- Home

- »

- Advanced Interior Materials

- »

-

Middle East 3D Printing Filaments Market Size Report, 2033GVR Report cover

![Middle East 3D Printing Filaments Market Size, Share & Trends Report]()

Middle East 3D Printing Filaments Market (2025 - 2033) Size, Share & Trends Analysis Report By Plastic Type (Polylactic Acid (PLA), Acrylonitrile Butadiene Styrene (ABS)), By Type, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-721-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East 3D Printing Filaments Market Summary

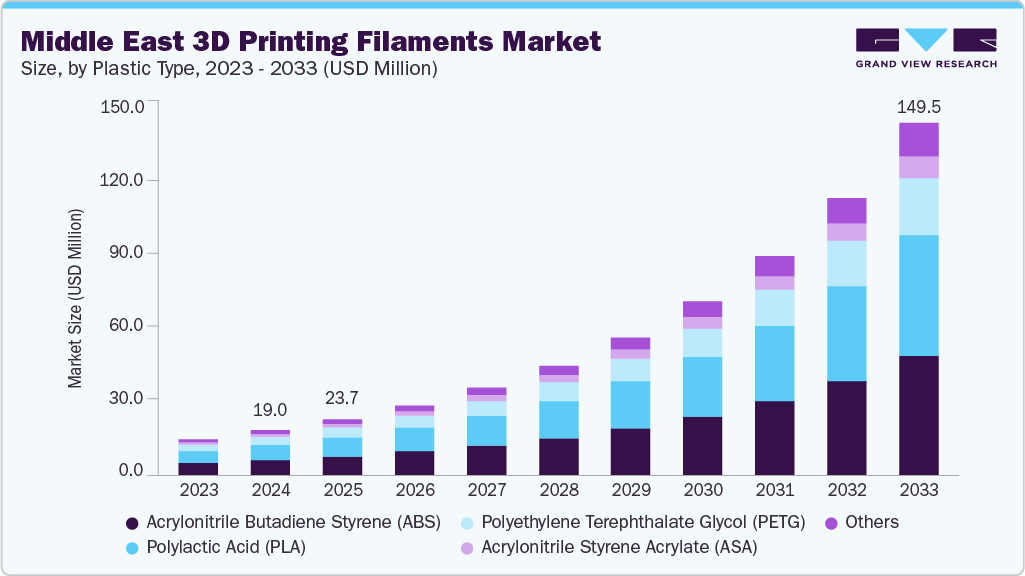

The Middle East 3D printing filaments market size was estimated at USD 19.0 million in 2024 and is projected to reach USD 149.5 million by 2033, growing at a CAGR of 25.9% from 2025 to 2033, due to the rapid adoption of additive manufacturing in education and research institutions. Governments across the region are investing in STEM programs, innovation hubs, and technical universities to build a skilled workforce equipped for advanced manufacturing.

Key Market Trends & Insights

- Egypt is expected to grow at fastest CAGR of 26.5% over the forecast period.

- By plastic type, the polylactic acid (PLA) segment is expected to grow at the fastest CAGR of 26.3% over the forecast period.

- By type, plastics segment is expected to grow at fastest CAGR of 26.1% over the forecast period.

- By application, aerospace & defense segment is expected to grow at fastest CAGR of 26.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 19.0 Million

- 2033 Projected Market Size: USD 149.5 Million

- CAGR (2025-2033): 25.9%

Affordable and easy-to-use filaments such as PLA and ABS are gaining traction in academic settings, enabling students and researchers to explore prototyping, design, and product development. This rising adoption in education is creating a consistent demand for consumer-grade and mid-tier filaments across the region. The construction and manufacturing sectors contribute significantly to market growth, as industries look toward 3D printing to achieve cost efficiency and sustainability. Engineering-grade filaments, including carbon-fiber reinforced composites and high-performance polymers, are being adopted to create lightweight yet durable components for automotive, aerospace, and industrial tools. This shift aligns with broader Middle Eastern strategies emphasizing industrial diversification and technological innovation, reducing dependence on conventional manufacturing imports.

Another major driver is the increasing use of 3D printing filaments in healthcare applications, particularly for producing prosthetics, dental solutions, and surgical models. The growing need for patient-specific and customized medical devices has accelerated the demand for biocompatible filaments such as PETG, Nylon, and flexible TPU. Regional investments in modern healthcare infrastructure and supportive regulations for innovative treatment technologies are further boosting the integration of high-quality medical-grade filaments into hospital and clinical workflows.

