- Home

- »

- Next Generation Technologies

- »

-

Middle East Artificial Intelligence Market Size Report, 2033GVR Report cover

![Middle East Artificial Intelligence Market Size, Share & Trends Report]()

Middle East Artificial Intelligence Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Software & Services), By Technology (Deep Learning, Machine Learning, Natural Language Processing, Machine Vision), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-856-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

ME Artificial Intelligence Market Summary

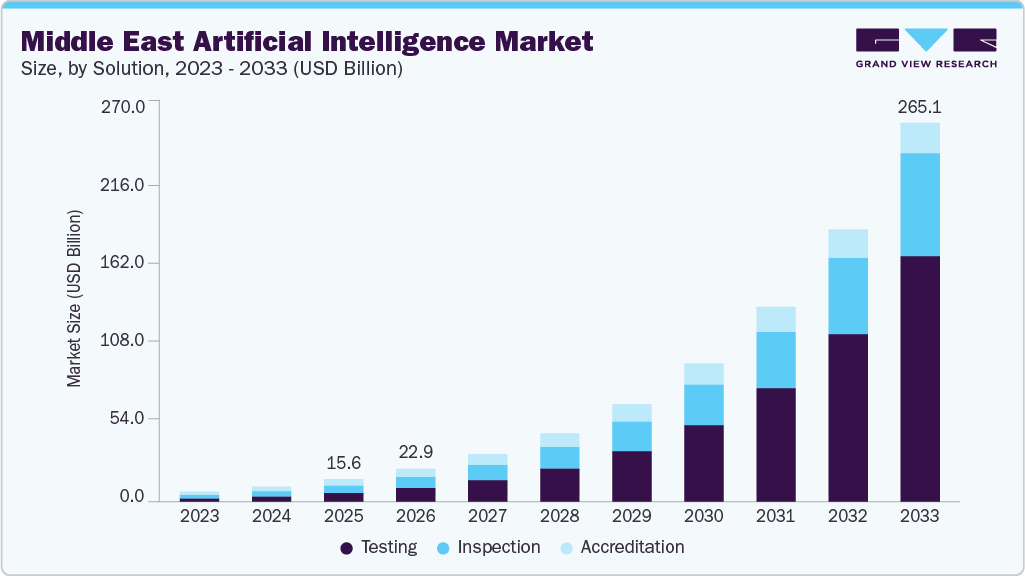

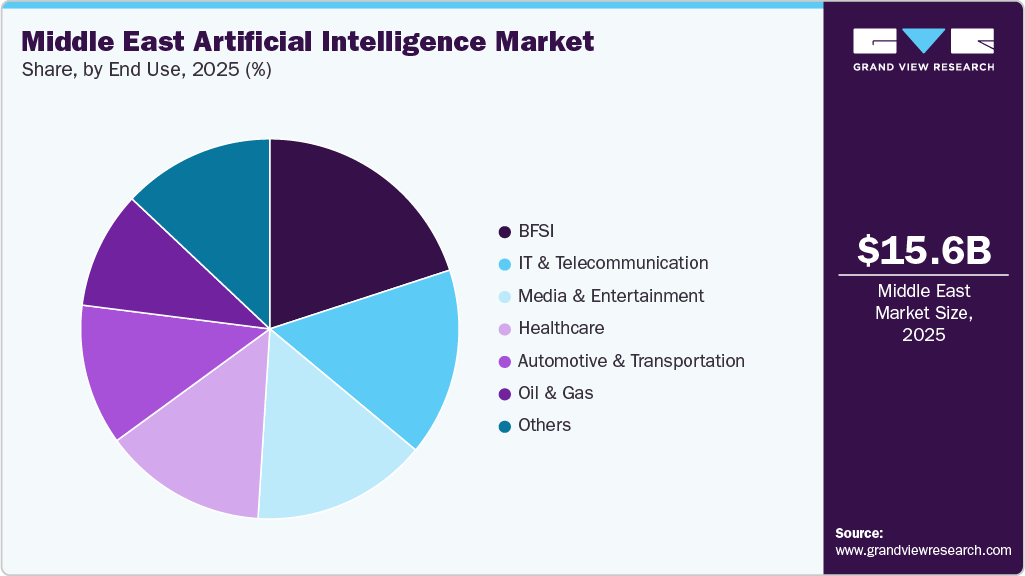

The Middle East artificial intelligence market size was estimated at USD 15.63 billion in 2025 and is projected to reach USD 265.06 billion by 2033, growing at a CAGR of 41.8% from 2026 to 2033. The market growth is driven by accelerating government-led digital transformation programs, rising investments in AI infrastructure and hyperscale data centers, increasing adoption of AI-enabled automation across oil & gas and financial services, expansion of smart city and e-government initiatives, and growing deployment of generative AI and advanced analytics across enterprise operations.

Key Market Trends & Insights

- By solutions, services segment led the market and held the largest revenue share of over 38% in 2025.

- By technology, deep learning segment led the market and held the largest revenue share of 34% in 2025.

- By end use, automotive & transportation segment is expected to grow at the fastest CAGR of over 45% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 15.63 Billion

- 2033 Projected Market Size: USD 265.06 Billion

- CAGR (2026-2033): 41.8%

The Middle East AI market is witnessing strong momentum, driven by large-scale government digital transformation agendas and national AI strategies across key economies. Rising investments in hyperscale data centers, cloud infrastructure, and high-performance computing are accelerating enterprise-level AI deployment across the Middle East AI ecosystem. Key sectors such as oil & gas, financial services, healthcare, and public administration are increasingly adopting AI-enabled automation to improve operational efficiency and decision-making. The expansion of smart city initiatives and e-government platforms is further creating sustained demand for AI-powered analytics, computer vision, and intelligent services. In addition, growing enterprise interest in generative AI, predictive analytics, and customer experience solutions is reinforcing the region’s long-term AI adoption trajectory.

