0%

73.6%

13

Brow Lift

386,427

2.4%

352,324

270,917

9.7%

42.6%

14

Gynecomastia

352,302

2.2%

305,340

273,344

15.4%

28.9%

15

Breast Implant Removal

335,939

2.1%

320,765

229,680

4.7%

46.3%

16

Ear Surgery

327,990

2.1%

303,906

288,905

7.9%

13.5%

17

Upper Arm Lift

244,977

1.5%

204,011

168,289

20.1%

45.6%

18

Labiaplasty

189,058

1.2%

194,086

164,667

-2.6%

14.8%

19

Facial Bone Contouring

153,749

1.0%

138,115

108,536

11.3%

41.7%

20

Thigh Lift

146,264

0.9%

113,746

93,334

28.6%

56.7%

21

Lower Body Lift

128,998

0.8%

123,123

75,895

4.8%

70.0%

22

Buttock Lift

110,167

0.7%

95,174

54,894

15.8%

100.7%

23

Vaginal Rejuvenation

84,495

0.5%

70,645

N/A

19.6%

N/A

24

Upper Body Lift

70,306

0.4%

54,120

N/A

29.9%

N/A

Total Surgical Procedures

15,813,353

-

14,986,982

11,363,569

5.5%

39.2%

Source: International Society of Aesthetic Plastic Surgery, Grand View Research (ISAPS)

Advancements in suture technology significantly drive demand in the microsutures industry by improving surgical outcomes and patient recovery. Innovations such as biodegradable and absorbable materials, and enhanced knot security.

The increasing prevalence of chronic diseases and traumatic injuries, such as ophthalmic injuries, is a primary driver in the global microsutures industry. Improving health systems, advancements in surgical technology, and an aging population have resulted in increased surgical procedures across various specialties. For instance, according to the American Academy of Ophthalmology report published in 2025, work-related eye injuries are alarmingly prevalent. The U.S. Bureau of Labor Statistics reports that approximately 20,000 eye injuries happen annually in the workplace, many of which result in missed days of work for recovery. These injuries vary from minor eye strain to serious trauma that can lead to permanent damage or vision loss.

Medical Tourism, Percent of Patients Attending from Other Countries

Worldwide

Average

Colombia

35.9%

Mexico

35.1%

Turkey

30.7%

Thailand

25.4%

Peru

15.9%

Malaysia

14.6%

Spain

14.9%

Brazil

14.2%

Source: International Society of Aesthetic Plastic Surgery (ISAPS)

The rise in road accidents worldwide is a significant driver of the microsutures industry. With increasing traffic-related injuries, such as deep lacerations, fractures, and internal injuries, the demand for quick surgical intervention and wound closure is higher. According to the World Health Organization (WHO), approximately 1.19 million people die each year from road traffic crashes. Although they have only 60% of the world's vehicles, low- and middle-income nations account for 92% of the road deaths in the world. This increasing rate of road accidents, particularly in these regions, drives the demand for sutures to manage the injuries resulting from such accidents effectively. Moreover, continued innovations in the microsutures industry enhance patient outcomes by improving healing times, minimizing scarring, and reducing the risk of infection, further fueling the demand for sutures in trauma care.