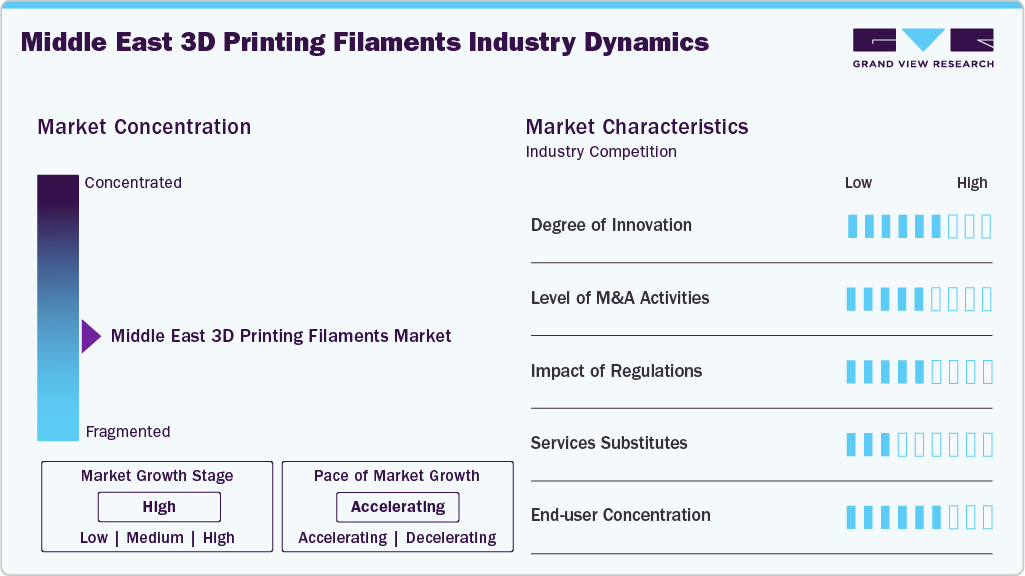

Market Concentration & Characteristics

The Middle East 3D printing filaments industry demonstrates a moderate degree of innovation, with global and regional players investing in advanced polymer blends, flexible TPU, carbon-fiber composites, and bio-based filaments to cater to diverse applications. Different mergers and collaborations are gradually increasing, as international filament manufacturers partner with regional distributors and technology hubs to strengthen market presence and localize supply. Regulatory frameworks, particularly in healthcare and construction, significantly influence market adoption by ensuring filaments meet safety, biocompatibility, and environmental standards, thereby shaping demand patterns and supplier competitiveness.

In terms of substitutes, traditional manufacturing materials remain alternatives; however, they lack the customization, cost-efficiency, and design flexibility offered by 3D printing filaments, limiting their competitiveness in fast-growing applications. End-user concentration is diverse, with demand distributed across education, healthcare, automotive, aerospace, and consumer sectors. Nonetheless, education and healthcare account for a higher share of filament usage due to the rising adoption of prototyping in universities and hospital patient-specific solutions. This combination of innovation, regulatory oversight, and concentrated demand in key end-user segments defines the evolving competitive characteristics of the Middle East 3D printing filaments industry.

Plastic Type Insights

The acrylonitrile butadiene styrene (ABS) segment dominated the market and accounted for the largest revenue share of 34.1% in 2024, driven by its durability, strength, and suitability for functional prototyping and end-use parts. In the Middle East, the automotive and consumer goods industries rely heavily on ABS filaments to produce customized components that withstand mechanical stress. Educational institutions also favor ABS due to its affordability and compatibility with a wide range of desktop 3D printers. As regional demand for robust prototypes and industrial-grade products grows, ABS continues to hold a strong position in the filament market.

Polylactic acid (PLA) is expected to grow at fastest CAGR of 26.3% over the forecast period, driven by its cost-effectiveness, ease of use, and eco-friendly characteristics, making it one of the most widely adopted filaments in the Middle East. PLA’s biodegradability aligns with regional sustainability initiatives, particularly in the UAE and Saudi Arabia. Universities, research labs, and makerspaces extensively use PLA filaments for training and prototyping. Its smooth printing properties and wide availability position PLA as a preferred material for education and entry-level applications in the region.

Application Insights

The automotive segment dominated the market and accounted for the largest revenue share of 25.1% in 2024. The automotive segment drives demand for 3D printing filaments through the need for rapid prototyping, tooling, and lightweight parts. Filaments such as ABS, Nylon, and carbon-fiber composites are being adopted to produce durable yet efficient components. In Saudi Arabia and the UAE, automotive suppliers increasingly turn to additive manufacturing to reduce production timelines and costs. This trend aligns with industrial diversification efforts, as the region seeks to strengthen local manufacturing capabilities and reduce import dependency.

The aerospace and defense segment is expected to grow at the fastest CAGR of 26.6% over the forecast period. Filaments like PEEK, Nylon composites, and metal-filled variants are being adopted for critical applications, including aircraft components, drones, and defense equipment. The Middle East’s significant investments in aerospace infrastructure and defense modernization foster greater demand for specialty filaments. This adoption enhances local manufacturing capabilities and supports the region’s strategic push toward advanced technologies in high-value industries.