Rising investments in cloud infrastructure, high-performance computing, and hyperscale data centers are accelerating Middle East AI deployment across the region. Governments and private investors are funding large-scale digital infrastructure to support advanced analytics, generative AI, and machine learning workloads, strengthening the Middle East AI ecosystem. The growth of regional cloud availability zones is enabling enterprises to deploy AI solutions with improved latency, security, and regulatory compliance. Increased demand for AI-ready infrastructure is also driving partnerships between global technology providers and local telecom and data center operators. This infrastructure expansion is positioning the region as a strategic hub for Middle East AI-driven digital economies.

The rapid emergence of generative AI is driving new investment cycles across enterprise and government organizations, reinforcing the growth of the Middle East AI market. Companies are deploying generative AI for content creation, software development, customer service, and knowledge management applications, expanding Middle East AI use cases across industries. The increasing availability of localized language models and regional data sets is supporting broader adoption across Arabic-speaking markets. Organizations are also investing in advanced analytics and AI-driven decision intelligence to improve strategic planning and operational performance. This shift toward generative and advanced capabilities is accelerating the evolution of the Middle East AI ecosystem toward data-centric, AI-powered business models.

Solution Insights

The services segment led the market in 2025, accounting for over 38% of revenue, driven by increasing enterprise demand for consulting, integration, and managed offerings across the Middle East AI ecosystem. Organizations across the region are relying on specialized service providers to design, deploy, and scale Middle East AI solutions aligned with their digital transformation strategies. The complexity of AI implementation, including data preparation, model training, and system integration, is further accelerating demand for professional services. Enterprises are also investing in ongoing optimization, monitoring, and support to maximize return on AI investments. This sustained demand for end-to-end capabilities is reinforcing the segment’s leading revenue contribution within the Middle East AI market.