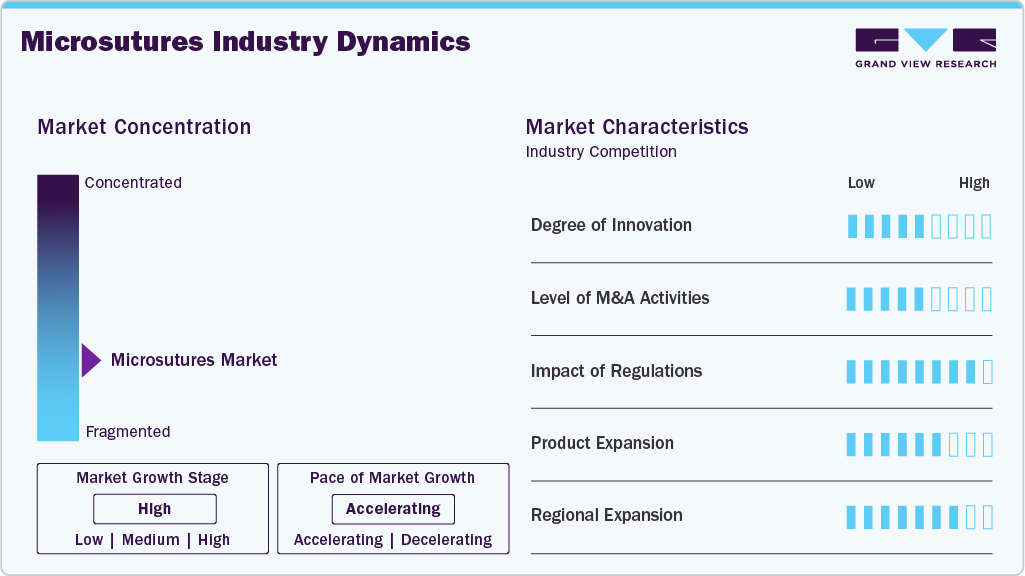

Market Concentration & Characteristics

The microsuture industry exhibits a moderate to high degree of innovation, driven by advancements in materials and suturing techniques. Recent developments include the use of ultra-thin, biocompatible materials that improve healing and reduce scarring. Innovation is also evident in the design of precision-engineered sutures that enhance accuracy and minimize tissue trauma. Overall, ongoing research and technological improvements continue to push the boundaries of microsuture performance and applications.

The merger and acquisition activity in the microsuture industry has been increasing steadily, driven by technological advancements and growing demand for minimally invasive surgical procedures. Major industry players are engaging in strategic acquisitions to expand their product portfolios and strengthen their market presence. This consolidation trend is also motivated by the desire to access new markets and enhance research and development capabilities. Overall, the level of mergers and acquisitions in the microsuture industry indicates a dynamic and competitive landscape focused on innovation and growth.

Regulatory frameworks play a pivotal role in shaping the development and commercialization of sutures, as they ensure safety, efficacy, and market confidence. In the U.S. microsutures are classified as class II medical devices, and the FDA mandates that certain types of sutures, such as absorbable and non-absorbable options, undergo a 510(k) premarket notification process, demonstrating their equivalence to existing products. More complex microsuture types, especially those with antimicrobial coatings or smart functionalities, may require stricter Premarket Approval (PMA), which includes clinical trials to validate safety and performance. Such regulation can influence development time and cost, but it is essential to confirm safety and reliability in sutures and instill confidence in the market.

Product substitutes in the microsuture industry include synthetic absorbable sutures made from materials such as polyglycolic acid or polyglactin, which can replace traditional silk or nylon sutures for certain applications. In addition, newer adhesive and tissue bonding agents serve as alternatives to sutures in some minimally invasive procedures.

The microsutures industry is witnessing significant regional expansion, driven by increasing minimally invasive procedures. North America and Europe remain dominant, supported by established healthcare systems, high adoption of advanced medical technologies, and continuous research in surgical techniques. However, the Asia-Pacific is now a key growth region with expanding healthcare access, rising awareness of surgical wound care, and growing demand for advanced microsuture products. Continued development of healthcare infrastructure and mounting emphasis on quality care will keep driving regional growth in the microsutures industry.

Product Insights

The non-absorbable microsuture segment led the market with the largest revenue share of 66.67% in 2024, driven by its durability and long-lasting wound support, which are essential in procedures requiring extended fixation or reinforcement. Non-absorbable sutures, such as nylon are preferred in cases where permanent or prolonged tissue stability is needed, such as in cardiovascular or orthopedic surgeries. Their ability to maintain strength over time reduces the risk of wound dehiscence and ensures optimal healing in complex or high-tension wounds. In addition, advancements in manufacturing and material quality have enhanced the performance of non-absorbable sutures, making them a reliable choice among surgeons, thus driving the segment’s dominance in the market.

The absorbable segment is anticipated to grow at the fastest CAGR during the forecast period, due to its numerous advantages over non-absorbable sutures. Absorbable microsutures eliminate the need for removal, reducing patient discomfort and the risk of infection, which makes them particularly appealing in delicate and minimally invasive procedures. Advances in biodegradable materials such as polyglycolic acid and polyglactin have improved the strength, flexibility, and predictability of absorption timelines, further boosting their popularity. In addition, the increasing preference for faster, more efficient surgical interventions and the growing demand for cosmetically favorable outcomes contribute to the rapid adoption of absorbable microsutures, driving their market growth. Some of the most common absorbable microsutures are made of Polyglycolic Acid (PGA) and polydioxanone.