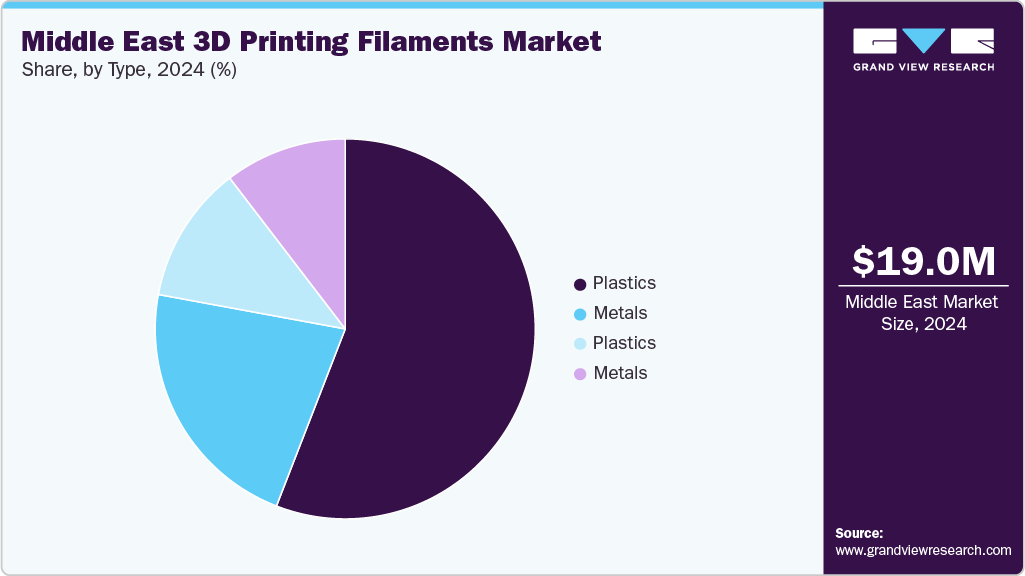

Type Insights

The plastics segment dominated the market and accounted for the largest revenue share of 55.9% in 2024, driven by rising demand for versatile and functional materials. PETG is gaining popularity in packaging and medical prototyping, while Nylon and TPU are valued for their flexibility and strength in industrial applications. Middle Eastern manufacturers are adopting these advanced plastics to reduce costs and enhance customization. The expanding scope of 3D printing in healthcare, consumer goods, and industrial design continues to fuel the plastics segment in the region.

The metals segment is expected to grow significantly at a CAGR of 25.5% over the forecast period, driven by the growing need for lightweight yet durable components in the aerospace, automotive, and defense industries. Metal-based filaments, such as stainless steel, titanium, and aluminum blends, are increasingly being explored for prototyping and low-volume manufacturing. Government investments in defense and energy infrastructure in the Middle East create opportunities for high-performance metal filaments. The segment is also supported by collaborations with global players that bring advanced metal additive manufacturing technologies to the region.

Country Insights

Saudi Arabia 3D Printing Filaments Market Trends

The 3D printing filaments market in Saudi Arabia is largely driven by the country’s Vision 2030 strategy, which promotes industrial diversification and technological innovation. Demand for engineering-grade filaments such as carbon-fiber composites and Nylon is growing within aerospace, automotive, and defense sectors. The expansion of mega-projects like NEOM also creates opportunities for customized prototyping and construction-related applications. In addition, government-backed R&D hubs encourage local adoption of advanced filaments to support smart manufacturing. This increasing focus on self-reliance and industrial modernization accelerates filament demand across multiple industries.

UAE 3D Printing Filaments Market Trends

The 3D printing filaments market in the UAE is propelled by the country’s ambition to become a global additive manufacturing hub under the Dubai 3D Printing Strategy. Affordable filaments such as PLA and ABS are widely adopted in education and prototyping, while industrial-grade filaments like PETG and TPU are gaining traction in healthcare and consumer goods. Hospitals and dental labs increasingly utilize biocompatible filaments for patient-specific implants and prosthetics. The construction industry is also experimenting with reinforced filaments for on-site applications. Supportive regulatory frameworks and international collaborations are further advancing demand across diverse sectors.

Egypt 3D Printing Filaments Market Trends

The 3D printing filaments market in Egypt is driven by rising adoption in the education and research sectors, where affordable PLA and ABS filaments are widely used for training and prototyping. The government’s focus on digital transformation and skill development has expanded the use of 3D printing in universities and technical institutes. In addition, the construction industry is beginning to integrate high-strength filaments to support large-scale infrastructure and housing projects. Automotive suppliers also explore filaments for component prototyping, helping reduce import reliance. Egypt’s growing innovation ecosystem and industrial modernization efforts are thus fueling steady filament demand.