The software segment is anticipated to witness a significant CAGR over the forecast period, driven by increasing adoption of platforms, machine learning frameworks, and generative applications across the Middle East AI landscape. Organizations are investing in Middle East AI software to automate workflows, enhance customer engagement, and enable data-driven decision-making. The growing availability of cloud-based tools and pre-trained models is reducing deployment complexity and accelerating adoption among small and mid-sized enterprises. Demand for industry-specific solutions in sectors such as finance, healthcare, retail, and energy is further supporting segment growth. In addition, continuous advancements in natural language processing, computer vision, and predictive analytics are expanding software use cases across the Middle East AI market.

Technology Insights

The deep learning technology segment held a significant market revenue share in 2025, owing to its strong adoption across high-value use cases such as computer vision, speech recognition, predictive analytics, and generative AI. Enterprises and government agencies are increasingly leveraging deep learning models to process large volumes of structured and unstructured data for advanced insights. The technology’s superior accuracy in image, video, and language-based applications is driving its integration into smart city, healthcare, financial services, and security solutions. Rising investments in high-performance computing and AI infrastructure are further supporting large-scale deep learning deployments. In addition, the growing availability of pre-trained models and cloud-based deep learning platforms is accelerating adoption across both large enterprises and emerging businesses.

The machine vision segment is anticipated to witness a significant CAGR over the forecast period, driven by rising adoption across manufacturing, logistics, retail, and security applications. Organizations are increasingly deploying AI-powered vision systems for quality inspection, defect detection, automated sorting, and surveillance. The expansion of smart factories and Industry 4.0 initiatives across the region is further accelerating demand for machine vision solutions. Advances in deep learning, edge computing, and high-resolution imaging technologies are improving accuracy and real-time processing capabilities. In addition, growing investments in automation and smart infrastructure are reinforcing the adoption of machine vision across both industrial and public sector environments.

End Use Insights

The BFSI segment held the largest market share in 2025, primarily driven by the rapid adoption of AI for fraud detection, risk assessment, customer analytics, and automated customer service. Financial institutions are investing heavily in AI-powered solutions to enhance security, improve regulatory compliance, and deliver personalized digital banking experiences. The growing shift toward mobile banking, digital payments, and fintech platforms is further accelerating AI deployment across the sector. Banks and insurers are also leveraging predictive analytics and machine learning to optimize credit scoring, underwriting, and claims processing. This strong focus on operational efficiency, customer engagement, and data-driven decision-making is reinforcing the BFSI sector’s leading position in the AI market.

The Automotive & Transportation segment is anticipated to witness a significant CAGR over the forecast period, driven by increasing adoption of AI across connected vehicles, autonomous driving technologies, and intelligent traffic management systems. Automotive manufacturers and mobility providers are investing in AI-powered advanced driver assistance systems, predictive maintenance, and in-vehicle infotainment solutions. The expansion of smart mobility initiatives and intelligent transportation infrastructure across major Middle Eastern cities is further accelerating demand. AI is also being deployed in logistics and fleet management to optimize route planning, fuel efficiency, and supply chain operations. These developments are positioning AI as a critical enabler of safer, more efficient, and data-driven transportation ecosystems.

Country Insights

The Middle East AI market is gaining strong momentum, driven by government-backed national AI strategies and large-scale digital transformation programs. Rising investments in cloud infrastructure, hyperscale data centers, and high-performance computing are accelerating enterprise AI adoption across the region. Key industries such as energy, financial services, healthcare, and logistics are increasingly deploying AI to improve efficiency, enhance customer experience, and optimize operations. In addition, the expansion of smart city initiatives and the growing adoption of generative AI solutions are reinforcing long-term market growth.

