- Home

- »

- Organic Chemicals

- »

-

Middle East Carbon Dioxide Market, Industry Report, 2033GVR Report cover

![Middle East Carbon Dioxide Market Size, Share & Trends Report]()

Middle East Carbon Dioxide Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide), By Application (Food & Beverages, Oil & Gas, Medical, Rubber, Fire Fighting), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-715-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Carbon Dioxide Market Summary

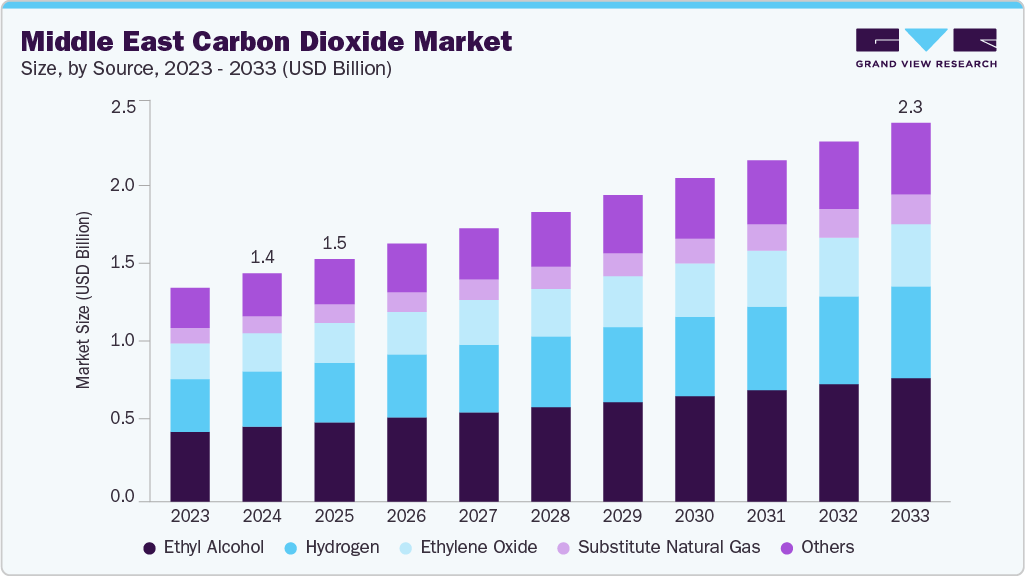

The Middle East carbon dioxide market size was estimated at USD 1,381.4 million in 2024 and is projected to reach USD 2,293.2 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The growth is driven by robust demand from the food and beverage sector, where carbonation, modified atmosphere packaging, and cold-chain applications ensure steady consumption.

Key Market Trends & Insights

- The Middle East carbon dioxide market is projected to grow at a CAGR of 5.7% from 2025 to 2033.

- By source, the ethyl alcohol segment dominated the market with the largest revenue share of 32.6% in 2024.