Surgery Insights

The general surgery segment led the market with the largest revenue share of 24.77% in 2024, due to its widespread application across a broad range of surgical procedures, including wound closure, gastrointestinal surgeries, and vascular repairs. Microsutures used in general surgery are essential for achieving precise, minimally invasive, and secure closures, which are critical for patient recovery and reducing complications. In addition, the increasing volume of surgeries worldwide, advancements in minimally invasive techniques, and the demand for high-quality sutures that minimize tissue trauma have propelled the adoption of microsutures in this segment. The versatility, reliability, and proven clinical benefits of microsutures in general surgery procedures make this segment the leading contributor to the overall microsutures industry, driving innovation and higher demand within this field.

The neurosurgery segment is expected to grow at the fastest CAGR during the forecast period. Neurosurgical procedures often require highly precise and minimally invasive techniques to treat delicate neural tissues, which demand specialized sutures with superior strength and minimal tissue trauma. Advances in neurosurgical technology, along with an increasing prevalence of neurological disorders such as brain tumors, traumatic brain injuries, and neurodegenerative diseases, are driving the demand for advanced microsurgical tools and sutures. In addition, the growing adoption of minimally invasive neurosurgical techniques necessitates the use of finer, more sophisticated sutures that can ensure better patient outcomes and faster recovery times.

According to the report published by The Trustees of the University of Pennsylvania, approximately 5.3 million Americans-more than 2% of the U.S. population-are living with a disability caused by traumatic brain injury (TBI). According to the same source, each year, approximately 2 million Americans experience some form of traumatic brain injury. Hence, growing cases of neurological disorders are fueling the market growth.

End Use Insights

The hospitals segment led the market with the largest revenue share of 39.60% in 2024, driven by the high volume of surgical procedures performed in hospital settings. Hospitals are key centers for emergency surgeries, trauma care, and complex medical procedures, all of which require precise and reliable suturing for wound closure and healing. Moreover, the rising demand for specialized wound care, particularly in critical care units, has solidified the dominance of clinics and hospitals in the microsutures industry.

The specialty clinics segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing prevalence of eye disorders and the rising demand for advanced surgical procedures. Advances in technology and techniques have made microsurgical procedures, such as cataract surgery, retinal repair, and corneal transplants, more precise and effective, driving the adoption of specialized microsutures. In addition, the growing focus on minimally invasive techniques in ophthalmology has contributed to the demand for high-quality, fine sutures that ensure better healing and visual outcomes. As the global population ages and eye health awareness improves, ophthalmic clinics are increasingly investing in specialized microsurgical tools, further accelerating the growth of this segment in the microsutures industry.

Material Insights

The nylon segment accounted for the largest revenue share in 2024, due to its excellent strength, durability, and biocompatibility. Nylon sutures are known for their high tensile strength, which ensures secure wound closure, especially in delicate or small tissues. In addition, nylon's flexibility and knot security make it a preferred choice among surgeons for various surgical procedures, including ophthalmic, cardiovascular, and neurological surgeries. Its relatively low tissue reactivity and ease of handling further contribute to its widespread adoption. As a result, nylon continues to be the material of choice in many microsuture applications, driving its dominance in the market.

The polyglycolic acid (PGA) segment is expected to grow at the fastest CAGR over the forecast period, due to its superior biocompatibility, predictable degradation profile, and excellent tensile strength. PGA sutures are absorbable, eliminating the need for suture removal and reducing the risk of infection or complications associated with non-absorbable materials. Their quick absorption rate aligns well with the healing process, making them ideal for a wide range of surgical procedures, especially in delicate or minimally invasive surgeries. In addition, advancements in manufacturing technologies have improved the quality and performance of PGA sutures, further driving their adoption and contributing to their rapid market growth.

Regional Insights

North America dominated the microsutures market with the largest revenue share of 39.22% in 2024, arising from a combination of factors including a well-established healthcare infrastructure, a growing number of eyelid and breast augmentation surgical procedures, high healthcare spending, and increasing demand for advanced wound care solutions. The region's strong focus on innovation, research, and development in medical devices, including sutures, has further contributed to its dominant market position. The presence of key industry players and robust healthcare policies supporting access to advanced treatment options are also significant drivers of market growth in the region.