Qatar Middle East Artificial Intelligence Market Trends

Qatar Middle East AI market is anticipated to witness a significant CAGR over the forecast period, owing to strong government-led digital transformation initiatives and the country’s strategic focus on building an AI-driven knowledge economy. Rising investments in smart city projects, intelligent infrastructure, and advanced data analytics are accelerating AI adoption across public and private sectors. The expansion of cloud computing, data centers, and high-speed connectivity is further enabling large-scale AI deployments. Key industries such as energy, financial services, healthcare, and transportation are increasingly integrating AI to improve operational efficiency and service delivery. In addition, ongoing national programs aimed at innovation, research, and technology development are reinforcing Qatar’s long-term AI market growth.

Key Middle East Artificial Intelligence Company Insights

Some of the key players operating in the market include Advanced Micro Devices, Inc.; AiCure; Baidu, Inc.; Google LLC; and IBM.

-

Google LLC is a provider of internet-related products and services, offering solutions across search, cloud computing, artificial intelligence, advertising, and enterprise software. As a wholly owned subsidiary of Alphabet Inc., the company focuses on developing advanced digital platforms, AI-driven technologies, and scalable cloud solutions for consumers and businesses. Google’s portfolio includes search engines, mobile operating systems, productivity tools, and AI services delivered through its cloud ecosystem. Its strong investments in machine learning, data analytics, and generative AI are positioning the company as a key innovator in the global artificial intelligence landscape.

-

International business machines corporation (IBM) is a technology company providing a broad portfolio of hardware, software, consulting, and cloud-based solutions. The company operates across multiple segments, including Cloud & Cognitive Software, Global Business Services, Global Technology Services, Systems, and Global Financing. IBM focuses on hybrid cloud, artificial intelligence, and enterprise automation solutions to support digital transformation across industries. Its strong presence in AI-driven analytics, quantum computing, and enterprise consulting services reinforces its position as a major player in the global technology and AI ecosystem.

Key Middle East Artificial Intelligence Companies:

- Advanced Micro Devices

- Omdena Inc.,

- DevisionX,

- Baidu, Inc.

- Google LLC

- IBM

- Intel Corporation

- Intelmatix

- Digital Energy

- Gleac

Recent Developments

-

In November 2025, Adobe and HUMAIN announced a global strategic partnership to develop generative AI models and AI-powered applications tailored for the Arab world. The collaboration combines HUMAIN’s Arabic-first large language models, sovereign cloud, and next-generation data centers with Adobe’s creative and AI software platforms. The initiative focuses on building culturally relevant multimodal AI across audio, image, video, and 3D use cases for industries such as advertising, education, entertainment, and social media. The partnership is expected to strengthen regional AI infrastructure, localized models, and large-scale adoption across the Middle East.

-

In April 2025, SailPoint launched its first regional SaaS instance in the Middle East to support growing digital transformation initiatives. The deployment provides locally hosted access to its AI-driven identity security cloud platform. It is designed to meet regional requirements for data sovereignty, regulatory compliance, and secure cloud adoption. The move highlights increasing investments in AI-enabled security and cloud infrastructure across the Middle East.

-

In May 2025, Cisco announced strategic artificial intelligence initiatives across the Middle East to support national AI strategies and digital transformation. The company formed partnerships with regional organizations in Saudi Arabia, the UAE, and Qatar to develop AI infrastructure and innovation programs. The initiatives include investments in AI-ready data centers, advanced networking, and talent development. This expansion highlights increasing enterprise and government investments in AI infrastructure across the Middle East.

ME Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 22.98 billion

Revenue forecast in 2033

USD 265.06 billion

Growth rate

CAGR of 41.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Market revenue in USD billion/million & CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Solution, technology, end use, country

Country scope

KSA; UAE; Kuwait; Qatar

Key companies profiled

Advanced Micro Devices; Omdena Inc.; Devision X; Baidu, Inc.; Google LLC; IBM; Intel Corporation; Intelmatix; Digital Energy; Gleac

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the ME Artificial Intelligence market report based on solution, technology, end use, and region.

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Hardware

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Oil & Gas

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

KSA

-

UAE

-

Kuwait

-

Qatar

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.