- Home

- »

- Advanced Interior Materials

- »

-

Middle East Cobalt Market Size, Share, Industry Report 2033GVR Report cover

![Middle East Cobalt Market Size, Share & Trends Report]()

Middle East Cobalt Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cobalt Sulfate, Cobalt Oxide, Cobalt Metal), By Application (EV, Industrial Metals, Superalloys), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-708-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Cobalt Market Summary

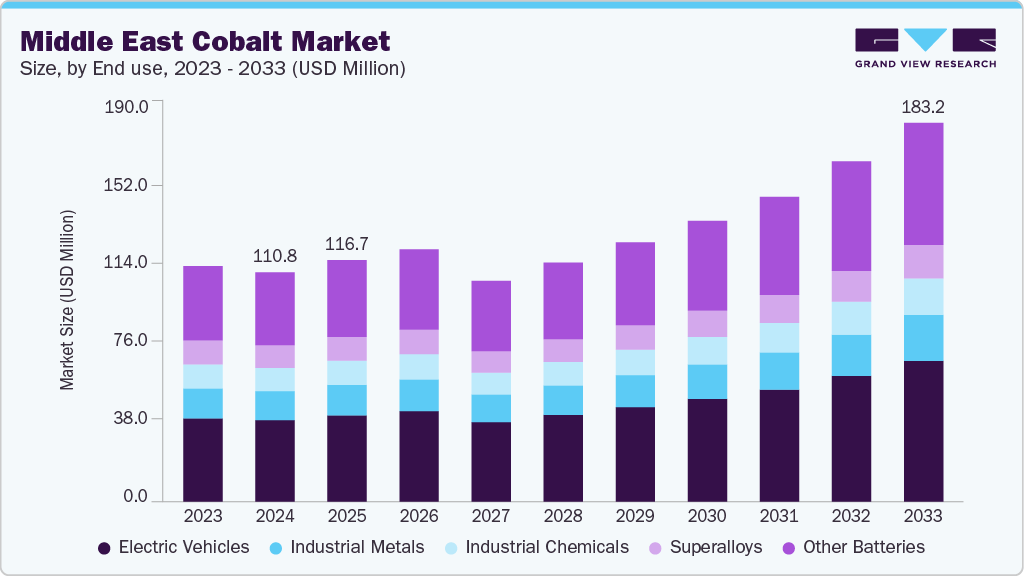

The Middle East cobalt market size was estimated at USD 110.8 million in 2024 and is expected to reach USD 183.2 million by 2033, at a CAGR of 5.8% from 2025 to 2033. The expanding production and adoption of electric vehicles (EVs) in the region are expected to drive increased demand for cobalt during the forecast period.

Key Market Trends & Insights

- Saudi Arabia held the revenue share of almost 32% in the Middle East for 2024.

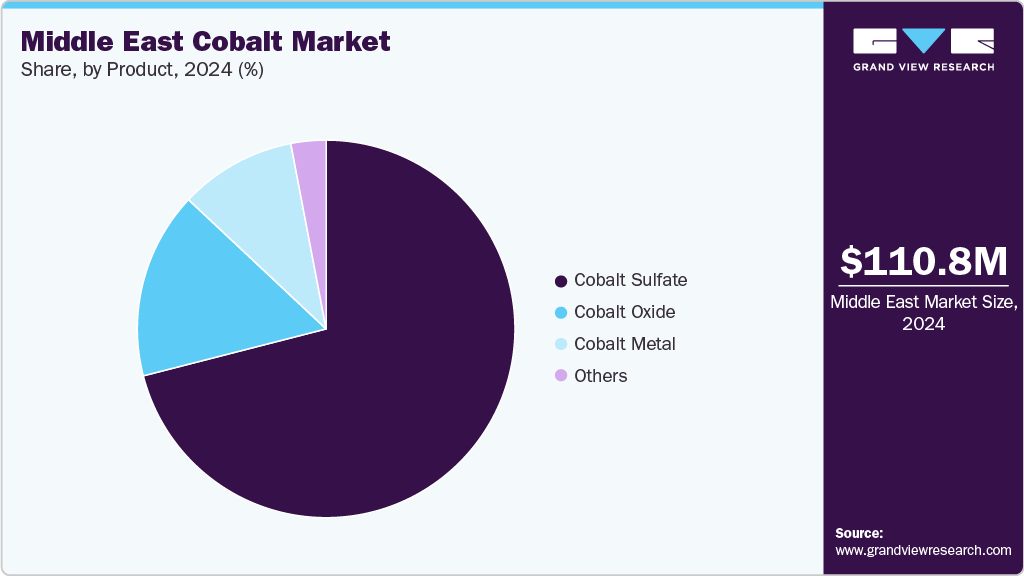

- By product, the cobalt sulfate segment held the revenue share of over 71.0% in 2024.