U.S. Microsutures Market Trends

The microsutures market in the U.S. accounted for the largest market revenue share of 77.87% in North America in 2024. The demand for microsutures in the U.S. is growing steadily, driven by factors such as an aging population, an increase in surgical procedures, and the growing demand for cosmetic and plastic surgeries, which often require surgical interventions. According to the ISAPS report, total surgical procedures (cosmetic) performed in 2023 were 1,791,102, among which the number of eyelid surgeries performed was 122,092. Some of the most common procedures performed included liposuction, breast augmentation, abdominoplasty, breast lift, and eyelid surgery. Moreover, continuous innovations in suture materials and techniques further fuel market growth. As a result, the U.S. microsutures industry is expected to experience sustained growth in the coming years. In addition, according to the report published by the U.S. Department of Labor, in calendar year 2023, more than 890,000 workplace injuries occurred. Hence, growing workplace injuries are further fueling the market growth in the country.

Europe Microsutures Market Trends

The microsutures market in Europe represents a key growth region for the suture industry, driven by advancements in medical technology and increasing demand for minimally invasive surgical procedures. Microsutures, characterized by their small size and precision, are essential in various medical fields such as ophthalmology, dermatology, and cosmetic surgery. The rising prevalence of chronic diseases, an aging population, and the expanding cosmetic surgery sector are key factors fueling market expansion in Europe. In addition, the adoption of innovative materials and techniques, along with a growing emphasis on patient safety and improved surgical outcomes, further contributes to market development. Major players are investing in research and development to introduce advanced microsuture products, thereby enhancing their market presence.

The Germany microsuture market is primarily driven by factors such as the increasing adoption of minimally invasive surgical procedures, advancements in medical technology, and a rising prevalence of chronic and lifestyle-related health conditions requiring precise surgical interventions. Moreover, Germany's robust healthcare infrastructure and focus on high-quality medical care encourage the adoption of innovative surgical tools like microsutures. The growing geriatric population, which often requires delicate and complex surgeries, further fuels demand. In addition, partnerships between medical device manufacturers and healthcare providers, along with favorable regulatory frameworks, support product innovation and market expansion in the microsuture segment. For instance, according to the ISAPS report, the total surgical procedures performed in 2023 were 463,026, among which, the most common procedures were liposuction (463,026), eyelid surgery (71,604), breast augmentation (71,464), and abdominoplasty (30,789).

Asia Pacific Microsutures Market Trends

The microsutures market in Asia Pacific is anticipated to grow at a notable CAGR over the forecast period, owing to an aging population, increasing surgical procedures, and the rising prevalence of chronic diseases. The region's expanding healthcare infrastructure, coupled with advancements in medical technologies. For instance, in August 2024, AIIMS Jammu, in collaboration with Ethicon (Johnson & Johnson), conducted a Surgical Skills Course and Workshop in Jammu and Kashmir. The event aimed to enhance surgical skills and training. This event highlights the region's ongoing efforts to improve surgical practices, further driving the demand for quality suture products.

The China microsutures market is driven by the country's rapidly evolving healthcare system, rising surgical volumes, and growing awareness of advanced medical treatments. With ongoing urbanization and improvements in healthcare access, more patients are undergoing surgical interventions such as plastic surgery, increasing the demand for reliable wound closure solutions. The government's continued investment in public health infrastructure and medical education also supports adopting modern surgical techniques that require high-quality microsutures.

Latin America Microsutures Trends

The microsutures market in Latin America is experiencing steady growth, supported by improvements in healthcare access, rising investments in hospital infrastructure, and a growing number of surgical procedures across the region. Countries such as Brazil and Argentina are expanding public and private healthcare services, which is increasing the demand for surgical supplies, including microsutures. Moreover, the rising burden of chronic diseases and trauma cases is leading to a greater need for both emergency and elective surgeries. Efforts to modernize medical practices, train healthcare professionals, and adopt advanced surgical techniques also contribute to the growing use of high-quality microsuture products across the region.

Middle East and Africa (MEA) Microsutures Market Trends

The microsuture market in the Middle East and Africa (MEA) is emerging and characterized by moderate growth driven by increasing healthcare investments and surgical procedures. Countries like the UAE, Saudi Arabia, and South Africa are leading the way, with expanding healthcare infrastructure and a growing demand for surgical interventions. However, in many areas of Africa, particularly in Sub-Saharan regions, significant hurdles exist. Limited access to advanced medical technologies and economic challenges often lead to the adopting of modern suturing materials on a larger scale. Despite these challenges, the region presents significant opportunities for growth, with international collaborations and investments aimed at improving healthcare access and quality.