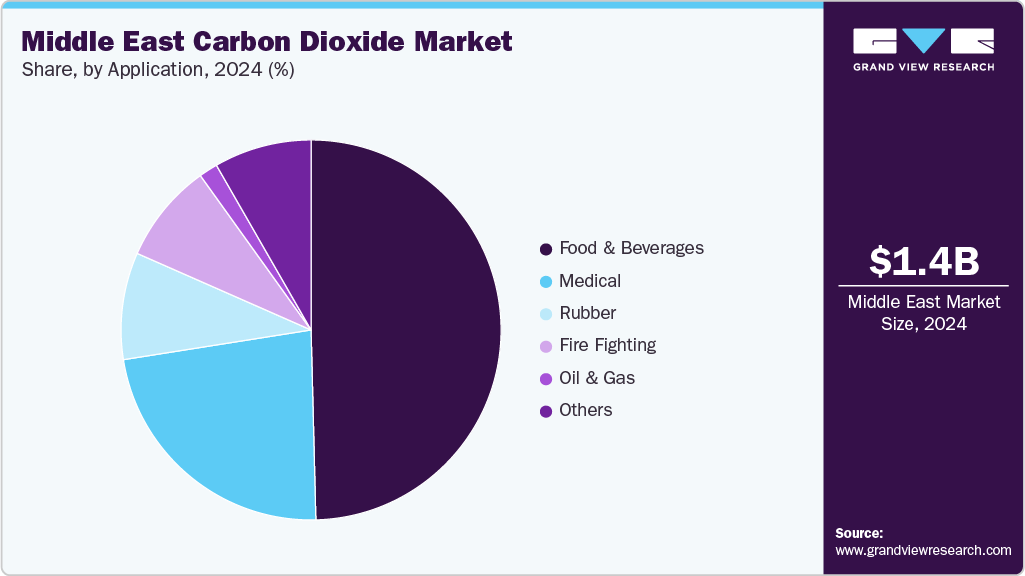

- By application, the food & beverages segment captured the largest revenue share of 49.6% in 2024.

Market Size & Forecasts

- 2024 Market Size: USD 1,381.4 Million

- 2033 Projected Market Size: USD 2,293.2 Million

- CAGR (2025-2033): 5.7%

Expanding healthcare infrastructure and pharmaceutical cold logistics further support medical-grade CO₂ adoption. In parallel, large-scale hydrogen, ammonia, and petrochemical projects provide abundant capture opportunities, while government-led decarbonization and CCUS initiatives across Saudi Arabia, the UAE, and Qatar accelerate the availability of purified CO₂ streams for industrial use.Significant opportunities lie in developing integrated CO₂ capture and utilization hubs near refineries, petrochemical clusters, and LNG facilities, which can reduce costs and ensure reliable merchant supply. The rising focus on blue hydrogen and blue ammonia creates a structural growth pathway for CO₂ capture. At the same time, new applications in e-fuels, mineral carbonation, and advanced chemicals represent long-term utilization avenues. The growth of tourism, packaged food, and cold-chain logistics in the region enhances opportunities for high-purity CO₂, dry ice, and medical-grade applications.

The Middle East carbon dioxide industry faces challenges related to supply reliability, as unplanned refinery or petrochemical shutdowns can cause shortages that disrupt merchant CO₂ availability. Compliance with stringent purity standards for food- and medical-grade CO₂ increases operational complexity and costs for producers. Moreover, the region’s high temperatures amplify storage and transportation challenges, increasing boil-off risks and logistics expenses. Finally, dependence on a limited number of large industrial emitters for feedstock CO₂ poses concentration risks, making the market vulnerable to operational and policy shifts in upstream industries.