- By end use, the electric vehicles segment held the revenue share of over 35.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 110.8 Million

- 2033 Projected Market Size: USD 183.2 Million

- CAGR (2025-2033): 5.8%

Lithium-nickel-manganese-cobalt-oxide (NMC) batteries, which typically contain 10-20% cobalt in their cathodes, remain the most widely used battery chemistry for EVs. Cobalt is a critical component of lithium-ion batteries, enhancing electric vehicles' driving range and durability. Sustainability is becoming a key focus in the market, driven by increasing environmental regulations and the global push towards greener technologies.

Cobalt sourcing and processing are under scrutiny to ensure ethical practices, including reducing the environmental impact of mining and promoting responsible supply chains. The Middle East is investing in sustainable battery recycling initiatives and exploring alternative materials to minimize cobalt dependency. These efforts aim to support the circular economy while meeting the growing demand for cobalt in clean energy applications, aligning the region’s cobalt industry with global sustainability goals.

Drivers, Opportunities & Restraints

The Middle East cobalt industry is primarily driven by the rapid growth of the electric vehicle (EV) sector, as cobalt plays a crucial role in lithium-ion batteries that power EVs. In addition, expanding renewable energy projects in the region are increasing demand for energy storage solutions, which rely heavily on cobalt-based batteries. Growing adoption of cobalt-containing batteries in consumer electronics, power tools, and electric bikes further fuels market growth. Government initiatives focused on clean energy and sustainable technologies strengthen the region’s cobalt consumption outlook.

Opportunities in the Middle East cobalt industry lie in developing robust battery recycling infrastructure to support a circular economy, reducing reliance on raw material imports while promoting environmental sustainability. The region’s strategic investments in cobalt mining and refining, locally or through partnerships, can stabilize supply chains and enhance security. Moreover, ongoing technological advancements in battery chemistries that optimize cobalt use or introduce new applications present significant growth potential. Infrastructure expansion, such as EV charging networks and renewable energy grids, is expected to boost cobalt demand further.

Despite these positive factors, the market faces certain restraints. The Middle East has limited domestic cobalt reserves, making it dependent on imports, which exposes the market to supply disruptions and price volatility. Ethical and environmental concerns related to cobalt mining practices globally pose challenges in maintaining sustainable and socially responsible supply chains. Furthermore, price fluctuations driven by geopolitical factors can affect market stability. Lastly, the emergence of alternative battery technologies with lower or zero cobalt content may restrain long-term demand growth for cobalt in the region.

End Use Insights

Growing emphasis on electric vehicle (EV) manufacturing in the Middle East drives increased demand for battery production, which supports the market growth. Regional governments in countries such as the UAE and Saudi Arabia are promoting partnerships with global manufacturers to develop local lithium battery facilities and strengthen the EV supply chain. Globally, major investments like General Motors' and Samsung SDI’s USD 3 billion EV battery plant announced in April 2023, and LG Energy Solution and Honda’s USD 3.5 billion battery plant in Ohio, highlight the expanding scale of battery production, which is expected to influence similar developments in the Middle East.

In terms of revenue, the cobalt-based superalloys segment is projected to register a CAGR of 4.5% over the forecast period. These superalloys are critical for industries that require materials capable of withstanding extreme temperatures, pressures, and stresses. They are commonly used in gas turbines for power generation and aircraft engines, where resistance to temperatures up to 1200°C (2192°F) without melting or degradation is essential. The growing aerospace and energy sectors in the Middle East are likely to increase demand for these high-performance cobalt superalloys, further supporting market expansion.

Product Insights

In the Middle East, cobalt sulfate is increasingly used in agriculture, dyeing, batteries, and catalysts. It is a key material in producing lithium batteries, which power many electronic devices, including smartphones, laptops, and electric vehicles (EVs). Cobalt sulfate enhances the performance and lifespan of these batteries. Increasing investment in lithium battery production and clean energy initiatives across countries like the UAE, Saudi Arabia, and Qatar is expected to drive product demand over the forecast period. For instance, in early 2025, Saudi Aramco, in partnership with state-owned mining company Ma'aden, announced plans to commercially produce lithium by 2027. This initiative aims to meet the kingdom's projected lithium demand, supporting the production of 500,000 EV batteries and 110 gigawatts of renewable energy by 2030.

The cobalt oxide segment in the Middle East is expected to register a CAGR of 5.7% in revenue over the forecast period. It is primarily used in producing magnetic materials, including magnetic recording media for hard drives, and finds applications in ceramics, glass, and batteries. Another key market segment is cobalt metal, which presents significant growth opportunities due to its unique properties such as high-temperature resistance, biocompatibility, strength, and durability. Given its critical industrial applications, cobalt is considered a global strategic metal, and the Middle East’s growing industrial base is increasingly focusing on securing reliable cobalt supplies to support economic development.