Qatar 3D Printing Filaments Market Trends

The 3D printing filaments market in Qatar is supported by the country’s emphasis on Qatar National Vision 2030, which promotes technological innovation and sustainable development. Educational institutions and R&D centers use PLA and ABS filaments for prototyping and academic projects. The healthcare sector is another strong driver, with increasing adoption of flexible TPU and medical-grade PETG filaments for dental and prosthetic applications. In addition, post-World Cup smart city and infrastructure projects encourage using high-performance filaments for lightweight and durable designs. This demand aligns with Qatar’s broader push toward advanced manufacturing.

Kuwait 3D Printing Filaments Market Trends

The 3D printing filaments market in Kuwait is driven by the government’s Vision 2035 strategy to diversify the economy and boost innovation. Educational programs and maker spaces foster demand for low-cost filaments like PLA and ABS, supporting widespread learning and experimentation. Meanwhile, healthcare institutions are beginning to adopt biocompatible filaments for dental and orthopedic applications. The construction sector is also interested in reinforced filament blends for sustainable building solutions. Growing awareness of localized production and innovation positions Kuwait as an emerging consumer-grade and industrial-grade filaments market.

Key Middle East 3D Printing Filaments Company Insights

Some key players operating in the market include Stratasys Ltd., 3D Systems, Inc.

-

Stratasys Ltd. is a key player in 3D printing filaments, offering a wide portfolio of thermoplastic filaments such as ABS, ASA, Nylon, and composite blends. The company’s filaments are tailored for functional prototyping, tooling, and end-use applications across the Middle East's aerospace, automotive, and healthcare industries, ensuring high strength and reliability.

-

3D Systems, Inc. provides advanced 3D printing filaments, focusing on engineering-grade materials like PLA, ABS, and Nylon, along with specialty blends for industrial applications. Its filaments are particularly valued in healthcare and manufacturing sectors for precision, durability, and compatibility with multiple printer systems.

Ultimaker BV and ColorFabb BV are emerging market participants.

-

Ultimaker BV is recognized for its open-material ecosystem and a range of filaments, including PLA, ABS, PETG, and CPE. Its materials are widely used in education, prototyping, and small-scale industrial manufacturing in the Middle East. Ultimaker emphasizes easy-to-use, reliable filaments designed for professional and academic environments.

-

ColorFabb BV is a filament manufacturer specializing in innovative materials such as wood-fill, carbon-fiber reinforced, and copper-fill filaments. Its unique product range serves creative industries, prototyping, and design applications. In the Middle East, ColorFabb supports sectors that require customized and aesthetically enhanced filament solutions.

Key Middle East 3D Printing Filaments Companies:

- Stratasys Ltd.

- 3D Systems, Inc.

- Ultimaker BV

- ColorFabb BV

- HATCHBOX 3D

- FormFutura BV

- Polymaker

- Fillamentum Manufacturing Czech s.r.o.

- MatterHackers, Inc.

3D Printing Filaments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.7 million

Revenue forecast in 2033

USD 149.5 million

Growth rate

CAGR of 25.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Plastic type, type, application, region

Region scope

Middle East

Key companies profiled

Stratasys Ltd.; 3D Systems, Inc.; Ultimaker BV; ColorFabb BV; HATCHBOX 3D; FormFutura BV; Polymaker; Fillamentum Manufacturing Czech s.r.o.; MatterHackers

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East 3D Printing Filaments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East 3D printing filaments market report based on plastic type, type, application, and region:

-

Plastic Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Polylactic Acid (PLA)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate Glycol (PETG)

-

Acrylonitrile Styrene Acrylate (ASA)

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastics

-

Metals

-

Ceramics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Aerospace & Defense

-

Automotive

-

Healthcare

-

Others

-

-

Country Outlook (Revenue, USD Million; 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East 3D printing filaments market size was estimated at USD 19.0 million in 2024 and is expected to reach USD 23.7 million in 2025.

b. The Middle East 3D printing filaments market is expected to grow at a compound annual growth rate of 25.9% from 2025 to 2033 to reach USD 149.5 million by 2033.

b. The plastics segment dominated the market and accounted for the largest revenue share of 55.9% in 2024, driven by rising demand for versatile and functional materials.

b. Some of the prominent companies in the Middle East 3D printing filaments market include Stratasys Ltd., 3D Systems, Inc., Ultimaker BV, ColorFabb BV, HATCHBOX 3D, FormFutura BV, Polymaker, Fillamentum Manufacturing Czech s.r.o., and MatterHackers

b. Key factors driving the Middle East 3D printing filaments market includethe rising adoption of additive manufacturing across automotive, aerospace, and healthcare industries, increasing demand for lightweight and sustainable materials, government initiatives supporting advanced manufacturing, and continuous improvements in filament quality and performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.