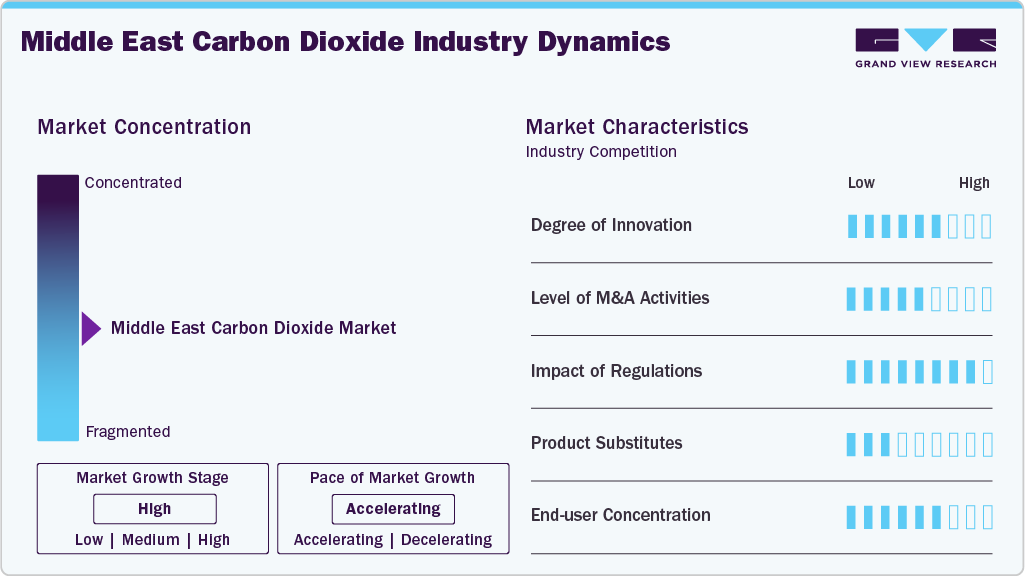

Market Concentration & Characteristics

Leading players in the Middle East carbon dioxide market are focusing on vertical integration and strategic partnerships to strengthen their position. Many are co-locating CO₂ capture and purification units with hydrogen, ammonia, and petrochemical facilities to secure stable feedstock and reduce production costs. They are also investing in advanced purification technologies to meet stringent food- and medical standards, ensuring premium market access. Long-term supply agreements with key beverage and healthcare customers further enhance market stability and lock in recurring revenues.

In parallel, companies are adopting expansion and innovation strategies to capture future growth. This includes developing CO₂ hubs and distribution networks across industrial clusters, investing in logistics infrastructure such as bulk storage, satellite depots, and cryogenic transport fleets, and exploring utilization opportunities in e-fuels, blue hydrogen, and mineral carbonation. Leading players are also aligning with regional decarbonization goals by actively participating in CCUS projects, thereby strengthening their role as reliable partners in both traditional merchant markets and emerging low-carbon value chains.

Source Insights

The ethyl alcohol segment held the largest revenue share of 32.6% in 2024, due to its ability to generate high-purity, food- and beverage-grade CO₂ as a byproduct of fermentation, making it a preferred source for applications where stringent quality standards are essential. This segment benefited from strong demand in carbonated beverages, packaged foods, and dry ice for cold-chain logistics, particularly in the Middle East’s expanding food and hospitality sector. The growing reliance on reliable, high-spec CO₂ for medical and pharmaceutical applications further reinforced the dominance of ethanol-derived supply in the regional market.

Beyond ethyl alcohol, hydrogen and ethylene oxide plants represent significant and scalable CO₂ sources in the Middle East, supported by the region’s large refining and petrochemical footprint. Hydrogen-derived CO₂, especially from steam methane reforming, is increasingly important as investments in blue hydrogen and blue ammonia projects accelerate. At the same time, ethylene oxide facilities provide continuous and consistent CO₂ streams for industrial use. Substitute natural gas and other sources, such as refineries, natural gas processing, and cement plants, currently hold smaller shares. Still, they represent strategic long-term opportunities as carbon capture, utilization, and storage (CCUS) technologies advance and governments push for decarbonization. Together, these diversified sources ensure supply resilience and open new pathways for CO₂ utilization in both conventional and emerging applications.

Application Insights

The food & beverages segment led the Middle East carbon dioxide industry with the largest revenue share of 49.6% in 2024, owing to the extensive use of CO₂ in carbonation, bottling, and modified atmosphere packaging, as well as its critical role in dry ice for cold-chain logistics. The Middle East’s rising population, expanding tourism, and robust growth of the hospitality and packaged food sectors created sustained demand for food-grade CO₂, making it the most dominant application area. Additionally, increasing consumption of carbonated beverages and frozen products, supported by strong retail and HORECA channels, reinforced the segment’s leadership position in the regional market.

Beyond food and beverages, oil and gas applications represent a key growth frontier as CCUS and enhanced oil recovery (EOR) initiatives gain traction in countries such as Saudi Arabia, the UAE, and Qatar. The medical segment contributes steadily, driven by the use of CO₂ in surgical procedures, respiratory treatments, and pharmaceutical logistics, while rubber and firefighting applications account for niche but consistent demand. Other uses, including welding, water treatment, and greenhouse enrichment, add to the market’s diversity. Collectively, these applications highlight a balanced demand profile, with food and beverages ensuring volume stability and oil and gas emerging as the future growth driver aligned with regional decarbonization strategies.