Country Insights

The Middle East cobalt market is influenced by global supply dynamics and regional industrial growth, particularly in aerospace, defense, and renewable energy sectors. Countries in the region are investing in strengthening local supply chains for cobalt and its derivatives, driven by rising demand for advanced materials used in high-tech manufacturing and clean energy solutions.

Saudi Arabia Cobalt Market Trends

The cobalt market in Saudi Arabia is rapidly expanding, especially in sectors like medical technology, magnetic alloys, and specialty materials. The country’s strong emphasis on research and development and its Vision 2030 industrial diversification plan are expected to drive growth in cobalt applications, including high-performance superalloys and medical implants.

UAE Cobalt Market Trends

The cobalt market in the UAE is experiencing growing cobalt demand fueled by investments in aerospace, defense, and advanced manufacturing industries. In addition, the nation’s ambitious renewable energy projects are increasing the need for cobalt in high-performance magnets and essential components for energy infrastructure, positioning the UAE as a regional hub for cobalt-driven technologies.

Key Middle East Cobalt Company Insights

Some key players operating in the cobalt market include Ma’aden, Saudi Aramco, and others.

-

Ma’aden is a Saudi Arabia-based mining company with core operations in mining, metals processing, and minerals exploration. The company is actively involved in strategic metals, including partnerships focused on cobalt sourcing and refining, supporting the region’s growing demand for battery materials.

-

Saudi Aramco is a Saudi Arabia-based energy giant primarily focused on oil and gas but expanding into advanced materials and clean energy technologies. Aramco invests in cobalt supply chains and battery material projects to diversify its portfolio and support the Middle East’s clean energy transition.

-

Emirates Global Aluminium (EGA) is a UAE-based metals producer specializing in aluminum but increasingly exploring battery materials and critical metals supply chains. EGA is partnering with Cobalt and other battery-related materials to integrate into its portfolio and support the region’s growing EV and renewable energy markets.

Key Middle East Cobalt Companies:

- Ma’aden

- Saudi Aramco

- Emirates Global Aluminium (EGA)

- Advanced Battery Metals Middle East

- Qatar Mining Company (QM)

- Aluminium Bahrain (Alba)

- Dubai Multi Commodities Centre (DMCC)

- Rusal Middle East

- FAMCO (Fajr Capital)

- Gulf Mining Group

Recent Developments

-

In January 2025, Saudi Aramco announced a strategic partnership with Ma’aden to develop advanced battery materials, including cobalt refining capabilities, to support the kingdom’s Vision 2030 clean energy goals.

-

In March 2024, Emirates Global Aluminium (EGA) signed a memorandum of understanding with a European battery materials producer to explore cobalt sourcing and processing, strengthening the UAE’s regional battery supply chain position.

-

In November 2023, the Dubai Multi Commodities Centre (DMCC) launched a new cobalt trading platform to facilitate transparent and efficient cobalt transactions across the Middle East, enhancing the region’s role in the global market.

Middle East Cobalt Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 116.7 million

Revenue forecast in 2033

USD 183.2 million

Growth rate

CAGR of 5.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, country

Regional Scope

Middle East

Country scope

Saudi Arabia; UAE; Qatar; Oman

Key companies profiled

Ma’aden; Saudi Aramco; Emirates Global Aluminium (EGA); Advanced Battery Metals Middle East; Qatar Mining Company (QM); Aluminium Bahrain (Alba); Dubai Multi Commodities Centre (DMCC); Rusal Middle East; FAMCO (Fajr Capital); Gulf Mining Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Cobalt Market Report Segmentation

This report forecasts revenue and volume growth at country levels and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East cobalt market report based on product, end use, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Cobalt Sulfate

-

Cobalt Oxide

-

Cobalt Metal

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electric Vehicles

-

Other Batteries

-

Industrial Metals

-

Industrial Chemicals

-

Superalloys

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Middle East

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The Middle East cobalt market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2033 to reach USD 183.2 million by 2033.

b. By end use, the electric vehicles segment held the revenue share of over 35.0% in 2024.

b. Some of the key players operating in the Middle East cobalt market include Ma’aden, Saudi Aramco, Emirates Global Aluminium (EGA), Advanced Battery Metals Middle East, Qatar Mining Company (QM), Aluminium Bahrain (Alba), Dubai Multi Commodities Centre (DMCC), Rusal Middle East, FAMCO (Fajr Capital), and Gulf Mining Group.

b. The Middle East cobalt market is primarily driven by the rapid expansion of electric vehicle (EV) manufacturing, increasing investments in renewable energy storage solutions, and the growing adoption of lithium-ion batteries across consumer electronics, aerospace, and defense sectors.

b. The Middle East cobalt market size was estimated at USD 110.8 million in 2024 and is expected to reach USD 116.7 million in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.