The Saudi Arabia microsutures market continues to grow steadily, supported by the country's broader healthcare transformation under initiatives like Vision 2030, which emphasizes expanding access to quality medical care and enhancing local healthcare capabilities. The government is investing heavily in hospital infrastructure, medical education, and the localization of medical device manufacturing, all of which contribute to increased demand for surgical supplies, including microsutures. Moreover, rising elective surgeries, cosmetic procedures, and medical tourism fuel market growth. With an increasing focus on modern surgical practices and international partnerships to bring advanced technologies, Saudi Arabia is positioning itself as a growing hub for the microsutures industry in the Middle East.

Key Microsutures Company Insights

Corza Medical, Baxter, AD Surgical, Ethicon (Johnson & Johnson), Kono Seisakusho Group, Suturex, AROSurgical Instruments, Bear Medic Corporation, and Altomed are some of the major players in the microsutures industry. Companies are expanding their portfolios of microsutures to gain a competitive advantage in the coming years.

Key Microsutures Companies:

The following are the leading companies in the microsutures market. These companies collectively hold the largest market share and dictate industry trends.

- Corza Medical

- Baxter

- AD Surgical

- Ethicon (Johnson & Johnson)

- Kono Seisakusho Group

- Suturex

- AROSurgical Instruments

- Bear Medic Corporation

- Altomed

Recent Developments

-

In October 2024, Corza Medical launched its new Onatec ophthalmic microsurgical sutures during the American Academy of Ophthalmology (AAO) conference in Chicago in October 2024. These sutures are designed with advanced precision, utilizing high-tempered stainless-steel needles that enhance bending resistance and durability. The automated manufacturing process ensures precise needle geometry, which supports the delicate handling of fine tissues during ophthalmic procedures.

-

In February 2024, Novo Integrated Sciences' subsidiary, Clinical Consultants International (CCI), signed a Consulting Services Agreement with Futura Surgicare Pvt Ltd, an India-based manufacturer of surgical products. The partnership aims to assist Futura in obtaining U.S. FDA 510(k) approvals for its advanced surgical products and to introduce high-quality Dolphin Sutures and mesh products to the North American healthcare market. This collaboration seeks to offer cost-effective surgical solutions and improve patient care in the U.S.

Microsutures Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.32 billion

Revenue forecast in 2030

USD 0.38 billion

Growth rate

CAGR of 3.31% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, surgery, end use, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Corza Medical; Baxter; AD Surgical; Ethicon (Johnson & Johnson); Kono Seisakusho Group; Suturex; AROSurgical Instruments; Bear Medic Corporation; Altomed.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microsutures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global microsutures market report based on product, surgery, end use, material, and region.

-

Product Outlook (Revenue, USD Million, 2025 - 2030)

-

Absorbable

-

Non-absorbable

-

-

Surgery Outlook (Revenue, USD Million, 2025 - 2030)

-

General Surgery

-

Ophthalmology

-

Plastic and Reconstructive Surgery

-

Neurosurgery

-

Cardiovascular Surgery

-

Transplantation

-

Gynecological Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2025 - 2030)

-

Hospitals

-

Ambulatory Surgery Center (ASC)

-

Specialty Clinics

-

Ophthalmic and Eye Surgery Clinics

-

Plastic and Reconstructive Surgery Clinics

-

Fertility Clinics

-

Dental Clinics

-

-

Others

-

-

Material Outlook (Revenue, USD Million, 2025 - 2030)

-

Nylon

-

Polyglycolic Acid (PGA)

-

Polydioxanone

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2025 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global microsutures market was valued at USD 0.31 billion in 2024 and is expected to reach the value of USD 0.32 billion by 2025.

b. The global microsutures market is projected to grow at a compound annual growth rate (CAGR) of 3.31% from 2025 to 2030 to reach USD 0.38 billion by 2030.

b. The non-absorbable microsutures segment accounted for the largest market share of 66.67% in 2024, driven by growing demand for cosmetic and reconstructive surgeries.

b. Some of the key players operating in the microsutures market include Corza Medical, Baxter, AD Surgical, Ethicon (Johnson & Johnson), Kono Seisakusho Group, Suturex, AROSurgical Instruments, Bear Medic Corporation, and Altomed.

b. The microsutures market growth is largely attributed to the advancements in minimally invasive surgical techniques, increasing prevalence of chronic diseases requiring precise wound management, and expanding medical tourism industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.