Country Insights

The Middle East carbon dioxide market is characterized by abundant feedstock availability from large-scale hydrogen, ammonia, and petrochemical facilities, combined with rising demand across food & beverages, medical, and industrial sectors. Robust economic diversification programs, population expansion, and increasing investment in cold-chain logistics and healthcare infrastructure underpin regional growth. Furthermore, government-led decarbonization agendas and CCUS initiatives are creating new pathways for CO₂ capture and utilization, positioning the region as a key hub for both conventional merchant CO₂ and emerging low-carbon applications such as blue hydrogen, blue ammonia, and e-fuels.

Saudi Arabia Carbon Dioxide Market Trends

Saudi Arabia dominates the Middle East carbon dioxide industry, supported by its vast refinery, petrochemical, and hydrogen production base, which provides consistent CO₂ capture opportunities. Strong demand from the food and beverage sector, coupled with a rapidly expanding tourism and hospitality industry, underpins the country’s merchant CO₂ consumption. At the same time, the Kingdom’s Vision 2030 and its large-scale CCUS and blue hydrogen projects are driving structural growth in CO₂ utilization, particularly in enhanced oil recovery and emerging sustainable applications. This combination of strong domestic demand and proactive decarbonization investments positions Saudi Arabia as the growth engine of the regional carbon dioxide market.

Key Middle East Carbon Dioxide Company Insights

Some of the key players operating in the Middle East carbon dioxide market include Air Liquide SA; Air Products and Chemicals, Inc.; and Acail Gas.

-

Air Liquide SA plays a prominent role in the Middle East carbon dioxide industry through its extensive expertise in industrial gases, advanced purification technologies, and strong presence across key regional hubs. The company leverages its global leadership in gas production and distribution to supply high-purity CO₂ for food and beverage, medical, and industrial applications, supported by a robust logistics network of bulk storage, satellite depots, and cryogenic transport. Air Liquide is also actively engaged in carbon capture and utilization initiatives aligned with regional decarbonization goals, particularly in Saudi Arabia and the UAE, where large-scale hydrogen and CCUS projects are underway. By combining long-term customer contracts, innovation in gas purification, and partnerships with leading energy and petrochemical players, Air Liquide continues to strengthen its market position and capitalize on both traditional merchant demand and emerging low-carbon opportunities in the region.

Key Middle East Carbon Dioxide Companies:

- Acail Gas

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Greco Gas Inc.

- Linde PLC

- Messer Group

- Sicgil

- Quimetal

- Taiyo Nippon Sanso Corp.

Middle East Carbon Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,468.8 million

Revenue forecast in 2033

USD 2,293.2 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Israel; Rest of Middle East

Key companies profiled

Acail Gas; Air Liquide SA; Air Products and Chemicals, Inc.; Greco Gas Inc.; Linde PLC; Messer Group; Sicgil; Quimetal; Taiyo Nippon Sanso Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Carbon Dioxide Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East carbon dioxide market report based on product, application, and country:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Hydrogen

-

Ethyl Alcohol

-

Ethylene Oxide

-

Substitute Natural Gas

-

Other Sources

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food & Beverages

-

Oil & Gas

-

Medical

-

Rubber

-

Fire Fighting

-

Other Applications

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East carbon dioxide market size was estimated at USD 1,381.4 million in 2024 and is expected to reach USD 1,468.8 million in 2025.

b. The Middle East carbon dioxide market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 2,293.2 million by 2033.

b. The food & beverages segment held the largest revenue share in 2024 due to the extensive use of CO₂ in carbonation, bottling, modified atmosphere packaging, and dry ice for cold-chain logistics, driven by strong demand from the region’s expanding hospitality, packaged food, and beverage industries. Its critical role in ensuring product quality, preservation, and distribution efficiency reinforced its dominance in the Middle East carbon dioxide market.

b. Some of the key players operating in the Middle East carbon dioxide market include Acail Gas, Air Liquide SA, Air Products and Chemicals, Inc., Greco Gas Inc., Linde PLC, Messer Group, Sicgil, Quimetal, and Taiyo Nippon Sanso Corp.

b. The Middle East carbon dioxide market is driven by rising demand from the food & beverage and healthcare sectors, coupled with growing investments in cold-chain logistics and medical infrastructure. The government-led decarbonization and CCUS initiatives are expanding CO₂ capture and utilization opportunities across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.